false

0001083446

0001083446

2024-07-15

2024-07-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): July 15, 2024

ASTRANA HEALTH, INC.

(Exact Name of Registrant as Specified in its

Charter)

| Delaware |

001-37392 |

95-4472349 |

| (State or Other Jurisdiction |

(Commission |

(I.R.S. Employer |

| of Incorporation) |

File Number) |

Identification No.) |

1668 S. Garfield Avenue, 2nd Floor, Alhambra, California 91801

(Address of Principal Executive Offices) (Zip Code)

(626) 282-0288

Registrant’s Telephone Number, Including

Area Code

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock |

|

ASTH |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

As previously disclosed, a consolidated variable

interest entity of Astrana Health, Inc. (the “Company”) completed its acquisition of all of the outstanding shares of Asian

American Medical Group, a California professional medical corporation (“AAMG”), on October 31, 2022. Pursuant to the terms

of the purchase agreement for the transaction, the Company agreed to register the resale of certain shares of the Company’s common

stock, par value $0.001 per share, that certain former stockholders of AAMG have the contingent right to receive upon the achievement

of certain targets by AAMG during each of the year ended December 31, 2023 and year ending December 31, 2024, as consideration in the

transaction (the “Earn-Out Shares”). On July 15, 2024, the Company filed with the Securities and Exchange Commission a prospectus

supplement pursuant to Rule 424(b) under the Securities Act of 1933, as amended, which supplements the prospectus dated August 16, 2023,

which was included in the Company’s Registration Statement on Form S-3ASR (File No. 333-274013), relating to the potential resale

of the Earn-Out Shares. The Company will not receive any proceeds from the resale of the Earn-Out Shares.

A copy of the opinion of Thompson Hine LLP, relating

to the validity of the Earn-Out Shares, is filed with this Current Report on Form 8-K as Exhibit 5.1.

This Current Report on Form 8-K shall not constitute

an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of any securities in any state or

jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities

laws of any such state or jurisdiction.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ASTRANA HEALTH, INC. |

| |

|

| Date: July 15,

2024 |

By: |

/s/ Brandon K.

Sim |

| |

Name: |

Brandon

K. Sim |

| |

Title: |

Chief Executive Officer and President |

Exhibit 5.1

July 15, 2024

Astrana Health, Inc.

1668 S. Garfield Avenue, 2nd Floor

Alhambra, California 91801

Re: Registration Statement on Form S-3

(File No. 333-274013); 341,416 shares of common stock

Ladies and Gentlemen:

We have acted as counsel to Astrana Health, Inc., a Delaware corporation

(the “Company”), in connection with the offering of up to 341,416 shares of the Company’s common stock, par value

$0.001 per share (the “Common Stock”), that certain individuals have the contingent right to receive upon the achievement

of certain targets by Asian American Medical Group, a California professional medical corporation (“AAMG”), during

each of the year ended December 31, 2023 and year ending December 31, 2024 (the “Earn-Out Shares”), pursuant to that

certain Purchase Agreement, dated September 2022, by and among the Company, AAMG and the other parties thereto (the “Purchase

Agreement”), that may be sold by certain selling stockholders as described in the Prospectus (as defined below), all of which

Earn-Out Shares, once issued, may be sold from time to time and on a delayed or continuous basis, as described in Prospectus. The offering

and sale of the Earn-Out Shares is covered by the above-referenced Registration Statement (the “Registration Statement”),

filed by the Company with the Securities and Exchange Commission (the “Commission”), under the Securities Act of 1933,

as amended (the “Securities Act”), a base prospectus dated August 16, 2023 included in the Registration Statement at

the time it originally became effective (the “Base Prospectus”) and a prospectus supplement dated July 15, 2024 filed

with the Commission pursuant to Rule 424(b) under the Act (the “Prospectus Supplement” and, together with the Base

Prospectus, the “Prospectus”).

In rendering this opinion, we have examined copies of (a) the Company’s

Restated Certificate of Incorporation, as amended, (b) the Company’s Amended and Restated Bylaws, (c) the Registration Statement

and Prospectus, (d) the Purchase Agreement, and (e) copies of such other agreements, documents, instruments, and records as we have deemed

advisable in order to render our opinion set forth below. In such examination, we have assumed the genuineness of all signatures, the

legal capacity of all natural persons, that all parties (other than the Company) had the requisite power and authority (corporate or otherwise)

to execute, deliver and perform such agreements or instruments, that all such agreements or instruments have been duly authorized by all

requisite action (corporate or otherwise), executed and delivered by such parties and that such agreements or instruments are valid, binding

and enforceable obligations of such parties, the authenticity of all documents submitted to us as originals, the conformity to original

documents of all documents submitted to us as certified, conformed or photostatic copies and the authenticity of the originals of such

latter documents. In providing this opinion, we have further relied as to certain matters on information obtained from public officials

and officers of the Company. We have also assumed that, before the Earn-Out Shares are issued, the Company will not issue shares of Common

Stock or reduce the total number of shares of Common Stock that the Company is authorized to issue under its then-effective certificate

of incorporation such that the number of unissued shares of Common Stock authorized under the certificate of incorporation is less than

the number of the Earn-Out Shares.

On the basis of the foregoing, and in reliance thereon, we are of the

opinion that the Earn-Out Shares have been duly authorized by all necessary corporate action of the Company and, when and if issued pursuant

to the terms of the Purchase Agreement, will be validly issued, fully paid and non-assessable.

Our opinions expressed above are limited to the Delaware General Corporation

Law, as currently in effect, and we express no opinion as to the effect on the matters covered by this letter of the laws of any other

jurisdiction. We express no opinion that the Company is obligated to issue Earn-Out Shares under the Purchase Agreement at any time. We

express no opinion as to (a) any provision for liquidated damages, default interest, late charges, monetary penalties, make-whole premiums

or other economic remedies to the extent such provisions are deemed to constitute a penalty, (b) consents to, or restrictions upon, governing

law, jurisdiction, venue, arbitration, remedies or judicial relief, (c) waivers of rights or defenses, (d) any provision requiring the

payment of attorneys’ fees, where such payment is contrary to law or public policy, (e) the creation, validity, attachment, perfection

or priority of any lien or security interest, (f) advance waivers of claims, defenses, rights granted by law or notice, opportunity for

hearing, evidentiary requirements, statutes of limitation, trial by jury or at law or other procedural rights, (g) waivers of broadly

or vaguely stated rights, (h) provisions for exclusivity, election or cumulation of rights or remedies, (i) provisions authorizing or

validating conclusive or discretionary determinations, (j) grants of setoff rights, (k) proxies, powers and trusts, (l) provisions prohibiting,

restricting or requiring consent to assignment or transfer of any right or property, (m) any provision to the extent it requires that

a claim with respect to a security denominated in other than U.S. dollars (or a judgment in respect of such a claim) be converted into

U.S. dollars at a rate of exchange at a particular date, to the extent applicable law otherwise provides, and (n) the severability, if

invalid, of provisions to the foregoing effect.

Our opinions set forth above are subject to bankruptcy, insolvency,

fraudulent transfer, reorganization, moratorium and other similar laws of general application affecting the rights and remedies of creditors

and to general principles of equity.

This opinion letter is expressly limited to the matters set forth above,

and we render no opinion, whether by implication or otherwise, as to any other matters relating to the Company, the Earn-Out Shares, the

Registration Statement, the Base Prospectus or the Prospectus Supplement.

We hereby consent to the filing of this opinion

as an exhibit to the Company’s Current Report on Form 8-K dated July 15, 2024 and to being named under the caption “Legal

Matters” contained in the Prospectus. In giving this consent, we do not hereby admit that we are within the category of persons

whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission promulgated thereunder.

Very truly yours,

/s/ Thompson Hine LLP

Thompson Hine LLP

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

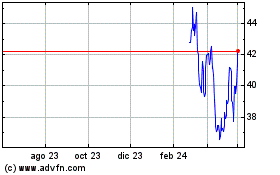

Astrana Health (NASDAQ:ASTH)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

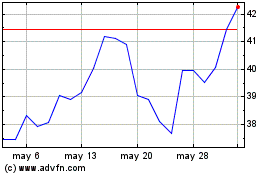

Astrana Health (NASDAQ:ASTH)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024