0000046080false00000460802023-12-092023-12-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 9, 2023

Hasbro, Inc.

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

Rhode Island | 1-6682 | 05-0155090 | |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) | |

| |

1027 Newport Avenue | Pawtucket, | Rhode Island | 02861 | |

(Address of Principal Executive Offices) | | (Zip Code) | |

Registrant’s telephone number, including area code: (401) 431-8697

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act. | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.50 par value per share | HAS | The NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.05. Costs Associated With Exit or Disposal Activities.

In October 2022, following a strategic review, Hasbro, Inc. (the “Company” or “Hasbro”) announced an Operational Excellence Program (the “Operational Excellence Program"), an ongoing enterprise-wide initiative intended to improve our business through specialized organizational programs that include targeted cost-savings, supply chain transformation and certain other restructuring actions designed to drive growth and enhance shareholder value. As part of this program, in January 2023, the Company announced the intention to eliminate approximately 1,000 positions from its global workforce, or approximately 15% of global full-time employees (“Initial Actions”).

On December 11, 2023, following a further review of the Company’s cost structure and organizational design, the Company announced additional strategic steps to position the business for future growth, including a revised organizational structure whereby certain corporate functions are anticipated to be supported by a third-party outsourcing provider as well as additional headcount reductions under the Operational Excellence Program. The Company’s organizational structure changes will result in the reallocation of people and resources, which will include voluntary early retirement for certain groups of employees and additional involuntary reductions in employees (“Additional Actions”). The Company currently anticipates that approximately 900 incremental positions will be eliminated as part of the Additional Actions, which are expected to be substantially completed over the next 18 to 24 months.

In connection with the Initial Actions, the Company accrued approximately $94 million of expenses related to severance, stock compensation and employee benefits, and expects to accrue approximately $40 million of incremental severance related expenses in connection with the Additional Actions. The Company expects that the cash payments related to the Additional Actions will begin in the fourth quarter of 2023 and continue through the next 18 to 24 months.

The Additional Actions are expected to deliver gross annual run-rate cost savings of approximately $100 million. As a result, under the Company’s Operational Excellence Program, the Company now expects to deliver gross annual run-rate cost savings of approximately $350 million to $400 million by the end of 2025 which is increased from the previous estimate of $250 million to $300 million. The foregoing amounts are estimates. Actual amounts may vary based on a number of factors, including, but not limited to, the number of employees who are impacted through both the voluntary and involuntary workforce reductions.

Cautionary Note on Forward-Looking Statements

This report contains estimates and forward-looking statements, including statements regarding the anticipated expenses, cost savings, and timing and size of the workforce reduction. These estimates and forward-looking statements are based on the Company’s current expectations and estimates of future events and trends, which affect or may affect the Company’s businesses and operations. Our actual actions or results may differ materially from those expected or anticipated in the forward-looking statements due to both known and unknown risks and uncertainties. Factors that might cause such a difference include but are not limited to: any delays in the implementation of the actions, fluctuations in the number of employees impacted, failure of our outsourcing partner to perform as expected, and other risks and uncertainties as may be detailed from time to time in our public announcements and SEC filings. The statements contained herein are based on our current beliefs and expectations. We undertake no obligation to make any revisions to the forward-looking statements contained in this report or to update them to reflect events or circumstances occurring after the date of this report.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

99.1 | |

104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | | | | | | | | |

| | |

HASBRO, INC. |

| | |

|

| | By: | /s/ Gina Goetter |

| | Name: | Gina Geotter |

| | Title: | Executive Vice President and Chief Financial Officer

(Duly Authorized Officer and Principal Financial Officer) |

| Date: December 11, 2023 | | |

EXHIBIT 99.1

To: All Company

From: Corp Comms

Date: 12/11 at 4:30 pm ET

Subject: An Update on Our Business

Team,

A year ago, we laid out our strategy to focus on building fewer, bigger, better brands and began the process of transforming Hasbro. Since then, we've had some important wins, like retooling our supply chain, improving our inventory position, lowering costs, and reinvesting over $200M back into the business while growing share across many of our categories. But the market headwinds we anticipated have proven to be stronger and more persistent than planned. While we’re confident in the future of Hasbro, the current environment demands that we do more, even if these choices are some of the hardest we have to make.

Today we’re announcing additional headcount reductions as part of our previously communicated strategic transformation, affecting approximately 1,100 colleagues globally in addition to the roughly 800 reductions already taken.

Our leadership team came to this difficult decision after much deliberation. We recognize this is heavy news that affects the livelihoods of our friends and colleagues. Our focus is communicating with each of you transparently and supporting you through this period of change. I want to start by addressing why we are doing this now, and what’s next.

Why now?

We entered 2023 expecting a year of change including significant updates to our leadership team, structure, and scope of operations. We anticipated the first three quarters to be challenging, particularly in Toys, where the market is coming off historic, pandemic-driven highs. While we have made some important progress across our organization, the headwinds we saw through the first nine months of the year have continued into Holiday and are likely to persist into 2024.

To position Hasbro for growth, we must first make sure our foundation is solid and profitable. To do that, we need to modernize our organization and get even leaner. While we see workforce reductions as a last resort, given the state of our business, it’s a lever we must pull to keep Hasbro healthy.

What happens next?

While we’re making changes across the entire organization, some functional areas will be affected more than others. Many of those whose roles are affected have been or will be informed in the next 24 hours, although the timings will vary by country, in line with local rules and subject to employee consultations where required. This includes team members who have raised their hands to step down from their roles at the end of the year as part of our Voluntary Early Retirement Program (VRP) in the U.S. We’re immensely grateful to these colleagues for their many years of dedication, and we wish them all the best.

The majority of the notifications will happen over the next six months, with the balance occurring over the next year as we tackle the remaining work on our organizational model. This includes standardizing processes within Finance, HR, IT and Consumer Care as part of our Global Business Enablement project, but it also means doing more work across the entire business to minimize management layers and create a nimbler organization.

What else are we doing?

I know this news is especially difficult during the holiday season. We value each of our team members – they aren’t just employees, they’re friends and colleagues. We decided to communicate now so people have time to plan and process the changes. For those employees affected we are offering comprehensive packages including job placement support to assist in their transition.

We’ve also done what we can to minimize the scale of impact, like launching the VRP and exploring options to reduce our global real estate footprint. On that note, our Providence, Rhode Island office is currently not being used to its full capacity and we’ve decided to exit the space at the end of the lease term in January 2025. Over the next year, we’ll welcome teams from our Providence office to our headquarters down the road in Pawtucket, Rhode Island. It’s an opportunity to reshape how we work and ensure our workspace is vibrant and productive, while reflecting our more flexible in-person cadence since the pandemic.

Looking ahead

As Gina often says, cost-cutting is not a strategy. We know this, and that’s why we’ll continue to grow and invest in several areas in 2024.

As we uncover more cost savings, we'll invest in new systems, insights and analytics, product development and digital – all while strengthening our leading franchises and ensuring our brands have the essential marketing they need to thrive well into the future.

We’ll also tap into unlocked potential across our business, like our new supply chain efficiency, our direct-to-consumer capabilities, and key partnerships to maximize licensing opportunities, scale entertainment, and free up our own content dollars to drive new brand development.

I know there is no sugar-coating how hard this is, particularly for the employees directly affected. We're grateful to them for their contributions, and we wish them all the best. In the coming weeks, let's support each other, and lean in to drive through these necessary changes, so we can return our business to growth and carry out Hasbro’s mission.

Thanks,

Chris

v3.23.3

Cover

|

Dec. 09, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Dec. 09, 2023

|

| Entity Registrant Name |

Hasbro, Inc.

|

| Entity Central Index Key |

0000046080

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

RI

|

| Entity File Number |

1-6682

|

| Entity Tax Identification Number |

05-0155090

|

| Entity Address, Address Line One |

1027 Newport Avenue

|

| Entity Address, City or Town |

Pawtucket,

|

| Entity Address, State or Province |

RI

|

| Entity Address, Postal Zip Code |

02861

|

| City Area Code |

401

|

| Local Phone Number |

431-8697

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.50 par value per share

|

| Trading Symbol |

HAS

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

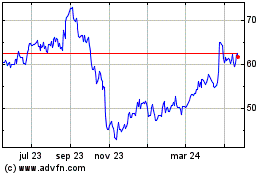

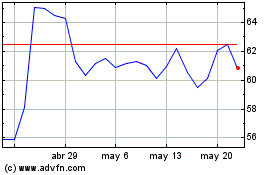

Hasbro (NASDAQ:HAS)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Hasbro (NASDAQ:HAS)

Gráfica de Acción Histórica

De May 2023 a May 2024