Form 8-K - Current report

09 Septiembre 2024 - 5:03AM

Edgar (US Regulatory)

0000049196false00000491962024-09-092024-09-090000049196us-gaap:SeriesHPreferredStockMember2024-09-092024-09-090000049196hban:SeriesIPreferredStockMember2024-09-092024-09-090000049196hban:SeriesJPreferredStockMember2024-09-092024-09-090000049196us-gaap:CommonStockMember2024-09-092024-09-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________________________________________________________________________________________________

FORM 8-K

_______________________________________________________________________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) September 9, 2024

______________________________________________________________________________________________________________________________

Huntington Bancshares Incorporated

(Exact name of registrant as specified in its charter)

_______________________________________________________________________________________________________________________________

| | | | | | | | |

| Maryland | 1-34073 | 31-0724920 |

(State or other jurisdiction of

incorporation or organization) | (Commission

File Number) | (I.R.S. Employer

Identification No.) |

Registrant's address: 41 South High Street, Columbus, Ohio 43287

Registrant’s telephone number, including area code: (614) 480-2265

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

_______________________________________________________________________________________________________________________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of class | Trading

Symbol(s) | Name of exchange on which registered |

| Depositary Shares (each representing a 1/40th interest in a share of 4.500% Series H Non-Cumulative, perpetual preferred stock) | HBANP | NASDAQ |

| Depositary Shares (each representing a 1/1000th interest in a share of 5.70% Series I Non-Cumulative, perpetual preferred stock) | HBANM | NASDAQ |

| Depositary Shares (each representing a 1/40th interest in a share of 6.875% Series J Non-Cumulative, perpetual preferred stock) | HBANL | NASDAQ |

| Common Stock—Par Value $0.01 per Share | HBAN | NASDAQ |

| | |

| | | | | | | | | | | | | | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (§24012b-2). |

| | | | | |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

Item 7.01 Regulation FD Disclosure.

As previously announced, Huntington Bancshares Incorporated ("Huntington") will be participating at the 2024 Barclays Global Financial Services Conference on Monday, September 9, 2024. Zach Wasserman, Chief Financial Officer, and Brant Standridge, President of Consumer and Regional Banking, are scheduled to present to analysts and investors. A copy of the presentation slides is attached hereto as Exhibit 99.1 and is incorporated herein by reference. The presentation slides will also be available in the Investor Relations section of Huntington’s web site at www.huntington.com.

The presentation slides are being furnished pursuant to Item 7.01, and the information contained therein shall not be deemed "filed" for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that section. Furthermore, the information contained in Exhibit 99.1 shall not be deemed to be incorporated by reference in any filing under the Securities Act of 1933, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

The exhibits referenced below shall be treated as “furnished” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended.

(d) Exhibits.

Exhibit 99.1 – Presentation Slides

EXHIBIT INDEX

| | | | | |

| Exhibit No. | Description |

| |

| |

| Exhibit 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | | HUNTINGTON BANCSHARES INCORPORATED |

| | | |

| Date: | September 9, 2024 | | By: | | /s/ Zachary Wasserman |

| | | |

| | | | | Zachary Wasserman |

| | | | | Chief Financial Officer |

2024 Barclays Global Financial Services Conference Welcome.® 2024 Barclays Global Financial Services Conference September 9, 2024 The Huntington National Bank is Member FDIC. ®, Huntington® and Huntington. Welcome.® are federally registered service marks of Huntington Bancshares Incorporated. ©2024 Huntington Bancshares Incorporated.

2024 Barclays Global Financial Services Conference Disclaimer 2 CAUTION REGARDING FORWARD-LOOKING STATEMENTS The information contained or incorporated by reference in this presentation contains certain forward-looking statements, including, but not limited to, certain plans, expectations, goals, projections, and statements, which are not historical facts and are subject to numerous assumptions, risks, and uncertainties. Statements that do not describe historical or current facts, including statements about beliefs and expectations, are forward-looking statements. Forward-looking statements may be identified by words such as expect, anticipate, believe, intend, estimate, plan, target, goal, or similar expressions, or future or conditional verbs such as will, may, might, should, would, could, or similar variations. The forward-looking statements are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995. While there is no assurance that any list of risks and uncertainties or risk factors is complete, below are certain factors which could cause actual results to differ materially from those contained or implied in the forward-looking statements: changes in general economic, political, or industry conditions; deterioration in business and economic conditions, including persistent inflation, supply chain issues or labor shortages, instability in global economic conditions and geopolitical matters, as well as volatility in financial markets; the impact of pandemics and other catastrophic events or disasters on the global economy and financial market conditions and our business, results of operations, and financial condition; the impacts related to or resulting from bank failures and other volatility, including potential increased regulatory requirements and costs, such as FDIC special assessments, long-term debt requirements and heightened capital requirements, and potential impacts to macroeconomic conditions, which could affect the ability of depository institutions, including us, to attract and retain depositors and to borrow or raise capital; unexpected outflows of uninsured deposits which may require us to sell investment securities at a loss; changing interest rates which could negatively impact the value of our portfolio of investment securities; the loss of value of our investment portfolio which could negatively impact market perceptions of us and could lead to deposit withdrawals; the effects of social media on market perceptions of us and banks generally; cybersecurity risks; uncertainty in U.S. fiscal and monetary policy, including the interest rate policies of the Federal Reserve; volatility and disruptions in global capital and credit markets; movements in interest rates; competitive pressures on product pricing and services; success, impact, and timing of our business strategies, including market acceptance of any new products or services including those implementing our “Fair Play” banking philosophy; the nature, extent, timing, and results of governmental actions, examinations, reviews, reforms, regulations, and interpretations, including those related to the Dodd-Frank Wall Street Reform and Consumer Protection Act and the Basel III regulatory capital reforms, as well as those involving the OCC, Federal Reserve, FDIC, and CFPB; and other factors that may affect the future results of Huntington. Additional factors that could cause results to differ materially from those described above can be found in Huntington’s Annual Report on Form 10-K for the year ended December 31, 2023 and Quarterly Report on Form 10-Q for the quarters ended March 31, 2024 and June 30, 2024, which are on file with the Securities and Exchange Commission (the “SEC”) and available in the “Investor Relations” section of Huntington’s websitehttp://www.huntington.com, under the heading “Publications and Filings” and in other documents Huntington files with the SEC. All forward-looking statements speak only as of the date they are made and are based on information available at that time. Huntington does not assume any obligation to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements were made or to reflect the occurrence of unanticipated events except as required by federal securities laws. As forward-looking statements involve significant risks and uncertainties; caution should be exercised against placing undue reliance on such statements.

2024 Barclays Global Financial Services Conference Huntington: A Purpose-Driven Company 3 OUR PURPOSE We make people’s lives better, help businesses thrive, and strengthen the communities we serve OUR VISION To be the leading People-First, Digitally Powered Bank Purpose and Vision Linked to Business Strategies Guided by Through-the-Cycle Aggregate Moderate-to-Low Risk Appetite

2024 Barclays Global Financial Services Conference Key Messages 4 Delivering high-quality loan and deposit growth, through performance in core businesses and new markets and verticals2 Leveraging success in the Carolinas and broadening initiative to include full franchise expansion in these attractive geographies 4 Leveraging position of strength to execute organic growth strategies, supported by robust liquidity and capital base 1 Driving net interest income higher, supported by expanding earnings assets, dynamic hedging strategies, and proactive down beta action plan3 Delivering expanded profitability throughout the year and into 20255

2024 Barclays Global Financial Services Conference +5.1% +0.1% 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 QTD Huntington Peer Median +2.5% -3.8% 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 QTD Huntington Peer Median Loans and Deposits | Balanced and Diversified Growth 5 +$2.2B 3Q QTD(1) $108.1 $112.5 2Q23 2Q24 Total EOP Loans Ex CRE +4.1% +$0.8B increase in average loans, including: -$0.4B decline in CRE balances -$0.8B seasonally lower Distrib. Finance balances +$1.1B higher C&I balances and other, including new geographies & verticals +$0.8B higher consumer balances, with auto, RV/Marine and residential mortgage higher QTD Continue to expect accelerated growth in Q4 vs Q3 3Q QTD(1): +$0.8B (Ex CRE: +$1.1B) Cumulative Average Growth Cumulative Average Growth Deposits Loans QTD Trends Through 8/31: Consumer primary bank relationship (PBR) growth 2% and business PBR of 4% YoY(2) Cumulative deposit growth of ~$9B+ since 1Q23 Core CML deposit growth of ~$3B 3Q QTD $90B of liquid money market and interest checking deposits Robust deposit growth enables down beta action Recent Trends Note: $ in billions unless otherwise noted See notes on slide 15

2024 Barclays Global Financial Services Conference $1,357 $1,379 $1,327 $1,300 $1,325 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 4Q25 3.11% 3.20% 3.07% 3.01% 2.99% Net… Net Interest Income | Driving Sequential Growth 6 Expect NII growth and maintaining FY24 guidance range Net Interest Margin Net Interest Income Net Interest Income (FTE) and Net Interest Margin (NIM) Taking Actions to Reduce Asset Sensitivity -4.2% -3.1% -2.5% 4 Q 21 1 Q 24 2 Q 24 3 Q 24 4 Q 24 M id 2 0 2 5 Drivers include: • Maturity of PF Swaps • Effective forward starting of RF Swaps • Ongoing Securities Mgmt -100bps 12Mo Ramp Executing Down Beta Action Plan Implementing lower acquisition rates and shifting acquisitions mix from time deposits to money market Shortening duration of time deposits Targeted rate reductions in select client segments Pre-funding loan growth adds deposit rate / volume optionality Achieved 53% cumulative down beta in 2000-04 rate cut cycle Positioned to dynamically implement contingent down beta actions according to rate reduction pace Expect ~40% reduction in asset sensitivity by 4Q24 and >50% by 2Q25 Note: $ in millions unless otherwise noted

2024 Barclays Global Financial Services Conference 1.70% 1.93% 1.96% 1.97% 1.97% 1.95% 1.51% 1.52% 1.56% 1.62% 1.66% 1.67% CECL Day 1 2Q23 3Q23 4Q23 1Q24 2Q24 HBAN Peer Median 0.16% 0.24% 0.31% 0.30% 0.29% 0.31% 0.35% 0.38% 0.40% 0.42% 2Q23 3Q23 4Q23 1Q24 2Q24 HBAN Peer Median Through the Cycle Target NCO Range (25 – 45bps) 7 Asset Quality and Reserve | Top Tier Credit Performance Net Charge-off Ratio(1) Allowance for Credit Losses (ACL) % of Loans(1) Robust Client Selection and Underwriting Consumer – 44% of total loans Prime, super-prime focus with ~770 weighted average FICO(2) Over 95% of book is secured (Residential Mortgage, Home Equity, Auto) Commercial – 56% of total loans Breadth of industry verticals and diverse geographic footprint supported by rigorous client selection CRE concentration is lowest quartile (9.6% of total loans) supported by highest quartile reserve (4.5%)(3) Well diversified by property type Multifamily: 3.7% of total loans Industrial: 1.6% of total loans Office: 1.4% of total loans Disciplined Credit Culture Supports Through the Cycle Outperformance Note: as of 2Q24 EOP unless otherwise noted See notes on slide 15

2024 Barclays Global Financial Services Conference 8 Disciplined Management Approach Leveraging robust liquidity to execute organic growth initiatives inclusive of new geographies and commercial verticals Delivering high-quality loan growth and expanding deposit balances Executing down-beta action plan Reducing asset sensitivity and maintaining NIM within a tight corridor Powering fee revenue growth across capital markets, payments, and wealth management Managing expense growth in line with prior guidance with a focus on creating ongoing efficiencies to self-fund investments Maintaining disciplined focus on credit through the cycle aligned with our aggregate moderate-to-low risk appetite Providing Comprehensive Strategy Update on February 6th, 2025 Investor Day

2024 Barclays Global Financial Services Conference Executing on New Growth Initiatives Commercial Specialty Verticals Regional Expansions Focus on full banking relationships, Commercial led expansion, #2 GDP ranking nationally(1), 8th largest global economy(2) Texas 9 Focus on full banking relationships, Commercial led expansion, #3 projected population growth(3), #5 GDP ranking nationally(4) Carolinas Summary of Recent Growth Initiatives Drive Deep Full Customer Relationships Inclusive of Loans, Deposits, and Fee Income Bolstered Fee Capabilities Launched Secured Credit Card In-House Merchant Acquiring Mortgage Servicing Deposits Fund Finance Healthcare ABL Native American Financial Services HOA, Title, & Escrow Deposits Mortgage Servicing Lending See notes on slide 15

2024 Barclays Global Financial Services Conference Commercial-led Expansion Successfully Executing Carolina Expansion Strategy 10 Driving Primary Banking Relationships Building on existing coverage of corporate and specialty banking Managing relationships locally and leveraging national expertise Focused on middle market, corporate and specialty banking, regional banking, SBA, and practice finance Full relationships with loans, deposits, capital markets, and payment revenues #1 State for Business(3) N. Carolina #3 Projected Population Growth(1) #2 SBA Lender N. Carolina(4) #5 GDP Ranking Nationally(2) #4 SBA Lender S. Carolina(4) Exceeding Strategic Plan Triad Charleston Upstate S.C. Charlotte Raleigh / Durham Staffed 5 regions with over 60 established bankers providing Commercial Banking, Regional Banking, and Treasury Management locally Over 120 new Regional and Middle Market Banking relationships added YTD 2024 exceeding business case expectations See notes on slide 15

2024 Barclays Global Financial Services Conference Detroit, #2 Minneapolis, #4 Denver, #20 Pittsburgh, #6 Cleveland, #2Cincinnati, #5 Charlotte Columbus, #1 Indianapolis, #5 Milwaukee, #18 The Triad Raleigh/Durham Upstate S.C. Grand Rapids, #1 Charleston Akron, #1 Columbia Dayton, #6 Boulder, #28 -0.5% 0.0% 0.5% 1.0% 1.5% - 20 40 60 80 100 120 Po pu la tio n C AG R 20 23 -2 02 9 Fo re ca st Deposit Market Size (Billions) Capitalizing on Carolina Growth Opportunity Sizeable deposit markets with outsized growth projections 11See notes on slide 15 $300$100$50 Six Carolina Regions feature an aggregate deposit market >$150B, population of 9.5M, and expected annual growth of 1.2% through 2029 Top 20 HBAN Regions by Deposit Market Size(1) Acquired Expansion Regions Carolina Expansion Markets Existing HBAN Regions Deposit Market Share Rank# Chicago, #12

2024 Barclays Global Financial Services Conference Expanding on National Franchise Middle Market Commercial and Specialty Treasury Management Payments Capital Markets Regional, SBA, & Practice Finance Commercial Focused Launch (4Q23) Expanding Full Huntington Franchise (2025+) Building Middle Market and SBA franchise with deep local expertise across 5 regions Deploying proven de novo playbook and bringing complete Huntington franchise to 6 Carolina regions Community Development 4 13 25 40 55 - 1 2 3 4 5 6 7 0 10 20 30 40 50 2025 2026 2027 2028 2029 Branch Count Deposit Growth $8B+ LT Deposit Opportunity Total branch investment and capex included within BAU investment capacity for 2025+ Wealth Management Incremental Regional Banking Incremental Commercial Banking Consumer Finance & Payments Local Branch Expansion Localized Marketing Supported by Infrastructure Leading With People Optimizing Performance Bringing the Full Huntington Franchise to the Carolinas 12

2024 Barclays Global Financial Services Conference 13 Environments that spotlight our value proposition with an immersive experience that invites customers to explore and tailored financial solutions Reimagine the role of the Banker to advise and guide customers through their individual journey Optimized Performance (15) 5 25 45 65 85 -1.00 0.00 1.00 2.00 3.00 4.00 5.00 6.00 Ye ar 1 Ye ar 2 Ye ar 3 Ye ar 4 Ye ar 5 Deposits Loans PPNR $0 Huntington’s proven de novo branch playbook reaches breakeven in 1-2 years Innovative Experience Proprietary models select for A+ locations with high traffic, visibility, convenience, and growth potential Aligning culture by localizing regional leadership Shared accountability among regional leadership on unique & localized business plan Localized marketing strategy targets customers within 10-mile radius Five de novo branches opened this year (in established markets) already secured loan & deposit balances at 6–12-month target levels upon open Localized marketing playbooks focus on goals by market – improving awareness and lifting markets to produce at scale Driving Toward 25% Unaided Awareness Executing Proven De Novo Branch Playbook

2024 Barclays Global Financial Services Conference Key Messages 14 Delivering high-quality loan and deposit growth, through performance in core businesses and new markets and verticals2 Leveraging success in the Carolinas and broadening initiative to include full franchise expansion in these attractive geographies 4 Leveraging position of strength to execute organic growth strategies, supported by robust liquidity and capital base 1 Driving net interest income higher, supported by expanding earnings assets, dynamic hedging strategies, and proactive down beta action plan3 Delivering expanded profitability throughout the year and into 20255

2024 Barclays Global Financial Services Conference Notes 15 Slide 5: (1) Average QTD growth as of 8/31/24 (2) As of 2Q24 Slide 7: (1) Source: Company Financials. Includes all peers: CMA, FITB, ZION, KEY, MTB, PNC, RF, TFC, CFG, and USB. (2) As of 2Q24 (3) Source: Company Second Quarter 2024 Form 10Q's. Includes publicly listed US-based banks with >$50 billion in assets as of 2Q24 if data was available for both the CRE concentration and CRE reserve ratio. Excludes BHC's primarily classified as card issuers or adjacent to a depository institution. CRE Concentration and CRE Reserves based on SEC financials where available. Slide 9: (1) Texas GDP contribution to total US economy in 3Q23. Source: U.S Bureau of Economic Analysis (2) Source: ‘Texas Economic Snapshot’ – Office of the Texas Governor website (3) Average projected population growth by number from 2024-2029. Source: S&P Global Market Intelligence (4) Combined North Carolina and South Carolina GDP contribution to total US economy in 3Q23. Source: U.S Bureau of Economic Analysis Slide 10: (1) Average projected population growth by number from 2024-2029. Source: S&P Global Market Intelligence (2) Combined North Carolina and South Carolina GDP contribution to total US economy in 3Q23. Source: U.S Bureau of Economic Analysis (3) Per CNBC 2022 & 2023 (4) By number (units) of 7(a) loans in 2023 Slide 11: (1) Source: S&P global; deposit market defined as total deposit market excluding deposits at branches with greater than $1B in deposits; Carolina expansion regions include the following MSAs, Charlotte: Charlotte-Concord-Gastonia; Raleigh: Raleigh-Cary + Durham-Chapel Hill; Upstate S.C: Greenville-Anderson-Greer + Spartanburg; The Triad: Greensboro-High Point & Winston-Salem

v3.24.2.u1

Cover Page

|

Sep. 09, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Sep. 09, 2024

|

| Entity Registrant Name |

Huntington Bancshares Incorporated

|

| Entity Central Index Key |

0000049196

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

1-34073

|

| Entity Tax Identification Number |

31-0724920

|

| Entity Address, Address Line One |

41 South High Street

|

| Entity Address, City or Town |

Columbus

|

| Entity Address, State or Province |

OH

|

| Entity Address, Postal Zip Code |

43287

|

| City Area Code |

614

|

| Local Phone Number |

480-2265

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Common Stock-Par Value $0.01 per share |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock—Par Value $0.01 per Share

|

| Trading Symbol |

HBAN

|

| Security Exchange Name |

NASDAQ

|

| Series H Preferred Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Depositary Shares (each representing a 1/40th interest in a share of 4.500% Series H Non-Cumulative, perpetual preferred stock)

|

| Trading Symbol |

HBANP

|

| Security Exchange Name |

NASDAQ

|

| Series I Preferred Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Depositary Shares (each representing a 1/1000th interest in a share of 5.70% Series I Non-Cumulative, perpetual preferred stock)

|

| Trading Symbol |

HBANM

|

| Security Exchange Name |

NASDAQ

|

| Series J preferred stock [Domain] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Depositary Shares (each representing a 1/40th interest in a share of 6.875% Series J Non-Cumulative, perpetual preferred stock)

|

| Trading Symbol |

HBANL

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesHPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=hban_SeriesIPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=hban_SeriesJPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

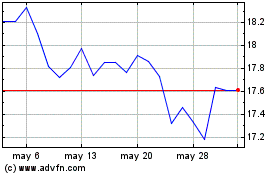

Huntington Bancshares (NASDAQ:HBANP)

Gráfica de Acción Histórica

De Sep 2024 a Oct 2024

Huntington Bancshares (NASDAQ:HBANP)

Gráfica de Acción Histórica

De Oct 2023 a Oct 2024