Generated $23.3 Million in Consolidated

Revenue, up 131% Year Over Year

Energy Operations Generated $15.8 Million in

Revenue and Industrial Operations Generated $7.0 Million in

Revenue, Up 12% and 11%, Respectively Quarter Over Quarter

Generated $70.4 Million in Operating Cash Flow

During the Nine Months Ended September 30, 2024

Repurchased 3.0 Million Shares for $14.0

Million Via the Company’s Stock Repurchase Program Through November

7, 2024

Subsequent to the Quarter, Acquired Deflecto

for $103.7 Million

Acacia Research Corporation (Nasdaq: ACTG) (“Acacia” or

the “Company”), which acquires and operates businesses

across the industrial, energy and technology sectors, today

reported financial results for the three and nine months ended

September 30, 2024. The Company also posted its third quarter 2024

earnings presentation on its website at www.acaciaresearch.com

under Events & Presentations.

Martin (“MJ”) D. McNulty, Jr., Chief Executive Officer, stated,

“Acacia’s third quarter results reflect the Company’s unwavering

focus on value creation via its core technology, energy and

industrials verticals. The Company generated $23.3 million in

consolidated revenue, up 131% compared to the third quarter last

year, recorded a net loss of $14.0 million and produced $1.7

million of Total Company Adjusted EBITDA, and $6.9 million of

Operated Segment Adjusted EBITDA for the quarter.1 Excluding the

Company’s Intellectual Property Operations, Operated Segment

Adjusted EBITDA was $9.0 million for the quarter. A breakdown of

the Adjusted EBITDA for each of the Company’s operating segments

for the three months ended March 31, June 30 and September 30, and

the nine months ended September 30 is included in this Earnings

Release and in the Company’s third quarter 2024 earnings

presentation.

Subsequent to the quarter, Acacia completed its third

transaction in the last twelve months, acquiring Deflecto

Acquisition, Inc., a leading specialty manufacturer of essential

products serving the commercial transportation, HVAC and office

markets for $103.7 million. I’m excited about the value creation

potential Deflecto offers through product and operational

optimization, and strategic M&A, and look forward to

integrating Deflecto into Acacia’s growing portfolio of strategic

assets.

Following the Deflecto acquisition, the Company’s cash reserves

were approximately $280 million for potential future transactions.

The Company also delivered approximately $14 million to

shareholders as of November 7, 2024, via our stock repurchase

program as part of our long-term strategy to deploy excess cash and

increase total shareholder returns over time.”

Key Business Highlights

- Recorded book value per share of $5.85 at September 30, 2024

compared to $5.90 per share at December 31, 2023. Excluding the

impact of $14.9 million in non-recurring expenses related to legacy

legal matters, which have now been settled, book value per share at

September 30, 2024 would have been $6.00 per share.

- Generated $23.3 million in consolidated revenue for the

quarter, up 131% compared to $10.1 million in revenue in the third

quarter of 2023.

- Recorded a GAAP net loss of $14.0 million, or $0.14 diluted net

loss per share, for the third quarter and a GAAP net loss of $22.6

million, or $0.23 diluted net loss per share, for the first nine

months of 2024.

- Generated $6.9 million and $26.1 million of Operated Segment

Adjusted EBITDA in the three and nine months ended September 30,

2024, respectively.

- Generated $1.7 million and $12.1 million of Total Company

Adjusted EBITDA in the three and nine months ended September 30,

2024, respectively.

- Continued to manage Parent Costs2 within Parent Interest

Income, with Parent Costs of $14.0 million and Parent Interest

Income of $14.7 million, respectively, for the nine months ended

September 30, 2024.

- Generated $70.4 million in operating cash flow during the nine

months ended September 30, 2024.

- Repurchased 3,007,294 shares for approximately $14.0 million as

of November 7, 2024, through the Company’s stock repurchase program

as part of the Company’s overall long-term strategy to deploy

excess cash and increase total shareholder returns over time.

- Subsequent to the quarter, on October 18, acquired Deflecto

Acquisition, Inc. (“Deflecto”) for $103.7 million (the

“Transaction”). Headquartered in Indianapolis, Indiana,

Deflecto is a leading specialty manufacturer of essential products

serving the commercial transportation, HVAC and office markets.

Deflecto is a market leader across each of its segments and end

markets, supplying essential, regulatory mandated products to a

blue-chip customer base via long-term relationships with more than

1,500 leading retail, wholesale and OEM customers and distribution

partners globally. In the trailing twelve-month period ended August

31, 2024, Deflecto generated revenue of approximately $131 million.

Based on current market conditions and trends, Acacia expects

Deflecto to generate approximately $128-$136 million in revenue in

2024. The Transaction was funded utilizing cash on hand and

borrowings under a new senior credit facility secured by Deflecto.

For more information, see the Company’s 8-K filed with the U.S.

Securities and Exchange Commission (the “SEC”) on October

21, 2024.

_________________________

1 Total Company Adjusted EBITDA and

Operated Segment Adjusted EBITDA are non-GAAP financial measures.

See below for a reconciliation of Total Company Adjusted EBITDA to

net loss, the most directly comparable GAAP financial measure. For

the definition of these measures and a reconciliation of the

components of Operated Segment Adjusted EBITDA to their most

directly comparable GAAP financial measures, see the accompanying

supplemental information section.

The following table provides a reconciliation of Total Company

Adjusted EBITDA to consolidated net loss, the most directly

comparable GAAP measure for the three months ended March 31, June

30 and September 30, and the nine months ended September 30.

Three Months Ended

March 31,

Three Months Ended

June 30,

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2024

2024

2024

(In thousands)

(Unaudited)

GAAP Net Loss

$

(186

)

$

(8,446

)

$

(13,996

)

$

(22,628

)

Net (Loss) Income Attributable to

Noncontrolling Interests

(3

)

(383

)

2,339

1,953

Income Tax (Benefit) Expense

(1,109

)

(7,061

)

5,497

(2,673

)

Interest Income and Other, Net

(4,769

)

(3,019

)

(2,022

)

(9,810

)

Loss (Gain) on Foreign Currency

Exchange

68

134

(130

)

72

Net Realized and Unrealized (Gain) / Loss

on Derivatives

(171

)

2,659

(8,034

)

(5,546

)

Net Realized and Unrealized (Gain) / Loss

on Investments

(2,160

)

4,744

4,074

6,658

Non-recurring Legacy Legal Expense

6,243

6,614

2,000

14,857

GAAP Operating Loss

$

(2,087

)

$

(4,758

)

$

(10,272

)

$

(17,117

)

Depreciation, Depletion &

Amortization

4,568

7,405

9,762

21,735

Stock-Based Compensation

858

891

781

2,530

Realized Hedge Gain

800

113

715

1,628

Transaction-Related Costs

—

222

320

542

Legacy Matter Costs

2,193

216

368

2,777

Total Company Adjusted EBITDA

$

6,332

$

4,089

$

1,674

$

12,095

_________________________

2 Parent Cost is a non-GAAP financial

measure. For the definition of this measure and a reconciliation of

this measure to Operating (Loss) Income, the most directly

comparable GAAP financial measure, see the accompanying

supplemental information section.

The following table provides the Adjusted EBITDA for each of the

Company’s operating segments for the three months ended March 31,

June 30 and September 30, and the nine months ended September

30.

Three Months Ended

March 31,

Three Months Ended

June 30,

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2024

2024

2024

(In thousands)

(Unaudited)

Energy Operations Adjusted EBITDA3

$

1,378

$

7,039

$

8,442

$

16,859

Industrial Operations Adjusted EBITDA3

1,897

449

579

2,925

Operated Segment Adjusted EBITDA

(excluding Intellectual Property Operations Adjusted EBITDA)

3,275

7,488

9,021

19,784

Intellectual Property Operations Adjusted

EBITDA3

7,160

1,309

(2,139

)

6,330

Operated Segment Adjusted EBITDA

10,435

8,797

6,882

26,114

Parent Costs

(4,103

)

(4,708

)

(5,208

)

(14,019

)

Total Company Adjusted EBITDA

$

6,332

$

4,089

$

1,674

$

12,095

The following table provides Parent Costs and Parent Interest

Income for the three months ended March 31, June 30 and September

30, and the nine months ended September 30.

Three Months Ended

March 31,

Three Months Ended

June 30,

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2024

2024

2024

(In thousands)

(Unaudited)

Parent Costs

$

(4,103

)

$

(4,708

)

$

(5,208

)

$

(14,019

)

Parent Interest Income

$

5,079

$

5,028

$

4,570

$

14,677

_________________________

3 Energy Operations Adjusted EBITDA,

Industrial Operations Adjusted EBITDA and Intellectual Operations

Adjusted EBITDA are non-GAAP financial measures. For the

definitions of these measures and reconciliations of these measures

to the most directly comparable GAAP financial measures, see the

accompanying supplemental information section.

Third Quarter 2024 Financial Summary and Highlights:

- Total revenues were $23.3 million, up 131% compared to $10.1

million in the same quarter last year.

- Energy Operations generated $15.8 million in revenue in the

quarter. As the Company’s initial investment in Benchmark closed on

November 13, 2023, there is no comparable revenue in the same

quarter last year.

- Industrial Operations generated $7.0 million in revenue during

the quarter, compared to $8.3 million in the same quarter last

year. The decrease in revenue was primarily due to a decrease in

printer sales.

- Intellectual Property Operations generated $0.5 million in

licensing and other revenue during the quarter, compared to $1.8

million in the same quarter last year.

- General and administrative (G&A) expenses were $11.1

million, compared to $11.6 million in the same quarter of last

year. The decrease was primarily due to a decrease in Parent

company G&A partially offset by the addition of the Company’s

new energy segment operations.

- The Company recorded a GAAP operating loss of $10.3 million,

compared to a GAAP operating loss of $13.2 million in the same

quarter of last year primarily due to higher revenues generated.

- Energy Operations contributed $3.1 million in operating income,

which included $4.3 million of non-cash depreciation, depletion and

amortization expenses, $0.3 million in one-time transaction costs

and does not reflect $0.7 million of realized derivatives gain.

Such income includes revenue from the Revolution assets that

Benchmark acquired earlier in 2024. Adjusted EBITDA for Energy

Operations was $8.4 million.

- Industrial Operations contributed $0.1 million in operating

loss which included $0.7 million of non-cash depreciation and

amortization expenses. Adjusted EBITDA for Acacia’s Industrial

Operations was $0.6 million.

- The third quarter included $1.9 million in non-recurring Parent

general and administrative charges.

- The Company recorded GAAP net loss of $14.0 million, or $0.14

diluted net loss per share, compared to GAAP net income of $1.6

million, or $0.03 diluted net loss per share, in the third quarter

of last year.

- Net loss included $4.1 million in unrealized loss related to

the fair value of equity securities at September 30, 2024.

- Net loss included $2.0 million in non-recurring expense related

to legacy legal matters, which have now been settled.

The following table provides a breakdown of the Company’s

financial highlights for the three and nine months ended September

30, 2024 and 2023.

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

(unaudited)

(unaudited)

Intellectual property operations

$

0.5

$

1.8

$

19.4

$

6.3

Industrial operations

7.0

8.3

22.2

26.5

Energy operations

15.8

—

31.8

—

Total revenues

$

23.3

$

10.1

$

73.5

$

32.8

Operating loss

$

(10.3

)

$

(13.2

)

$

(17.1

)

$

(35.0

)

Unrealized gains (losses) 1

$

(4.1

)

$

8.8

$

(35.5

)

$

18.8

Realized gains (losses)

$

—

$

—

$

28.9

$

(9.4

)

Non-recurring legacy legal expense

$

(2.0

)

$

—

$

(14.9

)

$

—

GAAP Net (loss) income

$

(14.0

)

$

1.6

$

(22.6

)

$

(7.7

)

GAAP Diluted net loss per share

$

(0.14

)

$

(0.03

)

$

(0.23

)

$

(0.23

)

1 Unrealized gains and (losses)

are related to the change in fair value of equity securities as of

the end of the reported period and for the nine months ended

September 30, 2024, and include the reversal of the previously

recorded unrealized gain related to the Company’s Arix Bioscience

Plc. position for a realized gain.

Life Sciences Portfolio

Acacia has generated $564.1 million in proceeds from sales and

royalties of its Life Sciences Portfolio, which was purchased for

an aggregate price of $301.4 million in 2020. At September 30, 2024

Acacia’s remaining positions in its Life Sciences Portfolio

represented $25.7 million in book value:

- Acacia holds interests in three private companies, valued at an

aggregate of $25.7 million, net of non-controlling interests,

including an approximately 26% interest in Viamet Pharmaceuticals,

Inc., an approximately 18% interest in AMO Pharma, Ltd. and an

approximately 4% interest in NovaBiotics Ltd. Values are based on

cost or equity accounting.

Balance Sheet and Capital Structure

- Cash, cash equivalents and equity investments measured at fair

value totaled $374.2 million at September 30, 2024 compared to

$403.2 million at December 31, 2023. The decrease in cash was

primarily due to $60.0 million paid to acquire the Revolution

assets, $12.0 million paid on the Benchmark revolving credit

facility and $7.3 million in repurchases of common stock during the

quarter, offset by cash provided by operating activities.

- Equity securities without readily determinable fair value

totaled $5.8 million at September 30, 2024, unchanged from December

31, 2023.

- Investment securities representing equity method investments

totaled $19.9 million at September 30, 2024 (net of noncontrolling

interests), unchanged from December 31, 2023. Acacia owns 64% of

MalinJ1, which results in a 26% indirect ownership stake in Viamet

Pharmaceuticals, Inc. for Acacia.

- The Parent company’s total indebtedness was zero at September

30, 2024. On a consolidated basis, Acacia’s total indebtedness was

$70.0 million in non-recourse debt at Benchmark as of September 30,

2024.

Book Value as of September 30, 2024

At September 30, 2024, Acacia’s book value was $578.6 million

and there were 98.8 million shares of common stock outstanding, for

a book value per share of $5.85. Excluding the impact of $14.9

million in non-recurring expenses related to legacy legal matters,

which have now been settled, the Company’s book value per share at

September 30, 2024 would have been $6.00 per share.

Share Repurchase Program

On November 9, 2023, Acacia’s Board of Directors approved a

stock repurchase program (the “Repurchase Program”) for up

to $20.0 million, subject to a cap of 5,800,000 shares of Acacia

common stock. As of November 7, 2024, the Company has repurchased

3,007,294 common shares for $14.0 million as part of the Company’s

overall long-term strategy to deploy excess cash and increase total

shareholder returns over time. The Company intends to continue to

opportunistically complete share repurchases in the open market

during the fourth quarter of 2024 and into 2025, subject to

operating needs, market conditions, legal requirements, stock price

and other considerations. The Repurchase Program has no time limit

and does not require the repurchase of a minimum number of shares.

The common stock may be repurchased on the open market, in block

trades, or in privately negotiated transactions, including under

plans complying with the provisions of Rule 10b5-1 and Rule 10b-18

of the Exchange Act. Refer to Note 14 to the consolidated financial

statements in the Company’s Quarterly Report on Form 10-Q for the

three months ended September 30, 2024 for additional

information.

Investor Conference Call

The Company will host a conference call today, November 12, 2024

at 8:00 a.m. Eastern Time (5:00 a.m. Pacific Time). To access the

live call, please dial 877-545-0523 (U.S. and Canada) or

973-528-0016 (international) and if requested, reference the access

code “847853.” The conference call will also be simultaneously

webcast at https://www.webcaster4.com/Webcast/Page/2371/51508 and

on the investor relations section of the Company’s website at

http://www.acaciaresearch.com under Events & Presentations.

Following the conclusion of the live call, a replay of the webcast

will be available on the Company's website for at least 30

days.

About the Company

Acacia (Nasdaq: ACTG) is a publicly traded company that is

focused on acquiring and operating attractive businesses across the

mature technology, energy, and industrial/manufacturing sectors

where it believes it can leverage its expertise, significant

capital base, and deep industry relationships to drive value.

Acacia evaluates opportunities based on the attractiveness of the

underlying cash flows, without regard to a specific investment

horizon. Acacia operates its businesses based on three key

principles of people, process and performance and has built a

management team with demonstrated expertise in research,

transactions and execution, and operations and management.

Additional information about Acacia and its subsidiaries is

available at www.acaciaresearch.com.

Safe Harbor Statement

This news release contains forward-looking statements within the

meaning of the “safe harbor” provisions of the Private Securities

Litigation Reform Act of 1995. These statements are based upon the

Company’s current expectations and speak only as of the date

hereof. All statements other than statements of historical fact are

forward-looking statements and include statements related to

estimates and projections with respect to, among other things, the

Company’s anticipated financial condition, operating performance,

the value of the Company’s assets, general economic and market

conditions and other future circumstances and events. This news

release attempts to identify forward-looking statements by using

words such as “anticipate,” “believe,” “continue,” “could,”

“estimate,” “expect,” “forecast,” “future,” “guidance,” “intend,”

“may,” “outlook,” “plan,” “potential,” “predict,” “project,”

“seek,” “should,” “target” and “will,” and similar words and

expressions; however, the absence of these words does not mean that

the statements are not forward-looking. While the Company believes

its assumptions concerning future events are reasonable, a number

of factors could cause actual results to differ materially and

adversely from those expressed or implied in any forward-looking

statements, including, but not limited to: the Company’s ability to

successfully identify, diligence, complete, and integrate strategic

acquisitions of businesses, divisions, and/or assets, the

performance of the Company’s businesses, divisions, and/or assets,

disruptions or uncertainty caused by an ability to retain or

changes to the employees or management teams of the Company’s

businesses, changes to the Company’s relationship and arrangements

with Starboard Value LP, any inability of the Company’s operating

businesses to execute on their business and, with respect to

Benchmark, hedging strategy, risks related to price and other

fluctuations in the oil and gas market, inflationary pressures,

supply chain disruptions or labor shortages, non-performance by

third parties of contractual or legal obligations, changes in the

Company’s credit ratings or the credit ratings of the Company’s

businesses, security threats, including cybersecurity threats and

disruptions to the Company’s business and operations from breaches

of information technology systems, or breaches of information

technology systems, facilities and infrastructure of third parties

with which the Company transacts business, oil or natural gas

production becoming uneconomic, causing write downs or adversely

affecting Benchmark’s ability to borrow, Benchmark’s ability to

replace reserves and efficiently develop current reserves, risks,

operational hazards, unforeseen interruptions and other

difficulties involved in the production of oil and natural gas, the

impact of any seismic events, environmental liability risk,

regulatory changes related to the oil and gas industry, the ability

to successfully develop licensing programs and attract new

business, changes in demand for current and future intellectual

property rights, legislative, regulatory and competitive

developments addressing licensing and enforcement of patents and/or

intellectual property in general, the decrease in demand for

Printronix' products, changes in safety, health, environmental, tax

and other regulations, requirements or initiatives, hazards such as

weather conditions, a health pandemic (similar to COVID-19), acts

of war or terrorist acts and the government or military response

thereto, general economic conditions, and the success of the

Company’s investments. For further discussions of risks and

uncertainties, you should refer to the Company’s filings with the

Securities and Exchange Commission, including the “Risk Factors”

section of the Company’s most recent Annual Report on Form 10-K and

any subsequent Quarterly Reports on Form 10-Q. In addition, actual

results may differ materially as a result of additional risks and

uncertainties of which the Company is currently unaware or which

the Company does not currently view as material. Except as

otherwise required by applicable law, the Company undertakes no

obligation to revise or update publicly any forward-looking

statements for any reason.

ACACIA RESEARCH

CORPORATION

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands, except share

and per share data)

September 30, 2024

December 31, 2023

(Unaudited)

ASSETS

Current assets:

Cash and cash equivalents

$

360,050

$

340,091

Equity securities

14,100

63,068

Equity securities without readily

determinable fair value

5,816

5,816

Equity method investments

30,934

30,934

Accounts receivable, net

10,733

80,555

Inventories

12,218

10,921

Prepaid expenses and other current

assets

23,795

23,127

Total current assets

457,646

554,512

Property, plant and equipment, net

2,366

2,356

Oil and natural gas properties, net

190,149

25,117

Goodwill

8,990

8,990

Other intangible assets, net

30,872

33,556

Operating lease, right-of-use assets

1,366

1,872

Deferred income tax assets, net

8,424

2,915

Other non-current assets

7,759

4,227

Total assets

$

707,572

$

633,545

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current liabilities:

Accounts payable

$

5,258

$

3,261

Accrued expenses and other current

liabilities

8,668

8,405

Accrued compensation

4,969

4,207

Current asset retirement obligation

1,562

—

Royalties and contingent legal fees

payable

6,194

10,786

Deferred revenue

1,268

977

Total current liabilities

27,919

27,636

Asset retirement obligation

28,065

—

Long-term lease liabilities

1,251

1,736

Revolving credit facility

70,000

10,525

Other long-term liabilities

1,771

4,039

Total liabilities

129,006

43,936

Commitments and contingencies

Stockholders' equity:

Preferred stock, par value $0.001 per

share; 10,000,000 shares authorized; no shares issued or

outstanding

—

—

Common stock, par value $0.001 per share;

300,000,000 shares authorized; 98,838,337 and 99,895,473 shares

issued and outstanding as of September 30, 2024 and December 31,

2023, respectively

99

100

Treasury stock, at cost, 17,720,825 and

16,183,703 shares as of September 30, 2024 and December 31, 2023,

respectively

(105,560

)

(98,258

)

Additional paid-in capital

907,996

906,153

Accumulated deficit

(262,357

)

(239,729

)

Total Acacia Research Corporation

stockholders' equity

540,178

568,266

Noncontrolling interests

38,388

21,343

Total stockholders' equity

578,566

589,609

Total liabilities and stockholders'

equity

$

707,572

$

633,545

ACACIA RESEARCH

CORPORATION

UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except share

and per share data)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Revenues:

Intellectual property operations

$

486

$

1,760

$

19,442

$

6,330

Industrial operations

7,007

8,324

22,183

26,461

Energy operations

15,817

—

31,843

—

Total revenues

23,310

10,084

73,468

32,791

Costs and expenses:

Cost of revenues - intellectual property

operations

5,707

5,470

18,473

15,218

Cost of revenues - industrial

operations

3,523

4,377

10,849

13,530

Cost of production - energy operations

11,729

—

23,082

—

Engineering and development expenses -

industrial operations

108

172

420

593

Sales and marketing expenses - industrial

operations

1,391

1,613

4,333

5,385

General and administrative expenses

11,124

11,605

33,428

33,071

Total costs and expenses

33,582

23,237

90,585

67,797

Operating loss

(10,272

)

(13,153

)

(17,117

)

(35,006

)

Other income (expense):

Equity securities investments:

Change in fair value of equity

securities

(4,074

)

8,823

(35,519

)

18,783

Gain (loss) on sale of equity

securities

—

—

28,861

(9,360

)

Earnings on equity investment in joint

venture

—

3,375

—

3,375

Net realized and unrealized (loss)

gain

(4,074

)

12,198

(6,658

)

12,798

Non-recurring legacy legal expense

(2,000

)

—

(14,857

)

—

Change in fair value of the Series B

warrants and embedded derivatives

—

1,525

—

8,241

Gain on derivatives - energy

operations

8,034

—

5,546

—

Gain (loss) on foreign currency

exchange

130

(70

)

(72

)

25

Interest expense on Senior Secured

Notes

—

(130

)

—

(1,930

)

Interest income and other, net

2,022

2,195

9,810

9,943

Total other income (expense)

4,112

15,718

(6,231

)

29,077

(Loss) income before income taxes

(6,160

)

2,565

(23,348

)

(5,929

)

Income tax (expense) benefit

(5,497

)

197

2,673

(641

)

Net (loss) income including noncontrolling

interests in subsidiaries

(11,657

)

2,762

(20,675

)

(6,570

)

Net loss attributable to noncontrolling

interests in subsidiaries

(2,339

)

(1,126

)

(1,953

)

(1,126

)

Net (loss) income attributable to Acacia

Research Corporation

$

(13,996

)

$

1,636

$

(22,628

)

$

(7,696

)

Loss per share:

Net loss attributable to common

stockholders - Basic

$

(13,996

)

$

(1,741

)

$

(22,628

)

$

(15,703

)

Weighted average number of shares

outstanding - Basic

99,854,723

94,328,452

99,893,336

67,072,835

Basic net loss per common share

$

(0.14

)

$

(0.02

)

$

(0.23

)

$

(0.23

)

Net loss attributable to common

stockholders - Diluted

$

(13,996

)

$

(3,164

)

$

(22,628

)

$

(15,703

)

Weighted average number of shares

outstanding - Diluted

99,854,723

99,122,973

99,893,336

67,072,835

Diluted net loss per common share

$

(0.14

)

$

(0.03

)

$

(0.23

)

$

(0.23

)

ACACIA RESEARCH CORPORATION - SUPPLEMENTAL

INFORMATION NON-GAAP FINANCIAL MEASURE

This earnings release includes adjusted EBITDA on a consolidated

basis and for each of the Company’s segments. Total Company

Adjusted EBITDA, Operated Segment Adjusted EBITDA and adjusted

EBITDA for each of the Company’s segments are supplemental non-GAAP

financial measures used by management and external users of the

Company’s consolidated financial statements. GAAP refers to

generally accepted accounting principles in the United States. A

non-GAAP financial measure is a numerical measure of historical or

future performance, financial position or cash flow that includes

or excludes amounts that are excluded or included, respectively, in

the most directly comparable measure calculated and presented in

accordance with GAAP in the Company’s financial statements.

Total Company Adjusted EBITDA is defined as net income / (loss)

before net income / (loss) attributable to noncontrolling

interests, income tax (benefit) / expense, interest income and

other, net, loss / (gain) on foreign currency exchange, net

realized and unrealized (gain) / loss on derivatives, net realized

and unrealized loss / (gain) on investments, non-recurring legacy

legal expenses, depreciation, depletion and amortization,

stock-based compensation, realized hedge gain / (loss),

transaction-related costs, and costs related to certain legacy

items. Operated Segment Adjusted EBITDA is the aggregate of Energy

Operations Adjusted EBITDA, Industrial Operations Adjusted EBITDA

and Intellectual Property Operations Adjusted EBITDA. The Company

is providing Total Company Adjusted EBITDA and Operated Segment

Adjusted EBITDA, non-GAAP financial measures, because management

believes these metrics provide investors with useful supplemental

information in comparing the operating results across reporting

periods by excluding items that are not considered indicative of

core operating performance. These measures are not intended to

replace the presentation of financial results in accordance with

GAAP and may be different from or otherwise inconsistent with

similar non-GAAP financial measures used by other companies. The

presentation of these non-GAAP financial measures supplements other

metrics the Company uses to internally evaluate its subsidiary

businesses and facilitate the comparison of past and present

operating performance. These measures should not be considered in

isolation or as a substitute for measures calculated and presented

in accordance with GAAP.

Energy Operations

Energy Operations Adjusted EBITDA is defined as operating income

/ (loss) for Acacia’s Energy Operations before depreciation,

depletion and amortization expense and transaction related costs,

and including realized hedge gain / (loss). The Company is

providing its Energy Operations’ Adjusted EBITDA, a non-GAAP

financial measure, because the metric provides investors with

useful supplemental information in comparing the operating results

across reporting periods by excluding items that are not considered

indicative of core operating performance.

Industrial Operations

Industrial Operations Adjusted EBITDA is defined as operating

income / (loss) for Acacia’s Industrial Operations before

intangibles amortization and depreciation and amortization expense.

The Company is providing its Industrial Operations’ Adjusted

EBITDA, a non-GAAP financial measure, because the metric provides

investors with useful supplemental information in comparing the

operating results across reporting periods by excluding items that

are not considered indicative of core operating performance.

Intellectual Property Operations

Intellectual Property Operations Adjusted EBITDA is defined as

operating income / (loss) for Acacia’s Intellectual Property

Operations before patent amortization, depreciation and

amortization expense and stock-based compensation. The Company is

providing Intellectual Property Operations’ Adjusted EBITDA, a

non-GAAP financial measure, because the metric provides investors

with useful supplemental information in comparing the operating

results across reporting periods by excluding items that are not

considered indicative of core operating performance.

Parent Costs

Parent Costs are defined as operating income / (loss)

attributable to Parent before depreciation and amortization

expense, stock-based compensation, and costs related to certain

legacy matters attributable to the Parent organization. The Company

is providing Parent Costs, a non-GAAP financial measure, because it

believes it gives the investor a clear picture of a normalized

parent-level expense burden.

The following tables reconcile the most directly comparable GAAP

financial measures to Adjusted EBITDA for each of the Company’s

operating segments and for Parent Costs for the three months ended

March 31, June 30 and September 30, and the nine months ended

September 30.

Three Months Ended March 31,

2024

Adjusted

EBITDA

Energy

Operations

Industrial

Operations

Intellectual Property

Operations

Parent Costs

Consolidated

Total

(In thousands)

(Unaudited)

GAAP Operating (Loss) Income

$

156

$

1,212

$

3,282

$

(6,737

)

$

(2,087

)

Depreciation, Depletion &

Amortization

422

685

3,435

26

4,568

Stock-Based Compensation

—

—

443

415

858

Realized Hedge Gain

800

—

—

—

800

Transaction-Related Costs

—

—

—

—

—

Legacy Matter Costs

—

—

—

2,193

2,193

Adjusted EBITDA

$

1,378

$

1,897

$

7,160

$

(4,103

)

$

6,332

Parent Interest Income

$

5,079

Three Months Ended June 30,

2024

Adjusted

EBITDA

Energy

Operations

Industrial

Operations

Intellectual Property

Operations

Parent Costs

Consolidated

Total

(In thousands)

(Unaudited)

GAAP Operating (Loss) Income

$

3,249

$

(234

)

$

(2,253

)

$

(5,520

)

$

(4,758

)

Depreciation, Depletion &

Amortization

3,455

683

3,241

26

7,405

Stock-Based Compensation

—

—

321

570

891

Realized Hedge Gain

113

—

—

—

113

Transaction-Related Costs

222

—

—

—

222

Legacy Matter Costs

—

—

—

216

216

Adjusted EBITDA

$

7,039

$

449

$

1,309

$

(4,708

)

$

4,089

Parent Interest Income

$

5,028

Three Months Ended September

30, 2024

Adjusted

EBITDA

Energy

Operations

Industrial

Operations

Intellectual Property

Operations

Parent Costs

Consolidated

Total

(In thousands)

(Unaudited)

GAAP Operating (Loss) Income

$

3,064

$

(101

)

$

(7,138

)

$

(6,097

)

$

(10,272

)

Depreciation, Depletion &

Amortization

4,343

680

4,714

25

9,762

Stock-Based Compensation

—

—

285

496

781

Realized Hedge Gain

715

—

—

—

715

Transaction-Related Costs

320

—

—

—

320

Legacy Matter Costs

—

—

—

368

368

Adjusted EBITDA

$

8,442

$

579

$

(2,139

)

$

(5,208

)

$

1,674

Parent Interest Income

$

4,570

Nine Months Ended September

30, 2024

Adjusted

EBITDA

Energy

Operations

Industrial

Operations

Intellectual Property

Operations

Parent Costs

Consolidated

Total

(In thousands)

(Unaudited)

GAAP Operating (Loss) Income

$

6,469

$

877

$

(6,109

)

$

(18,354

)

$

(17,117

)

Depreciation, Depletion &

Amortization

8,220

2,048

11,390

77

21,735

Stock-Based Compensation

—

—

1,049

1,481

2,530

Realized Hedge Gain

1,628

—

—

—

1,628

Transaction-Related Costs

542

—

—

—

542

Legacy Matter Costs

—

—

—

2,777

2,777

Adjusted EBITDA

$

16,859

$

2,925

$

6,330

$

(14,019

)

$

12,095

Parent Interest Income

$

14,677

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241112999797/en/

Investor Contact:

Gagnier Communications ir@acaciares.com

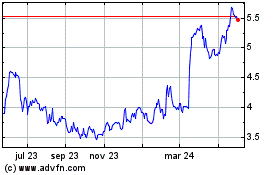

Acacia Research Technolo... (NASDAQ:ACTG)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

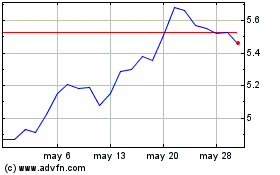

Acacia Research Technolo... (NASDAQ:ACTG)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024