Filed

pursuant to Rule 424(b)(5)

Registration No. 333-279252

PROSPECTUS SUPPLEMENT

(TO PROSPECTUS DATED MAY 16, 2024)

Up to $10,366,156

Shares of Common Stock

____________________

On June 3, 2024, we entered into an at the market offering agreement

(the “Sales Agreement”), with Ladenburg Thalmann & Co. Inc. (“Ladenburg”), relating to the offer and sale

of shares of our common stock, par value $0.001 per share, offered by this prospectus supplement to or through Ladenburg as agent or principal.

We may, under this prospectus supplement and accompanying prospectus, offer and sell shares of our common stock having an aggregate offering

price of up to $10,366,156 in accordance with the terms of the Sales Agreement. You should read this prospectus supplement and the accompanying

prospectus, as well as the documents incorporated or deemed to be incorporated by reference herein or therein, before you invest.

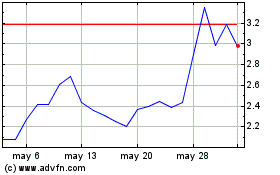

Our common stock is listed on the Nasdaq Capital

Market under the symbol “NEON.” On June 3, 2024, the last reported sale price of our common stock on the Nasdaq Capital Market

was $2.80 per share. As of June 3, 2024, the aggregate market value of our public float, calculated according to General Instructions

I.B.6. of Form S-3, is $38,728,576, based on 15,359,481 shares of common stock outstanding as of June 3, 2024, of which 11,560,769 shares

of our common stock are held by non-affiliates. We have not offered any securities pursuant to General Instruction I.B.6. of Form S-3

during the prior 12 calendar month period that ends on, and includes, the date of this prospectus supplement. Pursuant to General Instruction

I.B.6 of Form S-3, in no event will we sell our common stock in a public primary offering with a value exceeding more than one-third of

our public float in any 12-month period so long as our public float remains below $75,000,000.

Sales

of our common stock, if any, under this prospectus supplement may be made in sales deemed to be an “at the market offering”

as defined in Rule 415(a)(4) promulgated under the Securities Act of 1933, as amended, or the Securities Act), including sales made directly

on or through the Nasdaq Capital Market, the existing trading market for our common stock, sales made to or through a market maker other

than on an exchange or otherwise, directly to Ladenburg as principal, in negotiated transactions at market prices prevailing at the time

of sale or at prices related to such prevailing market prices, and/or in any other method permitted by applicable law. Ladenburg

is not required to sell any specific amount of securities, but will act as our sales agent using commercially reasonable efforts consistent

with its normal trading and sales practices. There is no arrangement for funds to be received in escrow, trust or similar arrangement.

Ladenburg will be entitled to compensation at

a commission rate of 3.0% of the gross sales price per share sold under the Sales Agreement. In connection with the sale of the common

stock on our behalf, Ladenburg will be deemed to be an “underwriter” within the meaning of the Securities Act, and the compensation

of Ladenburg will be deemed to be underwriting commissions or discounts. We have also agreed to provide indemnification and contribution

to Ladenburg with respect to certain liabilities, including liabilities under the Securities Act.

____________________

Investing in our securities involves a

high degree of risk. See “Risk Factors” on page S-6 of this prospectus supplement and the risk factors

that are incorporated by reference into this prospectus supplement and the accompanying prospectus from our filings made with the

Securities and Exchange Commission pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”) for

a discussion of the factors you should carefully consider before deciding to invest in our common stock.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal

offense.

Ladenburg Thalmann

The date of this prospectus supplement is June 4, 2024.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus dated May

16, 2024 are part of a registration statement on Form S-3 that we have filed with the Securities and Exchange Commission (the “SEC”),

using a “shelf” registration process. Under the shelf registration statement, we may offer any combination of the securities

described in our base prospectus included in the shelf registration statement in one or more offerings, up to a total aggregate offering

price of $70,971,000. Under this prospectus supplement and the accompanying prospectus, we may offer shares of our common stock having

an aggregate offering price of up to $10,366,156 from time to time at prices and on terms to be determined by market conditions at the

time of offering pursuant to the terms of the Sales Agreement, a copy of which is incorporated by reference into this prospectus supplement.

Before buying any of the common stock that we

are offering, we urge you to carefully read this prospectus supplement and the accompanying prospectus, together with the information

incorporated by reference herein and therein as described under the heading “Incorporation of Certain Information by Reference”

in this prospectus supplement and the information in any free writing prospectus that we may authorize for use in connection with this

offering. These documents contain important information that you should consider when making your investment decision.

This prospectus supplement describes the specific

terms of the common stock we are offering and also adds to and updates information contained in the accompanying prospectus and the documents

incorporated by reference into this prospectus supplement and the accompanying prospectus. To the extent there is a conflict between

the information contained in this prospectus supplement, on the one hand, and the information contained in the accompanying prospectus

and any document incorporated by reference into this prospectus supplement or the accompanying prospectus that was filed with the SEC

before the date of this prospectus supplement, on the other hand, you should rely on the information in this prospectus supplement. If

any statement in one of these documents is inconsistent with a statement in another document having a later date — for example,

a document incorporated by reference into this prospectus supplement — the statement in the document having the later date modifies

or supersedes the earlier statement.

You should rely only on the information contained

in, or incorporated by reference into this prospectus supplement and the accompanying prospectus and in any free writing prospectus that

we may authorize for use in connection with this offering. We have not, and Ladenburg has not, authorized any other person to provide

you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are

not, and Ladenburg is not, making an offer to sell or soliciting an offer to buy our common stock in any jurisdiction in which an offer

or solicitation is not authorized or in which the person making that offer or solicitation is not qualified to do so or to anyone to

whom it is unlawful to make an offer or solicitation. You should assume that the information appearing in this prospectus supplement

and the accompanying prospectus, the documents incorporated by reference herein and therein, and in any free writing prospectus that

we may authorize for use in connection with this offering, is accurate only as of the date of those respective documents. Our business,

financial condition, results of operations and prospects may have changed since those dates. You should read this prospectus supplement,

the accompanying prospectus, the documents incorporated by reference herein and therein, and any free writing prospectus that we may

authorize for use in connection with this offering, in their entirety before making an investment decision. You should also read and

consider the information in the documents to which we have referred you in the sections of this prospectus supplement entitled “Where

You Can Find More Information” and “Incorporation of Certain Information by Reference.”

We are offering to sell, and seeking offers to buy, shares of common

stock only in jurisdictions where offers and sales are permitted. The distribution of this prospectus and the offering of the common stock

in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus must

inform themselves about, and observe any restrictions relating to, the offering of the common stock and the distribution of this prospectus

outside the United States. This prospectus does not constitute, and may not be used in connection with, an offer to sell, or a solicitation

of an offer to buy, any securities offered by this prospectus by any person in any jurisdiction in which it is unlawful for such person

to make such an offer or solicitation.

Unless the context otherwise requires, “Neonode,”

“the Company,” “we,” “us,” “our” and similar terms refer to Neonode Inc.

Trademarks, service marks or trade names of any

other companies appearing in this prospectus supplement and the accompanying prospectus are the property of their respective owners.

Use or display by us of trademarks, service marks or trade names owned by others is not intended to and does not imply a relationship

between us, and/or endorsement or sponsorship by, the owners of the trademarks, service marks or trade names.

PROSPECTUS SUPPLEMENT SUMMARY

The following summary highlights information contained elsewhere

in this prospectus supplement, the accompanying prospectus or incorporated by reference herein or therein and does not contain all the

information that may be important to purchasers of our securities. You should carefully read this prospectus supplement, the accompanying

prospectus, all documents incorporated by reference herein or therein, any related free writing prospectus and the additional information

described under the caption “Where You Can Find More Information,” beginning on page S-11 before buying any

of the securities being offered.

The Company

Our company provides advanced optical sensing

solutions for touch, contactless touch, and gesture sensing. We also provide software solutions for machine perception that feature advanced

machine learning algorithms to detect and track persons and objects in video streams from cameras and other types of imagers. We base

our touch, contactless touch, and gesture sensing products and solutions using our zForce technology platform and our machine perception

solutions on our MultiSensing technology platform. zForce (zero force) is the name for our patented optical sensing technology built

on infrared light, invisible to the human eye. Our MultiSensing platform was designed to provide advanced, safe, and scalable software

solutions to provide situational context. We market and sell our solutions to customers in many different markets and segments including,

but not limited to, office equipment, automotive, industrial automation, medical, military and avionics.

In 2010, we began licensing to Original Equipment

Manufacturers (“OEMs”) and automotive Tier 1 suppliers who embed our technology into products they develop, manufacture,

and sell. Since 2010, our licensing customers have sold approximately 95 million products that feature our technology. In October 2017,

we augmented our licensing business and began manufacturing and shipping touch sensor modules (“TSMs”) that incorporate our

patented technology. We sell these TSMs to OEMs, Original Design Manufacturers (“ODMs”), and systems integrators for use

in their products.

As of December 31, 2023, we had nine agreements

with value added resellers (“VARs”) for integration of our TSMs in the products they offer to global OEMs, ODMs and systems

integrators. In addition to this, we distribute our TSMs through Digi-Key Corporation, Serial Microelectronics HK Ltd., and Nexty Electronics

Corporation.

During 2023, we continued to focus our efforts

on maintaining our current licensing customers and achieving design wins for new programs both with current and future customers. In

parallel we continued to market and sell TSMs directly and indirectly through partners. We made investments enhancing the design and

improving the production yield of our TSMs in our production unit Pronode Technologies AB and improving the related firmware and configuration

tools software platforms.

On December 12, 2023, we announced a new, sharpened

strategy with full focus on the licensing business. Consequently, we will phase out the TSM product business during 2024 through licensing

of the TSM technology to strategic partners or outsourcing.

Licensing

We license our zForce technology to OEMs and automotive

Tier 1 suppliers who embed our technology into products that they develop, manufacture and sell. Since 2010, our licensing customers

have sold approximately 95 million devices that use our patented technology.

As of December 31, 2023, we had 34 valid technology

license agreements with global OEMs, ODMs and automotive Tier 1 suppliers.

Our licensing customer base is primarily in the

automotive and printer segments. Ten of our licensing customers are currently shipping products that embed our technology. We anticipate

current customers will continue to ship products with our technology in 2024 and in future years. We also expect to expand our customer

base with a number of new customers who will be looking to ship new products incorporating our zForce and MultiSensing technologies as

they complete final product development and release cycles. We typically earn our license fees on a per unit basis when our customers

ship products using our technology, but in the future we may use other business models as well.

Product Sales

In addition to our licensing business, we design

and manufacture TSMs that incorporate our patented technology. We sell our TSMs to OEMs, ODMs and systems integrators for use in their

products.

We utilize a robotic manufacturing process designed

specifically for our TSMs. The TSMs are commercial-off-the-shelf products based on our patent-protected zForce technology platform and

can support the development of contactless touch, touch, gesture and object sensing solutions that, paired with our technology licensing

offering, give us a full range of options to enter and compete in key markets.

We began selling our TSMs to customers in the

industrial and consumer electronics segments in 2017. We will phase out the TSM product business during 2024 through licensing of the

TSM technology to strategic partners or outsourcing.

Non-recurring Engineering Services

We also offer non-recurring engineering (“NRE”)

services related to application development linked to our TSMs and our zForce and MultiSensing technology platforms on a flat rate or

hourly rate basis.

Typically, our licensing customers require engineering

support during the development and initial manufacturing phase for their products using our technology, while our TSM customers require

hardware or software modifications to our standard products or support during the development and initial manufacturing phases of their

products using our technology. In both cases we can offer NRE services and earn NRE revenues.

Intellectual Property

We rely on a combination of intellectual

property laws and contractual provisions to establish and protect the proprietary rights in our technology. The number of our issued

and pending patents and patents filed in each jurisdiction as of the date of this prospectus supplement is set forth in the

following table:

| Jurisdiction | |

No. of Reg.

Designs | | |

No. of

Issued

Patents | | |

No. of

Patents

Pending | |

| United States | |

| 5 | | |

| 49 | | |

| 9 | |

| Europe | |

| - | | |

| 13 | | |

| 3 | |

| Japan | |

| - | | |

| 7 | | |

| 2 | |

| China | |

| - | | |

| 6 | | |

| 2 | |

| South Korea | |

| - | | |

| 6 | | |

| 2 | |

| Patent Convention Treaty | |

| Not Applicable | | |

| Not Applicable | | |

| 1 | |

| Total: | |

| 5 | | |

| 81 | | |

| 19 | |

Our patents cover optical blocking technologies

for touchscreens and head-up displays, optical reflective technologies for contactless interaction with kiosks and elevators, as well

as machine perception solutions for driver and in-cabin monitoring.

Our software may also be protected by copyright

laws in most countries, including Sweden and the European Union, if the software is deemed new and original. Protection can be claimed

from the date of creation.

In 2023 we filed eleven new patent applications

and had eight new patent grants issued; seven patents have lapsed.

The duration of our patent protection for utility

patents is generally 20 years from the date of filing. The duration of our patent protection for design patents varies throughout the

world between 10 and 25 years from the date of grant, depending on the jurisdiction. We believe the duration of our intellectual property

rights is adequate relative to the expected lives of our products.

We also protect and promote our brand by registering

trademarks in key markets around the world. Our trademarks include: Neonode (26 registrations, 1 pending application), the Neonode logo

(8 registrations), zForce (10 registrations), and MultiSensing (3 registrations).

Risk Factor Summary

Below is a summary of material factors that make

an investment in our common stock speculative or risky. Importantly, this summary does not address all of the risks and uncertainties

that we face. You should understand that it is not possible to predict or identify all such factors. Consequently, you should not consider

this summary to be a complete discussion of all potential risks or uncertainties that may substantially impact our business. Additional

discussion of the risks and uncertainties summarized in this risk factor summary, as well as other risks and certainties that we face,

are described under the heading “Risk Factors” beginning on page S-6 of this prospectus supplement, and this summary is qualified

in its entirety by that discussion. Moreover, we operate in a competitive and rapidly changing environment. New factors emerge from time

to time and it is not possible to predict the impact of all of these factors on our business, financial condition or results of operations.

You should consider carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page S-6

of this prospectus supplement as part of your evaluation of an investment in our securities.

Risks

Related to This Offering

| ● | Management

will have broad discretion as to the use of the proceeds from this offering and may not use the proceeds effectively. |

| ● | You

may experience immediate and substantial dilution. |

| ● | The

actual number of shares we will issue under the Sales Agreement with Ladenburg, at any one time or in total, is uncertain. |

| ● | The

common stock offered hereby will be sold in “at the market offerings,” and investors who buy shares at different times will

likely pay different prices. |

| ● | There

is a limited trading market for our common stock, which could make it difficult to liquidate an investment in our common stock, in a

timely manner. |

| ● | You

may experience future dilution as a result of future equity offerings. |

| ● | We

do not intend to pay dividends in the foreseeable future. |

Risks

Related to Our Business

| ● | We

have had a history of losses and may require additional capital to fund our operations, which may not be available to us on commercially

attractive terms or at all. |

| ● | We

are dependent on a limited number of customers. |

| ● | We

rely on the ability of our customers to design, manufacture and sell their products that incorporate our touch technology. |

| ● | The

length of a customer’s product development and release cycle depends on many factors outside of our control and any delays could

cause us to incur significant expenses without offsetting revenues, or revenues that vary significantly from quarter to quarter. |

| ● | Our

license customers rely upon component suppliers to manufacture and sell products containing our technology and limited availability of

components may adversely affect our and our customers’ businesses. |

| ● | It

can be difficult for us to verify royalty amounts owed to us under licensing agreements, and this may cause us to lose potential revenue. |

| ● | If

we fail to develop and introduce new technology successfully, and in a cost-effective and timely manner, we will not be able to compete

effectively and our ability to generate revenues will suffer. |

| ● | Our

operating results may fluctuate significantly as a result of a variety of factors, many of which are outside of our control. |

| ● | We

must enhance our sales and technology development organizations. If we are unable to identify, hire, or retain qualified sales, marketing,

and technical personnel, our ability to achieve future revenue may be adversely affected. |

| ● | We

may make acquisitions and strategic investments that are dilutive to existing stockholders,

result in unanticipated accounting charges or otherwise adversely affect our results of operations. |

| ● | We

are dependent on the services of our key personnel. |

| ● | If

we are unable to obtain and maintain patent or other intellectual property protection for any products we develop or for our technologies,

or if the scope of the patents and other intellectual property protection obtained is not sufficiently broad, our competitors could develop

and commercialize products and technologies similar or identical to ours, and our ability to successfully commercialize any products

we may develop, and our technologies, may be harmed. |

| ● | We

may not be successful in our strategic efforts around patent monetization. |

| ● | If

third parties infringe upon our intellectual property, we may expend significant resources enforcing our rights or suffer competitive

injury. |

| ● | The

laws of certain foreign countries may not provide sufficient protection of our intellectual property rights to the same extent as the

laws of the United States, which may make it more difficult for us to protect our intellectual property. |

| ● | Security

breaches and other disruptions to our information technology infrastructure could interfere with our operations, compromise confidential

information, and expose us to liability which could materially adversely impact our business and reputation. |

| ● | Third

parties that maintain our confidential and proprietary information could experience a cybersecurity

incident. |

| ● | If

we are unable to detect material weaknesses in our internal control, our financial reporting and our business may be adversely affected. |

Risks

Related to Owning Our Stock

| ● | Future

sales of our common stock by us or our insiders could adversely affect the trading price of our common stock and dilute your investment. |

| ● | We

currently have fewer than 300 stockholders of record and, therefore, are eligible to terminate the registration of our common stock under

the Exchange Act and cease being a U.S. public company with reporting obligations. |

| ● | Our

stock price has been volatile, and your investment in our common stock could suffer a decline in value. |

| ● | A

limited number of stockholders, including directors, hold a significant number of shares

of our outstanding common stock. |

| ● | Our

certificate of incorporation and bylaws and the Delaware General Corporation Law contain provisions that could delay or prevent a change

in control. |

| ● | If securities analysts do not publish research or if securities analysts or other third parties publish

inaccurate or unfavorable research about us, the price of our common stock could decline. |

Corporate Information

Neonode Inc. was incorporated in the State of

Delaware on September 4, 1997. Our principal executive office is located Karlavägen 100, 115 26 Stockholm, Sweden, and our telephone

number is +46 (0) 70 29 58 519. Our office in the United States is located in San Jose, California. Our website address is www.neonode.com.

The information contained on, or that can be accessed through, our website is not part of this prospectus supplement or the accompanying

prospectus.

We have the following wholly owned subsidiaries:

Neonode Technologies AB (Sweden) (established in 2008 to develop and license touchscreen technology); Neonode Japan Inc. (Japan) (established

in 2013); Neonode Korea Ltd. (South Korea) (established in 2014). Neonode Korea Ltd. is currently dormant. In 2015, we established Pronode

Technologies AB, a subsidiary of Neonode Technologies AB. Since October 1, 2022, Pronode Technologies AB is a wholly owned subsidiary

of Neonode Technologies AB.

The

Offering

| Common stock offered by us |

|

Shares of our common stock having an aggregate offering price of up

to $10,366,156. |

| |

|

|

| Common stock to be outstanding following this

offering |

|

Up to 18,453,855 shares of our common stock, assuming the sale of

3,094,374 shares of our common stock in this offering at an offering price of $3.35 per share, which was the last reported sale price

of our common stock on Nasdaq on May 29, 2024. The actual number of shares of our common stock issued will vary depending on the sale

price under this offering. |

| |

|

|

| Manner of offering |

|

Sales of our common stock, if any, will be made from time to time in

sales deemed to be an “at the market offering” as defined in Rule 415 promulgated under the Securities Act to or through Ladenburg,

as agent or principal.. See “Plan of Distribution” on page S-10. |

| |

|

|

| Use of proceeds |

|

We intend to use the net proceeds from this offering,

if any, for working capital and general corporate purposes, which may include research and development expenses and capital expenditures.

See “Use of Proceeds” on page S-8. |

| |

|

|

| Risk factors |

|

Investing in our common stock involves a high degree

of risk. See “Risk Factors” and the other information included in this prospectus supplement, the accompanying prospectus,

and incorporated by reference herein or therein for a discussion of factors you should carefully consider before deciding to invest

in our common stock. These risk factors may be amended, supplemented or superseded from time to time by other reports we file with

the SEC in the future. |

| |

|

|

| Nasdaq Capital Market Listing |

|

Our common stock is listed on the Nasdaq Capital Market

under the symbol “NEON.” |

The number of shares of our common stock expected to be outstanding

immediately after this offering is based on 15,359,481 shares of our common stock issued and outstanding as of June 3, 2024, and excludes

691,399 shares of our common stock reserved for future issuance under our 2020 Stock Incentive Plan as of June 3, 2024.

RISK FACTORS

An investment in our common stock involves a

high degree of risk. Prior to making a decision about investing in our common stock, you should carefully consider the specific risks

described below, the risks discussed in the sections entitled “Risk Factors” contained in our most recent Annual Report on

Form 10-K or Quarterly Report on Form 10-Q, as filed with the SEC, which are incorporated in this prospectus supplement and accompanying

prospectus by reference in their entirety, as well as any amendment or updates to our risk factors reflected in subsequent filings with

the SEC, including any free writing prospectus that we may authorize for use in connection with this offering. These risks and uncertainties

are not the only risks and uncertainties we face. Additional risks and uncertainties not presently known to us, or that we currently

see as immaterial, may also impair our business. If any of the risks or uncertainties described in our SEC filings or any additional

risks and uncertainties actually occur, our business, financial condition, results of operations and cash flow could be materially and

adversely affected. In that case, the market value and/or trading price, as applicable, of our securities could decline, and you might

lose all or part of your investment.

Risks Related to This Offering

Management will have broad discretion as to the use of the proceeds

from this offering and may not use the proceeds effectively.

Because we have not designated the amount of

net proceeds from this offering to be used for any particular purpose, our management will have broad discretion as to the application

of the net proceeds from this offering and could use them for purposes other than those contemplated at the time of the offering. Our

management may use the net proceeds for corporate purposes that may not improve our financial condition or market value.

You may experience immediate and substantial dilution.

The offering prices per share in this offering

may exceed the net tangible book value per share of our common stock prior to this offering. Assuming that an aggregate of 3,094,374 shares

of our common stock are sold at a price of $3.35 per share pursuant to this prospectus supplement, which was the last reported sale price

of our common stock on the Nasdaq Capital Market on May 29, 2024, you would experience immediate dilution of $2.00 per share, representing

the difference between our as adjusted net tangible book value per share as of March 31, 2024 after giving effect to this offering and

the assumed offering price. The exercise of outstanding stock options and warrants may result in further dilution of your investment.

See the section titled “Dilution” below for a more detailed illustration of the dilution you would incur if you participate

in this offering. Because the sales of the common shares offered hereby will be made directly into the market or in negotiated transactions,

the prices at which we sell these shares will vary and these variations may be significant. Purchasers of the shares we sell, as well

as our existing shareholders, will experience significant dilution if we sell shares at prices significantly below the price at which

they invested.

The actual number of shares we will issue

under the Sales Agreement with Ladenburg, at any one time or in total, is uncertain.

Subject to certain limitations in the Sales Agreement

with Ladenburg and compliance with applicable law, we have the discretion to deliver placement notices to Ladenburg at any time throughout

the term of the Sales Agreement. The number of shares that are sold by Ladenburg after delivering a placement notice will fluctuate based

on the market price of our common stock during the sales period and limits we set with Ladenburg.

The common stock offered hereby will be

sold in “at the market offerings,” and investors who buy shares at different times will likely pay different prices.

Investors who purchase shares

of our common stock in this offering at different times will likely pay different prices, and accordingly may experience different levels

of dilution and different outcomes in their investment results. We will have discretion, subject to market demand and the terms of the

Sales Agreement, to vary the timing, prices, and number of shares of common stock sold in this offering. In addition, subject to the final

determination by our board of directors or any restrictions we may place in any applicable placement notice, there is no minimum or maximum

sales price for shares to be sold in this offering. Investors may experience a decline in the value of the shares they purchase in this

offering as a result of sales made at prices lower than the prices they paid.

There is a limited trading market for our

common stock, which could make it difficult to liquidate an investment in our common stock, in a timely manner.

Our common stock is currently traded on the Nasdaq

Capital Market. Because there is a limited public market for our common stock, investors may not be able to liquidate their investment

whenever desired. We cannot assure that there will be an active trading market for our common stock and the lack of an active public trading

market could mean that investors may be exposed to increased risk. In addition, if we failed to meet the criteria set forth in SEC regulations,

various requirements would be imposed by law on broker-dealers who sell our securities to persons other than established customers and

accredited investors. Consequently, such regulations may deter broker-dealers from recommending or selling our common stock, which may

further affect its liquidity.

You may experience future dilution as a result of future equity

offerings.

In order to raise additional capital, we may

in the future offer additional shares of our common stock or other securities convertible into or exchangeable for our common stock at

prices that may not be the same as the price per share paid by any investor in this offering. We may sell shares or other securities

in any other offering at a price per share that is less than the price per share paid by any investor in this offering, and investors

purchasing shares or other securities in the future could have rights superior to you. The price per share at which we sell additional

shares of our common stock, or securities convertible or exchangeable into common stock, in future transactions may be higher or lower

than the price per share paid by any investor in this offering.

We do not intend to pay dividends in the foreseeable future.

We have never paid cash dividends on our common

stock and currently do not plan to pay any cash dividends in the foreseeable future.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying

prospectus, the documents that we incorporate by reference herein or therein and any free writing prospectuses that we may authorize

for use in connection with this offering contain “forward-looking statements” within the meaning of Section 27A of the Securities

Act and Section 21E of the Exchange Act. These forward-looking statements can generally be identified as such because the context of

the statement will include words such as “may,” “will,” “intend,” “plan,” “believe,”

“anticipate,” “expect,” “estimate,” “predict,” “potential,” “continue,”

“likely,” or “opportunity,” the negative of these words or words of similar import. Similarly, statements that

describe our future plans, strategies, intentions, expectations, objectives, goals or prospects are also forward-looking statements.

Discussions containing these forward-looking statements may be found, among other places, in the “Business” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” sections incorporated by reference from our most recent

Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q for the quarterly periods ended subsequent to our filing of such Annual

Report on Form 10-K, as well as any amendments thereto reflected in subsequent filings with the SEC.

These forward-looking statements are based largely

on our expectations and projections about future events and future trends affecting our business, and are subject to risks and uncertainties

that could cause actual results to differ materially from those anticipated in the forward-looking statements. The risks and uncertainties

include, among others, those noted in “Risk Factors” above and in any applicable prospectus supplement or free writing prospectus,

and those included in the documents that we incorporate by reference herein and therein.

In addition, past financial and/or operating

performance is not necessarily a reliable indicator of future performance, and you should not use our historical performance to anticipate

results or future period trends. We can give no assurances that any of the events anticipated by the forward-looking statements will

occur or, if any of them do, what impact they will have on our results of operations and financial condition. Except as required by law,

we undertake no obligation to publicly revise our forward-looking statements to reflect events or circumstances that arise after the

filing of this prospectus supplement or any supplement or free writing prospectus, or documents incorporated by reference herein and

therein, that include forward-looking statements.

USE OF PROCEEDS

We may issue and sell shares of our common stock having aggregate sales

proceeds of up to $10,366,156 from time to time. Because there is no minimum offering amount required pursuant to the Sales Agreement,

the actual total proceeds to us, if any, are not determinable at this time. Actual net proceeds will depend on the number of shares we

sell and the prices at which such sales occur. We cannot assure you that we will sell any shares under or fully utilize the Sales Agreement

as a source of financing. As a result, our management will have broad discretion in the allocation and use of the net proceeds from this

offering, and investors will be relying on the judgment of our management regarding the application of the proceeds of this offering.

We currently intend to use the net proceeds from

the sale of the securities under this prospectus supplement for general corporate purposes, including for research and development, sales

and marketing initiatives and general administrative expenses, working capital and capital expenditures. Pending our use of the net proceeds

from this offering, we plan to hold the net proceeds in cash.

DILUTION

If you purchase shares of our common stock in this offering, your ownership

interest will be diluted to the extent of the difference between the public offering price per share of our common stock and the as adjusted

net tangible book value per share of our common stock after giving effect to this offering. We calculate net tangible book value per share

by dividing the net tangible book value, which is total tangible assets less total liabilities, by the number of outstanding shares of

our common stock. Dilution represents the difference between the price per share paid by purchasers of shares in this offering and the

as adjusted net tangible book value per share of our common stock immediately after giving effect to this offering. Our net tangible book

value as of March 31, 2024 was approximately $15 million, or $0.98 per share. “Net tangible book value” is total assets minus

the sum of liabilities and intangible assets.

After giving effect to the sale of our

common stock during the term of the Sales Agreement with Ladenburg in the aggregate amount of $10,366,156 at an assumed offering

price of $3.35 per share, the last reported sale price of our common stock on the Nasdaq Capital Market on May 29, 2024 the fixed commission rate of 3.0% payable to Ladenburg and our estimated total expenses for this offering, our net

tangible book value as of March 31, 2024 would have been $24.9 million, or $1.35 per share of common stock. This represents an

immediate increase in the net tangible book value of $0.37 per share to our existing stockholders and an immediate dilution in net

tangible book value of $2.00 per share to new investors. The following table illustrates this per share dilution:

| Assumed public offering price per share | |

| | | |

$ | 3.35 | |

| Net tangible book value per share as of March 31, 2024 | |

$ | 0.98 | | |

| | |

| Increase in net tangible book value per share attributable to this offering | |

$ | 0.37 | | |

| | |

| As adjusted net tangible book value per share as of March 31, 2024, after giving effect to this offering | |

| | | |

$ | 1.35 | |

| Dilution per share to new investors purchasing shares in this offering | |

| | | |

$ | 2.00 | |

The table above assumes for illustrative purposes

that an aggregate of 3,094,374 shares of our common stock are sold during the term of the Sales Agreement with Ladenburg at a price of

$3.35 per share, the last reported sale price of our common stock on the Nasdaq Capital Market on May 29, 2024, for aggregate gross proceeds

of $10,366,156. Changes in the assumed public offering price of $3.35 per share would not affect our as adjusted net tangible book value

after this offering because this offering is currently limited to $10,366,156. However, the shares subject to the Sales Agreement with

Ladenburg are being sold from time to time at various prices. An increase of $0.50 per share in the price at which the shares are sold

from the assumed offering price per share shown in the table above, to $3.85 per share, assuming all of our common stock in the aggregate

amount of $10,366,156 during the remaining term of the Sales Agreement with Ladenburg is sold at that price, would increase our adjusted

net tangible book value per share after the offering to $1.38 per share and would increase the dilution in net tangible book value per

share to new investors in this offering to $2.47 per share, after deducting commissions and estimated aggregate offering expenses payable

by us. A decrease of $0.50 per share in the price at which the shares are sold from the assumed offering price per share shown in the

table above, to $2.85 per share, assuming all of our common stock in the aggregate amount of $10,366,156 during the term of the Sales

Agreement with Ladenburg is sold at that price, would decrease our adjusted net tangible book value per share after the offering to $1.31

per share and would decrease the dilution in net tangible book value per share to new investors in this offering to $1.54 per share, after

deducting commissions and estimated aggregate offering expenses payable by us. This information is supplied for illustrative purposes

only.

The above discussion and table are based on 15,359,481 shares of our

common stock issued and outstanding as of March 31, 2024, and exclude 691,399 shares of our common stock reserved for future issuance

under our 2020 Stock Incentive Plan as of March 31, 2024.

To the extent that options or warrants outstanding

as of March 31, 2024, if any, have been or are exercised, or other shares are issued, investors purchasing shares in this offering could

experience further dilution. In addition, we may choose to raise additional capital due to market conditions or strategic considerations,

including for potential acquisition or in-licensing opportunities, even if we believe we have sufficient funds for our current or future

operating plans. To the extent that additional capital is raised through the sale of equity or convertible debt securities, the issuance

of these securities could result in further dilution to our stockholders.

PLAN OF DISTRIBUTION

We have entered into an At

The Market Offering Agreement, or the Sales Agreement, with Ladenburg under which we may issue and sell shares of our common stock having

an aggregate gross sales price of up to $10,366,156 from time to time through or to Ladenburg acting as agent or principal.

Upon delivery of a placement

notice and subject to the terms and conditions of the Sales Agreement, Ladenburg may sell our common stock by any method permitted by

law deemed to be an “at the market offering” as defined in Rule 415(a)(4) promulgated under the Securities Act), including

sales made directly on or through the Nasdaq Capital Market, the existing trading market for our common stock, sales made to or through

a market maker other than on an exchange or otherwise, directly to Ladenburg as principal, in negotiated transactions at market prices

prevailing at the time of sale or at prices related to such prevailing market prices, and/or in any other method permitted by applicable

law. We may instruct Ladenburg not to sell common stock if the sales cannot be effected at or above the price designated by us from time

to time. We or Ladenburg may suspend the offering of common stock upon notice and subject to other conditions.

We will pay Ladenburg commissions,

in cash, for its services in acting as agent in the sale of our common stock. Ladenburg will be entitled to compensation at a fixed commission

rate of 3.0% of the gross sales price per share sold. Because there is no minimum offering amount required as a condition of this offering,

the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time. We have also agreed

to reimburse Ladenburg for certain specified expenses, including the fees and disbursements of its legal counsel, in an amount not to

exceed $50,000. We estimate that the total expenses for the offering, excluding compensation and reimbursement payable to Ladenburg under

the terms of the Sales Agreement, will be approximately $150,500.

Settlement for sales of common

stock will occur on the first trading day following the date on which any sales are made (or any such shorter settlement cycle as may

be in effect under Exchange Act Rule 15c6-1 from time to time), or on some other date that is agreed upon by us and Ladenburg, in return

for payment of the net proceeds to us. Sales of our common stock as contemplated in this prospectus will be settled through the facilities

of The Depository Trust Company or by such other means as we and Ladenburg may agree upon. There is no arrangement for funds to be received

in an escrow, trust, or similar arrangement.

Ladenburg will use its commercially

reasonable efforts, consistent with its sales and trading practices, to solicit offers to purchase the common stock shares under the terms

and subject to the conditions set forth in the Sales Agreement. In connection with the sale of the common stock on our behalf, Ladenburg

will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of Ladenburg will be deemed

to be underwriting commissions or discounts. We have agreed to provide indemnification and contribution to Ladenburg against certain civil

liabilities, including liabilities under the Securities Act.

The offering of our common

stock pursuant to the Sales Agreement will terminate upon the earlier of the sale of all of the shares of our common stock provided for

in this prospectus supplement or the termination of the Sales Agreement as permitted therein.

To the extent required by

Regulation M, Ladenburg will not engage in any market making activities involving our common stock while the offering is ongoing under

this prospectus in violation of Regulation M. Ladenburg and its affiliates may provide various investment banking, commercial banking,

and other financial services for us and our affiliates, for which services they may in the future receive customary fees.

The Sales Agreement will

be filed as an exhibit to a Current Report on Form 8-K on even date herewith. This prospectus supplement in electronic format may be made

available on a website maintained by Ladenburg, and Ladenburg may distribute this prospectus supplement electronically.

LEGAL MATTERS

The validity of the shares of common stock being

offered by this prospectus supplement, and certain other matters have been passed upon by Reed Smith LLP, New York, New York. Sheppard,

Mullin, Richter & Hampton LLP, New York, New York has acted as counsel to Ladenburg in connection with this offering.

EXPERTS

KMJ Corbin & Company LLP, our

independent registered public accounting firm, has audited our consolidated balance sheets as of December 31, 2023 and 2022, and the

related consolidated statements of operations, comprehensive loss, stockholders’ equity and cash flows for each of the two

years in the period ended December 31, 2023, which report is incorporated by reference in this prospectus supplement and in this

registration statement. We have incorporated by reference our consolidated financial statements in this prospectus supplement and in

this registration statement in reliance on the report of KMJ Corbin & Company LLP given on their authority as experts in

accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

As permitted by SEC rules, this prospectus supplement

omits certain information that is included in the registration statement of which this prospectus supplement forms a part and its exhibits.

Since this prospectus supplement may not contain all of the information that you may find important, we urge you to review the full text

of these documents. If we have filed a contract, agreement or other document as an exhibit to the registration statement of which this

prospectus supplement forms a part, please read the exhibit for a more complete understanding of the document or matter involved. Each

statement in this prospectus supplement, including statements incorporated by reference as discussed above, regarding a contract, agreement

or other document is qualified in its entirety by reference to the actual document.

We are subject to the information reporting requirements

of the Exchange Act and, in accordance with these requirements, we file annual, quarterly and current reports, proxy statements, information

statements, and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s website

at www.sec.gov. In addition, we provide free access to these materials through our website, www.neonode.com, as soon as

reasonably practicable after they are filed with or furnished to the SEC.

INCORPORATION OF INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference”

information that we file with them. Incorporation by reference allows us to disclose important information to you by referring you to

those other documents. The information incorporated by reference is an important part of this prospectus supplement, and information

that we file later with the SEC will automatically update and supersede this information. This prospectus supplement omits certain information

contained in the registration statement, as permitted by the SEC. You should refer to the registration statement and any prospectus supplement

filed hereafter pertaining to the securities offered hereby, including the exhibits, for further information about us and the securities

we may offer pursuant to this prospectus supplement. Statements in this prospectus supplement regarding the provisions of certain documents

filed with, or incorporated by reference in, the registration statement are not necessarily complete and each statement is qualified

in all respects by that reference. The documents we are incorporating by reference are:

| |

● |

our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 filed with the SEC on February 28, 2024; |

| |

|

|

| |

● |

our Proxy Statement on DEF 14A filed with the SEC on April 26, 2024, as supplemented on April 26, 2024; |

| |

|

|

| |

● |

our Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2024 filed with the SEC on May 8, 2024; |

| |

|

|

| |

● |

our Current Report on Form 8-K filed on April 10, 2024, as amended by Form 8-K/A on April 16, 2024; and |

| |

|

|

| |

● |

the description of the Company’s Common Stock contained in the Company’ Registration Statement on Form 8-A (File No. 001-35526) filed on April 26, 2012, including any amendment or report filed for the purpose of updating such description. |

In addition, all documents that the Company files

pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, subsequent to the filing of this Registration Statement and prior

to the filing of a post-effective amendment which indicates that all securities offered hereby have been sold or which deregisters all

securities then remaining unsold, shall be deemed to be incorporated by reference into this Registration Statement and to be a part hereof

from the date of filing of such documents, except as to any document or portion of any document that is deemed furnished and not filed.

Pursuant to Rule 412 under the Securities Act,

any statement contained in the documents incorporated or deemed to be incorporated by reference in this Registration Statement shall

be deemed to be modified, superseded or replaced for purposes of this Registration Statement to the extent that a statement contained

herein or in any other subsequently filed document which also is incorporated or deemed to be incorporated by reference in this Registration

Statement modifies, supersedes or replaces such statement. Any such statement so modified, superseded or replaced shall not be deemed,

except as so modified, superseded or replaced, to constitute a part of this Registration Statement.

Upon written or oral request made to us at the

address or telephone number below, we will, at no cost to the requester, provide to each person, including any beneficial owner, to whom

this prospectus supplement is delivered, a copy of any or all of the information that has been incorporated by reference into this prospectus

supplement (other than an exhibit to a filing, unless that exhibit is specifically incorporated by reference into that filing), but not

delivered with this prospectus supplement:

Neonode Inc.

Karlavägen 100, 115 26 Stockholm, Sweden

+46 (0) 70 29 58 519

PROSPECTUS

NEONODE INC.

$70,971,000

COMMON STOCK

PREFERRED STOCK

DEBT SECURITIES

WARRANTS

RIGHTS

UNITS

This prospectus will allow us to issue, from time

to time at prices and on terms to be determined at or prior to the time of the offering, up to $70,971,000 of any combination of the securities

described in this prospectus, either individually or in units. We may also offer common stock or preferred stock upon conversion of or

exchange for the debt securities; and common stock or preferred stock or debt securities upon the exercise of warrants or rights.

This prospectus describes the general terms of

these securities and the general manner in which these securities will be offered. We will provide you with the specific terms of any

offering in one or more supplements to this prospectus. The prospectus supplements will also describe the specific manner in which these

securities will be offered and may also supplement, update or amend information contained in this document. You should read this prospectus

and any prospectus supplement, as well as any documents incorporated by reference into this prospectus or any prospectus supplement, carefully

before you invest.

Our securities may be sold directly by us to you,

through agents designated from time to time or to or through underwriters or dealers. For additional information on the methods of sale,

you should refer to the section entitled “Plan of Distribution” in this prospectus and in the applicable prospectus supplement.

If any underwriters or agents are involved in the sale of our securities with respect to which this prospectus is being delivered, the

names of such underwriters or agents and any applicable fees, commissions or discounts and over-allotment options will be set forth in

a prospectus supplement. The price to the public of such securities and the net proceeds that we expect to receive from such sale will

also be set forth in a prospectus supplement.

Our common stock is listed on the Nasdaq Capital

Market, under the symbol “NEON.” On May 8, 2024, the last reported sale price of our common stock on the Nasdaq Capital

Market was $2.42 per share. As of May 9, 2024, the aggregate market value of our public float, calculated according to General Instructions

I.B.6. of Form S-3, is $28,092,668, based on 15,359,481 shares of common stock outstanding as of May 8, 2024, of which 11,560,769

shares of our common stock are held by non-affiliates. We have not offered any securities pursuant to General Instruction I.B.6. of Form

S-3 during the prior 12 calendar month period that ends on, and includes, the date of this prospectus. Pursuant to General Instruction

I.B.6 of Form S-3, in no event will we sell our common stock in a public primary offering with a value exceeding more than one-third of

our public float in any 12-month period so long as our public float remains below $75,000,000.

Investing in our securities involves a

high degree of risk. Before deciding whether to invest in our securities, you should consider carefully the risks that we have

described on page 4 of this prospectus under the caption “Risk Factors.” We may include specific risk factors in

supplements to this prospectus under the caption “Risk Factors.” This prospectus may not be used to sell our securities

unless accompanied by a prospectus supplement.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

The date of this prospectus is May 16, 2024

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement

that we filed with the Securities and Exchange Commission, or SEC, utilizing a “shelf” registration process. Under this shelf

registration process, we may offer shares of our common stock, preferred stock, various series of debt securities and/or warrants or rights

to purchase any of such securities, either individually or in units, in one or more offerings, with a total value of up to $70,971,000.

This prospectus provides you with a general description of the securities we may offer. Each time we offer a type or series of securities

under this prospectus, we will provide a prospectus supplement that will contain specific information about the terms of that offering.

This prospectus does not contain all of the information

included in the registration statement. For a more complete understanding of the offering of the securities, you should refer to the registration

statement, including its exhibits. The prospectus supplement may also add, update or change information contained or incorporated by reference

in this prospectus. However, no prospectus supplement will offer a security that is not registered and described in this prospectus at

the time of its effectiveness. This prospectus, together with the applicable prospectus supplements and the documents incorporated by

reference into this prospectus, includes all material information relating to the offering of securities under this prospectus. You should

carefully read this prospectus, the applicable prospectus supplement, the information and documents incorporated herein by reference and

the additional information under the heading “Where You Can Find More Information” before making an investment decision.

You should rely only on the information we have

provided or incorporated by reference in this prospectus or any prospectus supplement. We have not authorized anyone to provide you with

information different from that contained or incorporated by reference in this prospectus. No dealer, salesperson or other person is authorized

to give any information or to represent anything not contained or incorporated by reference in this prospectus. You must not rely on any

unauthorized information or representation. This prospectus is an offer to sell only the securities offered hereby, but only under circumstances

and in jurisdictions where it is lawful to do so. You should assume that the information in this prospectus or any prospectus supplement

is accurate only as of the date on the front of the document and that any information we have incorporated herein by reference is accurate

only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any sale of a

security.

We further note that the representations, warranties

and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in the accompanying

prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating

risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such

representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and

covenants should not be relied on as accurately representing the current state of our affairs.

This prospectus may not be used to consummate

sales of our securities, unless it is accompanied by a prospectus supplement. To the extent there are inconsistencies between any prospectus

supplement, this prospectus and any documents incorporated by reference, the document with the most recent date will control.

Unless the context otherwise requires, “Neonode,”

“the Company,” “we,” “us,” “our” and similar terms refer to Neonode Inc.

PROSPECTUS SUMMARY

The following is a summary of what we believe

to be the most important aspects of our business and the offering of our securities under this prospectus. We urge you to read this entire

prospectus, including the more detailed consolidated financial statements, notes to the consolidated financial statements and other information

incorporated by reference from our other filings with the SEC or included in any applicable prospectus supplement. Investing in our securities

involves risks. Therefore, carefully consider the risk factors set forth in any prospectus supplements and in our most recent annual and

quarterly filings with the SEC, as well as other information in this prospectus and any prospectus supplements and the documents incorporated

by reference herein or therein, before purchasing our securities. Each of the risk factors could adversely affect our business, operating

results and financial condition, as well as adversely affect the value of an investment in our securities.

The Company

Our company provides advanced optical sensing

solutions for touch, contactless touch, and gesture sensing. We also provide software solutions for machine perception that feature advanced

machine learning algorithms to detect and track persons and objects in video streams from cameras and other types of imagers. We base

our touch, contactless touch, and gesture sensing products and solutions using our zForce technology platform and our machine perception

solutions on our MultiSensing technology platform. zForce (zero force) is the name for our patented optical sensing technology built on

infrared light, invisible to the human eye. Our MultiSensing platform was designed to provide advanced, safe, and scalable software solutions

to provide situational context. We market and sell our solutions to customers in many different markets and segments including, but not

limited to, office equipment, automotive, industrial automation, medical, military and avionics.

In 2010, we began licensing to Original Equipment

Manufacturers (“OEMs”) and automotive Tier 1 suppliers who embed our technology into products they develop, manufacture, and

sell. Since 2010, our licensing customers have sold approximately 95 million products that feature our technology. In October 2017, we

augmented our licensing business and began manufacturing and shipping touch sensor modules (“TSMs”) that incorporate our patented

technology. We sell these TSMs to OEMs, Original Design Manufacturers (“ODMs”), and systems integrators for use in their products.

As of December 31, 2023, we had nine agreements

with value added resellers (“VARs”) for integration of our TSMs in the products they offer to global OEMs, ODMs and systems

integrators. In addition to this, we distribute our TSMs through Digi-Key Corporation, Serial Microelectronics HK Ltd., and Nexty Electronics

Corporation.

During 2023, we continued to focus our efforts

on maintaining our current licensing customers and achieving design wins for new programs both with current and future customers. In parallel

we continued to market and sell TSMs directly and indirectly through partners. We made investments enhancing the design and improving

the production yield of our TSMs in our production unit Pronode Technologies AB and improving the related firmware and configuration tools

software platforms.

On December 12, 2023, we announced a new, sharpened

strategy with full focus on the licensing business. Consequently, we will phase out the TSM product business during 2024 through licensing

of the TSM technology to strategic partners or outsourcing.

Licensing

We license our zForce technology to OEMs and automotive

Tier 1 suppliers who embed our technology into products that they develop, manufacture and sell. Since 2010, our licensing customers have

sold approximately 95 million devices that use our patented technology.

As of December 31, 2023, we had 34 valid technology

license agreements with global OEMs, ODMs and automotive Tier 1 suppliers.

Our licensing customer base is primarily in the

automotive and printer segments. Ten of our licensing customers are currently shipping products that embed our technology. We anticipate

current customers will continue to ship products with our technology in 2024 and in future years. We also expect to expand our customer

base with a number of new customers who will be looking to ship new products incorporating our zForce and MultiSensing technologies as

they complete final product development and release cycles. We typically earn our license fees on a per unit basis when our customers

ship products using our technology, but in the future we may use other business models as well.

Product Sales

In addition to our licensing business, we design

and manufacture TSMs that incorporate our patented technology. We sell our TSMs to OEMs, ODMs and systems integrators for use in their

products.

We utilize a robotic manufacturing process designed

specifically for our TSMs. The TSMs are commercial-off-the-shelf products based on our patent-protected zForce technology platform and

can support the development of contactless touch, touch, gesture and object sensing solutions that, paired with our technology licensing

offering, give us a full range of options to enter and compete in key markets.

We began selling our TSMs to customers in the industrial

and consumer electronics segments in 2017. We have begun phasing out the TSM product business during 2024 and will begin to focus solely

on licensing of the TSM technology to strategic partners or outsourcing.

Non-recurring Engineering Services

We also offer non-recurring engineering (“NRE”)

services related to application development linked to our TSMs and our zForce and MultiSensing technology platforms on a flat rate or

hourly rate basis.

Typically, our licensing customers require engineering

support during the development and initial manufacturing phase for their products using our technology, while our TSM customers require

hardware or software modifications to our standard products or support during the development and initial manufacturing phases of their

products using our technology. In both cases we can offer NRE services and earn NRE revenues.

Corporate Information

Neonode Inc. was incorporated in the State of

Delaware on September 4, 1997. Our principal executive office is located Karlavägen 100, 115 26 Stockholm, Sweden, and our telephone

number is +46 (0) 70 29 58 519. Our office in the United States is located in San Jose, California. Our website address is www.neonode.com.

The information contained on, or that can be accessed through, our website is not part of this prospectus.

We have the following wholly owned subsidiaries:

Neonode Technologies AB (Sweden) (established in 2008 to develop and license touchscreen technology); Neonode Japan Inc. (Japan) (established

in 2013); Neonode Korea Ltd. (South Korea) (established in 2014). Neonode Korea Ltd. is currently dormant. In 2015, we established Pronode

Technologies AB, a subsidiary of Neonode Technologies AB. Since October 1, 2022, Pronode Technologies AB is a wholly owned subsidiary

of Neonode Technologies AB.

Offerings Under This Prospectus

Under this prospectus, we may offer shares of

our common stock, preferred stock, various series of debt securities and/or warrants or rights to purchase any of such securities, either

individually or in units, with a total value of up to $70,971,000, from time to time at prices and on terms to be determined by market

conditions at the time of the offering. This prospectus provides you with a general description of the securities we may offer. Each time

we offer a type or series of securities under this prospectus, we will provide a prospectus supplement that will describe the specific

amounts, prices and other important terms of the securities.

The prospectus supplement also may add, update

or change information contained in this prospectus or in documents we have incorporated by reference into this prospectus. However, no

prospectus supplement will fundamentally change the terms that are set forth in this prospectus or offer a security that is not registered

and described in this prospectus at the time of its effectiveness.

We may sell the securities directly to investors

or to or through agents, underwriters or dealers. We, and our agents or underwriters, reserve the right to accept or reject all or part

of any proposed purchase of securities. If we offer securities through agents or underwriters, we will include in the applicable prospectus

supplement:

| ● | the

names of those agents or underwriters; |

| ● | applicable

fees, discounts and commissions to be paid to them; |

| |

● |

details regarding over-allotment options, if any; and |

| |

● |

the net proceeds to us. |

RISK FACTORS

Please carefully consider the risk factors described

in our periodic reports filed with the SEC, which are incorporated by reference in this prospectus. Before making an investment decision,

you should carefully consider these risks as well as other information we include or incorporate by reference in this prospectus or include

in any applicable prospectus supplement. Additional risks and uncertainties not presently known to us or that we deem currently immaterial

may also impair our business operations or adversely affect our results of operations or financial condition.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, the documents that we incorporate

by reference and any free writing prospectuses that we may authorize for use in connection with this offering contain “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E

of the Securities Exchange Act of 1934, as amended, or the Exchange Act. These forward-looking statements can generally be identified

as such because the context of the statement will include words such as “may,” “will,” “intend,” “plan,”

“believe,” “anticipate,” “expect,” “estimate,” “predict,” “potential,”

“continue,” “likely,” or “opportunity,” the negative of these words or words of similar import. Similarly,

statements that describe our future plans, strategies, intentions, expectations, objectives, goals or prospects are also forward-looking

statements. Discussions containing these forward-looking statements may be found, among other places, in the “Business” and

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections incorporated by reference

from our most recent Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q for the quarterly periods ended subsequent to our

filing of such Annual Report on Form 10-K, as well as any amendments thereto reflected in subsequent filings with the SEC.

These forward-looking statements are based largely

on our expectations and projections about future events and future trends affecting our business, and are subject to risks and uncertainties

that could cause actual results to differ materially from those anticipated in the forward-looking statements. The risks and uncertainties

include, among others, those noted in “Risk Factors” above and in any applicable prospectus supplement or free writing prospectus,

and those included in the documents that we incorporate by reference herein and therein.

In addition, past financial and/or operating performance

is not necessarily a reliable indicator of future performance, and you should not use our historical performance to anticipate results

or future period trends. We can give no assurances that any of the events anticipated by the forward-looking statements will occur or,

if any of them do, what impact they will have on our results of operations and financial condition. Except as required by law, we undertake

no obligation to publicly revise our forward-looking statements to reflect events or circumstances that arise after the filing of this

prospectus or any applicable prospectus supplement or free writing prospectus, or documents incorporated by reference herein and therein,

that include forward-looking statements.

USE OF PROCEEDS

We cannot assure you that we will receive any

proceeds in connection with securities that may be offered pursuant to this prospectus. Unless otherwise indicated in the applicable prospectus

supplement, we intend to use any net proceeds from the sale of securities under this prospectus for our operations and for other general

corporate purposes, including, but not limited to, capital expenditures, general working capital and possible future acquisitions. We

have not determined the amounts we plan to spend on any of the areas listed above or the timing of these expenditures. As a result, our

management will have broad discretion to allocate the net proceeds, if any, we receive in connection with securities offered pursuant

to this prospectus for any purpose. Pending application of the net proceeds as described above, we may initially invest the net proceeds

in short-term, investment-grade, interest-bearing securities or apply them to the reduction of short-term indebtedness.

PLAN OF DISTRIBUTION

General Plan of Distribution

We may offer and sell the securities described

in this prospectus from time to time pursuant to underwritten public offerings, “at the market” offerings, negotiated transactions,

block trades, or a combination of these methods. We may sell the securities (1) to or through underwriters or dealers, (2) through agents,

or (3) directly to one or more purchasers, or through a combination of such methods. We may distribute the securities from time to time

in one or more transactions at:

| ● | a

fixed price or prices, which may be changed from time to time; |

| ● | market