Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

27 Enero 2023 - 7:51AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of January 2023

Commission

File Number: 001-36582

Altamira

Therapeutics Ltd.

(Exact

name of registrant as specified in its charter)

Clarendon

House, 2 Church Street

Hamilton

HM 11, Bermuda

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ☐ No ☒

Loan

Agreements

On

December 28, 2022, Altamira Therapeutics Ltd. (the “Company”) entered into two loan agreements with separate private investors

(the “Private Lenders”), pursuant to which the Private Lenders loaned the Company an aggregate of CHF 350,000.00 (the “December

2022 Loan Agreements”), collectively, which loans bear interest at the rate of 5% per annum and mature as of May 30, 2023. The

Company agreed to grant to the Private Lenders warrants to purchase an aggregate of 47,180 of the Company’s common shares. Such

warrants will be exercisable immediately at an exercise price of CHF 4.4512 per share, may be exercised up to five years from the date

of issuance and may be exercised on a cashless basis in certain circumstances specified therein. The December 2022 Loan Agreements and

related warrants used the same form of agreement and warrant as the previously disclosed loan agreement dated September 9, 2022, among

the Company, FiveT Investment Management Ltd., Dominik Lysek and Thomas Meyer, the Company’s CEO, and related warrants, other than

the applicable principal amount, maturity date and warrant exercise price and amount.

FiveT

Loan Amendment

On

February 4, 2022, the Company entered into a convertible loan agreement (the “FiveT Loan”) with FiveT Investment Management

Ltd., or FiveT IM, an affiliate of FiveT Capital Holding Ltd., or FiveT, pursuant to which FiveT IM agreed to loan to the Company CHF

5,000,000, which loan bears interest at the rate of 10% per annum. On January 26, 2023, the Company and FiveT IM entered into an amendment

to the FiveT Loan (the “FiveT Loan Amendment”), which amendment (i) extends the maturity date of the FiveT Loan to March

15, 2023; (ii) provides that the Company may repay amounts owed under the FiveT Loan prior to maturity with no penalty or premium; (iii)

provides that in the event of a public or private offering (a “Qualifying Offering”) by the Company of common shares (other

than through an equity line or at-the-market program), the Company will make a partial repayment, upon the closing of the offering, of

the principal amount of the FiveT Loan comprised of (A) $1,000,000 in cash and (B) newly issued common shares in an amount equaling 9.9%

of the total outstanding common shares post-issuance and after giving effect to such offering, with such common shares being valued for

purposes of such repayment at the offering price per common share in such offering (the “Qualifying Offering Price”); and

(iv) provides that upon the closing of such offering, assuming the Company has sufficient authorized and unissued common shares, the

Company shall have the option to cause FiveT IM to convert the remaining outstanding amount of the FiveT Loan after the repayment described

in (iii) above into a pre-funded warrant (the “Pre-Funded Warrant”), having an exercise price of CHF 0.01 per common share,

giving FiveT IM the right to purchase a number of common shares equal to (A) the total remaining outstanding amount of the FiveT Loan

divided by (B) the Qualifying Offering Price less CHF 0.01. The Pre-Funded Warrants will provide that until February 21, 2024, FiveT

IM may cause the Company to redeem for cash all or portions of the Pre-Funded Warrant using up to 40% of the cash proceeds from certain

out-licensing or divestiture transactions to the extent completed by the Company, with the amount of the Pre-Funded Warrant being redeemed

equal to (A) the desired redemption amount divided by (B) the Qualifying Offering Price less CHF 0.01.

Special

General Meeting of Shareholders

The Board of Directors of Altamira Therapeutics

Ltd. has decided to call a Special General Meeting of Shareholders (“Special General Meeting”) in order to propose an increase

in the authorized share capital of the Company from CHF 1,400,000 divided into 5,000,000 common shares of CHF 0.20 each and 20,000,000

preference shares of CHF 0.02 each to CHF 5,400,000 divided into 25,000,000 common shares of CHF 0.20 each and 20,000,000 preference shares

of CHF 0.02 each, by the creation of an additional 20,000,000 common shares of CHF 0.20 each ranking pari-passu with the existing common

shares of the Company. The proposed modification of the amount of the authorized share capital shall increase the Company’s flexibility

for corporate finance purposes and does not imply or constitute any immediate increase in the amount of shares outstanding.

The

Special General Meeting will be held on February 17, 2023, 8:30 AM local Bermuda time at Clarendon House, 2 Church Street, Hamilton HM

11, Bermuda.

INCORPORATION

BY REFERENCE

This

Report on Form 6-K, including the exhibits to this Report on Form 6-K, shall be deemed to be incorporated by reference into the registration

statements on Form F-3 (Registration Numbers 333-228121, 333-249347, 333-261127 and 333-264298) and Form S-8

(Registration Numbers 333-232735 and 333-252141) of Altamira Therapeutics Ltd. (formerly Auris Medical Holding Ltd.) and

to be a part thereof from the date on which this report is filed, to the extent not superseded by documents or reports subsequently filed

or furnished.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

Altamira

Therapeutics Ltd. |

| |

|

| Date:

January 27, 2023 |

By: |

/s/

Thomas Meyer |

| |

|

Name: |

Thomas

Meyer |

| |

|

Title: |

Chief

Executive Officer |

EXHIBIT

INDEX

4

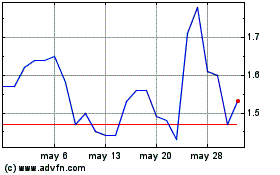

Altamira Therapeutics (NASDAQ:CYTO)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Altamira Therapeutics (NASDAQ:CYTO)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025