2024Q3FALSE000143922212/31Subsequent Events[Open until filing]

454148460xbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:pureagio:securityutr:sqft00014392222024-01-012024-09-3000014392222024-10-2500014392222024-09-3000014392222023-12-310001439222us-gaap:ProductMember2024-07-012024-09-300001439222us-gaap:ProductMember2023-07-012023-09-300001439222us-gaap:ProductMember2024-01-012024-09-300001439222us-gaap:ProductMember2023-01-012023-09-3000014392222024-07-012024-09-3000014392222023-07-012023-09-3000014392222023-01-012023-09-300001439222us-gaap:CommonStockMember2023-12-310001439222us-gaap:AdditionalPaidInCapitalMember2023-12-310001439222us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001439222us-gaap:RetainedEarningsMember2023-12-310001439222us-gaap:TreasuryStockCommonMember2023-12-310001439222us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-3100014392222024-01-012024-03-310001439222us-gaap:CommonStockMember2024-01-012024-03-310001439222us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001439222us-gaap:RetainedEarningsMember2024-01-012024-03-310001439222us-gaap:CommonStockMember2024-03-310001439222us-gaap:AdditionalPaidInCapitalMember2024-03-310001439222us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001439222us-gaap:RetainedEarningsMember2024-03-310001439222us-gaap:TreasuryStockCommonMember2024-03-3100014392222024-03-310001439222us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-3000014392222024-04-012024-06-300001439222us-gaap:CommonStockMember2024-04-012024-06-300001439222us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300001439222us-gaap:RetainedEarningsMember2024-04-012024-06-300001439222us-gaap:CommonStockMember2024-06-300001439222us-gaap:AdditionalPaidInCapitalMember2024-06-300001439222us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300001439222us-gaap:RetainedEarningsMember2024-06-300001439222us-gaap:TreasuryStockCommonMember2024-06-3000014392222024-06-300001439222us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-07-012024-09-300001439222us-gaap:CommonStockMember2024-07-012024-09-300001439222us-gaap:AdditionalPaidInCapitalMember2024-07-012024-09-300001439222us-gaap:RetainedEarningsMember2024-07-012024-09-300001439222us-gaap:CommonStockMember2024-09-300001439222us-gaap:AdditionalPaidInCapitalMember2024-09-300001439222us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-09-300001439222us-gaap:RetainedEarningsMember2024-09-300001439222us-gaap:TreasuryStockCommonMember2024-09-300001439222us-gaap:CommonStockMember2022-12-310001439222us-gaap:AdditionalPaidInCapitalMember2022-12-310001439222us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001439222us-gaap:RetainedEarningsMember2022-12-310001439222us-gaap:TreasuryStockCommonMember2022-12-3100014392222022-12-310001439222us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-3100014392222023-01-012023-03-310001439222us-gaap:CommonStockMember2023-01-012023-03-310001439222us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001439222us-gaap:RetainedEarningsMember2023-01-012023-03-310001439222us-gaap:CommonStockMember2023-03-310001439222us-gaap:AdditionalPaidInCapitalMember2023-03-310001439222us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001439222us-gaap:RetainedEarningsMember2023-03-310001439222us-gaap:TreasuryStockCommonMember2023-03-3100014392222023-03-310001439222us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-3000014392222023-04-012023-06-300001439222us-gaap:CommonStockMember2023-04-012023-06-300001439222us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001439222us-gaap:RetainedEarningsMember2023-04-012023-06-300001439222us-gaap:CommonStockMember2023-06-300001439222us-gaap:AdditionalPaidInCapitalMember2023-06-300001439222us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001439222us-gaap:RetainedEarningsMember2023-06-300001439222us-gaap:TreasuryStockCommonMember2023-06-3000014392222023-06-300001439222us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300001439222us-gaap:CommonStockMember2023-07-012023-09-300001439222us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300001439222us-gaap:RetainedEarningsMember2023-07-012023-09-300001439222us-gaap:CommonStockMember2023-09-300001439222us-gaap:AdditionalPaidInCapitalMember2023-09-300001439222us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300001439222us-gaap:RetainedEarningsMember2023-09-300001439222us-gaap:TreasuryStockCommonMember2023-09-3000014392222023-09-300001439222agio:AlnylamPharmaceuticalsIncMember2023-07-012023-09-300001439222agio:AlnylamPharmaceuticalsIncMember2023-01-012023-12-310001439222us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberagio:AgiosOncologyBusinessMember2021-03-312021-03-310001439222us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberagio:AgiosOncologyBusinessMember2021-03-310001439222country:USagio:AgiosOncologyBusinessMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMemberagio:TIBSOVOMember2021-03-312021-03-310001439222country:USagio:AgiosOncologyBusinessMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMemberagio:VorasidenibMember2021-03-312021-03-310001439222agio:Agreement2010Member2021-03-310001439222country:USagio:AgiosOncologyBusinessMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMemberagio:TIBSOVOMember2022-09-302022-09-300001439222country:USagio:AgiosOncologyBusinessMemberus-gaap:DiscontinuedOperationsDisposedOfBySaleMemberagio:TIBSOVOMember2022-01-012022-12-310001439222us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberagio:VorasidenibMember2024-09-012024-09-300001439222agio:ContingentPaymentsAndRoyaltyRightsMemberagio:VorasidenibMember2024-05-012024-05-310001439222agio:ContingentPaymentsAndRoyaltyRightsMemberagio:VorasidenibMember2024-05-310001439222us-gaap:FairValueInputsLevel1Memberus-gaap:CashEquivalentsMemberus-gaap:FairValueMeasurementsRecurringMember2024-09-300001439222us-gaap:FairValueInputsLevel2Memberus-gaap:CashEquivalentsMemberus-gaap:FairValueMeasurementsRecurringMember2024-09-300001439222us-gaap:FairValueInputsLevel3Memberus-gaap:CashEquivalentsMemberus-gaap:FairValueMeasurementsRecurringMember2024-09-300001439222us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashEquivalentsMember2024-09-300001439222us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-09-300001439222us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-09-300001439222us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-09-300001439222us-gaap:FairValueMeasurementsRecurringMember2024-09-300001439222us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CertificatesOfDepositMember2024-09-300001439222us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CertificatesOfDepositMember2024-09-300001439222us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CertificatesOfDepositMember2024-09-300001439222us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CertificatesOfDepositMember2024-09-300001439222us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMember2024-09-300001439222us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMember2024-09-300001439222us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMember2024-09-300001439222us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMember2024-09-300001439222us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMember2024-09-300001439222us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMember2024-09-300001439222us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMember2024-09-300001439222us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMember2024-09-300001439222us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2024-09-300001439222us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2024-09-300001439222us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2024-09-300001439222us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2024-09-300001439222agio:CurrentAssetMemberus-gaap:CertificatesOfDepositMember2024-09-300001439222agio:CurrentAssetMemberus-gaap:USTreasurySecuritiesMember2024-09-300001439222agio:CurrentAssetMemberus-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMember2024-09-300001439222agio:CurrentAssetMemberus-gaap:CorporateDebtSecuritiesMember2024-09-300001439222agio:CurrentAssetMember2024-09-300001439222agio:NonCurrentAssetsMemberus-gaap:USTreasurySecuritiesMember2024-09-300001439222agio:NonCurrentAssetsMemberus-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMember2024-09-300001439222agio:NonCurrentAssetsMemberus-gaap:CorporateDebtSecuritiesMember2024-09-300001439222agio:NonCurrentAssetsMember2024-09-300001439222agio:CurrentAssetMemberus-gaap:USTreasurySecuritiesMember2023-12-310001439222agio:CurrentAssetMemberus-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMember2023-12-310001439222agio:CurrentAssetMemberus-gaap:CorporateDebtSecuritiesMember2023-12-310001439222agio:CurrentAssetMember2023-12-310001439222agio:NonCurrentAssetsMemberus-gaap:USTreasurySecuritiesMember2023-12-310001439222agio:NonCurrentAssetsMemberus-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMember2023-12-310001439222agio:NonCurrentAssetsMemberus-gaap:CorporateDebtSecuritiesMember2023-12-310001439222agio:NonCurrentAssetsMember2023-12-310001439222us-gaap:OtherNoncurrentAssetsMember2024-09-300001439222agio:ThirtyEightSydneyStreetLeaseMember2021-08-310001439222agio:SixtyFourSydneyStreetLeaseMember2022-04-300001439222agio:SixtyFourSydneyStreetLeaseMember2023-05-310001439222agio:TwoThousandSevenStockIncentivePlanAndTwoThousandThirteenStockIncentivePlanMember2024-09-300001439222agio:TwoThousandAndThirteenStockIncentivePlanMember2024-09-300001439222agio:TwoThousandAndThirteenStockIncentivePlanMember2024-01-012024-09-300001439222us-gaap:RestrictedStockUnitsRSUMember2023-12-310001439222us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-09-300001439222us-gaap:RestrictedStockUnitsRSUMember2024-09-300001439222agio:PerformanceStockUnitMember2023-12-310001439222agio:PerformanceStockUnitMember2024-01-012024-09-300001439222agio:PerformanceStockUnitMember2024-09-300001439222agio:MarketBasedStockUnitsMember2023-12-310001439222agio:MarketBasedStockUnitsMember2024-01-012024-09-300001439222agio:MarketBasedStockUnitsMember2024-09-300001439222agio:EmployeeStockPurchasePlan2013Member2024-01-012024-09-300001439222agio:EmployeeStockPurchasePlan2013Member2023-01-012023-09-300001439222agio:EmployeeStockPurchasePlan2013Member2024-09-300001439222us-gaap:EmployeeStockOptionMember2024-07-012024-09-300001439222us-gaap:EmployeeStockOptionMember2023-07-012023-09-300001439222us-gaap:EmployeeStockOptionMember2024-01-012024-09-300001439222us-gaap:EmployeeStockOptionMember2023-01-012023-09-300001439222us-gaap:RestrictedStockUnitsRSUMember2024-07-012024-09-300001439222us-gaap:RestrictedStockUnitsRSUMember2023-07-012023-09-300001439222us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-09-300001439222agio:PerformanceStockUnitMember2024-07-012024-09-300001439222agio:PerformanceStockUnitMember2023-07-012023-09-300001439222agio:PerformanceStockUnitMember2023-01-012023-09-300001439222agio:EmployeePurchasePlanMember2024-07-012024-09-300001439222agio:EmployeePurchasePlanMember2023-07-012023-09-300001439222agio:EmployeePurchasePlanMember2024-01-012024-09-300001439222agio:EmployeePurchasePlanMember2023-01-012023-09-300001439222us-gaap:ResearchAndDevelopmentExpenseMember2024-07-012024-09-300001439222us-gaap:ResearchAndDevelopmentExpenseMember2023-07-012023-09-300001439222us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-09-300001439222us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-09-300001439222us-gaap:GeneralAndAdministrativeExpenseMember2024-07-012024-09-300001439222us-gaap:GeneralAndAdministrativeExpenseMember2023-07-012023-09-300001439222us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-09-300001439222us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-09-300001439222us-gaap:PerformanceSharesMember2024-07-012024-09-300001439222us-gaap:PerformanceSharesMember2023-07-012023-09-300001439222us-gaap:PerformanceSharesMember2024-01-012024-09-300001439222us-gaap:PerformanceSharesMember2023-01-012023-09-300001439222us-gaap:EmployeeStockMember2024-07-012024-09-300001439222us-gaap:EmployeeStockMember2023-07-012023-09-300001439222us-gaap:EmployeeStockMember2024-01-012024-09-300001439222us-gaap:EmployeeStockMember2023-01-012023-09-300001439222us-gaap:EmployeeStockOptionMember2024-07-012024-09-300001439222us-gaap:EmployeeStockOptionMember2023-07-012023-09-300001439222us-gaap:EmployeeStockOptionMember2024-01-012024-09-300001439222us-gaap:EmployeeStockOptionMember2023-01-012023-09-300001439222us-gaap:RestrictedStockUnitsRSUMember2024-07-012024-09-300001439222us-gaap:RestrictedStockUnitsRSUMember2023-07-012023-09-300001439222us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-09-300001439222us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-09-300001439222agio:EmployeePurchasePlanMember2024-07-012024-09-300001439222agio:EmployeePurchasePlanMember2023-07-012023-09-300001439222agio:EmployeePurchasePlanMember2024-01-012024-09-300001439222agio:EmployeePurchasePlanMember2023-01-012023-09-300001439222agio:RahulBallalMember2024-07-012024-09-300001439222agio:RahulBallalMember2024-09-300001439222agio:JamesBurnsMember2024-07-012024-09-300001439222agio:JamesBurnsMember2024-09-300001439222agio:DavidScaddenMember2024-07-012024-09-300001439222agio:DavidScaddenMember2024-09-30 UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

(Mark One) | | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2024

OR | | | | | |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 001-36014

AGIOS PHARMACEUTICALS, INC.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | | | | |

| Delaware | 26-0662915 |

(State or Other Jurisdiction of

Incorporation or Organization) | (I.R.S. Employer

Identification No.) |

| | | |

88 Sidney Street, Cambridge, Massachusetts | 02139 |

| (Address of Principal Executive Offices) | (Zip Code) |

(617) 649-8600

(Registrant’s Telephone Number, Including Area Code)

(Former Name, Former Address and Former Fiscal Year, if Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

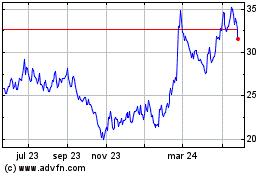

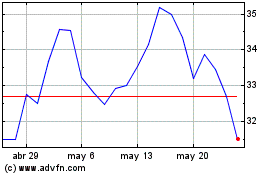

| Common Stock, Par Value $0.001 per share | AGIO | Nasdaq Global Select Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. | | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Number of shares of the registrant’s Common Stock, $0.001 par value, outstanding on October 25, 2024: 57,030,195

AGIOS PHARMACEUTICALS, INC.

FORM 10-Q

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2024

TABLE OF CONTENTS

| | | | | | | | |

| | Page No. |

| |

Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

| |

Item 1A. | | |

Item 5. | | |

Item 6. | | |

| | |

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements (Unaudited)

AGIOS PHARMACEUTICALS, INC.

Condensed Consolidated Balance Sheets

(Unaudited) | | | | | | | | | | | |

(In thousands, except share and per share data) | September 30,

2024 | | December 31,

2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 253,730 | | | $ | 88,205 | |

| Marketable securities | 751,027 | | | 688,723 | |

| Accounts receivable, net | 3,118 | | | 2,810 | |

| | | |

| | | |

| | | |

| Inventory | 26,429 | | | 19,076 | |

| Prepaid expenses and other current assets | 39,885 | | | 35,021 | |

| | | |

| Total current assets | 1,074,189 | | | 833,835 | |

| Marketable securities | 655,889 | | | 29,435 | |

| Operating lease assets | 45,841 | | | 54,409 | |

| Property and equipment, net | 11,819 | | | 15,382 | |

| Other non-current assets | 4,056 | | | 4,057 | |

| | | |

| Total assets | $ | 1,791,794 | | | $ | 937,118 | |

| Liabilities and stockholders’ equity | | | |

| Current liabilities: | | | |

| | | |

| Accounts payable | $ | 17,143 | | | $ | 9,780 | |

| Accrued expenses | 33,307 | | | 43,167 | |

| Income taxes payable | 52,682 | | | — | |

| Operating lease liabilities | 16,319 | | | 15,008 | |

| | | |

| | | |

| | | |

| | | |

| Total current liabilities | 119,451 | | | 67,955 | |

| | | |

| Operating lease liabilities, net of current portion | 44,515 | | | 56,988 | |

| Other non-current liabilities | 1,156 | | | 1,156 | |

| | | |

| | | |

| Total liabilities | 165,122 | | | 126,099 | |

| Stockholders’ equity: | | | |

Preferred stock, $0.001 par value; 25,000,000 shares authorized; no shares issued or outstanding at September 30, 2024 and December 31, 2023 | — | | | — | |

Common stock, $0.001 par value; 125,000,000 shares authorized; 73,237,954 shares issued and 57,021,543 shares outstanding at September 30, 2024, and 72,161,489 shares issued and 55,945,078 shares outstanding at December 31, 2023 | 73 | | | 72 | |

| Additional paid-in capital | 2,478,066 | | | 2,436,523 | |

| Accumulated other comprehensive income (loss) | 3,420 | | | (441) | |

Treasury stock, at cost (16,216,411 shares at September 30, 2024 and December 31, 2023) | (802,486) | | | (802,486) | |

| Accumulated deficit | (52,401) | | | (822,649) | |

| Total stockholders’ equity | 1,626,672 | | | 811,019 | |

| Total liabilities and stockholders’ equity | $ | 1,791,794 | | | $ | 937,118 | |

See accompanying Notes to Condensed Consolidated Financial Statements.

AGIOS PHARMACEUTICALS, INC.

Condensed Consolidated Statements of Operations

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

(In thousands, except share and per share data) | 2024 | | 2023 | | 2024 | | 2023 |

| Revenues: | | | | | | | |

| Product revenue, net | $ | 8,964 | | | $ | 7,399 | | | $ | 25,768 | | | $ | 19,720 | |

| | | | | | | |

| | | | | | | |

| Total revenue | 8,964 | | | 7,399 | | | 25,768 | | | 19,720 | |

| Operating expenses: | | | | | | | |

| Cost of sales | $ | 783 | | | $ | 633 | | | $ | 2,905 | | | $ | 2,295 | |

| Research and development | 72,455 | | | 81,841 | | | 218,476 | | | 218,037 | |

| Selling, general and administrative | 38,537 | | | 25,822 | | | 105,087 | | | 84,598 | |

| Total operating expenses | 111,775 | | | 108,296 | | | 326,468 | | | 304,930 | |

| Loss from operations | (102,811) | | | (100,897) | | | (300,700) | | | (285,210) | |

| Gain on sale of contingent payments | 889,136 | | | — | | | 889,136 | | | — | |

| Milestone payment from gain on sale of oncology business | 200,000 | | | — | | | 200,000 | | | — | |

| Interest income, net | 13,059 | | | 8,375 | | | 30,068 | | | 24,720 | |

| Other income, net | 1,651 | | | 1,198 | | | 4,864 | | | 4,342 | |

| | | | | | | |

| | | | | | | |

| Net income (loss) before taxes | 1,001,035 | | | (91,324) | | | 823,368 | | | (256,148) | |

| Income tax expense | 53,120 | | | — | | | 53,120 | | | — | |

| | | | | | | |

| Net income (loss) | $ | 947,915 | | | $ | (91,324) | | | $ | 770,248 | | | $ | (256,148) | |

| | | | | | | |

| | | | | | | |

| Net income (loss) per share - basic | $ | 16.65 | | | $ | (1.64) | | | $ | 13.58 | | | $ | (4.61) | |

| Net income (loss) per share - diluted | $ | 16.22 | | | $ | (1.64) | | | $ | 13.38 | | | $ | (4.61) | |

| | | | | | | |

| Weighted-average number of common shares used in computing net income (loss) per share – basic | 56,939,403 | | | 55,803,663 | | | 56,709,318 | | | 55,559,766 | |

| Weighted-average number of common shares used in computing net income (loss) per share – diluted | 58,432,796 | | | 55,803,663 | | | 57,581,382 | | | 55,559,766 | |

| | | | | | | |

See accompanying Notes to Condensed Consolidated Financial Statements.

AGIOS PHARMACEUTICALS, INC.

Condensed Consolidated Statements of Comprehensive Income (Loss)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

(In thousands) | 2024 | | 2023 | | 2024 | | 2023 |

| Net income (loss) | $ | 947,915 | | | $ | (91,324) | | | $ | 770,248 | | | $ | (256,148) | |

| Other comprehensive income | | | | | | | |

| Unrealized gain on available-for-sale securities | 4,465 | | | 2,974 | | | 3,861 | | | 6,639 | |

| Comprehensive income (loss) | $ | 952,380 | | | $ | (88,350) | | | $ | 774,109 | | | $ | (249,509) | |

See accompanying Notes to Condensed Consolidated Financial Statements.

AGIOS PHARMACEUTICALS, INC.

Condensed Consolidated Statements of Stockholders' Equity

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional

Paid-In

Capital | | Accumulated

Other

Comprehensive

Loss | | Accumulated

Deficit | | Treasury Stock | | Total

Stockholders’

Equity |

| (in thousands, except share amounts) | Shares | | Amount | | Shares | | Amount | |

| Balance at December 31, 2023 | 72,161,489 | | | $ | 72 | | | $ | 2,436,523 | | | $ | (441) | | | $ | (822,649) | | | (16,216,411) | | | $ | (802,486) | | | $ | 811,019 | |

| | | | | | | | | | | | | | | |

| Unrealized loss on available-for-sale securities | — | | | — | | | — | | | (646) | | | — | | | — | | | — | | | (646) | |

| Common stock issued under stock incentive plan and ESPP | 806,433 | | | 1 | | | 5,863 | | | — | | | — | | | — | | | — | | | 5,864 | |

| Stock-based compensation expense | — | | | — | | | 9,234 | | | — | | | — | | | — | | | — | | | 9,234 | |

| | | | | | | | | | | | | | | |

| Net loss | — | | | — | | | — | | | — | | | (81,549) | | | — | | | — | | | (81,549) | |

| | | | | | | | | | | | | | | |

| Balance at March 31, 2024 | 72,967,922 | | | $ | 73 | | | $ | 2,451,620 | | | $ | (1,087) | | | $ | (904,198) | | | (16,216,411) | | | $ | (802,486) | | | $ | 743,922 | |

| Unrealized gain on available-for-sale securities | — | | | — | | | — | | | 42 | | | — | | | — | | | — | | | 42 | |

| Common stock issued under stock incentive plan and ESPP | 123,568 | | | — | | | 1,099 | | | — | | | — | | | — | | | — | | | 1,099 | |

| Stock-based compensation expense | — | | | — | | | 11,565 | | | — | | | — | | | — | | | — | | | 11,565 | |

| | | | | | | | | | | | | | | |

| Net loss | — | | | — | | | — | | | — | | | (96,118) | | | — | | | — | | | (96,118) | |

| Balance at June 30, 2024 | 73,091,490 | | | $ | 73 | | | $ | 2,464,284 | | | $ | (1,045) | | | $ | (1,000,316) | | | (16,216,411) | | | $ | (802,486) | | | $ | 660,510 | |

| Unrealized gain on available-for-sale securities | — | | | — | | | — | | | 4,465 | | | — | | | — | | | — | | | 4,465 | |

| Common stock issued under stock incentive plan and ESPP | 146,464 | | | — | | | 2,637 | | | — | | | — | | | — | | | — | | | 2,637 | |

| Stock-based compensation expense | — | | | — | | | 11,145 | | | — | | | — | | | — | | | — | | | 11,145 | |

| Net income | — | | | — | | | — | | | — | | | 947,915 | | | — | | | — | | | 947,915 | |

| Balance at September 30, 2024 | 73,237,954 | | | 73 | | | 2,478,066 | | | 3,420 | | | (52,401) | | | (16,216,411) | | | (802,486) | | | 1,626,672 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional

Paid-In

Capital | | Accumulated

Other

Comprehensive

(Loss) Income | | Accumulated

Deficit | | Treasury Stock | | Total

Stockholders’

Equity |

| (in thousands, except share amounts) | Shares | | Amount | | Shares | | Amount | |

| Balance at December 31, 2022 | 71,256,118 | | | $ | 71 | | | $ | 2,386,325 | | | $ | (12,535) | | | $ | (470,561) | | | (16,216,411) | | | $ | (802,486) | | | $ | 1,100,814 | |

| Unrealized gain on available-for-sale securities | — | | | — | | | — | | | 4,124 | | | — | | | — | | | — | | | 4,124 | |

| | | | | | | | | | | | | | | |

| Common stock issued under stock incentive plan and ESPP | 501,660 | | | 1 | | | 2,466 | | | — | | | — | | | — | | | — | | | 2,467 | |

| Stock-based compensation expense | — | | | — | | | 10,139 | | | — | | | — | | | — | | | — | | | 10,139 | |

| Net loss | — | | | — | | | — | | | — | | | (81,018) | | | — | | | — | | | (81,018) | |

| Balance at March 31, 2023 | 71,757,778 | | | $ | 72 | | | $ | 2,398,930 | | | $ | (8,411) | | | $ | (551,579) | | | (16,216,411) | | | $ | (802,486) | | | $ | 1,036,526 | |

| Unrealized loss on available-for-sale securities | — | | | — | | | — | | | (459) | | | — | | | — | | | — | | | (459) | |

| | | | | | | | | | | | | | | |

| Common stock issued under stock incentive plan and ESPP | 193,408 | | | — | | | 238 | | | — | | | — | | | — | | | — | | | 238 | |

| Stock-based compensation expense | — | | | — | | | 11,737 | | | — | | | — | | | — | | | — | | | 11,737 | |

| | | | | | | | | | | | | | | |

| Net loss | — | | | — | | | — | | | — | | | (83,806) | | | — | | | — | | | (83,806) | |

| Balance at June 30, 2023 | 71,951,186 | | | $ | 72 | | | $ | 2,410,905 | | | $ | (8,870) | | | $ | (635,385) | | | (16,216,411) | | | $ | (802,486) | | | $ | 964,236 | |

| Unrealized gain on available-for-sale securities | — | | | — | | | — | | | 2,974 | | | — | | | — | | | — | | | 2,974 | |

| Common stock issued under stock incentive plan and ESPP | 149,198 | | | — | | | 1,881 | | | — | | | — | | | — | | | — | | | 1,881 | |

| Stock-based compensation expense | — | | | — | | | 9,076 | | | — | | | — | | | — | | | — | | | 9,076 | |

| Net loss | — | | | — | | | — | | | — | | | (91,324) | | | — | | | — | | | (91,324) | |

| Balance at September 30, 2023 | 72,100,384 | | | $ | 72 | | | $ | 2,421,862 | | | $ | (5,896) | | | $ | (726,709) | | | (16,216,411) | | | $ | (802,486) | | | $ | 886,843 | |

See accompanying Notes to Condensed Consolidated Financial Statements.

AGIOS PHARMACEUTICALS, INC.

Condensed Consolidated Statements of Cash Flows

(Unaudited) | | | | | | | | | | | |

| Nine Months Ended

September 30, |

| (In thousands) | 2024 | | 2023 |

| Operating activities | | | |

| Net income (loss) | $ | 770,248 | | | $ | (256,148) | |

| | | |

| | | |

| Adjustments to reconcile net income (loss) to net cash used in operating activities: | | | |

| Depreciation and amortization | 4,286 | | | 5,220 | |

| Stock-based compensation expense | 31,944 | | | 30,952 | |

| Net accretion of discount on marketable securities | (8,870) | | | (4,658) | |

| (Gain) loss on disposal of property and equipment | (39) | | | 278 | |

| Non-cash operating lease expense | 8,568 | | | 7,967 | |

| Expense associated with license agreement | — | | | 17,500 | |

| Realized gain on investments | (168) | | | (28) | |

| Gain on sale of contingent payments | (889,136) | | | — | |

| Milestone payment from gain on sale of oncology business | (200,000) | | | — | |

| | | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable, net | (308) | | | 1,030 | |

| | | |

| | | |

| | | |

| Inventory | (7,353) | | | (8,782) | |

| | | |

| | | |

| Prepaid expenses and other current and non-current assets | (4,863) | | | 440 | |

| Accounts payable | 7,357 | | | (5,201) | |

| Accrued expenses and other current liabilities | (9,860) | | | 140 | |

| | | |

| Income taxes payable | 52,682 | | | — | |

| Operating lease liabilities | (11,162) | | | (10,161) | |

| | | |

| Other non-current liabilities | — | | | (2,123) | |

| | | |

| | | |

| Net cash used in operating activities | (256,674) | | | (223,574) | |

| Investing activities | | | |

| Purchases of marketable securities | (1,344,107) | | | (327,490) | |

| Proceeds from maturities and sales of marketable securities | 668,248 | | | 488,492 | |

| Payments associated with license agreement | — | | | (17,500) | |

| Proceeds from sale of contingent payments | 889,136 | | | — | |

| Proceeds from milestone payment from gain on sale of oncology business | 200,000 | | | — | |

| Purchases of property and equipment | (718) | | | (765) | |

| Proceeds from sale of equipment | 40 | | | 1,325 | |

| | | |

| | | |

| Net cash provided by investing activities | 412,599 | | | 144,062 | |

| Financing activities | | | |

| | | |

| | | |

| | | |

| Net proceeds from stock option exercises and employee stock purchase plan | 9,600 | | | 4,586 | |

| | | |

| | | |

| Net cash provided by financing activities | 9,600 | | | 4,586 | |

| Net change in cash and cash equivalents | 165,525 | | | (74,926) | |

| Cash and cash equivalents at beginning of the period | 88,205 | | | 139,259 | |

| Cash and cash equivalents at end of the period | $ | 253,730 | | | $ | 64,333 | |

| | | |

| | | |

| | | | | | | | | | | |

| Supplemental disclosure of non-cash investing and financing transactions | | | |

| Additions to property and equipment in accounts payable and accrued expenses | $ | 61 | | | $ | 14 | |

| | | |

| | | |

| | | |

| | | |

| Net cash taxes (returned) paid | $ | (637) | | | $ | 1,586 | |

See accompanying Notes to Condensed Consolidated Financial Statements.

AGIOS PHARMACEUTICALS, INC.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

1. Overview and Basis of Presentation

References to Agios

Throughout this Quarterly Report on Form 10-Q, "Agios," "the company," “we,” “us,” and “our,” and similar expressions, except where the context requires otherwise, refer to Agios Pharmaceuticals, Inc. and its consolidated subsidiaries, and “our Board of Directors” refers to the board of directors of Agios Pharmaceuticals, Inc.

Overview

We are a biopharmaceutical company committed to transforming patients’ lives through leadership in the field of cellular metabolism, with the goal of creating differentiated medicines for rare diseases, with a focus on classical hematology. With a history of focused study on cellular metabolism, we have a deep and mature understanding of this biology, which is involved in the healthy functioning of nearly every system in the body. Building on this expertise, these learnings can be rapidly applied to our clinical trials with the goal of developing medicines that can have a significant impact for patients. We accelerate the impact of our portfolio by cultivating connections with patient communities, healthcare professionals, partners and colleagues to discover, develop and deliver potential therapies for rare diseases. We are located in Cambridge, Massachusetts.

The lead product candidate in our portfolio, PYRUKYND® (mitapivat), is an activator of both wild-type and mutant pyruvate kinase, or PK, enzymes for the potential treatment of hemolytic anemias. In February 2022, the U.S. Food and Drug Administration, or FDA, approved PYRUKYND® for the treatment of hemolytic anemia in adults with PK deficiency in the United States. In November 2022, we received marketing authorization from the European Commission for PYRUKYND® for the treatment of PK deficiency in adult patients in the European Union, or EU. In December 2022, we received marketing authorization in Great Britain for PYRUKYND® for the treatment of PK deficiency in adult patients under the European Commission Decision Reliance Procedure. In addition, we are currently evaluating PYRUKYND® in clinical trials for the treatment of thalassemia, sickle cell disease, or SCD, and in pediatric patients with PK deficiency. We are also developing (i) AG-946 (tebapivat), a novel PK activator, for the potential treatment of lower-risk myelodysplastic syndrome, or LR MDS, and hemolytic anemias, and (ii) AG-181, our phenylalanine hydroxylase, or PAH, stabilizer for the potential treatment of phenylketonuria, or PKU. In September 2024, AG-946 (tebapivat) was granted Orphan Drug Designation by the FDA for the treatment of MDS.

In addition to the aforementioned development programs, in July 2023 we entered into a license agreement with Alnylam Pharmaceuticals, Inc., or Alnylam, for the development and commercialization of products containing or comprised of an siRNA preclinical development candidate discovered by Alnylam and targeting the transmembrane serine protease 6, or TMPRSS6, gene, and we have begun preclinical development of a product candidate for the potential disease-modifying treatment of patients with polycythemia vera, or PV, a rare blood disorder.

We are subject to risks common to companies in our industry including, but not limited to, uncertainties relating to conducting preclinical and clinical research and development, the manufacture and supply of products for clinical and commercial use, obtaining and maintaining regulatory approvals and pricing and reimbursement for our products, market acceptance, managing global growth and operating expenses, availability of additional capital, competition, obtaining and enforcing patents, stock price volatility, dependence on collaborative relationships and third-party service providers, dependence on key personnel, potential litigation, potential product liability claims and potential government investigations.

Alnylam License Agreement

On July 28, 2023, we entered into a license agreement with Alnylam under which we acquired the rights to develop and commercialize Alnylam’s novel preclinical siRNA targeting the TMPRSS6 gene, as a potential disease-modifying treatment for patients with PV. Because the acquired assets do not meet the definition of a business in accordance with Accounting Standards Codification, or ASC, 805, Business Combinations, we accounted for the agreement as an asset acquisition.

In accordance with the license agreement, in the three months ended September 30, 2023, we made an up-front payment to Alnylam and recognized in-process research and development of $17.5 million. We will also pay Alnylam for certain expenses associated with the development of the TMPRSS6 program, and these will be recorded in our Consolidated Statements of Operations as incurred. Additionally, we are responsible to pay up to $130.0 million in potential development and regulatory milestones, in addition to sales milestones as well as tiered royalties on annual net sales, if any, of licensed products, which may be subject to specified reductions and offsets.

Sale of Oncology Business to Servier and Sale of Contingent Payments

On March 31, 2021, we completed the sale of our oncology business to Servier Pharmaceuticals, LLC, or Servier, which represented a discontinued operation. The transaction included the sale of our oncology business, including TIBSOVO®, our clinical-stage product candidates vorasidenib, AG-270 and AG-636, and our oncology research programs for a payment of approximately $1.8 billion in cash at the closing, subject to certain adjustments, and a payment of $200.0 million in cash, if, prior to January 1, 2027, vorasidenib is granted new drug application approval from the FDA with an approved label that permits vorasidenib’s use as a single agent for the adjuvant treatment of patients with Grade 2 glioma that have an isocitrate dehydrogenase, or IDH, 1 or 2 mutation (and, to the extent required by such approval, the vorasidenib companion diagnostic test is granted an FDA premarket approval), or the Vorasidenib Milestone Payment, as well as a royalty of 5% of U.S. net sales of TIBSOVO® from the close of the transaction through loss of exclusivity, and a royalty of 15% of U.S. net sales of vorasidenib from the first commercial sale of vorasidenib through loss of exclusivity, or the Vorasidenib Royalty Rights. The Vorasidenib Milestone Payment, Vorasidenib Royalty Rights and royalty payments related to TIBSOVO® are referred to as contingent payments and recognized as income when realizable. Servier also acquired our co-commercialization rights for Bristol Myers Squibb’s IDHIFA® and the right to receive a $25.0 million potential milestone payment under our prior collaboration agreement with Celgene Corporation, or Celgene, and following the sale Servier has agreed to conduct certain clinical development activities within the IDHIFA® development program.

In October 2022, we sold our rights to future contingent payments associated with the royalty of 5% of U.S. net sales of TIBSOVO® from the close of the transaction through the loss of exclusivity to entities affiliated with Sagard Healthcare Partners, or Sagard, and recognized income of $127.9 million in our consolidated statements of operations for the year ended December 31, 2022.

In August 2024, the FDA approved vorasidenib for adult and pediatric patients 12 years and older with Grade 2 astrocytoma or oligodendroglioma with a susceptible IDH1 or IDH2 mutation, following surgery including biopsy, sub-total resection, or gross total resection. In September 2024, we received the Vorasidenib Milestone Payment from Servier and recognized income of $200.0 million within the milestone payment from gain on sale of oncology business line item in our consolidated statements of operations for the three and nine months ended September 30, 2024.

In May 2024, we entered into a purchase and sale agreement to sell the Vorasidenib Royalty Rights to Royalty Pharma Investments 2019 ICAV, or Royalty Pharma, for $905.0 million in cash, or the Upfront Payment. The sale was contingent upon FDA approval of vorasidenib and other customary closing conditions. Upon consummation of the sale in August 2024, Royalty Pharma acquired 100% of the Vorasidenib Royalty Rights payments made by Servier on account of up to $1.0 billion in U.S. net sales for each calendar year. In addition, any such Vorasidenib Royalty Rights payments made by Servier on account of U.S. net sales in each calendar year in excess of $1.0 billion will be split, with Royalty Pharma having the rights to a 12% earn-out on those excess payments and Agios retaining the rights to a 3% earn-out on those excess payments, or the Retained Earn-Out Rights. As a result of the sale, we recognized $889.1 million ($905.0 million net of fees of $15.9 million) within the gain on sale of contingent payments line item in our consolidated statements of operations for the three and nine months ended September 30, 2024. Royalty income related to the Retained Earn-Out Rights will be recognized in the period when realizable.

Basis of Presentation

The condensed consolidated balance sheet as of September 30, 2024, the condensed consolidated statements of operations, comprehensive income (loss) and stockholders' equity for the three and nine months ended September 30, 2024 and 2023, and the condensed consolidated statements of cash flows for the nine months ended September 30, 2024 and 2023 are unaudited. The unaudited condensed consolidated financial statements have been prepared on the same basis as the annual financial statements and, in the opinion of our management, reflect all adjustments, which include only normal recurring adjustments, necessary to fairly state our financial position as of September 30, 2024, our results of operations and stockholders' equity for the three and nine months ended September 30, 2024 and 2023, and cash flows for the nine months ended September 30, 2024 and 2023. The financial data and the other financial information disclosed in these notes to the condensed consolidated financial statements related to the three and nine-month periods are also unaudited. The results of operations for the three and nine months ended September 30, 2024 are not necessarily indicative of the results to be expected for the year ending December 31, 2024 or for any other future annual or interim period. The condensed consolidated balance sheet data as of December 31, 2023 was derived from our audited financial statements, but does not include all disclosures required by U.S. generally accepted accounting principles, or U.S. GAAP. The condensed consolidated interim financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2023 that was filed with the Securities and Exchange Commission, or SEC, on February 15, 2024.

Our condensed consolidated financial statements include our accounts and the accounts of our wholly owned subsidiaries. All intercompany transactions have been eliminated in consolidation. The condensed consolidated financial statements have been prepared in conformity with U.S. GAAP.

Use of Estimates

The preparation of our condensed consolidated financial statements requires us to make estimates, judgments and assumptions that may affect the reported amounts of assets, liabilities, equity, revenues and expenses and related disclosure of contingent assets and liabilities. On an ongoing basis we evaluate our estimates, judgments and methodologies. We base our estimates on historical experience and on various other assumptions that we believe are reasonable, the results of which form the basis for making judgments about the carrying values of assets, liabilities and equity and the amount of revenues and expenses. The full extent to which pandemics or public health emergencies, may in the future directly or indirectly impact our business, results of operations and financial condition, including expenses, reserves and allowances, clinical trials, research and development costs and employee-related amounts, will depend on future developments that are highly uncertain.

Liquidity

As of September 30, 2024, we had cash, cash equivalents and marketable securities of $1.7 billion. Although we have incurred recurring losses and expect to continue to incur losses for the foreseeable future, we expect our cash, cash equivalents and marketable securities to be sufficient to fund current operations for at least the next twelve months from the issuance of the financial statements. If we are unable to raise additional funds through equity or debt financings, we may be required to delay, limit, reduce or terminate product development or future commercialization efforts, or grant rights to develop and market products or product candidates that we would otherwise prefer to develop and market ourselves.

2. Summary of Significant Accounting Policies

There have been no material changes to the significant accounting policies previously disclosed in our Annual Report on Form 10-K for the year ended December 31, 2023.

Recent Accounting Pronouncements

Accounting standards that have been issued by the Financial Accounting Standards Board or other standards-setting bodies that do not require adoption until a future date are not expected to have a material impact on our financial statements upon adoption.

3. Fair Value Measurements

We record cash equivalents and marketable securities at fair value. ASC 820, Fair Value Measurements and Disclosures, establishes a fair value hierarchy for those instruments measured at fair value that distinguishes between assumptions based on market data (observable inputs) and our own assumptions (unobservable inputs). The hierarchy consists of three levels:

Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities.

Level 2 – Quoted prices for similar assets and liabilities in active markets, quoted prices in markets that are not active, or inputs which are observable, directly or indirectly, for substantially the full term of the asset or liability.

Level 3 – Unobservable inputs that reflect our own assumptions about the assumptions market participants would use in pricing the asset or liability in which there is little, if any, market activity for the asset or liability at the measurement date.

The following table summarizes our cash equivalents and marketable securities measured at fair value and by level on a recurring basis as of September 30, 2024: | | | | | | | | | | | | | | | | | | | | | | | |

| (In thousands) | Level 1 | | Level 2 | | Level 3 | | Total |

| Cash equivalents | $ | 20,154 | | | $ | 149,936 | | | $ | — | | | $ | 170,090 | |

| Total cash equivalents | 20,154 | | | 149,936 | | | — | | | 170,090 | |

| | | | | | | |

| Marketable securities: | | | | | | | |

| Certificates of deposit | $ | — | | | $ | 13,743 | | | $ | — | | | $ | 13,743 | |

| U.S. Treasuries | — | | | 266,598 | | | — | | | 266,598 | |

| Government securities | — | | | 297,557 | | | — | | | 297,557 | |

| Corporate debt securities | — | | | 829,018 | | | — | | | 829,018 | |

| Total marketable securities | — | | | 1,406,916 | | | — | | | 1,406,916 | |

| Total cash equivalents and marketable securities | $ | 20,154 | | | $ | 1,556,852 | | | $ | — | | | $ | 1,577,006 | |

Cash equivalents and marketable securities have been initially valued at the transaction price and are subsequently valued, at the end of each reporting period, utilizing third-party pricing services or other observable market data. The pricing services utilize industry standard valuation models, including both income and market-based approaches, and observable market inputs to

determine value. After completing our validation procedures, we did not adjust or override any fair value measurements provided by the pricing services as of September 30, 2024.

There have been no changes to the valuation methods during the nine months ended September 30, 2024, and we had no financial assets or liabilities that were classified as Level 3 at any point during the nine months ended September 30, 2024.

4. Marketable Securities

Our marketable securities are classified as available-for-sale pursuant to ASC 320, Investments – Debt and Equity Securities, and are recorded at fair value. Unrealized gains and losses are included as a component of accumulated other comprehensive income (loss) in the condensed consolidated balance sheets and statements of stockholders’ equity, and a component of total comprehensive income (loss) in the condensed consolidated statements of comprehensive income (loss), until realized. Unrealized losses are evaluated for impairment under ASC 326, Financial Instruments - Credit Losses, to determine if the impairment is credit-related or noncredit-related. Credit-related impairment is recognized as an allowance on the condensed consolidated balance sheets with a corresponding adjustment to earnings, and noncredit-related impairment is recognized in other comprehensive income, net of taxes. Realized gains and losses are included in investment income on a specific-identification basis. There were no material realized gains or losses on marketable securities for the three and nine months ended September 30, 2024 or 2023.

Marketable securities at September 30, 2024 consisted of the following:

| | | | | | | | | | | | | | | | | | | | | | | |

| (In thousands) | Amortized

Cost | | Unrealized

Gains | | Unrealized

Losses | | Fair

Value |

| Current: | | | | | | | |

| Certificates of deposit | $ | 13,724 | | | $ | 19 | | | $ | — | | | $ | 13,743 | |

| U.S. Treasuries | 179,560 | | | 299 | | | (10) | | | 179,849 | |

| Government securities | 160,442 | | | 235 | | | (34) | | | 160,643 | |

| Corporate debt securities | 396,143 | | | 718 | | | (69) | | | 396,792 | |

| Total Current | 749,869 | | | 1,271 | | | (113) | | | 751,027 | |

| | | | | | | |

| Non-current: | | | | | | | |

| | | | | | | |

| U.S. Treasuries | 86,299 | | | 477 | | | (27) | | | 86,749 | |

| Government securities | 136,747 | | | 250 | | | (83) | | | 136,914 | |

| Corporate debt securities | 430,581 | | | 1,733 | | | (88) | | | 432,226 | |

| Total Non-current | 653,627 | | | 2,460 | | | (198) | | | 655,889 | |

| Total marketable securities | $ | 1,403,496 | | | $ | 3,731 | | | $ | (311) | | | $ | 1,406,916 | |

Marketable securities at December 31, 2023 consisted of the following:

| | | | | | | | | | | | | | | | | | | | | | | |

| (In thousands) | Amortized

Cost | | Unrealized

Gains | | Unrealized

Losses | | Fair

Value |

| Current: | | | | | | | |

| | | | | | | |

| U.S. Treasuries | $ | 30,876 | | | $ | — | | | $ | (56) | | | $ | 30,820 | |

| Government securities | 247,460 | | | 194 | | | (695) | | | 246,959 | |

| Corporate debt securities | 411,045 | | | 874 | | | (975) | | | 410,944 | |

| Total Current | 689,381 | | | 1,068 | | | (1,726) | | | 688,723 | |

| | | | | | | |

| Non-current: | | | | | | | |

| | | | | | | |

| U.S. Treasuries | 4,802 | | | 30 | | | — | | | 4,832 | |

| Government securities | 9,986 | | | 75 | | | — | | | 10,061 | |

| Corporate debt securities | 14,430 | | | 112 | | | — | | | 14,542 | |

| Total Non-current | 29,218 | | | 217 | | | — | | | 29,435 | |

| Total marketable securities | $ | 718,599 | | | $ | 1,285 | | | $ | (1,726) | | | $ | 718,158 | |

As of September 30, 2024 and December 31, 2023, we held both current and non-current investments. Investments classified as current have maturities of less than one year. Investments classified as non-current are those that: (i) have a maturity of greater than one year, and (ii) we do not intend to liquidate within the next twelve months, although these funds are available for use and, therefore, are classified as available-for-sale.

As of September 30, 2024 and December 31, 2023, we held 91 and 151 debt securities, respectively, that were in an unrealized loss position for less than one year. We did not record an allowance for credit losses as of September 30, 2024 and December 31, 2023 related to these securities. The aggregate fair value of debt securities in an unrealized loss position at September 30, 2024 and December 31, 2023 was $336.6 million and $513.5 million, respectively. There were no individual securities that were in a significant unrealized loss position as of September 30, 2024 and December 31, 2023. We regularly review the securities in an unrealized loss position and evaluate the current expected credit loss by considering factors such as historical experience, market data, issuer-specific factors, and current economic conditions. We do not consider these marketable securities to be impaired as of September 30, 2024 and December 31, 2023.

5. Inventory

Inventory, which consists of commercial supply of PYRUKYND®, consisted of the following:

| | | | | | | | | | | |

| (In thousands) | September 30,

2024 | | December 31,

2023 |

| Raw materials | $ | 90 | | | $ | 51 | |

| Work-in-process | 24,079 | | | 17,568 | |

| Finished goods | 2,260 | | | 1,457 | |

| Total inventory | $ | 26,429 | | | $ | 19,076 | |

6. Leases

Our building leases are comprised of office and laboratory space under non-cancelable operating leases. These lease agreements have remaining lease terms of approximately three years and contain various clauses for renewal at our option. The renewal options were not included in the calculation of the operating lease assets and the operating lease liabilities as the renewal options are not reasonably certain of being exercised. The lease agreements do not contain residual value guarantees.

The components of lease expense and other information related to leases were as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (In thousands) | 2024 | | 2023 | | 2024 | | 2023 |

| Operating lease costs | $ | 3,807 | | | $ | 3,807 | | | $ | 11,420 | | | $ | 11,420 | |

| Cash paid for amounts included in the measurement of operating lease liabilities | 4,684 | | | 4,550 | | | 14,015 | | | $ | 13,614 | |

We have not entered into any material short-term leases or financing leases as of September 30, 2024.

In arriving at the operating lease liabilities as of September 30, 2024 and December 31, 2023, we applied the weighted-average incremental borrowing rate of 5.7% for both periods over a weighted-average remaining lease term of 3.4 and 4.2 years, respectively.

As of September 30, 2024, undiscounted minimum rental commitments under non-cancelable leases were as follows: | | | | | |

| |

| (In thousands) | |

| Remaining 2024 | $ | 3,126 | |

| 2025 | 19,507 | |

| 2026 | 20,151 | |

| 2027 | 20,755 | |

| 2028 | 3,479 | |

| |

| |

| Undiscounted minimum rental commitments | $ | 67,018 | |

| Interest | (6,184) | |

| Operating lease liabilities | $ | 60,834 | |

We provided our landlord a security deposit of $2.9 million as security for our leases, which is included within other non-current assets on our condensed consolidated balance sheet.

In August 2021, we entered into a long-term sublease agreement for 13,000 square feet of the office space at 38 Sidney Street, Cambridge, Massachusetts, with the term of the lease running through December 2024. In April 2022, we entered into a long-term sublease agreement for 27,000 square feet of the office space at 64 Sidney Street, Cambridge, Massachusetts, with the term of the lease running through April 2025. In May 2023, we entered into a long-term sublease agreement for 7,407 square feet of office space on the first floor of 64 Sidney Street, Cambridge, Massachusetts, with the term of the lease running through April 2025. We recorded operating sublease income of $1.6 million and $1.7 million for the three months ended September 30, 2024 and 2023, respectively, and $4.8 million and $4.5 million for the nine months ended September 30, 2024 and 2023, respectively, in other income, net in the condensed consolidated statements of operations. We hold security deposits from our sublessees of approximately $1.2 million which is recorded within other non-current assets on our condensed consolidated balance sheet.

As of September 30, 2024, the future minimum lease payments to be received under the long-term sublease agreements were as follows: | | | | | |

| (In thousands) | |

| Remaining 2024 | $ | 1,284 | |

| 2025 | 1,310 | |

| |

| |

| Total | $ | 2,594 | |

7. Accrued Expenses

Accrued expenses consisted of the following: | | | | | | | | | | | |

| (In thousands) | September 30,

2024 | | December 31,

2023 |

| Accrued compensation | $ | 17,686 | | | $ | 23,232 | |

| Accrued research and development costs | 9,731 | | | 15,463 | |

| Accrued professional fees | 3,273 | | | 3,115 | |

| Accrued other | 2,617 | | | 1,357 | |

| Total accrued expenses | $ | 33,307 | | | $ | 43,167 | |

8. Product Revenue

We sell PYRUKYND®, our wholly owned product, to a limited number of specialty distributors and specialty pharmacy providers, or collectively, the Customers. These Customers subsequently resell PYRUKYND® to pharmacies or dispense PYRUKYND® directly to patients. In addition to distribution agreements with Customers, we enter into arrangements with

healthcare providers and payors that provide for government-mandated and/or privately-negotiated rebates, chargebacks and discounts with respect to the purchase of PYRUKYND®.

The performance obligation related to the sale of PYRUKYND® is satisfied and revenue is recognized when the Customer obtains control of the product, which occurs at a point in time, typically upon delivery to the Customer.

Product revenue, net, were as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| (In thousands) | 2024 | | 2023 | | 2024 | | 2023 |

| Product revenue, net | $ | 8,964 | | | $ | 7,399 | | | $ | 25,768 | | | $ | 19,720 | |

Reserves for Variable Consideration

Revenues from product sales are recorded at the net sales price, or transaction price, which includes estimates of variable consideration for which reserves are established and result from contractual adjustments, government rebates, returns and other allowances that are offered within the contracts with our Customers, healthcare providers, payors and other indirect customers relating to the sale of our products.

Contractual Adjustments

We generally provide Customers with discounts, including prompt pay discounts, and allowances that are explicitly stated in the contracts and are recorded as a reduction of revenue in the period the related product revenue is recognized. In addition, we receive sales order management, data and distribution services from certain Customers.

Chargebacks and discounts represent the estimated obligations resulting from contractual commitments to sell products to qualified healthcare providers at prices lower than the list prices charged to Customers who directly purchase the product from us. Customers charge us for the difference between what they pay for the product and the ultimate selling price to the qualified healthcare providers. These reserves are estimated using the expected value method, based upon a range of possible outcomes that are probability-weighted for the estimated channel mix and are established in the same period that the related revenue is recognized, resulting in a reduction of product revenue.

Government Rebates

Government rebates include Medicare, TriCare, and Medicaid rebates, which we estimate using the expected value method, based upon a range of possible outcomes that are probability-weighted for the estimated payor mix. These reserves are recorded in the same period the related revenue is recognized, resulting in a reduction of product revenue. For Medicare, we also estimate the number of patients in the prescription drug coverage gap for whom we will owe an additional liability under the Medicare Part D program.

Returns / Replacement

We estimate the amount of product sales that may be returned by Customers or replaced by Agios and record this estimate as a reduction of revenue in the period the related product revenue is recognized. We currently estimate product return and replacement liabilities using the expected value method, based on available industry data, including our visibility into the inventory remaining in the distribution channel.

The following table summarizes balances and activity in each of the product revenue allowance and reserve categories for the nine months ended September 30, 2024:

| | | | | | | | | | | | | | | | | | | | | | | |

| (In thousands) | Contractual Adjustments | | Government Rebates | | Returns/ Replacement | | Total |

| Balance at December 31, 2023 | $ | 156 | | | $ | 1,084 | | | $ | 232 | | | $ | 1,472 | |

| Current provisions relating to sales in the current year | 1,021 | | | 1,915 | | | 289 | | | 3,225 | |

| Adjustments relating to prior years | (39) | | | (49) | | | 40 | | | (48) | |

| Payments/returns relating to sales in the current year | (860) | | | (731) | | | — | | | (1,591) | |

| Payments/returns relating to sales in the prior years | (85) | | | (373) | | | (71) | | | (529) | |

| Balance at September 30, 2024 | $ | 193 | | | $ | 1,846 | | | $ | 490 | | | $ | 2,529 | |

Total revenue-related reserves above, included in our condensed consolidated balance sheets, are summarized as follows:

| | | | | | | | | | | |

| (In thousands) | September 30, 2024 | | December 31, 2023 |

| Reduction of accounts receivable | $ | 91 | | | $ | 151 | |

| Component of accrued expenses | 2,438 | | | 1,321 | |

| Total revenue-related reserves | $ | 2,529 | | | $ | 1,472 | |

The following table presents changes in our contract assets during the nine months ended September 30, 2024:

| | | | | | | | | | | | | | | | | | | | | | | |

| (In thousands) | December 31, 2023 | | Additions | | Deductions | | September 30, 2024 |

Contract assets(1) | | | | | | | |

| Accounts receivable, net | $ | 2,810 | | | $ | 28,921 | | | $ | (28,613) | | | $ | 3,118 | |

(1) Additions to contract assets relate to amounts billed to Customers for product sales and deductions to contract assets primarily relate to collection of receivables during the reporting period.

9. Share-Based Payments

2023 Stock Incentive Plan and Inducement Grants

In June 2023, our stockholders approved the 2023 Stock Incentive Plan, or the 2023 Plan. The 2023 Plan provides for the grant of incentive stock options, nonstatutory stock options, stock appreciation rights, restricted stock awards, restricted stock units, or RSUs, performance-based share units, or PSUs, and other stock-based awards to employees, advisors, consultants and non-employee directors.

Following the adoption of the 2023 Plan, we ceased granting equity awards under the 2013 Stock Incentive Plan, or the 2013 Plan. Any outstanding equity awards that were previously granted under the 2013 Plan continue to be governed by their terms. Following adoption of the 2013 Plan, we ceased granting equity awards under the 2007 Stock Incentive Plan, or the 2007 Plan. There are no outstanding equity awards under the 2007 Plan.

In connection with the start of employment of our Chief Executive Officer and Chief Financial Officer in 2022, and our Chief Commercial Officer in 2023, our board of directors granted each of them equity awards in the form of stock options, RSUs and PSUs, which awards were made outside our equity incentive plans as inducements material to their respective entry into employment with us in accordance with Nasdaq Listing Rule 5635(c)(4).

As of September 30, 2024, the maximum number of shares reserved under the 2013 Plan, the 2023 Plan and the inducement grants described above was 11,030,891, and we had 2,819,436 shares available for future issuance under the 2023 Plan.

Stock options

The following table presents stock option activity for the nine months ended September 30, 2024: | | | | | | | | | | | |

| Number of

Stock Options | | Weighted-Average Exercise Price |

| Outstanding at December 31, 2023 | 5,263,681 | | | $ | 44.94 | |

| Granted | 1,023,433 | | | 34.04 | |

| Exercised | (223,740) | | | 31.13 | |

| Cancelled/Forfeited | (46,427) | | | 42.18 | |

| Expired | (24,750) | | | 35.37 | |

| Outstanding at September 30, 2024 | 5,992,197 | | | $ | 43.65 | |

| Exercisable at September 30, 2024 | 3,840,761 | | | $ | 50.47 | |

| Vested and expected to vest at September 30, 2024 | 5,992,197 | | | $ | 43.65 | |

At September 30, 2024, there was approximately $33.5 million of total unrecognized compensation expense related to unvested stock option awards, which we expect to recognize over a weighted-average period of approximately 2.49 years.

Restricted stock units

The following table presents RSU activity for the nine months ended September 30, 2024: | | | | | | | | | | | |

| Number of

Stock Units | | Weighted-Average Grant Date Fair Value |

| Unvested shares at December 31, 2023 | 1,346,701 | | | $ | 29.67 | |

| Granted | 1,117,510 | | | 31.95 | |

| Vested | (579,370) | | | 32.72 | |

| Forfeited | (40,166) | | | 30.41 | |

| Unvested shares at September 30, 2024 | 1,844,675 | | | $ | 30.08 | |

As of September 30, 2024, there was approximately $39.6 million of total unrecognized compensation expense related to RSUs, which we expect to recognize over a weighted-average period of approximately 2.01 years.

Performance-based stock units

The following table presents PSU activity for the nine months ended September 30, 2024: | | | | | | | | | | | |

| Number of

Stock Units | | Weighted-Average Grant Date Fair Value |

| Unvested shares at December 31, 2023 | 362,133 | | | $ | 30.66 | |

| Granted | 183,000 | | | 32.27 | |

| Vested | (170,550) | | | 35.04 | |

| | | |

| Unvested shares at September 30, 2024 | 374,583 | | | $ | 29.45 | |

Stock-based compensation expense associated with these PSUs is recognized if the underlying performance condition is considered probable of achievement using our management’s best estimates.

As of September 30, 2024, there was no unrecognized compensation expense related to PSUs with performance-based vesting criteria that are considered probable of achievement, and $11.0 million of total unrecognized compensation expense related to PSUs with performance-based vesting criteria that are considered not probable of achievement.

Market-based stock units

The following table presents market-based stock unit, or MSU, activity for the nine months ended September 30, 2024: | | | | | | | | | | | |

| Number of

Stock Units | | Weighted-Average

Grant Date Fair

Value |

| Unvested shares at December 31, 2023 | 42,695 | | | $ | 41.50 | |

| | | |

| | | |

| Expired | (42,695) | | | 41.50 | |

| Unvested shares at September 30, 2024 | — | | | $ | — | |

The fair value of MSUs are estimated using a Monte Carlo simulation model. Assumptions and estimates utilized in the model include the risk-free interest rate, dividend yield, expected stock volatility and the estimated period to achievement of the market condition. As of September 30, 2024, there was no remaining unrecognized compensation expense related to MSUs.

2013 Employee Stock Purchase Plan

In June 2013, our Board of Directors adopted, and in July 2013 our stockholders approved, the 2013 Employee Stock Purchase Plan, or the 2013 ESPP. We issued and sold 102,805 and 112,832 shares of common stock during the nine months ended September 30, 2024 and 2023, respectively, under the 2013 ESPP. The 2013 ESPP provides participating employees with the opportunity to purchase up to an aggregate of 2,363,636 shares of our common stock. As of September 30, 2024, we had 1,583,234 shares of common stock available for future issuance under the 2013 ESPP.

Stock-based compensation expense

Stock-based compensation expense by award type included within the condensed consolidated statements of operations is as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (In thousands) | 2024 | | 2023 | | 2024 | | 2023 |

| Stock options | $ | 4,579 | | | $ | 4,171 | | | $ | 13,011 | | | $ | 13,065 | |

| Restricted stock units | 6,314 | | | 4,735 | | | 17,491 | | | 14,436 | |

| Performance-based stock units | — | | | — | | | 750 | | | 2,784 | |

| Employee stock purchase plan | 252 | | | 170 | | | 692 | | | 667 | |

| | | | | | | |

| Total stock-based compensation expense | $ | 11,145 | | | $ | 9,076 | | | $ | 31,944 | | | $ | 30,952 | |

Expenses related to stock options and stock-based awards were allocated as follows in the condensed consolidated statements of operations:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (In thousands) | 2024 | | 2023 | | 2024 | | 2023 |

| Research and development expense | $ | 4,391 | | | $ | 3,635 | | | $ | 12,626 | | | $ | 12,530 | |

| Selling, general and administrative expense | 6,754 | | | 5,441 | | | 19,318 | | | 18,422 | |

| Total stock-based compensation expense | $ | 11,145 | | | $ | 9,076 | | | $ | 31,944 | | | $ | 30,952 | |

10. Income (Loss) per Share

Basic net income (loss) per share is calculated by dividing net income (loss) by the weighted-average shares outstanding during the period, without consideration for common stock equivalents. Diluted net income (loss) per share is calculated by adjusting the weighted-average shares outstanding for the dilutive effect of common stock equivalents outstanding for the period, determined using the treasury stock method. For purposes of the dilutive net income (loss) per share calculation, stock options, RSUs and PSUs for which the performance and market vesting conditions, respectively, have been deemed probable, and 2013 ESPP shares are considered to be common stock equivalents, while PSUs with performance and market vesting conditions, respectively, that were not deemed probable as of September 30, 2024 are not considered to be common stock equivalents.

We utilize the control number concept in the computation of diluted earnings per share to determine whether potential common stock equivalents are dilutive. The control number used is net income (loss) from continuing operations. The control number concept requires that the same number of potentially dilutive securities applied in computing diluted earnings per share from continuing operations be applied to all other categories of income or loss, regardless of their anti-dilutive effect on such categories. Since we had a net loss for the three and nine months ended September 30, 2023, no dilutive effect was recognized in the calculation of loss per share and basic and diluted net loss per share was the same for those periods.

The following is a reconciliation of basic weighted-average number of common shares used in computing net income (loss) per share to diluted weighted-average number of common shares used in computing net income (loss) per share for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Basic shares | 56,939,403 | | | 55,803,663 | | | 56,709,318 | | | 55,559,766 | |

| Effect of dilutive securities | | | | | | | |

| Stock options | 557,300 | | | — | | | 231,082 | | | — | |

| Restricted stock units | 927,149 | | | — | | | 626,208 | | | — | |

| Performance-based stock units | — | | | — | | | 11,793 | | | — | |

| Employee stock purchase plan shares | 8,944 | | | — | | | 2,981 | | | — | |

| Diluted shares | 58,432,796 | | | 55,803,663 | | | 57,581,382 | | | 55,559,766 | |

The following common stock equivalents were excluded from the calculation of diluted net income (loss) per share applicable to common stockholders for the periods indicated because including them would have had an anti-dilutive effect: | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Stock options | 3,463,344 | | | 5,542,418 | | | 5,176,610 | | | 5,542,418 | |

| Restricted stock units | — | | | 1,355,987 | | | 90,480 | | | 1,355,987 | |

| | | | | | | |

| Employee stock purchase plan shares | 3,139 | | | 11,383 | | | 4,393 | | | 11,383 | |

| Total common stock equivalents | 3,466,483 | | | 6,909,788 | | | 5,271,483 | | | 6,909,788 | |

11. Income Taxes

We are subject to taxation in numerous U.S. states and territories. As a result, our effective tax rate is derived from a combination of applicable tax rates in the various places that we operate. In preparing our financial statements, we estimate the amount of tax that will become payable in each of such places. Nevertheless, our effective tax rate may be different from previous periods or our current expectations due to numerous factors, including as a result of changes in the mix of our profitability from state to state, the results of examinations and audits of our tax filings, our inability to secure or sustain acceptable agreements with tax authorities, changes in accounting for income taxes and changes in tax laws. Any of these factors may result in tax obligations in excess of amounts accrued in our financial statements.

We recorded income tax expense of $53.1 million for the three and nine months ended September 30, 2024 compared to no income tax expense for the three and nine months ended September 30, 2023. The income tax expense in the three and nine months ended September 30, 2024 was predominantly due to the current tax impact of the sale of the Vorasidenib Royalty Rights and the Vorasidenib Milestone Payment received in the three months ended September 30, 2024 as discussed above in Note 1, Overview and Basis of Presentation. While we released a portion of our valuation allowance when we utilized certain net operating loss carryforwards, or NOLs, and research and development tax credits as a result of the income associated with the sale of Vorasidenib Royalty Rights and the Vorasidenib Milestone Payment in the three months ended September 30, 2024, we continue to maintain a full valuation allowance against all of our net deferred tax assets.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-looking Information

The following discussion of our financial condition and results of operations should be read in conjunction with our unaudited condensed consolidated financial statements as of September 30, 2024 and for the three and nine months ended September 30, 2024 and 2023, and related notes included in Part I, Item 1 of this Quarterly Report on Form 10-Q, as well as the audited consolidated financial statements and notes and Management’s Discussion and Analysis of Financial Condition and Results of Operations, included in our Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on February 15, 2024. This Management’s Discussion and Analysis of Financial Condition and Results of Operations contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on current expectations, estimates, forecasts and projections, and the beliefs and assumptions of our management, and include, without limitation, statements with respect to our expectations regarding our research, development and commercialization plans and prospects, results of operations, selling, general and administrative expenses, research and development expenses, and the sufficiency of our cash for future operations. Words such as “aim,” “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “goal,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “should,” “strategy,” “target,” “vision,” “will,” “would” or the negatives of these words and similar expressions are intended to identify these forward-looking statements, although not all forward-looking statements contain these identifying words. Readers are cautioned that these forward-looking statements are predictions and are subject to risks, uncertainties and assumptions that are difficult to predict. Therefore, actual results may differ materially and adversely from those expressed in any forward-looking statements. Among the important factors that could cause actual results to differ materially from those indicated by our forward-looking statements are those discussed under the heading “Risk Factors” in Part II, Item 1A and elsewhere in this report, and in our Annual Report on Form 10-K for the year ended December 31, 2023. We undertake no obligation to revise the forward-looking statements contained herein to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events, except as required by law. Overview