- Third quarter revenue $95.3 million, approximately 67%

recurring

- Gross margin of 46.8%; non-GAAP gross margin of 47.1%

- Sequential order growth with recurring improving 8%

quarter-over-quarter

Cohu, Inc. (NASDAQ: COHU), a global supplier of equipment and

services optimizing semiconductor manufacturing yield and

productivity, today reported fiscal 2024 third quarter net sales of

$95.3 million and GAAP loss of $18.1 million or $0.39 per share.

Net sales for the first nine months of 2024 were $307.7 million and

GAAP loss was $48.5 million or $1.03 per share.

Cohu also reported non-GAAP results, with third quarter 2024

loss of $3.8 million or $0.08 per share and loss of $3.8 million or

$0.08 per share for the first nine months of 2024.

GAAP Results

(in millions, except per share

amounts)

Q3 FY 2024

Q2 FY 2024

Q3 FY 2023

9 Months 2024

9 Months 2023

Net sales

$

95.3

$

104.7

$

150.8

$

307.7

$

499.1

Net income (loss)

$

(18.1

)

$

(15.8

)

$

3.9

$

(48.5

)

$

30.2

Net income (loss) per share

$

(0.39

)

$

(0.34

)

$

0.08

$

(1.03

)

$

0.63

Non-GAAP Results

(in millions, except per share

amounts)

Q3 FY 2024

Q2 FY 2024

Q3 FY 2023

9 Months 2024

9 Months 2023

Net income (loss)

$

(3.8

)

$

(0.6

)

$

16.9

$

(3.8

)

$

66.8

Net income (loss) share

$

(0.08

)

$

(0.01

)

$

0.35

$

(0.08

)

$

1.39

Total cash and investments at the end of third quarter 2024 were

$269.2 million. Cohu repurchased 315,000 shares of its common stock

in the third quarter for an aggregate amount of approximately $8.1

million.

“We continued to execute on our strategy to win customers on

Cohu’s Diamondx tester, capturing design-wins in mixed signal

applications, while also expanding our inspection metrology

business with Neon and the new Krypton system,” said Cohu President

and CEO Luis Müller. “We are focused on developing new products

that are aligned to higher near-term growth opportunities in data

centers and continuing to build our recurring software

revenue.”

Cohu expects fourth quarter 2024 sales to be in a range of $95

million +/- $7 million.

Conference Call Information:

The Company will host a live conference call and webcast with

slides to discuss third quarter 2024 results at 1:30 p.m. Pacific

Time/4:30 p.m. Eastern Time on October 31, 2024. Interested parties

may listen live via webcast on Cohu’s investor relations website at

https://edge.media-server.com/mmc/p/4pae8v3k.

To participate via telephone and join the call live, please

register in advance at

https://register.vevent.com/register/BI24f4649d559f4b5d9688d8da0a83a4e9

to receive the dial-in number along with a unique PIN number that

can be used to access the call.

About Cohu:

Cohu (NASDAQ: COHU) is a global technology leader supplying

test, automation, inspection and metrology products and services to

the semiconductor industry. Cohu’s differentiated and broad product

portfolio enables optimized yield and productivity, accelerating

customers’ manufacturing time-to-market. Additional information can

be found at www.cohu.com.

Use of Non-GAAP Financial Information:

Included within this press release and accompanying materials

are non-GAAP financial measures, including non-GAAP Gross

Margin/Profit, Income and Income (adjusted earnings) per share,

Operating Income, Operating Expense, effective tax rate, free cash

flow, net cash per share and Adjusted EBITDA that supplement the

Company’s Condensed Consolidated Statements of Operations prepared

under generally accepted accounting principles (GAAP). These

non-GAAP financial measures adjust the Company’s actual results

prepared under GAAP to exclude charges and the related income tax

effect for: share-based compensation, the amortization of purchased

intangible assets, restructuring costs, manufacturing transition

and severance costs, acquisition-related costs and associated

professional fees, impairments, inventory step-up, depreciation of

purchase accounting adjustments to property, plant and equipment,

amortization of cloud-based software implementation costs (Adjusted

EBITDA only) and loss on

extinguishment of debt (Adjusted EBITDA only). Reconciliations of GAAP to non-GAAP amounts

for the periods presented herein are provided in schedules

accompanying this release and should be considered together with

the Condensed Consolidated Statements of Operations. With respect

to any forward-looking non-GAAP figures, we are unable to provide

without unreasonable efforts, at this time, a GAAP to non-GAAP

reconciliation of any forward-looking figures due to their inherent

uncertainty.

These non-GAAP measures are not meant as a substitute for GAAP,

but are included solely for informational and comparative purposes.

The Company’s management believes that this information can assist

investors in evaluating the Company’s operational trends, financial

performance, and cash generating capacity. Management uses non-GAAP

measures for a variety of reasons, including to make operational

decisions, to determine executive compensation in part, to forecast

future operational results, and for comparison to our annual

operating plan. However, the non-GAAP financial measures should not

be regarded as a replacement for (or superior to) corresponding,

similarly captioned, GAAP measures.

Forward Looking Statements:

Certain statements contained in this release and accompanying

materials may be considered forward-looking statements within the

meaning of the U.S. Private Securities Litigation Reform Act of

1995, including statements regarding new product introductions or

customer adoptions and corresponding financial impacts;

expectations related to our FY2024 outlook, including quarterly

projections; effects of near-term growth opportunities and

recurring software revenue on future business; and any other

statements that are predictive in nature and depend upon or refer

to future events or conditions; and/or include words such as “may,”

“will,” “should,” “would,” “expect,” “anticipate,” “plan,”

“likely,” “believe,” “estimate,” “project,” “intend;” and/or other

similar expressions among others. Statements that are not

historical facts are forward-looking statements. Forward-looking

statements are based on current beliefs and assumptions that are

subject to risks and uncertainties and are not guarantees of future

performance. Any third-party industry analyst forecasts quoted are

for reference only and Cohu does not adopt or affirm any such

forecasts.

Actual results and future business conditions could differ

materially from those contained in any forward-looking statement as

a result of various factors, including, without limitation: new

product investments and product enhancements which may not be

commercially successful; the semiconductor industry is seasonal,

cyclical, volatile and unpredictable; recent erosion in mobile,

automotive and industrial market sales; our ability to manage and

deliver high quality products and services; failure of sole source

contract manufacturer or our ability to manage third-party raw

material, component and/or service providers; ongoing inflationary

pressures on material and operational costs coupled with rising

interest rates; economic recession; the semiconductor industry is

intensely competitive, subject to rapid technological changes, and

experiences consolidation of key customers for semiconductor test

equipment; a limited number of customers account for a substantial

percentage of net sales; significant exports to foreign countries

with economic and political instability and competition from a

number of Asia-based manufacturers; our relationships with

customers may deteriorate; loss of key personnel; risks of using

artificial intelligence within Cohu’s product developments and

business; reliance on foreign locations and geopolitical

instability in such locations critical to Cohu and its customers;

natural disasters, war and climate-related changes, including

related economic impacts; levels of debt; access to sufficient

capital on reasonable or favorable terms; foreign operations and

related currency fluctuations; required or desired accounting

charges and the cost or effectiveness of accounting controls;

instability of financial institutions where we maintain cash

deposits and potential loss of uninsured cash deposits; significant

goodwill and other intangibles as percentage of our total assets;

increasingly restrictive trade and export regulations impacting our

ability to sell products, specifically within China; risks

associated with acquisitions, investments and divestitures such as

integration and synergies; constraints related to corporate

governance structures; share repurchases and related impacts;

financial or operating results that are below forecast or credit

rating changes impacting our stock price or financing ability;

law/regulatory changes and including environmental or tax law

changes; significant volatility in our stock price; the risk of

cybersecurity breaches; enforcing or defending intellectual

property claims or other litigation.

These and other risks and uncertainties are discussed more fully

in Cohu’s filings with the SEC, including our most recent Form 10-K

and Form 10-Q, and the other filings made by Cohu with the SEC from

time to time, which are available via the SEC’s website at

www.sec.gov. Except as required by applicable law, Cohu does not

undertake any obligation to revise or update any forward-looking

statement, or to make any other forward-looking statements, whether

as a result of new information, future events or otherwise.

For press releases and other information of interest to

investors, please visit Cohu’s website at www.cohu.com.

COHU, INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(Unaudited)

(in thousands, except per share

amounts)

Three Months Ended (1) (2)

Nine Months Ended (1) (2)

September 28,

September 30,

September 28,

September 30,

2024

2023

2024

2023

Net sales

$

95,342

$

150,804

$

307,657

$

499,096

Cost and expenses:

Cost of sales (excluding amortization)

50,685

79,909

166,829

261,638

Research and development

20,324

21,478

64,002

66,454

Selling, general and administrative

30,297

32,416

97,497

99,403

Amortization of purchased intangible

assets

9,791

8,857

29,334

26,617

Restructuring charges

14

742

36

2,046

111,111

143,402

357,698

456,158

Income (loss) from operations

(15,769

)

7,402

(50,041

)

42,938

Other (expense) income:

Interest expense

(86

)

(773

)

(519

)

(2,628

)

Interest income

2,609

3,207

7,651

8,657

Foreign transaction loss

(1,579

)

(1,200

)

(2,493

)

(2,285

)

Loss on extinguishment of debt

-

-

(241

)

(369

)

Income (loss) from operations before

taxes

(14,825

)

8,636

(45,643

)

46,313

Income tax provision

3,231

4,721

2,817

16,129

Net income (loss)

$

(18,056

)

$

3,915

$

(48,460

)

$

30,184

Income (loss) per share:

Basic:

$

(0.39

)

$

0.08

$

(1.03

)

$

0.64

Diluted:

$

(0.39

)

$

0.08

$

(1.03

)

$

0.63

Weighted average shares used in computing

income (loss) per share: (3)

Basic

46,815

47,615

46,971

47,525

Diluted

46,815

48,107

46,971

48,102

(1)

The three- and nine-month periods

ended September 28, 2024 and September 30, 2023 were both comprised

of 13 weeks and 39 weeks, respectively.

(2)

On January 30, 2023 the Company

completed the acquisition of MCT Worldwide, LLC (“MCT”) and on

October 2, 2023 the Company completed the acquisition of Equiptest

Engineering Pte. Ltd. (“EQT”). The results of MCT’s and EQT’s

operations have been included since those dates.

(3)

For the three- and nine-month periods

ended September 28, 2024, potentially dilutive securities were

excluded from the per share computations due to their antidilutive

effect.

COHU, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(in thousands)

September 28,

December 30,

2024

2023

Assets:

Current assets:

Cash and investments (1)

$

269,238

$

335,698

Accounts receivable

91,937

124,624

Inventories

144,125

155,793

Other current assets

37,154

22,703

Total current assets

542,454

638,818

Property, plant & equipment, net

76,666

69,085

Goodwill

242,867

241,658

Intangible assets, net

122,624

151,770

Operating lease right of use assets

14,067

16,778

Other assets

33,668

32,243

Total assets

$

1,032,346

$

1,150,352

Liabilities & Stockholders’

Equity:

Current liabilities:

Short-term borrowings

$

1,407

$

1,773

Current installments of long-term debt

1,199

4,551

Deferred profit

4,053

3,586

Other current liabilities

78,316

93,511

Total current liabilities

84,975

103,421

Long-term debt (1)

7,914

34,303

Non-current operating lease

liabilities

10,429

13,175

Other noncurrent liabilities

44,490

49,283

Cohu stockholders’ equity

884,538

950,170

Total liabilities & stockholders’

equity

$

1,032,346

$

1,150,352

(1)

On February 9, 2024, the Company

made a cash payment of $29.3 million to repay the remaining

outstanding amounts owed under our Term Loan B.

COHU, INC.

Supplemental Reconciliation of GAAP

Results to Non-GAAP Financial Measures (Unaudited)

(in thousands, except per share

amounts)

Three Months Ended

September 28,

June 29,

September 30,

2024

2024

2023

Income (loss) from operations - GAAP basis

(a)

$

(15,769

)

$

(16,299

)

$

7,402

Non-GAAP adjustments:

Share-based compensation included in

(b):

Cost of sales (COS)

270

262

223

Research and development (R&D)

765

1,001

849

Selling, general and administrative

(SG&A)

4,213

4,320

3,262

5,248

5,583

4,334

Amortization of purchased intangible

assets (c)

9,791

9,748

8,857

Restructuring charges related to inventory

adjustments in COS (d)

(20

)

(12

)

(18

)

Restructuring charges (d)

14

13

742

Manufacturing and sales transition costs

included in (e):

COS

-

2

-

R&D

62

44

-

SG&A

393

1,196

61

455

1,242

61

Impairment charge included in SG&A

(f)

(63

)

-

-

Acquisition costs included in SG&A

(g)

-

1

758

Depreciation of PP&E step-up included

in SG&A (h)

12

12

14

Income (loss) from operations - non-GAAP

basis (i)

$

(332

)

$

288

$

22,150

Net income (loss) - GAAP basis

$

(18,056

)

$

(15,769

)

$

3,915

Non-GAAP adjustments (as scheduled

above)

15,437

16,587

14,748

Tax effect of non-GAAP adjustments (j)

(1,178

)

(1,400

)

(1,754

)

Net income (loss) - non-GAAP basis

$

(3,797

)

$

(582

)

$

16,909

GAAP net income (loss) per share -

diluted

$

(0.39

)

$

(0.34

)

$

0.08

Non-GAAP net income (loss) per share -

diluted (k)

$

(0.08

)

$

(0.01

)

$

0.35

Management believes the presentation of these non-GAAP financial

measures, when taken together with the corresponding GAAP financial

measures, provides meaningful supplemental information regarding

the Company’s operating performance. Our management uses these

non-GAAP financial measures in assessing the Company's operating

results, as well as when planning, forecasting and analyzing future

periods and these non-GAAP measures allow investors to evaluate the

Company’s financial performance using some of the same measures as

management. Management views share-based compensation as an expense

that is unrelated to the Company’s operational performance as it

does not require cash payments and can vary in amount from period

to period and the elimination of amortization charges provides

better comparability of pre- and post-acquisition operating results

and to results of businesses utilizing internally developed

intangible assets. Management initiated certain restructuring and

manufacturing transition activities including employee headcount

reductions and other organizational changes to align our business

strategies in light of the acquisitions of MCT and EQT.

Restructuring and manufacturing transition costs have been excluded

because such expense is not used by Management to assess the core

profitability of Cohu’s business operations. Impairment charges

have been excluded as these amounts are infrequent and are

unrelated to the operational performance of Cohu. PP&E and

inventory step-up costs have been excluded by management as they

are unrelated to the core operating activities of the Company.

Acquisition costs have been excluded by management as they are

unrelated to the core operating activities of the Company and the

frequency and variability in the nature of the charges can vary

significantly from period to period. Excluding this data provides

investors with a basis to compare Cohu’s performance against the

performance of other companies without this variability. However,

the non-GAAP financial measures should not be regarded as a

replacement for (or superior to) corresponding, similarly

captioned, GAAP measures. The presentation of non-GAAP financial

measures above may not be comparable to similarly titled measures

reported by other companies and investors should be careful when

comparing our non-GAAP financial measures to those of other

companies.

(a)

(16.5)%, (15.6)% and 4.9% of net sales,

respectively.

(b)

To eliminate compensation expense for

employee stock options, stock units and our employee stock purchase

plan.

(c)

To eliminate the amortization of acquired

intangible assets.

(d)

To eliminate restructuring costs incurred

related to the integration of MCT.

(e)

To eliminate the manufacturing transition

and severance costs.

(f)

To eliminate the impairment of the

Company’s investment in Fraes-und Technologiezentrum GmbH

Frasdorf.

(g)

To eliminate professional fees and other

direct incremental expenses incurred related to acquisitions.

(h)

To eliminate depreciation of PP&E step

up charges related to the acquisitions.

(i)

(0.3)%, 0.3% and 14.7% of net sales,

respectively.

(j)

To adjust the provision for income taxes

related to the adjustments described above based on applicable tax

rates.

(k)

All periods presented were computed using

the number of GAAP diluted shares outstanding.

COHU, INC.

Supplemental Reconciliation of GAAP

Results to Non-GAAP Financial Measures (Unaudited)

(in thousands, except per share

amounts)

Nine Months Ended

September 28,

September 30,

2024

2023

Income (loss) from operations - GAAP basis

(a)

$

(50,041

)

$

42,938

Non-GAAP adjustments:

Share-based compensation included in

(b):

Cost of sales (COS)

759

619

Research and development (R&D)

2,600

2,534

Selling, general and administrative

(SG&A)

12,100

9,527

15,459

12,680

Amortization of purchased intangible

assets (c)

29,334

26,617

Restructuring charges related to inventory

adjustments in COS (d)

(36

)

(59

)

Restructuring charges (d)

36

2,046

Manufacturing and sales transition costs

included in (e):

COS

2

18

R&D

120

22

SG&A

3,229

480

3,351

520

Impairment charge included in SG&A

(f)

903

-

Inventory step-up included in COS (g)

-

273

Acquisition costs included in SG&A

(h)

175

1,283

Depreciation of PP&E step-up included

in SG&A (i)

36

37

Income (loss) from operations - non-GAAP

basis (j)

$

(783

)

$

86,335

Net income (loss) - GAAP basis

$

(48,460

)

$

30,184

Non-GAAP adjustments (as scheduled

above)

49,258

43,397

Tax effect of non-GAAP adjustments (k)

(4,577

)

(6,815

)

Net income (loss) - non-GAAP basis

$

(3,779

)

$

66,766

GAAP net income (loss) per share -

diluted

$

(1.03

)

$

0.63

Non-GAAP income (loss) per share - diluted

(l)

$

(0.08

)

$

1.39

Management believes the presentation of these non-GAAP financial

measures, when taken together with the corresponding GAAP financial

measures, provides meaningful supplemental information regarding

the Company’s operating performance. Our management uses these

non-GAAP financial measures in assessing the Company's operating

results, as well as when planning, forecasting and analyzing future

periods and these non-GAAP measures allow investors to evaluate the

Company’s financial performance using some of the same measures as

management. Management views share-based compensation as an expense

that is unrelated to the Company’s operational performance as it

does not require cash payments and can vary in amount from period

to period and the elimination of amortization charges provides

better comparability of pre- and post-acquisition operating results

and to results of businesses utilizing internally developed

intangible assets. Management initiated certain restructuring and

manufacturing transition activities including employee headcount

reductions and other organizational changes to align our business

strategies in light of the acquisitions of MCT and EQT.

Restructuring and manufacturing transition costs have been excluded

because such expense is not used by Management to assess the core

profitability of Cohu’s business operations. Impairment charges

have been excluded as these amounts are infrequent and are

unrelated to the operational performance of Cohu. PP&E and

inventory step-up costs have been excluded by management as they

are unrelated to the core operating activities of the Company.

Acquisition costs have been excluded by management as they are

unrelated to the core operating activities of the Company and the

frequency and variability in the nature of the charges can vary

significantly from period to period. Excluding this data provides

investors with a basis to compare Cohu’s performance against the

performance of other companies without this variability. However,

the non-GAAP financial measures should not be regarded as a

replacement for (or superior to) corresponding, similarly

captioned, GAAP measures. The presentation of non-GAAP financial

measures above may not be comparable to similarly titled measures

reported by other companies and investors should be careful when

comparing our non-GAAP financial measures to those of other

companies.

(a)

(16.3)% and 8.6% of net sales,

respectively.

(b)

To eliminate compensation expense for

employee stock options, stock units and our employee stock purchase

plan.

(c)

To eliminate the amortization of acquired

intangible assets.

(d)

To eliminate restructuring costs incurred

related to the integration of MCT.

(e)

To eliminate the manufacturing transition

and severance costs.

(f)

To eliminate the impairment of the

Company’s investment in Fraes-und Technologiezentrum GmbH

Frasdorf.

(g)

To eliminate amortization of inventory

step up charges related to acquisitions.

(h)

To eliminate professional fees and other

direct incremental expenses incurred related to acquisitions.

(i)

To eliminate the property, plant &

equipment step-up depreciation accelerated related to

acquisitions.

(j)

(0.3)% and 17.3% of net sales,

respectively.

(k)

To adjust the provision for income taxes

related to the adjustments described above based on applicable tax

rates.

(l)

All periods presented were computed using

the number of GAAP diluted shares outstanding.

COHU, INC.

Supplemental Reconciliation of GAAP

Results to Non-GAAP Financial Measures (Unaudited)

(in thousands)

Three Months Ended

September 28,

June 29,

September 30,

2024

2024

2023

Gross Profit Reconciliation

Gross profit - GAAP basis (excluding

amortization) (1)

$

44,657

$

46,922

$

70,895

Non-GAAP adjustments to cost of sales (as

scheduled above)

250

252

205

Gross profit - Non-GAAP basis

$

44,907

$

47,174

$

71,100

As a percentage of net sales:

GAAP gross profit

46.8

%

44.8

%

47.0

%

Non-GAAP gross profit

47.1

%

45.1

%

47.1

%

Adjusted EBITDA Reconciliation

Net income - GAAP Basis

$

(18,056

)

$

(15,769

)

$

3,915

Income tax provision

3,231

1,286

4,721

Interest expense

86

144

773

Interest income

(2,609

)

(2,333

)

(3,207

)

Amortization of purchased intangible

assets

9,791

9,748

8,857

Depreciation

3,362

3,413

3,319

Amortization of cloud-based software

implementation costs (2)

709

709

700

Other non-GAAP adjustments (as scheduled

above)

5,634

6,827

5,877

Adjusted EBITDA

$

2,148

$

4,025

$

24,955

As a percentage of net sales:

Net income - GAAP Basis

(18.9

)%

(15.1

)%

2.6

%

Adjusted EBITDA

2.3

%

3.8

%

16.5

%

Operating Expense

Reconciliation

Operating Expense - GAAP basis

$

60,426

$

63,221

$

63,493

Non-GAAP adjustments to operating expenses

(as scheduled above)

(15,187

)

(16,335

)

(14,543

)

Operating Expenses - Non-GAAP basis

$

45,239

$

46,886

$

48,950

(1)

Excludes amortization of $7,518, $7,486

and $6,948 for the three months ending September 28, 2024, June 29,

2024 and September 30, 2023, respectively.

(2)

Represents amortization of capitalized

implementation costs related to cloud-based software arrangements

that are included within SG&A.

Nine Months Ended

September 28,

September 30,

2024

2023

Gross Profit Reconciliation

Gross profit - GAAP basis (excluding

amortization) (1)

$

140,828

$

237,458

Non-GAAP adjustments to cost of sales (as

scheduled above)

725

851

Gross profit - Non-GAAP basis

$

141,553

$

238,309

As a percentage of net sales:

GAAP gross profit

45.8

%

47.6

%

Non-GAAP gross profit

46.0

%

47.7

%

Adjusted EBITDA Reconciliation

Net income (loss) - GAAP Basis

$

(48,460

)

$

30,184

Income tax provision

2,817

16,129

Interest expense

519

2,628

Interest income

(7,651

)

(8,657

)

Amortization of purchased intangible

assets

29,334

26,617

Depreciation

10,204

10,017

Amortization of cloud-based software

implementation costs (2)

2,127

2,100

Loss on extinguishment of debt

241

369

Other non-GAAP adjustments (as scheduled

above)

19,888

16,743

Adjusted EBITDA

$

9,019

$

96,130

As a percentage of net sales:

Net income (loss) - GAAP Basis

(15.8

)%

6.0

%

Adjusted EBITDA

2.9

%

19.3

%

Operating Expense

Reconciliation

Operating Expense - GAAP basis

$

190,869

$

194,520

Non-GAAP adjustments to operating expenses

(as scheduled above)

(48,533

)

(42,546

)

Operating Expenses - Non-GAAP basis

$

142,336

$

151,974

(1)

Excludes amortization of $22,526 and

$20,941 for the nine months ending September 28, 2024 and September

30, 2023, respectively.

(2)

Represents amortization of capitalized

implementation costs related to cloud-based software arrangements

that are included within SG&A.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241031933443/en/

Cohu, Inc. Jeffrey D. Jones - Investor Relations

858-848-8106

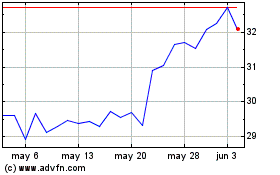

Cohu (NASDAQ:COHU)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Cohu (NASDAQ:COHU)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024