Natural Alternatives International, Inc. ("NAI") (Nasdaq: NAII), a

leading formulator, manufacturer, and marketer of customized

nutritional supplements, today announced a net loss of $1.9

million, or ($0.32) per diluted share, on net sales of $29.5

million for the fourth quarter of fiscal year 2024 compared to a

net income of $2.0 million, or $0.35 per diluted share, in the

fourth quarter of the prior fiscal year.

Net sales during the three months ended June 30,

2024, decreased $6.4 million, or 18%, to $29.5 million as compared

to $35.9 million recorded in the comparable prior year period.

During the same period, private-label contract manufacturing sales

decreased 14% to $27.6 million. Private-label contract

manufacturing sales decreased primarily due to reduced orders from

one of our larger customers associated with their efforts to reduce

excess on-hand inventories, partially offset by increased shipments

from other existing customers and shipments to new customers.

CarnoSyn® beta-alanine royalty, licensing and

raw material sales revenue decreased 48% to $1.85 million during

the fourth quarter of fiscal year 2024, as compared to $3.57

million for the fourth quarter of fiscal year 2023. The decrease in

CarnoSyn® beta-alanine royalty, licensing, and raw material sales

revenue during the fourth quarter of fiscal 2024 was primarily due

to decreased raw material sales and unfavorable changes in

estimates for volume rebates.

Our net loss for fiscal year 2024 was $7.2

million, or ($1.23) per diluted share, compared to net income of

$2.5 million, or $0.43 per diluted share, for fiscal year 2023.

Net sales during the year ended June 30, 2024,

decreased $40.2 million, or 26%, to $113.8 million as compared to

$154.0 million recorded in the comparable prior year period. During

the year ended June 30, 2024, private-label contract manufacturing

sales decreased 27% to $105.4 million, as compared to $145.3

million in the comparable prior period. CarnoSyn® beta-alanine

royalty, licensing and raw material sales revenue decreased 3% to

$8.4 million during the fiscal 2024, as compared to $8.7 million

for fiscal 2023.

We experienced a loss from operations during the

three and twelve months ended June 30, 2024. This was

primarily due to a slowdown in sales across our private-label

contract manufacturing segment. Although our overall sales

forecast for fiscal 2025 includes a significant increase in sales

as compared to fiscal 2024, we currently anticipate we will

experience a net loss in the first half of fiscal 2025, net income

in the second half of fiscal 2025, and we will break-even or have a

slight profit for the full fiscal 2025 year.

As of June 30, 2024, we had cash of $12.0

million and working capital of $38.1 million, compared to $13.6

million and $41.1 million respectively, as of June 30, 2023. As of

June 30, 2024, we had $12.0 million of borrowing capacity on our

credit facility of which we had outstanding borrowings of $3.4

million.

Mark A. Le Doux, Chairman and Chief Executive

Officer of NAI stated, “As planned, our Carlsbad powder facility

re-opened in the fourth quarter with on-going production to meet

our customer requirements. We continue to gain traction with new

business opportunities and expect these efforts to bear fruit in

the coming months. Our new business opportunity pipeline remains

healthy, and we are optimistic these opportunities will generate

positive sales growth and pave our pathway back to profitability.”

“We recently attended the ESPEN conference in

Milan, Italy where we debuted our groundbreaking new patent pending

carnosine boosting ingredient called TriBsynTM to researchers,

healthcare professionals, and brands within the medical foods

industry. This was an exciting event for us to introduce TriBsynTM

which is the world’s first paresthesia free beta-alanine to the

industry, and we are encouraged by the reception it

received.”

An updated investor presentation will be posted

to the investor relations page on our website later today

(https://www.nai-online.com/our-company/investors/).

NAI, headquartered in Carlsbad, California, is a

leading formulator, manufacturer and marketer of nutritional

supplements and provides strategic partnering services to its

customers. Our comprehensive partnership approach offers a wide

range of innovative nutritional products and services to our

clients including scientific research, clinical studies,

proprietary ingredients, customer-specific nutritional product

formulation, product testing and evaluation, marketing management

and support, packaging, and delivery system design, regulatory

review, and international product registration assistance. For more

information about NAI, please see our website at

http://www.nai-online.com.

This press release contains forward-looking

statements within the meaning of Section 21E of the Securities

Exchange Act of 1934 that are not historical facts and information.

These statements represent our intentions, expectations and beliefs

concerning future events, including, among other things, our

ability to develop, maintain or increase sales to new and existing

customers, our future revenue, profits and financial condition, as

well as current and future economic conditions and the impact of

such conditions on our business. We wish to caution readers these

statements involve risks and uncertainties that could cause actual

results and outcomes for future periods to differ materially from

any forward-looking statement or views expressed herein. NAI's

financial performance and the forward-looking statements contained

herein are further qualified by other risks, including those set

forth from time to time in the documents filed by us with the

Securities and Exchange Commission, including our most recent

Annual Report on Form 10-K.

SOURCE – Natural Alternatives International, Inc.

CONTACT – Michael Fortin, Chief Financial Officer, Natural

Alternatives International, Inc., at 760-736-7700 or

investor@nai-online.com.

Web site: http://www.nai-online.com

| NATURAL

ALTERNATIVES INTERNATIONAL, INC. |

|

| CONDENSED

CONSOLIDATED STATEMENTS OF INCOME |

|

| (In thousands,

except per share data) |

|

| |

|

|

|

|

|

|

|

|

| |

(Unaudited) |

|

|

|

|

|

|

|

| |

Three Months

Ended |

|

|

|

Year Ended |

|

|

|

| |

June 30, |

|

|

|

June 30, |

|

|

|

| |

|

2024 |

|

|

|

|

|

2023 |

|

|

|

|

|

2024 |

|

|

|

|

|

2023 |

|

|

|

|

|

NET SALES |

$ |

29,489 |

|

|

100.0 |

% |

|

$ |

35,894 |

|

|

100.0 |

% |

|

$ |

113,796 |

|

|

100.0 |

% |

|

$ |

154,015 |

|

|

100.0 |

% |

|

| Cost of

goods sold |

|

28,070 |

|

|

95.2 |

% |

|

|

30,697 |

|

|

85.5 |

% |

|

|

106,931 |

|

|

94.0 |

% |

|

|

135,857 |

|

|

88.2 |

% |

|

| Gross

profit |

|

1,419 |

|

|

4.8 |

% |

|

|

5,197 |

|

|

14.5 |

% |

|

|

6,865 |

|

|

6.0 |

% |

|

|

18,158 |

|

|

11.8 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selling,

general & administrative expenses |

|

3,944 |

|

|

13.4 |

% |

|

|

2,023 |

|

|

5.6 |

% |

|

|

15,399 |

|

|

13.5 |

% |

|

|

13,445 |

|

|

8.7 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(LOSS) INCOME FROM OPERATIONS |

|

(2,525 |

) |

|

-8.6 |

% |

|

|

3,174 |

|

|

8.8 |

% |

|

|

(8,534 |

) |

|

-7.5 |

% |

|

|

4,713 |

|

|

3.1 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other

(expense) income, net |

|

(256 |

) |

|

-0.9 |

% |

|

|

(435 |

) |

|

-1.2 |

% |

|

|

(930 |

) |

|

-0.8 |

% |

|

|

(1,158 |

) |

|

-0.8 |

% |

|

|

(LOSS) INCOME BEFORE TAXES |

|

(2,781 |

) |

|

-9.4 |

% |

|

|

2,739 |

|

|

7.6 |

% |

|

|

(9,464 |

) |

|

-8.3 |

% |

|

|

3,555 |

|

|

2.3 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax

(benefit) expense |

|

(907 |

) |

|

|

|

|

702 |

|

|

|

|

|

(2,247 |

) |

|

|

|

|

1,033 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET

(LOSS) INCOME |

$ |

(1,874 |

) |

|

|

|

$ |

2,037 |

|

|

|

|

$ |

(7,217 |

) |

|

|

|

$ |

2,522 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET

(LOSS) INCOME PER COMMON SHARE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic: |

($0.32 |

) |

|

|

|

$0.35 |

|

|

|

|

($1.23 |

) |

|

|

|

$0.43 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted: |

($0.32 |

) |

|

|

|

$0.35 |

|

|

|

|

($1.23 |

) |

|

|

|

$0.43 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| WEIGHTED

AVERAGE COMMON SHARES OUTSTANDING: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

5,916 |

|

|

|

|

|

5,850 |

|

|

|

|

|

5,871 |

|

|

|

|

|

5,863 |

|

|

|

|

| Diluted |

|

5,916 |

|

|

|

|

|

5,855 |

|

|

|

|

|

5,871 |

|

|

|

|

|

5,878 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NATURAL

ALTERNATIVES INTERNATIONAL, INC. |

|

| CONDENSED

CONSOLIDATED BALANCE SHEETS |

|

| (In thousands) |

|

|

|

|

|

|

|

|

|

June

30, |

|

June

30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

| Cash and

cash equivalents |

$ |

11,981 |

|

$ |

13,604 |

|

| Accounts

receivable, net |

|

16,891 |

|

|

7,022 |

|

| Inventories,

net |

|

24,249 |

|

|

29,694 |

|

| Other

current assets |

|

8,489 |

|

|

6,690 |

|

|

Total current assets |

|

61,610 |

|

|

57,010 |

|

| Property and

equipment, net |

|

52,211 |

|

|

53,841 |

|

| Operating

lease right-of-use assets |

|

43,537 |

|

|

20,369 |

|

| Other

noncurrent assets, net |

|

4,984 |

|

|

2,932 |

|

|

Total Assets |

$ |

162,342 |

|

$ |

134,152 |

|

| |

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

| Accounts

payable and accrued liabilities |

|

19,456 |

|

|

14,450 |

|

| Line of

Credit |

|

3,400 |

|

|

- |

|

| Mortgage

note payable |

|

9,229 |

|

|

9,517 |

|

| Operating

lease liability |

|

47,662 |

|

|

21,413 |

|

|

Total Liabilities |

|

79,747 |

|

|

45,380 |

|

|

Stockholders’ Equity |

|

82,595 |

|

|

88,772 |

|

|

Total Liabilities and Stockholders’ Equity |

$ |

162,342 |

|

$ |

134,152 |

|

|

|

|

|

|

|

This press release was published by a CLEAR® Verified

individual.

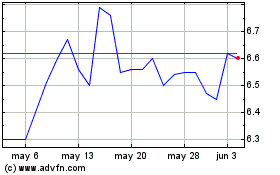

Natural Alternatives (NASDAQ:NAII)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Natural Alternatives (NASDAQ:NAII)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024