Arch Wireless Reports Second Quarter Operating Results WESTBOROUGH,

Mass., Aug. 3 /PRNewswire-FirstCall/ -- Arch Wireless, Inc.

(NASDAQ:AWIN)(BSE:AWL), a leading wireless messaging and mobile

information company, today announced consolidated net income of

$3.1 million, or $0.15 per share, for the quarter ended June 30,

2004. Consolidated revenues for the second quarter of 2004 were

$116 million. "Despite ongoing competition in the wireless

messaging industry, we continued to improve our operations and

business processes and are pleased with the company's second

quarter operating results," said C. Edward Baker, Jr., chairman and

chief executive officer. "During 2003 and the first half of 2004 we

made several important changes to our operating processes, allowing

for continued expense savings and the creation of necessary

processes to eliminate excess network capacity and maintain or

improve many of our operating metrics," he added. Arch reported a

net decline of 209,000 messaging units in service for the quarter

ended June 30, 2004 comprised of 202,000 one-way messaging units

and 7,000 two-way messaging units. Messaging units in service

totaled 3,969,000 at June 30, 2004 including 3,380,000 direct units

in service and 589,000 indirect units in service. Average revenue

per direct unit in service was $10.10 during the second quarter

compared to $3.66 per indirect unit in service. J. Roy Pottle,

executive vice president and chief financial officer, said Arch

continued to strengthen its financial position during the quarter.

"Arch became debt-free on May 28, 2004 when our wholly owned

subsidiary, Arch Wireless Holdings, Inc. (AWHI), completed the

final redemption of its 12% Subordinated Secured Compounding Notes

due 2009," he said. "In addition to repaying $300 million of debt

over the past twenty-four months," Pottle noted, "the company has

successfully restructured its operations to reduce fixed costs in

order to maintain operating margins despite declines in revenue.

This provides Arch with increased operating and financial

flexibility in advance of our pending merger with Metrocall." Baker

noted that progress toward Arch's proposed merger with Metrocall is

on schedule. "We expect to file a definitive joint proxy

statement/prospectus relating to the merger with the Securities and

Exchange Commission in the near future," he said, "which will clear

the way for shareholders of both companies to vote on the merger

after distribution and review of the definitive joint

proxy/prospectus." Arch and Metrocall currently plan to schedule

special meetings of their respective shareholders for

mid-September. Baker said the proposed merger also requires the

approval and consent of the Federal Communications Commission and

clearance from the U.S. Department of Justice. "We expect those

agency reviews to be completed within the next few months," he

added, "and that, as anticipated, the merger will be completed at

the end of the third quarter or early in the fourth quarter." Arch

and Metrocall announced a definitive merger agreement on March 29,

2004 in which both companies would combine into a new holding

company. In connection with the proposed business combination

transaction, on July 23, 2004 USA Mobility, Inc. (formerly known as

Wizards-Patriots Holdings, Inc.), the holding company in the

proposed transaction ("Parent"), filed with the Securities and

Exchange Commission (the "SEC") an amended registration statement

on Form S-4, which includes a preliminary joint proxy

statement/prospectus of Arch and Metrocall and other relevant

documents in connection with the proposed transaction. In addition,

Parent will prepare and file a definitive joint proxy

statement/prospectus and other documents regarding the proposed

transaction with the SEC. Investors of Arch and Metrocall are urged

to read the definitive joint proxy statement/prospectus and other

relevant materials because they will contain important information

about Parent, Arch and Metrocall and the proposed transaction. The

definitive joint proxy statement/prospectus will be sent to

stockholders of Arch and Metrocall seeking their approval of the

proposed transaction. Investors may obtain a free copy of these

materials and other documents filed by Parent, Arch and Metrocall

with the Securities and Exchange Commission at the SEC's website at

http://www.sec.gov/. A free copy of the definitive joint proxy

statement/prospectus, once it is available, also may be obtained

from Arch Wireless, Inc., 1800 West Park Drive, Suite 250,

Westborough, MA 01581, Attention: Jerry Cimmino (tel.:

508-870-6700), or Metrocall Holdings, Inc., 6677 Richmond Highway,

Alexandria, Virginia 22306, Attention: Shirley White (tel.:

703-660-6677). Investors also may access free copies of the

documents filed with the SEC by Arch on Arch's website at

http://www.arch.com/ or upon written request to Arch at its address

listed above, and investors may access free copies of the documents

filed with the SEC by Metrocall on Metrocall's website at

http://www.metrocall.com/ or upon written request to Metrocall at

its address indicated above. Arch and Metrocall and their

respective directors and executive officers may be deemed to be

participants in the solicitation of proxies from Arch stockholders.

The directors and executive officers of Arch include: William E.

Redmond, Jr., Richard A. Rubin, Samme L. Thompson, James V.

Continenza, Eric Gold, Carroll D. McHenry, Matthew Oristano, J. Roy

Pottle and C. Edward Baker, Jr. The directors and executive

officers of Metrocall include: Vincent D. Kelly, Royce Yudkoff,

Eugene I. Davis, Nicholas A. Gallopo, David J. Leonard, Brian

O'Reilly, Steven D. Scheiwe, George Z. Moratis and Stan Sech.

Stockholders may obtain additional information regarding the

interests of such participants by reading the preliminary joint

proxy statement/prospectus and, when it becomes available, the

definitive joint proxy statement/prospectus. Arch Wireless, Inc.,

headquartered in Westborough, Mass., is a leading wireless

messaging and mobile information company with operations throughout

the United States. It offers a full range of wireless messaging and

wireless e-mail services, including mobile data solutions for the

enterprise, to business and retail customers nationwide. Arch

provides services to customers in all 50 states, the District of

Columbia, Puerto Rico, Canada, Mexico and in the Caribbean

principally through a nationwide direct sales force, as well as

through indirect resellers, retailers and other strategic partners.

Additional information on Arch is available on the Internet at

http://www.arch.com/. Statement under the Private Securities

Litigation Reform Act: Statements contained herein or in prior

press releases which are not historical fact, such as statements

regarding Arch's expectations for future operating and financial

performance and completion of its pending merger with Metrocall,

are forward-looking statements for purposes of the safe harbor

provisions under the Private Securities Litigation Reform Act of

1995. These forward-looking statements involve risks and

uncertainties that may cause Arch's actual results to be materially

different from the future results expressed or implied by such

forward-looking statements. Factors that could cause actual results

to differ materially from those expectations include, but are not

limited to, declining demand for its paging products and services,

Arch's ability to continue to reduce operating expenses, possible

delays in or failure to obtain shareholder or regulatory approvals

of the merger with Metrocall, Arch's future capital needs,

competitive pricing pressures, competition from both traditional

paging services and other wireless communications services,

government regulation, reliance upon third party providers for

certain equipment and services, as well as other risks described

from time to time in Arch's periodic reports and registration

statements filed with the Securities and Exchange Commission.

Although Arch believes the expectations reflected in the

forward-looking statements are based on reasonable assumptions, it

can give no assurance that its expectations will be attained. Arch

disclaims any intent or obligation to update any forward- looking

statements. ARCH WIRELESS, INC. CONSOLIDATED CONDENSED BALANCE

SHEETS (unaudited and in thousands) June 30, December 31, 2004 2003

ASSETS Current assets: Cash and cash equivalents $22,367 $34,582

Accounts receivable, net 20,279 26,052 Deposits 3,224 6,776 Prepaid

rent 384 514 Prepaid expenses and other 8,331 7,381 Deferred income

tax 25,893 30,206 Total current assets 80,478 105,511 Property and

equipment 391,936 394,436 Less accumulated depreciation and

amortization (224,615) (180,563) Property and equipment, net

167,321 213,873 Assets held for sale - 1,139 Intangible and other

assets, net 3 3 Deferred income tax 191,955 189,346 $439,757

$509,872 LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities:

Current maturities of long-term debt $- $20,000 Accounts payable

8,403 8,836 Accrued compensation and benefits 7,131 17,820 Accrued

network costs 7,100 7,893 Accrued property and sales taxes 8,887

10,076 Accrued interest - 1,520 Accrued restructuring charges 8,470

11,481 Accrued other 7,028 8,104 Customer deposits and deferred

revenue 21,316 25,477 Total current liabilities 68,335 111,207

Long-term debt, less current maturities - 40,000 Other long-term

liabilities 6,921 4,042 Stockholders' equity: Common stock 2 2

Treasury stock (3,112) - Additional paid-in capital 344,576 339,928

Deferred stock compensation (2,261) (2,682) Retained earnings

25,296 17,375 Total stockholders' equity 364,501 354,623 $439,757

$509,872 ARCH WIRELESS, INC. CONSOLIDATED CONDENSED STATEMENTS OF

OPERATIONS (in thousands, except share and per share amounts)

(unaudited) Three Months Ended Six Months Ended June 30, June 30,

2004 2003 2004 2003 Revenues: One-way messaging $93,680 $126,761

$194,042 $263,632 Two-way messaging 22,117 27,315 45,414 55,197

Total revenues 115,797 154,076 239,456 318,829 Operating expenses:

Cost of products sold 856 1,374 1,794 3,032 Service, rental, and

maintenance 36,988 48,511 75,976 98,646 Selling 8,757 11,721 17,825

24,215 General and administrative 28,968 43,887 60,085 92,979

Depreciation and amortization 31,071 30,638 57,380 63,861 Stock

based and other compensation 2,510 4,276 5,448 6,471 Restructuring

charges - - 3,018 - Total operating expenses 109,150 140,407

221,526 289,204 Operating income 6,647 13,669 17,930 29,625

Interest expense, net (1,700) (4,827) (5,029) (10,473) Other income

(expense) 177 73 345 83 Income before income tax expense 5,124

8,915 13,246 19,235 Income tax expense (2,060) (3,671) (5,325)

(7,920) Net income $3,064 $5,244 $7,921 $11,315 Basic net income

per common share $0.15 $0.26 $0.40 $0.57 Diluted net income per

common share $0.15 $0.26 $0.39 $0.57 Basic weighted average common

shares outstanding 19,965,076 20,000,000 19,982,635 20,000,000

Diluted weighted average common shares outstanding 20,109,191

20,025,555 20,093,617 20,012,848 ARCH WIRELESS, INC. CONSOLIDATED

CONDENSED STATEMENTS OF CASH FLOWS (unaudited and in thousands) Six

Months Ended June 30, 2004 2003 Cash flows from operating

activities: Net income $7,921 $11,315 Adjustments to reconcile net

income to net cash provided by operating activities: Depreciation

and amortization 57,380 63,861 Accretion of long-term debt - 4,750

Amortization of stock and other compensation 1,448 1,773 Deferred

income tax provision 5,325 7,920 (Gains) losses on disposals of

property and equipment (230) 61 Other income (110) (119) Provisions

for doubtful accounts and service adjustments 4,378 15,294 Changes

in assets and liabilities: Accounts receivable 1,395 (2,298)

Prepaid expenses and other (129) 13,071 Accounts payable and

accrued expenses (18,711) (16,708) Customer deposits and deferred

revenue (4,161) (4,340) Other long-term liabilities 2,801 1,733 Net

cash provided by operating activities 57,307 96,313 Cash flows from

investing activities: Additions to property and equipment (8,138)

(9,695) Proceeds from disposals of property and equipment 1,618

2,232 Receipts from note receivable 110 119 Net cash used for

investing activities (6,410) (7,344) Cash flows from financing

activities: Repayment of long-term debt (60,000) (80,000) Capital

contribution (distribution) (3,112) - Net cash used for financing

activities (63,112) (80,000) Net increase (decrease) in cash and

cash equivalents (12,215) 8,969 Cash and cash equivalents,

beginning of period 34,582 37,187 Cash and cash equivalents, end of

period $22,367 $46,156 Supplemental disclosures: Interest paid

$6,690 $5,456 Asset retirement obligations $- $1,244 ARCH WIRELESS,

INC. UNIT IN SERVICE ACTIVITY Three Months Ended September 2003

December 2003 March 2004 June 2004 Direct One-Way: Beginning units

in service 3,476,000 3,300,000 3,393,000 3,247,000 Unit in service

growth (decline) (176,000) 93,000 (146,000) (125,000) Ending units

in service 3,300,000 3,393,000 3,247,000 3,122,000 Revenues (000s)

$107,455 $101,497 $92,940 $87,226 Average revenue per unit $9.43

$9.35 $9.00 $8.77 Two-Way: Beginning units in service 310,000

300,000 281,000 269,000 Unit in service growth (decline) (10,000)

(19,000) (12,000) (11,000) Ending units in service 300,000 281,000

269,000 258,000 Revenues (000s) $25,940 $24,630 $22,756 $21,593

Average revenue per unit $27.67 $27.27 $26.66 $26.28 Indirect

One-Way: Beginning units in service 978,000 860,000 754,000 654,000

Unit in service growth (decline) (118,000) (106,000) (100,000)

(77,000) Ending units in service 860,000 754,000 654,000 577,000

Revenues (000s) $9,491 $8,256 $7,422 $6,454 Average revenue per

unit $3.44 $3.39 $3.49 $3.47 Two-Way: Beginning units in service

9,000 8,000 9,000 8,000 Unit in service growth (decline) (1,000)

1,000 (1,000) 4,000 Ending units in service 8,000 9,000 8,000

12,000 Revenues (000s) $737 $643 $541 $524 Average revenue per unit

$21.96 $21.24 $21.09 $14.92 (1) Total Beginning units in service

4,773,000 4,468,000 4,437,000 4,178,000 Unit in service growth

(decline) (305,000) (280,000) (259,000) (209,000) Adjustment -

249,000 - - Ending units in service 4,468,000 4,437,000 4,178,000

3,969,000 (1) Average revenue per unit includes the effect of

approximately 4,900 telemetry unit additions during the quarter.

These units have lower monthly charges than typical indirect units.

Contact: Bob Lougee, (508) 435-6117 DATASOURCE: Arch Wireless, Inc.

CONTACT: Bob Lougee, Arch Wireless, Inc., +1-508-435-6117 Web site:

http://www.arch.com/

Copyright

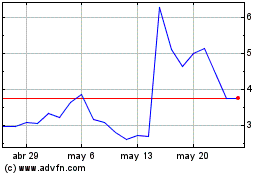

AERWINS Technologies (NASDAQ:AWIN)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

AERWINS Technologies (NASDAQ:AWIN)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024