- Second Quarter 2023 GAAP EPS of $0.78, Compared to $0.84 in

2022

- Second Quarter 2023 Adjusted EPS (Non-GAAP) of $0.81, Compared

to $0.84 in 2022

- Declares Quarterly Dividend of $0.6125 per share

- 2023 GAAP EPS Guidance of $3.55 to $3.75; Reaffirms 2023

Adjusted EPS (Non-GAAP) Guidance of $3.55 to $3.75

Evergy, Inc. (NASDAQ: EVRG) today announced second quarter 2023

GAAP earnings of $179.1 million, or $0.78 per share, compared to

GAAP earnings of $194.5 million, or $0.84 per share, for second

quarter 2022.

Evergy’s second quarter 2023 adjusted earnings (non-GAAP) and

adjusted earnings per share (non-GAAP) were $186.1 million and

$0.81, respectively, compared to $194.5 million and $0.84 in 2022.

Adjusted earnings (non-GAAP) and adjusted earnings per share

(non-GAAP) are reconciled to GAAP earnings in the financial table

included in this release.

Second quarter adjusted earnings (non-GAAP) per share were

driven by higher weather-normalized demand, lower operations and

maintenance expense, and higher transmission margin, partially

offset by unfavorable weather compared to the corresponding period

in the prior year, higher depreciation and amortization expense,

and higher interest expense.

“We remain on track to meet our expectations for the year after

delivering solid second quarter performance," said David Campbell,

Evergy president and chief executive officer. "We'd like to thank

the nearly 3,500 Evergy employees, contractors and personnel from

neighboring utilities that assisted in making repairs, working with

customers, and restoring power following the July 14 storms that

produced 80-100 mph winds across our service territory - our most

impactful storm event in recent history. Going forward, we remain

laser-focused on executing our strategy of investing in beneficial

infrastructure to drive continued improvement in affordability,

reliability and sustainability for our customers and

communities."

Earnings Guidance

The Company reaffirmed its 2023 GAAP EPS guidance range of $3.55

to $3.75, along with its 2023 adjusted EPS (Non-GAAP) guidance

range of $3.55 to $3.75. Additionally, the Company reaffirmed its

long-term adjusted EPS (Non-GAAP) annual growth target of 6% to 8%

through 2025 from the $3.30 midpoint of the original 2021 adjusted

EPS (Non-GAAP) guidance range. Adjusted EPS (non-GAAP) guidance is

reconciled to GAAP EPS guidance in the financial table included in

this release.

Dividend Declaration

The Board of Directors declared a dividend on the Company’s

common stock of $0.6125 per share payable on September 20, 2023.

The dividends are payable to shareholders of record as of August

21, 2023.

Earnings Conference Call

Evergy management will host a conference call Friday, August 4,

with the investment community at 9:00 a.m. ET (8:00 a.m. CT). To

view the webcast and presentation slides, please go to

investors.evergy.com. To access via phone, investors and analysts

will need to register using this link where they will be provided a

phone number and access code.

Members of the media are invited to listen to the conference

call and then contact Gina Penzig with any follow-up questions.

This earnings announcement, a package of detailed first quarter

financial information, the Company's quarterly report on Form 10-Q

for the period ended June 30, 2023, and other filings the Company

has made with the Securities and Exchange Commission are available

on the Company's website at http://investors.evergy.com.

Adjusted Earnings (non-GAAP) and

Adjusted Earnings Per Share (non-GAAP)

Management believes that adjusted earnings (non-GAAP) and

adjusted EPS (non-GAAP) are representative measures of Evergy's

recurring earnings, assist in the comparability of results and are

consistent with how management reviews performance. Evergy's

adjusted earnings (non-GAAP) and adjusted EPS (non-GAAP) for the

three months ended and year to date June 30, 2022 have been recast,

as applicable, to conform to the current year presentation.

Evergy's adjusted earnings (non-GAAP) and adjusted EPS

(non-GAAP) for the three months ended and year to date June 30,

2023 were $186.1 million or $0.81 per share and $322.2 million or

$1.40 per share, respectively. For the three months ended and year

to date June 30, 2022, Evergy's adjusted earnings (non-GAAP) and

adjusted EPS (non-GAAP) were $194.5 million or $0.84 per share and

$324.4 million or $1.41 per share, respectively.

In addition to net income attributable to Evergy, Inc. and

diluted EPS, Evergy's management uses adjusted earnings (non-GAAP)

and adjusted EPS (non-GAAP) to evaluate earnings and EPS without

i.) the costs resulting from non-regulated energy marketing margins

from the February 2021 winter weather event; ii.) gains or losses

related to equity investments subject to a restriction on sale;

iii.) the revenues collected from customers for the return on

investment of the retired Sibley Station in 2022 for future refunds

to customers; iv.) the mark-to-market impacts of economic hedges

related to Evergy Kansas Central's non-regulated 8% ownership share

of JEC; v.) costs resulting from advisor expenses; vi.) the

transmission revenues collected from customers in 2022 through

Evergy Kansas Central's FERC TFR to be refunded to customers in

accordance with a December 2022 FERC order; and vii.) the second

quarter 2023 deferral of the cumulative amount of prior year

revenues collected since October 2019 for costs related to an

electric subdivision rebate program to be refunded to customers in

accordance with a June 2020 KCC order.

Adjusted earnings (non-GAAP) and adjusted EPS (non-GAAP) are

intended to aid an investor's overall understanding of results.

Management believes that adjusted earnings (non-GAAP) provides a

meaningful basis for evaluating Evergy's operations across periods

because it excludes certain items that management does not believe

are indicative of Evergy's ongoing performance or that can create

period to period earnings volatility.

Adjusted earnings (non-GAAP) and adjusted EPS (non-GAAP) are

used internally to measure performance against budget and in

reports for management and the Evergy Board. Adjusted earnings

(non-GAAP) and adjusted EPS (non-GAAP) are financial measures that

are not calculated in accordance with GAAP and may not be

comparable to other companies' presentations or more useful than

the GAAP information provided elsewhere in this report.

Evergy, Inc

Consolidated Earnings and

Diluted Earnings Per Share

(Unaudited)

Earnings (Loss)

Earnings (Loss) per Diluted

Share

Earnings (Loss)

Earnings (Loss) per Diluted

Share

Three Months Ended June 30

2023

2022

(millions, except per share

amounts)

Net income attributable to Evergy,

Inc.

$

179.1

$

0.78

$

194.5

$

0.84

Non-GAAP reconciling items:

Sibley Station return on investment,

pre-tax(a)

—

—

(3.1

)

(0.01

)

Mark-to-market impact of JEC economic

hedges, pre-tax(b)

6.4

0.03

—

—

Non-regulated energy marketing costs

related to February 2021

winter weather event, pre-tax(c)

0.1

—

0.3

—

Advisor expenses, pre-tax(d)

—

—

2.5

0.01

Restricted equity investment losses,

pre-tax(e)

—

—

2.1

0.01

TFR refund, pre-tax(f)

—

—

(1.9

)

(0.01

)

Electric subdivision rebate program costs

refund, pre-tax(g)

2.6

0.01

—

—

Income tax expense (benefit)(h)

(2.1

)

(0.01

)

0.1

—

Adjusted earnings (non-GAAP)

$

186.1

$

0.81

$

194.5

$

0.84

Earnings (Loss)

Earnings (Loss) per Diluted

Share

Earnings (Loss)

Earnings (Loss) per Diluted

Share

Year to Date June 30

2023

2022

(millions, except per share

amounts)

Net income attributable to Evergy,

Inc.

$

321.7

$

1.40

$

317.0

$

1.38

Non-GAAP reconciling items:

Sibley Station return on investment,

pre-tax(a)

—

—

(6.2

)

(0.03

)

Mark-to-market impact of JEC economic

hedges, pre-tax(b)

(2.0

)

(0.01

)

—

—

Non-regulated energy marketing costs

related to February 2021 winter weather event, pre-tax(c)

0.2

—

0.6

—

Advisor expenses, pre-tax(d)

—

—

2.5

0.01

Restricted equity investment losses,

pre-tax(e)

—

—

16.3

0.07

TFR refund, pre-tax(f)

—

—

(3.8

)

(0.02

)

Electric subdivision rebate program costs

refund, pre-tax(g)

2.6

0.01

—

—

Income tax (benefit) expense (h)

(0.3

)

—

(2.0

)

—

Adjusted earnings (non-GAAP)

$

322.2

$

1.40

$

324.4

$

1.41

(a)

Reflects revenues collected from customers

for the return on investment of the retired Sibley Station in 2022

that are included in operating revenues on the consolidated

statements of comprehensive income.

(b)

Reflects mark-to-market gains or losses

related to forward contracts for natural gas and electricity

entered into as economic hedges against fuel price volatility

related to Evergy Kansas Central's non-regulated 8% ownership share

of JEC that are included in operating revenues on the consolidated

statements of comprehensive income.

(c)

Reflects non-regulated energy marketing

incentive compensation costs related to the February 2021 winter

weather event that are included in operating and maintenance

expense on the consolidated statements of comprehensive income.

(d)

Reflects advisor expenses incurred

associated with strategic planning and are included in operating

and maintenance expense on the consolidated statements of

comprehensive income

(e)

Reflects losses related to equity

investments which were subject to a restriction on sale that are

included in investment earnings on the consolidated statements of

comprehensive income.

(f)

Reflects transmission revenues collected

from customers in 2022 through Evergy Kansas Central's FERC TFR to

be refunded to customers in accordance with a December 2022 FERC

order that are included in operating revenues on the consolidated

statements of comprehensive income.

(g)

Reflects the second quarter 2023 deferral

of the cumulative amount of prior year revenues collected since

October 2019 for costs related to an electric subdivision rebate

program to be refunded to customers in accordance with a June 2020

KCC order that are included in operating revenues on the

consolidated statements of comprehensive income.

(h)

Reflects an income tax effect calculated

at a statutory rate of approximately 22%.

GAAP to Non-GAAP Earnings

Guidance

Original 2021 Earnings per

Diluted Share Guidance

2023 Earnings per

Diluted Share Guidance

Net income attributable to Evergy,

Inc.

$3.14 - $3.34

$3.55 - $3.75

Non-GAAP reconciling items:

Advisor expense, pre-tax(a)

0.05

-

Executive transition cost, pre-tax(b)

0.03

-

Income tax benefit(c)

(0.02)

-

Adjusted earnings (non-GAAP)

$3.20 - $3.40

$3.55 - $3.75

(a)

Reflects our advisor expense incurred associated with strategic

planning.

(b)

Reflects costs associated with certain executive transition

costs at the Evergy Companies.

(c)

Reflects an income tax effect calculated at a statutory rate of

approximately 26% with the exception of certain non-deductible

items.

About Evergy

Evergy, Inc. (NASDAQ: EVRG), serves 1.7 million customers in

Kansas and Missouri. Evergy’s mission is to empower a better

future. Our focus remains on producing, transmitting and delivering

reliable, affordable, and sustainable energy for the benefit of our

stakeholders. Today, about half of Evergy’s power comes from

carbon-free sources, creating more reliable energy with less impact

to the environment. We value innovation and adaptability to give

our customers better ways to manage their energy use, to create a

safe, diverse and inclusive workplace for our employees, and to add

value for our investors. Headquartered in Kansas City, our

employees are active members of the communities we serve.

For more information about Evergy, visit us at

http://investors.evergy.com.

Forward Looking

Statements

Statements made in this document that are not based on

historical facts are forward-looking, may involve risks and

uncertainties, and are intended to be as of the date when made.

Forward-looking statements include, but are not limited to,

statements relating to Evergy's strategic plan, including, without

limitation, those related to earnings per share, dividend,

operating and maintenance expense and capital investment goals; the

outcome of legislative efforts and regulatory and legal

proceedings; future energy demand; future power prices; plans with

respect to existing and potential future generation resources; the

availability and cost of generation resources and energy storage;

target emissions reductions; and other matters relating to expected

financial performance or affecting future operations.

Forward-looking statements are often accompanied by forward-looking

words such as "anticipates," "believes," "expects," "estimates,"

"forecasts," "should," "could," "may," "seeks," "intends,"

"proposed," "projects," "planned," "target," "outlook," "remain

confident," "goal," "will" or other words of similar meaning.

Forward-looking statements involve risks, uncertainties and other

factors that could cause actual results to differ materially from

the forward-looking information.

In connection with the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995, the Evergy, Inc., Evergy

Kansas Central, Inc. and Evergy Metro, Inc. (collectively the

Evergy Companies) are providing a number of risks, uncertainties

and other factors that could cause actual results to differ from

the forward-looking information. These risks, uncertainties and

other factors include, but are not limited to: economic and weather

conditions and any impact on sales, prices and costs; changes in

business strategy or operations; the impact of federal, state and

local political, legislative, judicial and regulatory actions or

developments, including deregulation, re-regulation, securitization

and restructuring of the electric utility industry; decisions of

regulators regarding, among other things, customer rates and the

prudency of operational decisions such as capital expenditures and

asset retirements; changes in applicable laws, regulations, rules,

principles or practices, or the interpretations thereof, governing

tax, accounting and environmental matters, including air and water

quality and waste management and disposal; the impact of climate

change, including increased frequency and severity of significant

weather events and the extent to which counterparties are willing

to do business with, finance the operations of or purchase energy

from the Evergy Companies due to the fact that the Evergy Companies

operate coal-fired generation; prices and availability of

electricity and natural gas in wholesale markets; market perception

of the energy industry and the Evergy Companies; the impact of

future Coronavirus (COVID-19) variants on, among other things,

sales, results of operations, financial condition, liquidity and

cash flows, and also on operational issues, such as supply chain

issues and the availability and ability of the Evergy Companies'

employees and suppliers to perform the functions that are necessary

to operate the Evergy Companies; changes in the energy trading

markets in which the Evergy Companies participate, including

retroactive repricing of transactions by regional transmission

organizations (RTO) and independent system operators; financial

market conditions and performance, current disruptions in the

banking industry, including changes in interest rates and credit

spreads and in availability and cost of capital and the effects on

derivatives and hedges, nuclear decommissioning trust and pension

plan assets and costs; impairments of long-lived assets or

goodwill; credit ratings; inflation rates; effectiveness of risk

management policies and procedures and the ability of

counterparties to satisfy their contractual commitments; impact of

physical and cybersecurity breaches, criminal activity, terrorist

attacks, acts of war and other disruptions to the Evergy Companies'

facilities or information technology infrastructure or the

facilities and infrastructure of third-party service providers on

which the Evergy Companies rely; impact of the Russian, Ukrainian

conflict on the global energy market, ability to carry out

marketing and sales plans; cost, availability, quality and timely

provision of equipment, supplies, labor and fuel; ability to

achieve generation goals and the occurrence and duration of planned

and unplanned generation outages; delays and cost increases of

generation, transmission, distribution or other projects; the

Evergy Companies' ability to manage their transmission and

distribution development plans and transmission joint ventures; the

inherent risks associated with the ownership and operation of a

nuclear facility, including environmental, health, safety,

regulatory and financial risks; workforce risks, including those

related to the Evergy Companies' ability to attract and retain

qualified personnel, maintain satisfactory relationships with their

labor unions and manage costs of, or changes in, wages, retirement,

health care and other benefits; disruption, costs and uncertainties

caused by or related to the actions of individuals or entities,

such as activist shareholders or special interest groups, that seek

to influence Evergy's strategic plan, financial results or

operations; the impact of changing expectations and demands of the

Evergy Companies' customers, regulators, investors and

stakeholders, including heightened emphasis on environmental,

social and governance concerns; the possibility that strategic

initiatives, including mergers, acquisitions and divestitures, and

long-term financial plans, may not create the value that they are

expected to achieve in a timely manner or at all; difficulties in

maintaining relationships with customers, employees, regulators or

suppliers; and other risks and uncertainties.

This list of factors is not all-inclusive because it is not

possible to predict all factors. You should also carefully consider

the information contained in the Evergy Companies' other filings

with the Securities and Exchange Commission (SEC). Additional risks

and uncertainties are discussed from time to time in current,

quarterly and annual reports filed by the Evergy Companies with the

SEC. Each forward-looking statement speaks only as of the date of

the particular statement. The Evergy Companies undertake no

obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230803457690/en/

Investor Contact: Pete Flynn Director, Investor Relations

Phone: 816-652-1060 Peter.Flynn@evergy.com Media Contact:

Gina Penzig Sr. Manager, Corporate Communications Phone:

785-508-2410 Gina.Penzig@evergy.com Media line: 888-613-0003

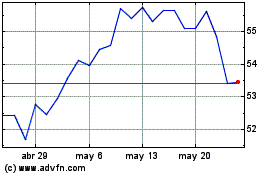

Evergy (NASDAQ:EVRG)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Evergy (NASDAQ:EVRG)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024