Molecular Templates, Inc. (Nasdaq: MTEM, “Molecular

Templates,” or “MTEM”), a clinical-stage biopharmaceutical company

focused on the discovery and development of proprietary targeted

biologic therapeutics, engineered toxin bodies (“ETBs”), to create

novel therapies with potent differentiated mechanisms of action for

cancer, today reported financial results for the fourth quarter and

full year ended December 31, 2023.

Company Highlights

-

Durable single agent activity observed with MT-6402, a PD-L1

targeting direct-cell kill agent, in heavily pre-treated patients

with low PD-L1+ head and neck cancer who had progressed on multiple

prior therapies including checkpoint and EGFR antibodies.

-

Enrollment is on-going in the dose escalation study with MT-8421, a

novel CTLA-4 targeting agent designed to potently deplete Tregs in

the tumor environment. Unique pharmacodynamic effects demonstrating

potent Treg clearance and IL-2 increases observed in patients.

-

Recently completed $9.5 million private placement supports

continued funding of clinical stage programs.

Eric Poma, PhD., Chief Executive and Chief

Scientific Officer of MTEM, stated, “We are very excited to see

objective responses in heavily pre-treated, checkpoint-experienced

head and neck cancer patients, a setting with high unmet medical

need, with MT-6402. We are seeing evidence of monotherapy activity

of long duration and in patients refractory to checkpoint therapy

through a novel mechanism of tumor microenvironment remodeling. We

believe these data demonstrate a new and potentially best-in-class

approach to targeting the PD-1-PD-L1 axis.” Dr. Poma further added,

“MT-8421 is currently in dose escalation as a novel direct

cell-kill approach targeting CTLA-4 to potently deplete Tregs in

the tumor microenvironment. Through the first dose cohort, we are

already seeing promising and differentiate pharmacodynamic effects

including dramatic Treg depletion in patients.”

MT-6402 (PD-L1 ETB)

- MT-6402 was

designed to activate T-cells through direct cell-kill of

immunosuppressive PD-L1+ immune cells resulting in a remodeling of

the tumor microenvironment.

- In addition,

MT-6402 can deliver and induce the presentation of an MHC class I

CMV antigen on tumor cells for pre-existing CD8 T-cell recognition

and destruction in HLA-A*02/CMV+ patients with high PD-L1

expression on their tumors.

- Compelling

signal of monotherapy activity with MT-6402 at higher doses in

relapsed or refractory head and neck cancer (R-R HNSCC) with dose

expansion study planned in low PD-L1+ R-R HNSCC patients.

- 10 patients with

R-R HNSCC in dose escalation

- Patients dosed

at 63, 83 (MTD), or 100 mcg/kg; median # of prior treatments of

greater than 3

- 2 patients

currently in responses; 1 patient (63 mcg/kg) has a confirmed PR

with 70% reduction in tumor volume at cycle 18 (1 cycle = 4

weeks)

- 1 patient (83

mcg/kg) has an uPR(37% reduction) at cycle 8 w/ reductions of 3%,

9%, and 15% across three previous cycles; the patient is on therapy

in cycle 9

- 2 patients (one

uPR and one 15% reduction) came off therapy for Gr1 hs-Trop

elevation; guidelines now revised to allow patients to continue

therapy despite advent of Gr1 hs-Trop elevation. In all instances,

Gr1 hs-Trop elevations were asymptomatic and without evidence of

cardiac changes. Similar troponin changes are observed in patients

receiving checkpoint inhibitors.

- No gr 4 or gr 5

drug-related toxicities were observed

- Patients with

responses/tumor reduction had low PD-L1

- Dose expansion

is on-going in patients with high PD-L1+ tumors.

MT-8421 (CTLA-4 ETB)

- MT-8421, along with

MT-6402, represents our unique approach to immuno-oncology based on

remodeling the tumor microenvironment through the elimination of

immunosuppressive cells and activation of CD8 T-cells.

- MT-8421 is designed

to potently destroy CTLA-4+ Tregs via enzymatic ribosome

destruction but does not have activity against low CTLA-4

expressing peripheral Tregs.

- Two of the three

patients enrolled in the first cohort remain on study in cycle 5.

Both patients show evidence of Treg clearance and T-cell

activation. Enrollment is on-going in the second cohort of 48

mcg/kg for the phase I study of MT-8421.

MT-0169 (CD38 ETB)

- MT-0169 is designed

to destroy CD38+ tumor cells through internalization of CD38 and

cell destruction via a novel mechanism of action (enzymatic

ribosomal destruction and immunogenic cell death).

- A phase 1 study in

patients with relapsed or refractory multiple myeloma was closed on

Dec 2023 due to slow patient enrollment in the wake of multiple new

approvals in myeloma. This study enrolled 14 patients and no

drug-related Grade 4 or 5 adverse events have been observed. One

patient with IgA myeloma who was quad-refractory was treated at 5

mcg/kg and had a stringent Complete Response for 16 cycles (1 cycle

= 4 weeks) before discontinuing treatment for progression of

disease.

- MTEM is evaluating

plans to initiate an investigator sponsored study to evaluate

MT-0169 in relapsed or refractory CD38+ AML patients.

Second Closing of July 2023 Private

Placement

On March 28, 2024, the Company and certain

institutional and accredited investors (the “March 2024

Purchasers”) entered into an Amended and Restated July 2023

Purchase Agreement pursuant to which the Company will issue common

stock, prefunded warrants, and common warrants with an aggregate

purchase price of $9.5 million on amended and restated second

tranche terms. The second tranche, as amended and restated, will

consist of the sale and issuance of (i) 1,209,612 shares of the

Company’s common stock (and, in lieu thereof, prefunded warrants to

purchase 2,460,559 shares of the Company’s common stock (the “March

2024 Prefunded Warrants”)) for a purchase price of $2.35 per share

of the Company’s common stock (the closing price of our common

stock on March 27, 2024 as reported by the Nasdaq Capital Market)

and $2.349 per March 2024 Prefunded Warrant, and (ii) common stock

warrants (the “March 2024 Common Warrants”) to purchase up to

7,340,342 shares of the Company’s common stock (or March 2024

Prefunded Warrants in lieu thereof) at an exercise price of $2.35

per share of the Company’s common stock underlying the March 2024

Common Warrants. The March 2024 Common Warrants will be sold at a

price of $0.125 per underlying share of common stock and will have

a term of five years. The March 2024 Prefunded Warrants will expire

when fully exercised in accordance with their terms. The March 2024

Prefunded Warrants and March 2024 Common Warrants may not be

exercised if the aggregate number of shares of our common stock

beneficially owned by the holder thereof immediately following such

exercise would exceed a specified beneficial ownership limitation

(4.99%/9.99%/19.99%); provided, however, that a holder may increase

or decrease the beneficial ownership limitation by giving 61 days’

notice to the Company, but not to any percentage in excess of

19.99%. The Amended and Restated July 2023 Purchase Agreement

contains customary representations and warranties and agreements of

the Company and the Purchasers and customary indemnification rights

and obligations of the parties. The second tranche will include

gross proceeds of approximately $9.5 million and net proceeds,

following the payment of related offering expenses, of

approximately $8.9 million.

Key Milestones for 2024

- Clinical data on

MT-6402 expansion cohorts in low and high PD-L1+ HNSCC

patients

- Clinical data from

dose escalation study for MT-8421 Treg depleting agent in solid

tumors

Bristol-Myers Squibb Collaboration

Agreement

On March 13, 2024, Bristol-Myers Squibb notified the Company

that following a corporate portfolio prioritization process, it

does not intend to continue the research collaboration it entered

into with the Company pursuant to the BMS Collaboration Agreement

and would be terminating the BMS Collaboration Agreement in its

entirety. The termination will be effective on June 13, 2024, or 90

days following the Company’s receipt of Bristol-Myers Squibb’s

written notice of termination. MTEM plans to reduce costs related

to the Collaboration Agreement.

Conferences

MTEM will present an abstract, “First-in-human, dose escalation

and expansion study of MT-6402, a novel engineered toxin body (ETB)

targeting PD-L1, in patients with PD-L1 expressing

relapsed/refractory advanced solid tumors: Interim Data”, Tuesday,

April 9, 2024, 9am – 12:30pm ET (Section 48, Poster #19, Abstract

#CT191), at the American Association for Cancer Research (“AACR”)

Annual Meeting taking place in San Diego, CA.

Financial Results

The net loss attributable to common shareholders for the fourth

quarter of 2023 was $3.9 million, or $0.73 per basic and diluted

share. This compares with a net loss attributable to common

shareholders of $22.0 million, or $5.87 per basic and diluted

share, for the same period in 2022.

Revenues for the fourth quarter of 2023 were $7.0 million,

compared to $2.6 million for the same period in 2022. Revenues for

the fourth quarter of 2023 were comprised of revenues from

collaborative research and development agreements with

Bristol-Myers Squibb and grant revenue.

Total research and development expenses for the fourth quarter

of 2023 were $8.8 million, compared with $17.6 million for the same

period in 2022. Total general and administrative expenses for the

fourth quarter of 2023 were $3.6 million, compared with $6.1

million for the same period in 2022.

As of December 31, 2023, MTEM’s unrestricted cash and cash

equivalents totaled $11.5 million. MTEM anticipates a cash runway

into the second quarter of 2024. Following the completion of the

recent Second Closing of the July 2023 Private Placement, the

Company anticipates that cash runway will extend to the end of the

fourth quarter 2024.

For more details on MTEM’s financial results for 2023, refer to

Form 10-K filed with the SEC.

|

|

|

Molecular Templates, Inc. CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS (in

thousands, except share and per share data)

(unaudited) |

| |

| |

Three Months Ended

December 31, |

|

Year Ended December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Research and development

revenue |

$ |

6,639 |

|

|

$ |

2,611 |

|

|

$ |

52,625 |

|

|

$ |

19,754 |

|

| Grant revenue |

|

377 |

|

|

|

— |

|

|

|

4,681 |

|

|

|

— |

|

|

Total revenue |

|

7,016 |

|

|

|

2,611 |

|

|

|

57,306 |

|

|

|

19,754 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Research and development |

|

8,796 |

|

|

|

17,590 |

|

|

|

48,875 |

|

|

|

82,425 |

|

|

General and administrative |

|

3,591 |

|

|

|

6,080 |

|

|

|

18,897 |

|

|

|

26,200 |

|

|

Total operating expenses |

|

12,387 |

|

|

|

23,670 |

|

|

|

67,772 |

|

|

|

108,625 |

|

| Loss from operations |

|

5,371 |

|

|

|

21,059 |

|

|

|

10,466 |

|

|

|

88,871 |

|

| Interest and other income,

net |

|

178 |

|

|

|

425 |

|

|

|

1,208 |

|

|

|

988 |

|

| Interest and other expense,

net |

|

(39 |

) |

|

|

(1,351 |

) |

|

|

(2,654 |

) |

|

|

(4,716 |

) |

| Gain on extinguishment of

debt |

|

— |

|

|

|

— |

|

|

|

1,795 |

|

|

|

— |

|

| Change in valuation of contingent

value right |

|

1,273 |

|

|

|

— |

|

|

|

2,457 |

|

|

|

— |

|

| Loss on disposal of property and

equipment |

|

— |

|

|

|

(37 |

) |

|

|

(475 |

) |

|

|

(66 |

) |

| Loss before provision (benefit)

for income taxes |

|

3,959 |

|

|

|

22,022 |

|

|

|

8,135 |

|

|

|

92,665 |

|

| Provision (benefit) for income

taxes |

|

(11 |

) |

|

|

27 |

|

|

|

(11 |

) |

|

|

53 |

|

| Net loss attributable to

common shareholders |

$ |

3,948 |

|

|

$ |

22,049 |

|

|

$ |

8,124 |

|

|

$ |

92,718 |

|

| Net loss per share

attributable to common shareholders: |

|

|

|

|

|

|

|

|

Basic and diluted |

$ |

0.73 |

|

|

$ |

5.87 |

|

|

$ |

1.80 |

|

|

$ |

24.69 |

|

| Weighted average number of

shares used in net loss per share calculations: |

|

|

|

|

|

|

|

|

Basic and diluted |

|

5,374,268 |

|

|

|

3,756,711 |

|

|

|

4,501,206 |

|

|

|

3,755,564 |

|

|

|

|

Molecular Templates, Inc. CONDENSED

CONSOLIDATED BALANCE SHEETS (in thousands, except

share and per share data) |

| |

| |

December 31,2023 |

|

December 31,2022 |

| ASSETS |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

11,523 |

|

|

$ |

32,190 |

|

|

Marketable securities, current |

|

— |

|

|

|

28,859 |

|

|

Prepaid expenses |

|

2,195 |

|

|

|

3,459 |

|

|

Grants revenue receivable |

|

250 |

|

|

|

— |

|

|

Other current assets |

|

2,804 |

|

|

|

3,790 |

|

|

Total current assets |

|

16,772 |

|

|

|

68,298 |

|

|

Operating lease right-of-use assets |

|

9,161 |

|

|

|

11,132 |

|

|

Property and equipment, net |

|

7,393 |

|

|

|

14,632 |

|

|

Other assets |

|

2,057 |

|

|

|

3,486 |

|

|

Total assets |

$ |

35,383 |

|

|

$ |

97,548 |

|

| LIABILITIES AND STOCKHOLDERS’

EQUITY/(DEFICIT) |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

$ |

1,523 |

|

|

$ |

504 |

|

|

Accrued liabilities |

|

4,279 |

|

|

|

8,823 |

|

|

Deferred revenue, current |

|

9,031 |

|

|

|

45,573 |

|

|

Other current liabilities |

|

2,488 |

|

|

|

2,182 |

|

|

Total current liabilities |

|

17,321 |

|

|

|

57,082 |

|

|

Deferred revenue, long-term |

|

— |

|

|

|

5,904 |

|

|

Long-term debt, net of current portion |

|

— |

|

|

|

36,168 |

|

|

Operating lease liabilities, long term portion |

|

9,742 |

|

|

|

12,231 |

|

|

Contingent value right liability |

|

2,702 |

|

|

|

— |

|

|

Other liabilities |

|

1,406 |

|

|

|

1,295 |

|

|

Total liabilities |

|

31,171 |

|

|

|

112,680 |

|

| Commitments and

contingencies |

|

|

|

|

|

|

Stockholders’ equity/(deficit) |

|

|

|

|

|

|

Preferred stock, $0.001 par value per share: |

|

|

|

|

|

|

Authorized: 2,000,000 shares as of December 31, 2023 and 2022;

Issued and outstanding: 250 shares as of December 31, 2023 and

2022 |

|

— |

|

|

|

— |

|

|

Common stock, $0.001 par value per share: |

|

|

|

|

|

|

Authorized: 150,000,000 shares as of December 31, 2023 and

2022; Issued and outstanding: 5,374,268 shares as of

December 31, 2023 and 3,756,711 shares as of December 31,

20221 |

|

5 |

|

|

|

4 |

|

|

Additional paid-in capital1 |

|

457,099 |

|

|

|

429,698 |

|

|

Accumulated other comprehensive loss |

|

— |

|

|

|

(66 |

) |

|

Accumulated deficit |

|

(452,892 |

) |

|

|

(444,768 |

) |

|

Total stockholders’ equity/(deficit) |

|

4,212 |

|

|

|

(15,132 |

) |

|

Total liabilities and stockholders’

equity/(deficit) |

$ |

35,383 |

|

|

$ |

97,548 |

|

|

|

1. Prior period amounts have been retrospectively adjusted for

the 1-for-15 reverse stock split that was effective August 11,

2023.

About Molecular Templates

Molecular Templates is a clinical-stage

biopharmaceutical company focused on the discovery and development

of targeted biologic therapeutics. Our proprietary drug platform

technology, known as engineered toxin bodies, or ETBs, leverages

the resident biology of a genetically engineered form of Shiga-like

Toxin A subunit to create novel therapies with potent and

differentiated mechanisms of action for cancer.

Forward-Looking

Statements

This press release contains forward-looking statements for

purposes of the Private Securities Litigation Reform Act of 1995

(the “Act”). Molecular Templates disclaims any intent or obligation

to update these forward-looking statements and claims the

protection of the Act’s Safe Harbor for forward-looking statements.

All statements, other than statements of historical facts, included

in this press release, including, but not limited to those

regarding strategy, future operations, the Company’s ability to

execute on its objectives, prospects, plans, future clinical

development of the Company’s product candidates, any implication

that the preliminary results, interim results, or the results of

earlier clinical trials or ongoing clinical trials will be

representative of the results of future or later clinical trials or

final results, the potential benefits, safety or efficacy and any

evaluations or judgements regarding the Company’s product

candidates, [the results of any strategic process which are

inherently uncertain at the present time] and future execution of

corporate goals. In addition, when or if used in this press

release, the words “may,” “could,” “should,” “continue”,

“anticipate,” “potential”, “believe,” “estimate,” “appears”,

“expect,” “intend,” “plan,” “predict” and similar expressions and

their variants, as they relate to Molecular Templates may identify

forward-looking statements. Forward-looking statements are not

guarantees of future performance and involve risks and

uncertainties. Actual events or results may differ materially from

those discussed in the forward-looking statements as a result of

various factors including, but not limited to the following: the

continued availability of financing on commercially reasonable

terms, whether Molecular Templates’ cash resources will be

sufficient to fund its continuing operations; the results of MTEM’s

ongoing clinical studies and the ability to effectively operate

MTEM, and those risks identified under the heading “Risk Factors”

in Molecular Templates’ filings with the Securities and Exchange

Commission (the “SEC”), including its Form 10-K for the year ended

December 31, 2023 and any subsequent reports filed with the SEC.

Any forward-looking statements contained in this press release

speak only as of the date hereof, and Molecular Templates

specifically disclaims any obligation to update any forward-looking

statement, whether because of new information, future events or

otherwise.

Contacts:grace.kim@mtem.com

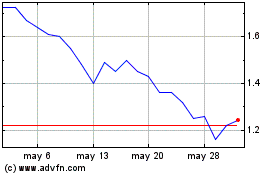

Molecular Templates (NASDAQ:MTEM)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Molecular Templates (NASDAQ:MTEM)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024