AngioDynamics, Inc. (NASDAQ: ANGO), a leading and transformative

medical technology company focused on restoring healthy blood flow

in the body’s vascular system, expanding cancer treatment options,

and improving quality of life for patients, today announced

financial results for the first quarter of fiscal year 2025, which

ended August 31, 2024.

Fiscal Year 2025 First Quarter Highlights

Quarter Ended August 31,

2024

Pro Forma* YoY Growth

Net Sales

$67.5 million

1.1%

Med Tech Net Sales

$28.0 million

8.7%

Med Device Net Sales

$39.5 million

(3.6)%

- GAAP gross margin of 54.4%

- GAAP loss per share of $0.31

- Adjusted loss per share of $0.11

- Submitted for FDA 510(k) clearance for Prostate Tissue

indication for NanoKnife

- Received CE Mark Approval in Europe for the Auryon System

- Initiated RECOVER-AV Clinical Trial in Europe for AlphaVac

*Pro forma results exclude the Dialysis and BioSentry businesses

divested in June 2023 and the PICC and Midline product portfolios

divested in February 2024, as well as the discontinued

Radiofrequency and Syntrax products in February 2024.

"We are pleased with our strong start to fiscal year 2025,

particularly in our Med Tech segment, with Auryon and AlphaVac both

delivering over 20% growth in the quarter," commented Jim Clemmer,

President and Chief Executive Officer of AngioDynamics, Inc. "We

continue to view 2025 as an inflection point in the trajectory of

our business. We expect to continue to deliver strong revenue

growth within our Med Tech business as we execute on key commercial

initiatives. We remain focused on executing our growth strategy and

advancing our innovative product portfolio."

Fiscal Year 2025 First Quarter Financial Results

Unless otherwise noted, all financial metrics and growth rates

presented below are on a pro forma basis.

Net sales for the first quarter of fiscal year 2025 were $67.5

million, an increase of 1.1% compared to the prior-year

quarter.

Med Tech net sales were $28.0 million, an 8.7% increase from

$25.7 million in the prior-year period. Med Tech includes the

Auryon peripheral atherectomy platform, the thrombus management

platform, which includes the AlphaVac and AngioVac mechanical

thrombectomy systems, and the NanoKnife irreversible

electroporation platform.

Growth was driven by Auryon sales during the quarter of $13.7

million, which increased 24.9% and AlphaVac sales of $2.2 million,

an increase of 21.1% over the prior year. NanoKnife sales were $5.1

million during the quarter, a decrease of 6.9% compared to the

prior year period, primarily due to the timing of international

orders during last year.

Med Device net sales were $39.5 million, a decrease of 3.6%

compared to $41.0 million in the prior-year period. U.S. net sales

of Med Device products grew 2.1% during the first quarter compared

to last year.

U.S. net sales in the first quarter of fiscal 2025 were $59.5

million, an increase of 6.2% from $56.0 million a year ago.

International net sales were $8.0 million, a decrease of 25.4%,

compared to $10.7 million a year ago, primarily due to the timing

of international orders during last year.

Gross margin for the first quarter of fiscal 2025 was 54.4%,

which was 40 basis points down compared to the first quarter of

fiscal 2024, and 10 basis points sequentially up from 54.3% in the

fourth quarter of fiscal 2024.

Gross margin for the Med Tech business was 63.3%, a decrease of

160 basis points from the first quarter of fiscal 2024 due to

increased capital placements and inflationary costs. Gross margin

for the Med Device business was 48.2%, a decrease of 40 basis

points compared to the first quarter of fiscal 2024 due to

inflationary pressures and costs associated with the transition to

outsourced manufacturing.

The Company recorded a GAAP net loss of $12.8 million, or a loss

per share of $0.31, in the first quarter of fiscal 2025. Excluding

the items shown in the non-GAAP reconciliation table below,

adjusted net loss for the first quarter of fiscal 2025 was $4.4

million, or a loss per share of $0.11. This compares to an adjusted

net loss during the fiscal first quarter of 2024 of $6.2 million,

or a loss per share of $0.16.

Adjusted EBITDA in the first quarter of fiscal 2025, excluding

the items shown in the non-GAAP reconciliation table below, was

$(0.2) million, compared to $(1.1) million in the first quarter of

fiscal 2024.

In the first quarter of fiscal 2025, the Company used $18.3

million in operating cash. The Company’s first fiscal quarter has

historically exhibited the highest utilization of cash and the

first quarter of fiscal 2025 was in line with the Company’s

expectations.

At August 31, 2024, the Company had $55.0 million in cash and

cash equivalents compared to $76.1 million in cash and cash

equivalents at May 31, 2024.

NanoKnife System's PRESERVE Study Results Submitted for FDA

510(k) Clearance

In September, the Company submitted results from its Pivotal

Study of the NanoKnife System for Ablation of Prostate Tissue in an

Intermediate-Risk Patient Population (PRESERVE) to the U.S. Food

and Drug Administration (FDA) for 510(k) indication of its

NanoKnife System in the ablation of prostate tissue in an

intermediate-risk population. The comprehensive study enrolled and

treated 121 patients across 17 facilities throughout the United

States.

CE Mark Approval in Europe for the Auryon System

Prior to the end of the quarter AngioDynamics received European

CE Mark approval for its Auryon Atherectomy System. This regulatory

approval allows AngioDynamics to market the Auryon System in Europe

for the treatment of Peripheral Artery Disease (PAD), including

Critical Limb Ischemia (CLI) and In-Stent Restenosis (ISR). The

Auryon System uses solid-state laser technology to treat PAD

lesions and occlusions. It has been cleared by the FDA since 2020

and has treated over 50,000 patients in the United States. The

system is designed to treat lesions of various types, lengths, and

locations, both above and below the knee. This CE Mark approval

expands AngioDynamics' potential market reach, as the global PAD

market is valued at $1.1 billion.

RECOVER-AV Clinical Trial

Subsequent to the end of the first fiscal quarter, the Company

initiated its RECOVER-AV clinical trial, marking a significant step

in evaluating the AlphaVac F18⁸⁵ System for treating acute,

intermediate-risk pulmonary embolism (PE) in the European market.

This multi-center, multi-national study will assess the efficacy,

safety, and long-term functional outcomes of the system across up

to 20 hospital sites in Europe. Following the successful APEX-AV

study in the United States, RECOVER-AV aims to further demonstrate

the system's capabilities in a region where PE prevalence is

notably higher. The trial will track patient outcomes over a

12-month period, focusing on key efficacy and safety endpoints.

Fiscal Year 2025 Financial Guidance

For fiscal year 2025, the Company continues to expect:

- Net sales to be in the range of $282 to $288 million,

representing growth of between 4.2% – 6.4% over fiscal 2024 pro

forma revenue of $270.7 million

- Med Tech net sales are expected to grow in the range of 10% to

12%

- Med Device net sales are expected to grow in the range of 1% to

3%

- Gross margin to be approximately 52% to 53%

- Adjusted EBITDA loss of $2.5 million to $0, compared to a pro

forma adjusted EBITDA loss of $3.2 million in fiscal year 2024

- Adjusted loss per share in the range of $0.38 to $0.42,

compared to pro forma adjusted loss per share of $0.45 in fiscal

year 2024

Conference Call

The Company’s management will host a conference call at 8:00

a.m. ET the same day to discuss the results. To participate in the

conference call, dial 1-877-407-0784 (domestic) or +1-201-689-8560

(international).

This conference call will also be webcast and can be accessed

from the “Investors” section of the AngioDynamics website at

www.angiodynamics.com. The webcast replay of the call will be

available at the same site approximately one hour after the end of

the call.

A recording of the call will also be available, until Thursday,

October 10, 2024 at 11:59 PM ET. To hear this recording, dial

1-844-512-2921 (domestic) or +1-412-317-6671 (international) and

enter the passcode 13748896.

Use of Non-GAAP Measures

Management uses non-GAAP measures to establish operational goals

and believes that non-GAAP measures may assist investors in

analyzing the underlying trends in AngioDynamics' business over

time. Investors should consider these non-GAAP measures in addition

to, not as a substitute for or as superior to, financial reporting

measures prepared in accordance with GAAP. In this news release,

AngioDynamics has reported pro forma results, adjusted EBITDA,

adjusted net income and adjusted earnings per share. Management

uses these measures in its internal analysis and review of

operational performance. Management believes that these measures

provide investors with useful information in comparing

AngioDynamics' performance over different periods. By using these

non-GAAP measures, management believes that investors get a better

picture of the performance of AngioDynamics' underlying business.

Management encourages investors to review AngioDynamics' financial

results prepared in accordance with GAAP to understand

AngioDynamics' performance taking into account all relevant

factors, including those that may only occur from time to time but

have a material impact on AngioDynamics' financial results. Please

see the tables that follow for a reconciliation of non-GAAP

measures to measures prepared in accordance with GAAP.

About AngioDynamics, Inc.

AngioDynamics is a leading and transformative medical technology

company focused on restoring healthy blood flow in the body’s

vascular system, expanding cancer treatment options and improving

quality of life for patients.

The Company’s innovative technologies and devices are chosen by

talented physicians in fast-growing healthcare markets to treat

unmet patient needs. For more information, visit

www.angiodynamics.com.

Safe Harbor

This release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

All statements regarding AngioDynamics' expected future financial

position, results of operations, cash flows, business strategy,

budgets, projected costs, capital expenditures, products,

competitive positions, growth opportunities, plans and objectives

of management for future operations, as well as statements that

include the words such as "expects," "reaffirms," "intends,"

"anticipates," "plans," "believes," "seeks," "estimates,"

"projects," "optimistic," or variations of such words and similar

expressions, are forward-looking statements. These forward-looking

statements are not guarantees of future performance and are subject

to risks and uncertainties. Investors are cautioned that actual

events or results may differ materially from AngioDynamics'

expectations, expressed or implied. Factors that may affect the

actual results achieved by AngioDynamics include, without

limitation, the scale and scope of the COVID-19 global pandemic,

the ability of AngioDynamics to develop its existing and new

products, technological advances and patents attained by

competitors, infringement of AngioDynamics' technology or

assertions that AngioDynamics' technology infringes the technology

of third parties, the ability of AngioDynamics to effectively

compete against competitors that have substantially greater

resources, future actions by the FDA or other regulatory agencies,

domestic and foreign health care reforms and government

regulations, results of pending or future clinical trials, overall

economic conditions (including inflation, labor shortages and

supply chain challenges including the cost and availability of raw

materials), the results of on-going litigation, challenges with

respect to third-party distributors or joint venture partners or

collaborators, the results of sales efforts, the effects of product

recalls and product liability claims, changes in key personnel, the

ability of AngioDynamics to execute on strategic initiatives, the

effects of economic, credit and capital market conditions, general

market conditions, market acceptance, foreign currency exchange

rate fluctuations, the effects on pricing from group purchasing

organizations and competition, the ability of AngioDynamics to

obtain regulatory clearances or approval of its products, or to

integrate acquired businesses, as well as the risk factors listed

from time to time in AngioDynamics' SEC filings, including but not

limited to its Annual Report on Form 10-K for the year ended May

31, 2024. AngioDynamics does not assume any obligation to publicly

update or revise any forward-looking statements for any reason.

In the United States, the NanoKnife System has received a 510(k)

clearance by the Food and Drug Administration for use in the

surgical ablation of soft tissue and is similarly approved for

commercialization in Canada, the European Union and Australia. The

NanoKnife System has not been cleared for the treatment or therapy

of a specific disease or condition.

ANGIODYNAMICS, INC. AND

SUBSIDIARIES

CONSOLIDATED INCOME

STATEMENTS

(in thousands, except per share

data)

Three Months Ended

Three Months Ended

Actual (1)

Pro Forma Adjustments (2)

Pro Forma

As Reported (1)

Pro Forma Adjustments (2)

Pro Forma

Aug 31, 2024

Aug 31, 2024

Aug 31, 2024

Aug 31, 2023

Aug 31, 2023

Aug 31, 2023

(unaudited)

(unaudited)

Net sales

$

67,491

9

$

67,500

$

78,679

(11,935

)

$

66,744

Cost of sales (exclusive of intangible

amortization)

30,767

(2

)

30,765

38,619

(8,482

)

30,137

Gross profit

36,724

11

36,735

40,060

(3,453

)

36,607

% of net sales

54.4

%

54.4

%

50.9

%

54.8

%

Operating expenses

Research and development

6,285

—

6,285

7,941

(207

)

7,734

Sales and marketing

25,605

—

25,605

27,368

(1,487

)

25,881

General and administrative

10,975

—

10,975

10,856

(1

)

10,855

Amortization of intangibles

2,570

—

2,570

3,625

(964

)

2,661

Change in fair value of contingent

consideration

76

—

76

(130

)

—

(130

)

Acquisition, restructuring and other

items, net

4,311

154

4,465

3,212

(22

)

3,190

Total operating expenses

49,822

154

49,976

52,872

(2,681

)

50,191

Gain on sale of assets

—

—

—

47,842

(47,842

)

—

Operating income (loss)

(13,098

)

(143

)

(13,241

)

35,030

(48,614

)

(13,584

)

Interest income, net

606

—

606

119

—

119

Other expense, net

(173

)

—

(173

)

(288

)

—

(288

)

Total other income (expense), net

433

—

433

(169

)

—

(169

)

Income (loss) before income tax

benefit

(12,665

)

(143

)

(12,808

)

34,861

(48,614

)

(13,753

)

Income tax expense (benefit)

133

—

133

(11,023

)

—

(11,023

)

Net income (loss)

$

(12,798

)

$

(143

)

$

(12,941

)

$

45,884

$

(48,614

)

$

(2,730

)

Earnings (loss) per share

Basic

$

(0.31

)

$

(0.32

)

$

1.15

$

(0.07

)

Diluted

$

(0.31

)

$

(0.32

)

$

1.15

$

(0.07

)

Weighted average shares outstanding

Basic

40,653

40,653

39,842

39,842

Diluted

40,653

40,653

39,968

39,842

(1) Reflects the Company's US GAAP

consolidated financial statements before pro forma adjustments

related to the sale of the Dialysis and BioSentry Businesses on

June 8, 2023, the sale of the PICCs and Midlines Businesses on

February 15, 2024 and the discontinuation of the RadioFrequency

Ablation and Syntrax products ("the Businesses") as of February 29,

2024, for the three months ended August 31, 2024 and 2023.

(2) Reflects the elimination of revenues

and expenses representing the operating results from the sales and

discontinuation of the Businesses.

ANGIODYNAMICS, INC. AND

SUBSIDIARIES

GAAP TO NON-GAAP

RECONCILIATION

(in thousands, except per share

data)

Reconciliation of Net Income (Loss) to

non-GAAP Adjusted Net Loss:

Three Months Ended

Aug 31, 2024

Aug 31, 2023

(unaudited)

Net income (loss)

$

(12,798

)

$

45,884

Amortization of intangibles

2,570

3,625

Change in fair value of contingent

consideration

76

(130

)

Acquisition, restructuring and other

items, net (1)

4,311

3,212

Gain on sale of assets

—

(47,842

)

Tax effect of non-GAAP items (2)

1,446

(9,580

)

Adjusted net loss

$

(4,395

)

$

(4,831

)

Reconciliation of Diluted Earnings

(Loss) Per Share to non-GAAP Adjusted Diluted Loss Per

Share:

Three Months Ended

Aug 31, 2024

Aug 31, 2023

(unaudited)

Diluted earnings (loss) per share

$

(0.31

)

$

1.15

Amortization of intangibles

0.06

0.09

Change in fair value of contingent

consideration

0.00

0.00

Acquisition, restructuring and other

items, net (1)

0.10

0.08

Gain on sale of assets

—

(1.20

)

Tax effect of non-GAAP items (2)

0.04

(0.24

)

Adjusted diluted loss per share

$

(0.11

)

$

(0.12

)

Adjusted diluted sharecount (3)

40,653

39,842

(1) Includes costs related to merger and

acquisition activities, restructuring, and unusual items, including

asset impairments and write-offs, certain litigation, and other

items.

(2) Adjustment to reflect the income tax

provision on a non-GAAP basis has been calculated assuming no

valuation allowance on the Company's U.S. deferred tax assets and

an effective tax rate of 23% for the periods ended August 31, 2024

and 2023.

(3) Diluted shares may differ for non-GAAP

measures as compared to GAAP due to a GAAP loss.

ANGIODYNAMICS, INC. AND

SUBSIDIARIES

GAAP TO NON-GAAP

RECONCILIATION (Continued)

(in thousands, except per share

data)

Reconciliation of Net Income (Loss) to

Adjusted EBITDA:

Three Months Ended

Aug 31, 2024

Aug 31, 2023

(unaudited)

Net income (loss)

$

(12,798

)

$

45,884

Income tax expense (benefit)

133

(11,023

)

Interest income, net

(606

)

(119

)

Depreciation and amortization

6,785

6,688

Change in fair value of contingent

consideration

76

(130

)

Stock based compensation

3,205

4,144

Acquisition, restructuring and other

items, net (1)

3,042

3,212

Gain on sale of assets

—

(47,842

)

Adjusted EBITDA

$

(163

)

$

814

Per diluted share:

Adjusted EBITDA

$

0.00

$

0.02

(1) Includes costs related to merger and

acquisition activities, restructuring, and unusual items, including

asset impairments and write-offs, certain litigation, and other

items.

ANGIODYNAMICS, INC. AND

SUBSIDIARIES

GAAP TO NON-GAAP

RECONCILIATION

(in thousands, except per share

data)

Reconciliation of Pro Forma Net Loss to

Pro Forma Adjusted Net Loss:

Pro Forma

Three Months Ended

Aug 31, 2024

Aug 31, 2023

(unaudited)

Pro forma net loss

$

(12,941

)

$

(2,730

)

Amortization of intangibles

2,570

2,661

Change in fair value of contingent

consideration

76

(130

)

Acquisition, restructuring and other

items, net (1)

4,465

3,190

Tax effect of non-GAAP items (2)

1,443

(9,176

)

Adjusted pro forma net loss

$

(4,387

)

$

(6,185

)

Reconciliation of Pro Forma Diluted

Loss Per Share to Pro Forma Adjusted Diluted Loss Per

Share:

Pro Forma

Three Months Ended

Aug 31, 2024

Aug 31, 2023

(unaudited)

Pro forma diluted loss per share

$

(0.32

)

$

(0.07

)

Amortization of intangibles

0.06

0.07

Change in fair value of contingent

consideration

0.00

0.00

Acquisition, restructuring and other

items, net (1)

0.11

0.08

Tax effect of non-GAAP items (2)

0.04

(0.24

)

Adjusted pro forma diluted loss per

share

$

(0.11

)

$

(0.16

)

Adjusted diluted sharecount (3)

40,653

39,842

(1) Includes costs related to merger and

acquisition activities, restructuring, and unusual items, including

asset impairments and write-offs, certain litigation, and other

items.

(2) Adjustment to reflect the income tax

provision on a non-GAAP basis has been calculated assuming no

valuation allowance on the Company's U.S. deferred tax assets and

an effective tax rate of 23% for the periods ended August 31, 2024

and 2023.

(3) Diluted shares may differ for non-GAAP

measures as compared to GAAP due to a GAAP loss.

ANGIODYNAMICS, INC. AND

SUBSIDIARIES

GAAP TO NON-GAAP

RECONCILIATION (Continued)

(in thousands, except per share

data)

Reconciliation of Pro Forma Net Loss to

Pro Forma Adjusted EBITDA:

Pro Forma

Three Months Ended

Aug 31, 2024

Aug 31, 2023

(unaudited)

Pro forma net loss

$

(12,941

)

$

(2,730

)

Income tax expense (benefit)

133

(11,023

)

Interest income, net

(606

)

(119

)

Depreciation and amortization

6,785

5,682

Change in fair value of contingent

consideration

76

(130

)

Stock based compensation

3,205

4,058

Acquisition, restructuring and other

items, net (1)

3,196

3,190

Adjusted EBITDA

$

(152

)

$

(1,072

)

Per diluted share:

Adjusted EBITDA

$

0.00

$

(0.03

)

(1) Includes costs related to merger and

acquisition activities, restructuring, and unusual items, including

asset impairments and write-offs, certain litigation, and other

items.

ANGIODYNAMICS, INC. AND

SUBSIDIARIES

ACQUISITION, RESTRUCTURING,

AND OTHER ITEMS, NET DETAIL

(in thousands)

Three Months Ended

(in thousands)

Aug 31, 2024

Aug 31, 2023

Legal (1)

$

507

$

1,817

Plant closure (2)

3,589

—

Transition service agreement (3)

(507

)

(145

)

Manufacturing relocation (4)

—

587

Other

722

953

Total

$

4,311

$

3,212

(1) Legal expenses related to litigation that is outside the normal

course of business. (2) Plant closure expense, related to the

restructuring of our manufacturing footprint which was announced on

January 5, 2024. (3) Transition services agreements that were

entered into with Merit and Spectrum. (4) Expenses to relocate

certain manufacturing lines out of Queensbury, NY.

ANGIODYNAMICS, INC. AND

SUBSIDIARIES

NET SALES BY PRODUCT CATEGORY

AND BY GEOGRAPHY

(in thousands)

Three Months Ended

Three Months Ended

Actual (1)

Pro Forma Adj. (2)

Pro Forma

As Reported (1)

Pro Forma Adj. (2)

Pro Forma

Actual

Pro Forma

Aug 31, 2024

Aug 31, 2024

Aug 31, 2024

Aug 31, 2023

Aug 31, 2023

Aug 31, 2023

% Growth

Currency Impact

Constant Currency Growth

% Growth

Currency Impact

Constant Currency Growth

(unaudited)

(unaudited)

Net Sales

Med Tech

$

27,969

$

—

$

27,969

$

25,860

$

(131

)

$

25,729

8.2

%

8.7

%

Med Device

39,522

9

39,531

52,819

(11,804

)

41,015

(25.2

)%

(3.6

)%

$

67,491

$

9

$

67,500

$

78,679

$

(11,935

)

$

66,744

(14.2

)%

0.0

%

(14.2

)%

1.1

%

0.0

%

1.1

%

Net Sales

United States

$

59,481

$

10

$

59,491

$

64,399

$

(8,395

)

$

56,004

(7.6

)%

6.2

%

International

8,010

(1

)

8,009

14,280

(3,540

)

10,740

(43.9

)%

0.0

%

(43.9

)%

(25.4

)%

$

67,491

$

9

$

67,500

$

78,679

$

(11,935

)

$

66,744

(14.2

)%

0.0

%

(14.2

)%

1.1

%

0.0

%

1.1

%

(1) Reflects the Company's US GAAP

consolidated financial statements before pro forma adjustments

related to the sale of the Dialysis and BioSentry Businesses on

June 8, 2023, the sale of the PICCs and Midlines Businesses on

February 15, 2024 and the discontinuation of the RadioFrequency

Ablation and Syntrax products ("the Businesses") as of February 29,

2024, for the three months ended August 31, 2024 and 2023.

(2) Reflects the elimination of revenues

and expenses representing the operating results from the sales and

discontinuation of the Businesses.

GROSS PROFIT BY PRODUCT

CATEGORY

(in thousands)

Three Months Ended

Three Months Ended

Actual (1)

Pro Forma

Adj. (2)

Pro Forma

As Reported (1)

Pro Forma

Adj. (2)

Pro Forma

Actual

Pro Forma

Aug 31, 2024

Aug 31, 2024

Aug 31, 2024

Aug 31, 2023

Aug 31, 2023

Aug 31, 2023

% Change

% Change

(unaudited)

(unaudited)

Med Tech

$

17,697

$

—

$

17,697

$

16,727

$

(39

)

$

16,688

5.8

%

6.0

%

Gross profit % of sales

63.3

%

63.3

%

64.7

%

64.9

%

Med Device

$

19,027

$

11

$

19,038

$

23,333

$

(3,414

)

$

19,919

(18.5

)%

(4.4

)%

Gross profit % of sales

48.1

%

48.2

%

44.2

%

48.6

%

Total

$

36,724

$

11

$

36,735

$

40,060

$

(3,453

)

$

36,607

(8.3

)%

0.3

%

Gross profit % of sales

54.4

%

54.4

%

50.9

%

54.8

%

(1) Reflects the Company's US GAAP

consolidated financial statements before pro forma adjustments

related to the sale of the Dialysis and BioSentry Businesses on

June 8, 2023, the sale of the PICCs and Midlines Businesses on

February 15, 2024 and the discontinuation of the RadioFrequency

Ablation and Syntrax products ("the Businesses") as of February 29,

2024, for the three months ended August 31, 2024 and 2023.

(2) Reflects the elimination of revenues

and expenses representing the operating results from the sales and

discontinuation of the Businesses.

ANGIODYNAMICS, INC. AND

SUBSIDIARIES

CONSOLIDATED BALANCE

SHEETS

(in thousands)

Aug 31, 2024

May 31, 2024

(unaudited)

(audited)

Assets

Current assets:

Cash and cash equivalents

$

55,005

$

76,056

Accounts receivable, net

39,563

43,610

Inventories

64,700

60,616

Prepaid expenses and other

13,326

12,971

Total current assets

172,594

193,253

Property, plant and equipment, net

34,377

35,666

Other assets

10,883

11,369

Intangible assets, net

75,774

77,383

Total assets

$

293,628

$

317,671

Liabilities and stockholders'

equity

Current liabilities:

Accounts payable

$

31,272

$

37,751

Accrued liabilities

34,108

41,098

Current portion of contingent

consideration

4,804

4,728

Other current liabilities

6,515

7,578

Total current liabilities

76,699

91,155

Deferred income taxes

4,626

4,852

Other long-term liabilities

15,721

16,078

Total liabilities

97,046

112,085

Stockholders' equity

196,582

205,586

Total Liabilities and Stockholders'

Equity

$

293,628

$

317,671

ANGIODYNAMICS, INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(in thousands)

Three Months Ended

Aug 31, 2024

Aug 31, 2023

(unaudited)

Cash flows from operating

activities:

Net income (loss)

$

(12,798

)

$

45,884

Adjustments to reconcile net income (loss)

to net cash used in operating activities:

Depreciation and amortization

6,785

6,688

Non-cash lease expense

494

476

Stock based compensation

3,205

4,144

Gain on disposal of assets

—

(47,842

)

Transaction costs for disposition

—

(2,427

)

Change in fair value of contingent

consideration

76

(130

)

Deferred income taxes

(339

)

(11,415

)

Change in accounts receivable

allowances

270

(78

)

Fixed and intangible asset impairments and

disposals

20

65

Write-off of other assets

—

869

Other

121

(9

)

Changes in operating assets and

liabilities:

Accounts receivable

3,784

3,157

Inventories

(4,053

)

(4,574

)

Prepaid expenses and other

(836

)

(4,168

)

Accounts payable, accrued and other

liabilities

(14,982

)

(16,539

)

Net cash used in operating

activities

(18,253

)

(25,899

)

Cash flows from investing

activities:

Additions to property, plant and

equipment

(1,092

)

(791

)

Additions to placement and evaluation

units

(1,313

)

(767

)

Proceeds from sale of assets

—

100,000

Net cash (used in) provided by

investing activities

(2,405

)

98,442

Cash flows from financing

activities:

Repayment of long-term debt

—

(50,000

)

Payment of acquisition related contingent

consideration

—

(10,000

)

Repurchase of common stock

(552

)

—

Proceeds from exercise of stock options

and employee stock purchase plan

43

410

Net cash used in financing

activities

(509

)

(59,590

)

Effect of exchange rate changes on cash

and cash equivalents

116

13

Increase (decrease) in cash and cash

equivalents

(21,051

)

12,966

Cash and cash equivalents at beginning of

period

76,056

44,620

Cash and cash equivalents at end of

period

$

55,005

$

57,586

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241003678383/en/

Investors: AngioDynamics, Inc. Stephen Trowbridge, Executive

Vice President & CFO (518) 795-1408

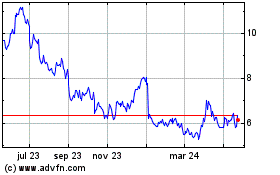

AngioDynamics (NASDAQ:ANGO)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

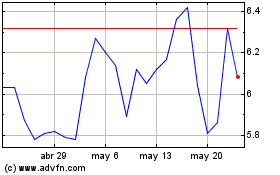

AngioDynamics (NASDAQ:ANGO)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025