TIDMSTJ

RNS Number : 3004Q

St. James's Place PLC

17 October 2023

-1-

PRESS RELEASE

17 October 2023

ST. JAMES'S PLACE DELIVERS ANOTHER RESILIENT NEW BUSINESS

PERFORMANCE

St. James ' s Place plc ('SJP') today issues an update on new

business inflows and funds under management for the three months

ended 30 September 2023.

Q3 2023 Q3 2022

----------- -----------

GBP'Billion GBP'Billion

---------------------------------------------------------- ----------- -----------

Gross inflows 3.68 4.05

Net inflows 0.91 2.19

Closing funds under management 158.57 143.14

Year-to-date funds under management annual retention rate

(full year) (1) 95.3% 96.5%

Year-to-date annualised net inflows/opening funds under

management (full year) 3.9% 6.7%

---------------------------------------------------------- ----------- -------------

(1) Throughout this press release our retention rate is

calculated as annualised surrenders and part-surrenders, divided by

average funds under management. It excludes regular income

withdrawals and maturities.

Andrew Croft, Chief Executive Officer, commented:

"I am pleased to announce another robust quarter for St. James's

Place, with our advisers attracting GBP3.7 billion of new client

investments to the business, while annualised retention rates

remain strong at 95.3% for the year-to-date.

The demand for trusted, face-to-face financial advice remains as

strong as ever, but client capacity and confidence to commit to

long-term investment continues to be impacted by an environment

characterised by higher interest rates, stubbornly high inflation

and short-term alternatives in the form of cash.

Despite the challenging operating environment, we continue to

generate significant levels of net inflows, once again

demonstrating the ongoing resilience of our business model.

Looking forward, we are beginning to see signs that inflation is

moderating and that the current cycle of interest rate increases

may be reaching a peak, bringing some optimism that this will ease

the pressure on clients and will, in due course, provide for a more

favorable operating environment over time.

As a long-term business, we remain committed to delivering

strong client outcomes, and working towards our 2025

ambitions."

The details of the announcement are attached.

Enquiries:

Hugh Taylor, Director - Investor Relations Tel: 07818 075143

Jamie Dunkley, External Communications Director Tel: 07779 999651

Brunswick Group: Tel: 020 7404 5959

Eilis Murphy Email: sjp@brunswickgroup.com

Charles Pretzlik

Contents

1. Funds under management

2. Analysis of funds under management

3. EEV net asset value per share

-2-

1. Funds under management

UT/ISA and

Investment Pension DFM Total

------------------------------------------------------ ----------- ----------- ----------- -----------

Three months ended 30 September 2023 GBP'Billion GBP'Billion GBP'Billion GBP'Billion

------------------------------------------------------ ----------- ----------- ----------- -----------

Opening FUM 34.36 79.87 43.29 157.52

Gross inflows 0.51 2.42 0.75 3.68

Net investment return 0.14 0.26 (0.26) 0.14

Regular income withdrawals and maturities (0.07) (0.65) - (0.72)

Surrenders and part-surrenders (0.51) (0.59) (0.95) (2.05)

------------------------------------------------------ ----------- ----------- ----------- -----------

Closing FUM 34.43 81.31 42.83 158.57

------------------------------------------------------ ----------- ----------- ----------- -----------

Net inflows/(outflows) (0.07) 1.18 (0.20) 0.91

Implied surrender rate as a percentage of average FUM 5.9% 2.9% 8.8% 5.2%

------------------------------------------------------ ----------- ----------- ----------- -----------

Included in the table above is:

-- Rowan Dartington Group FUM of GBP3.26 billion at 30 September

2023, gross inflows of GBP0.09 billion for the quarter and outflows

of GBP0.05 billion.

-- SJP Asia FUM of GBP1.62 billion at 30 September 2023, gross

inflows of GBP0.04 billion for the quarter and outflows of GBP0.03

billion.

UT/ISA and

Investment Pension DFM Total

------------------------------------------------------ ----------- ----------- ----------- -----------

Three months ended 30 September 2022 GBP'Billion GBP'Billion GBP'Billion GBP'Billion

------------------------------------------------------ ----------- ----------- ----------- -----------

Opening FUM 32.75 69.58 39.93 142.26

Gross inflows 0.56 2.46 1.03 4.05

Net investment return (0.33) (0.56) (0.42) (1.31)

Regular income withdrawals and maturities (0.07) (0.43) - (0.50)

Surrenders and part-surrenders (0.37) (0.38) (0.61) (1.36)

------------------------------------------------------ ----------- ----------- ----------- -----------

Closing FUM 32.54 70.67 39.93 143.14

------------------------------------------------------ ----------- ----------- ----------- -----------

Net inflows 0.12 1.65 0.42 2.19

Implied surrender rate as a percentage of average FUM 4.5% 2.2% 6.1% 3.8%

------------------------------------------------------ ----------- ----------- ----------- -----------

Included in the table above is:

-- Rowan Dartington Group FUM of GBP3.18 billion at 30 September

2022, gross inflows of GBP0.08 billion for the quarter and outflows

of GBP0.03 billion.

-- SJP Asia FUM of GBP1.50 billion at 30 September 2022, gross

inflows of GBP0.05 billion for the quarter and outflows of GBP0.03

billion.

-3-

UT/ISA and

Investment Pension DFM Total

------------------------------------------------------ ----------- ----------- ----------- -----------

Nine months ended 30 September 2023 GBP'Billion GBP'Billion GBP'Billion GBP'Billion

------------------------------------------------------ ----------- ----------- ----------- -----------

Opening FUM 33.29 73.86 41.22 148.37

Gross inflows 1.61 7.31 2.80 11.72

Net investment return 1.22 3.36 1.27 5.85

Regular income withdrawals and maturities (0.28) (1.71) - (1.99)

Surrenders and part-surrenders (1.41) (1.51) (2.46) (5.38)

------------------------------------------------------ ----------- ----------- ----------- -----------

Closing FUM 34.43 81.31 42.83 158.57

------------------------------------------------------ ----------- ----------- ----------- -----------

Net inflows/(outflows) (0.08) 4.09 0.34 4.35

Implied surrender rate as a percentage of average FUM 5.6% 2.6% 7.8% 4.7%

------------------------------------------------------ ----------- ----------- ----------- -----------

Included in the table above is:

-- Rowan Dartington Group FUM of GBP3.26 billion at 30 September

2023, gross inflows of GBP0.29 billion for the nine-month period

and outflows of GBP0.14 billion.

-- SJP Asia FUM of GBP1.62 billion at 30 September 2023, gross

inflows of GBP0.15 billion for the nine-month period and outflows

of GBP0.10 billion.

UT/ISA and

Investment Pension DFM Total

------------------------------------------------------ ----------- ----------- ----------- -----------

Nine months ended 30 September 2022 GBP'Billion GBP'Billion GBP'Billion GBP'Billion

------------------------------------------------------ ----------- ----------- ----------- -----------

Opening FUM 35.95 74.83 43.21 153.99

Gross inflows 1.76 7.56 3.84 13.16

Net investment return (3.82) (9.32) (5.44) (18.58)

Regular income withdrawals and maturities (0.22) (1.29) - (1.51)

Surrenders and part-surrenders (1.13) (1.11) (1.68) (3.92)

------------------------------------------------------ ----------- ----------- ----------- -----------

Closing FUM 32.54 70.67 39.93 143.14

------------------------------------------------------ ----------- ----------- ----------- -----------

Net inflows 0.41 5.16 2.16 7.73

Implied surrender rate as a percentage of average FUM 4.4% 2.0% 5.4% 3.5%

------------------------------------------------------ ----------- ----------- ----------- -----------

Included in the table above is:

-- Rowan Dartington Group FUM of GBP3.18 billion at 30 September

2022, gross inflows of GBP0.33 billion for the nine-month period

and outflows of GBP0.09 billion.

-- SJP Asia FUM of GBP1.50 billion at 30 September 2022, gross

inflows of GBP0.22 billion for the nine-month period and outflows

of GBP0.07 billion.

-4-

2. Analysis of funds under management

The table below provides a geographical and investment-type

analysis of FUM at 30 September.

30 September

30 September 2023 2022

-------------------------- ----------------------- -----------------------

Percentage Percentage

GBP'Billion of total GBP'Billion of total

-------------------------- ----------- ---------- ----------- ----------

North American equities 54.2 34% 47.3 33%

Fixed income securities 24.5 16% 21.7 15%

European equities 22.8 14% 17.1 12%

Asia and Pacific equities 19.6 12% 17.8 12%

UK equities 15.5 10% 15.4 11%

Alternative investments 11.2 7% 12.4 9%

Cash 5.6 4% 6.1 4%

Other 3.3 2% 2.7 2%

Property 1.9 1% 2.6 2%

Total 158.6 100% 143.1 100%

-------------------------- ----------- ---------- ----------- ----------

3. EEV net asset value per share

The net asset value on the European Embedded Value basis at 30

September 2023 was approximately GBP13.60 per share, taking into

account the changes to our charging structure that we have

announced today.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTKZMMGLVZGFZM

(END) Dow Jones Newswires

October 17, 2023 02:00 ET (06:00 GMT)

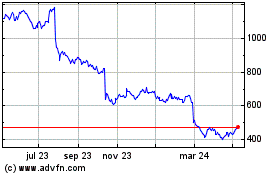

St. James's Place (LSE:STJ)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

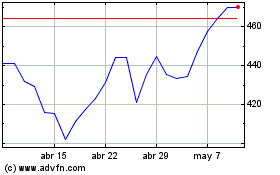

St. James's Place (LSE:STJ)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024