Biote Announces $20 Million Share Repurchase Authorization

25 Enero 2024 - 3:05PM

Business Wire

biote Corp. (NASDAQ: BTMD) (“Biote” or the “Company”), a

leading solutions provider in preventive health care through the

delivery of personalized hormone optimization and therapeutic

wellness, today announced that its Board of Directors has approved

a $20 million share repurchase program of the Company's common

stock. This approval grants Biote’s management the authority to

repurchase outstanding shares of the Company’s common stock, from

time to time, in the open market, in privately negotiated

transactions and/or by such other means in accordance with

applicable state and federal securities laws. This is the Company's

first authorization for share repurchases.

Terry Weber, Biote’s Chief Executive Officer, commented, "As we

continue to advance our strategic objectives and position Biote to

become the leader in evidence-based therapeutic wellness, we remain

confident in our growth opportunity and the outlook for our

business. We believe that now is an ideal time to initiate a

substantial share repurchase authorization. Supported by our strong

balance sheet, we believe opportunistic share repurchases represent

an efficient use of capital that can benefit our shareholders."

The timing of any repurchases under the share repurchase program

will be at the discretion of management and will depend on a

variety of factors including market conditions, contractual

limitations and other considerations. The program may be expanded,

modified, suspended or discontinued at any time, and does not

obligate the Company to repurchase any dollar amount or number of

shares.

About Biote

Biote is transforming healthy aging through innovative,

personalized hormone optimization and therapeutic wellness

solutions delivered by Biote-certified medical providers. Biote

trains practitioners to identify and treat early indicators of

aging conditions, an underserved global market, providing

affordable symptom relief for patients and driving clinic success

for practitioners.

Forward-Looking Statements

This press release contains certain forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Some of the forward-looking statements can be identified

by the use of forward-looking words. Statements that are not

historical in nature, including the words “may,” “can,” “should,”

“will,” “estimate,” “plan,” “project,” “forecast,” “intend,”

“expect,” “hope,” “anticipate,” “believe,” “seek,” “target,”

“continue,” “could,” “might,” “ongoing,” “potential,” “predict,”

“would” and other similar expressions, are intended to identify

forward-looking statements. Forward-looking statements are

predictions, projections and other statements about future events

that are based on current expectations and assumptions and, as a

result, are subject to risks and uncertainties. Many factors could

cause actual results or developments to differ materially from

those expressed or implied by such forward-looking statements,

including but not limited to: the Company’s operating performance,

cash flow and financial position, the market price of the shares

and general economic and market conditions; the success of our

dietary supplements to attain significant market acceptance among

clinics, practitioners and their patients; our customers’ reliance

on certain third parties to support the manufacturing of

bio-identical hormones for prescribers; our and our customers’

sensitivity to regulatory, economic, environmental and competitive

conditions in certain geographic regions; our ability to increase

the use by practitioners and clinics of the Biote Method at the

rate that we anticipate or at all; our ability to grow our

business; the significant competition we face in our industry; the

impact of strategic acquisitions and the implementation of our

growth strategies; our limited operating history; our ability to

protect our intellectual property; the heavy regulatory oversight

in our industry; changes in applicable laws or regulations; the

inability to profitably expand in existing markets and into new

markets; the possibility that we may be adversely impacted by other

economic, business and/or competitive factors, including recent

bank failures; and future exchange and interest rates. The

foregoing list of factors is not exhaustive. You should carefully

consider the risks and uncertainties described in the “Risk

Factors” section of the Biote’s Quarterly Report on Form 10-Q for

the fiscal quarter ended September 30, 2023 and other documents

filed by Biote from time to time with the Securities and Exchange

Commission. These filings identify and address other important

risks and uncertainties that could cause actual events and results

to differ materially from those contained in the forward-looking

statements. Forward-looking statements speak only as of the date

they are made. Readers are cautioned not to put undue reliance on

forward-looking statements, and Biote assumes no obligation and

does not intend to update or revise these forward-looking

statements, whether as a result of new information, future events,

or otherwise. Biote does not give any assurance that it will

achieve its expectations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240125835517/en/

Investor Relations: Eric Prouty AdvisIRy Partners

eric.prouty@advisiry.com

Media: Press@biote.com

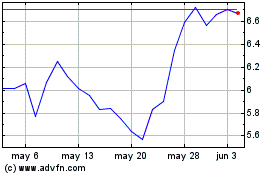

Biote (NASDAQ:BTMD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Biote (NASDAQ:BTMD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024