Taseko Mines Limited Taseko Mines Provides Update on Florence Copper

16 Enero 2024 - 6:55AM

UK Regulatory

TIDMTKO

Taseko Provides Financing and Construction Update for the Florence Copper

Project

VANCOUVER, BC, Jan. 16, 2024 - Taseko Mines Limited (TSX: TKO) (NYSE American:

TGB) (LSE: TKO) ("Taseko" or the "Company") is pleased to provide an update on

financing and construction progress at its Florence Copper project.

On January 15, 2024, the Company signed a definitive agreement with Taurus

Mining Royalty Fund L.P. ("Taurus") for the previously announced sale of a US$50

million royalty. The royalty will be for 1.95% of the gross revenue from the

sale of all copper from Florence Copper. Funding of the US$50 million is subject

to customary closing conditions, and proceeds are expected to be received in

early February. The Company also expects to drawdown the first US$10 million of

the US$50 million Mitsui financing later this month. With these financings in

hand, construction activities at Florence will be accelerating.

To date, site activities have focussed on site preparations, earthworks and

civil work for the commercial wellfield. The initial drilling contracts are now

being finalized, with drilling of the commercial facility wellfield to commence

in February. Additionally, the Company expects to sign a fixed-price contract

with TIC Kiewit as general contractor for construction of the SX/EW plant and

associated surface infrastructure. All the major plant components are onsite and

the build will begin in the second quarter of this year.

Stuart McDonald, President & CEO of Taseko, commented, "Signing of the Taurus

royalty agreement is another positive milestone for the project. We are excited

to be ramping up construction activities at Florence Copper, which will soon be

a major new supplier of low-carbon copper cathode to the US market.

Site preparations and civil work are well advanced, and we're looking forward to

commencing wellfield drilling, with four rigs planned to be onsite initially.

Construction of the SX/EW plant and other infrastructure represents a

significant portion of the remaining project spend, and a fixed-price contract

with TIC Kiewit will reduce inflationary risks, as Arizona continues to be a

very active construction market. Our early work on detailed engineering and

procurement of long-lead items has significantly de-risked the construction

schedule and we're tracking towards first copper production in the fourth

quarter of 2025. We're taking a disciplined approach to the buildout of the

commercial facility at Florence, while our existing operations at the Gibraltar

Mine continue to generate good cashflows in a strong copper price environment."

"As an existing copper producer, Taseko is in an enviable and unique position

with near-term, low cost production growth coming from a fully-permitted and

environmentally beneficial copper project. With copper now added to the US

Department of Energy's critical materials list, market interest in our project

and future copper production remains strong," added Mr. McDonald.

Stuart McDonald

President and CEO

No regulatory authority has approved or disapproved of the information contained

in this news release.

Caution Regarding Forward-Looking Information

This document contains "forward-looking statements" that were based on Taseko's

expectations, estimates and projections as of the dates as of which those

statements were made. Generally, these forward-looking statements can be

identified by the use of forward-looking terminology such as "outlook",

"anticipate", "project", "target", "believe", "estimate", "expect", "intend",

"should" and similar expressions.

Forward-looking statements are subject to known and unknown risks, uncertainties

and other factors that may cause the Company's actual results, level of

activity, performance or achievements to be materially different from those

expressed or implied by such forward-looking statements. These included but are

not limited to:

· uncertainties about the future market price of copper and the other metals

that we produce or may seek to produce;

· changes in general economic conditions, the financial markets, inflation and

interest rates and in the demand and market price for our input costs, such as

diesel fuel, reagents, steel, concrete, electricity and other forms of energy,

mining equipment, and fluctuations in exchange rates, particularly with respect

to the value of the U.S. dollar and Canadian dollar, and the continued

availability of capital and financing;

· uncertainties resulting from the war in Ukraine, and the accompanying

international response including economic sanctions levied against Russia, which

has disrupted the global economy, created increased volatility in commodity

markets (including oil and gas prices), and disrupted international trade and

financial markets, all of which have an ongoing and uncertain effect on global

economics, supply chains, availability of materials and equipment and execution

timelines for project development;

· uncertainties about the continuing impact of the novel coronavirus ("COVID

-19") and the response of local, provincial, state, federal and international

governments to the ongoing threat of COVID-19, on our operations (including our

suppliers, customers, supply chains, employees and contractors) and economic

conditions generally including rising inflation levels and in particular with

respect to the demand for copper and other metals we produce;

· inherent risks associated with mining operations, including our current

mining operations at Gibraltar, and their potential impact on our ability to

achieve our production estimates;

· uncertainties as to our ability to control our operating costs, including

inflationary cost pressures at Gibraltar without impacting our planned copper

production;

· the risk of inadequate insurance or inability to obtain insurance to cover

material mining or operational risks;

· uncertainties related to the feasibility study for Florence copper project

(the "Florence Copper Project" or "Florence Copper") that provides estimates of

expected or anticipated capital and operating costs, expenditures and economic

returns from this mining project, including the impact of inflation on the

estimated costs related to the construction of the Florence Copper Project and

our other development projects;

· the risk that the results from our operations of the Florence Copper

production test facility ("PTF") and ongoing engineering work including updated

capital and operating costs will negatively impact our estimates for current

projected economics for commercial operations at Florence Copper;

· uncertainties related to the accuracy of our estimates of Mineral Reserves

(as defined below), Mineral Resources (as defined below), production rates and

timing of production, future production and future cash and total costs of

production and milling;

· the risk that we may not be able to expand or replace reserves as our

existing mineral reserves are mined;

· the availability of, and uncertainties relating to the development of,

additional financing and infrastructure necessary for the advancement of our

development projects, including with respect to our ability to obtain any

remaining construction financing potentially needed to move forward with

commercial operations at Florence Copper;

· our ability to comply with the extensive governmental regulation to which

our business is subject;

· uncertainties related to our ability to obtain necessary title, licenses and

permits for our development projects and project delays due to third party

opposition;

· our ability to deploy strategic capital and award key contracts to assist

with protecting the Florence Copper project execution plan, mitigating inflation

risk and the potential impact of supply chain disruptions on our construction

schedule and ensuring a smooth transition into construction;

· uncertainties related to First Nations claims and consultation issues;

· our reliance on rail transportation and port terminals for shipping our

copper concentrate production from Gibraltar;

· uncertainties related to unexpected judicial or regulatory proceedings;

· changes in, and the effects of, the laws, regulations and government

policies affecting our exploration and development activities and mining

operations and mine closure and bonding requirements;

· our dependence solely on our 87.5% interest in Gibraltar (as defined below)

for revenues and operating cashflows;

· our ability to collect payments from customers, extend existing concentrate

off-take agreements or enter into new agreements;

· environmental issues and liabilities associated with mining including

processing and stock piling ore;

· labour strikes, work stoppages, or other interruptions to, or difficulties

in, the employment of labour in markets in which we operate our mine, industrial

accidents, equipment failure or other events or occurrences, including third

party interference that interrupt the production of minerals in our mine;

· environmental hazards and risks associated with climate change, including

the potential for damage to infrastructure and stoppages of operations due to

forest fires, flooding, drought, or other natural events in the vicinity of our

operations;

· litigation risks and the inherent uncertainty of litigation, including

litigation to which Florence Copper could be subject to;

· our actual costs of reclamation and mine closure may exceed our current

estimates of these liabilities;

· our ability to meet the financial reclamation security requirements for the

Gibraltar mine and Florence Project;

· the capital intensive nature of our business both to sustain current mining

operations and to develop any new projects, including Florence Copper;

· our reliance upon key management and operating personnel;

· the competitive environment in which we operate;

· the effects of forward selling instruments to protect against fluctuations

in copper prices, foreign exchange, interest rates or input costs such as fuel;

· the risk of changes in accounting policies and methods we use to report our

financial condition, including uncertainties associated with critical accounting

assumptions and estimates; and Management Discussion and Analysis ("MD&A"),

quarterly reports and material change reports filed with and furnished to

securities regulators, and those risks which are discussed under the heading

"Risk Factors".

For further information on Taseko, investors should review the Company's annual

Form 40-F filing with the United States Securities and Exchange Commission

www.sec.gov and home jurisdiction filings that are available at www.sedar.com,

including the "Risk Factors" included in our Annual Information Form.

see the Company's website at www.tasekomines.com or contact: Brian Bergot, Vice

President, Investor Relations - 778-373-4533 or toll free 1-877-441-4533

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

January 16, 2024 07:55 ET (12:55 GMT)

Taseko Mines (LSE:TKO)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

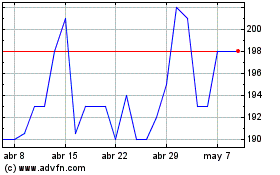

Taseko Mines (LSE:TKO)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024