AIM Schedule One Update - Unbound Group PLC (8532Z)

27 Enero 2022 - 3:59AM

UK Regulatory

TIDMUBG

RNS Number : 8532Z

AIM

27 January 2022

ANNOUNCEMENT TO BE MADE BY THE AIM APPLICANT PRIOR TO ADMISSION

IN ACCORDANCE WITH RULE 2 OF THE AIM RULES FOR COMPANIES ("AIM

RULES")

COMPANY NAME:

Unbound Group PLC

COMPANY REGISTERED OFFICE ADDRESS AND IF DIFFERENT, COMPANY

TRADING ADDRESS (INCLUDING POSTCODES) :

Registered address:

17 Old Park Lane

London

W1K 1QT

Trading address

2 Peel Road

West Pimbo

Skelmersdale

WN8 9PT

COUNTRY OF INCORPORATION:

England and Wales

COMPANY WEBSITE ADDRESS CONTAINING ALL INFORMATION REQUIRED

BY AIM RULE 26:

https://unboundgroupplc.com/investors/

COMPANY BUSINESS (INCLUDING MAIN COUNTRY OF OPERATION) OR,

IN THE CASE OF AN INVESTING COMPANY, DETAILS OF ITS INVESTING

POLICY). IF THE ADMISSION IS SOUGHT AS A RESULT OF A REVERSE

TAKE-OVER UNDER RULE 14, THIS SHOULD BE STATED:

Unbound Group PLC ("Unbound" or the "Company") will be the

parent company for a range of brands focused on the 55 plus

demographic. Initially focused on Hotter Shoes, Unbound's curated,

multi-brand retail platform will offer additional products

and services that will enhance the enjoyment and wellbeing

of its targeted customer community. This online platform will

be based on the foundations of Hotter Shoes as a trusted brand,

cloud-based digital infrastructure, and strong customer personalisation

through data insight. Unbound's expanded offering beyond footwear

will feature apparel and wellness products and services, with

third-party complementary brands featuring alongside new Unbound

brands, as well as Hotter Shoes.

Hotter Shoes has been transformed from a retail to a multi-channel

business with a strong and growing digital focus over the last

2 years, and is now a fast-growing, profitable and cash-generative

e-commerce focused footwear brand. Hotter Shoes provides footwear

with uncompromising focus on comfort and fit through the use

of differentiating technology, to a targeted demographic that

values its brand and products. Hotter Shoes' direct-to-consumer

channels now reach 29% of the female population in the UK over

the age of 55, providing them with footwear that allows them

to do more of what they love. Cultural and demographic shifts

now provide an opportunity to further monetise the existing

Hotter Shoes customer database and grow it through the addition

of similarly themed products beyond footwear.

The Company currently generates revenue globally. The main

country of operation is the UK

DETAILS OF SECURITIES TO BE ADMITTED INCLUDING ANY RESTRICTIONS

AS TO TRANSFER OF THE SECURITIES (i.e. where known, number

and type of shares, nominal value and issue price to which

it seeks admission and the number and type to be held as treasury

shares):

42,258,128 ordinary shares of 25 pence each

No restrictions on the transfer of shares

The Company holds no ordinary shares in treasury

CAPITAL TO BE RAISED ON ADMISSION (AND/OR SECONDARY OFFERING)

AND ANTICIPATED MARKET CAPITALISATION ON ADMISSION:

No capital being raised on Admission. Anticipated market cap

c.GBP30m

PERCENTAGE OF AIM SECURITIES NOT IN PUBLIC HANDS AT ADMISSION:

Approximately 42%

DETAILS OF ANY OTHER EXCHANGE OR TRADING PLATFORM TO WHICH

THE AIM SECURITIES (OR OTHER SECURITIES OF THE COMPANY) ARE

OR WILL BE ADMITTED OR TRADED:

None

FULL NAMES AND FUNCTIONS OF DIRECTORS AND PROPOSED DIRECTORS

(underlining the first name by which each is known or including

any other name by which each is known):

Neil Anthony Johnson - proposed non executive chairman

Ian Andrew Watson - proposed chief executive officer

Daniel (Dan) Malachy Lampard - proposed chief financial officer

Gavin Maxwell Manson - proposed non-executive director

Paul Andrew Goodson - independent non executive director

Linda Wilding - independent non executive director

Suzanne (Suki) Frances Allison Thompson - independent non executive

director

Baroness Kate Rock - independent non executive director

FULL NAMES AND HOLDINGS OF SIGNIFICANT SHAREHOLDERS EXPRESSED

AS A PERCENTAGE OF THE ISSUED SHARE CAPITAL, BEFORE AND AFTER

ADMISSION (underlining the first name by which each is known

or including any other name by which each is known):

% of ISC pre % of ISC post

admission admission

Witan Investment Trust

plc 13.1% 13.1%

Fidelity International 11.0% 11.0%

Ian Watson 5.0% 5.0%

Aviva plc 4.0% 4.0%

Crown Sigma UCITS plc 3.6% 3.6%

NAMES OF ALL PERSONS TO BE DISCLOSED IN ACCORDANCE WITH SCHEDULE

2, PARAGRAPH (H) OF THE AIM RULES:

* Hypnotion Limited

* One Advisory

* KPMG

* BDO

* Alvarez & Marsal

* Interpath Advisory

* Vico Partners

(i) ANTICIPATED ACCOUNTING REFERENCE DATE

(ii) DATE TO WHICH THE MAIN FINANCIAL INFORMATION IN THE ADMISSION

DOCUMENT HAS BEEN PREPARED (this may be represented by unaudited

interim financial information)

(iii) DATES BY WHICH IT MUST PUBLISH ITS FIRST THREE REPORTS

PURSUANT TO AIM RULES 18 AND 19:

(i) 30 January

(ii) 1 August 2021 (audited interim financial information)

(iii) 30 July 2022 (audited accounts for the 16 months to 30

January 2022);

31 October 2022 (unaudited interims for the 6 months to 31

July 2022;

5 August 2023 (audited accounts for the 12 months to 5 February

2023)

EXPECTED ADMISSION DATE:

1 February 2022

NAME AND ADDRESS OF NOMINATED ADVISER:

Stifel Nicolaus Europe Limited

150 Cheapside

London

EC2V 6ET

NAME AND ADDRESS OF BROKER:

Stifel Nicolaus Europe Limited

150 Cheapside

London

EC2V 6ET

OTHER THAN IN THE CASE OF A QUOTED APPLICANT, DETAILS OF WHERE

(POSTAL OR INTERNET ADDRESS) THE ADMISSION DOCUMENT WILL BE

AVAILABLE FROM, WITH A STATEMENT THAT THIS WILL CONTAIN FULL

DETAILS ABOUT THE APPLICANT AND THE ADMISSION OF ITS SECURITIES:

The admission document, which will contain full details of

the applicant and its securities, will be available from https://unboundgroupplc.com/investors/

THE CORPORATE GOVERNANCE CODE THE APPLICANT HAS DECIDED TO

APPLY

The QCA Corporate Governance Code

DATE OF NOTIFICATION:

27 January 2022

NEW/ UPDATE:

UPDATE

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

AIMBKOBBCBKKCDB

(END) Dow Jones Newswires

January 27, 2022 04:59 ET (09:59 GMT)

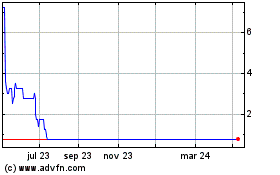

Unbound (LSE:UBG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

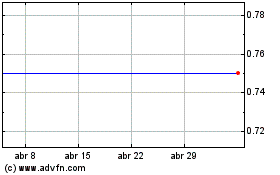

Unbound (LSE:UBG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024