UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2024

Commission File Number: 001-41579

American Lithium Corp.

(Translation of registrant's name into English)

1030 West Georgia St., Suite 710

Vancouver, BC

Canada V6E 2Y3

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

American Lithium Corp.

(Registrant)

|

| Date: December 17, 2024 |

/s/ Alex Tsakumis

Alex Tsakumis

Interim Chief Executive Officer & Director |

EXHIBIT INDEX

FORM 51-102F3

MATERIAL CHANGE REPORT

ITEM 1 NAME AND ADDRESS

American Lithium Corp. (the "Company")

Suite 710, 1030 West Georgia Street

Vancouver, British Columbia, V6E 2Y3

ITEM 2 DATE OF MATERIAL CHANGE

December 11, 2024

ITEM 3 NEWS RELEASE

A news release announcing the material change was issued on December 11, 2024 through DMI Digital Media Innovations Canada Inc. and subsequently filed under the profile for the Company on SEDAR+ at www.sedarplus.ca.

ITEM 4 SUMMARY OF MATERIAL CHANGE:

The Company intends to voluntarily delist its common shares from the Nasdaq Capital Market ("Nasdaq") and the deregistration with the U.S. Securities and Exchange Commission (the "SEC").

ITEM 5.1 FULL DESCRIPTION OF MATERIAL CHANGE

On December 11, 2024 the Company announced that the Board of Directors had approved the voluntary delisting of its common shares ("American Lithium Shares") from the Nasdaq Capital Market ("Nasdaq") and the deregistration with the U.S. Securities and Exchange Commission (the "SEC"). The Company has notified Nasdaq of its intention to voluntarily delist the American Lithium Shares. The Company currently anticipates that it will file with the SEC a Form 25, Notification of Removal of Listing and/or Registration under Section 12(b) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), relating to the delisting and deregistration on or about December 20, 2024, with the delisting of American Lithium Shares taking effect ten calendar days thereafter. As a result, the last trading day of the American Lithium Shares on the Nasdaq Capital Market will be December 27, 2024.

The American Lithium Shares will continue their listing on the TSX Venture Exchange and the Frankfurt Stock Exchange. In addition, the Company has applied for the American Lithium Shares to be quoted on the OTCQX Markets in the United States, operated by OTC Markets Group Inc. The Company anticipates transferring their shares on to the OTCQX Best® Market immediately following the Nasdaq delist. The Company will continue to provide information to its shareholders and take such actions to enable a trading market in the American Lithium Shares to exist in the United States. Following satisfaction of the relevant deregistration conditions under the applicable U.S. federal securities laws, the Form 25 will also terminate the Company's reporting obligations under the Exchange Act. The Company expects that its reporting obligations will be suspended upon filing of the Form 25. As previously disclosed, on March 8, 2024, Nasdaq notified the Company that it was not in compliance with the minimum bid price requirement of US$1.00 per share under Nasdaq Listing Rule 5550(a)(2) based upon the closing bid price of the American Lithium Shares for the thirty consecutive business days from January 25, 2024 to March 7, 2024. The Company was initially provided 180 calendar days from the date of the notice, or until September 4, 2024, to regain compliance with the minimum bid requirement. On September 11, 2024 Nasdaq notified the Company that it was eligible for an additional 180 calendar period, or until March 3, 2025, to regain compliance with the minimum bid price requirement of US$1.00 per share.

ITEM 5.2 DISCLOSURE FOR RESTRUCTURING TRANSACTIONS

Not applicable

ITEM 6 RELIANCE ON SUBSECTION 7.1(2) OF NATIONAL INSTRUMENT 51-102

Not applicable. This report is not being filed on a confidential basis.

ITEM 7 OMITTED INFORMATION

No information was omitted.

ITEM 8 EXECUTIVE OFFICER

The following executive officer of the Company is knowledgeable about the material change and this report:

Paul Charlish, Chief Financial Officer and Corporate Secretary

Telephone: (604) 428-6128

ITEM 9 DATE OF REPORT

December 16, 2024

Forward looking and other cautionary statements

This material change report contains "forward-looking information" which may include, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future. Forward-looking information in this material change report includes statements regarding the voluntary delisting from Nasdaq and the anticipated listing on the OTCQX Markets. Such forward-looking information is often, but not always, identified by the use of words and phrases such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or variations (including negative variations) of such words and phrases, or state that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved.

These forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business. Management believes that these assumptions are reasonable. Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information.

Forward-looking statements contained herein are made as of the date of this material change report and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results, except as may be required by applicable securities laws. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

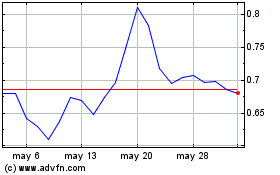

American Lithium (NASDAQ:AMLI)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

American Lithium (NASDAQ:AMLI)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025