Domo Announces Term Loan Extended to 2028

19 Agosto 2024 - 3:05PM

Business Wire

Domo (Nasdaq: DOMO) announced that it has amended its existing

debt facility. Under the terms of the amended agreement, the debt

will mature in August 2028, and the overall interest rate and the

annual cash interest cost have been reduced.

David Jolley, Domo’s Chief Financial Officer, commented, “Our

priority is getting Domo back to growth through the prioritization

of initiatives such as converting our customer base to a

consumption-based pricing model and expanding our go-to-market

capabilities through partnerships with other leaders in the

ecosystem. We are very pleased with the continued support from

funds and accounts managed by BlackRock and to modify the terms of

our debt facility under what we believe are mutually beneficial

terms. This amendment will allow Domo to invest in the

opportunities that we believe will deliver the greatest impact for

our business.”

About Domo

Domo puts data to work for everyone so they can multiply their

impact on the business. Our cloud-native data experience platform

goes beyond traditional business intelligence and analytics, making

data visible and actionable with user-friendly dashboards and apps.

Underpinned by AI, data science and a secure data foundation that

connects with existing cloud and legacy systems, Domo helps

companies optimize critical business processes at scale and in

record time to spark the bold curiosity that powers exponential

business results.

For more information, visit www.domo.com. You can also follow

Domo on LinkedIn, X and Facebook.

Forward-Looking Statements

This press release contains forward-looking statements or

information within the meaning of applicable securities

legislation, including Section 27A of the Securities Act of 1933,

Section 21E of the Securities Exchange Act of 1934 and the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements include statements of our Chief Financial Officer and

regarding our future opportunities, growth and go-to-market

capabilities. Forward-looking statements are subject to risks and

uncertainties and are based on potentially inaccurate assumptions

that could cause actual results to differ materially from those

expected or implied by the forward-looking statements. Actual

results may differ materially from the results predicted, and

reported results should not be considered as an indication of

future performance. The potential risks and uncertainties that

could cause actual results to differ from the results predicted

include, among others, those risks and uncertainties included under

the caption “Risk Factors” and elsewhere in our filings with the

SEC, including, without limitation, the Annual Report on Form 10-K

for the fiscal year ended January 31, 2024 filed with the SEC on

March 28, 2024 and the Quarterly Report on Form 10-Q for the fiscal

quarter ended April 30, 2024 filed with the SEC on June 7, 2024.

All information provided in this press release is as of the date

hereof, and we undertake no duty to update, republish, or revise

this information unless required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240819980542/en/

Media – Cynthia Cowen PR@domo.com

Investors – Peter Lowry IR@domo.com

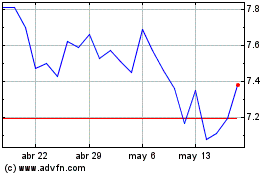

Domo (NASDAQ:DOMO)

Gráfica de Acción Histórica

De Jul 2024 a Ago 2024

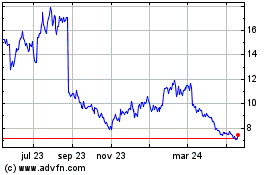

Domo (NASDAQ:DOMO)

Gráfica de Acción Histórica

De Ago 2023 a Ago 2024