Cocrystal Pharma, Inc. (Nasdaq: COCP) (“Cocrystal” or the

“Company”) reports financial results for the three and nine months

ended September 30, 2024, and provides updates on its antiviral

product pipeline, upcoming milestones and business activities.

“The coming months are critically important to

Cocrystal as we expect to report topline results from two ongoing

clinical studies with our best-in-class antiviral candidates in

major medical indications,” said Sam Lee, Ph.D., President and

co-CEO of Cocrystal. “In the Phase 2a influenza A challenge study

with our oral PB2 inhibitor CC-42344, we expect to report topline

results before year end. Earlier this year, we received feedback

from the U.S. Food and Drug Administration (FDA) on a Pre-IND

package that improves our clarity on the regulatory path and

requirements for the late-stage influenza A clinical study we plan

to conduct in the U.S.

“The multiple-ascending dose portion in our

Phase 1 pan-norovirus/pan-coronavirus study with oral protease

inhibitor CDI-988 is underway and we are on track to report topline

results in late 2024 or early 2025,” he added. “We view the

development of an effective antiviral for norovirus as a

significant opportunity for Cocrystal. There is no approved vaccine

or antiviral for norovirus, which is highly contagious and the most

common cause of acute gastroenteritis. In in vitro studies, CDI-988

exhibited pan-viral activity against multiple norovirus strains,

including the strain that is responsible for major outbreaks.”

“Our significant clinical progress so far this

year puts us on track for an active 2025,” said James Martin, CFO

and co-CEO of Cocrystal. “I’m pleased to report that based on our

currently projected expenditures and our cost-efficient business

model, we expect our cash will be sufficient to fund the

advancement of our planned development programs through the coming

12 months.”

Antiviral Product Pipeline

Overview

We apply our proprietary structure-based drug

discovery platform technology for developing broad-spectrum

antivirals that inhibit viral replication. By designing and

selecting antiviral drug candidates that target the highly

conserved regions of the viral enzymes, we seek to develop drugs

that are effective against the virus and mutations of the virus,

and also reduce off-target interactions that may cause undesirable

side effects. Our drug discovery process differs from traditional,

empirical medicinal chemistry approaches that often require

iterative high-throughput compound screening and lengthy

hit-to-lead processes.

Influenza Programs

Influenza is a major global health threat that

may become more challenging to treat due to the emergence of highly

pathogenic avian influenza viruses and resistance to approved

influenza antivirals. Each year there are approximately 1 billion

cases of seasonal influenza worldwide, 3-5 million severe illnesses

and up to 650,000 deaths. On average, about 8% of the U.S.

population contracts influenza each season. In addition to the

health risk, influenza is responsible for an estimated $11.2

billion in direct and indirect costs in the U.S. annually.

- Oral CC-42344 for the treatment of

pandemic and seasonal Influenza A infections

- Our novel PB2 inhibitor CC-42344

showed excellent in vitro antiviral activity against pandemic and

seasonal influenza A strains, as well as strains that are resistant

to Tamiflu® and Xofluza®.

- In December 2022 we reported

favorable safety and tolerability results from the oral CC-42344

Phase 1 study.

- In December 2023 we began a

randomized, double-blind, placebo-controlled Phase 2a human

challenge study to evaluate the safety, tolerability, viral and

clinical measurements of CC-42344 in influenza A-infected subjects

in the United Kingdom, following authorization from the UK

Medicines and Healthcare Products Regulatory Agency (MHRA).

- In May 2024 we completed enrollment

in the Phase 2a human challenge study.

- In June 2024 we reported that in

vitro studies demonstrated CC-42344 inhibits the activity of the

new highly pathogenic avian influenza A (H5N1) PB2 protein recently

identified in humans exposed to infected dairy cows.

- We expect to report topline results

from the Phase 2a human challenge study by yearend and plan to file

an IND application in 2025 to conduct a late-stage study in the

U.S.

- Inhaled CC-42344 for the

therapeutic and prophylactic treatment of pandemic and seasonal

Influenza A infections

- Our preclinical testing showed

superior pulmonary pharmacology with CC-42344 including high

exposure to drug and a long half-life.

- We completed CC-42344 inhalation

formulation development.

- We initiated GLP toxicology

studies.

- Influenza A/B Program

- Our work to develop a preclinical

lead of novel influenza replication inhibitors is underway.

Norovirus Program

Norovirus is a highly contagious infection and

is the most common cause of acute gastroenteritis. Worldwide,

norovirus causes about one out of five cases of acute

gastroenteritis that leads to diarrhea and vomiting. An estimated

685 million cases and an estimated 50,000 child deaths are

attributed to norovirus each year worldwide, with an estimated

societal cost of $60 billion. By targeting viral replication, we

believe it is possible to develop an effective treatment and/or

short-term prophylactic for closed environments for all genogroups

of norovirus.

- Oral pan-viral protease inhibitor

CDI-988 for the treatment of norovirus and coronavirus infections

- Our novel broad-spectrum protease

inhibitor CDI-988 is being evaluated as a potential oral treatment

for noroviruses and coronaviruses.

- CDI-988 has shown in vitro

pan-viral activity against multiple norovirus strains, including

the genogroup II, genotype 4 (GII.4) norovirus strain that is

responsible for major norovirus outbreaks.

- In May 2023 we announced approval

of our application to the Australian regulatory agency for a

randomized, double-blind, placebo-controlled Phase 1 study to

evaluate the safety, tolerability and pharmacokinetics (PK) of oral

CDI-988 in healthy volunteers.

- In August 2023 we announced our

selection of CDI-988 as our lead for the oral treatment for

norovirus, in addition to coronavirus.

- In September 2023 we began dosing

subjects in a first-in-human study in healthy volunteers with oral

CDI-988.

- In July 2024 we reported favorable

safety and tolerability results from the single-ascending dose

cohort in the Phase 1 study.

- In September 2024 we advanced

CDI-988 into the multiple-ascending dose cohort of the Phase 1

study.

- We expect to report topline results

from the CDI-988 Phase 1 study in late 2024 or early 2025.

COVID-19 and Other Coronavirus Programs

By targeting viral replication enzymes and

proteases, we believe it is possible to develop effective

treatments for all diseases caused by coronaviruses including

COVID-19 and its variants, Severe Acute Respiratory Syndrome (SARS)

and Middle East Respiratory Syndrome (MERS). CDI-988 showed potent

in vitro pan-viral activity against common human coronaviruses,

rhinoviruses and respiratory enteroviruses, as well as against

noroviruses. The global COVID-19 therapeutics market is estimated

to exceed $16 billion by the end of 2031.

- Oral pan-viral protease inhibitor

CDI-988 for the treatment of coronaviruses and noroviruses

- CDI-988 exhibited superior in vitro

potency against SARS-CoV-2 and demonstrated a favorable safety

profile and PK properties.

- In September 2023 we dosed the

first subject in our dual pan-norovirus/pan-coronavirus oral

CDI-988 study, which is expected to serve as a Phase 1 study for

both indications.

- In July 2024 we reported favorable

safety and tolerability results from the single-ascending dose

cohort in the Phase 1 study.

- In September 2024 we advanced

CDI-988 into the multiple-ascending dose cohort of the Phase 1

study.

- We expect to report topline results

from the CDI-988 Phase 1 study in late 2024 or early 2025.

Third Quarter Financial

Results

Research and development (R&D) expenses for

the third quarter of 2024 were $3.2 million, compared with $4.2

million for the third quarter of 2023, with the decrease primarily

due to lower clinical study expenses. General and administrative

(G&A) expenses for the third quarters of 2024 and 2023 remained

relatively stable at $1.8 million.

The net loss for the third quarter of 2024 was

$4.9 million, or $0.49 per share, compared with a net loss for the

third quarter of 2023 of $4.2 million, or $0.41 per share, that

included a $1.6 million payment to the Company in 2023 for a legal

settlement.

Nine Month Financial

Results

R&D expenses for the first nine months of

2024 were $10.5 million, compared with $10.9 million for the first

nine months of 2023. G&A expenses for the first nine months of

2024 were $4.1 million, compared with $4.6 million for the first

nine months of 2023.

The net loss for the first nine months of 2024

was $14.2 million, or $1.40 per share, compared with a net loss for

the first nine months of 2023 of $13.5 million, or $1.43 per

share.

Cocrystal reported unrestricted cash as of

September 30, 2024 of $13.0 million, compared with $26.4 million as

of December 31, 2023. Net cash used in operating activities for the

first nine months of 2024 was $13.3 million, compared with $11.3

million for the first nine months of 2023. The Company had working

capital of $12.3 million and 10.2 million common shares outstanding

as of September 30, 2024.

About Cocrystal Pharma,

Inc.

Cocrystal Pharma, Inc. is a clinical-stage

biotechnology company discovering and developing novel antiviral

therapeutics that target the replication process of influenza

viruses, coronaviruses (including SARS-CoV-2), noroviruses and

hepatitis C viruses. Cocrystal employs unique structure-based

technologies and Nobel Prize-winning expertise to create first- and

best-in-class antiviral drugs. For further information about

Cocrystal, please visit www.cocrystalpharma.com.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995, including statements regarding our plans for

the future development of preclinical and clinical drug candidates,

our expectations regarding future characteristics of the product

candidates we develop, the expected time of achieving certain

value-driving milestones in our programs, including preparation,

commencement and advancement of clinical studies for certain

product candidates in 2024 and 2025, the viability and efficacy of

potential treatments for diseases our product candidates are

designed to treat, expectations for the markets for certain

therapeutics, our ability to execute our clinical and regulatory

goals and deploy regulatory guidance towards future studies, and

the expected sufficiency of our cash balance to advance our

programs and fund our planned operations. The words "believe,"

"may," "estimate," "continue," "anticipate," "intend," "should,"

"plan," "could," "target," "potential," "is likely," "will,"

"expect" and similar expressions, as they relate to us, are

intended to identify forward-looking statements. We have based

these forward-looking statements largely on our current

expectations and projections about future events. Some or all of

the events anticipated by these forward-looking statements may not

occur. Important factors that could cause actual results to differ

from those in the forward-looking statements include, but are not

limited to, the risks and uncertainties arising from future

inflation, potential future increases in interest rates uncertainty

in the financial markets, the possibility of a recession, and

geopolitical conflict including in Ukraine and Israel on our

Company, our collaboration partners, and on the U.S., UK, Australia

and global economies, including manufacturing and research delays

arising from raw materials and labor shortages, supply chain

disruptions and other business interruptions on our ability to

proceed with studies as well as similar problems with our vendors

and our current and any future clinical research organization

(CROs) and contract manufacturing organizations (CMOs), the ability

of our CROs to recruit volunteers for, and to proceed with,

clinical studies, our and our collaboration partners’ technology

and software performing as expected, financial difficulties

experienced by certain partners, the results of any current and

future preclinical and clinical studies, general risks arising from

clinical studies, receipt of regulatory approvals, regulatory

changes including potential downward pressure on government

spending on healthcare in the wake of the recent presidential

election in the U.S., the impact of the recent U.S. presidential

election on regulation affecting the FDA and other healthcare

agencies and potential staffing issues, potential mutations in a

virus we are targeting that may result in variants that are

resistant to a product candidate we develop. Further information on

our risk factors is contained in our filings with the SEC,

including our Annual Report on Form 10-K for the year ended

December 31, 2023. Any forward-looking statement made by us herein

speaks only as of the date on which it is made. Factors or events

that could cause our actual results to differ may emerge from time

to time, and it is not possible for us to predict all of them. We

undertake no obligation to publicly update any forward-looking

statement, whether as a result of new information, future

developments or otherwise, except as may be required by law.

Investor Contact:Alliance

Advisors IRJody Cain310-691-7100jcain@allianceadvisors.com

Media Contact:JQA PartnersJules

Abraham917-885-7378Jabraham@jqapartners.com

Financial Tables to follow COCRYSTAL

PHARMA, INC.

CONSOLIDATED BALANCE

SHEETS(in thousands)

|

|

|

September 30, 2024 |

|

|

December 31, 2023 |

|

|

|

|

(unaudited) |

|

|

|

|

| Assets |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

|

Cash |

|

$ |

13,020 |

|

|

$ |

26,353 |

|

|

Restricted cash |

|

|

75 |

|

|

|

75 |

|

|

Tax credit receivable |

|

|

652 |

|

|

|

890 |

|

|

Prepaid expenses and other current assets |

|

|

509 |

|

|

|

1,773 |

|

| Total current assets |

|

|

14,256 |

|

|

|

29,091 |

|

| Property and equipment,

net |

|

|

181 |

|

|

|

271 |

|

| Deposits |

|

|

29 |

|

|

|

46 |

|

| Operating lease right-of-use

assets, net (including $163 and $42 respectively, to related

party) |

|

|

1,767 |

|

|

|

1,851 |

|

| Total assets |

|

$ |

16,233 |

|

|

$ |

31,259 |

|

| |

|

|

|

|

|

|

|

|

| Liabilities and stockholders’

equity |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

1,655 |

|

|

$ |

3,022 |

|

|

Current maturities of operating lease liabilities (including $55

and $42 respectively, to related party) |

|

|

293 |

|

|

|

240 |

|

| Total current liabilities |

|

|

1,948 |

|

|

|

3,262 |

|

| Long-term liabilities: |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Operating lease liabilities (including $163 and $0 respectively, to

related party) |

|

|

1,582 |

|

|

|

1,613 |

|

| |

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

3,530 |

|

|

|

4,875 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

| Common stock, $0.001 par value

100,000 and 150,000 shares authorized as of September 30, 2024, and

December 31, 2023; 10,174 shares issued and outstanding as of

September 30, 2024 and December 31, 2023 |

|

|

10 |

|

|

|

10 |

|

| Additional paid-in

capital |

|

|

342,845 |

|

|

|

342,288 |

|

| Accumulated deficit |

|

|

(330,152 |

) |

|

|

(315,914 |

) |

| Total stockholders’

equity |

|

|

12,703 |

|

|

|

26,384 |

|

| Total liabilities and

stockholders’ equity |

|

$ |

16,233 |

|

|

$ |

31,259 |

|

COCRYSTAL PHARMA, INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS(unaudited)(in thousands, except per

share data)

|

|

|

Three months ended September 30, |

|

|

Nine months ended September 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

3,242 |

|

|

|

4,194 |

|

|

|

10,500 |

|

|

|

10,902 |

|

|

General and administrative |

|

|

1,800 |

|

|

|

1,849 |

|

|

|

4,148 |

|

|

|

4,591 |

|

|

Legal settlement |

|

|

- |

|

|

|

(1,600 |

) |

|

|

- |

|

|

|

(1,600 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

5,042 |

|

|

|

4,443 |

|

|

|

14,648 |

|

|

|

13,893 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

|

(5,042 |

) |

|

|

(4,443 |

) |

|

|

(14,648 |

) |

|

|

(13,893 |

) |

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income (expense), net |

|

|

111 |

|

|

|

320 |

|

|

|

482 |

|

|

|

460 |

|

|

Foreign exchange loss |

|

|

(8 |

) |

|

|

(42 |

) |

|

|

(72 |

) |

|

|

(87 |

) |

|

Total other expense, net |

|

|

103 |

|

|

|

278 |

|

|

|

410 |

|

|

|

373 |

|

| Net loss |

|

$ |

(4,939 |

) |

|

$ |

(4,165 |

) |

|

|

(14,238 |

) |

|

|

(13,520 |

) |

| Net loss per common share,

basic and diluted |

|

$ |

(0.49 |

) |

|

$ |

(0.41 |

) |

|

|

(1.40 |

) |

|

|

(1.43 |

) |

| Weighted average number of

common shares, basic and diluted |

|

|

10,174 |

|

|

|

10,153 |

|

|

|

10,174 |

|

|

|

9,461 |

|

# # #

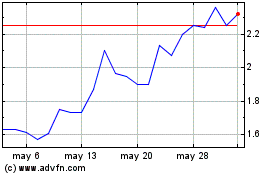

Cocrystal Pharma (NASDAQ:COCP)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Cocrystal Pharma (NASDAQ:COCP)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025