false000133960500013396052024-10-292024-10-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 29, 2024

H&E Equipment Services, Inc.

(Exact name of registrant as specified in its charter)

Commission File Number: 000-51759

|

|

|

Delaware |

|

81-0553291 |

(State or other jurisdiction of |

|

(IRS Employer |

incorporation) |

|

Identification No.) |

7500 Pecue Lane

Baton Rouge, LA 70809

(Address of principal executive offices, including zip code)

(225) 298-5200

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of Each Class |

Trading Symbol(s) |

Name of Each Exchange on Which Registered |

Common Stock, par value $0.01 per share |

HEES |

Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On October 29, 2024, we issued a press release announcing our financial results for the three month period ended September 30, 2024. A copy of the press release is attached as Exhibit 99.1 and is incorporated herein by reference.

The information in this Form 8-K and the attached exhibit shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

Exhibit 99.1 Press Release, dated October 29, 2024, announcing financial results for the three month period ended September 30, 2024.

Exhibit 104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

Date: October 29, 2024 |

By: |

/s/ Leslie S. Magee |

|

|

Leslie S. Magee |

|

|

Chief Financial Officer and Secretary |

Exhibit 99.1

News Release

Contacts:

Leslie S. Magee

Chief Financial Officer

225-298-5261

lmagee@he-equipment.com

Jeffrey L. Chastain

Vice President of Investor Relations

225-952-2308

jchastain@he-equipment.com

H&E Rentals Reports

Third Quarter 2024 Results

BATON ROUGE, La. -- (October 29, 2024) -- H&E Equipment Services, Inc. (NASDAQ: HEES) (“H&E”, the “Company”, d/b/a "H&E Rentals") today reported financial results for the third quarter ended September 30, 2024. The report includes the Company's branch expansion achievements, with the addition of eight new locations in the third quarter, expanding the Company's branch network to 157 locations across 32 states.

THIRD QUARTER 2024 SUMMARY WITH A COMPARISON TO THIRD QUARTER 2023

•Revenues declined 4.0% to $384.9 million compared to $400.7 million.

•Net income was $31.1 million compared to $48.9 million. The effective income tax rate was 28.3% compared to 26.1%.

•Adjusted EBITDA totaled $175.3 million, a decrease of 8.4% compared to $191.4 million. Adjusted EBITDA margins were 45.6% of revenues compared to 47.8%.

•Total equipment rental revenues were $326.2 million, an increase of $10.4 million, or 3.3%, compared to $315.8 million. Rental revenues were $288.1 million, an increase of $7.8 million, or 2.8%, compared to $280.3 million.

•Sales of rental equipment decreased 47.3% to $27.8 million compared to $52.7 million.

•Gross margin declined to 44.5% compared to 47.0%.

•Total equipment rental gross margins were 45.3% compared to 47.4%. Rental gross margins were 51.2% compared to 53.3%.

•Average time utilization (based on original equipment cost) was 67.6% compared to 70.0%. The Company’s rental fleet, based on original equipment cost, closed the third quarter of 2024 at slightly below $3.0 billion, an increase of $220.1 million, or 8.1%.

•Average rental rates declined 0.1% compared to the third quarter of 2023, and declined 0.6% compared to the second quarter of 2024.

•Dollar utilization was 39.4% compared to 41.5% in the third quarter of 2023 and 38.6% in the second quarter of 2024.

H&E Rentals Reports Third Quarter 2024 Results

Page 2

October 29, 2024

•Average rental fleet age on September 30, 2024, was 40.8 months compared to an industry average age of 47.9 months.

•Paid regular quarterly cash dividend of $0.275 per share of common stock.

“Industry fundamentals in the third quarter continued to trail year-ago measures,” said Brad Barber, chief executive officer of H&E Rentals. “Physical fleet utilization averaged 67.6%, or 240 basis points below the third quarter of 2023, evidence of the lower customer demand and a lingering modest oversupply of equipment. On a sequential quarterly basis, utilization improved 120 basis points. In addition, rental rates declined 0.1% compared to the prior-year quarter and were down 0.6% from the second quarter of 2024. Despite weakness in these key metrics, rental revenues grew 2.8% compared to the year-ago quarter due largely to the steady expansion of our branch count since the close of the third quarter of 2023. Finally, gross fleet expenditures in the quarter were $131.3 million, resulting in gross expenditures through the first nine months of 2024 of $327.8 million. We concluded the third quarter with a fleet original equipment cost of slightly below $3.0 billion."

Mr. Barber acknowledged the Company’s impressive expansion achievements, noting, “A record number of eight branches were added in the third quarter, while a ninth branch was opened in the month of October. The strong outcome reflected the outstanding execution of our accelerated new location program, which has achieved a record 16 additional locations in 2024, exceeding our stated expansion expectation. Our U.S. geographic coverage through September 30, 2024 improved to 157 locations across 32 states. When accounting for both new locations and branches added through acquisition, our branch count is up more than 14% in 2024 and approximately 54% since the close of 2021. Both measures are dominant accomplishments in our industry.”

With the final quarter of 2024 underway, Mr. Barber provided updated expectations for the rental equipment industry, stating, “Construction spending in the U.S. continues to demonstrate the slowing rate of growth observed over the first half of 2024. We believe a trend of moderating activity will persist through the remainder of the year, with physical fleet utilization and rental rates below year-ago measures. Beyond the fourth quarter, the developing outlook for our industry is more encouraging into 2025. The Dodge Momentum Index (DMI), a leading indicator of construction spending, has exhibited gains for five of the last six months, while construction employment remains on a steady upward trajectory. Also, a cycle of easing interest rates is expected to have positive implications for local construction activity as projects are reevaluated under more favorable lending conditions. Finally, the strong expansion of mega projects remains a significant driver of growth for our industry, both today and into the future. Our branch expansion has led to a greater and more diverse exposure to mega projects, including a growing presence on data centers, solar and wind farms and LNG export facilities.”

FINANCIAL DISCUSSION FOR THIRD QUARTER 2024

Revenue

Total revenues were $384.9 million in the third quarter, a decline of 4.0% compared to $400.7 million in the third quarter of 2023. Total equipment rental revenues of $326.2 million improved 3.3% compared to $315.8 million in the third quarter of 2023. Rental revenues of $288.1 million increased 2.8% compared to $280.3 million in the third quarter of 2023. Sales of rental equipment totaled $27.8 million, a decrease of 47.3% compared to $52.7 million in the third quarter of 2023.

H&E Rentals Reports Third Quarter 2024 Results

Page 3

October 29, 2024

Sales of new equipment of $14.1 million increased 11.2% compared to $12.6 million in the same quarter of 2023.

Gross Profit

Gross profit totaled $171.5 million in the third quarter of 2024, a decrease of 9.0% compared to $188.4 million in the third quarter of 2023. Gross margin declined to 44.5% for the third quarter of 2024 compared to 47.0% for the same quarter in 2023. On a segment basis, gross margin on total equipment rentals was 45.3% in the third quarter of 2024 compared to 47.4% in the third quarter of 2023. Rental margins were 51.2% compared to 53.3% over the same period of comparison. Rental rates in the third quarter of 2024 declined 0.1% compared to the third quarter of 2023. Time utilization (based on original equipment cost) was 67.6% in the third quarter of 2024 compared to 70.0% in the third quarter of 2023. Gross margins on sales of rental equipment improved to 60.2% in the third quarter of 2024 compared to 58.5% in third quarter of 2023. Gross margins on sales of new equipment were 19.8% in the third quarter of 2024 compared to 13.2% over the same period of comparison.

Rental Fleet

The original equipment cost of the Company’s rental fleet as of September 30, 2024, was slightly below $3.0 billion, representing an increase of $220.1 million, or 8.1%, compared to the end of the third quarter of 2023. Dollar utilization in the third quarter of 2024 was 39.4% compared to 41.5% in the third quarter of 2023.

Selling, General and Administrative Expenses

Selling, General, and Administrative ("SG&A") expenses for the third quarter of 2024 were $112.4 million, an increase of $8.2 million, or 7.9%, compared to $104.2 million in the third quarter of 2023. The increase was primarily due to higher expenses associated with facilities and depreciation and amortization, as well as employee salaries, wages, payroll taxes and other related employee expenses. SG&A expenses in the third quarter of 2024 as a percentage of total revenues were 29.2% compared to 26.0% in the third quarter of 2023. Approximately $11.0 million of the increase in SG&A expenses in the third quarter of 2024 were attributable to a combined 27 branches opened or acquired during or after the third quarter of 2023.

Income from Operations

Income from operations for the third quarter of 2024 was $60.7 million, or 15.8% of revenues, compared to $79.2 million, or 19.8% of revenues, in the third quarter of 2023. Results in the year-ago quarter included a $5.7 million non-cash goodwill impairment charge. Adjusted income from operations in the third quarter of 2023, excluding the impairment charge was $84.9 million, or 21.2% of revenues.

Interest Expense

Interest expense was $18.8 million for the third quarter of 2024, compared to $16.1 million in the third quarter of 2023.

Net Income

Net income in the third quarter of 2024 was $31.1 million, or $0.85 per diluted share, compared to net income in the third quarter of 2023 of $48.9 million, or $1.35 per diluted share. Results in the year-ago quarter included a pre-tax $5.7 million non-cash goodwill impairment charge. Adjusted net income, excluding the impairment charge in the third quarter of 2023 was $53.0 million, or $1.46 per diluted share. The effective income tax rate for the third quarter of 2024 was 28.3% compared to an effective income tax rate of 26.1% in the same quarter of 2023.

H&E Rentals Reports Third Quarter 2024 Results

Page 4

October 29, 2024

Adjusted EBITDA

Adjusted EBITDA in the third quarter of 2024 totaled $175.3 million, or 45.6% of revenues, compared to $191.4 million, or 47.8% of revenues, in the same quarter of 2023.

Non-GAAP Financial Measures

This press release contains certain non-GAAP (generally accepted accounting principles) measures (EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Income from Operations, Adjusted Net Income, Adjusted Net Income per share and the disaggregation of equipment rental revenues and cost of sales numbers) detailed below. EBITDA and Adjusted EBITDA are non-GAAP measures as defined under the rules of the Securities and Exchange Commission ("SEC"). We define Adjusted EBITDA for the periods presented as EBITDA adjusted for non-cash stock-based compensation expense and the impairment of goodwill. Adjusted EBITDA Margin is calculated as Adjusted EBITDA divided by total revenues.

We use EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin in our business operations to, among other things, evaluate the performance of our business, develop budgets and measure our performance against those budgets. We also believe that analysts and investors use EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin as supplemental measures to evaluate a company’s overall operating performance. However, EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin have material limitations as analytical tools and you should not consider them in isolation, or as substitutes for analysis of our results as reported under GAAP. We consider them useful tools to assist us in evaluating performance because it eliminates items related to components of our capital structure, taxes and non-cash charges. The items that we have eliminated in determining EBITDA for the periods presented are interest expense, income taxes, depreciation of fixed assets (which includes rental equipment and property and equipment) and amortization of intangible assets. For Adjusted EBITDA, we eliminate non-cash items such as non-cash stock-based compensation expense and any other non-recurring items described above applicable to the particular period. However, some of these eliminated items are necessary to our business. For example, (i) interest expense is a necessary element of our costs and ability to generate revenue because we incur a significant amount of interest expense related to our outstanding indebtedness; (ii) payment of income taxes is a necessary element of our costs; (iii) depreciation is a necessary element of our costs and ability to generate revenue because rental equipment is the single largest component of our total assets and we recognize a significant amount of depreciation expense over the estimated useful life of this equipment; and (iv) stock compensation expense while non-cash, is an element of our costs. Any measure that eliminates components of our capital structure and costs associated with carrying significant amounts of fixed assets on our consolidated balance sheet has material limitations as a performance measure. In light of the foregoing limitations, we do not rely solely on EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin as performance measures and also consider our GAAP results. EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin are not measurements of our financial performance or liquidity under GAAP and, accordingly, should not be considered alternatives to net income, operating income or any other measures derived in accordance with GAAP. Because EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin may not be calculated in the same manner by all companies, these measures may not be comparable to other similarly titled measures used by other companies.

We use Adjusted Income from Operations, Adjusted Net Income and Adjusted Net Income per Share ("Adjusted Income Measures") in our business operations to, among other things, analyze our financial performance on a comparative period basis without the effects of significant one-time, non-recurring items. We define the Adjusted Income Measures for the periods presented as Income from Operations, Net Income and Net Income per Share, respectively, adjusted for the impairment of goodwill. Additionally, we believe Adjusted Income Measures, in combination with

H&E Rentals Reports Third Quarter 2024 Results

Page 5

October 29, 2024

financial results calculated in accordance with GAAP, provide investors with useful information and additional perspective concerning future profitability. However, Adjusted Income Measures are not measurements of our financial performance under GAAP and, accordingly, should not be considered in isolation or as alternatives to GAAP Income from Operations, Net Income and Net Income per Share. Because Adjusted Income Measures may not be calculated in the same manner by all companies, these measures may not be comparable to other similarly titled measures used by other companies.

We have presented in a supplemental schedule the disaggregation of our equipment rental revenues to provide further detail in evaluating the period over period performance of our rental business relative to equipment rental gross profit and equipment rental gross margin and believe these non-GAAP measures may be useful to investors for this reason. However, you should not consider this in isolation, or as substitutes for analysis of our results as reported under GAAP.

Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures can be found in the financial tables accompanying this earnings release.

Conference Call

The Company’s management will hold a conference call to discuss third quarter 2024 results today, October 29, 2024, at 10:00 a.m. (Eastern Time). To listen to the call, participants should dial 844-887-9400 approximately 10 minutes prior to the start of the call. A telephonic replay will become available after 1:00 p.m. (Eastern Time) on October 29, 2024, and will continue through November 12, 2024, by dialing 877-344-7529 and entering the confirmation code 3897091.

The live broadcast of H&E's quarterly conference call will be available online at herentals.com on October 29, 2024, beginning at 10:00 a.m. (Eastern Time) and will remain available for 30 days. Related presentation materials will be posted to the “Investor Relations” section of the Company’s web site at herentals.com prior to the call. The presentation materials will be in Adobe Acrobat format.

About H&E Rentals

Founded in 1961, H&E is one of the largest rental equipment companies in the nation. The Company’s fleet is comprised of aerial work platforms, earthmoving, material handling, and other general and specialty lines. H&E serves a diverse set of end markets in many high-growth geographies and has branches throughout the Pacific Northwest, West Coast, Intermountain, Southwest, Gulf Coast, Southeast, Midwest and Mid-Atlantic regions.

Forward-Looking Statements

Statements contained in this press release that are not historical facts, including statements about H&E’s beliefs and expectations, are “forward-looking statements” within the meaning of the federal securities laws. Statements containing the words “may,” “could,” “would,” “should,” “believe,” “expect,” “anticipate,” “plan,” “estimate,” “target,” “project,” “intend,” “foresee” and similar expressions constitute forward-looking statements. Forward-looking statements involve known and unknown risks and uncertainties, which could cause actual results to differ materially from those contained in any forward-looking statement. Such factors include, but are not limited to, the following: (1) general economic and geopolitical conditions in North America and elsewhere throughout the globe and construction and industrial activity in the markets where we operate in North America; (2) our ability to forecast trends in our business accurately, and the impact of economic downturns and economic uncertainty on the markets we serve (including as a result of current uncertainty due to inflation and increasing interest rates); (3) the impact of conditions in the global credit and commodity markets and their effect on construction spending and the economy in general; (4) trends in oil and natural gas which could adversely affect the demand for

H&E Rentals Reports Third Quarter 2024 Results

Page 6

October 29, 2024

our products and services; (5) our inability to obtain equipment and other supplies for our business from our key suppliers on acceptable terms or at all, as a result of supply chain disruptions, insolvency, financial difficulties, supplier relationships or other factors; (6) increased maintenance and repair costs as our fleet ages and decreases in our equipment’s residual value; (7) risks related to a global pandemic and similar health concerns, such as the scope and duration of the outbreak, government actions and restrictive measures implemented in response to the pandemic, material delays and cancellations of construction or infrastructure projects, labor shortages, supply chain disruptions and other impacts to the business; (8) our indebtedness; (9) risks associated with the expansion of our business and any potential acquisitions we may make, including any related capital expenditures, or our ability to consummate such acquisitions; (10) our ability to integrate any businesses or assets we acquire; (11) competitive pressures; (12) security breaches, cybersecurity attacks, increased adoption of artificial intelligence technologies, failure to protect personal information, compliance with data protection laws and other disruptions in our information technology systems; (13) adverse weather events or natural disasters; (14) risks related to climate change and climate change regulation; (15) compliance with laws and regulations, including those relating to environmental matters, corporate governance matters and tax matters, as well as any future changes to such laws and regulations; and (16) other factors discussed in our public filings, including the risk factors included in the Company’s most recent Annual Report on Form 10-K. Investors, potential investors and other readers are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. Except as required by applicable law, including the securities laws of the United States and the rules and regulations of the SEC, we are under no obligation to publicly update or revise any forward-looking statements after the date of this release, whether as a result of any new information, future events or otherwise. These statements are based on the current beliefs and assumptions of H&E’s management, which in turn are based on currently available information and important, underlying assumptions. Investors, potential investors, security holders and other readers are urged to consider the above-mentioned factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements.

H&E Rentals Reports Third Quarter 2024 Results

Page 7

October 29, 2024

H&E EQUIPMENT SERVICES, INC.

CONSOLIDATED STATEMENTS OF INCOME (unaudited)

(Amounts in thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

Equipment rentals |

|

$ |

326,219 |

|

|

$ |

315,811 |

|

|

$ |

933,900 |

|

|

$ |

869,278 |

|

Sales of rental equipment |

|

|

27,790 |

|

|

|

52,708 |

|

|

|

110,842 |

|

|

|

124,476 |

|

Sales of new equipment |

|

|

14,054 |

|

|

|

12,633 |

|

|

|

35,136 |

|

|

|

29,308 |

|

Parts, service and other |

|

|

16,799 |

|

|

|

19,544 |

|

|

|

52,623 |

|

|

|

60,348 |

|

Total revenues |

|

|

384,862 |

|

|

|

400,696 |

|

|

|

1,132,501 |

|

|

|

1,083,410 |

|

Cost of revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

Rental depreciation |

|

|

95,194 |

|

|

|

90,361 |

|

|

|

278,990 |

|

|

|

258,146 |

|

Rental expense |

|

|

45,494 |

|

|

|

40,545 |

|

|

|

131,423 |

|

|

|

117,169 |

|

Rental other |

|

|

37,687 |

|

|

|

35,056 |

|

|

|

105,499 |

|

|

|

93,381 |

|

|

|

|

178,375 |

|

|

|

165,962 |

|

|

|

515,912 |

|

|

|

468,696 |

|

Sales of rental equipment |

|

|

11,057 |

|

|

|

21,893 |

|

|

|

42,006 |

|

|

|

51,396 |

|

Sales of new equipment |

|

|

11,266 |

|

|

|

10,962 |

|

|

|

28,777 |

|

|

|

25,278 |

|

Parts, service and other |

|

|

12,710 |

|

|

|

13,496 |

|

|

|

38,207 |

|

|

|

39,918 |

|

Total cost of revenues |

|

|

213,408 |

|

|

|

212,313 |

|

|

|

624,902 |

|

|

|

585,288 |

|

Gross profit |

|

|

171,454 |

|

|

|

188,383 |

|

|

|

507,599 |

|

|

|

498,122 |

|

Selling, general and administrative expenses |

|

|

112,449 |

|

|

|

104,218 |

|

|

|

338,558 |

|

|

|

298,812 |

|

Impairment of goodwill |

|

|

— |

|

|

|

(5,714 |

) |

|

|

— |

|

|

|

(5,714 |

) |

Gain on sales of property and equipment, net |

|

|

1,664 |

|

|

|

763 |

|

|

|

6,449 |

|

|

|

1,866 |

|

Income from operations |

|

|

60,669 |

|

|

|

79,214 |

|

|

|

175,490 |

|

|

|

195,462 |

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(18,771 |

) |

|

|

(16,145 |

) |

|

|

(55,364 |

) |

|

|

(44,542 |

) |

Other, net |

|

|

1,448 |

|

|

|

3,071 |

|

|

|

4,482 |

|

|

|

5,851 |

|

Total other expense, net |

|

|

(17,323 |

) |

|

|

(13,074 |

) |

|

|

(50,882 |

) |

|

|

(38,691 |

) |

Income from operations before provision for income taxes |

|

|

43,346 |

|

|

|

66,140 |

|

|

|

124,608 |

|

|

|

156,771 |

|

Provision for income taxes |

|

|

12,278 |

|

|

|

17,261 |

|

|

|

34,390 |

|

|

|

41,002 |

|

Net income |

|

$ |

31,068 |

|

|

$ |

48,879 |

|

|

$ |

90,218 |

|

|

$ |

115,769 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.86 |

|

|

$ |

1.35 |

|

|

$ |

2.49 |

|

|

$ |

3.21 |

|

Diluted |

|

$ |

0.85 |

|

|

$ |

1.35 |

|

|

$ |

2.47 |

|

|

$ |

3.19 |

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

36,300 |

|

|

|

36,134 |

|

|

|

36,249 |

|

|

|

36,078 |

|

Diluted |

|

|

36,459 |

|

|

|

36,322 |

|

|

|

36,497 |

|

|

|

36,326 |

|

H&E Rentals Reports Third Quarter 2024 Results

Page 8

October 29, 2024

H&E EQUIPMENT SERVICES, INC.

SELECTED BALANCE SHEET DATA (unaudited)

(Amounts in thousands)

|

|

|

|

|

|

|

|

|

|

|

September 30, 2024 |

|

|

December 31, 2023 |

|

Cash |

|

$ |

11,083 |

|

|

$ |

8,500 |

|

Rental equipment, net |

|

|

1,924,653 |

|

|

|

1,756,578 |

|

Total assets |

|

|

2,892,666 |

|

|

|

2,639,886 |

|

Total debt (1) |

|

|

1,530,423 |

|

|

|

1,434,661 |

|

Total liabilities |

|

|

2,295,454 |

|

|

|

2,105,597 |

|

Stockholders' equity |

|

|

597,212 |

|

|

|

534,289 |

|

Total liabilities and stockholders' equity |

|

$ |

2,892,666 |

|

|

$ |

2,639,886 |

|

(1)Total debt consists of the aggregate amounts on the senior unsecured notes, senior secured credit facility, and finance lease obligations.

H&E EQUIPMENT SERVICES, INC.

UNAUDITED RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(Amounts in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, 2023 |

|

|

|

As Reported |

|

|

Adjustment |

|

|

As Adjusted |

|

Gross profit |

|

$ |

188,383 |

|

|

$ |

— |

|

|

$ |

188,383 |

|

Selling, general and administrative expenses |

|

|

104,218 |

|

|

|

— |

|

|

|

104,218 |

|

Impairment of goodwill |

|

|

(5,714 |

) |

|

|

5,714 |

|

|

|

— |

|

Gain on sale of property and equipment, net |

|

|

763 |

|

|

|

— |

|

|

|

763 |

|

Income from operations |

|

|

79,214 |

|

|

|

5,714 |

|

|

|

84,928 |

|

Interest expense |

|

|

(16,145 |

) |

|

|

— |

|

|

|

(16,145 |

) |

Other income, net |

|

|

3,071 |

|

|

|

— |

|

|

|

3,071 |

|

Income from operations before provision for income taxes |

|

|

66,140 |

|

|

|

5,714 |

|

|

|

71,854 |

|

Provision for income taxes |

|

|

17,261 |

|

|

|

1,585 |

|

|

|

18,846 |

|

Net income |

|

$ |

48,879 |

|

|

$ |

4,129 |

|

|

$ |

53,008 |

|

|

|

|

|

|

|

|

|

|

|

NET INCOME PER SHARE (1) |

|

|

|

|

|

|

|

|

|

Basic - Net income per common share: |

|

$ |

1.35 |

|

|

$ |

0.11 |

|

|

$ |

1.47 |

|

Basic - Weighted average common shares outstanding: |

|

|

36,134 |

|

|

|

36,134 |

|

|

|

36,134 |

|

|

|

|

|

|

|

|

|

|

|

Diluted - Net income per common share |

|

$ |

1.35 |

|

|

$ |

0.11 |

|

|

$ |

1.46 |

|

Diluted - Weighted average common shares outstanding: |

|

|

36,322 |

|

|

|

36,322 |

|

|

|

36,322 |

|

(1)Because of the method used in calculating per share data, the summation of the above per share data may not necessarily total to the as adjusted per share data.

H&E Rentals Reports Third Quarter 2024 Results

Page 9

October 29, 2024

H&E EQUIPMENT SERVICES, INC.

UNAUDITED RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(Amounts in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended

September 30, 2023 |

|

|

|

As Reported |

|

|

Adjustment |

|

|

As Adjusted |

|

Gross profit |

|

$ |

498,122 |

|

|

$ |

— |

|

|

$ |

498,122 |

|

Selling, general and administrative expenses |

|

|

298,812 |

|

|

|

— |

|

|

|

298,812 |

|

Impairment of goodwill |

|

|

(5,714 |

) |

|

|

5,714 |

|

|

|

— |

|

Gain on sale of property and equipment, net |

|

|

1,866 |

|

|

|

— |

|

|

|

1,866 |

|

Income from operations |

|

|

195,462 |

|

|

|

5,714 |

|

|

|

201,176 |

|

Interest expense |

|

|

(44,542 |

) |

|

|

— |

|

|

|

(44,542 |

) |

Other income, net |

|

|

5,851 |

|

|

|

— |

|

|

|

5,851 |

|

Income from operations before provision for income taxes |

|

|

156,771 |

|

|

|

5,714 |

|

|

|

162,485 |

|

Provision for income taxes |

|

|

41,002 |

|

|

|

1,585 |

|

|

|

42,587 |

|

Net income |

|

$ |

115,769 |

|

|

$ |

4,129 |

|

|

$ |

119,898 |

|

|

|

|

|

|

|

|

|

|

|

NET INCOME PER SHARE (1) |

|

|

|

|

|

|

|

|

|

Basic - Net income per common share: |

|

$ |

3.21 |

|

|

$ |

0.11 |

|

|

$ |

3.32 |

|

Basic - Weighted average common shares outstanding: |

|

|

36,078 |

|

|

|

36,078 |

|

|

|

36,078 |

|

|

|

|

|

|

|

|

|

|

|

Diluted - Net income per common share |

|

$ |

3.19 |

|

|

$ |

0.11 |

|

|

$ |

3.30 |

|

Diluted - Weighted average common shares outstanding: |

|

|

36,326 |

|

|

|

36,326 |

|

|

|

36,326 |

|

(1)Because of the method used in calculating per share data, the summation of the above per share data may not necessarily total to the as adjusted per share data.

H&E EQUIPMENT SERVICES, INC.

UNAUDITED RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(Amounts in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income |

|

$ |

31,068 |

|

|

$ |

48,879 |

|

|

$ |

90,218 |

|

|

$ |

115,769 |

|

Interest Expense |

|

|

18,771 |

|

|

|

16,145 |

|

|

|

55,364 |

|

|

|

44,542 |

|

Provision for income taxes |

|

|

12,278 |

|

|

|

17,261 |

|

|

|

34,390 |

|

|

|

41,002 |

|

Depreciation |

|

|

108,014 |

|

|

|

99,437 |

|

|

|

314,056 |

|

|

|

283,629 |

|

Amortization of intangibles |

|

|

2,598 |

|

|

|

1,683 |

|

|

|

7,668 |

|

|

|

5,048 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA |

|

$ |

172,729 |

|

|

$ |

183,405 |

|

|

$ |

501,696 |

|

|

$ |

489,990 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-cash stock-based compensation expense |

|

$ |

2,616 |

|

|

$ |

2,275 |

|

|

$ |

8,606 |

|

|

$ |

7,304 |

|

Impairment of goodwill |

|

|

— |

|

|

|

5,714 |

|

|

|

— |

|

|

|

5,714 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

|

$ |

175,345 |

|

|

$ |

191,394 |

|

|

$ |

510,302 |

|

|

$ |

503,008 |

|

H&E Rentals Reports Third Quarter 2024 Results

Page 10

October 29, 2024

H&E EQUIPMENT SERVICES, INC.

UNAUDITED RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(Amounts in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

RENTAL |

|

|

|

|

|

|

|

|

|

|

|

|

Equipment rentals (1) |

|

$ |

288,094 |

|

|

$ |

280,257 |

|

|

$ |

825,308 |

|

|

$ |

771,056 |

|

Rental other |

|

|

38,125 |

|

|

|

35,554 |

|

|

|

108,592 |

|

|

|

98,222 |

|

Total equipment rentals |

|

|

326,219 |

|

|

|

315,811 |

|

|

|

933,900 |

|

|

|

869,278 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RENTAL COST OF SALES |

|

|

|

|

|

|

|

|

|

|

|

|

Rental depreciation |

|

|

95,194 |

|

|

|

90,361 |

|

|

|

278,990 |

|

|

|

258,146 |

|

Rental expense |

|

|

45,494 |

|

|

|

40,545 |

|

|

|

131,423 |

|

|

|

117,169 |

|

Rental other |

|

|

37,687 |

|

|

|

35,056 |

|

|

|

105,499 |

|

|

|

93,381 |

|

Total rental cost of sales |

|

|

178,375 |

|

|

|

165,962 |

|

|

|

515,912 |

|

|

|

468,696 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RENTAL REVENUES GROSS PROFIT |

|

|

|

|

|

|

|

|

|

|

|

|

Equipment rentals |

|

|

147,406 |

|

|

|

149,351 |

|

|

|

414,895 |

|

|

|

395,741 |

|

Rentals other |

|

|

438 |

|

|

|

498 |

|

|

|

3,093 |

|

|

|

4,841 |

|

Total rental revenues gross profit |

|

$ |

147,844 |

|

|

$ |

149,849 |

|

|

$ |

417,988 |

|

|

$ |

400,582 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RENTAL REVENUES GROSS MARGIN |

|

|

|

|

|

|

|

|

|

|

|

|

Equipment rentals |

|

|

51.2 |

% |

|

|

53.3 |

% |

|

|

50.3 |

% |

|

|

51.3 |

% |

Rentals other |

|

|

1.1 |

% |

|

|

1.4 |

% |

|

|

2.8 |

% |

|

|

4.9 |

% |

Total rental revenues gross margin |

|

|

45.3 |

% |

|

|

47.4 |

% |

|

|

44.8 |

% |

|

|

46.1 |

% |

(1)Pursuant to SEC Regulation S-X, the Company's equipment rental revenues are aggregated and presented in our unaudited condensed consolidated statements of operations in this press release as a single line item, “Equipment Rentals.” The above table disaggregates the Company's equipment rental revenues for discussion and analysis purposes only.

v3.24.3

Document and Entity Information

|

Oct. 29, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 29, 2024

|

| Entity Registrant Name |

H&E Equipment Services, Inc.

|

| Entity Central Index Key |

0001339605

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

000-51759

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

81-0553291

|

| Entity Address, Address Line One |

7500 Pecue Lane

|

| Entity Address, City or Town |

Baton Rouge

|

| Entity Address, State or Province |

LA

|

| Entity Address, Postal Zip Code |

70809

|

| City Area Code |

225

|

| Local Phone Number |

298-5200

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

HEES

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

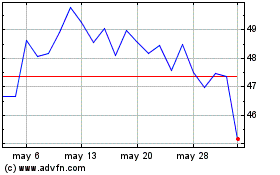

H and E Equipment Services (NASDAQ:HEES)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

H and E Equipment Services (NASDAQ:HEES)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025