TIDMTRIN

RNS Number : 0778K

Trinity Exploration & Production

22 August 2023

22 August 2023

Trinity Exploration & Production plc

('Trinity' or the 'Company' or the 'Group')

V esting of the 201 9 Annual Award under the Long Term Incentive

Plan ("LTIP")

and

Grant of 2022 Annual LTIP Awards

Trinity Exploration & Production plc (AIM: TRIN), the

independent E&P company focused on Trinidad and Tobago,

announces on 21 August 2023 the vesting of awards made under the

LTIP Award granted on 25 June 2020 ("2019 LTIP Awards") and new

awards granted under the LTIP.

2019 LTIP Awards

On 25 June 2020 the Company issued Awards under the LTIP to

Management in respect of performance during the financial year

ended 31 December 2019 (the "2019 Annual Award"). The Company

granted options over 381,586 ordinary shares (amounts restated to

reflect the Share Consolidation) which, subject to meeting the set

performance criteria, vested on 02 January 2023 to those

participants who remained in employment with the Company at the

time of vesting.

The Awards are subject to the achievement of relative Total

Shareholder Return ("Relative TSR") performance targets measured

over a three year performance period ending on 31 December 2022.

The Relative TSR ranking was determined by calculating the three

month average TSR to the end of the performance period and dividing

this by the three month average TSR to the beginning of the

performance period for all companies in the agreed comparator

group. Companies were ranked on this basis with the highest

performing company ranked first.

Based on the performance targets, 70.53% (249,655) of the

options vested, including the vesting of 55,809 options to Jeremy

Bridglalsingh, Chief Executive Officer.

The Options are exercisable at nil cost by the participants and

remain available to be exercised until 1 January 2026.

LTIP Award Granted on 21 August 2023

The Company announces that 565,000 options have been granted

under the LTIP in respect of the Company's performance in the year

to 31 December 2022 (the "2022 LTIP Award"), including 100,000

options granted to Jeremy Bridglalsingh, Chief Executive Officer,

175,000 options granted to Julian Kennedy, Chief Financial Officer

, (CFO) (of which 100,000 are one-off options granted on joining

the Board), and 100,000 one-off options granted to the new Chief

Operating Officer , (COO) who joined earlier this year. The 2022

Annual LTIP Award represents 1.42 % of the Company's current issued

share capital. Excluding the one-off options issued to the CFO and

COO concerning their appointments, the 2022 Annual LTIP Award

represents 0.91 per cent of the current issued share capital of the

Company.

The performance targets set for awards made under the 2022

Annual LTIP Award will be measured considering both the Company's

absolute TSR performance and the Company's relative TSR performance

over a three year period, commencing with the current financial

year of the Company (i.e. a measurement period of 1 January 2023 to

31 December 2025). TSR calculations will be determined by reference

to the three month average closing price prior to the start and end

of the measurement period. The three month average closing price at

the start of the performance period for the 2022 Annual LTIP Award

was GBP 1.15.

The performance targets provide that:

-- No portion of a distinct one-half of the 2022 Annual LTIP

Award (the "Absolute TSR Part") may vest unless the Company's

compound annual growth rate of TSR over the performance period is

at least 10% p.a., for which 30% of the Absolute TSR Part may vest,

rising on a straight line basis for full vesting of the Absolute

TSR Part if the Company's compound annual growth rate of TSR over

the performance period equals or exceeds 20% p.a.

-- No portion of the other distinct one-half of the 2022 Annual

LTIP Award (the "Relative TSR Part") may vest unless the Company's

TSR over the performance period ranks at least median relative to

the TSR performance within a comparator group of companies, for

which 30% of the Relative TSR Part may vest, rising on a straight

line basis for full vesting of the Relative TSR Part if the

Company's TSR over the performance period ranks upper quartile or

better relative to the TSR performance within a comparator group.

However, an underpin term applies to the Relative TSR Part which

provides that, regardless of relative TSR performance, no vesting

may ordinarily accrue in respect of the Relative TSR Part unless

the Company's compound annual growth rate of TSR over the

performance period is at least 10% per annum.

The Relative TSR Comparator Group has been determined in 2021 as

follows:

-- FTSE AIM All Share Oil & Gas constituents.

-- Market capitalisation of between GBP 20 million and GBP 400 million.

-- Exploration & Production operations, excluding oil

equipment and service, pure-play exploration and alternative energy

companies.

For 2023, the same companies will be used which form a

comparator group of some 30 companies.

The earliest vesting date for the 2022 Annual LTIP Award will be

1 January 2026.

The Remuneration Committee believes that the Company's LTIP

continues to be an important tool for aligning the interests of the

Trinity Executive Management Team with those of shareholders.

The Company noted that the TSR is being determined by

calculating the three month average closing price rather than using

the three month volume weighted average price, as previously

communicated. Since there is minimal difference between the two and

the former is also industry practice, going forward, the three

month average closing price will be used to determine if TSR

performance criteria are met.

The information set out below is provided in accordance with the

requirements of Article 19(3) of the UK Market Abuse

Regulations.

1 Details of the person discharging managerial responsibilities/person closely associated

a) Name Jeremy Bridglalsingh

-------------------------------------------------------- -------------------------------------------------------

2 Reason for the notification

-----------------------------------------------------------------------------------------------------------------

a) Position/status Chief Executive Officer

-------------------------------------------------------- -------------------------------------------------------

b) Initial notification/Amendment Initial notification

-------------------------------------------------------- -------------------------------------------------------

3 Details of the issuer, emission allowance market participant, auction platform, auctioneer

or auction monitor

-----------------------------------------------------------------------------------------------------------------

a) Name Trinity Exploration & Production plc

-------------------------------------------------------- -------------------------------------------------------

b) LEI 213800WHW7571LAEDG63

-------------------------------------------------------- -------------------------------------------------------

4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii)

each type of transaction; (iii) each date; and (iv) each place where transactions have been

conducted

-----------------------------------------------------------------------------------------------------------------

a) Description of the financial instrument, type of Ordinary shares of USD 0.01 per share par value

instrument

Identification code

GB00BN7CJ686

-------------------------------------------------------- -------------------------------------------------------

b) Nature of the transaction Grant of Options under the Trinity Exploration &

Production plc Long-Term Incentive Plan

-------------------------------------------------------- -------------------------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

Nil 100,000

----------

-------------------------------------------------------- -------------------------------------------------------

d) Aggregated information- Aggregated volume

- Price 100,000 ordinary shares of USD 0.01 per share par

value

Nil consideration

-------------------------------------------------------- -------------------------------------------------------

e) Date of the transaction 21 August 2023

-------------------------------------------------------- -------------------------------------------------------

f) Place of the transaction Outside a trading venue

-------------------------------------------------------- -------------------------------------------------------

1 Details of the person discharging managerial responsibilities/person closely associated

a) Name Julian Kennedy

-------------------------------------------------------- -------------------------------------------------------

2 Reason for the notification

-----------------------------------------------------------------------------------------------------------------

a) Position/status Chief Financial Officer

-------------------------------------------------------- -------------------------------------------------------

b) Initial notification/Amendment Initial notification

-------------------------------------------------------- -------------------------------------------------------

3 Details of the issuer, emission allowance market participant, auction platform, auctioneer

or auction monitor

-----------------------------------------------------------------------------------------------------------------

a) Name Trinity Exploration & Production plc

-------------------------------------------------------- -------------------------------------------------------

b) LEI 213800WHW7571LAEDG63

-------------------------------------------------------- -------------------------------------------------------

4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii)

each type of transaction; (iii) each date; and (iv) each place where transactions have been

conducted

-----------------------------------------------------------------------------------------------------------------

a) Description of the financial instrument, type of Ordinary shares of USD 0.01 per share par value

instrument

Identification code

GB00BN7CJ686

-------------------------------------------------------- -------------------------------------------------------

b) Nature of the transaction Grant of Options under the Trinity Exploration &

Production plc Long-Term Incentive Plan

-------------------------------------------------------- -------------------------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

Nil 175,000

----------

-------------------------------------------------------- -------------------------------------------------------

d) Aggregated information- Aggregated volume

- Price 175,000 ordinary shares of USD 0.01 per share par

value

Nil consideration

-------------------------------------------------------- -------------------------------------------------------

e) Date of the transaction 21 August 2023

-------------------------------------------------------- -------------------------------------------------------

f) Place of the transaction Outside a trading venue

-------------------------------------------------------- -------------------------------------------------------

Enquiries:

Trinity Exploration & Production plc Via Vigo Consulting

Jeremy Bridglalsingh, Chief Executive Officer

Julian Kennedy, Chief Financial Officer

Nick Clayton, Non- Executive Chairman

SPARK Advisory Partners Limited

(Nominated Adviser and Financial Adviser)

Mark Brady

James Keeshan +44 (0)20 3368 3550

Cenkos Securities PLC (Broker)

Leif Powis +44 (0)20 7397 8900

Neil McDonald +44 (0)131 220 6939

Vigo Consulting Limited t rinity @vigoconsulting.com

Finlay Thomson / Patrick d'Ancona +44 (0)20 739 0 0230

About Trinity ( www.trinityexploration.com )

Trinity is an independent oil production company focused solely

on Trinidad and Tobago. Trinity operates producing and development

assets both onshore and offshore, in the shallow water West and

East Coasts of Trinidad. Trinity's portfolio includes current

production, significant near-term production growth opportunities

from low-risk developments and multiple exploration prospects with

the potential to deliver meaningful reserves/resources growth. The

Company operates all of its ten licences and, across all of the

Group's assets, management's estimate of the Group's 2P reserves as

at the end of 2022 was 17.96 mmbbls. Group 2C contingent resources

are estimated to be 48.88 mmbbls. The Group's overall 2P plus 2C

volumes are therefore 66.84 mmbbls.

Trinity is quoted on AIM, a market operated and regulated by the

London Stock Exchange Plc, under the ticker TRIN.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCZZGZRRZVGFZG

(END) Dow Jones Newswires

August 22, 2023 04:30 ET (08:30 GMT)

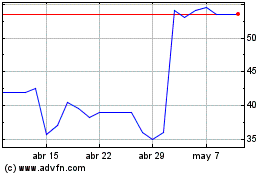

Trinity Exploration & Pr... (LSE:TRIN)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Trinity Exploration & Pr... (LSE:TRIN)

Gráfica de Acción Histórica

De May 2023 a May 2024