Current Report Filing (8-k)

26 Mayo 2023 - 3:44PM

Edgar (US Regulatory)

0001866547

false

0001866547

2023-03-23

2023-03-23

0001866547

GMFI:UnitsEachConsistingOfOneShareOfClassCommonStockAndOneRedeemableWarrantMember

2023-03-23

2023-03-23

0001866547

GMFI:ClassCommonStockParValue0.0001PerShareMember

2023-03-23

2023-03-23

0001866547

GMFI:WarrantsMember

2023-03-23

2023-03-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

8-K

Current

Report

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

March

23, 2023

Date

of Report (Date of earliest event reported)

Aetherium

Acquisition Corp.

(Exact

Name of Registrant as Specified in its Charter)

| Delaware |

|

001-41189 |

|

86-3449713 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

79B

Pemberwick Rd.

Greenwich,

CT |

|

06831 |

| (Address of Principal Executive

Offices) |

|

(Zip Code) |

Registrant’s

telephone number, including area code: (650) 450-6836

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act |

| |

|

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

| Units, each consisting of one share of Class A Common

Stock and one Redeemable Warrant |

|

GMFIU |

|

The

Nasdaq Stock Market LLC |

| Class A Common Stock, par value $0.0001 per share |

|

GMFI |

|

The

Nasdaq Stock Market LLC |

| Warrants |

|

GMFIW |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

3.01. Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

As

previously reported in a Form 12b-25 Notification of Late Filing filed with the Securities and Exchange Commission (the “SEC”)

by Aetherium Acquisition Corp. (the “Company”) on May 15, 2023, the Company is delayed in filing with the SEC its Quarterly

Report on Form 10-Q for the quarter ended March 31, 2023 (the “Form 10-Q”).

On

May 23, 2023, the Company received a late filer notification from the Listing Qualifications department

of The Nasdaq Stock Market LLC (“Nasdaq”) notifying the Company that due to the delay in filing the Form 10-Q, the Company

is not in compliance with Nasdaq Listing Rule 5250(c)(1), which requires listed companies to timely file all periodic financial reports

with the SEC. The Nasdaq notification letter has no immediate effect on the listing or trading of the Company’s common stock

on the Nasdaq Global Market. As stated in the letter, in accordance with Nasdaq rules, the Company

has 60 calendar days (July 24, 2023) to submit a plan to regain compliance and if Nasdaq accepts such plan, Nasdaq can grant an exception

of up to 180 calendar days from the Form 10-Q’s due date, or until November 20, 2023, to file the Form 10-Q and regain compliance.

If Nasdaq does not accept the plan, the Company will have the opportunity to appeal that decision to a Hearings Panel.

The

Company continues to work diligently to finalize its Form 10-Q and plans to file its Form 10-Q as promptly as possible to regain compliance.

Item

7.01 Regulation FD Disclosure.

A

press release, dated May 26, 2023, disclosing the Company’s receipt of the Nasdaq notification letter is attached as Exhibit 99.1

and is furnished herewith.

The

information included in Item 7.01 of this Current Report on Form 8-K and Exhibit 99.1 attached hereto is being furnished and shall not

be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section,

nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended, regardless of any

general incorporation language in any such filing.

Forward-Looking

Statements

Certain

matters discussed in this Current Report on Form 8-K (including Exhibit 99.1 hereto) constitute

forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of

1934, as amended, and the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements involve many

risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. These

forward-looking statements speak only as of the date hereof, and the Company expressly disclaims any obligation or undertaking to disseminate

any updates or revisions to any forward-looking statement contained herein to reflect any change in its expectations with regard thereto

or any change in events, conditions or circumstances on which any such statement is based. Please refer to the publicly filed documents

of the Company, including its most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, for risks and uncertainties

related to the Company’s business which may affect the statements made in this Current Report on Form 8-K.

Item

9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Dated: May 26, 2023 |

|

| |

|

|

| AETHERIUM ACQUISITION CORP. |

|

| |

|

|

| By: |

/s/ Jonathan

Chan |

|

| Name: |

Jonathan Chan |

|

| Title: |

Chief Executive Officer and Chairman |

|

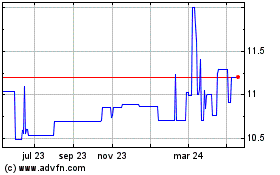

Aetherium Acquisition (NASDAQ:GMFIU)

Gráfica de Acción Histórica

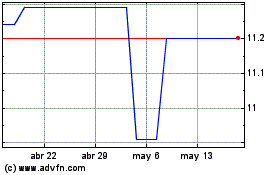

De Abr 2024 a May 2024

Aetherium Acquisition (NASDAQ:GMFIU)

Gráfica de Acción Histórica

De May 2023 a May 2024