UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

FORM 6-K

____________________

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

Dated January 10, 2024

Commission File Number: 001-40286

____________________

Arrival

(Translation of registrant’s name into English)

60A, rue des Bruyères

L-1274 Howald,

Grand Duchy of Luxembourg

+352 26845062

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

THIS REPORT ON FORM 6-K SHALL BE DEEMED TO BE INCORPORATED BY REFERENCE IN EACH OF THE REGISTRATION STATEMENTS ON FORM F-3 (FILE NO. 333-254885, FILE NO. 333-266472 AND FILE NO. 333-270019) AND THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-259673) OF ARRIVAL AND TO BE A PART THEREOF FROM THE DATE ON WHICH THIS REPORT IS FURNISHED, TO THE EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY FILED OR FURNISHED.

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

Arrival (the “Company”) announced the calling of an Ordinary General Meeting (“OGM”) of shareholders to vote to approve and confirm the appointment or re-appointment, as applicable, of certain directors to the board of directors of the Company. The OGM is planned for January 22, 2024 and Shareholders holding shares of the Company as of January 12, 2024 will be invited to vote on the resolutions.

The Company published the convening notice for the OGM together with a copy of the related proxy card on its website, copies of which are furnished as Exhibit 99.1 and Exhibit 99.2, respectively, to this report on Form 6-K.

Exhibit Index

| | | | | | | | |

| Exhibit Number | |

Exhibit Title |

| 99.1 | | |

| 99.2 | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

ARRIVAL

By: /s/ John Wozniak

Name: John Wozniak

Title: Chief Financial Officer

Dated: January 10, 2024

Exhibit 99.1

Arrival

Société anonyme

Siège social : 60A, rue des Bruyères, L-1274 Howald

Grand-Duché de Luxembourg

R.C.S. Luxembourg: B248209

__________________________________________________________________________

AVIS DE CONVOCATION A UNE ASSEMBLEE GENERALE DES ACTIONNAIRES

CONVENING NOTICE FOR A GENERAL MEETING OF THE SHAREHOLDERS

__________________________________________________________________________

1.Notice

A general meeting of the shareholders of Arrival (the “Company”) will be held on 22 January 2024 at 2:00 p.m. (local time) (the “Meeting”), at the Company’s registered office, at 60A, rue des Bruyères, L-1274 Howald, Grand Duchy of Luxembourg.

In accordance with applicable laws and article 25 of the Company’s articles of associations, the Company’s shareholders will be allowed to attend and participate to the Meeting through the webcast hosted on www.virtualshareholdermeeting.com/ARVL2023SM

2.Agenda of the Meeting

The Meeting shall have the following agenda:

1.Opening of the Meeting.

2.Special report on the relevant conflict of interests of each of the directors of the Company in accordance with article 17 of the articles of association of the Company and article 441-7 of the Luxembourg law on dated 10 August 1915 commercial companies, as amended (the “Law”) with respect to the directors’ respective indemnitee agreements entered into with the Company (non voting item).

3.To approve and confirm the following appointments by the board of directors of the Company:

–the appointment of Maxim Krasnykh as class A director of the Company in replacement of Yun Seong Hwang made on 25 May 2023 for a period ending at the annual general meeting which will approve the annual accounts for the period ending on 31 December 2024 and corresponding to the remainder of the duration of the mandate of Yun Seong Hwang;

–the appointment of Igor Torgov as class C director of the Company in replacement of Alain Kinsch made on 31 July 2023 for a period ending at the annual general meeting which will approve the annual accounts for the period ending on 31 December 2023 and corresponding to the remainder of the duration of the mandate of Alain Kinsch;

–the appointment of Alexandre Zyngier as class C director of the Company in replacement of Tawni Lynn Cranz made on 21 September 2023 for a period ending at the annual general meeting which will approve the annual accounts for the period ending on 31 December 2023 and corresponding to the remainder of the duration of the mandate of Tawni Lynn Cranz;

–the appointment of Julian Nemirovsky as class C director of the Company in replacement of Igor Torgov made on 16 November 2023 for a period ending at the annual general meeting

which will approve the annual accounts for the period ending on 31 December 2023 and corresponding to the remainder of the duration of the mandate of Igor Torgov;

in each case, in accordance with article 441-2 of the Law (voting item).

4.To re-appoint Rexford Tibbens as class B director of the Company for a period ending at the annual general meeting which will approve the annual accounts for the period ending on 31 December 2025 (voting item).

5.Closing of the meeting.

3.Explanatory notes to the agenda

Agenda item 2 - Presentation by the board of directors of the special report on relevant conflict of interests (non voting item)

Article 441-7 of the Law provides that “any director having a direct or indirect financial interest conflicting with that of the company in a transaction which has to be considered by the board of directors, must advise the board thereof and cause a record of his statement to be included in the minutes of the meeting. He may not take part in these deliberations. At the next following general meeting, before any other resolution is put to vote, a special report shall be made on the transactions in which any of the directors may have had an interest conflicting with that of the company […]”.

In accordance with article 441-7 of the Law, the relevant conflicts of interest that each of the directors declared (in each case as far as such director was concerned) with respect to the entry by the Company into indemnity agreements with each of the directors of the Company approved at the occasion of the meeting of the board of directors of the Company held on 22 November 2023 will be reported to the shareholders of the Company.

Agenda item 3 – Approval and confirmation of the appointments by the board of directors of the Company of Maxim Krasnykh as class A director, Igor Torgov as class C director, Alexandre Zyngier as class C director and Julian Nemirovsky as class C director of the Company (voting item)

Article 11 of the articles of association of the Company (the “Articles”) provides that “in the event of a vacancy on the Board of Directors, the remaining Directors may elect by cooptation a new Director to fill such vacancy until the next General Meeting, which shall ratify such co-optation or elect a new Director instead.”

In accordance with article 11 of the Articles, the board of directors of the Company appointed Maxim Krasnykh as class A director, Igor Torgov as class C director, Alexandre Zyngier as class C director and Julian Nemirovsky as class C director of the Company to fill certain vacancies that occurred during the 2023 financial year as follows:

–Maxim Krasnykh as class A director of the Company in replacement of Yun Seong Hwang made on 25 May 2023 for a period ending at the annual general meeting which will approve the annual accounts for the period ending on 31 December 2024 and corresponding to the remainder of the duration of the mandate of Yun Seong Hwang;

Maxim Krasnykh has served as a director at the Company since May 2023. Mr. Krasnykh is a technology executive and entrepreneur. Currently, he serves as the founder and chief executive officer of a business-to-business, software-as-a-service startup specializing in the future of work. From 2014 to 2022, Mr. Krasnykh played pivotal roles as the vice president of strategy and corporate development, chief operating officer, and co-chief executive officer at Gett. During his tenure at Gett, Mr. Krasnykh guided the

company from the Series A stage to over $300 million in revenue and profitability. From 2011 to 2014, he served as an investment director at Intel Capital, where he led technology investments on behalf of Intel Corporation. Prior to Intel, Mr. Krasnykh held various positions in corporate finance, strategy, and private equity, including at Fleming Family and Partners and PricewaterhouseCoopers. Mr. Krasnykh holds an MBA from Columbia Business School and is a member of the CFA Institute and the National Association of Corporate Directors.

–Igor Torgov as class C director of the Company was appointed in replacement of Alain Kinsch on 31 July 2023 for a period ending at the annual general meeting which will approve the annual accounts for the period ending on 31 December 2023 and corresponding to the remainder of the duration of the mandate of Alain Kinsch. However, Igor Torgov resigned from his position on 16 November 2023 and was replaced by Julian Nemirovsky;

Igor Torgov has served the Company since 2020 in his role as Executive Vice President of multiple divisions including Fintech, Commercialization, Business Systems, IT and Digital products. On January 30th, 2023, Igor was appointed Chief Executive Officer by the Board, following former Interim CEO Peter Cuneo’s brief assignment in the office between November 2022 and January 2023. Prior to Arrival, Igor has held numerous COO, CEO, and leadership positions at Atol, Bitfury, Yota, Columbus IT and Microsoft. Igor holds an MBA in Strategic Management from California State University in Hayward, California.

–Alexandre Zyngier as class C director of the Company in replacement of Tawni Lynn Cranz made on 21 September 2023 for a period ending at the annual general meeting which will approve the annual accounts for the period ending on 31 December 2023 and corresponding to the remainder of the duration of the mandate of Tawni Lynn Cranz;

Mr. Alexandre Zyngier, Founder of Batuta Capital Advisors in 2013, brings over 30 years of extensive experience in investment, strategy, governance, and operations. Currently serving as Chairman of the Board at EVO Transportation (EVOA), he has held key roles in reorganizing COFINA in Puerto Rico and serves as a Director for Atari SA (ATA FP), Schmitt Industries (SMIT), and other private entities. His comprehensive background includes prior directorships at Appvion, Inc., GT Advanced Technologies Inc., AudioEye, Inc., Eileen Fisher, Inc., Torchlight Energy Resources, Inc., Vertis Inc., Island One LLC, and DTV America Corporation. Mr. Zyngier also brings fiduciary expertise as the Liquidating Trustee to Clovis Oncology Inc, Linc Energy, and as the sole liquidating Director for Tetralogic Pharmaceuticals Inc. His diverse career spans roles as a Portfolio Manager at Alden Global Capital, Goldman Sachs & Co., and Deutsche Bank Co., with a focus on distressed investments. He also worked as a strategy consultant at McKinsey & Company and as a technical brand manager at Procter & Gamble. Mr. Zyngier holds an MBA in Finance and Accounting from the University of Chicago and a BSc. in Chemical Engineering from UNICAMP in Brazil.

–Julian Nemirovsky as class C director of the Company in replacement of Igor Torgov made on 16 November 2023 for a period ending at the annual general meeting which will approve the annual accounts for the period ending on 31 December 2023 and corresponding to the remainder of the duration of the mandate of Igor Torgov.

Julian Nemirovsky is the Founder and President of Long Castle Advisors, Corp., offering capital structure and related consulting services to operationally challenged and liquidity constrained businesses. He was formerly Head of Capital Markets at MacAndrews & Forbes, where he was responsible for managing all capital-structure matters relating to the firm’s portfolio companies and new investments. Prior to joining MacAndrews in 2020, he spent 8 years at MidOcean Credit Partners, where he held the title of Principal and Portfolio Manager. In that role, he was responsible for management of over $1 billion of assets across several opportunistic credit strategies including long/short hedge funds and illiquid credit drawdown funds. Prior to joining MidOcean in 2011, he was an Associate at Union Capital, a lower-middle market private equity firm. He began his career in 2006 as an Analyst in Goldman Sachs’ Leveraged Finance group within the Investment Banking division. Mr. Nemirovsky is currently a director of SIGA

Technologies serving on the audit committee and compensation committee. Mr. Nemirovsky holds a BBA from Baruch College and an MBA from the Tuck School of Business (Dartmouth).

Pursuant to article 11 of the Articles, the board of directors shall be composed of not less than 6 members. Failure to confirm the above appointments would result in:

–the mandates of such directors terminating with immediate effect;

–the Company’s board of directors being composed of less than 6 members in breach of the Articles;

–the validity of decisions of the board of directors of the Company being challenged;

–the directors being at risk for gross negligence and breach of the Law;

–the general meeting of shareholders being required to appoint other directors on the board of directors of the Company at the time of the Meeting;

–as far as the appointment of Alexandre Zyngier and Julian Nemirovsky are concerned, an event of default under existing financing documents.

Draft Resolution

The Meeting resolved to approve and, to the extent necessary, ratify the appointment by the board of directors of the Company of:

–Maxim Krasnykh as class A director of the Company in replacement of Yun Seong Hwang effective as of 25 May 2023 for a period ending at the annual general meeting which will approve the annual accounts for the period ending on 31 December 2024; and

–Igor Torgov as class C director of the Company in replacement of Alain Kinsch effective as of 1 August 2023 for a period ending at the annual general meeting which will approve the annual accounts for the period ending on 31 December 2023; and

–Alexandre Zyngier as class C director of the Company in replacement of Tawni Lynn Cranz effective as 21 September 2023 for a period ending at the annual general meeting which will approve the annual accounts for the period ending on 31 December 2023; and

–Julian Nemirovsky as class C director of the Company in replacement of Igor Torgov effective as of 16 November 2023 for a period ending at the annual general meeting which will approve the annual accounts for the period ending on 31 December 2023.

This resolution shall be taken at a simple majority of the votes cast by shareholders present or represented, provided that a quorum of at least 33 1/3 % of the outstanding shares of the Company's is reached.

Agenda item 4 – Re-appointment of Rexford Tibbens as class B director of the Company for a period ending at the annual general meeting which will approve the annual accounts for the period ending on 31 December 2025 (voting item)

Mr. Rexford Tibbens was appointed as class B director of the Company at the occasion of the extraordinary general meeting of the shareholders of the Company held on 23 March 2021 for a period ending in 2023. It is therefore proposed to re-appoint Rexford Tibbens effective as of 1 January 2024 for a period ending on 31 December 2025.

Pursuant to article 11 of the Articles, the board of directors shall be composed of not less than 6 members. Failure to confirm the above re-appointment would result in:

–the Company’s board of directors being composed of less than 6 members in breach of the Articles;

–the validity of decisions of the board of directors of the Company being challenged;

–the directors being at risk for gross negligence and breach of the Law;

–the general meeting of shareholders being required to appoint another director on the board of directors of the Company in replacement of Rexford Tibbens at the time of the Meeting.

If appointed, following the above appointments, the board of directors will be composed of:

–Maxim Krasnykh, class A director;

–Denis Sverdlov, class A director;

–Rexford Tibbens, class B director;

–Alexandre Zyngier, class C director;

–Julian Nemirovsky, class C director; and

–Avinash Rugoobur, class C director.

Draft Resolution

The Meeting resolved to approve the re-appointment with immediate effect of Rexford Tibbens as class B director of the Company for a period ending at the annual general meeting which will approve the annual accounts for the period ending on 31 December 2025.

This resolution shall be taken at a simple majority of the votes cast by shareholders present or represented, provided that a quorum of at least 33 1/3 % of the outstanding shares of the Company's is reached .

4.Key dates

| | | | | |

12 January 2024, at 4 p.m. (Eastern Standard Time) | Voting Record Date, for the Meeting |

| 18 January 2024, 11:59 p.m. (Eastern Standard Time) | Deadline to submit proxies/vote remotely with respect to the Meeting |

| 22 January 2024, 2:00 p.m. (local time) | Meeting |

5.Right to participate at the Meeting, and voting procedures

5.1 Shareholders

The following persons who comply with the procedure below, and who hold shares on 12 January 2024 at 4 p.m. (Eastern Standard Time) (the “Voting Record Date”) are eligible to attend and vote at the Meeting:

–registered shareholders of the Company; and

–holders of the Company’s shares traded on the Nasdaq Stock Market in the US under the ticker symbol ARVL that are registered with Broadridge Investor Communications, Inc. (“Broadridge”), including those held by Cede & Co. (“DTCC”).

Each shareholder is entitled to one vote for each ordinary share held of record by such shareholder as of the Voting Record Date, on each matter submitted to a vote at the Meeting.

Holders of shares held through the operator of a securities settlement system or with a depositary (including nominees or brokers that hold shares through DTCC) have the right to instruct their nominee or broker on how to vote with a voter instruction form, or as may otherwise be established by the nominee or broker. Beneficial holders who wish to vote directly must request the nominee or broker that appears as the registered shareholder on the Voting Record Date to issue a “legal proxy” which allows the beneficial

owner to vote his or her shares directly. Beneficial owners who do not vote remotely at the Meeting through the webcast, via their brokers or nominees in accordance with the instructions received or do not have a legal proxy are not eligible to vote.

5.2 Bondholders

This convening notice is also sent to the holders of bonds issued by the Company. Holders of bonds do not have the right to vote at the Meeting.

5.3 Voting procedure

The Company urges each shareholder to cast its vote at the Meeting by completing, signing, dating and returning the proxy made available by the Company for use at the Meeting in accordance with the instructions below.

The Company’s shareholders may attend the Meeting by proxy (the “Proxy”) to be submitted in accordance with the information contained therein such that it is received no later than 18 January 2024 at 11:59 p.m. (Eastern Standard Time) (the “Voting Deadline”).

Shareholders may also vote remotely by submitting a ballot paper containing their voting instructions (the “Voting Form”) in writing or electronically in accordance with the instructions contained therein, such that it is received no later than the Voting Deadline.

The Company has sent by post or email, as the case may be, the convening notice, a form of Proxy and a form of Voting Form, together with a control number. Votes to the Meeting can be cast using this control number at https://www.proxyvote.com/. If you consider that you are eligible to vote but you have not received the control number by post or email, as the case may be, and you would like to submit your vote online, please contact your bank or broker. If you plan to vote over the internet or by telephone, your vote must be received no later than the Voting Deadline to allow sufficient time to tabulate the votes prior to the start of the Meeting.

Alternatively, the Voting Form can be submitted by post. The original completed, dated and signed Voting Form should be mailed to the address provided in the form. Shareholders that choose to send their Voting Form by post should also send a scanned copy to shmeeting@arrival.com.

Shareholders may also vote in person at the Meeting. All shareholders must present valid government issued photo identification documentation to attend the Meeting, as well as a proof of ownership of shares of the Company as at the Voting Record Date. Admittance of shareholders to the Meeting and acceptance of written voting proxies will be governed by Luxembourg law.

Even If you plan to attend the Meeting, we recommend that you vote your shares in advance of the Meeting in one of the manners available to you so that your vote will be counted if you later are unable to attend the Meeting.

A holder of ordinary shares held through the operator of a securities settlement system of with a depositary wishing to attend the Meeting must provide the Company with a certificate issued by such operator or depositary certifying the number of ordinary shares recorded in the relevant account on the Voting Record Date. Such certificate must be provided to the Company no later than three (3) business days prior to the date of the Meeting. If you plan to attend the Meeting, you are kindly requested to notify the Company thereof in writing and provide your name, address and telephone number and any other necessary materials before on 12 January 2024 at 5:00 p.m. (local time) to the registered office of the Company at 60A, rue des Bruyères, L-1274 Howald, Grand Duchy of Luxembourg or by email to shmeeting@arrival.com.

All forms and all supporting documents can be downloaded from the Company’s website https://arrival.gcs-web.com/

5.4 Supporting documents and information

Information concerning the matters to be considered and voted upon at the Meeting is available to the shareholders at the registered office of the Company and on the Company’s website

(https://arrival.gcs-web.com/).

Shareholders and bondholders have the right to ask questions about items on the agenda of the Meeting during the meeting. They may also ask questions ahead of the Meeting. The Company will on a best-efforts basis provide responses to the questions at the Meeting. Written questions must be received by the Company no later than on 15 January 2024, 5:00 p.m. (local time). Written questions must be submitted either by registered letters to the registered office of the Company or to shmeeting@arrival.com and include the shareholder’s full name and address.

5.5 Personal Data

In connection with the Meeting, the Company is required to collect certain data including personal data in order to confirm the identity of individual shareholders or shareholder representatives for the purpose of carrying out the Meeting and to comply with applicable laws and regulations. Such personal data may include the contact details and identification details of shareholders (name, address, date of birth, ID number, etc.). By submitting the Proxy or Voting Form, you confirm that you understand the fact that the personal data will be collected, processed and used in connection with the Meeting including for the purpose of the organization of the Meeting and the voting on the resolutions in accordance with the Company’s articles of association and applicable laws.

If you choose not to share personal data with us, you will not be able to participate and vote in the Meeting, respectively.

The Company is the data controller for any personal data that is collected in connection with the Meeting. A controller is the entity that decides why and how your information is processed.

We may disclose your personal data to certain entities to the extent required to perform the various activities related to the Meeting. In particular, your personal data may be disclosed to Stibbe Avocats or Ropes & Gray LLP and Broadridge. If we do this, we will require such third parties to protect the confidentiality and privacy of the personal data and to use such information solely for the purposes for which such information is shared. The Company will ensure that transfers of personal data to such third parties will be carried out in compliance with applicable data protection laws and regulations and in particular, will establish suitable safeguards to ensure that such transfers are carried out in compliance with applicable data protection laws and regulations.

Personal data will be retained no longer than necessary for the purposes indicated hereinabove, unless otherwise required by applicable laws or regulations.

Under certain circumstances, you have rights under data protection laws in relation to your personal data. In particular, you have a right to (i) access your personal data, (ii) be informed about how personal data is used, (iii) have inaccurate personal data rectified, (iv) data portability, and, in certain circumstances, have the right to have your personal data erased, restrict processing of your personal data and object to the processing thereof. To exercise these rights or if you have any other data protection queries, please contact us at privacy@arrival.com.

More information on how we process your data and your rights with respect thereto can be found in our privacy policy, available on our website (https://arrival.com/world/en/legal/privacy#contents)

Luxembourg, 27 December 2023

The Board of Directors of Arrival

Exhibit 99.2

Proxy Card

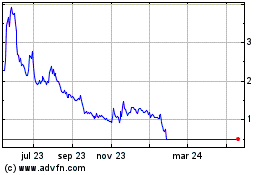

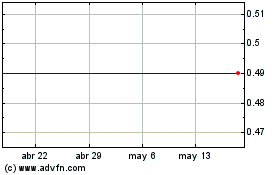

Arrival (NASDAQ:ARVL)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Arrival (NASDAQ:ARVL)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024