TIDMTRT

RNS Number : 4388N

Transense Technologies PLC

25 September 2023

The information communicated within this announcement is deemed

to constitute inside information as stipulated under the Market

Abuse Regulations (EU) No. 596/2014 which is part of UK law by

virtue of the European Union (withdrawal) Act 2018. Upon the

publication of this announcement, this inside information is now

considered to be in the public domain.

25 September 2023

Transense Technologies plc

("Transense" or the "Company")

Final results for the year ended 30 June 2023

& notice of investor presentation

Transense Technologies plc (AIM: TRT), the provider of

specialist sensor systems, announces its final results for the year

ended 30 June 2023.

The Board of Transense is pleased to announce substantial

increases in revenue and profitability, and further considerable

progress in the development of commercial pipeline opportunities.

The Company has achieved the strategic objectives set out in 2020,

and now sets out commercial and financial goals for the medium term

to 2028.

The directors consider that there are positive market drivers

across all key target market sectors which provide ample

opportunity to expand, despite current uncertain economic

conditions, and Transense is investing in technology, equipment and

human resources in order to build strategic and sustainable long

term shareholder value.

Financial highlights:

-- Revenue up 34% to GBP3.53m (FY22: GBP2.63m)

-- iTrack royalty increased 29% to GBP2.01m (FY22: GBP1.56m)

-- Translogik probe revenue up 17% to GBP1.03m (FY22: GBP0.88m)

-- SAW revenue up 146% to GBP0.49m (FY22: GBP0.20m) with further

substantial increases in activity from prospective customers

-- Adjusted profit before taxation of GBP1.09m (FY22: GBP0.27m) *

-- Earnings per share up more than 64% to 8.81 pence (FY22: 5.36 pence)

-- Cash and cash equivalents at year end of GBP0.98m (FY22: GBP1.06m)

-- Completed share buybacks of GBP0.40m (FY22: GBP0.30m)

-- Distributable reserves at year end of GBP2.90m (FY22: GBP1.20m)

*Before exceptional administrative expenses

Executive Chairman of Transense, Nigel Rogers, said:

"We are pleased to report these results, showing continued

growth and our strategy delivering. We have visibility of several

exciting growth opportunities for Translogik and are now adding an

experienced and successful business development leader with sole

focus on the delivery of greater scale and reach.

"There has been a rapid expansion of market awareness at

SAWsense, and an increasing intensity of funded development

projects.

"We now believe that we have built a dynamic leadership group

within the executive team, with the requisite skills, experience

and networks to deliver further step changes in results in coming

years."

Investor Presentation: 4pm, Monday 25 September 2023

Nigel Rogers (Executive Chairman) and Melvyn Segal (Chief

Financial Officer) will provide a presentation to review the

Company's results and prospects at 4pm on Monday 25 September 2023.

The presentation will be hosted through the online platform

Investor Meet Company.

To attend the presentation, investors can sign up to Investor

Meet Company for free and select to meet Transense Technologies plc

via the following link:

https://www.investormeetcompany.com/transense-technologies-plc/register-investor

. Investors who have already registered and selected to meet the

Company will automatically be invited to the presentation.

Questions can be submitted before the event to

transense@walbrookpr.com or in real time during the presentation

via the "Ask a Question" function.

For further information please visit www.transense.com or

contact:

Transense Technologies plc Tel: Via Walbrook PR

Nigel Rogers (Executive Chairman)

Melvyn Segal (CFO)

Allenby Capital (Nominated Adviser and Tel: +44 (0)20 3328

Broker) 5656

Jeremy Porter/George Payne (Corporate Finance)

Tony Quirke/Stefano Aquilino (Sales & Corporate

Broking)

Walbrook PR Tel: +44 (0)20 7933

Tom Cooper/Nick Rome 8780

Transense@walbrookpr.com

Notes to Editors:

Transense is a developer of specialist wireless sensor systems

used to enable real-time data gathering and monitoring. Products

include the patent protected Surface Acoustic Wave (SAW) sensor

technology, used to improve equipment power, performance,

reliability and efficiency; iTrack, Transense 's Tyre Pressure

Monitoring System, licensed to Bridgestone Corporation, the world's

largest tyre producer, under a ten-year deal in June 2020; and a

range of intelligent tyre monitoring equipment under the Translogik

brand. Target sectors include aerospace, electric motors &

drives, industrial machinery and performance automotive.

The Company's strategy is to maximise shareholder value through

the delivery of sustained revenue growth from all three principal

technologies - SAW, iTrack and Translogik probes - through

leveraging excellence in innovation, know-how in commercialising

technologies, industry partnerships and exposure to global growth

markets.

Transense is headquartered in Oxfordshire, UK, and was admitted

to trading on AIM, a market operated by the

London Stock Exchange (AIM: TRT), in 1999. www.transense.com

For further information please contact transense@walbrookpr.com .

CHAIRMAN'S STATEMENT

The Company has delivered excellent results with revenues up by

one third and pre tax profits (before exceptional administrative

costs) up fourfold. The potential to continue on this trajectory is

underpinned by a healthy pipeline of new business opportunities,

giving the directors confidence in the prospects for Transense.

Business strategy

The business strategy of the Company remains to develop

innovative sensing solutions across a range of applications, which

are commercialised either through the launch of products and

services to customers or by forming strategic alliances with

partner organisations. Value is realised through a combination of

commercial income, royalties, licensing income and capital gains on

disposals.

There are currently two active business segments: Translogik and

SAWsense. Translogik develops and supplies smart, connected tyre

monitoring equipment for the commercial truck and bus market, and

SAWsense designs and supplies advanced sensor solutions for

accurate non-contact measurement of torque, force, pressure and

temperature for aerospace, electric motors and drives (EMD),

industrial machinery and high performance automotive sectors. In

addition, the company earns residual royalty income from iTrack, a

system developed by the company for monitoring mining haul tyre

performance which was licenced to Bridgestone Corporation for a ten

year period expiring in 2030.

The directors consider that there are positive market drivers

across all of our key target market sectors which provide ample

opportunity to expand both businesses, despite current uncertain

economic conditions. We are investing in technology, equipment and

human resources across both active business segments in order to

secure greater access to the target markets and build strategic and

sustainable long term shareholder value.

Results for the year

Revenues for the year increased by 34% to GBP3.53m (FY22:

GBP2.63m), with SAWsense up 146% and Translogik up 17%. Royalty

income from iTrack increased by 29%, reflecting an expected

improvement in the second half of the year. Gross margin improved

to 87% of revenue (FY22: 85%) amounting to GBP3.05m (FY22:

GBP2.23m).

Administrative expenses increased a modest amount to GBP2.09m

(FY22: GBP1.97m), before exceptional severance costs of GBP0.22m.

Earnings before Interest, Taxation, Depreciation and Amortisation

(EBITDA) adjusted for the charge for exceptional costs and

share-based payments was GBP1.40m (FY22: GBP0.62m), and the

adjusted net profit before taxation (excluding exceptional costs)

was GBP1.09m (FY22: GBP0.27m).

There was a credit for taxation of GBP0.53m (FY22: GBP0.61m)

arising from the increase in the deferred taxation asset relating

to the use of previous years' tax losses in the future, reflecting

a future forecast period of two years which is in line with the

basis adopted in the prior year. In total, the Company has UK tax

losses available to carry forward at 30 June 2023 in excess of

GBP21m, which are available for offset against future profits

subject to HMRC agreement, of which approximately GBP4.70m is

currently recognised for deferred taxation purposes (FY22:

GBP2.58m).

The resulting net total comprehensive income attributable to

equity shareholders was GBP1.40m (FY22: GBP0.88m) resulting in

earnings per share (EPS) of 8.81 pence (FY22: 5.36 pence).

The adjusted EPS before exceptional administrative costs was

10.20 pence.

The Company's financial position strengthened further during the

year with net assets increasing to GBP4.19m (FY22: GBP3.09m) as a

result of the retention of net profits after taxation. Net

available cash balances amounted to GBP0.98m (FY22: GBP1.06m), and

the final quarter royalty income on iTrack receivable on 31 July

2022 stood at GBP0.54m (FY22: 0.47m).

Net cash generated from operations amounted to GBP0.65m (FY22:

GBP0.41m). This was re-invested in capital expenditure of GBP0.26m

(FY22: GBP0.10m) and in the share buy-back programme during the

year totaling GBP0.41m (FY22: GBP0.30m). The directors anticipate

that the Company will continue to be cash generative for the

foreseeable future and will accumulate further cash balances well

in excess of the ongoing and any proposed new buy-back

programme.

Mid-term financial goals 2023-28

Mid-term financial goals for the Company's businesses were last

set out in June 2020, immediately following the completion of the

iTrack licence with Bridgestone. Since that time, financial results

have been in line with or ahead of our expectations.

The directors now consider it an appropriate time to set out new

mid-term goals for the company for the period 2023 to 2028. During

this period it is anticipated that the iTrack licence income will

continue to show healthy growth before reaching a peak in the year

ending 30 June 2025. The increase in the number of installations

thereafter is unlikely to fully offset the reduction in the unit

royalty rate, and the annual royalty in the year to 30 June 2026 is

expected to reduce to a level comparable with the year ended 30

June 2023.

The directors are confident that prospects in each of the two

active business segments will be such that the Company can maintain

the overall level of profitability and earnings despite any

reduction in the level of iTrack royalty revenues.

Segmental review

Translogik tyre monitoring

Our range of tyre monitoring equipment marketed under the

Translogik brand generated revenue of GBP1.03m; an increase of

almost 17% over the prior year (FY22: GBP0.88m), and the segmental

result was up by 17% to GBP0.42m (FY22: GBP0.36m).

The road haulage and transport logistics sector continues to

experience strong volume growth yet is also subject to intense

competitive pressure to reduce unit costs and optimise asset

utilisation. In parallel, however, operators are subject to

increasing road safety regulations, including the mandatory use of

tyre pressure monitoring systems (TPMS) in the EU from 2024 and the

US from 2028. These add to the existing regulations for mandatory

vehicle inspections and digital record keeping, and the increasing

adoption of radio frequency identification tags (RFID) for tyre

inventory management.

All of these challenges can be managed efficiently through the

use of Translogik tyre monitoring equipment, which digitises key

tyre data to integrate into a fleet management platform. We have a

robust blue chip customer base of global tyre manufacturers upon

which to build, lending credibility to the effectiveness and

reliability of our equipment.

The directors estimate that there is an addressable market for

fleet management tools exceeding US$25m per annum, and this leads

us to believe that Translogik provides the capacity to accelerate

segmental revenue in the next three to five years. Accordingly, we

have recently secured the appointment of a dedicated business

development director to lead this activity who has the breadth of

knowledge and established network of contacts to deliver step

change when he takes up this new role shortly.

SAWsense

SAWsense revenues more than doubled to GBP0.49m (FY22: GBP0.20m)

and with operating overheads almost unchanged the net loss (before

exceptional costs) for the segment reduced by 33% to GBP0.55m

(FY22: GBP0.82m). During the year, changes were implemented to the

segmental management structure to better align the senior team to

customer needs, which is now led by Ryan Maughan as Business

Development Director and Andy Bullock as Technical Director.

Our market approach for SAW technology continues to focus on

four sectors in which there are applications with clear

differentiated benefits, and we have made good progress in each

during the year.

Target market sectors for SAWsense:

Aerospace

The aerospace sector is undergoing a period of profound change

driven by the need to reduce the environmental impact of air

travel, and opportunities to expand the sector through new and

innovative platforms for electrified urban air mobility (UAM). This

has created intense development activity by established market

leaders and new entrants, focused on developing cleaner and more

efficient conventional aircraft, and on the feasibility of new

propulsion systems including all-electric, hybrid electric and

hydrogen fuel cell technology.

In the past twelve months, we have doubled the number of

potential customers with whom we are working to introduce SAW

technology into aerospace applications from seven to fourteen.

These include GE Aerospace, to whom we have granted existing

licences, and Parker Meggitt who are subject of a Memorandum of

Understanding signed in September 2022 with the shared intention of

agreeing terms for a licence before the end of 2023. Discussions

with Parker Meggitt are ongoing, and a further update will be

provided in due course. In addition, there are several other

potential customers in this sector whose involvement is covered by

confidentiality agreements .

The case for using SAW torque sensing has been proven for

helicopter engines, and there are now live development activities

for use in electric actuator force and torque control, and torque

in hybrid generation systems and advanced open rotor engines. In

addition, there are other opportunities to introduce SAW for use in

electric propulsion motors for aerospace applications, as well as

torque, pressure and/or temperature measurement for a variety of

other airframe and propulsion systems.

The aircraft sensor market was estimated to be valued at US$4bn

in 2021, with forecast compound annual growth at a rate of 8% in

the period to 2028. The directors believe that a realistic goal for

annual revenue from development, engineering services and component

supply into this sector by SAWsense could lie in the range US$5-10m

by 2030.

Industrial Machinery (including Off-Highway Vehicles and

Robotics)

The use of SAW sensing technology for torque and/or temperature

can improve accuracy, efficiency and power distribution in

industrial machinery ranging from robots to agricultural equipment.

Enhanced sensing is also required to enable more autonomous

operation of machinery.

During the year, SAWsense technology underwent rigorous trials

by a major producer of agricultural machinery. The project was

completed on schedule and validated the accuracy and reliability of

the resulting data. Whilst this is expected to strengthen the

business case for the use of SAW, this was an advanced research and

technology program and work continues to explore production

applications for the technology. A number of other off-highway

OEM's have also expressed interest and are at an early stage of

engagement in information exchange under NDA. We believe that the

addressable market for torque and temperature sensors in this

sector exceeds US$25m per annum.

The global market for force and torque sensors for industrial

robotics was estimated to be worth US$300m in 2022 and was forecast

to grow to more than US$650m by 2028. Engagement with a select

group of leading companies in this industry indicates that SAW

technology can provide an improved way to measure torque and

temperature in a robotic system, increasing the speed and accuracy

of the robot by reducing joint flex and motor jitter. This in turn

offers increased load capacity and productivity, because of this we

believe that this valuable differentiation results in more than

US$50m per annum of the robot torque sensor market to be

addressable by our technology by 2028.

Motorsport and high-performance vehicles

SAWsense continues to work closely in the premium motor sport

sector with our joint collaboration agreement partner, McLaren

Applied. During the year, use of SAW was extended beyond its roots

in IndyCar to the Le Mans Daytona Hybrid series of endurance

racing. There are further opportunities to extend to additional

championships at proposal stage, with the outcome expected in the

final quarter of 2023.

SAW has proven to be more accurate and reliable than competitor

systems and offers a lower lifecycle cost to event organisations

and race teams. Whilst motorsport is a niche sector, we estimate

that the addressable market for motorsport torque measurement

exceeds US$25m per annum and believe that there are unique

characteristics in our technology to be successful.

Success in these motor sport applications demonstrates the

performance and reliability of the technology in harsh operating

conditions.

Electric Motors and Drives (EMD)

The drive to reduce global dependency on fossil fuels is heavily

dependent on the development and commercialisation of efficient

electric motors and drives across a broad range of transport and

industrial applications. Using SAW technology offers access to

real-time torque and temperature data to improve performance,

efficiency, range and functional safety, and provides opportunity

to reduce material costs, particularly of rare earth materials in

permanent magnet motors.

Unlike our other key target sectors, the use of real time torque

data to control electric motors and drives is not common practice,

and instead controls are reliant upon traditional torque estimation

methods with roots going back decades. During the year we have

contracted a leading engineering consultancy to carry out a program

of simulation work to demonstrate the benefits of using real time

actual torque in the control loop, with good results.

In the current year, these findings will be expanded by

conducting live trials on a demonstration test rig, and we

anticipate that this activity will generate opportunities to expand

our intellectual property portfolio further and to build a platform

for commercial advancement.

Business development activities

Throughout the year there has been an increasing volume of

inbound enquiries across all of our main target markets, mostly

driven by the increased awareness of the benefits of our technology

from marketing assets such as on-line video content, conference

presentations and trade show attendance.

Discussions with Parker Meggitt are ongoing, a further update

will be provided in due course. There are several other potential

customers in this sector whose involvement is covered by

confidentiality agreements.

Enquiries are carefully vetted, and those which meet our

qualification criteria enter a standardised process through a

number of stage gates. Passage through this mechanism can take

several months before reaching agreement on a funded development

project to instrument a demonstration unit and carry out

performance assessment. Beyond that, there are many other factors

to evaluate (including for example productionisation methods,

supply chain and associated cost) before customers are ready to

commit to full scale commercial implementation.

Overall, it is realistic to expect that achieving volume

production in highly regulated markets such as aerospace and

automotive will take three to five years, during which period

customers will have the capacity and willingness to fund further

development work.

This process has been underway for more than one year, and

progress has been made both in the number of active qualified

enquiries (which has more than doubled from 24 to 57), and the

depth of engagement indicated by moving to towards funded

development (which has also doubled from 6 to 13). Full details are

as follows:

Status of potential customers by sector as at September 2023

(September 2022)

Electric Industrial Performance

Aerospace Motors & Machinery Automotive Total

Drives

Stage 4 - Contracted 1 (1) 0 (0) 0 (0) 1 (1) 2 (2)

------------ ---------- ----------- ------------ --------

Stage 3 - Contract

under negotiation 2 (1) 0 (0) 0 (0) 0 (0) 2 (1)

------------ ---------- ----------- ------------ --------

Stage 2 - In development 1 (1) 3 (1) 1 (1) 1 (0) 6 (3)

------------ ---------- ----------- ------------ --------

Stage 1a - Development

project in planning 3 (0) 2 (2) 1 (1) 1 (0) 7 (3)

------------ ---------- ----------- ------------ --------

Stage 1b - Active

enquiry 7 (4) 24 (8) 8 (3) 1 (0) 40 (15)

------------ ---------- ----------- ------------ --------

Total 14 (7) 29 (11) 10 (5) 4 (1) 57 (24)

------------ ---------- ----------- ------------ --------

iTrack royalty income

Royalty income from iTrack generated income of GBP2.01m during

the year, representing an increase of 29% over the prior year

(FY22: GBP1.56m). By the end of the year, the installed base had

risen to almost four times that which prevailed at the outset of

the licence, and the annualised royalty run rate had increased to

$2.92m, compared with $2.26m, representing a 29% increase over the

prior year.

Bridgestone Corporation, Japan, continues to indicate that

iTrack is a key strategic component of their mobility solutions

business and express confidence in the future growth potential for

this technology.

Board structure and composition

In May 2023, Steve Parker joined the Board as an independent

non-executive director. He is a highly experienced board director

with an enviable track record of leading and advising businesses

across the technology, automotive and transportation sectors. The

Company has already benefited greatly from his expertise and

judgement, and I am grateful for his valuable support.

Rodney Westhead has indicated that he intends to retire from the

Board following the appointment of an appropriate independent

non-executive director and chair of audit committee to replace him.

He has served as a director since 2007 and has made an invaluable

contribution over many years, especially more recently as the

commercialisation of SAW technology has come to the forefront of

the Company's strategy. The directors intend to appoint a suitable

successor during the current financial year.

Distribution policy

Since February 2022, when the Company first announced the

commencement of a programme to conduct market purchases of ordinary

shares of 10 pence each in the Company, a total of 935,356 ordinary

shares have been acquired for treasury at an average price of 80

pence each (including 40,000 post year end).

During the financial year the share price fluctuated between

48.5 pence and 95.5 pence, and averaged approximately 80 pence. The

directors continue to view the Company's shares as undervalued at

this level and will execute further market purchases when suitable

opportunities arise, subject to the renewal of shareholder approval

for such action at the upcoming Annual General Meeting.

The board has given careful consideration to the relative merits

of share buybacks as an alternative form of distribution over the

payment of dividends. On balance, share buybacks are considered to

be more flexible and tax efficient, and are the preferred mechanism

for the majority of shareholders by both number and value.

Accordingly, the directors do not recommend the payment of a

dividend at the present time.

Current trading and outlook

In the first two months of trading since the end of the

financial year revenues have increased year on year by 16%, and the

commercial pipeline in both Translogik and SAWsense continue to

expand.

Royalties from iTrack have increased almost fourfold since

inception in 2020, and with seven years of the licence to run it is

expected to provide more than sufficient cash income to enable

further significant investment in both SAWsense and Translogik and

deliver strong returns to shareholders.

We have visibility of several exciting growth opportunities for

Translogik and are now adding an experienced and successful

business development leader with sole focus on the delivery of

greater scale and reach.

There has been a rapid expansion of market awareness at

SAWsense, and an increasing intensity of funded development

projects. Taken together with the potential to add depth, breadth

and longevity to the intellectual property portfolio of this

segment, the directors are confident of achieving a financially

self-sustaining business model with substantial strategic

value.

We now believe that we have built a dynamic leadership group

within the executive team, with the requisite skills, experience

and networks to deliver further step changes in results in coming

years.

Nigel Rogers

Executive Chairman

25 September 2023

Consolidated Statement of Comprehensive Income

For the year ended 30 June 2023

Year ended Year ended

30 June 30 June

2023 2022

GBP'000 GBP'000

Revenue 3,529 2,632

Cost of sales (474) (398)

---------------------------------------------- ----------------------------------------------

Gross profit 3,055 2,234

Administrative

expenses (2,086) (1,970)

Exceptional (220) -

administrative

expenses

---------------------------------------------- ----------------------------------------------

Operating Profit 749 264

Financial

income/(expense) 4 (12)

Other income 113 16

---------------------------------------------- ----------------------------------------------

Profit before

taxation 866 268

Taxation 530 609

---------------------------------------------- ----------------------------------------------

Profit and total

comprehensive

income

for the year

attributable 1,396 877

To the equity

holders of the

parent ---------------------------------------------- ----------------------------------------------

Basic profit per

share for the year

(pence) 8.81 5.36

============================================== =============================================

Consolidated Balance Sheet

At 30 June 2023

At 30 June At 30 June

2023 2023 2022 2022

GBP'000 GBP'000 GBP'000 GBP'000

Non current assets

Property, plant and

equipment 154 167

Intangible assets 731 671

Deferred tax 1,175 645

---------------------------------------------- ----------------------------------------------

2,060 1,483

Current assets

Inventories 260 88

Trade and other

receivables 1,263 1,133

Cash and cash

equivalents 978 1,055

---------------------------------------------- ----------------------------------------------

2,501 2,276

---------------------------------------------- ----------------------------------------------

Total assets 4,561 3,759

Current liabilities

Trade and other

payables (334) (560)

Lease liabilities (36) (65)

---------------------------------------------- ----------------------------------------------

(370) (625)

Non current liabilities

Lease liabilities - (42)

---------------------------------------------- --------------------------------------

Total liabilities (370) (667)

---------------------------------------------- --------------------------------------

Net assets 4,191 3,092

============================================= =====================================

Equity

Issued share capital 1,644 1,644

Share premium 65 65

Treasury Shares (708) (303)

Share based payments 288 180

Retained

earnings/(accumulated

loss) 2,902 1,506

---------------------------------------------- ----------------------------------------------

Total equity 4,191 3,092

============================================== ==============================================

Consolidated Statement of Changes in Equity

For the year ended 30 June 2023

Share Share Share Retained Treasury Total

capital premium based earnings Shares Equity

payments

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 July

2021 1,631 - 82 629 - 2,342

Comprehensive

income for

the year:

Profit for the

year - - - 877 - 877

Share based

payment - - 98 - - 98

Warrants

exercised 13 65 - - - 78

Treasury shares - - - - (303) (303)

------------------------------ ---------------------------------------------- ---------------------------------------------- ---------------------------------------------- ---------------------------------------------- ----------------------------------------------

Balance at 30

June 2022 1,644 65 180 1,506 (303) 3,092

------------------------------ ---------------------------------------------- ---------------------------------------------- ---------------------------------------------- ---------------------------------------------- ----------------------------------------------

Share Share Share Retained Treasury Total

capital premium based earnings Shares Equity

payments

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 July

2022 1,644 65 180 1,506 (303) 3,092

Comprehensive

income for

the year:

Profit for the

year - - - 1,396 - 1,396

Share based

payment - - 108 - - 108

Treasury shares - - - - (405) (303)

------------------------------ ---------------------------------------------- ---------------------------------------------- ---------------------------------------------- ---------------------------------------------- ----------------------------------------------

Balance at 30

June 2022 1,644 65 288 2,902 (708) 4,191

------------------------------ ---------------------------------------------- ---------------------------------------------- ---------------------------------------------- ---------------------------------------------- ----------------------------------------------

Consolidated Cash Flow Statement

For the year ended 30 June 2023

Year ended Year ended

30 June 30 June

2023 2022

GBP'000 GBP'000

Profit/(loss) from

operations 1,396 877

Adjustments for:

Taxation (530) (609)

Net financial

(income)/expense (4) 12

Share based payment 108 98

Depreciation 98 88

Amortisation and

impairment of

intangible

assets 112 155

---------------------------------------------- ----------------------------------------------

Operating cash flows

before movements

in working capital 1,180 621

(Increase) in

receivables (130) (569)

(Decrease)/increase

in payables (226) 300

(Increase) in

inventories (172) (15)

---------------------------------------------- ----------------------------------------------

Cash generated/(used)

in operations 652 337

Taxation received - 71

---------------------------------------------- ----------------------------------------------

Net cash generated in

operations 652 408

---------------------------------------------- ----------------------------------------------

Investing activities

Acquisitions of

property, plant and

equipment (85) (44)

Acquisitions of

intangible assets (172) (56)

---------------------------------------------- ----------------------------------------------

Net cash (used

in)/generated from

investing

activities (257) (100)

---------------------------------------------- ----------------------------------------------

Financing activities

Treasury shares (405) (303)

Warrants exercised - 78

Interest

received/(paid) 4 (12)

Payment of lease

liabilities (71) (62)

---------------------------------------------- ----------------------------------------------

Net cash used in

financing activities (472) (299)

---------------------------------------------- ----------------------------------------------

Net

(decrease)/increase

in cash and

cash equivalents (77) 9

Cash and equivalents

at the beginning

of year 1,055 1,046

---------------------------------------------- ----------------------------------------------

Cash and equivalents

at the end of

year 978 1,055

============================================== ==============================================

NOTES RELATING TO THE COMPANY FINANCIAL STATEMENTS

BASIS OF PREPARATION

Both the Parent Company financial statements and the Company

financial statements have been prepared and approved by the

Directors in accordance with International Financial Reporting

Standards as adopted by the United Kingdom ("Adopted IFRSs") and

those parts of the Companies Act 2006 that are relevant to

companies preparing accounts under IFRS. On publishing the Parent

Company financial statements here together with the Company

financial statements, the Company is taking advantage of the

exemption in s408 of the Companies Act 2006 not to present its

individual statement of comprehensive income and related notes that

form a part of these approved financial statements.

1 SEGMENT INFORMATION

The Company had three reportable segments being the unique

trading divisions, SAW and Translogik, which make use of technology

developed by the Company to measure and record temperature,

pressure and torque, and the iTrack royalty activity in respect of

income from licensed technology.

Revenue and EBITDA are the Company's key focus and in turn is

the main performance measure adopted by management.

The tables below set out the Company's revenue split and

operating segments. These disclose information for continuing

operations and in view of their relative size, information for

discontinued operations. The disposal of iTrack operations will

result in future royalty income replacing direct sales income and

costs.

Revenue

Year ended Year ended

30 June 30 June

2023 2022

GBP'000 GBP'000

North America 351 323

South America 143 123

Australia 32 41

Europe 485 387

UK 379 92

Rest of the World 129 109

-------------------------------------------- --------------------------------------------

1,519 1,075

=========================================== ===========================================

iTrack Royalty 2,010 1,557

Total Revenue 3,529 2,632

Segments

Translogik SAW iTrack Unallocated Total

GBP'000 GBP'000 royalties GBP'000 GBP'000

GBP'000

Year ended 30

June

2023

Sales 1,027 492 2,010 - 3,529

===================== ===================== ===================== ===================== ====================

Gross profit 588 457 2,010 - 3,055

Administrative

expenses (165) (1,119) (44) (758) (2,066)

Exceptional

administrative

expenses (220) (220)

----------------------------- ----------------------------- ----------------------------- ----------------------------- -----------------------------

Operating

profit/(loss) 423 (882) 1,966 (758) 749

Other income - 113 - - 113

Net financial

income - - - 4 4

Taxation - - - 530 530

----------------------------- ---------------------------- ----------------------------- ----------------------------- -----------------------------

Profit/(loss)

for the

year 423 (769) 1,966 (224) 1,396

========== =========== =========== =========== ===========

EBITDA

reconciliation

Operating

profit 749

Other income 113

Depreciation

and

amortisation 209

------------------

EBITDA 1,071

===========

Note: Adjusted EBITDA (excluding share based payments) 1,179

Translogik SAW iTrack Unallocated Total

GBP'000 GBP'000 royalties GBP'000 GBP'000

GBP'000

Year ended 30

June

2022

Sales 875 200 1,557 - 2,632

================== =================== =================== =================== ====================

Gross profit 484 193 1,557 - 2,234

Administrative

expenses (126) (1,014) (44) (786) (1,970)

--------------------------- -------------------------- -------------------------- -------------------------- -----------------------------

Operating

profit/(loss) 358 (821) 1,513 (786) 264

Other income - 16 - - 16

Net financial

expense - - - (12) (12)

Taxation - - - 609 609

--------------------------- -------------------------- -------------------------- -------------------------- -----------------------------

Profit/(loss)

for the

year 358 (805) 1,513 (189) 877

========== ========= ========== ======= ===========

During the year ended 30 June 2023 there was 1 customer (2022:

2) whose turnover accounted for more than 10% of the Company's

total continuing revenue as follows:

Year ended 30 June 2023 Revenue Percentage

GBP'000 of total

Customer A 2,010 57

Year ended 30 June 2022 Revenue Percentage

GBP000 of total

Customer A 1,557 59

Customer B 339 13

2 TAXATION

Recognised in the statement of comprehensive income in respect

of continuing operations

Year ended Year ended

30 June 30 June

2023 2022

GBP'000 GBP'000

Current tax credit

Adjustment for

previous year - (11)

Deferred tax

credit

Current year (530) (598)

--------------------------------------------- ---------------------------------------------

Tax credit in

Statement of

Comprehensive

Income (530) (609)

============================================ ============================================

Reconciliation of effective tax rate

Year ended Year ended

30 June 30 June

2023 2022

GBP'000 GBP'000

Profit/(loss)

before tax 866 268

============================================= =============================================

Tax calculated at

the average

standard UK

corporation

tax rate of 23.50%

(2022: 19:00%) 178 51

Expenses not

deductible for tax

purposes 23 19

Utilisation of

losses brought

forward for which

no deferred tax

asset was

recognised 25 (23)

Recognition of

deferred tax in

respect of prior

year losses (756) (645)

Prior year

adjustment - (11)

---------------------------------------------- ----------------------------------------------

Total tax credit (530) (609)

============================================= =============================================

Deferred tax assets

are

Recognised - in

respect of tax

losses 1,175 645

Unrecognised - in

respect of tax

losses and

other timing

differences 4,528 4,900

============================================= =============================================

The applicable UK corporation tax rate is a blend of 19% for the

first 9 months and 25% thereafter giving an average rate for the

reporting period of 20.5%. The Group has tax losses, subject to

agreement by HM Revenue and Customs, in the sum of GBP21.9m (2022:

GBP22.8m), which are available for offset against future profits of

the same trade. There is no expiry date for tax losses. An

appropriate deferred tax asset is being recognised as the Group is

able to demonstrate a reasonable expectation of sufficient future

taxable profits arising in order to utilise the losses.

3 EARNINGS PER SHARE

Year ended Year ended

30 June 30 June

2023 2022

Number Number

Weighted average number of shares - basic 15,849,527 16,365,640

Share option adjustment for potentially dilutive

shares - -

-------------------- -------------------

Weighted average number of shares - diluted 15,849,527 16,365,640

============ ===========

Last year showed potential dilutive impact of share options

being 431,808 however this was incorrect as none of the share

options had reached the hurdle requirement necessary for the option

to be exercised. There are 1,504,300 share options and no warrants

in place at 30 June 2023 (1,594,500 share options 30 June

2022).

Year ended Year ended

30 June 30 June

2023 2022

GBP'000 GBP'000

Profit/(loss) 1,396 877

-------------------- --------------------

Basic profit per share 8.81 5.36

There are 1,504,300 share options and no warrants in place at 30

June 2023 (1,594,500 share options at 30 June 2022).

4 STATUTORY ACCOUNTS

The Financial information set out in this announcement does not

constitute the Company's Consolidated Financial Statements for the

financial years ended 30 June 2023 or 30 June 2022 but are derived

from those Financial Statements. Statutory Financial Statements for

2022 have been delivered to the Registrar of Companies and those

for 2023 will be delivered following the Company's AGM. The

auditors Cooper Parry Group Limited have reported on the 2022 and

2023 financial statements. Their reports were unqualified, did not

draw attention to any matters by way of emphasis without qualifying

their report and did not contain statements under Section 498(2) or

(3) of the Companies Act 2006 in respect of the Financial

Statements for 2022 or 2021.

The Statutory accounts are available on the Company's website

and will be posted to shareholders who have requested a copy and

thereafter by request to the Company's reg

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR EZLFLXKLXBBF

(END) Dow Jones Newswires

September 25, 2023 02:00 ET (06:00 GMT)

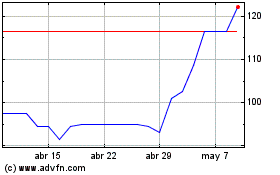

Transense Technologies (LSE:TRT)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Transense Technologies (LSE:TRT)

Gráfica de Acción Histórica

De May 2023 a May 2024