true

0001849380

S-1/A

0001849380

2023-01-01

2023-12-31

0001849380

dei:BusinessContactMember

2023-01-01

2023-12-31

0001849380

2023-12-31

0001849380

2022-12-31

0001849380

us-gaap:RelatedPartyMember

2023-12-31

0001849380

us-gaap:RelatedPartyMember

2022-12-31

0001849380

ONMD:SeriesATwoPreferredStockMember

2023-12-31

0001849380

ONMD:SeriesATwoPreferredStockMember

2022-12-31

0001849380

ONMD:SeriesAOnePreferredStockMember

2023-12-31

0001849380

ONMD:SeriesAOnePreferredStockMember

2022-12-31

0001849380

us-gaap:CommonClassAMember

2023-12-31

0001849380

us-gaap:CommonClassAMember

2022-12-31

0001849380

ONMD:CommonClassAOneMember

2023-12-31

0001849380

ONMD:CommonClassAOneMember

2022-12-31

0001849380

2022-01-01

2022-12-31

0001849380

us-gaap:PreferredStockMember

ONMD:SeriesATwoPreferredStockMember

2021-12-31

0001849380

us-gaap:PreferredStockMember

ONMD:SeriesAOnePreferredStockMember

2021-12-31

0001849380

us-gaap:CommonStockMember

us-gaap:CommonClassAMember

ONMD:DataKnightsAcquisitionCorpMember

2021-12-31

0001849380

us-gaap:CommonStockMember

us-gaap:CommonClassBMember

ONMD:DataKnightsAcquisitionCorpMember

2021-12-31

0001849380

us-gaap:CommonStockMember

us-gaap:CommonClassAMember

2021-12-31

0001849380

ONMD:CommitmentMember

2021-12-31

0001849380

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001849380

us-gaap:RetainedEarningsMember

2021-12-31

0001849380

2021-12-31

0001849380

us-gaap:PreferredStockMember

ONMD:SeriesATwoPreferredStockMember

2022-12-31

0001849380

us-gaap:PreferredStockMember

ONMD:SeriesAOnePreferredStockMember

2022-12-31

0001849380

us-gaap:CommonStockMember

us-gaap:CommonClassAMember

ONMD:DataKnightsAcquisitionCorpMember

2022-12-31

0001849380

us-gaap:CommonStockMember

us-gaap:CommonClassBMember

ONMD:DataKnightsAcquisitionCorpMember

2022-12-31

0001849380

us-gaap:CommonStockMember

us-gaap:CommonClassAMember

2022-12-31

0001849380

ONMD:CommitmentMember

2022-12-31

0001849380

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001849380

us-gaap:RetainedEarningsMember

2022-12-31

0001849380

us-gaap:PreferredStockMember

ONMD:SeriesATwoPreferredStockMember

2022-01-01

2022-12-31

0001849380

us-gaap:PreferredStockMember

ONMD:SeriesAOnePreferredStockMember

2022-01-01

2022-12-31

0001849380

us-gaap:CommonStockMember

us-gaap:CommonClassAMember

ONMD:DataKnightsAcquisitionCorpMember

2022-01-01

2022-12-31

0001849380

us-gaap:CommonStockMember

us-gaap:CommonClassBMember

ONMD:DataKnightsAcquisitionCorpMember

2022-01-01

2022-12-31

0001849380

us-gaap:CommonStockMember

us-gaap:CommonClassAMember

2022-01-01

2022-12-31

0001849380

ONMD:CommitmentMember

2022-01-01

2022-12-31

0001849380

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-12-31

0001849380

us-gaap:RetainedEarningsMember

2022-01-01

2022-12-31

0001849380

us-gaap:PreferredStockMember

ONMD:SeriesATwoPreferredStockMember

2023-01-01

2023-12-31

0001849380

us-gaap:PreferredStockMember

ONMD:SeriesAOnePreferredStockMember

2023-01-01

2023-12-31

0001849380

us-gaap:CommonStockMember

us-gaap:CommonClassAMember

ONMD:DataKnightsAcquisitionCorpMember

2023-01-01

2023-12-31

0001849380

us-gaap:CommonStockMember

us-gaap:CommonClassBMember

ONMD:DataKnightsAcquisitionCorpMember

2023-01-01

2023-12-31

0001849380

us-gaap:CommonStockMember

us-gaap:CommonClassAMember

2023-01-01

2023-12-31

0001849380

ONMD:CommitmentMember

2023-01-01

2023-12-31

0001849380

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-12-31

0001849380

us-gaap:RetainedEarningsMember

2023-01-01

2023-12-31

0001849380

us-gaap:PreferredStockMember

ONMD:SeriesATwoPreferredStockMember

2023-12-31

0001849380

us-gaap:PreferredStockMember

ONMD:SeriesAOnePreferredStockMember

2023-12-31

0001849380

us-gaap:CommonStockMember

us-gaap:CommonClassAMember

ONMD:DataKnightsAcquisitionCorpMember

2023-12-31

0001849380

us-gaap:CommonStockMember

us-gaap:CommonClassBMember

ONMD:DataKnightsAcquisitionCorpMember

2023-12-31

0001849380

us-gaap:CommonStockMember

us-gaap:CommonClassAMember

2023-12-31

0001849380

ONMD:CommitmentMember

2023-12-31

0001849380

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001849380

us-gaap:RetainedEarningsMember

2023-12-31

0001849380

ONMD:SecuritiesPurchaseAgreementMember

ONMD:DataKnightsAcquisitionCorpMember

2023-06-28

2023-06-28

0001849380

ONMD:SecuritiesPurchaseAgreementMember

ONMD:DataKnightsAcquisitionCorpMember

2023-06-28

0001849380

us-gaap:RevenueFromContractWithCustomerMember

us-gaap:CustomerConcentrationRiskMember

ONMD:OneCustomerMember

2023-01-01

2023-12-31

0001849380

us-gaap:RevenueFromContractWithCustomerMember

us-gaap:CustomerConcentrationRiskMember

ONMD:TwoCustomersMember

2022-01-01

2022-12-31

0001849380

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

ONMD:ThreeCustomersMember

2023-01-01

2023-12-31

0001849380

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

ONMD:TwoCustomersMember

2022-01-01

2022-12-31

0001849380

us-gaap:RevenueFromContractWithCustomerMember

us-gaap:CustomerConcentrationRiskMember

ONMD:CustomerOneMember

2023-01-01

2023-12-31

0001849380

us-gaap:RevenueFromContractWithCustomerMember

us-gaap:CustomerConcentrationRiskMember

ONMD:CustomerOneMember

2022-01-01

2022-12-31

0001849380

us-gaap:RevenueFromContractWithCustomerMember

us-gaap:CustomerConcentrationRiskMember

ONMD:CustomerTwoMember

2023-01-01

2023-12-31

0001849380

us-gaap:RevenueFromContractWithCustomerMember

us-gaap:CustomerConcentrationRiskMember

ONMD:CustomerTwoMember

2022-01-01

2022-12-31

0001849380

us-gaap:RevenueFromContractWithCustomerMember

us-gaap:CustomerConcentrationRiskMember

ONMD:CustomersMember

2023-01-01

2023-12-31

0001849380

us-gaap:RevenueFromContractWithCustomerMember

us-gaap:CustomerConcentrationRiskMember

ONMD:CustomersMember

2022-01-01

2022-12-31

0001849380

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

ONMD:CustomerOneMember

2023-01-01

2023-12-31

0001849380

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

ONMD:CustomerOneMember

2022-01-01

2022-12-31

0001849380

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

ONMD:CustomerTwoMember

2023-01-01

2023-12-31

0001849380

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

ONMD:CustomerTwoMember

2022-01-01

2022-12-31

0001849380

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

ONMD:CustomerThreeMember

2023-01-01

2023-12-31

0001849380

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

ONMD:CustomerThreeMember

2022-01-01

2022-12-31

0001849380

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

ONMD:CustomerFourMember

2023-01-01

2023-12-31

0001849380

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

ONMD:CustomerFourMember

2022-01-01

2022-12-31

0001849380

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

ONMD:CustomerFiveMember

2023-01-01

2023-12-31

0001849380

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

ONMD:CustomerFiveMember

2022-01-01

2022-12-31

0001849380

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

ONMD:CustomersMember

2023-01-01

2023-12-31

0001849380

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

ONMD:CustomersMember

2022-01-01

2022-12-31

0001849380

us-gaap:ComputerEquipmentMember

2023-12-31

0001849380

us-gaap:ComputerEquipmentMember

2022-12-31

0001849380

us-gaap:FurnitureAndFixturesMember

2023-12-31

0001849380

us-gaap:FurnitureAndFixturesMember

2022-12-31

0001849380

us-gaap:DomesticCountryMember

2023-12-31

0001849380

us-gaap:StateAndLocalJurisdictionMember

2023-12-31

0001849380

ONMD:DataKnightsAcquisitionCorpMember

2023-12-31

0001849380

ONMD:DataKnightsAcquisitionCorpMember

2023-01-01

2023-12-31

0001849380

us-gaap:NonrelatedPartyMember

2023-12-31

0001849380

us-gaap:NonrelatedPartyMember

2022-12-31

0001849380

us-gaap:RelatedPartyMember

ONMD:ConvertiblePromissoryNotesMember

2022-11-11

0001849380

us-gaap:RelatedPartyMember

ONMD:ConvertiblePromissoryNotesMember

2022-11-10

2022-11-11

0001849380

us-gaap:RelatedPartyMember

ONMD:SeriesATwoPreferredStockMember

ONMD:ConvertiblePromissoryNotesMember

2022-11-11

0001849380

us-gaap:RelatedPartyMember

ONMD:ConvertiblePromissoryNotesMember

2019-11-30

0001849380

ONMD:ConvertiblePromissoryNotesMember

2022-12-31

0001849380

us-gaap:RelatedPartyMember

ONMD:DataKnightsAcquisitionCorpMember

2023-11-30

0001849380

ONMD:CEBALoanMember

2020-12-01

2020-12-31

0001849380

ONMD:CEBALoanMember

2020-01-01

2020-12-31

0001849380

ONMD:CEBALoanMember

2020-12-31

0001849380

ONMD:SeriesATwoPreferredStockMember

2023-01-01

2023-12-31

0001849380

ONMD:SeriesAOnePreferredStockMember

2023-01-01

2023-12-31

0001849380

ONMD:BoardOfDirectorsMember

2023-01-01

2023-12-31

0001849380

ONMD:BoardOfDirectorsMember

2022-01-01

2022-12-31

0001849380

ONMD:BoardOfDirectorsMember

2023-12-31

0001849380

us-gaap:CommonStockMember

srt:BoardOfDirectorsChairmanMember

2022-12-31

0001849380

us-gaap:CommonStockMember

srt:BoardOfDirectorsChairmanMember

2023-01-01

2023-12-31

0001849380

us-gaap:CommonStockMember

srt:BoardOfDirectorsChairmanMember

2023-12-31

0001849380

ONMD:EmployeesDirectorsAndConsultantsMember

ONMD:NewEquityIncentivePlanMember

2020-01-01

2020-12-31

0001849380

ONMD:EmployeesDirectorsAndConsultantsMember

ONMD:NewEquityIncentivePlanMember

srt:MaximumMember

2020-01-01

2020-12-31

0001849380

ONMD:EmployeesDirectorsAndConsultantsMember

ONMD:NewEquityIncentivePlanMember

2020-12-31

0001849380

2021-01-01

2021-12-31

0001849380

2023-11-07

0001849380

2023-10-17

2023-10-17

0001849380

us-gaap:EmployeeStockOptionMember

2023-01-01

2023-12-31

0001849380

2020-12-31

0001849380

us-gaap:MeasurementInputExpectedTermMember

2022-01-01

2022-12-31

0001849380

us-gaap:MeasurementInputExpectedTermMember

2021-01-01

2021-12-31

0001849380

us-gaap:MeasurementInputRiskFreeInterestRateMember

2022-12-31

0001849380

us-gaap:MeasurementInputRiskFreeInterestRateMember

2021-12-31

0001849380

us-gaap:MeasurementInputExpectedDividendRateMember

2022-12-31

0001849380

us-gaap:MeasurementInputExpectedDividendRateMember

2021-12-31

0001849380

us-gaap:MeasurementInputPriceVolatilityMember

2022-12-31

0001849380

us-gaap:MeasurementInputPriceVolatilityMember

2021-12-31

0001849380

ONMD:TwentyTwentyOneServiceMember

2022-12-31

0001849380

ONMD:TwentyTwentyTwoServiceMember

2022-12-31

0001849380

ONMD:ConvertiableNotesMember

2022-12-31

0001849380

ONMD:ConvertiableNotesMember

2023-12-31

0001849380

ONMD:WarrantOneMember

2023-12-31

0001849380

us-gaap:CommonStockMember

2023-12-31

0001849380

ONMD:PubliclyTradedWarrantsMember

2022-12-31

0001849380

ONMD:PubliclyTradedWarrantsMember

2023-12-31

0001849380

ONMD:PrivateWarrantsMember

2023-12-31

0001849380

ONMD:PrivateWarrantsMember

2022-12-31

0001849380

us-gaap:WarrantMember

2023-12-31

0001849380

us-gaap:WarrantMember

2022-12-31

0001849380

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel1Member

ONMD:InvestmentsHeldInTrustMember

2023-12-31

0001849380

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel2Member

ONMD:InvestmentsHeldInTrustMember

2023-12-31

0001849380

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel3Member

ONMD:InvestmentsHeldInTrustMember

2023-12-31

0001849380

us-gaap:FairValueMeasurementsRecurringMember

ONMD:InvestmentsHeldInTrustMember

2023-12-31

0001849380

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel1Member

ONMD:InvestmentsHeldInTrustMember

2022-12-31

0001849380

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel2Member

ONMD:InvestmentsHeldInTrustMember

2022-12-31

0001849380

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel3Member

ONMD:InvestmentsHeldInTrustMember

2022-12-31

0001849380

us-gaap:FairValueMeasurementsRecurringMember

ONMD:InvestmentsHeldInTrustMember

2022-12-31

0001849380

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel1Member

2023-12-31

0001849380

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel2Member

2023-12-31

0001849380

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel3Member

2023-12-31

0001849380

us-gaap:FairValueMeasurementsRecurringMember

2023-12-31

0001849380

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel1Member

2022-12-31

0001849380

us-gaap:FairValueMeasurementsRecurringMember

us-gaap:FairValueInputsLevel2Member

2022-12-31

0001849380

us-gaap:FairValueMeasurementsRecurringMember

2022-12-31

0001849380

ONMD:DataKnightsAcquisitionCorpMember

us-gaap:RelatedPartyMember

2023-12-31

0001849380

us-gaap:RelatedPartyMember

ONMD:ManagementAndDirectorsMember

2023-12-31

0001849380

ONMD:SecuritiesPurchaseAgreementMember

2023-11-01

2023-11-30

0001849380

ONMD:SeniorConvertibleNotesMember

ONMD:SecuritiesPurchaseAgreementMember

2023-11-01

2023-11-30

0001849380

us-gaap:RelatedPartyMember

ONMD:SecuritiesPurchaseAgreementMember

2023-11-30

0001849380

ONMD:SecuritiesPurchaseAgreementMember

us-gaap:WarrantMember

2023-11-01

2023-11-30

0001849380

ONMD:SecuritiesPurchaseAgreementMember

2023-11-30

0001849380

srt:ScenarioForecastMember

ONMD:EFHuttonMember

2024-01-01

2024-12-31

0001849380

srt:ScenarioForecastMember

ONMD:KingwoodCapitalPartnersLLCMember

2024-01-01

2024-12-31

0001849380

srt:ScenarioForecastMember

2024-01-01

2024-12-31

0001849380

us-gaap:SubsequentEventMember

us-gaap:MajorityShareholderMember

2024-01-01

2024-12-31

0001849380

us-gaap:SubsequentEventMember

2024-01-01

2024-12-31

0001849380

srt:ScenarioForecastMember

srt:BoardOfDirectorsChairmanMember

2024-03-26

2024-03-27

0001849380

srt:ScenarioForecastMember

srt:BoardOfDirectorsChairmanMember

2024-03-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

ONMD:Integer

As

filed with the Securities and Exchange Commission on April 16, 2024

Registration

No. 333-276130

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Amendment

No. 1 to

FORM

S-1

REGISTRATION

STATEMENT

UNDER THE SECURITIES ACT OF 1933

ONEMEDNET

CORPORATION

(Exact

name of registrant as specified in its charter)

| Delaware |

|

3721 |

|

86-2049355 |

(State

or other jurisdiction

of

incorporation or organization) |

|

(Primary

Standard Industrial

Classification

Code Number) |

|

(I.R.S.

Employer

Identification

Number) |

OneMedNet

Corporation

6385

Old Shady Oak Road, Suite 250

Eden Prairie, MN 55344

Telephone:

800-918-7189

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

The

Corporation Trust Company

Corporation

Trust Center

1209

Orange Street

Wilmington,

DE 19801

Telephone:

302-658-7581

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Debbie

A. Klis, Esq.

Rimon

P.C.

1990

K. Street, NW, Suite 420

Washington,

DC 20006

Telephone:

(202) 935-3390

Approximate

date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933 check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large-accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large-accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large-accelerated

filer ☐ |

Accelerated

filer ☐ |

| |

|

| Non-accelerated

filer ☒ |

Smaller

reporting company ☒ |

| |

|

| |

Emerging

growth company ☒ |

If

an emerging growth company, indicate by check market if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date

as the Commission acting pursuant to said section 8(a), may determine.

The

information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration

statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities

and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY

PROSPECTUS |

|

SUBJECT

TO COMPLETION |

|

DATED

APRIL __, 2024 |

Primary

Offering of

Up

to 12,085,275 Shares of Common Stock

Upon the Exercise of Warrants

Secondary

Offering of

Up

to 19,683,367 Shares of Common Stock

Up

to 681,019 Warrants

This

prospectus relates to the primary issuance by us of up to an aggregate of 12,085,275 shares of common stock, par value $0.0001 per share

(the “Common Stock”), of OneMedNet Corporation, a Delaware corporation (“we,” “us,” the “Company”

and “OneMedNet”), which consists of (i) up to 11,500,000 shares of Common Stock issuable upon the exercise of 11,500,000

warrants (the “Public Warrants”) originally issued in the initial public offering of Data Knights Acquisition Corp”

as a special purpose acquisition company (“DKAC”), and (ii) up to an aggregate of 585,275 shares of Common Stock issuable

upon the exercise of 585,275 warrants (the “Placement Warrants,” together with the Public Warrants, the “Warrants”)

that made up a part of the private units originally issued in a private placement in connection with DKAC’s initial public offering.

We will receive the proceeds from any exercise of the Warrants for cash.

This

prospectus also relates to the offer and resale from time to time, upon the expiration of lock-up agreements, if applicable, by: (a) the

selling shareholders named in this prospectus (including their permitted transferees, donees, pledgees and other successors-in-interest)

(collectively, the “Selling Securityholders”) of up to an aggregate of 19,683,367 shares of Common Stock consisting of (i) 797,872

shares of Common Stock upon conversion of up to $1,595,744.70 of OneMedNet Senior Secured Convertible Notes (the “Pre-Closing PIPE

Notes”) issued at the closing of the Business Combination (as defined below) subject to a floor price of $2.00 per share pursuant

to the terms of the Securities Purchase Agreement dated June 28, 2023, by and among Data Knights Acquisition Corp, a Delaware corporation

(“Data Knights”) and the named investors (the “Pre-Closing PIPE”), (ii) 95,744 shares underlying 95,744 warrants

related to the Pre-Closing PIPE and the Warrant Agreements executed at the closing of the Business Combination, (iii) 7,312,817 shares

of Common Stock upon conversion (the “Conversion Shares) of up to $4,547,500 of funding to the Company pursuant to the Securities

Purchase Agreement and convertible promissory notes dated March 28, 2024 (the

“PIPE Notes Financing”) with Helena Global Investment Opportunities 1 Ltd. (the “Notes Investor”), (iv)

3,656,408 shares underlying 3,656,408 warrants related to the PIPE Notes Financing with

the Notes Investor, (v) 277,778 shares of Common Stock issued pursuant to the terms of the Satisfaction and Discharge Agreement at $10.88

per share dated as of June 28, 2023, by and among the Company, Data Knights, and EF Hutton LLC (“EF Hutton”), (vi) 1,315,840

shares of Common Stock issuable pursuant to the outstanding loans converted to equity at $1 per share to Data Knights to fund its extension

payments prior to the Business Combination by certain of the Selling Securityholders named in this prospectus, (vii) 1,439,563 shares

of Common Stock issued upon the closing of the Business Combination to ARC Group Limited, as consideration for its financial advisory

services, (viii) 1,327,070 shares of Common Stock at $0.7535 (95% of VWAP 10-day average $0.7932) for $1,000,000 investment by Dr. Thomas

Kosasa, and (ix) 3,609,859 shares of Common Stock issued to Data Knights LLC (the “Sponsor”) and its affiliates, including

2,875,000 shares of Common Stock originally issued as share of Class B Stock in connection with the initial public offering of DKAC for

aggregate consideration of $25,000, or approximately $0.009 per share, and 585,275 shares of Common Stock originally issued to Sponsor

as part of the Placement Units issued to the Sponsor in connection with DKAC’s initial public offering at $10.00 per unit, and

which are subject to six month lock-up restrictions set forth herein; and (b) the selling warrant holders named in this prospectus

(including their permitted transferees, donees, pledgees and other successors-in-interest) (collectively, the “Selling Warrantholders”

and, together with the Selling Shareholders and including their permitted transferees, the “Selling Securityholders”) of

up to an aggregate of 585,275 Placement Warrants.

On

April 25, 2022, the Company, Data Knights Merger Sub, Inc., a Delaware corporation (“Merger Sub”), and Data Knights, LLC,

the Company’s sponsor (the “Sponsor”), entered into a definitive Agreement and Plan of Merger (the “Merger Agreement”)

with OneMedNet Corporation, Inc., a Delaware corporation (the “Target,” which has since been renamed “OneMedNet Solutions

Corporation”), and together with the Company and Merger Sub, the “Parties”) and Paul Casey, as seller representative

(“Casey”). Pursuant to the Merger Agreement, upon the closing (the “Closing”) of the transactions contemplated

in the Merger Agreement (collectively, the “Business Combination”), the Parties would consummate the merger of Merger Sub

with and into the Target, with the Target continuing as the surviving entity (the “Merger”), which would result in all of

the issued and outstanding capital stock of the Target being exchanged for shares of the Company’s Common Stock upon the terms

set forth in the Merger Agreement. The Merger and Merger Agreement and the related transactions were approved unanimously by the boards

of directors of each of the Company and the Target.

As

described herein, the Selling Securityholders named in this prospectus or their permitted transferees, may resell from time to time up

to 19,683,367 shares of our Common Stock and 681,019 Warrants. We are registering the offer and sale of these securities to satisfy certain

registration rights we have granted. The Selling Securityholders may offer, sell or distribute all or a portion of the securities hereby

registered publicly or through private transactions at prevailing market prices or at negotiated prices. We will not receive any of the

proceeds from such sales of our shares of our Common Stock or Warrants, except with respect to amounts received by us upon the exercise

of the Warrants. We will bear all costs, expenses and fees in connection with the registration of these securities, including with regard

to compliance with state securities or “blue sky” laws. The Selling Securityholders will bear all commissions and discounts,

if any, attributable to their sale of shares of our Common Stock or Warrants. See section entitled “Plan of Distribution”

beginning on page 61 of this prospectus.

Our

Common Stock and warrants are listed on The Nasdaq Stock Market LLC (“Nasdaq”) under the symbols, “ONMD” and

“ONMDW.” As of April 15, 2024, we had approximately 23,850,010 shares of Common

Stock and 12,181,019 warrants outstanding. On April 15, 2024, the last reported closing price of our of

Common Stock and warrants as reported on Nasdaq was $0.68 per share and $0.180 per warrant.

We

are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, have

elected to comply with certain reduced public company reporting requirements. We may amend or supplement this prospectus from time

to time by filing amendments or supplements as required. You should read this entire prospectus and any amendments or supplements carefully

before you make your investment decision.

Investing

in our securities involves a high degree of risk. See “Risk Factors” beginning on page 32 of this prospectus for a discussion

of information that should be considered in connection with an investment in our securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Prospectus

dated ______, 2024.

TABLE

OF CONTENTS

You

should rely only on the information contained in this prospectus or any supplement. Neither we nor the Selling Securityholders have authorized

anyone else to provide you with different information. The securities offered by this prospectus are being offered only in jurisdictions

where the offer is permitted. You should not assume that the information in this prospectus or any supplement is accurate as of any date

other than the date on the front of each document. Our business, financial condition, results of operations and prospects may have changed

since that date.

Except

as otherwise set forth in this prospectus, neither we nor the Selling Securityholders have taken any action to permit a public offering

of these securities outside the United States or to permit the possession or distribution of this prospectus outside the United States.

Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions

relating to the offering of these securities and the distribution of this prospectus outside the United States.

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement that we filed with the SEC using a “shelf” registration process. By using

a shelf registration statement, the Selling Securityholders may sell up to 19,683,367 shares of Common Stock and up to 681,019 Warrants

from time to time in one or more offerings as described in this prospectus. We will not receive any proceeds from the sale of Common

Stock or Warrants by the Selling Securityholders. This prospectus also relates to the issuance by up to 12,085,275 Common Stock upon

the exercise of Warrants. We will receive the proceeds from any exercise of the Warrants for cash.

We

may also file a prospectus supplement or post-effective amendment to the registration statement of which this prospectus forms a part

that may contain material information relating to these offerings. The prospectus supplement or post-effective amendment, as the case

may be, may add, update or change information contained in this prospectus with respect to such offering. If there is any inconsistency

between the information in this prospectus and the applicable prospectus supplement or post-effective amendment, you should rely on the

prospectus supplement or post-effective amendment, as applicable. Before purchasing any of the Common Stock or Warrants, you should carefully

read this prospectus and any prospectus supplement and/or post-effective amendment, as applicable, together with the additional information

described under “Where You Can Find More Information.”

Neither

we nor the Selling Securityholders have authorized anyone to provide you with any information or to make any representations other than

those contained in this prospectus and any prospectus supplement and/or post-effective amendment, as applicable, prepared by or on behalf

of us or to which we have referred you. We and the Selling Securityholders take no responsibility for, and can provide no assurance as

to the reliability of, any other information that others may give you. We and the Selling Securityholders will not make an offer to sell

the Common Stock or Warrants in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing

in this prospectus and any prospectus supplement and/or post-effective amendment, as applicable, is accurate only as of the date on the

respective cover. Our business, prospects, financial condition or results of operations may have changed since those dates. This prospectus

contains, and any prospectus supplement or post-effective amendment may contain, market data and industry statistics and forecasts that

are based on independent industry publications and other publicly available information. Although we believe these sources are reliable,

we do not guarantee the accuracy or completeness of this information and we have not independently verified this information. In addition,

the market and industry data and forecasts that may be included in this prospectus and any prospectus supplement and/or post-effective

amendment, as applicable, may involve estimates, assumptions and other risks and uncertainties and are subject to change based on various

factors, including those discussed under “Risk Factors” in this prospectus and any prospectus supplement and/or post-effective

amendment, as applicable. Accordingly, investors should not place undue reliance on this information.

MARKET

AND INDUSTRY DATA

Unless

otherwise indicated, information contained in this prospectus concerning our industry and the regions in which we operate, including

our general expectations and market position, market opportunity, market share and other management estimates, is based on information

obtained from various independent publicly available sources and other industry publications, surveys and forecasts. While we believe

that the market data, industry forecasts and similar information included in this prospectus are generally reliable, such information

is inherently imprecise. In addition, assumptions and estimates of our future performance and growth objectives and the future performance

of our industry and the markets in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety

of factors, including those discussed under the headings “Risk Factors,” “Cautionary Note Regarding Forward-Looking

Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this

prospectus.

Information

contained in this prospectus concerning our industry, market and competitive position data in this prospectus from our own internal estimates

and research as well as from publicly available information, industry and general publications and research, surveys and studies conducted

by third parties.

Industry

publications and forecasts generally state that the information they contain has been obtained from sources believed to be reliable,

but such information is inherently imprecise. Forecasts and other forward-looking information obtained from these sources are subject

to the same qualifications and uncertainties as the other forward-looking statements in this prospectus. These forecasts and forward-looking

information are subject to uncertainty and risk due to a variety of factors, including those described under “Risk Factors.”

These and other factors could cause results to differ materially from those expressed in any forecasts or estimates.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains forward-looking statements that involve risks and uncertainties. You should not place undue reliance on these forward-looking

statements. All statements other than statements of historical facts contained in this prospectus are forward-looking statements. The

forward-looking statements in this prospectus are only predictions. We have based these forward-looking statements largely on our current

expectations and projections about future events and financial trends that we believe may affect our business, financial condition, and

results of operations. In some cases, you can identify these forward-looking statements by terms such as “anticipate,” “believe,”

“continue,” “could,” “depends,” “estimate,” “expects,” “intend,”

“may,” “ongoing,” “plan,” “potential,” “predict,” “project,”

“should,” “will,” “would” or the negative of those terms or other similar expressions, although not

all forward-looking statements contain those words. We have based these forward-looking statements on our current expectations and projections

about future events and trends that we believe may affect our financial condition, results of operations, strategy, short- and long-term

business operations and objectives, and financial needs. These forward-looking statements include, but are not limited to, statements

concerning the following:

| |

● |

our

projected financial position and estimated cash burn rate; |

| |

|

|

| |

● |

our

estimates regarding expenses, future revenues and capital requirements; |

| |

|

|

| |

● |

our

ability to continue as a going concern; |

| |

|

|

| |

● |

our

need to raise substantial additional capital to fund our operations; |

| |

|

|

| |

● |

our

ability to compete in the global space industry; |

| |

|

|

| |

● |

our

ability to obtain and maintain intellectual property protection for our current products and services; |

| |

|

|

| |

● |

our

ability to protect our intellectual property rights and the potential for us to incur substantial costs from lawsuits to enforce

or protect our intellectual property rights; |

| |

|

|

| |

● |

the

possibility that a third party may claim we have infringed, misappropriated or otherwise violated their intellectual property rights

and that we may incur substantial costs and be required to devote substantial time defending against these claims; |

| |

|

|

| |

● |

our

reliance on third-party suppliers and manufacturers; |

| |

|

|

| |

● |

the

success of competing products or services that are or become available; |

| |

|

|

| |

● |

our

ability to expand our organization to accommodate potential growth and our ability to retain and attract key personnel; and |

| |

|

|

| |

● |

the

potential for us to incur substantial costs resulting from lawsuits against us and the potential for these lawsuits to cause us to

limit our commercialization of our products and services. |

These

forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in “Risk

Factors.” Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is

not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which

any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements

we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this prospectus

may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

You

should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected

in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events

and circumstances reflected in the forward-looking statements will be achieved or occur. Moreover, except as required by law, neither

we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. We undertake no obligation

to update publicly any forward-looking statements for any reason after the date of this prospectus to conform these statements to actual

results or to changes in our expectations.

You

should read this prospectus and the documents that we reference in this prospectus and have filed with the SEC as exhibits to the registration

statement of which this prospectus is a part with the understanding that our actual future results, levels of activity, performance and

events and circumstances may be materially different from what we expect. As a result of a number of known and unknown risks and uncertainties,

our actual results or performance may be materially different from those expressed or implied by these forward-looking statements including

those described in the “Risk Factors” section beginning on page 32 and elsewhere in this prospectus.

TRADEMARKS

AND COPYRIGHTS

We

own or have rights to trademarks or trade names that we use in connection with the operation of our business, including our corporate

names, logos and website names. In addition, we own or have the rights to copyrights, trade secrets and other proprietary rights that

protect the content of our products and the formulations for such products. This prospectus may also contain trademarks, service marks

and trade names of other companies, which are the property of their respective owners. Our use or display of third parties’ trademarks,

service marks, trade names or products in this prospectus is not intended to, and should not be read to, imply a relationship with or

endorsement or sponsorship of us. Solely for convenience, some of the copyrights, trade names and trademarks referred to in this prospectus

are listed without their ©, ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights

to our copyrights, trade names and trademarks. All other trademarks are the property of their respective owners.

IMPLICATIONS

OF BEING AN EMERGING GROWTH COMPANY AND

A

SMALLER REPORTING COMPANY

We

qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”).

For so long as we remain an emerging growth company, we are permitted, and currently intend, to rely on the following provisions of the

JOBS Act that contain exceptions from disclosure and other requirements that otherwise are applicable to public companies and file periodic

reports with the SEC. These provisions include, but are not limited to:

| |

● |

being

permitted to present only two years of audited financial statements and selected financial data and only two years of related “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” in our periodic reports and registration statements,

including this prospectus, subject to certain exceptions; |

| |

|

|

| |

● |

not

being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended (“SOX”); |

| |

|

|

| |

● |

reduced

disclosure obligations regarding executive compensation in our periodic reports, proxy statements, and registration statements, including

in this prospectus; |

| |

|

|

| |

● |

not

being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board (the “PCAOB”)

regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the

audit and the financial statements; and |

| |

|

|

| |

● |

exemptions

from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute

payments not previously approved. |

We

will remain an emerging growth company until the earliest to occur of:

| |

● |

December

31, 2028 (the last day of the fiscal year that follows the fifth anniversary of the completion of our initial public offering); |

| |

● |

the

last day of the fiscal year in which we have total annual gross revenue of at least $1.235 billion; |

| |

|

|

| |

● |

the

date on which we are deemed to be a “large-accelerated filer,” as defined in the U.S. Securities Exchange Act of 1934,

as amended (the “Exchange Act”); and |

| |

|

|

| |

● |

the

date on which we have issued more than $1 billion in non-convertible debt over a three-year period. |

We

have elected to take advantage of certain of the reduced disclosure obligations in this prospectus and may elect to take advantage of

other reduced reporting requirements in our future filings with the SEC. As a result, the information that we provide to holders of our

Common Stock may be different than what you might receive from other public reporting companies in which you hold equity interests. We

have elected to avail ourselves of the provision of the JOBS Act that permits emerging growth companies to take advantage of an extended

transition period to comply with new or revised accounting standards applicable to public companies. As a result, we will not be subject

to new or revised accounting standards at the same time as other public companies that are not emerging growth companies.

We

are also a “smaller reporting company” as defined in the Exchange Act. We may continue to be a smaller reporting company

even after we are no longer an emerging growth company. We may take advantage of certain of the scaled disclosures available to smaller

reporting companies until the fiscal year following the determination that our voting and non-voting common stock held by non-affiliates

is $250 million or more measured on the last business day of our second fiscal quarter, or our annual revenues are less than $100 million

during the most recently completed fiscal year and our voting and non-voting common stock held by non-affiliates is $700 million or more

measured on the last business day of our second fiscal quarter.

PROSPECTUS

SUMMARY

This

summary of the prospectus highlights material information concerning our business and this offering. This summary does not contain all

of the information that you should consider before making your investment decision. You should carefully read the entire prospectus,

including the information presented under the section entitled “Risk Factors” and the financial data and related notes, before

making an investment decision. It does not contain all the information that may be important to you and your investment decision. You

should carefully read this entire prospectus, including the matters set forth under “Risk Factors,” “Management’s

Discussion and Analysis of Financial Condition and Results of Operations,” and our financial statements and related notes included

elsewhere in this prospectus. This summary contains forward-looking statements that involve risks and uncertainties. Our actual results

may differ significantly from future results contemplated in the forward-looking statements as a result of factors such as those set

forth in “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements.”

In

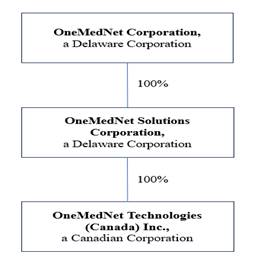

this prospectus, unless the context indicates otherwise, “OneMedNet,” the “Company,” “we,” “our,”

“ours” or “us” refer to OneMedNet Corporation a Delaware corporation, and its direct and indirect subsidiaries,

including, but not limited to, OneMedNet Solutions Corporation, a Delaware corporation and its wholly-owned subsidiary, OneMedNet Technologies

(Canada) Inc., incorporated on October 16, 2015 under the provisions of the Business Corporations Act of British Columbia whose functional

currency is the Canadian dollar.

We

have not authorized anyone to provide you with different information and you must not rely on any unauthorized information or representation.

We are not making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. This document may only

be used where it is legal to sell these securities. You should assume that the information appearing in this prospectus is accurate only

as of the date on the front of this prospectus, regardless of the time of delivery of this prospectus, or any sale of our Common Stock.

Our business, financial condition and results of operations may have changed since the date on the front of this prospectus. We urge

you to carefully read this prospectus before deciding whether to invest in any of the Common Stock being offered.

The

Company

OneMedNet

Corporation a Delaware corporation (the “Company,” “we,” “us,” or “OneMedNet”) together

with its wholly-owned subsidiary OneMedNet Solutions Corporation, a Delaware corporation, founded in 2009 and incorporated in November

20, 2015, and its wholly-owned subsidiary, OneMedNet Technologies (Canada) Inc., incorporated on October 16, 2015 under the provisions

of the Business Corporations Act of British Columbia whose functional currency is the Canadian dollar. All refences in this prospectus

to the “Company,” “we,” “us,” or “OneMedNet” include OneMedNet Solutions Corporation.

Corporate

History

We

were originally incorporated in Delaware on February 8, 2021 under the name “Data Knights Acquisition Corp” as a special

purpose acquisition company, formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase,

reorganization or similar business combination with one or more businesses.

On

May 11, 2021, we consummated an initial public offering (the “Initial Public Offering”). The registration statement for the

Company’s Initial Public Offering was declared effective on May 6, 2021. The Company’s Initial Public Offering of 10,000,000

units (the “Units” and, with respect to the Common Stock included in the Units being offered, the “Public Shares”),

at $10.00 per Unit, generated gross proceeds of $100,000,000. The Company granted the underwriter a 45-day option to purchase up to an

additional 1,500,000 Units at the Initial Public Offering price to cover over-allotments, which the underwriters exercised the over-allotment

option in full, and the closing of the issuance and sale of the additional Units occurred (the “Over-allotment Option Units”).

The total aggregate issuance by the Company of 1,500,000 units at a price of $10.00 per unit resulted in total gross proceeds of $15,000,000.

Simultaneously with the consummation of the closing of the Offering, the Company consummated the private placement of an aggregate of

585,275 units (the “Placement Units”) to the Sponsor at a price of $10.00 per Placement Unit, generating total gross proceeds

of $5,852,750 (the “Private Placement”).

The

Placement Units were issued pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended, as the transactions did not involve

a public offering. A total of $117,300,000, comprised of the proceeds from the Offering and the proceeds of private placements that closed

on May 11, 2021, net of the underwriting commissions, discounts, and offering expenses, was deposited in a trust account established

for the benefit of the Company’s public stockholders. On June 22, 2021, the Common Stock and Public Warrant included in the Units

began separate trading.

No

payments for our expenses were made in the offering described above directly or indirectly to (i) any of our directors, officers or their

associates, (ii) any person(s) owning 10% or more of any class of our equity securities or (iii) any of our affiliates, except in connection

with the repayment of outstanding loans and pursuant to the administrative support agreement disclosed herein which we entered into with

our sponsor.

On

April 25, 2022, the Company, Data Knights Merger Sub, Inc., a Delaware corporation (“Merger Sub”), and Data Knights, LLC,

the Company’s sponsor (the “Sponsor”), entered into a definitive Agreement and Plan of Merger (the “Merger Agreement”)

with OneMedNet Corporation, Inc., a Delaware corporation (the “Target,” which has since been renamed “OneMedNet Solutions

Corporation”), and together with the Company and Merger Sub, the “Parties”) and Paul Casey, as seller representative

(“Casey”). Pursuant to the Merger Agreement, upon the closing (the “Closing”) of the transactions contemplated

in the Merger Agreement (collectively, the “Business Combination”), the Parties would consummate the merger of Merger Sub

with and into the Target, with the Target continuing as the surviving entity (the “Merger”), which would result in all of

the issued and outstanding capital stock of the Target being exchanged for shares of the Company’s Common Stock upon the terms

set forth in the Merger Agreement. The Merger and Merger Agreement and the related transactions were approved unanimously by the boards

of directors of each of the Company and the Target.

On

December 31, 2022, substantially all of the assets held in the Trust Account were held in mutual funds.

On

June 28, 2023, the Company executed a Securities Purchase Agreement for PIPE financing in the aggregate original principal amount of

$1,595,744.70 and a purchase price of $1.5 million (the “Pre-Closing PIPE”). Pursuant to the Securities Purchase Agreement,

the Company agreed to issue and sell to each of Thomas Kosasa, Dr. Jeffrey Yu, Aaron Green and Steve Kester (the “PIPE Investors”),

a new series of senior secured convertible notes (the “Pre-Closing PIPE Notes”), which Notes shall be convertible

into shares of Common Stock at the PIPE Investors election at the conversion price (rounded to the nearest 1/100th of one cent) which

shall be computed as the lesser of:

(a)

with respect to a conversion pursuant to Section 4.1 of the Securities Purchase Agreement (discussed below), the lesser of: (i) a price

per share equal to the product of (x) 100% less the Discount and (y) the lowest per share purchase price of the Equity Securities issued

in the Next Equity Financing; and (ii) $2.50 per share; and

(b)

with respect to a conversion pursuant to Section 4.2 (discussed below), (relating to payment at maturity) or Section 4.3, $2.50 per share.

The Securities Purchase agreement provided that the PIPE Investors’ $1.5 million investment in the Pre-Closing PIPE Notes

would close and fund contemporaneous to the Closing of the Business Combination.

Section

4.1 of the Securities Purchase Agreement provides that the principal balance and unpaid accrued interest on each Note will automatically

convert into the PIPE Conversion Shares upon the closing of the Next Equity Financing (“Next Equity Financing” means the

next sale or series of related sales by the Company of its Common Stock in one or more offerings relying on Section 4(a)(2) of the Securities

Act or Regulation D thereunder for exemption from the registration requirements of Section 5 of the Securities Act, from which the Company

receives gross proceeds of not less than US$5,000,000 (excluding, for the avoidance of doubt, the aggregate principal amount of the Notes).

Section

4.2 of the Securities Purchase Agreement provides that in the event of a Corporate Transaction or the repayment of such Note, at the

closing of a corporate transaction, the holder of each Note may elect that either: (a) the Company will pay the holder of such Note an

amount equal to the sum of (x) the outstanding principal balance of such Note, and (y) a premium equal to 20% of the outstanding principal

balance of such Note (which premium, is in lieu of all accrued and unpaid interest due on such Note); or (b) such Note will convert into

that number of Conversion Shares equal to the quotient (rounded down to the nearest whole share) obtained by dividing (x) the outstanding

principal balance and unpaid accrued interest of such Note on a date that is no more than five days prior to the closing of such corporate

transaction by (y) the applicable Conversion Price.

Notwithstanding

the foregoing, any sale (or series of related sales) of the Company’s Equity Securities to a special purpose acquisition company

will not be deemed a “Next Equity Financing. Notwithstanding the foregoing, the Company may, at its option, pay any unpaid accrued

interest on each Note in cash at the time of conversion. The number of PIPE Conversion Shares the Company issues upon such conversion

will equal the quotient (rounded down to the nearest whole share) obtained by dividing (x) the outstanding principal balance and unpaid

accrued interest under each converting Note on a date that is no more than five days prior to the closing of the Next Equity Financing

by (y) the applicable Conversion Price. At least five days prior to the closing of the Next Equity Financing, the Company will notify

the holder of each Note in writing of the terms of the Equity Securities that are expected to be issued in such financing. The issuance

of PIPE Conversion Shares pursuant to the conversion of each Note will be on, and subject to, the same terms and conditions applicable

to the Equity Securities issued in the Next Equity Financing.

Also

on June 28, 2023, EF Hutton LLC (“EF Hutton”) waived $3,025,000 of the $4,025,000

cash deferred underwriting commission do to it at the Closing of the Business Combination, pursuant to a Satisfaction and Discharge Agreement.

In accordance with the Satisfaction and Discharge Agreement, EF Hutton accepted, in lieu of the cash deferred underwriting commission

due at closing (i) a one-time cash payment of $500,000 at the time of the Closing; (ii) a $500,000 promissory note executed by the Company

on June 30, 2023 in which it is obligated to make six monthly payments to EF Hutton in the cash amount of $83,333.33 commencing after

the Closing; and (iii) 277,778 shares of common stock of the Company (the “Common Stock”) at $10.89 per share, for an aggregate

value of $3,025,000.

On

September 21, 2023, the Securities and Exchange Commission (the “SEC”) declared effective the Company’s registration

statement and proxy statement/prospectus on Form S-4 (the “Definitive Proxy”).

As

of the close of business on September 20, 2023 (the “Record Date”), 5,172,973 shares of common stock of the Company (the

“Common Stock”) were issued and outstanding and entitled to vote at the Special Meeting. On October 17, 2023, the Company

held a special meeting of its stockholders (the “Stockholders”) in lieu of its 2023 annual meeting of Stockholders (the “Special

Meeting”) in connection with the transactions contemplated by the Merger Agreement. At the Special Meeting, the Stockholders were

asked to consider and vote on the proposals identified in the Definitive Proxy; 4,690,565 shares of Common Stock were represented in

person or by proxy at the Special Meeting, and, therefore, a quorum was present and all proposal were approved.

On

November 7, 2023, we held the Closing of the previously announced Merger whereby Merger Sub merged with and into OneMedNet Solutions

Corporation (formerly named OneMedNet Corporation), with OneMedNet Solutions Corporation continuing as the surviving entity, which resulted

in all of the issued and outstanding capital stock of OneMedNet Solutions Corporation being exchanged for shares of the Company’s

Common Stock upon the terms set forth in the Merger Agreement. The Merger and other transactions that closed on November 7, 2023, pursuant

to the Merger Agreement, led to Data Knights changing its name to “OneMedNet Corporation” and the business of the Company

became the business of OneMedNet Solutions Corporation.

Pursuant

to the terms of the Merger Agreement, the total consideration for the Business Combination and related transactions (the “Merger

Consideration”) was approximately $200 million. In connection with the Special Meeting, certain public holders (the “Redeeming

Stockholders”) holding 1,600,741 shares of Common Stock exercised their right to redeem such shares for a pro rata portion of the

funds held by Continental Stock Transfer & Trust Company, as trustee (“Continental”) in the trust account established

in connection with Data Knights’ initial public offering (the “Trust Account”).

Effective

November 7, 2023, Data Knights’ units ceased trading, and effective November 8, 2023, OneMedNet’s common stock began trading

on the Nasdaq Capital Market under the symbol “ONMD” and the warrants began trading on the Nasdaq Capital Market under the

symbol “ONMDW.”

As

a result of the Merger and the Business Combination, holders of Data Knights common stock automatically received common stock of OneMedNet,

and holders of Data Knights warrants automatically received warrants of OneMedNet with substantively identical terms. At the Closing

of the Business Combination, all shares of Data Knights owned by the Sponsor (consisting of shares of Common Stock and shares of Class

B common stock, which we refer to as the founder shares), automatically converted into an equal number of shares of OneMedNet’s

Common Stock, and the Private Placement Warrants held by the Sponsor, automatically converted into warrants to purchase one share of

OneMedNet Common Stock with substantively identical terms.

Effective

as of the Closing on November 7, 2023, among other holders, public stockholders own 98,178 shares of OneMedNet Common Stock approximately

representing 0.35% of the outstanding shares of OneMedNet Common Stock; the Sponsor and its affiliates own approximately 15.1% of the

outstanding shares of OneMedNet common stock (inclusive of shares received upon conversion of the Sponsor’s loan); OneMedNet’s

former security holders own approximately 61.992% of the outstanding shares of OneMedNet common stock from the conversion of their shares;

PIPE investors own 0.46% of the outstanding shares of OneMedNet Common Stock and former convertible note holders own approximately 16.24%

of the outstanding shares of OneMedNet Common Stock resulting from the issuance of 5,238,800 shares of Common Stock upon conversion of

their notes.

On

March 28, 2024, the Company entered into a definitive securities purchase agreement (the “Notes

Securities Purchase Agreement”) with Helena Global Investment Opportunities 1 Ltd. (the “Notes Investor”), an affiliate

of Helena Partners Inc., a Cayman-Islands based advisor and investor providing for up to USD$4.54 million in

funding through a private placement (the “PIPE Notes Financing”) for the issuance of senior secured convertible notes (the

“PIPE Notes”). In connection with the issuance of the Notes, the Company will issue to the Investor common stock purchase

warrants (the “Warrants”) across multiple tranches (the “Tranches”) consisting of an initial tranche (the “Initial

Tranche”) of (i) an aggregate principal amount $2,000,000.00 and including an original issue discount (“OID”) of up

to an aggregate of $300,000.00 plus Warrants to purchase a number of shares of Common Stock equal to the applicable Warrant Share Amounts

(defined below). The second tranche (the “Second Tranche”) consists of an aggregate principal amount of Notes of up to $350,000.00

and including an OID of up to $52,500.00 and Warrants to purchase a number of shares of Common Stock equal to the applicable Warrant

Share Amounts with respect to such Tranche. The Notes Securities Purchase Agreement contemplates three subsequent Tranches each of which

shall be in an aggregate principal amount of Notes of up to $1,000,000 each and each including an OID of 15.0% of the applicable principal

amount, and Warrants to purchase a number of shares of Common Stock equal to the applicable Warrant Share Amounts with respect to such

Tranches.

The

purchase price of a PIPE Note and its accompanying Warrant shall be computed by subtracting the portion of the OID represented by that

such PIPE Note from the portion of the principal amount represented by such Note (a “Purchase Price”).

The

Notes Securities Purchase Agreement defines Warrant Share Amounts means in respect of any Warrant issued in a Closing the initial amount

of shares of Common Stock (the “Warrant Shares”) for which such Warrant may be exercised and which shall be equal to the

applicable principal amount of the Note issued to the Investor in such closing multiplied by 50% and divided by the 95% of lowest VWAP

over the ten Trading Day period immediately preceding the applicable Closing Date.

In

connection with the closings of each Tranche, a portion of the proceeds will be held in escrow (the “Escrow”) pursuant to

an executed Escrow Agreement dated as of March 28, 2024 in accordance with the following: (i) $1,350,000.00 of the net proceeds of the

Initial Tranche will be paid into the Escrow Account for distribution in accordance with the release of proceeds conditions (the “Release

Conditions” discussed below), with the balance of the net proceeds paid to the Company less initial closing expenses relating to

such Initial Tranche; (ii) 100% of the net proceeds of the Third Tranche shall be paid into the Escrow Account for distribution in accordance

with the Release Conditions; and (iii) 75% of the net proceeds of the Third Tranche shall be paid into the Escrow Account for distribution

in accordance with the Release Conditions with the balance of the net proceeds of the Third Tranche being paid to the Company less initial

closing expenses relating to such Third Tranche.

The

Securities Purchase Agreement provides that the amounts in Escrow (the “Escrowed Proceeds”) related to the Initial Tranche,

Second Tranche and Third Tranche are governed by the following terms:

| |

a) |

The

Escrowed Proceeds will be released to the Investor for payment amounts owing in respect of the Notes, if the closing price of the

Common Stock shall have been less than the then Floor Price (as defined in the Notes) for a period of 10-consecutive trading days,

or an event of default shall have occurred; |

| |

|

|

| |

b) |

The

Escrowed Proceeds will be released to the Company if the aggregate outstanding amount is equal to zero; |

| |

|

|

| |

c) |

If

on the date that is 20 trading days following the closing of the Initial Tranche, the aggregate outstanding amount is more than zero

but less than $1,700,000.00, then the Escrowed Proceeds will be released to the Company in an amount equal to the difference between

$1,700,000.00 and the aggregate outstanding amount; and |

| |

|

|

| |

d) |

If

on the date that is 40 trading days following the Closing Date of the Initial Tranche and every 20 trading days thereafter, the aggregate

outstanding amount is more than zero but less than $1,700,000.00 minus the amount of any prior disbursement from the Escrow Account

pursuant to this provision (d) or provision (c) above (the “Adjusted Escrow Reference Amount”), then the Escrowed Proceeds

will be released to the Company an amount equal to the difference between the Adjusted Escrow Reference Amount and such aggregate

outstanding amount. |

In

connection with the Notes Securities Purchase Agreement, the Company and the Investor also entered into a Registration Rights Agreement,

dated as of March 28, 2024 (the “RRA”), providing for the registration of the Note shares (the “Note Conversion Shares”)

and the Warrant Shares (the “Registerable Securities”). The Company has agreed to prepare and file a registration statement

(the “Registration Statement”) with the Securities and Exchange Commission (the “SEC”) promptly, and in any event

within 30 days of the closing of the private placement. The Company has granted the Investor customary indemnification rights in connection

with the Registration Rights Agreement. The Investors have also granted the Company customary indemnification rights in connection with

the Registration Statement.

The

securities to be issued pursuant to the Notes Securities Purchase Agreement was

made in reliance on the exemption from registration provided by Section 3(a)(9) of the Securities Act of 1933, as amended (the “Securities

Act”), as promulgated by the Securities and Exchange Commission under the Securities Act.

Who

We Are

We

are OneMedNet, and our goal is to be a leader in the future of regulatory-grade Imaging Real Word Data (“RWD”) through

our intelligent, thoughtful and inclusive iRWDTM solution. We strive to revolutionize access fast and secure access to curated

medical images with our strategic thinking, successful market entry and execution to continue to open new possibilities for providing

clinical imaging evidence.

We

are bold, decisive and eager to advance a global platform for our OneMedNet iRWD™ solution.

We

aim to constantly push boundaries in our approach to technology, service innovation, customer engagement and curation excellence,

all for the sake of delivering an exceptional customer experience.

Our

mission is affect a material positive impact on the lives of tens of millions of people while improving our customers’ business

productivity. First and foremost, OneMedNet’s iRWDTM offering plays a significant role in enabling Life Science

companies to bring safer and more effective patient care to market sooner. Using our highly curated de-identified clinical data in our

iRWDTM offering in Life Science product development, validation, and regulatory approval processes, they contribute to patient

care advancements in more meaningful ways, which Life Sciences industry can improve their product development and validation processes,

which benefits all parties.

At

OneMedNet, our motto is to “Unlock the Value in Imaging ArchivesTM”. By utilizing OneMedNet’s iRWDTM

offering, providers can greatly improve their research efforts with streamlined data access. Health care providers such as hospitals,

clinics, and imaging centers can also accelerate life science patient care innovations by sharing de-identified data in a well-defined

and de-identified and secure manner. In return for doing so, income is generated and applied to critical and possibly unfunded provider

projects. In that spirit, we are breaking boundaries by focusing on the future, constantly innovating from a technology and user experience

perspective and are ready to push forward. With that said, we recognize that we cannot do this alone, and we urge those who share this

desire to unite with us on our journey to a brighter and greener future.

Come

join the charge with us.

Our

Business

OneMedNet

is a global provider of clinical imaging innovation and curator of regulatory-grade Imaging Real-World Data3 or iRWDTM. OneMedNet’s

innovative solutions connect healthcare providers and patients satisfying a crucial need within the Life Sciences field offering direct

access to clinical images and the associated contextual patient record. OneMedNet’s innovative technology proved the commercial

and regulatory viability of imaging Real-World Data, an emerging market, and provides regulatory-grade image-centric iRWDTM

that exactly matches OMN’s Life Science partners Case Selection Protocols and paves the way for Real World Evidence.

OneMedNet

was founded to solve a deficiency in how clinical images were shared between healthcare providers. This resulted in OMN’s initial

product BEAMTM image exchange that enabled the successful sharing of images for more than a decade with OMN’s largest

customer being the Country of Ireland.

OneMedNet

continued to innovate by responding to the demand for and utilization of Real-World Data and Real-World Evidence, specifically data that

focused on clinical images with its associated contextual clinical record. We were able to leverage internal technological competencies

along with OneMedNet’s formidable healthcare provider installed base from its first product with BEAMTM to become the

first RWD solution for Life Science companies with its launch of iRWDTM in 2019.

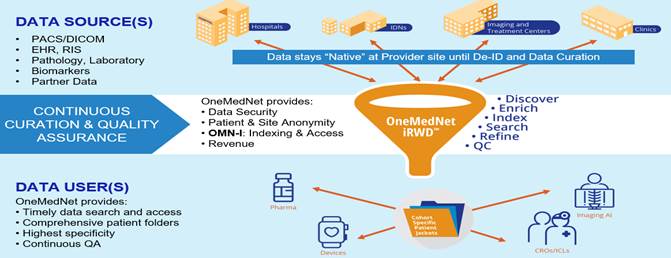

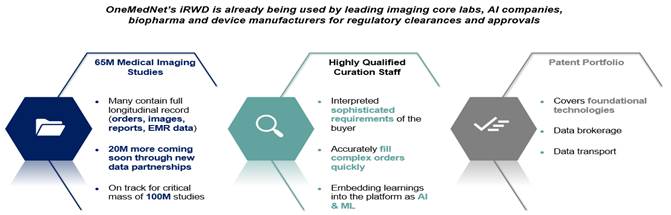

OneMedNet

provides innovative solutions that unlock the significant value contained within clinical image archives. With a growing federated network

of 95+ healthcare facilities, OneMedNet has the immediate ability to quickly search and extensively curate multi-layer data from a Federated

group of healthcare facilities. The term “healthcare facilities” refers specifically to the hospitals, integrated delivery

networks (“IDNs”) and imaging centers that provide imaging to OneMedNet, which represent the core source of our data. At

present, OneMedNet works with more than 95 facilities who provide regulatory grade imaging to us. OneMedNet has access to these more

than 95 facilities because these 95+ contracted facilities have more than 200 locations among them including offices and clinics, which

in total generates regulatory grade imaging from more than 200 customers. Among these customers, all are data providers and some are

data purchasers.

OneMedNet

is ahead of the curve when it comes to providing fast and secure access to curated medical images. Initially, it was all about solving

the diverse access needs of patient care providers. This focus systematically evolved to addressing the rapidly growing needs of image

analysis and researchers, clinicians, regulators, scientists and more.

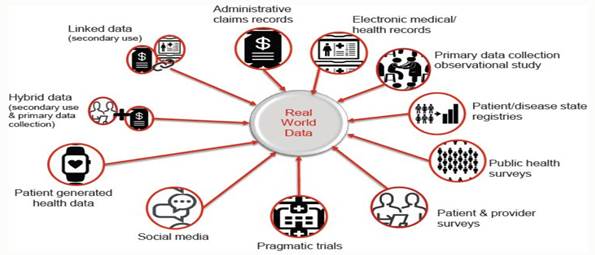

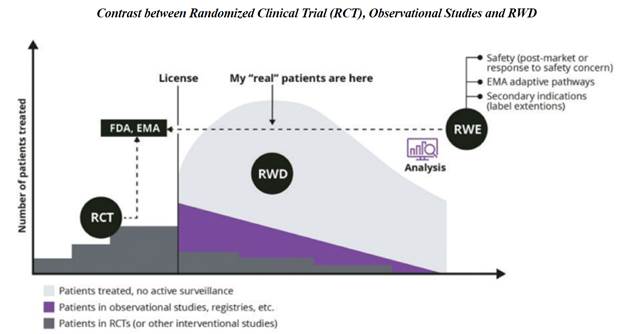

Real-world

data is any data that is collected in the context of the routine delivery of care, in contrast to data collected within a clinical trial

where study design controls variability in ways that are not representative of real-world care and outcomes.

A

key component driving its mission is that OneMedNet believes we have a unique opportunity to affect a material positive impact on the

lives of tens of millions of people while improving our customers’ business productivity. First and foremost, OneMedNet’s

iRWDTM offering plays a significant role in enabling Life Science companies to bring safer and more effective patient care

to market sooner. Using our highly curated de-identified clinical data in our iRWDTM offering in Life Science product development,

validation, and regulatory approval processes, they contribute to patient care advancements in more meaningful ways. Moreover, Life Sciences

improve their product development and validation processes, which benefits all parties.

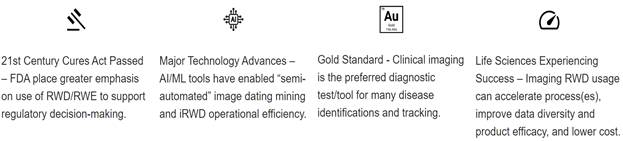

Significant

documentation exists that shows that Real-World Data can provide expanded insights across broader and more representative patient populations.1

For this reason, the Food and Drug Administration (“FDA”) has instituted Real-World Data guidelines for regulatory

approvals. Utilization of highly reliable and quality Real-World Data that strictly adheres to all of the very specific data stratification

requirements can supplement or supplant clinical trials.

OneMedNet