Successful Completion of Tender Offer on Carmila’s Bonds With €200,100,000 of Bonds Tendered

24 Septiembre 2024 - 11:10AM

Business Wire

Regulatory News:

Carmila (Paris:CARM) successfully completed its tender offer,

announced on 16 September 2024, on the following series of existing

notes:

- €300,000,000 1.625 per cent. Notes due 30 May 2027 (ISIN

FR0014000T33) (the "2027 Notes");

- €350,000,000 2.125 per cent. Notes due 7 March 2028 (ISIN

FR0013321536) (the "March 2028 Notes");

- €500,000,000 5.500 per cent. Notes due 9 October 2028 (ISIN

FR001400L1E0) (the "October 2028 Notes"); and

- €325,000,000 1.625 per cent. Notes due 1 April 2029 (ISIN

FR0014002QG3) (the "2029 Notes", together with the 2027

Notes, the March 2028 Notes and the October 2028 Notes, the

"Existing Notes").

A total aggregate principal amount of €200,100,000 was validly

tendered and accepted by Carmila for repurchase.

Aggregate principal amount validly tendered and accepted by

Carmila for repurchase in respect of each series of Existing

Notes:

- 2027 Notes: €53,500,000

- March 2028 Notes: €15,700,000

- October 2028 Notes: €130,900,000

None of the 2029 Notes have been accepted for purchase by

Carmila.

All notes purchased by Carmila will be cancelled. The Settlement

Date for the tender offer is expected to be 26 September 2024.

This tender offer follows the inaugural issuance of a green bond

of €300,000,000, with a maturity of 7 years and a coupon of 3.875%,

on 17 September 2024.

This operation allows Carmila to proactively manage and further

extend its debt maturity profile and optimise its balance sheet

structure.

INVESTOR AGENDA

17 October 2024 (after market close): Financial

information for the third quarter 2024

ABOUT CARMILA

As the third-largest listed owner of commercial property in

Europe, Carmila was founded by Carrefour and large institutional

investors in order to enhance the value of shopping centres

adjoining Carrefour hypermarkets in France, Spain and Italy. At 31

December 2023, its portfolio was valued at €5.9 billion and is made

up of 201 shopping centres, with leading positions in their

catchment areas.

Carmila is listed on Euronext-Paris Compartment A under the

symbol CARM. It benefits from the tax regime for French real estate

investment trusts (“SIIC”). Carmila has been a member of the SBF

120 since 20 June 2022.

IMPORTANT NOTICE

Some of the statements contained in this document are not

historical facts but rather statements of future expectations,

estimates and other forward-looking statements based on

management’s beliefs. These statements reflect such views and

assumptions prevailing as of the date of the statements and involve

known and unknown risks and uncertainties that could cause future

results, performance or events to differ materially from those

expressed or implied in such statements. Please refer to the most

recent Universal Registration Document filed in French by Carmila

with the Autorité des marchés financiers for additional information

in relation to such factors, risks and uncertainties. Carmila has

no intention and is under no obligation to update or review the

forward-looking statements referred to above. Consequently, Carmila

accepts no liability for any consequences arising from the use of

any of the above statements.

This press release is available in the

“Funding” section of Carmila’s Finance webpage:

https://www.carmila.com/en/finance/funding/

Visit our website at

https://www.carmila.com/en/

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240924965100/en/

INVESTORS AND ANALYSTS CONTACT

Pierre-Yves Thirion - CFO pierre_yves_thirion@carmila.com +33 6

47 21 60 49

PRESS CONTACT

Elodie Arcayna – Corporate Communications Director

elodie_arcayna@carmila.com +33 7 86 54 40 10

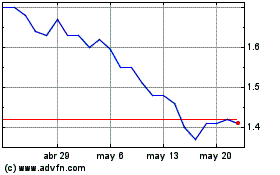

Carisma Therapeutics (NASDAQ:CARM)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Carisma Therapeutics (NASDAQ:CARM)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024