Avid Bioservices, Inc. (NASDAQ: CDMO), a dedicated biologics

contract development and manufacturing organization (CDMO) working

to improve patient lives by providing high quality development and

manufacturing services to biotechnology and pharmaceutical

companies, today announced financial results for the first quarter

ended July 31, 2024.

Highlights from the Quarter Ended July

31, 2024, and Other Events:

“Our first quarter continued the strong momentum

we have seen since the completion of our expansion program. We are

encouraged by the strong revenues and new business signings, which

continue to build our backlog and improve margins,” stated Nick

Green, president and CEO of Avid Bioservices.

“In addition to the strong overall bookings

during the quarter, it was encouraging to see the composition of

signings, which included a significant number of new customers, a

number of early-phase programs, and multiple late-stage programs,

including two PPQ campaigns, one of which is a Phase 3 program

advancing toward commercialization, and the other is a commercial

product. During the quarter, we continued to record strong revenues

from process development as we onboarded new business.

“The investments of the last few years in

infrastructure, facilities, and capacity, and the expansion of our

capabilities continue to attract new business and a wider range of

opportunities. Our new infrastructure and organization are now

better equipped to support the needs of large pharma with the same

excellence and agility that we provide smaller biotech companies.

We look forward to the continued diversification of our customer

base and our project pipeline with key programs from early stage to

commercialization.

“Looking ahead, our story remains unchanged with

our primary focus on filling our remaining capacity. As we continue

to sign new business, execute on our backlog and leverage our

sterling reputation in the industry, we expect revenues and

capacity utilization to increase, generating higher margins, and

positioning Avid to achieve strong growth going forward.”

Financial Highlights and

Guidance

- The company is reiterating revenue

guidance for fiscal 2025 of $160 million to $168 million.

- Revenues for the first quarter of

fiscal 2025 were $40.2 million, representing a 6% increase as

compared to revenues of $37.7 million recorded in the same prior

year period. The increase was primarily attributed to an increase

in process development revenues during the period.

- As of July 31, 2024, the

company’s backlog was $219 million, representing an increase of 16%

compared to $189 million at the end of the same quarter last year.

The company anticipates a significant amount of its backlog will be

recognized as revenue over the next five fiscal quarters.

- Gross profit for the first quarter

of fiscal 2025 was $5.7 million (14% gross margin), compared to

$4.1 million (11% gross margin) in the first quarter of fiscal

2024. The increase in gross profit for the first quarter ended July

31, 2024, compared to the same prior year period was primarily

driven by increased revenues and lower material costs used for

customer programs, partially offset by increases in compensation

and benefit related expenses, facility, manufacturing and other

related expenses, and depreciation expense.

- SG&A expenses for the first

quarter of fiscal 2025 were $8.2 million, an increase of 30%

compared to $6.3 million recorded for the first quarter of fiscal

2024. The increase in SG&A for the first quarter ended July 31,

2024, compared to the same prior year period was primarily due to

increases in compensation and benefit related expenses and audit,

legal and other consulting fees.

- During the first quarter of fiscal

2025, the company’s net loss was $5.5 million or $0.09 per basic

and diluted share, compared to a net loss of $2.1 million or $0.03

per basic and diluted share for the first quarter of fiscal

2024.

- On July 31, 2024, Avid

reported cash and cash equivalents of $33.4 million, compared

to $38.1 million on April 30, 2024.

More detailed financial information and analysis

may be found in Avid Bioservices’ Quarterly Report on Form 10-Q,

which is being filed with the Securities and Exchange

Commission today.

Recent Corporate

Developments

- The company’s commercial team

signed $66 million of net new orders during the first quarter of

fiscal 2025 resulting in a backlog of $219 million and our highest

net new orders signed since the third quarter of fiscal 2023. The

current backlog of $219 million represents a 13% increase over

fiscal 2024 year-end backlog of $193 million. These orders span a

broad range of the company’s capabilities, with the significant

majority representing new projects with new customers including the

addition of another large pharma customer. Building a larger

revenue base with larger pharma companies is one of the company’s

strategic growth initiatives.

Statement Regarding Use of Non-GAAP

Financial Measures

The company uses certain non-GAAP financial

measures such as non-GAAP adjusted net income, free cash flow, as

well as adjusted EBITDA. The company uses these non-GAAP financial

measures for financial and operational decision making and as a

means to evaluate period-to-period comparisons. The company

believes that they provide useful information about operating

results, enhance the overall understanding of its operating

performance and future prospects, and allow for greater

transparency with respect to key metrics used by management in its

financial and operational decision making. These non-GAAP financial

measures exclude amounts that the company does not consider part of

ongoing operating results when planning and forecasting and when

assessing the performance of the organization and its senior

management. The company computes non-GAAP financial measures

primarily using the same consistent method from quarter to quarter

and year to year, and may consider whether other significant items

that arise in the future should be excluded from its non-GAAP

financial measures.

The company reports non-GAAP financial measures

in addition to, and not as a substitute for, or superior to,

measures of financial performance prepared in accordance with U.S.

generally accepted accounting principles (GAAP). These non-GAAP

financial measures are not based on any comprehensive set of

accounting rules or principles, differ from GAAP measures with the

same names, and may differ from non-GAAP financial measures with

the same or similar names that are used by other companies. The

company believes that non-GAAP financial measures should only be

used to evaluate its results of operations in conjunction with the

corresponding GAAP financial measures and encourages investors to

carefully consider its results under GAAP, as well as the

supplemental non-GAAP information and the reconciliations between

these presentations, to more fully understand its business.

Non-GAAP net income (loss) excludes stock-based

compensation; business transition and related costs including, but

not limited to, corporate initiatives into new business activities

such as severance and related expenses; non-cash interest expense

on debt; and other income or expense items and is adjusted for

income taxes. Adjusted EBITDA excludes non-cash operating charges

for stock-based compensation, depreciation, and amortization as

well as non-operating items such as interest income, interest

expense, and income tax expense or benefit and is adjusted for

income taxes. For the reasons explained above, adjusted EBITDA also

excludes certain business transition and related costs. The company

also uses measures such as free cash flow, which represents cash

flow provided by or (used in) operations less cash used in the

acquisition and disposition of capital.

Additionally, non-GAAP net income (loss) and

adjusted EBITDA are key components of the financial metrics

utilized by the company’s compensation committee to measure, in

part, management’s performance and determine significant elements

of management’s compensation. The company encourages investors to

carefully consider its results under GAAP, as well as its

supplemental non-GAAP information and the reconciliation between

these presentations, to more fully understand its business.

Reconciliations between GAAP and non-GAAP financial measures are

included at the end of this press release.

Webcast

Avid will host a webcast on Monday, September 9,

2024, at 4:30 PM Eastern (1:30 PM Pacific). To listen to

the live webcast, or access the archived webcast, please

visit: https://ir.avidbio.com/investor-events.

About Avid Bioservices,

Inc.

Avid Bioservices (NASDAQ: CDMO) is a

dedicated contract development and manufacturing organization

(CDMO) focused on development and CGMP manufacturing of biologics.

The company provides a comprehensive range of process development,

CGMP clinical and commercial manufacturing services for the

biotechnology and biopharmaceutical industries. With more than 30

years of experience producing biologics, Avid's services include

CGMP clinical and commercial drug substance manufacturing, bulk

packaging, release and stability testing and regulatory submissions

support. For early-stage programs the company provides a variety of

process development activities, including cell line development,

upstream and downstream development and optimization, analytical

methods development, testing and characterization. The scope

of our services ranges from standalone process development projects

to full development and manufacturing programs through

commercialization. www.avidbio.com

Forward-Looking Statements

Statements in this press release, which are not

purely historical, including statements regarding the

company’s expected increases in revenues and capacity utilization

and resulting higher margins, future growth, the estimated annual

revenue-generating capacity of the company’s facilities, continued

customer diversification and our project pipeline, the anticipated

timing for recognizing revenue from the company’s backlog, the

realization of the company’s strategic objectives, the company’s

revenue guidance, and other statements relating to the

company’s intentions, hopes, beliefs, expectations,

representations, projections, plans or predictions of the future,

are forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. The forward-looking

statements involve risks and uncertainties that could cause actual

results to differ materially from those expressed or implied by the

forward-looking statements, including, but not limited to, the risk

the company may experience delays in engaging new customers, the

risk that the company may not be successful in executing customers

projects, the risk that changing economic conditions may delay or

otherwise adversely impact the realization of the company’s

backlog, the risk that the company may not be able to convert its

backlog into revenue within the contemplated time periods, the risk

that the company may experience technical difficulties in

completing customer projects due to unanticipated equipment

and/or manufacturing facility issues which could result

in projects being terminated or delay delivery of products to

customers, revenue recognition and receipt of payment

or result in the loss of the customer, the risk that the

company’s later-stage customers do not receive regulatory approval

or that commercial demand for an approved product is less than

forecast, the risk that one or more existing customers terminates

its contract prior to completion or reduces or delays its demand

for development or manufacturing services which could adversely

affect guided fiscal 2025 revenues, the risk that expanding into a

new biologics manufacturing capability may distract senior

management’s focus on the company’s existing operations, the risk

that the company may experience delays in hiring qualified

individuals into the cell and gene therapy business, the risk that

the company may experience delays in engaging customers for the

cell and gene therapy business, and the risk that the cell and gene

therapy business may not become profitable for several years, if

ever. Our business could be affected by a number of other factors,

including the risk factors listed from time to time in our reports

filed with the Securities and Exchange

Commission including, but not limited to, our annual report on

Form 10-K for the fiscal year ended April 30, 2024 (the

“Annual Report”), as well as any updates to these risk factors

filed from time to time in our other filings with

the Securities and Exchange Commission, including our most

recent quarterly report on Form 10-Q filed subsequent to the Annual

Report. We caution investors not to place undue reliance on the

forward-looking statements contained in this press release, and we

disclaim any obligation, and do not undertake, to update or revise

any forward-looking statements in this press release except as may

be required by law.

| |

| AVID

BIOSERVICES, INC.CONDENSED CONSOLIDATED STATEMENTS OF LOSS AND

COMPREHENSIVE LOSS(Unaudited) (In thousands, except per share

information) |

|

|

|

|

|

|

|

| |

Three Months Ended July 31, |

| |

2024 |

|

2023 |

| |

|

|

|

|

|

| Revenues |

$40,173 |

|

|

$37,726 |

|

| Cost of revenues |

34,460 |

|

|

33,626 |

|

|

Gross profit |

5,713 |

|

|

4,100 |

|

| |

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

Selling, general and administrative |

8,169 |

|

|

6,263 |

|

|

Total operating expenses |

8,169 |

|

|

6,263 |

|

| Operating loss |

(2,456 |

) |

|

(2,163 |

) |

| Interest expense |

(2,454 |

) |

|

(825 |

) |

| Other income (expense),

net |

(624 |

) |

|

258 |

|

| Net loss before income

taxes |

(5,534 |

) |

|

(2,730 |

) |

| Income tax benefit |

— |

|

|

(608 |

) |

| Net loss |

$(5,534 |

) |

|

$(2,122 |

) |

| Comprehensive loss |

$(5,534 |

) |

|

$(2,122 |

) |

| |

|

|

|

|

|

| Net loss per share: |

|

|

|

|

|

|

Basic and diluted |

$(0.09 |

) |

|

$(0.03 |

) |

| |

|

|

|

|

|

| Weighted average common shares

outstanding: |

|

|

|

|

|

|

Basic and diluted |

63,639 |

|

|

62,838 |

|

| |

|

|

|

|

|

|

AVID BIOSERVICES, INC.CONDENSED CONSOLIDATED BALANCE

SHEETS(Unaudited) (In thousands, except par value) |

|

|

|

|

|

|

|

|

|

|

|

July 31, 2024 |

|

April 30, 2024 |

|

ASSETS |

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$33,381 |

|

|

$38,106 |

|

|

Accounts receivable, net |

|

20,962 |

|

|

|

16,644 |

|

|

Contract assets |

|

14,209 |

|

|

|

12,364 |

|

|

Inventory |

|

29,196 |

|

|

|

30,375 |

|

|

Prepaid expenses and other current assets |

|

5,872 |

|

|

|

6,513 |

|

|

Total current assets |

|

103,620 |

|

|

|

104,002 |

|

|

Property and equipment, net |

|

185,617 |

|

|

|

186,514 |

|

|

Operating lease right-of-use assets |

|

40,741 |

|

|

|

41,157 |

|

|

Other assets |

|

4,664 |

|

|

|

4,884 |

|

|

Total assets |

$334,642 |

|

|

$336,557 |

|

| |

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

$19,999 |

|

|

$20,667 |

|

|

Accrued compensation and benefits |

|

5,608 |

|

|

|

5,437 |

|

|

Contract liabilities |

|

37,659 |

|

|

|

39,887 |

|

|

Current portion of operating lease liabilities |

|

1,399 |

|

|

|

1,354 |

|

|

Other current liabilities |

|

6,417 |

|

|

|

3,221 |

|

|

Total current liabilities |

|

71,082 |

|

|

|

70,566 |

|

|

Convertible senior notes, net |

|

153,867 |

|

|

|

153,593 |

|

|

Operating lease liabilities, less current portion |

|

43,971 |

|

|

|

44,336 |

|

|

Finance lease liabilities, less current portion |

|

6,725 |

|

|

|

7,101 |

|

|

Other liabilities |

|

361 |

|

|

|

72 |

|

|

Total liabilities |

|

276,006 |

|

|

|

275,668 |

|

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

|

| Preferred stock, $0.001 par

value; 5,000 shares authorized; no shares issued and

outstanding at respective dates |

|

— |

|

|

|

— |

|

| Common stock, $0.001 par

value; 150,000 shares authorized; 63,790 and 63,568 shares

issued and outstanding at respective dates |

|

64 |

|

|

|

64 |

|

|

Additional paid-in capital |

|

635,977 |

|

|

|

632,696 |

|

|

Accumulated deficit |

|

(577,405) |

|

|

|

(571,871) |

|

|

Total stockholders’ equity |

|

58,636 |

|

|

|

60,889 |

|

|

Total liabilities and stockholders’ equity |

$334,642 |

|

|

$336,557 |

|

| |

|

|

|

|

|

|

|

|

AVID BIOSERVICES, INC.ITEMIZED RECONCILIATION BETWEEN GAAP AND

NON-GAAP FINANCIAL MEASURES (Unaudited) (In thousands) |

|

|

|

|

Three Months Ended July 31, |

|

|

2024 |

|

2023 |

|

|

|

|

|

|

GAAP net loss |

$(5,534) |

|

|

$(2,122) |

|

|

Income tax benefit |

— |

|

|

(608) |

|

|

GAAP net loss before income taxes |

$(5,534) |

|

|

$(2,730) |

|

|

Stock-based compensation |

2,665 |

|

|

2,343 |

|

|

Non-cash interest expense |

305 |

|

|

339 |

|

|

Unrealized loss on equity investment |

935 |

|

|

— |

|

|

Income tax effect of adjustments |

— |

|

|

(588) |

|

|

Adjusted net loss |

($1,629) |

|

|

$(636) |

|

|

|

|

|

|

|

GAAP net loss |

$(5,534) |

|

|

$(2,122) |

|

|

Interest expense, net |

2,143 |

|

|

529 |

|

|

Income tax benefit |

— |

|

|

(608) |

|

|

Depreciation and amortization |

2,824 |

|

|

2,649 |

|

|

Stock-based compensation |

2,665 |

|

|

2,343 |

|

|

Unrealized loss on equity investment |

935 |

|

|

— |

|

|

Adjusted EBITDA |

$3,033 |

|

|

$2,791 |

|

|

|

|

|

|

|

GAAP net cash used in operating activities |

$(3,680) |

|

|

$(236) |

|

|

Purchase of property and equipment |

(1,311) |

|

|

(14,156) |

|

|

Free cash flow |

$(4,991) |

|

|

$(14,392) |

|

|

|

|

|

|

Contacts:

Stephanie Diaz (Investors)

Vida Strategic Partners

415-675-7401

sdiaz@vidasp.com

Tim Brons (Media)

Vida Strategic Partners

415-675-7402

tbrons@vidasp.com

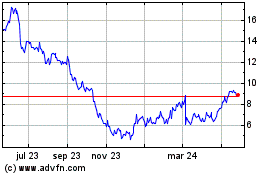

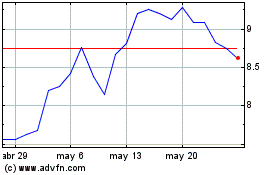

Avid Bioservices (NASDAQ:CDMO)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Avid Bioservices (NASDAQ:CDMO)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024