Aurora Announces Pricing of $420 Million Upsized Public Offering of Class A Common Stock

01 Agosto 2024 - 7:00AM

Business Wire

Aurora Innovation, Inc. (Nasdaq: AUR) today announced the

pricing of its underwritten upsized public offering of 116,666,667

shares of its Class A common stock at $3.60 per share. All of the

securities are to be sold by Aurora. In addition, Aurora has

granted the underwriters a 30-day option to purchase up to an

additional 17,500,000 shares of its Class A common stock at the

public offering price, less the underwriting discounts and

commissions. Before deducting the underwriting discounts and

commissions and estimated offering expenses, Aurora expects to

receive gross proceeds of approximately $420 million from the

public offering, assuming no exercise of the underwriters’ option

to purchase additional shares. The offering is expected to close on

or about August 2, 2024, subject to satisfaction of customary

closing conditions.

Goldman Sachs & Co. LLC, Allen & Company LLC and Morgan

Stanley are acting as joint book-running managers and Evercore ISI,

Canaccord Genuity, TD Cowen and Wolfe | Nomura Alliance are acting

as book-runners for the offering.

Aurora filed a Registration Statement on Form S-3 which was

declared effective by the U.S. Securities and Exchange Commission

(the “SEC”), and has filed a preliminary prospectus supplement and

accompanying prospectus relating to and describing the terms of the

underwritten public offering. A final prospectus supplement and

accompanying prospectus relating to the offering will also be filed

with the SEC. These documents can be accessed for free through the

SEC’s website at www.sec.gov. When available, copies of the final

prospectus supplement and the accompanying prospectus relating to

the underwritten public offering may also be obtained from: Goldman

Sachs & Co. LLC, Attention: Prospectus Department, 200 West

Street, New York, New York 10282-2198; Allen & Company LLC,

Attention: Prospectus Department, 711 Fifth Avenue New York, New

York 10022; or Morgan Stanley & Co. LLC, Attention: Prospectus

Department, 180 Varick Street, 2nd Floor, New York, NY 10014.

This press release does not constitute an offer to sell or a

solicitation of an offer to buy, nor will there be any sale of

these shares of Class A common stock in any state or other

jurisdiction in which such offer, solicitation, or sale would be

unlawful before registration or qualification under the securities

laws of any such state or jurisdiction.

About Aurora

Aurora (Nasdaq: AUR) is delivering the benefits of self-driving

technology safely, quickly, and broadly to make transportation

safer, increasingly accessible, and more reliable and efficient

than ever before. The Aurora Driver is a self-driving system

designed to operate multiple vehicle types, from freight-hauling

trucks to ride-hailing passenger vehicles, and underpins Aurora’s

driver-as-a-service products for trucking and ride-hailing.

Forward-Looking Statements

This press release contains forward-looking statements as that

term is defined in Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. Such statements

include, but are not limited to the timing and size of the

offering. These forward-looking statements are neither promises nor

guarantees and are subject to a variety of risks and uncertainties,

including but not limited to: whether or not Aurora will be able to

raise capital through the sale of Class A common stock or

consummate the proposed offering; and its expectations with respect

to granting the underwriters a 30-day option to purchase additional

shares of Class A common stock; the satisfaction of closing

conditions; and other risks. Information regarding the foregoing

and additional risks are described in the Risk Factors sections of

the preliminary prospectus supplement for the underwritten public

offering filed with the SEC, and the documents incorporated by

reference therein, including without limitation those risks and

uncertainties identified in the “Risk Factors” section of Aurora’s

Registration Statement on Form S-3 declared effective by the SEC on

January 8, 2024, the accompanying prospectus, Aurora’s Annual

Report on Form 10-K filed with the SEC on February 15, 2024, as

amended by Aurora’s Form 10-K/A filed with the SEC on May 24, 2024,

and other filings that Aurora makes with the SEC from time to time.

All forward-looking statements reflect Aurora’s beliefs and

assumptions only as of the date of this press release. Aurora

undertakes no obligation to update forward-looking statements to

reflect future events or circumstances.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240801604479/en/

Investor Relations: Stacy Feit ir@aurora.tech

Media: press@aurora.tech

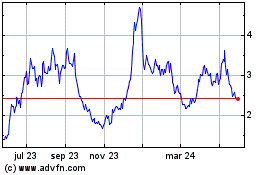

Aurora Innovations (NASDAQ:AUR)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Aurora Innovations (NASDAQ:AUR)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024