Taylor Maritime Investments Limited Dividend Currency Election (5531J)

17 Agosto 2023 - 1:00AM

UK Regulatory

TIDMTMIP TIDMTMI

RNS Number : 5531J

Taylor Maritime Investments Limited

17 August 2023

16 August 2023

Taylor Maritime Investments Limited

(the "Company")

Dividend Currency Election

An announcement was made on 28 July 2023 regarding the dividend

to be paid on 30 August 2023 and the option for shareholders to

elect to receive this in sterling rather than US dollars.

The dividend rate per share to be used to pay shareholders who

elected to receive their dividend in sterling will be 1.566048

pence per share (2 US cents per share converted into sterling using

a USD/GBP rate of 1.2771).

ENDS

For further information, please contact:

Taylor Maritime Investments IR@tminvestments.com

Limited

Edward Buttery

Camilla Pierrepont

Jefferies International Limited

Stuart Klein

Gaudi Le Roux +44 20 7029 8000

Montfort Communications TMI@montfort.london

Alison Allfrey

George Morris Seers

Sanne Fund Services (Guernsey)

Limited

Matt Falla +44 1481 737600

Notes to Editors

About the Company

Taylor Maritime Investments Limited is an internally managed

investment company listed on the Premium Segment of the Official

List, its shares trading on the Main Market of the London Stock

Exchange since May 2021. The Company specializes in the acquisition

and chartering of vessels in the Handysize and Supra/Ultramax bulk

carrier segments of the global shipping sector. The Company invests

in a diversified portfolio of vessels which are primarily

second-hand. TMI's fleet portfolio numbers 22 vessels in the geared

dry bulk segment. The ships are employed utilising a variety of

employment/charter strategies.

On 20 December, the Company announced it acquired a controlling

majority interest in Grindrod Shipping Holdings Ltd ("Grindrod")

(NASDAQ:GRIN, JSE:GSH), a Singapore incorporated, dual listed

company on NASDAQ and the Johannesburg Stock Exchange. Grindrod

owns 21 geared dry bulk vessels complementary to the Company's

fleet. They are mostly Japanese built, including 13 Handysize

vessels and 8 Supra/Ultramax vessels. Grindrod has seven vessels in

its chartered in fleet with purchase options on four.

The combined TMI and Grindrod fleet numbers 50 vessels

(including chartered in vessels).

The Company's target dividend policy is 8 cents p.a. paid on a

quarterly basis, with a targeted total NAV return of 10-12% per

annum over the medium to long-term.

The Company has the benefit of an experienced Executive Team led

by Edward Buttery and who previously worked closely together at the

Commercial Manager, Taylor Maritime. Established in 2014, Taylor

Maritime is a privately owned ship-owning and management business

with a seasoned team that includes the founders of dry bulk

shipping company Pacific Basin Shipping (listed in Hong Kong

2343.HK) and gas shipping company BW Epic Kosan (formerly Epic

Shipping) (listed in Oslo BWEK:NO). Taylor Maritime's team of

industry professionals are based in Hong Kong, Singapore and

London.

For more information, please visit

www.taylormaritimeinvestments.com .

About Geared Vessels

Geared vessels are characterised by their own loading equipment.

The Handysize and Supra/Ultramax market segments are particularly

attractive, given the flexibility, versatility and port

accessibility of these vessels which carry necessity goods -

principally food and products related to infrastructure building -

ensuring broad diversification of fleet activity and stability of

earnings through the cycle.

IMPORTANT NOTICE

The information in this announcement may include forward-looking

statements, which are based on the current expectations and

projections about future events and in certain cases can be

identified by the use of terms such as "may", "will", "should",

"expect", "anticipate", "project", "estimate", "intend",

"continue", "target", "believe" (or the negatives thereon) or other

variations thereon or comparable terminology. These forward-looking

statements are subject to risks, uncertainties and assumptions

about the Company, including, among other things, the development

of its business, trends in its operating industry, and future

capital expenditures and acquisitions. In light of these risks,

uncertainties and assumptions, the events in the forward-looking

statements may not occur.

References to target dividend yields and returns are targets

only and not profit forecasts and there can be no assurance that

these will be achieved.

LEI: 213800FELXGYTYJBBG50

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DIVUNANROAUWAAR

(END) Dow Jones Newswires

August 17, 2023 02:00 ET (06:00 GMT)

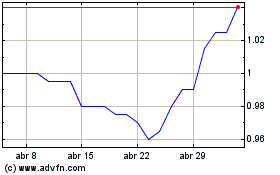

Taylor Maritime Investme... (LSE:TMI)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Taylor Maritime Investme... (LSE:TMI)

Gráfica de Acción Histórica

De May 2023 a May 2024