TIDMTM17

RNS Number : 8420M

Team17 Group PLC

19 September 2023

19 September 2023

Team17 Group plc

("Team17" or the "Group" or "Company")

UNAUDITED HALF YEAR RESULTS FOR THE SIX MONTHSED 30 JUNE

2023

Strong H1 revenue growth underpinned by new releases and

portfolio, expect full year results in line with expectations

Team17 , a global games label, creative partner, developer and

publisher of independent ("indie") premium video games, educational

entertainment apps for children, and working simulation games, is

pleased to announce its unaudited results for the six months ended

30 June 2023 ("H1 2023" or the "period").

H1 2023 financial highlights

-- Revenues increased 31% to GBP69.7m (H1 2022: GBP53.2m)

-- Gross profit increased 18% to GBP30.2m (H1 2022: GBP25.5m)

-- Adjusted EBITDA of GBP16.5m (H1 2022: GBP18.2m)

-- Profit before tax of GBP8.1m (H1 2022: GBP11.2m)

-- Adjusted profit before tax of GBP15.6m (H1 2022: GBP17.3m)

-- Earnings per share ("EPS") of 3.9 pence (H1 2022: 6.5 pence)

-- Adjusted earnings per share ("AEPS") of 8.6 pence (H1 2022: 10.4 pence)

-- Operating cash conversion of 142% (H1 2022: 139%)

-- Net cash and cash equivalents at 30 June 2023 of GBP45.2m (H1 2022: GBP51.3m)

-- Group headcount at 30 June 2023 was 438 (FY22: 392)

H1 2023 operational highlights

-- Strong H1 2023 revenue growth across the Group, driven by the

diversified portfolio of games, apps and strong new release

profile.

-- Group H1 2023 EBITDA performance reflects the early H2

release pipeline which drove increased marketing and operational

costs in H1 to support the release profile, with these costs

reducing in H2.

-- Team17 Games Label delivered strong revenue growth across its portfolio in H1 2023:

o 17 (H1 2022: 20) new downloadable content ("DLC") packages

released across 13 (H1 2022: 12) titles.

o Content portfolio now comprises over 800 digital revenue lines

(H1 2022: over 600 digital revenue lines).

o 5 new titles released in H1 which included Dredge , Trepang2

and Killer Frequency.

o 2 existing titles released on additional platforms.

-- astragon delivered a strong performance underpinned by own IP revenues:

o 12 paid DLC, two season passes and free content updates

launched to select own IP titles in the period (H1 2022: 10).

o Own IP working simulation titles Construction Simulator and

Police Simulator have maintained continued impressive sales

momentum following Q3 & Q4 FY 2022 launches respectively.

o Completed the acquisition of Independent Arts Software GmbH

("IAS") in April 2023, expanding the working simulation development

team to accelerate the creation and launch of a new own IP

title.

-- StoryToys delivered a strong performance across the portfolio

with payable active subscribers continuing to grow to over 320,000

(H1 2022: over 250,000):

o Extended and strengthened relationships with key license

partners including Mattel, Marvel Entertainment, Sesame Workshop,

The LEGO(R) Group and The Walt Disney Company.

o Launched 3 new apps in H1 2023: Barbie Color Creations,

LEGO(R) DUPLO(R) DISNEY - MICKEY AND FRIS and Marvel HQ.

o Developed and launched 134 (H1 2022: 108) app updates across

existing titles.

-- Continued to strengthen the leadership and Board bringing in

operational depth and video gaming experience as we prepare for the

next phase of diversified growth.

Outlook

-- Strong H1 revenue performance de-risks FY23 delivery with a reduced H2 weighting.

-- We expect H2 EBITDA to benefit from more favourable phasing

of costs, planned cost efficiencies and controls, which together

with the second half pipeline of new title releases and content

updates, will deliver second half weighted results.

-- The Board therefore expects to deliver full year results in

line with current market expectations.

-- The Group continues to be highly cash generative, maintains a

strong balance sheet and is mindful of the acquisition and

consolidation opportunities that exist in the current market.

-- Whilst cognisant of the competitive pressures in the games

market with high-quality games and elevated discounting levels, the

Board remains confident in the long-term trajectory of the

business.

-- The Group continues to bolster and differentiate Team17's

customer offering to broaden its market appeal.

-- The Board remains confident in the long-term trajectory of the business.

Debbie Bestwick MBE, CEO of Team17, said:

"We are pleased with the Group's first half performance, with

strong growth delivering record revenue levels, against a backdrop

of one of the most competitive years for high quality launches and

deep peer discounting that I can remember. The strength of our

results illustrates the success of our diverse portfolio strategy,

expertise in lifecycle management and franchise building,

disciplined approach to discounting, and the tireless commitment of

our people across the Group.

"We are mindful that the gaming environment remains highly

competitive, and we continuously review cost efficiencies to ensure

we have the right balance between internal and outsourced resources

in our service areas. We believe that this will enable us to remain

agile and cost effective to deliver the best results for our

partners and stakeholders over future years.

"astragon and StoryToys continue to deliver strong revenue

growth, high quality content and synergy opportunities. In the

current environment, I believe our strong balance sheet and M&A

track record puts us in an excellent position to pursue further

opportunities which can support our strategy of enhancing the

Group's reach across genres, platforms, and customer demographics.

We are being presented with more new content opportunities of

quality than ever before and will remain as highly disciplined in

our approach as ever to ensure we maintain our track record of

delivering exceptional games to our customers.

"I have been impressed with the passion, insight, and leadership

that Steve Bell has already brought to the Group in his role as CEO

designate and am delighted with Frank Sagnier's appointment as

Chair designate. So finally, as I enter my last few months as CEO,

I can confidently say I have never been more excited about the

Group's leadership and future."

Analyst and institutional investor webcast

A webcast presentation for analysts and institutional investors

will be held on Tuesday, 19 September 2023 at 8.00 a.m. BST. To

register for this event and join the stream on the day, please

click the following link: https://brrmedia.news/TM17_HYR23

Retail investor webcast

A webcast for retail investors will be held on Thursday, 21

September 2023 at 2.00 p.m. BST. The presentation will be hosted on

the Investor Meet Company platform. Questions can be submitted

pre-event via the Investor Meeting Company dashboard up until 9.00

a.m. the day before the meeting or at any time during the live

presentation.

Investors can sign up for free and add to meet Team17 via:

https://www.investormeetcompany.com/team17-group-plc/register-investor

Enquiries:

Team17 Group plc via Vigo Consulting

Debbie Bestwick MBE, Chief Executive Officer

Steve Bell, Chief Executive Officer Designate

Mark Crawford, Chief Financial Officer

James Targett, Group Investor Relations Director

Houlihan Lokey UK Limited (Nominated Adviser)

Adrian Reed / Tim Richardson +44 (0)161 250 3577

Berenberg (Joint Corporate Broker)

Toby Flaux / Ben Wright / Marie Moy / Alix

Mecklenburg-Solodkoff +44 (0)20 3207 7800

Peel Hunt (Joint Corporate Broker)

Neil Patel / Paul Gillam / Richard Chambers

/ James Smith +44 (0)20 7418 8900

Vigo Consulting (Financial Public Relations)

Jeremy Garcia / Fiona Hetherington / Kate

Kilgallen

team17@vigoconsulting.com +44 (0)20 7390 0233

About Team17

Team17 Group plc is a global provider of games entertainment to

a broad audience. The Group now includes a games entertainment

label and creative partner for indie developers, a leading

developer of educational apps, targeting children under the age of

eight, and a leading working simulation games developer and

publisher.

Visit www.team17.com for more info.

Operational Review

The Group delivered another solid performance in H1 2023,

reporting record revenue following strong contributions from the

three divisions: Games Label, StoryToys, and astragon.

Team17 now benefits from operating across a much enlarged

geographical footprint and customer demographic, and while the

divisions continue to function autonomously, with their own

distinct identities and audiences, they remain fully aligned to the

Group's shared company values and a collective drive to deliver the

highest quality games and apps for their customers.

The Group has continued to see significant traction in games and

apps across the portfolio, from both customers and platform

partners. Our divisions remain focused on bringing new titles to

our expanded audience base, as well as maintaining engagement

through additional content and where appropriate sequels for the

existing titles in their portfolios. During the period across the

three divisions, the Group has launched 5 new titles, 2 existing

titles on additional platforms, 3 new edutainment apps, 31 paid for

and free DLC updates and 134 app updates.

Revenues in H1 2023 grew 31% to a record GBP69.7m (H1 2022:

GBP53.2m), with gross profit of GBP30.2m (H1 2022: GBP25.5m). This

strong performance is underpinned by the combined contribution of

the Games Label, StoryToys and astragon, as well as growth in

revenues from third party IP of 30% to GBP42.7m (H1 2022:

GBP32.8m). This represented 61% (H1 2022: 62%) of total revenue and

benefited from StoryToys app sales alongside the standout

performance of the Games Label's Dredge which launched in the

period. Revenues from own IP titles grew 32% in total delivering

revenues of GBP27.0m (H1 2022: GBP20.4m) making up 39% of total

revenues (H1 2022: 38%). Own IP titles across the Group include

Golf With Your Friends ("GWYF"), Hell Let Loose ("HLL"),

Construction Simulator and Police Simulator.

The Group's new release revenues contributed GBP14.9m (H1 2022:

GBP0.2m) predominantly coming from the Games Label, with the back

catalogue generating revenues of GBP54.8m (H1 2022: GBP53.0m)

demonstrating the continued strength of the Group's broadening

portfolio.

Gross margins were impacted in H1 2023 by several factors

including: the sales mix between own and third party IP across the

divisions and their associated royalties; ongoing investment in the

back catalogue content updates; higher expensed development costs

and increased amortisation charges driven in part by the timing of

new titles launched in the period as well as those launched towards

the end of FY 2022.

Administrative expenses for H1 2023 were GBP21.7m (H1 2022:

GBP13.6m) which include GBP6.1m acquisition-related adjustments (H1

2022: GBP5.5m) which are outlined in Note 5 below. The underlying

cost base saw enlarged headcount across the Group to support the

increased demands to develop and launch titles across the

ever-expanding portfolio. Marketing costs were more heavily first

half weighted compared with the prior year supporting both the

launch of titles in the period and also titles launched at the

start of H2 2023. In addition, attendances at live events saw an

increase in spend in H1 2023. General inflation to other costs

alongside a strengthening GBP compared to the same period last year

have contributed to the overall increase in administrative

expenses.

Overall headcount has grown to 438 (H1 2022: 345) in part a

result of the increased headcount across the existing Group in the

second half of FY 2022, but also includes the development team of

45 within the Independent Arts Software GmbH ("IAS") acquired by

astragon in April 2023; this accounts for almost all of the

increase in headcount since the start of the year (FY2022:

392).

As a consequence of the factors influencing gross margin

outlined above combined with the front loading in marketing spend

and investment in people in H1, adjusted EBITDA decreased to

GBP16.5m (H1 2022: GBP18.2m) with an adjusted EBITDA margin(1) of

24% (H1 2022: 34%).

Earnings per Share for the period decreased to 3.9 pence (H1

2022: 6.5 pence) reflecting the cost impacts outlined above;

increase in the number of shares in issue; and also the relative

impact of tax rates across the Group including the increase in UK

tax rate in April 2023. The adjusted Earnings per Share ( adding

back share-based compensation costs, acquisition-related costs and

adjustments) of 8.6 pence (H1 2022: 10.4 pence) better reflects the

underlying performance in the period across the Group.

Operating cash conversion was 142% (H1 2022: 139%) elevated from

the 2022 year-end and reflects seasonal working capital movements.

Cash and cash equivalents at the end of the period were GBP45.2m

(H1 2022: GBP51.3m) after payments for contingent consideration

made in H1 2023 alongside GBP2.3m for the acquisition of IAS.

Following the announcement of Debbie Bestwick's intention to

step down as Group Chief Executive Office to assume a Non-Executive

Director ("NED") role, the Group appointed Steve Bell as her

successor. Steve joined the Group earlier this month and will be

working alongside Debbie until the end of the year to ensure a

smooth transition ahead of Debbie assuming her NED role in January

2024.

The Board has been further strengthened with the appointment of

Peter Whiting as NED/Chair of RemCom and Frank Sagnier as Chair

designate, who come with a wealth of experience in various NED

roles and video gaming respectively. The Group would like to thank

Jennifer Lawrence, Martin Hellawell and Chris Bell for their

unwavering support and contribution to Team17 and wish them all the

very best in their future endeavours.

Additionally, we have strengthened the Group leadership team

with the addition of Ann Hurley who joined in July 2023 as Group

Commercial Operations Director. She brings over 15 years of

outsourcing knowledge alongside her combined three decades of

experience across the games industry in senior sales, business

development, marketing, leadership and operational roles. James

Targett joined in August 2023 as Group Investor Relations Director

with over two decades of experience in equity research with several

major investment banks. Nigel Martin joins in September 2023 as

Group People and Culture Director with over three decades

experience in commercial, strategic, and international HR

leadership roles in large blue-chip companies as well as smaller

entrepreneurial businesses.

Having undergone a sustained period of acquisitive growth, the

core foundations of Team17's business strategy remain unchanged,

with a focus on identifying, developing, and publishing genre

agnostic content that appeals to a wide range of users and is

accessible through multiple platforms.

As demonstrated by the strong revenue growth in H1 2023, the

Group is also cognisant of the importance of lifecycle management

of existing games in the portfolio in addition to important new

title launches, and more recently, in exploring synergy

opportunities across the enlarged Group This was demonstrated when

astragon managed the physical launch for Team17 Games Label's

Blasphemous 2. To that end, we continue to develop and launch

exciting new content and extensions to our existing games and app

portfolio, responding to market demand and implementing customer

feedback wherever possible.

Games Label

The Games Label continues to perform well, having launched 5 new

titles and 2 existing titles on to additional platforms alongside

multiple DLC updates in H1 2023, delivering revenue growth of 15%

to GBP47.1m (H1 2022: GBP40.8m). The Games Label continues to build

out their diverse portfolio ensuring all new content is of the

highest possible quality, with each new title undergoing rigorous

quality assurance testing prior to release. The Games Label's

continued success remains rooted in our expertise in lifecycle

management, franchise building, own IP launches, and third party IP

management, all of which underpin stable and scalable revenue

streams.

Titles launched in H1 2023 included Trepang 2 and Dredge, and

DLC for GWYF and Marauders. Additionally, Team17 USA's Farmside

title was launched on Apple Arcade in February 2023, achieving top

5 engagement levels in week one and achieving a current worldwide

4.2 out of 5-star rating. This was followed by the release from

Team17 USA and subsequent launch of Summon Quest on Apple Arcade in

April 2023.

Within the Games Label, Team17 Digital now boasts over 800

digital revenue lines, an increase from the prior year period (H1

2022: over 600).

The Games Label titles Farmside and Dredge, and the Games Label

itself, were nominated in seven categories at the Develop:Star

Awards which took place in July 2023, with the Games Label and

Dredge crowned the winners in the Publishing Star and Best Small

Studio categories respectively.

The Games Label has launched a number of highly anticipated

sequels, including those to Moving Out and Blasphemous and launched

the new title Gord, all of which were released early in the second

half. The Games Label has a further 2 new title releases planned

for later in the second half, including Headbangers - Rhythm

Royale.

StoryToys

StoryToys has had an exceptionally busy H1 2023, delivering a

solid performance in line with expectations with revenues up 39 %

to GBP6.4m (H1 2022: GBP4.6m). Total subscriptions and subscription

revenues have continued to trend upwards in H1 2023, with StoryToys

now boasting over 320,000 active subscribers (H1 2022: over

250,000).

Through the strengthening of key partner relationships,

StoryToys has further consolidated their reputation with leading

brands wishing to extend their reach into the edutainment space.

StoryToys remains focused on providing a firm basis on which to

nurture and further grow their strategic brand partnerships for

years to come.

A number of titles were released in the period, the result of

new brand agreements and contract extensions with existing

partners. These include:

o New license agreement with Mattel to launch Barbie Color

Creations in June 2023

o New license agreement to launch LEGO(R) DUPLO(R) Disney Mickey

and Friends in April 2023

o Agreement extension with Marvel Entertainment to include a new

Marvel HQ app, which launched in May 2023

StoryToys also launched Disney Coloring World+ on Apple Arcade

in May 2023, expanding the active user base of the title.

(c)2023 The LEGO GROUP

(c) 2023 MARVEL

(c) 2023 Disney

StoryToys' H2 2023 pipeline is strong, with multiple new content

updates planned, in addition to the launch of LEGO(R) DUPLO(R)

WORLD+ on Apple Arcade in July 2023. Management is encouraged by

Mattel's decision to enter a long-term licensing deal with

StoryToys to build their brand in the edutainment space. Looking

ahead, StoryToys will continue to actively seek additional

opportunities to further expand its network of global license

partners.

astragon

astragon continues to perform strongly and in line with

management expectations, benefitting from the highly successful

launches of Construction Simulator and Police Simulator in Q3 and

Q4 2022 respectively. Overall, sales increased 109 % to GBP 16.3 m

in the period (H1 2022: GBP7.8m), noting that the prior year was

heavily second half weighted with launches on all own IP

titles.

Portfolio content updates were launched for a number of own IP

titles across the period, including a JCB pack and Airfield

Expansion for Construction Simulator, and Next Stop 21 for Bus

Simulator. All titles in the portfolio continue to gain good

customer traction, supported by the release of 12 DLC (H1 2022: 3)

and content updates in the period.

In June 2023, astragon announced a partnership with Randwerk

Games to publish their atmospheric physics-destruction building

game, ABRISS - build to destroy. The game is currently available

for PC in Early Access and won the Best Graphic Design award at the

German Computer Game Awards in 2023. ABRISS - build to destroy saw

its full launch on PC at the start of September with expectations

to release on wider platforms in the near future.

Alongside the third party title launches of ABRISS - build to

destroy and Howl, astragon has multiple planned updates and DLC

releases across their own IP titles during the second half.

In April 2023, the Group announced that astragon had acquired

Independent Arts Software ("IAS"), a long-established third party

development partner of astragon. This acquisition brings a team of

expert 'simulation' developers that will ultimately accelerate the

development and launch of new astragon IP. The integration of IAS

is now complete, with the team based in their own studio in Hamm,

Germany.

Outlook

-- The games market in the second half of the year FY 2023 is

expected to continue to be more competitive than it has been for a

number of years in terms of high-quality games and elevated

discounting levels.

-- Strong H1 revenue performance de-risks FY 2023 delivery with a reduced H2 weighting.

-- Anticipate adjusted EBITDA for FY 2023 will remain in line

with current market expectations, with improved adjusted EBITDA

margins in H2 due to more favourable phasing of costs, supported by

planned and identified cost efficiencies and controls.

-- The Group continues to be highly cash generative, maintaining

a strong balance sheet and is mindful of the ongoing acquisition

and consolidation opportunities that exist in the current

market.

-- We continue to focus on bolstering and differentiating

Team17's customer offering to broaden our market appeal.

-- The Board remains confident in the long-term trajectory of the business.

Debbie Bestwick MBE

Group Chief Executive Officer

19 September 2023

Condensed Consolidated Income Statement

Unaudited Unaudited

Six months Six months

ended ended

30 June 30 June

2023 2022

Note GBP'000 GBP'000

Revenue 4 69,708 53,249

Cost of sales (39,501) (27,705)

-------------------------------------------- ----- ------------ ------------------------------

Gross profit 30,207 25,544

Gross profit % 43.3% 48.0%

Administrative expenses (21,678) (13,639)

Other Income 2 257

-------------------------------------------- ----- ------------ ------------------------------

Operating profit 8,531 12,162

Amortisation of other intangibles 553 16

Depreciation 644 577

Share based compensation 612 (69)

Acquisition-related adjustments (excluding

interest on consideration) 6,117 5,539

-------------------------------------------- ----- ------------ ------------------------------

Adjusted EBITDA(1) 5 16,457 18,225

-------------------------------------------- ----- ------------ ------------------------------

Finance income 36 7

Finance cost (461) (1,000)

-------------------------------------------- ----- ------------ ------------------------------

Profit before tax 8,106 11,169

Taxation (2,546) (2,262)

-------------------------------------------- ----- ------------ ------------------------------

Profit for the period 5,560 8,907

============================================ ===== ============ ==============================

Basic earnings per share 6 3.9 Pence 6.5 Pence

Diluted earnings per share 6 3.9 Pence 6.4 Pence

Basic adjusted earnings per share 6 8.6 Pence 10.4 Pence

Diluted adjusted earnings per share 6 8.6 Pence 10.3 Pence

-------------------------------------------- ----- ------------ ------------------------------

All results relate to continuing activities.

(1) Adjusted EBITDA is defined as operating profit adjusted to

add back depreciation of property, plant and equipment,

amortisation of intangible assets (excluding capitalised

development costs), share based compensation and all acquisition

related adjustments and fees.

Condensed Consolidated Statement of Comprehensive Income

Unaudited Unaudited

Six months Six months

ended ended

30 June 30 June

2023 2022

GBP'000 GBP'000

Profit for the period 5,560 8,907

Items which might be potentially

reclassified to profit or loss:

Exchange difference on translation

of foreign operations (4,105) 5,345

------------------------------------- ------------- -------------

Total comprehensive income for

the period 1,455 14,252

------------------------------------- ------------- -------------

Condensed Consolidated Statement of Financial Position

Unaudited Unaudited Audited

30 June 30 June 31 December

2023 2022 2022

Note GBP'000 GBP'000 GBP'000

-------------------------------- ----- ---------- ---------- -------------

ASSETS

Non-current assets

Investments in associates 832 645 1,045

Intangible fixed assets 7 239,086 225,989 234,109

Property, plant and equipment 1,782 1,933 1,692

Right of use assets 4,271 2,818 2,785

Deferred tax asset - 14 -

-------------------------------- ----- ---------- ---------- -------------

245,971 231,399 239,631

-------------------------------- ----- ---------- ---------- -------------

Current assets

Trade and other receivables 26,490 18,966 36,044

Inventories 929 969 1,225

Cash and cash equivalents 45,159 51,295 50,828

-------------------------------- ----- ---------- ---------- -------------

72,578 71,230 88,097

-------------------------------- ----- ---------- ---------- -------------

Total assets 318,549 302,629 327,728

================================ ===== ========== ========== =============

EQUITY AND LIABILITIES

Equity

Share capital 1,457 1,456 1,456

Share premium 132,923 136,775 132,126

Merger reserve (restated) (149,173) (153,822) (149,173)

Currency translation reserve 3,865 5,245 7,970

Other reserves 159,296 159,296 159,296

Retained earnings 106,971 86,200 100,785

-------------------------------- ----- ---------- ---------- -------------

Total equity 255,339 235,150 252,460

-------------------------------- ----- ---------- ---------- -------------

Non-current liabilities

-------------------------------- ----- ---------- ---------- -------------

Lease liabilities 3,918 2,689 2,625

Other payables - 25,242 9,369

Provisions 155 124 140

Deferred tax liabilities 8,229 8,624 9,169

-------------------------------- ----- ---------- ---------- -------------

Total non-current liabilities 12,302 36,679 21,303

-------------------------------- ----- ---------- ---------- -------------

Current liabilities

Trade and other payables 49,097 28,722 52,339

Current tax liabilities 1,081 1,718 1,262

Lease liabilities 730 360 364

-------------------------------- ----- ---------- ---------- -------------

Total current liabilities 50,908 30,800 53,965

-------------------------------- ----- ---------- ---------- -------------

Total liabilities 63,210 67,479 75,268

-------------------------------- ----- ---------- ---------- -------------

Total equity and liabilities 318,549 302,629 327,728

-------------------------------- ----- ---------- ---------- -------------

Condensed Consolidated Statement of Changes in Equity

Share Share Merger Currency Other Retained

capital premium Reserve translation reserves earnings Total

(restated) (restated) reserve

Six months to Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

30 June 2022

----------------- ------ --------- -------------- ------------ ------------- ---------- ---------- -----------

Balance at

1 January 2022

(audited) 1,315 44,084 (153,822) (100) 159,296 76,863 127,636

------------------------- --------- -------------- ------------ ------------- ---------- ---------- -----------

Profit for the

period - - - - - 8,907 8,907

Other comprehensive

income for the

period - - - 5,345 - - 5,345

Transactions

with

owners

Issue of shares

for a business

combination (restated) 6 - 4,649 - - - 4,655

Issue of shares

for acquisition

of IP 15 11,779 - - - - 11,794

Issue of shares

to satisfy share

options 10 - - - - - 10

Contributions of

equity 110 76,263 - - - - 76,373

Share based compensation - - - - - 430 430

========================= ========= ============== ============ ============= ========== ========== ===========

Total transactions

with owners (restated) 141 88,042 4,649 - - 430 93,262

------------------------- --------- -------------- ------------ ------------- ---------- ---------- -----------

Balance at

30 June 2022 (restated)

(unaudited) 1,456 132,126 (149,173) 5,245 159,296 86,200 235,150

------------------------- --------- -------------- ------------ ------------- ---------- ---------- ===========

Six months to

31 December

2022

================= ====== ============== ---------------------------------------------------------------------------

Balance at

1 July 2022 (unaudited) 1,456 132,126 (149,173) 5,245 159,296 86,200 235,150

Profit for the

period - - - - - 14,571 14,571

Other comprehensive

expense for the

period - - - 2,725 - - 2,725

Transactions

with

owners

Share based compensation - - - - - 14 14

------------------------- --------- -------------- ------------ ------------- ---------- ---------- -----------

Total transactions

with owners - - - - - 14 14

------------------------- --------- -------------- ------------ ------------- ---------- ---------- -----------

Balance at

31 December 2022

(audited) 1,456 132,126 (149,173) 7,970 159,296 100,785 252,460

------------------------- --------- -------------- ------------ ------------- ---------- ---------- -----------

Six months to

30 June 2023

-------------------------- -------- ---------- ------------ -------- ---------- ---------- ----------

Balance at

1 January 2023

(audited) 1,456 132,126 (149,173) 7,970 159,296 100,785 252,460

Profit for the

period - - - - - 5,560 5,560

Other comprehensive

income - - - (4,105) - - (4,105)

Transactions

with owners

Share based compensation - - - - - 626 626

Issue of ordinary

shares 1 797 - - - - 798

--------------------------- -------- ---------- ------------ -------- ---------- ---------- ----------

Total transactions

with owners 1 797 - - - 626 1,424

--------------------------- -------- ---------- ------------ -------- ---------- ---------- ----------

Balance at

30 June 2023

(unaudited) 1,457 132,923 (149,173) 3,865 159,296 106,971 255,339

=========================== ======== ========== ============ ======== ========== ========== ==========

H1 22 restatement: The premium on the share for share exchange

as part of a business combination was reclassified to the merger

reserve instead

of the share premium reserve under the Companies Act.

Condensed Consolidated Statement of Cash Flows

Unaudited Unaudited

Six months Six months

ended ended

30 June 30 June

2023 2022

Note GBP'000 GBP'000

------------------------------------------- ----- ------------ ------------

Operating activities

Profit before tax 8,106 11,169

Adjustments for:

Depreciation of property, plant and

equipment 382 355

Depreciation of right-of-use assets 171 222

Amortisation of intangible fixed

assets 7 12,285 8,463

Share of profits of associates 239 -

Share-based compensation 626 440

Finance income (36) (7)

Financial expenses 461 1,000

Decrease/(increase) in trade and

other receivables 9,334 17,757

(Decrease)/increase in trade and

other payables (1,441) (10,555)

Decrease/(increase) in inventory 262 (521)

Increase in provisions 15 15

------------------------------------------- ----- ------------ ------------

Cash generated from operating activities 30,404 28,338

Tax paid (3,328) (3,430)

------------------------------------------- ----- ------------ ------------

Net cash inflow from operating activities 27,076 24,908

------------------------------------------- ----- ------------ ------------

Cash flow from investing activities

Acquisition of subsidiaries (net

of cash acquired) (4,875) (74,313)

Purchase of property, plant and equipment (392) (733)

Purchase of Intellectual Property 7 (7,500) (18,750)

Purchase of other intangibles (875) -

Capitalisation of development costs 7 (18,331) (10,018)

Interest received 36 7

------------------------------------------- ----- ------------ ------------

Net cash outflow from investing

activities (31,937) (103,807)

------------------------------------------- ----- ------------ ------------

Cash flow from financing activities

Interest paid (68) (361)

Proceeds from issues of shares - 76,372

Repayment of lease liabilities (184) (121)

------------------------------------------- ----- ------------ ------------

Net cash (outflow)/inflow from financing

activities (252) 75,890

------------------------------------------- ----- ------------ ------------

Net (decrease)/increase in cash

and cash equivalents (5,113) (3,009)

Cash and cash equivalents at beginning

of period 50,828 55,302

Effect of exchange rates on cash

and cash equivalents (556) (998)

------------------------------------------- ----- ------------ ------------

Cash and cash equivalents at end

of period 45,159 51,295

------------------------------------------- ----- ------------ ------------

Notes to the Condensed Consolidated Interim Financial

Statements

1. Nature of operations and general information

Team17 Group Plc and its subsidiaries (The Group) are a global

games label, creative partner and developer of independent

("indie"), premium video games and developer and publisher of

educational entertainment ("edutainment") apps for children and a

leading working simulation games developer and publisher.

2. Basis of preparation

These condensed consolidated interim financial statements have

been prepared in accordance with the AIM rules and UK adopted IAS

34 "Interim Financial Reporting". The condensed consolidated

interim financial statements for the 6 months ended 30 June 2023

should be read in conjunction with the financial statements of

Team17 Group Plc for the year ended 31 December 2022 (the "Prior

year financial statements") which includes the financial results of

the Group prepared in accordance with international accounting

standards in conformity with the requirements of the Companies Act

2006 ('IFRS') and the applicable legal requirements of the

Companies Act 2006.

The report of the auditors for the prior year financial

statements for the year ended 31 December 2022 was unqualified, did

not contain an emphasis of matter paragraph and did not include a

statement under Section 498 of the Companies Act 2006. The Group's

condensed consolidated interim financial statements are not audited

and do not constitute statutory financial statements as defined in

Section 434 of the Companies Act 2006. These condensed consolidated

interim financial statements were approved for issue on 12

September 2023.

Going concern

Management has produced forecasts that have also been sensitised

to reflect plausible downside scenarios which have been reviewed by

the directors. These demonstrate the Group is forecast to generate

profits and cash in the year ending 31 December 2024 and beyond and

that the Group has sufficient cash reserves to enable the Group to

meet its obligations as they fall due for a period of at least 12

months from the release of these results.

As such, the directors are satisfied that the Group has adequate

resources to continue to operate for the foreseeable future. For

this reason they continue to adopt the going concern basis for

preparing this interim report.

Accounting policies

The Group's principal accounting policies used in preparing this

information are as stated on pages 55 to 63 of the prior year

financial statements. There has been no change to any accounting

policy from the date of the prior year financial statements. A

review of revenue recognition focussing on the recognition of

revenue as either Gross or Net is currently underway recognising

the changing nature of the games sector.

3. Segmental information

The Group has three different operating segments within the

business which are as follows:

-- Games Label - Developing and publishing video games for the digital and physical market.

-- Simulation - Developing and publishing simulation games for

the digital and physical market.

-- Edutainment - Developing educational entertainment apps for children.

The chief operating decision maker ("CODM") of the Group is

considered to be Debbie Bestwick MBE and Mark Crawford, the group

executive directors. The CODM review's the Group's internal

reporting in order to assess performance and allocate resources.

The CODM determines the operating segments based on these reports

and on the internal reporting structure.

The CODM considered the aggregation criteria set out within IFRS

8 "Operating Segments" where two or more operating segments can be

combined for reporting purposes so long as aggregation provides

financial statement users with information to evaluate the business

and the environment in which it operates.

After assessing this criteria, the CODM deems it appropriate for

all three operating segments to be aggregated and reported as a

single segment. Each segment develops and publishes games and apps

using own and third-party IP through similar distribution methods

with similar margins in the same regulatory environments.

Therefore, all figures reported in these results are reported as a

single aggregated reporting segment.

4. Revenue

Whilst the CODM considers there to be only one reportable

segment, the Company's portfolio of games is split between internal

IP (those based on IP owned by the Group) and third-party IP

incurring royalties to the IP owner which are included in cost of

sales. Therefore, to aid the readers understanding of our results,

the split of revenue from these two categories is shown below:

Revenue by Own IP/Third Party IP:

Unaudited Unaudited

Six months Six months

ended ended

30 June 30 June

2023 2022

GBP'000 GBP'000

---------------- ------------ ------------

Own IP 27,031 20,414

Third Party IP 42,677 32,835

------------ ------------

69,708 53,249

============ ============

The Group does not provide any information on the geographical

location of sales as the majority of revenue is through third-party

distribution platforms which are responsible for the data of

consumers.

5. Alternative Performance Measures

Adjusted Profit After Tax

Unaudited

Six months Unaudited

ended Six months

30 June ended

2023 30 June 2022

GBP'000 GBP'000

----------------------------------------- ------------ --------------

Profit before tax 8,106 11,169

Share based compensation 612 (69)

Acquisition-related adjustments

:

Acquisition fees (Admin expenses) 87 550

Fair value movements on acquisition

balances (Admin expenses) 1,797 118

Interest on consideration (Finance

cost) 768 700

Other acquisition-related adjustments

(Admin expenses) (460) 172

Amortisation on acquired intangible

assets (Admin expenses) 4,693 4,683

------------ --------------

Adjusted profit before tax 15,603 17,323

Taxation (net of adjustments

above) (3,227) (3,031)

------------ --------------

Adjusted profit after tax 12,376 14,292

------------ --------------

The share-based compensation figure includes the add back of

Employers' National Insurance contributions due upon exercise of

the share options.

Adjusted EBITDA

Unaudited

Six months Unaudited

ended Six months

30 June ended

2023 30 June 2022

GBP'000 GBP'000

--------------------------------------- ------------ --------------

Profit before tax 8,106 11,169

Amortisation on other intangibles 553 16

Depreciation 644 577

Net interest (343) 293

Share based compensation 612 (69)

Acquisition-related adjustments

:

Acquisition fees 87 550

Fair value movements on acquisition

balances 1,797 118

Interest on consideration 768 700

Other acquisition-related

adjustments (460) 188

Amortisation on acquired

intangible assets 4,693 4,683

------------ --------------

Adjusted EBITDA 16,457 18,225

------------ --------------

Operating cash conversion

Operating cash conversion is defined as cash generated from

operating activities as per the statement of cash flows adjusted to

add back payments made to satisfy pre-acquisition liabilities

recognised under IFRS 3 "Business Combinations", divided by

earnings before interest, tax, depreciation and amortisation

("EBITDA").

Unaudited Unaudited

Six months Six months

ended ended

30 June 30 June

2023 2022

------------------------------- ------------ ------------

Cash generated from operating

activities 30,404 28,338

Payments made to satisfy

pre-acquisition liabilities

recognised under IFRS 3

"Business Combinations" - 1,036

------------ ------------

Adjusted cash generated

from operating activities 30,404 29,374

EBITDA 21,460 21,202

Adjusted operating cash 139%*

conversion 142%

------------ ------------

*The operating cash conversion metric was impacted by the

acquisitions made in the period and the acquired working capital.

After adjusting the metric to remove operating cashflows from

businesses acquired from the operating cash conversion calculation

in the period to 30 June 2022 the figure would have been 111%.

6. Earnings per share

The calculation of the basic earnings per share is based on the

profits attributable to the shareholders of Team17 Group plc

divided by the weighted average number of shares in issue. The

weighted average number of shares takes into account treasury

shares held by the Team17 Employee Benefit Trust. The diluted

earnings per share uses the same calculation however the number of

shares in issue is adjusted to include shares considered to be

dilutive under the treasury stock method. An option is considered

to be dilutive when the total proceeds per option are less than the

average share price for the period.

Unaudited Unaudited

Six months Six months

ended ended

30 June 30 June

2023 2022

------------------------------- ------------ ------------

Profit for the period GBP'000 5,560 8,907

Weighted average number

of shares 143,724,920 137,624,741

Weighted average diluted

number of shares 143,972,343 138,720,958

------------ ------------

Basic earnings per share

(pence) 3.9 6.5

Diluted earnings per share

(pence) 3.9 6.4

------------ ------------

The calculation of adjusted earnings per share is based on the

profit attributable to shareholders as shown in the Statement of

Comprehensive Income plus additional costs added back during the

year as shown in note 5. The weighted average diluted number of

shares includes share options considered to be dilutive under the

treasury stock method as described above.

Unaudited

Six months Unaudited

ended Six months

30 June ended

2023 30 June 2022

--------------------------- ------------ --------------

Adjusted profit for the

period GBP'000 12,375 14,308

Weighted average number

of shares 143,724,920 137,624,741

Weighted average diluted

number of shares 143,972,343 138,720,958

------------ --------------

Adjusted basic earnings

per share (pence) 8.6 10.4

Adjusted diluted earnings

per share (pence) 8.6 10.3

------------ --------------

7. Intangibles

Customer

Development Acquired and Developer Other

costs Brands Apps Relationships Intangibles Goodwill Total

GBP'000 GBP'000 GBP'0000 GBP'000 GBP'000 GBP'000 GBP'000

------------------- -------------- ---------- ----------- --------------- -------------- ----------- ----------

Cost

At 1 January 2022

(audited) 29,597 34,738 6,228 - 107 41,449 112,119

Additions 10,018 43,773 - - - - 53,791

Acquisitions - 2,034 21,716 4,720 - 65,964 94,434

Disposals (440) - - - - - (440)

Translation on

foreign

operations 145 48 407 545 - 3,830 4,975

-------------- ---------- ----------- --------------- -------------- ----------- ----------

At 30 June 2022

(unaudited) 39,320 80,593 28,351 5,265 107 111,243 264,879

Additions 16,014 - - - 11 - 16,025

Translation on

foreign

operations 158 90 1,003 15 6 2,181 3,453

-------------- ---------- ----------- --------------- -------------- ----------- ----------

At 31 December

2022 (audited) 55,492 80,683 29,354 5,280 124 113,424 284,357

Additions 18,823 - - - 875 - 19,698

Acquisitions - - - - 1 2,106 2,107

Disposals (975) - - - - - (975)

Translation on

foreign

operations (317) (92) (920) (252) (18) (3,243) (4,842)

-------------- ---------- ----------- --------------- -------------- ----------- ----------

At 30 June 2023

(unaudited) 73,023 80,591 28,434 5,028 982 112,287 300,345

-------------- ---------- ----------- --------------- -------------- ----------- ----------

Amortisation

At 1 January 2022

(audited) 19,749 10,749 311 - 2 - 30,811

Charge for the

period 2,804 3,097 2,298 248 16 - 8,463

Disposals (440) - - - - - (440)

Translation on

foreign

operations 3 2 43 15 - - 63

============== ========== =========== =============== ============== =========== ==========

At 30 June 2022

(unaudited) 22,116 13,848 2,652 263 18 - 38,897

Charge for the

period 6,473 3,118 1,371 268 - - 11,230

Translation on

foreign

operations 73 7 121 (3) 23 - 221

-------------- ---------- ----------- --------------- -------------- ----------- ----------

At 31 December

2022 (audited) 28,662 16,873 4,144 528 41 - 50,248

Charge for the

period 6,543 3,059 1,879 251 553 - 12,285

Disposals (975) - - - - - (975)

Translation on

foreign

operations (96) (10) (158) (25) (10) - (299)

-------------- ---------- ----------- --------------- -------------- ----------- ----------

At 30 June 2023

(unaudited) 34,134 19,922 5,865 754 584 - 61,259

============== ========== =========== =============== ============== =========== ==========

Net Book Value

At 30 June 2023

(unaudited) 38,889 60,669 22,569 4,274 398 112,287 239,086

------- ------- ------- ------ ---- -------- --------

At 1 January

2023 (audited) 26,830 63,810 25,210 4,752 83 113,424 234,109

======= ======= ======= ====== ==== ======== ========

Included within acquired apps are development costs from the

acquisition of astragon. The amortisation on this asset of GBP0.5m

(H1 2022: GBP1.0m) is treated as development cost amortisation for

the purposes of calculating adjusted EBITDA in note 5.

Acquisition of Independent Arts Software GmbH

On 27 April 2023 astragon Entertainment GmbH acquired 100% of

the share capital of Independent Arts Software GmbH for a maximum

payment of GBP3.1m (EUR3.5m) subject to the seller and Company

meeting certain requirements. The initial payment for the

acquisition was GBP1.8m (EUR2.0m) in cash. A further payment of up

to GBP1.3m (EUR1.5m) is payable in cash based on the seller meeting

certain requirements following completion of the acquisition. There

was no minimum due on the contingent payment. The results of the

business have been included in the Consolidated Statement of Profit

or Loss from the date of acquisition.

Independent Arts Software GmbH is a talented video game

developer based in Germany. The acquisition increases astragon's

development capabilities in the simulation space.

Contingent consideration of GBP1.0m (EUR1.1m) consists of the

payments to the sellers included at fair value and payable based on

them and the Company meeting certain requirements. There has been

no fair value adjustment to contingent consideration post the

acquisition date assessment.

The total consideration for the acquisition was GBP2.8m which is

made up of GBP0.7m of assets and liabilities along with GBP2.1m of

goodwill recognised. The goodwill is attributable to Independent

Arts Software's talented development team. It has been allocated to

the Simulation segment of the business led by astragon

Entertainment GmbH which is the development and publishing of

simulation games for the digital and physical market. None of the

goodwill is expected to be deductible for tax purposes.

Acquisition fees

Total acquisition fees for the period ended 30 June 2023 of

GBP0.1m (2022: GBP0.6m) are included in administrative expenses in

the Income Statement.

Goodwill

The Group tests for impairment annually, or more frequently if

there are indicators that goodwill might be impaired.

8. Share Capital

Unaudited Unaudited

Six months Six months Audited

ended ended Year ended

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

--------------------------------- ------------ ------------ -------------

Authorised, allotted, called

up and fully paid

145,803,620 (2022: 145,593,271)

ordinary shares of 1p each 1,457 1,456 1,456

------------ ------------ -------------

1,457 1,456 1,456

============ ============ =============

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FFFIVAFITLIV

(END) Dow Jones Newswires

September 19, 2023 02:00 ET (06:00 GMT)

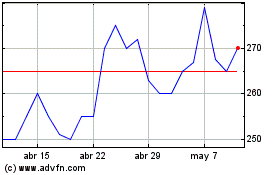

Team17 (LSE:TM17)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Team17 (LSE:TM17)

Gráfica de Acción Histórica

De May 2023 a May 2024