false

0001417926

0001417926

2024-08-14

2024-08-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported) August 14, 2024

INVO

BIOSCIENCE, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-39701 |

|

20-4036208 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

5582

Broadcast Court

Sarasota,

FL 34240

(Address

of principal executive offices, including zip code)

(978)

878-9505

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.0001 par value |

|

INVO |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02. Results of Operations and Financial Condition.

On

August 14, 2024, INVO Bioscience, Inc. (the “Company”) issued a press release announcing financial results for the period

ended June 30, 2024. The text of the press release is furnished as Exhibit 99.1 to this current report.

The

information in this Item 2.02 and Exhibit 99.1 hereto shall not be deemed “filed” for the purposes of or otherwise subject

to the liabilities under Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Unless expressly

incorporated into a filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, the information contained

in this Item 2.02 and Exhibit 99.1 hereto shall not be incorporated by reference into any Company filing, whether made before or after

the date hereof, regardless of any general incorporation language in such filing.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

August 14, 2024 |

INVO

BIOSCIENCE, INC. |

| |

|

| |

/s/ Steven Shum |

| |

Steven

Shum |

| |

Chief

Executive Officer |

Exhibit

99.1

INVO

Reports Record Second Quarter 2024 Financial Results with 481% Revenue Growth and a $1.1 Million Improvement to Adjusted EBITDA

SARASOTA,

Fla., August 14, 2024 — INVO Bioscience, Inc. (Nasdaq: INVO) (“INVO” or the “Company”), a healthcare services

fertility company focused on expanding access to advanced treatment through the establishment and acquisition of fertility clinics, and

with the intravaginal culture (“IVC”) procedure enabled by its INVOcell® medical device, today announced financial

results for the second quarter 2024 for the period ended June 30, 2024 and provided a business update.

Q2

2024 Financial Highlights (all metrics compared to Q2 2023 unless otherwise noted)

| |

● |

Revenue

was $1,836,597, an increase of 481% compared to $315,902. Revenue increased 17% sequentially compared to Q1 2024. |

| |

● |

Clinic

revenue increased 611% to $1,807,921, compared to $254,364. All reported clinic revenue is derived from the Company’s INVO

Center in Atlanta, Georgia, and its fertility clinic in Middleton, Wisconsin, both of which are consolidated in the Company’s

financial statements. |

| |

● |

Revenue

from all clinics, inclusive of both those accounted for as consolidated and under the equity method, was $2,141,229, an increase

of 201% compared to $712,433. |

| |

● |

Total

operating expenses were $3.7 million, a $1.3 million increase compared to $2.4 million. The increase was primarily due to a one-time

non-cash expense of $1.0 million and a $0.2 million increase in amortization costs. Q2 2024 operating expenses also included approximately

$25,000 pertaining to the proposed merger with NAYA Biosciences, Inc. (“NAYA”). |

| |

● |

Net

loss was $(2.2) million compared to $(2.2) million. |

| |

● |

Adjusted

EBITDA (see table included) was $(0.5) million, including approximately $25,000 in transaction costs related to the potential merger,

compared to $(1.6) million in the prior year. |

Management

Commentary

“The

growing, positive impact of our acquisition strategy remains in full swing as we report record second quarter revenue – up 481%

year-over-year and 17% sequentially – with a $1.1 million improvement in adjusted EBITDA,” commented Steve Shum, CEO of INVO.

“Our fertility centers in Middleton, Atlanta, and Birmingham are all experiencing sequential revenue growth and are collectively

profitable. This growth and clinic-level profit, coupled with our careful management of overall corporate expenses, positions us to achieve

our stated goal of reaching breakeven with our current operations. To accelerate our path to profitability, we also expect to resume

both our acquisition and new INVO Center activities in 2025. I look forward to the continued strong execution by our team and making

fertility care more accessible and inclusive to people in need.”

Definitive

Merger Agreement

As

originally reported, on October 23, 2023, INVO and NAYA, a company dedicated to increasing patient access to breakthrough treatments

in oncology and regenerative medicine, jointly announced that they had entered into a definitive merger agreement (the “Merger

Agreement”) for INVO to acquire NAYA in an all-stock transaction. The Merger Agreement was subsequently amended three times to

primarily extend the target closing date and interim funding requirements to be provided by NAYA. INVO and NAYA are currently in discussions

to agree to a further extension.

Financial

Tables

Included

in this press release is a reconciliation of Adjusted EBITDA. All additional financial tables are included in the Company’s 10-Q,

which can be found on the Company’s website at https://www.invobioscience.com/sec-filings/ or at https://www.sec.gov/.

Use

of Non-GAAP Measure

Adjusted

EBITDA is a non-GAAP measure. This measure is not intended to be a substitute for those financial measures reported in accordance with

GAAP. Adjusted EBITDA has been included because management believes that, when considered together with the GAAP figures, it provides

meaningful information related to our operating performance and liquidity and can enhance an overall understanding of financial results

and trends. Adjusted EBITDA may be calculated by us differently than other companies that disclose measures with the same or similar

terms. See our attached financials for a reconciliation of this non-GAAP measure to the nearest GAAP measure.

About

INVO Bioscience

We

are a healthcare services fertility company dedicated to expanding the assisted reproductive technology (“ART”) marketplace

by making fertility care accessible and inclusive to people around the world. Our commercialization strategy is focused on the opening

of dedicated “INVO Centers” offering the INVOcell® and IVC procedure (with three centers in North America

now operational), the acquisition of US-based, profitable in vitro fertilization (“IVF”) clinics and the sale and distribution

of our technology solution into existing fertility clinics. Our proprietary technology, INVOcell®, is a revolutionary

medical device that allows fertilization and early embryo development to take place in vivo within the woman’s body. This treatment

solution is the world’s first intravaginal culture technique for the incubation of oocytes and sperm during fertilization and early

embryo development. This technique, designated as “IVC”, provides patients a more natural, intimate, and more affordable

experience in comparison to other ART treatments. We believe the IVC procedure can deliver comparable results at a fraction of the cost

of traditional IVF and is a significantly more effective treatment than intrauterine insemination (“IUI”). For more information,

please visit www.invobio.com.

Safe

Harbor Statement

This

release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. The Company invokes the protections of the Private Securities Litigation Reform

Act of 1995. All statements regarding our expected future financial position, results of operations, cash flows, financing plans, business

strategies, products and services, competitive positions, growth opportunities, plans and objectives of management for future operations,

as well as statements that include words such as “anticipate,” “if,” “believe,” “plan,”

“estimate,” “expect,” “intend,” “may,” “could,” “should,” “will,”

and other similar expressions are forward-looking statements. All forward-looking statements involve risks, uncertainties, and contingencies,

many of which are beyond our control, which may cause actual results, performance, or achievements to differ materially from anticipated

results, performance, or achievements. Factors that may cause actual results to differ materially from those in the forward-looking statements

include those set forth in our filings at www.sec.gov. We are under no obligation to (and expressly disclaim any such obligation

to) update or alter our forward-looking statements, whether as a result of new information, future events, or otherwise.

CONTACT

INVO

Bioscience:

Steve

Shum

978-878-9505

sshum@invobio.com

INVO

Investor Contact:

Robert

Blum (Lytham Partners, LLC)

602-889-9700

INVO@lythampartners.com

Adjusted

EBITDA

| | |

Three Months Ended | |

| | |

June 30 | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Net loss attributable to INVO Bioscience, Inc. | |

$ | (2,245,170 | ) | |

$ | (2,240,511 | ) |

| Interest expense | |

| 118,640 | | |

| 52,474 | |

| Amortization of debt discount | |

| 250,972 | | |

| 122,718 | |

| Stock-based compensation | |

| 1,031,071 | | |

| 99,338 | |

| Stock option expense | |

| 69,035 | | |

| 326,916 | |

| Non cash compensation for services | |

| 45,000 | | |

| 45,000 | |

| Foreign currency exchange loss | |

| - | | |

| 265 | |

| (Gain) loss on disposal of fixed assets | |

| (50,000 | ) | |

| - | |

| Loss from debt extinguishment | |

| 40,491 | | |

| - | |

| Depreciation and amortization | |

| 230,338 | | |

| 19,705 | |

| Adjusted EBITDA | |

$ | (509,623 | ) | |

$ | (1,574,095 | ) |

| | |

| | | |

| | |

| Proforma net loss | |

$ | (2,245,170 | ) | |

$ | (2,041,621 | ) |

| Interest expense | |

| 118,640 | | |

| 52,474 | |

| Amortization of debt discount | |

| 250,972 | | |

| 122,718 | |

| Stock-based compensation | |

| 1,031,071 | | |

| 99,338 | |

| Stock option expense | |

| 69,035 | | |

| 326,916 | |

| Non-cash compensation for services | |

| 45,000 | | |

| 45,000 | |

| Foreign currency exchange loss | |

| - | | |

| 265 | |

| (Gain) loss on disposal of fixed assets | |

| (50,000 | ) | |

| - | |

| Loss from debt extinguishment | |

| 40,491 | | |

| - | |

| Depreciation and amortization | |

| 230,338 | | |

| 19,705 | |

| Proforma adjusted EBITDA | |

$ | (509,623 | ) | |

$ | (1,375,205 | ) |

INVO

BIOSCIENCE, INC.

CONSOLIDATED

STATEMENTS OF OPERATIONS

| | |

For the Three Months Ended

June 30, | | |

For the Six Months Ended

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Revenue: | |

| | | |

| | | |

| | | |

| | |

| Clinic revenue | |

$ | 1,807,921 | | |

$ | 254,364 | | |

$ | 3,345,120 | | |

$ | 551,745 | |

| Product revenue | |

| 28,676 | | |

| 61,538 | | |

| 67,763 | | |

| 112,182 | |

| Total revenue | |

| 1,836,597 | | |

| 315,902 | | |

| 3,412,883 | | |

| 663,927 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Cost of revenue | |

| 861,648 | | |

| 235,714 | | |

| 1,711,882 | | |

| 466,719 | |

| Selling, general and administrative | |

| 2,647,524 | | |

| 2,042,609 | | |

| 4,088,110 | | |

| 4,373,443 | |

| Research and development | |

| - | | |

| 83,850 | | |

| 4,880 | | |

| 157,370 | |

| Depreciation and amortization | |

| 230,338 | | |

| 19,705 | | |

| 457,298 | | |

| 38,792 | |

| Total operating expenses | |

| 3,739,510 | | |

| 2,381,879 | | |

| 6,262,170 | | |

| 5,036,324 | |

| Loss from operations | |

| (1,902,913 | ) | |

| (2,065,977 | ) | |

| (2,849,287 | ) | |

| (4,372,397 | ) |

| Other income (expense): | |

| | | |

| | | |

| | | |

| | |

| Gain (loss) from equity method investment | |

| 17,846 | | |

| 3,788 | | |

| 17,950 | | |

| (23,947 | ) |

| Gain (loss) on disposal of fixed assets | |

| 50,000 | | |

| - | | |

| (511,663 | ) | |

| - | |

| Gain on lease termination | |

| - | | |

| - | | |

| 94,551 | | |

| - | |

| Loss from debt extinguishment | |

| (40,491 | ) | |

| - | | |

| (40,491 | ) | |

| - | |

| Interest expense | |

| (369,612 | ) | |

| (175,192 | ) | |

| (550,907 | ) | |

| (391,781 | ) |

| Foreign currency exchange loss | |

| - | | |

| (265 | ) | |

| - | | |

| (400 | ) |

| Total other income (expense) | |

| (342,257 | ) | |

| (171,669 | ) | |

| (990,560 | ) | |

| (416,128 | ) |

| Loss before income taxes | |

| (2,245,170 | ) | |

| (2,237,646 | ) | |

| (3,839,847 | ) | |

| (4,788,525 | ) |

| Income taxes | |

| - | | |

| 2,865 | | |

| 1,836 | | |

| 2,865 | |

| Net loss | |

$ | (2,245,170 | ) | |

$ | (2,240,511 | ) | |

$ | (3,841,683 | ) | |

$ | (4,791,390 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per common share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (0.62 | ) | |

$ | (3.06 | ) | |

$ | (1.25 | ) | |

$ | (7.07 | ) |

| Diluted | |

$ | (0.62 | ) | |

$ | (3.06 | ) | |

$ | (1.25 | ) | |

$ | (7.07 | ) |

| Weighted average number of common shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 3,609,812 | | |

| 732,255 | | |

| 3,072,877 | | |

| 677,684 | |

| Diluted | |

| 3,609,812 | | |

| 732,255 | | |

| 3,072,877 | | |

| 677,684 | |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

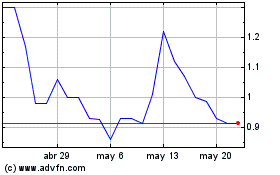

INVO BioScience (NASDAQ:INVO)

Gráfica de Acción Histórica

De Sep 2024 a Oct 2024

INVO BioScience (NASDAQ:INVO)

Gráfica de Acción Histórica

De Oct 2023 a Oct 2024