0001490281False00014902812024-07-302024-07-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 30, 2024

Commission File Number: 1-35335 | | | | | | | | | | | | | | |

| Groupon, Inc. |

| (Exact name of registrant as specified in its charter) |

| | | | |

| Delaware | | 27-0903295 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | | |

| 35 West Wacker Drive | | 60601 |

| 25th Floor | | (Zip Code) |

| Chicago | | |

| Illinois | | (773) | 945-6801 |

| (Address of principal executive offices) | | (Registrant's telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.0001 per share | | GRPN | | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 406 of the Securities Act of 1933 (230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (240.12b-2 of this chapter)

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On July 30, 2024, Groupon, Inc. (the "Company") issued a press release announcing its financial results for its fiscal quarter ended June 30, 2024. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits. | | | | | | | | | | | | | | | | | | | | |

| (d) | Exhibits: | |

| | Exhibit No. | | Description | |

| 99.1* | | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) | | |

*The information in Exhibit 99.1 is being furnished and shall not be deemed to be "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| | GROUPON, INC. |

Date: July 30, 2024 | |

| | By: /s/ Jiri Ponrt Name: Jiri Ponrt Title: Chief Financial Officer |

Groupon Reports Second Quarter 2024 Results

North America Local revenues grew 7% compared to prior year

Positive Second Quarter operating cash flow of $15 million and Free Cash Flow of $11 million

Positive Trailing twelve month operating cash flow of $46 million and Free Cash Flow of $30 million

Second Quarter revenue above the high-end of guidance

•Global revenue of $124.6 million

•Global billings of $373.6 million

•Net loss of $9.4 million

•Adjusted EBITDA of $16.5 million

•Exited Q2 with $178.1 million in cash

CHICAGO - July 30, 2024 - Groupon, Inc. (NASDAQ: GRPN) today announced its financial results for the second quarter ended June 30, 2024. The company filed its Form 10-Q with the Securities and Exchange Commission and posted an updated presentation on its investor relations website (investor.groupon.com).

"Our financial results, with positive Free Cash Flow and growing North America Local sales, are significantly improved compared to where we were one year ago," said Dusan Senkypl, Chief Executive Officer of Groupon. "While our transformation still faces numerous challenges, including site reliability, I am confident we can restart the engines of growth and realize our mission to become the ultimate destination for local experiences and services."

Second Quarter 2024 Summary

All comparisons in this press release are year-over-year unless otherwise noted.

Consolidated

•Revenue was $124.6 million in the second quarter 2024, down 3% (3% FX-neutral) compared with the prior year period. Local revenue was $114.1 million in the second quarter 2024, up 1% (1% FX-neutral) compared with the prior year period.

•Gross profit was $112.7 million in the second quarter 2024, flat compared with the prior year period.

•Marketing expense was $36.5 million, or 32% of gross profit, in the second quarter 2024, compared with $22.3 million, or 20% of gross profit, in the prior year period.

•SG&A was $77.2 million in the second quarter 2024 compared with $96.3 million in the prior year period. The decrease in SG&A was primarily due to a decrease in payroll costs.

•Net loss was $9.4 million in the second quarter 2024 compared with net loss of $12.0 million in the prior year period.

•Adjusted EBITDA, a non-GAAP financial measure, was positive $16.5 million in the second quarter 2024, compared with positive $15.2 million in the prior year period.

•Operating cash inflow for the second quarter 2024 was $15.3 million, and free cash flow, a non-GAAP financial measure, was positive $10.8 million.

•Cash and cash equivalents as of June 30, 2024 were $178.1 million.

North America

•North America revenue was $98.4 million in the second quarter 2024, up 3% compared with the prior year period. The increase is primarily due to favorable refund rates and an increase in demand for our Local category, partially offset by a decline in demand for our Goods category. North America Local segment revenue was $91.7 million in the second quarter 2024, up 7% compared with the prior year period.

•North America gross profit in the second quarter 2024 was $88.9 million, up 7% compared with the prior year period.

•North America active customers were 10.2 million as of June 30, 2024, flat sequentially and down 3% compared with the prior year period.

International

•International revenue was $26.3 million in the second quarter 2024, down 21% (21% FX-neutral) compared with the prior year period. The decrease is primarily attributable to an overall decline in demand for our Local, Goods, and Travel categories. International Local revenue was $22.4 million, down 18% (18% FX-neutral) compared with the prior year period.

•International gross profit in the second quarter 2024 was $23.8 million, down 20% (20% FX-neutral) compared with the prior year period.

•International active customers were 5.6 million as of June 30, 2024, down 5% sequentially and down 19% compared with the prior year period.

Definitions and reconciliations of all non-GAAP financial measures and additional information regarding operating measures are included below in the section titled "Non-GAAP Financial Measures and Operating Metrics" and in the accompanying tables.

Conference Call

A conference call will be webcast Tuesday, July 30, 2024 at 4:00 p.m. CT / 5:00 p.m. ET and will be available on Groupon’s investor relations website at https://investor.groupon.com. This call will contain forward-looking statements and other material information regarding our financial and operating results.

Groupon encourages investors to use its investor relations website as a way of easily finding information about the company. Groupon promptly makes available on this website, free of charge, the reports that the company files or furnishes with the SEC, corporate governance information (including Groupon’s Global Code of Conduct), and select press releases and social media postings. Groupon uses its investor relations website (investor.groupon.com) as a means of disclosing material non-public information and for complying with its disclosure obligations under Regulation FD.

Non-GAAP Financial Measures and Operating Metrics

In addition to financial results reported in accordance with U.S. GAAP, we have provided the following non-GAAP financial measures: Foreign currency exchange rate neutral operating results, Adjusted EBITDA, non-GAAP income (loss) from operations before provision (benefit) for

income taxes, non-GAAP net income (loss) attributable to common stockholders, non-GAAP income (loss) per share, non-GAAP provision (benefit) for income taxes and free cash flow. These non-GAAP financial measures, which are presented on an operations basis, are intended to aid investors in better understanding our current financial performance and prospects for the future as seen through the eyes of management. We believe that these non-GAAP financial measures facilitate comparisons with our historical results and with the results of peer companies who present similar measures (although other companies may define non-GAAP measures differently than we define them, even when similar terms are used to identify such measures). However, these non-GAAP financial measures are not intended to be a substitute for those reported in accordance with U.S. GAAP. For reconciliations of these measures to the most applicable financial measures under U.S. GAAP, see "Non-GAAP Reconciliation Schedules" and "Supplemental Financial and Operating Metrics" included in the tables accompanying this release.

We exclude the following items from one or more of our non-GAAP financial measures:

Stock-based compensation. We exclude stock-based compensation because it is primarily non-cash in nature and we believe that non-GAAP financial measures excluding this item provide meaningful supplemental information about our operating performance and liquidity.

Depreciation and amortization. We exclude depreciation and amortization expenses because they are non-cash in nature and we believe that non-GAAP financial measures excluding these items provide meaningful supplemental information about our operating performance and liquidity.

Interest and other non-operating items. Interest and other non-operating items include: gains and losses related to minority investments, foreign currency gains and losses, interest income and interest expense. We exclude interest and other non-operating items from certain of our non-GAAP financial measures because we believe that excluding these items provides meaningful supplemental information about our core operating performance and facilitates comparisons to our historical operating results.

Special charges and credits. For the three and six months ended June 30, 2024 and 2023, special charges and credits included charges related to our 2020 and 2022 restructuring plans, gain on sale of assets and foreign VAT assessments. We exclude special charges and credits from Adjusted EBITDA because we believe that excluding those items provides meaningful supplemental information about our core operating performance and facilitates comparisons with our historical results. For the Foreign VAT assessments, we also considered the fact we ceased operations in Portugal in 2016 and it is not part of our ongoing business. Since we ceased operations, we have not engaged in any revenue-generating or payroll-related activity and do not intend to engage in these activities in Portugal in the future.

Descriptions of the non-GAAP financial measures included in this release and the accompanying tables are as follows:

Foreign currency exchange rate neutral operating results show current period operating results as if foreign currency exchange rates had remained the same as those in effect in the prior year period. These measures are intended to facilitate comparisons to our historical performance.

Adjusted EBITDA is a non-GAAP performance measure that we define as Net income (loss) excluding income taxes, interest and other non-operating items, depreciation and amortization, stock-based compensation and other special charges and credits, including items that are

unusual in nature or infrequently occurring. Our definition of Adjusted EBITDA may differ from similar measures used by other companies, even when similar terms are used to identify such measures. Adjusted EBITDA is a key measure used by our management and Board of Directors to evaluate operating performance, generate future operating plans and make strategic decisions for the allocation of capital. Accordingly, we believe that Adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results in the same manner as our management and Board of Directors. However, Adjusted EBITDA is not intended to be a substitute for Net income (loss).

Non-GAAP Selling, general and administrative is a non-GAAP measure that adjusts our selling, general and administrative to exclude the impact of depreciation and amortization and stock-based compensation.

Non-GAAP income (loss) before provision (benefit) for income taxes, non-GAAP net income (loss) attributable to common stockholders and non-GAAP income (loss) per diluted share are non-GAAP performance measures that adjust our Net income attributable to common stockholders and earnings per share to exclude the impact of:

•stock-based compensation,

•amortization of acquired intangible assets,

•special charges and credits, including restructuring charges, strategic advisor costs, gain on sale of assets and foreign VAT assessments.

•non-cash interest expense on convertible senior notes

•non-operating foreign currency gains and losses related to intercompany balances

•non-operating gains and losses from minority investments that we have elected to record at fair value with changes in fair value reported in earnings, and

•non-operating gains and losses from sales of minority investments.

We believe that excluding the above items from our measures of non-GAAP income before provision (benefit) for income taxes, non-GAAP net income attributable to common stockholders and non-GAAP income per diluted share provides useful supplemental information for evaluating our operating performance and facilitates comparisons to our historical results by eliminating items that are non-cash in nature, relate to discrete events, or are otherwise not indicative of the core operating performance of our ongoing business.

Non-GAAP provision (benefit) for income taxes reflects our current and deferred tax provision computed based on non-GAAP income before provision (benefit) for income taxes.

Free cash flow is a non-GAAP liquidity measure that comprises Net cash provided by (used in) operating activities less purchases of property and equipment and capitalized software. We use free cash flow to conduct and evaluate our business because, although it is similar to cash flow from operations, we believe that it typically represents a more useful measure of cash flows because purchases of fixed assets, software developed for internal use and website development costs are necessary components of our ongoing operations. Free cash flow is not intended to represent the total increase or decrease in our cash balance for the applicable period.

Descriptions of the operating metrics included in this release and the accompanying tables are as follows:

Gross billings is the total dollar value of customer purchases of goods and services. Gross billings is presented net of customer refunds, order discounts and sales and related taxes. The substantial majority of our revenue transactions are comprised of sales of vouchers and similar transactions in which we collect the transaction price from the customer and remit a portion of the transaction price to the third-party merchant who will provide the related goods or services. For these transactions, gross billings differs from Revenue reported in our Condensed Consolidated Statements of Operations, which is presented net of the merchant's share of the transaction price. Gross billings is an indicator of our growth and business performance as it measures the dollar volume of transactions generated through our marketplaces. Tracking gross billings also allows us to monitor the percentage of gross billings that we are able to retain after payments to merchants. However, we are focused on achieving long-term gross profit and Adjusted EBITDA growth.

Active customers are unique user accounts that have made a purchase during the trailing twelve months ("TTM") either through one of our online marketplaces or directly with a merchant for which we earned a commission. We consider this metric to be an important indicator of our business performance as it helps us to understand how the number of customers actively purchasing our offerings is trending. Some customers could establish and make purchases from more than one account, so it is possible that our active customer metric may count certain customers more than once in a given period. We do not include consumers who solely make purchases with retailers using digital coupons accessed through our websites or mobile applications in our active customer metric, nor do we include consumers who solely make purchases of our inventory through third-party marketplaces with which we partner.

Units are the number of purchases during the reporting period, before refunds and cancellations, made either through one of our online marketplaces, a third-party marketplace, or directly with a merchant for which we earn a commission. We do not include purchases with retailers using digital coupons accessed through our websites or mobile applications in our units metric. We consider units to be an important indicator of the total volume of business conducted through our marketplaces. We report units on a gross basis prior to the consideration of customer refunds and therefore units are not always a good proxy for gross billings.

We do not provide a reconciliation for non-GAAP estimates on a forward-looking basis where we are unable to provide a meaningful calculation or estimation of reconciling items and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the timing or amount of various items that would impact the most directly comparable forward-looking U.S. GAAP financial measure that have not yet occurred, are out of the Company’s control and/or cannot be reasonably predicted. Forward-looking non-GAAP financial measures provided without the most directly comparable U.S. GAAP financial measures may vary materially from the corresponding U.S. GAAP financial measures.

Note on Forward-Looking Statements

The statements contained in this release that refer to plans and expectations for the next quarter, the full year or the future are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended ("Securities Act"), and Section 21E of the Exchange Act of 1934, as amended ("Exchange Act"), including statements regarding our future results of operations and financial position, business strategy and plans and our objectives for future operations and future liquidity. The words "may," "will," "should," "could," "expect," "anticipate," "believe," "estimate," "intend," "continue" and other similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on current expectations and projections about future events and financial trends that we believe

may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements involve risks and uncertainties that could cause our actual results to differ materially from those expressed or implied in our forward-looking statements. Such risks and uncertainties include, but are not limited to, our ability to execute and achieve the expected benefits of our go-forward strategy; execution of our business and marketing strategies; volatility in our operating results; challenges arising from our international operations, including fluctuations in currency exchange rates, tax, legal and regulatory developments in the jurisdictions in which we operate and geopolitical instability resulting from the conflicts in Ukraine and the Middle East; global economic uncertainty, including as a result of inflationary pressures; retaining and adding high quality merchants and third-party business partners; retaining existing customers and adding new customers; competing successfully in our industry; providing a strong mobile experience for our customers; managing refund risks; retaining and attracting members of our executive and management teams and other qualified employees and personnel; customer and merchant fraud; payment-related risks; our reliance on email, Internet search engines and mobile application marketplaces to drive traffic to our marketplace; cybersecurity breaches; maintaining and improving our information technology infrastructure; reliance on cloud-based computing platforms; completing and realizing the anticipated benefits from acquisitions, dispositions, joint ventures and strategic investments; lack of control over minority investments; managing inventory and order fulfillment risks; claims related to product and service offerings; protecting our intellectual property; maintaining a strong brand; the impact of future and pending litigation; compliance with domestic and foreign laws and regulations, including the CARD Act, GDPR, CPRA, and other privacy-related laws and regulations of the Internet and e-commerce; classification of our independent contractors, agency workers, or employees; our ability to remediate our material weakness over internal control over financial reporting; risks relating to information or content published or made available on our websites or service offerings we make available; exposure to greater than anticipated tax liabilities; adoption of tax laws; our ability to use our tax attributes; impacts if we become subject to the Bank Secrecy Act or other anti-money laundering or money transmission laws or regulations; our ability to raise capital if necessary; risks related to our access to capital and outstanding indebtedness, including our 1.125% Convertible Senior Notes due 2026 (the “2026 Notes”); our Common Stock, including volatility in our stock price; our ability to realize the anticipated benefits from the capped call transactions relating to our 2026 Notes; and those risks and other factors discussed in Part I, Item 1A. Risk Factors of our Annual Report on Form 10-K for the year ended December 31, 2023 and Part II, Item 1A. Risk Factors of our Quarterly Report on Form 10-Q for the quarters ended March 31, 2024 and June 30, 2024, and our other filings with the Securities and Exchange Commission (the "SEC"). Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. Neither the Company nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. We undertake no obligation to publicly update any forward-looking statements for any reason after the date of this report to conform these statements to actual results or to future events or circumstances. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

As used herein, “Groupon,” “the Company,” “we,” “our,” “us” and similar terms include Groupon, Inc. and its subsidiaries, unless the context indicates otherwise.

About Groupon

Groupon (www.groupon.com) (NASDAQ: GRPN) is a trusted local marketplace where consumers go to buy services and experiences that make life more interesting and deliver boundless value. To find out more about Groupon, please visit press.groupon.com.

Contacts:

Investor Relations

ir@groupon.com

Public Relations

Emma Coleman

press@groupon.com

Groupon, Inc.

Condensed Consolidated Balance Sheets

(in thousands, except share and per share amounts)

(unaudited) | | | | | | | | | | | |

| June 30, 2024 | | December 31, 2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 178,089 | | | $ | 141,563 | |

| Accounts receivable, net | 41,595 | | | 50,373 | |

| Prepaid expenses and other current assets | 51,607 | | | 63,647 | |

| | | |

| Total current assets | 271,291 | | | 255,583 | |

| Property, equipment and software, net | 22,618 | | | 30,530 | |

| Right-of-use assets - operating leases, net | 3,043 | | | 2,197 | |

| Goodwill | 178,685 | | | 178,685 | |

| Intangible assets, net | 5,543 | | | 11,404 | |

| Investments | 74,823 | | | 74,823 | |

| Deferred income taxes | 11,382 | | | 11,639 | |

| Other non-current assets | 5,459 | | | 6,095 | |

| Total assets | $ | 572,844 | | | $ | 570,956 | |

Liabilities and equity (deficit) | | | |

| Current liabilities: | | | |

| Short-term borrowings | $ | — | | | $ | 42,776 | |

| Accounts payable | 10,816 | | | 15,016 | |

| Accrued merchant and supplier payables | 172,977 | | | 209,423 | |

| Accrued expenses and other current liabilities | 106,079 | | | 101,939 | |

| Total current liabilities | 289,872 | | | 369,154 | |

| Convertible senior notes, net | 227,255 | | | 226,470 | |

| Operating lease obligations | 1,086 | | | 2,382 | |

| Other non-current liabilities | 14,221 | | | 13,262 | |

| Total liabilities | 532,434 | | | 611,268 | |

| Commitment and contingencies | | | |

| Stockholders' equity (deficit) | | | |

Common Stock, par value $0.0001 per share, 100,500,000 shares authorized; 49,998,258 shares issued and 39,704,141 shares outstanding at June 30, 2024; 42,147,266 shares issued and 31,853,149 shares outstanding at December 31, 2023 | 5 | | | 4 | |

| Additional paid-in capital | 2,423,780 | | | 2,337,565 | |

Treasury stock, at cost, 10,294,117 shares at June 30, 2024 and December 31, 2023 | (922,666) | | | (922,666) | |

| Accumulated deficit | (1,472,193) | | | (1,449,887) | |

| Accumulated other comprehensive income (loss) | 11,307 | | | (5,647) | |

| Total Groupon, Inc. stockholders' equity (deficit) | 40,233 | | | (40,631) | |

| Noncontrolling interests | 177 | | | 319 | |

| Total equity (deficit) | 40,410 | | | (40,312) | |

| Total liabilities and equity (deficit) | $ | 572,844 | | | $ | 570,956 | |

Groupon, Inc.

Condensed Consolidated Statements of Operations

(in thousands, except share and per share amounts)

(unaudited) | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | $ | 124,615 | | | $ | 129,109 | | | $ | 247,699 | | | $ | 250,720 | |

| Cost of revenue | 11,948 | | | 16,144 | | | 24,475 | | | 33,044 | |

| Gross profit | 112,667 | | | 112,965 | | | 223,224 | | | 217,676 | |

| Operating expenses: | | | | | | | |

| Marketing | 36,520 | | | 22,267 | | | 65,329 | | | 47,115 | |

| Selling, general and administrative | 77,212 | | | 96,263 | | | 151,610 | | | 197,897 | |

| | | | | | | |

| | | | | | | |

Restructuring and related charges (credits) | (379) | | | (689) | | | (283) | | | 8,105 | |

Gain on sale of assets | (5,044) | | | — | | | (5,160) | | | — | |

| Total operating expenses | 108,309 | | | 117,841 | | | 211,496 | | | 253,117 | |

| Income (loss) from operations | 4,358 | | | (4,876) | | | 11,728 | | | (35,441) | |

| Other income (expense), net | (4,483) | | | (4,805) | | | (17,165) | | | (1,735) | |

| Income (loss) before provision (benefit) for income taxes | (125) | | | (9,681) | | | (5,437) | | | (37,176) | |

| Provision (benefit) for income taxes | 9,287 | | | 2,323 | | | 15,481 | | | 3,441 | |

| Net income (loss) | (9,412) | | | (12,004) | | | (20,918) | | | (40,617) | |

| Net (income) loss attributable to noncontrolling interests | (623) | | | (603) | | | (1,388) | | | (1,137) | |

| Net income (loss) attributable to Groupon, Inc. | $ | (10,035) | | | $ | (12,607) | | | $ | (22,306) | | | $ | (41,754) | |

| | | | | | | |

| Basic and diluted net income (loss) per share: | $ | (0.25) | | | $ | (0.41) | | | $ | (0.58) | | | $ | (1.36) | |

| | | | | | | |

| Basic and diluted weighted average number of shares outstanding: | 39,430,656 | | | 31,020,493 | | | 38,570,401 | | | 30,796,943 | |

Groupon, Inc.

Condensed Consolidated Statements of Cash Flows

(in thousands) (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Operating activities | | | | | | | |

| Net income (loss) | $ | (9,412) | | | $ | (12,004) | | | $ | (20,918) | | | $ | (40,617) | |

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | | | | | | | |

| Depreciation and amortization of property, equipment and software | 7,224 | | | 11,173 | | | 15,411 | | | 23,560 | |

| Amortization of acquired intangible assets | 600 | | | 2,070 | | | 2,206 | | | 4,188 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Stock-based compensation | 6,418 | | | 7,519 | | | 8,792 | | | 9,882 | |

| | | | | | | |

| | | | | | | |

| Foreign currency (gains) losses, net | 3,863 | | | 3,928 | | | 13,660 | | | (159) | |

Foreign VAT assessments | 4,092 | | | — | | | 4,092 | | | — | |

Gain on sale of assets | (5,044) | | | — | | | (5,160) | | | — | |

| Change in assets and liabilities: | | | | | | | |

| Accounts receivable | 7,744 | | | 2,144 | | | 8,259 | | | 10,463 | |

| Prepaid expenses and other current assets | 10,531 | | | 1,891 | | | 14,095 | | | 5,384 | |

| Right-of-use assets - operating leases | 508 | | | 2,181 | | | 1,258 | | | 6,189 | |

| Accounts payable | 1,936 | | | (7,354) | | | (4,151) | | | (39,427) | |

| Accrued merchant and supplier payables | (18,578) | | | (18,980) | | | (34,660) | | | (48,447) | |

| Accrued expenses and other current liabilities | 5,723 | | | (31,339) | | | 3,425 | | | (30,557) | |

| Operating lease obligations | (1,354) | | | (7,504) | | | (3,843) | | | (15,743) | |

| Payment for early lease termination | — | | | (123) | | | (1,832) | | | (9,724) | |

| Other, net | 1,049 | | | 4,088 | | | 4,555 | | | 6,378 | |

| Net cash provided by (used in) operating activities | 15,300 | | | (42,310) | | | 5,189 | | | (118,630) | |

| Investing activities | | | | | | | |

| Purchases of property and equipment and capitalized software | (4,474) | | | (2,253) | | | (8,183) | | | (11,797) | |

Proceeds from sale of assets, net | 9,000 | | | 387 | | | 9,116 | | | 1,475 | |

| Acquisitions of intangible assets and other investing activities | (223) | | | (617) | | | (561) | | | (1,174) | |

| Net cash provided by (used in) investing activities | 4,303 | | | (2,483) | | | 372 | | | (11,496) | |

| Financing activities | | | | | | | |

| | | | | | | |

| Payments of borrowings under revolving credit agreement | — | | | (1,000) | | | (42,776) | | | (28,300) | |

Proceeds from Rights Offering, net of issuance costs | — | | | — | | | 79,619 | | | — | |

| | | | | | | |

| | | | | | | |

| Other financing activities | (1,721) | | | (1,939) | | | (3,223) | | | (3,836) | |

| Net cash provided by (used in) financing activities | (1,721) | | | (2,939) | | | 33,620 | | | (32,136) | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | 129 | | | 2,115 | | | (365) | | | 1,967 | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | 18,011 | | | (45,617) | | | 38,816 | | | (160,295) | |

Cash, cash equivalents and restricted cash, beginning of period (1) | 188,443 | | | 167,018 | | | 167,638 | | | 281,696 | |

Cash, cash equivalents and restricted cash, end of period (1) | $ | 206,454 | | | $ | 121,401 | | | $ | 206,454 | | | $ | 121,401 | |

(1)The following table provides a reconciliation of Cash, cash equivalents and restricted cash shown above to amounts reported within the Condensed Consolidated Balance Sheets as of June 30, 2024, December 31, 2023, June 30, 2023 and December 31, 2022 (in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| June 30, 2024 | | December 31, 2023 | | June 30, 2023 | | December 31, 2022 |

| Cash and cash equivalents | $ | 178,089 | | | $ | 141,563 | | | $ | 118,145 | | | $ | 281,279 | |

| Restricted cash included in prepaid expenses and other current assets | 28,365 | | | 26,075 | | | 3,256 | | | 417 | |

| Cash, cash equivalents and restricted cash | $ | 206,454 | | | $ | 167,638 | | | $ | 121,401 | | | $ | 281,696 | |

Groupon, Inc.

Supplemental Financial and Operating Metrics

(dollars and units in thousands; TTM active customers in millions)

(unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Q2 2023 | | Q3 2023 | | Q4 2023 | | Q1 2024 | | Q2 2024 | | | | | | | |

| North America Segment: | | | | | | | | | | | Q2 2024 | | | | | |

Gross billings (1): | | | | | | | | | | | Y/Y Growth | | | | | |

| Local | $ | 231,950 | | | $ | 260,425 | | | $ | 257,192 | | | $ | 231,053 | | | $ | 243,587 | | | 5.0 | % | | | | |

| Travel | 21,630 | | | 19,811 | | | 18,856 | | | 26,911 | | | 21,881 | | | 1.2 | | | | | |

| Goods | 22,256 | | | 18,749 | | | 24,223 | | | 14,968 | | | 13,501 | | | (39.3) | | | | | |

| Total gross billings | $ | 275,836 | | | $ | 298,985 | | | $ | 300,271 | | | $ | 272,932 | | | $ | 278,969 | | | 1.1 | % | | | | |

| Revenue: | | | | | | | | | | | | | | | | |

| Local | $ | 85,475 | | | $ | 88,558 | | | $ | 91,550 | | | $ | 86,460 | | | $ | 91,707 | | | 7.3 | % | | | | |

| Travel | 5,579 | | | 2,577 | | | 3,583 | | | 4,596 | | | 3,858 | | | (30.8) | | | | | |

| Goods | 4,780 | | | 3,801 | | | 4,790 | | | 3,078 | | | 2,792 | | | (41.6) | | | | | |

| Total revenue | $ | 95,834 | | | $ | 94,936 | | | $ | 99,923 | | | $ | 94,134 | | | $ | 98,357 | | | 2.6 | % | | | | |

| Gross profit: | | | | | | | | | | | | | | | | |

| Local | $ | 74,463 | | | $ | 77,588 | | | $ | 80,720 | | | $ | 77,826 | | | $ | 83,259 | | | 11.8 | % | | | | |

| Travel | 4,647 | | | 1,763 | | | 2,830 | | | 3,640 | | | 3,191 | | | (31.3) | | | | | |

| Goods | 3,983 | | | 3,123 | | | 3,934 | | | 2,662 | | | 2,429 | | | (39.0) | | | | | |

| Total gross profit | $ | 83,093 | | | $ | 82,474 | | | $ | 87,484 | | | $ | 84,128 | | | $ | 88,879 | | | 7.0 | % | | | | |

| | | | | | | | | | | | | | | | | |

Contribution profit (2) | $ | 68,646 | | | $ | 63,484 | | | $ | 63,046 | | | $ | 62,346 | | | $ | 59,402 | | | (13.5) | % | | | | |

| | | | | | | | | | | | | | | | |

| International Segment: | | | | | | | | | | | Q2 2024 | |

| Gross billings: | | | | | | | | | | | Y/Y Growth | | FX Effect | | Y/Y Growth excluding FX (3) | |

| Local | $ | 87,688 | | | $ | 93,645 | | | $ | 105,664 | | | $ | 85,033 | | | $ | 72,932 | | | (16.8) | | 0.1 | | (16.7) | % |

| Travel | 9,934 | | | 9,294 | | | 9,510 | | | 8,700 | | | 7,284 | | | (26.7) | | 0.9 | | (25.8) | |

| Goods | 20,000 | | | 16,923 | | | 20,883 | | | 14,481 | | | 14,422 | | | (27.9) | | 0.8 | | (27.1) | |

| Total gross billings | $ | 117,622 | | | $ | 119,862 | | | $ | 136,057 | | | $ | 108,214 | | | $ | 94,638 | | | (19.5) | | 0.2 | | (19.3) | % |

| Revenue: | | | | | | | | | | | | | | | | |

| Local | $ | 27,374 | | | $ | 26,900 | | | $ | 32,004 | | | $ | 24,750 | | | $ | 22,401 | | | (18.2) | | 0.2 | | (18.0) | % |

| Travel | 2,172 | | | 1,584 | | | 1,857 | | | 1,755 | | | 1,588 | | | (26.9) | | 0.8 | | (26.1) | |

| Goods | 3,729 | | | 3,054 | | | 3,932 | | | 2,445 | | | 2,269 | | | (39.2) | | 0.7 | | (38.5) | |

| Total revenue | $ | 33,275 | | | $ | 31,538 | | | $ | 37,793 | | | $ | 28,950 | | | $ | 26,258 | | | (21.1) | | 0.3 | | (20.8) | % |

| Gross profit: | | | | | | | | | | | | | | | | |

| Local | $ | 24,959 | | | $ | 24,367 | | | $ | 29,672 | | | $ | 22,832 | | | $ | 20,522 | | | (17.8) | | 0.2 | | (17.6) | % |

| Travel | 1,916 | | | 1,346 | | | 1,644 | | | 1,559 | | | 1,407 | | | (26.6) | | 0.9 | | (25.7) | |

| Goods | 2,997 | | | 2,491 | | | 3,510 | | | 2,038 | | | 1,859 | | | (38.0) | | 0.7 | | (37.3) | |

| Total gross profit | $ | 29,872 | | | $ | 28,204 | | | $ | 34,826 | | | $ | 26,429 | | | $ | 23,788 | | | (20.4) | | 0.3 | | (20.1) | % |

| | | | | | | | | | | | | | | | | |

| Contribution profit | $ | 22,052 | | | $ | 18,296 | | | $ | 24,772 | | | $ | 19,402 | | | $ | 16,745 | | | (24.1) | % | | | | |

| | | | | | | | | | | | | | | | |

| Consolidated Results of Operations: | | | | | | | | | | | | | | | | |

| Gross billings: | | | | | | | | | | | | | | | | |

| Local | $ | 319,638 | | | $ | 354,070 | | | $ | 362,856 | | | $ | 316,086 | | | $ | 316,519 | | | (1.0) | | — | | (1.0) | % |

| Travel | 31,564 | | | 29,105 | | | 28,366 | | | 35,611 | | | 29,165 | | | (7.6) | | 0.2 | | (7.4) | |

| Goods | 42,256 | | | 35,672 | | | 45,106 | | | 29,449 | | | 27,923 | | | (33.9) | | 0.3 | | (33.6) | |

| Total gross billings | $ | 393,458 | | | $ | 418,847 | | | $ | 436,328 | | | $ | 381,146 | | | $ | 373,607 | | | (5.0) | | — | | (5.0) | % |

| Revenue: | | | | | | | | | | | | | | | | |

| Local | $ | 112,849 | | | $ | 115,458 | | | $ | 123,554 | | | $ | 111,210 | | | $ | 114,108 | | | 1.1 | | 0.1 | | 1.2 | % |

| Travel | 7,751 | | | 4,161 | | | 5,440 | | | 6,351 | | | 5,446 | | | (29.7) | | 0.2 | | (29.5) | |

| Goods | 8,509 | | | 6,855 | | | 8,722 | | | 5,523 | | | 5,061 | | | (40.5) | | 0.3 | | (40.2) | |

| Total revenue | $ | 129,109 | | | $ | 126,474 | | | $ | 137,716 | | | $ | 123,084 | | | $ | 124,615 | | | (3.5) | | 0.1 | | (3.4) | % |

| Gross profit: | | | | | | | | | | | | | | | | |

| Local | $ | 99,422 | | | $ | 101,955 | | | $ | 110,392 | | | $ | 100,658 | | | $ | 103,781 | | | 4.4 | | — | | 4.4 | % |

| Travel | 6,563 | | | 3,109 | | | 4,474 | | | 5,199 | | | 4,598 | | | (29.9) | | 0.2 | | (29.7) | |

| Goods | 6,980 | | | 5,614 | | | 7,444 | | | 4,700 | | | 4,288 | | | (38.6) | | 0.3 | | (38.3) | |

| Total gross profit | $ | 112,965 | | | $ | 110,678 | | | $ | 122,310 | | | $ | 110,557 | | | $ | 112,667 | | | (0.3) | | 0.1 | | (0.2) | % |

| | | | | | | | | | | | | | | | | |

| Contribution profit | $ | 90,698 | | | $ | 81,780 | | | $ | 87,818 | | | $ | 81,748 | | | $ | 76,147 | | | (16.0) | % | | | | |

| Net cash provided by (used in) operating activities | $ | (42,310) | | | $ | (13,855) | | | $ | 54,500 | | | $ | (10,111) | | | $ | 15,300 | | | 136.2 | % | | | | |

| Free cash flow | $ | (44,563) | | | $ | (17,975) | | | $ | 51,132 | | | $ | (13,820) | | | $ | 10,826 | | | 124.3 | % | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Q2 2023 | | Q3 2023 | | Q4 2023 | | Q1 2024 | | Q2 2024 |

Active customers: (4) | | | | | | | | | |

| North America | 10.6 | | 10.4 | | 10.3 | | 10.2 | | 10.2 | |

| International | 6.9 | | 6.6 | | 6.2 | | 5.9 | | 5.6 | |

| Total active customers | 17.5 | | 17.0 | | 16.5 | | 16.1 | | 15.8 | |

| | | | | | | | | | |

| North America Units: | | | | | | | | | |

| Local | 5,083 | | | 5,426 | | | 5,832 | | | 5,102 | | | 5,308 | |

| Goods | 807 | | | 706 | | | 966 | | | 574 | | | 487 | |

| Travel | 84 | | | 79 | | | 85 | | | 108 | | | 87 | |

| Total North America units | 5,974 | | | 6,211 | | | 6,883 | | | 5,784 | | | 5,882 | |

| | | | | | | | | | |

| International Units: | | | | | | | | | |

| Local | 2,862 | | | 3,306 | | | 3,536 | | | 2,888 | | | 2,259 | |

| Goods | 746 | | | 550 | | | 684 | | | 404 | | | 381 | |

| Travel | 53 | | | 49 | | | 55 | | | 49 | | | 39 | |

| Total International units | 3,661 | | | 3,905 | | | 4,275 | | | 3,341 | | | 2,679 | |

| | | | | | | | | | |

| Consolidated Units: | | | | | | | | | |

| Local | 7,945 | | | 8,732 | | | 9,368 | | | 7,990 | | | 7,567 | |

| Goods | 1,553 | | | 1,256 | | | 1,650 | | | 978 | | | 868 | |

| Travel | 137 | | | 128 | | | 140 | | | 157 | | | 126 | |

| Total consolidated units | 9,635 | | | 10,116 | | | 11,158 | | | 9,125 | | | 8,561 | |

| | | | | | | | | | |

| Headcount: | | | | | | | | | |

| Sales (5) | 706 | | | 659 | | | 655 | | | 647 | | | 657 | |

| Other | 1,945 | | | 1,763 | | | 1,558 | | | 1,431 | | | 1,403 | |

| Total headcount | 2,651 | | | 2,422 | | | 2,213 | | | 2,078 | | | 2,060 | |

(1)Represents the total dollar value of customer purchases of goods and services.

(2)Represents gross profit less marketing expense.

(3)Represents the change in financial measures that would have resulted had average exchange rates in the reporting periods been the same as those in effect in the prior year periods.

(4)Reflects the total number of unique user accounts that have made a purchase during the TTM either through one of our online marketplaces or directly with a merchant for which we earned a commission.

(5)Includes merchant sales representatives, as well as sales support personnel.

Groupon, Inc.

Non-GAAP Reconciliation Schedules

(in thousands, except share and per share amounts)

(unaudited)

The following is a quarterly reconciliation of Adjusted EBITDA to the most comparable U.S. GAAP performance measure, Net income (loss):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Q2 2023 | | Q3 2023 | | Q4 2023 | | Q1 2024 | | Q2 2024 |

| Net income (loss) | | $ | (12,004) | | | $ | (40,806) | | | $ | 28,489 | | | $ | (11,506) | | | $ | (9,412) | |

| Adjustments: | | | | | | | | | | |

| Stock-based compensation | | 7,519 | | | 3,889 | | | 710 | | | 2,374 | | | 6,418 | |

| Depreciation and amortization | | 13,243 | | | 12,568 | | | 10,902 | | | 9,677 | | | 7,824 | |

| | | | | | | | | | |

| | | | | | | | | | |

Restructuring and related charges (credits) (1) | | (689) | | | 2,228 | | | (2,327) | | | 96 | | | (379) | |

Gain on sale of assets | | — | | | — | | | — | | | (116) | | | (5,044) | |

Foreign VAT assessments (2) | | — | | | — | | | — | | | — | | | 3,302 | |

Other (income) expense, net (3) | | 4,805 | | | 39,525 | | | (16,086) | | | 12,682 | | | 4,483 | |

| Provision (benefit) for income taxes | | 2,323 | | | 817 | | | 5,250 | | | 6,194 | | | 9,287 | |

| Total adjustments | | 27,201 | | | 59,027 | | | (1,551) | | | 30,907 | | | 25,891 | |

| Adjusted EBITDA | | $ | 15,197 | | | $ | 18,221 | | | $ | 26,938 | | | $ | 19,401 | | | $ | 16,479 | |

(1)Includes a settlement of $4.25 million related to Uptake for the three months ended December 31, 2023

(2)The Foreign VAT assessments adjustment excludes related interest expense of $0.8 million as the interest expense is included within Other (income) expense, net for the three months ended June 30, 2024.

(3)Includes a $25.8 million remeasurement of our investment in SumUp during the three months ended September 30, 2023.

The following is a reconciliation of Non-GAAP net income (loss) attributable to common stockholders to Net income (loss) attributable to common stockholders and a reconciliation of Non-GAAP net income (loss) per share to Diluted net income (loss) per share for the three and six months ended June 30, 2024 and 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, | | |

| 2024 | | 2023 | | 2024 | | 2023 | | | | |

| Net income (loss) attributable to common stockholders | $ | (10,035) | | | $ | (12,607) | | | $ | (22,306) | | | $ | (41,754) | | | | | |

| Less: Net income (loss) attributable to noncontrolling interest | (623) | | | (603) | | | (1,388) | | | (1,137) | | | | | |

| Net income (loss) | (9,412) | | | (12,004) | | | (20,918) | | | (40,617) | | | | | |

| Less: Provision (benefit) for income taxes | 9,287 | | | 2,323 | | | 15,481 | | | 3,441 | | | | | |

| Income (loss) before provision (benefit) for income taxes | (125) | | | (9,681) | | | (5,437) | | | (37,176) | | | | | |

| Stock-based compensation | 6,418 | | | 7,519 | | | 8,792 | | | 9,882 | | | | | |

| Amortization of acquired intangible assets | 600 | | | 2,070 | | | 2,206 | | | 4,188 | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Restructuring and related charges (credits) | (379) | | | (689) | | | (283) | | | 8,105 | | | | | |

| | | | | | | | | | | |

Gain on sale of assets | (5,044) | | | — | | | (5,160) | | | — | | | | | |

Foreign VAT assessments | 4,092 | | | — | | | 4,092 | | | — | | | | | |

| Intercompany foreign currency losses (gains), foreign currency translation adjustments reclassified into earnings and other | 4,084 | | | 3,859 | | | 16,071 | | | (673) | | | | | |

| Non-cash interest expense on convertible senior notes | 393 | | | 386 | | | 784 | | | 770 | | | | | |

| Non-GAAP income (loss) before provision (benefit) for income taxes | 10,039 | | | 3,464 | | | 21,065 | | | (14,904) | | | | | |

| Less: Non-GAAP provision (benefit) for income taxes | 10,023 | | | 5,965 | | | 17,882 | | | 6,942 | | | | | |

| Non-GAAP net income (loss) | 16 | | | (2,501) | | | 3,183 | | | (21,846) | | | | | |

| Net (income) loss attributable to noncontrolling interest | (623) | | | (603) | | | (1,388) | | | (1,137) | | | | | |

| Non-GAAP net income (loss) attributable to common stockholders | (607) | | | (3,104) | | | 1,795 | | | (22,983) | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Weighted-average shares of Common Stock - diluted | 39,430,656 | | | 31,020,493 | | | 38,570,401 | | | 30,796,943 | | | | | |

| Impact of dilutive securities | — | | | — | | | 2,560,919 | | | — | | | | | |

Weighted-average shares of Common Stock - non-GAAP | 39,430,656 | | | 31,020,493 | | | 41,131,320 | | | 30,796,943 | | | | | |

| | | | | | | | | | | |

| Diluted net income (loss) per share | $ | (0.25) | | | $ | (0.41) | | | $ | (0.58) | | | $ | (1.36) | | | | | |

| Impact of non-GAAP adjustments and related tax effects | 0.23 | | | 0.31 | | | 0.62 | | | 0.61 | | | | | |

| Non-GAAP diluted net income (loss) per share | $ | (0.02) | | | $ | (0.10) | | | $ | 0.04 | | | $ | (0.75) | | | | | |

Free cash flow is a non-GAAP liquidity measure. The following is a reconciliation of free cash flow to the most comparable U.S. GAAP liquidity measure, Net cash provided by (used in) operating activities.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q2 2023 | | Q3 2023 | | Q4 2023 | | Q1 2024 | | Q2 2024 |

| Net cash provided by (used in) operating activities | $ | (42,310) | | | $ | (13,855) | | | $ | 54,500 | | | $ | (10,111) | | | $ | 15,300 | |

| Purchases of property and equipment and capitalized software | (2,253) | | | (4,120) | | | (3,368) | | | (3,709) | | | (4,474) | |

| Free cash flow | $ | (44,563) | | | $ | (17,975) | | | $ | 51,132 | | | $ | (13,820) | | | $ | 10,826 | |

| | | | | | | | | |

| Net cash provided by (used in) investing activities | $ | (2,483) | | | $ | (5,469) | | | $ | 15,568 | | | $ | (3,931) | | | $ | 4,303 | |

| Net cash provided by (used in) financing activities | $ | (2,939) | | | $ | 1,183 | | | $ | (4,737) | | | $ | 35,341 | | | $ | (1,721) | |

v3.24.2

Cover

|

Jul. 30, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 30, 2024

|

| Entity File Number |

1-35335

|

| Entity Registrant Name |

Groupon, Inc.

|

| Entity Tax Identification Number |

27-0903295

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Postal Zip Code |

60601

|

| Entity Address, Address Line One |

35 West Wacker Drive

|

| Entity Address, Address Line Two |

25th Floor

|

| Entity Address, City or Town |

Chicago

|

| City Area Code |

(773)

|

| Entity Address, State or Province |

IL

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.0001 per share

|

| Trading Symbol |

GRPN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001490281

|

| Amendment Flag |

false

|

| Extension |

945-6801

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

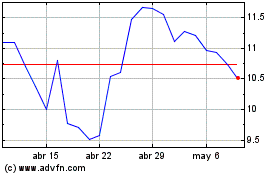

Groupon (NASDAQ:GRPN)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Groupon (NASDAQ:GRPN)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024