Mutual Fund Summary Prospectus (497k)

28 Febrero 2013 - 4:02PM

Edgar (US Regulatory)

The Hartford Healthcare Fund

Summary Prospectus

The Hartford Mutual Funds

March 1, 2013

|

Class

|

|

Ticker

|

|

A

|

|

HGHAX

|

|

B

|

|

HGHBX

|

|

C

|

|

HGHCX

|

|

I

|

|

HGHIX

|

|

R3

|

|

HGHRX

|

|

R4

|

|

HGHSX

|

|

R5

|

|

HGHTX

|

|

Y

|

|

HGHYX

|

Before you invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus and other information about the Fund online at www.hartfordfunds.com/prospectuses.html. You can also get this information at no cost by calling 1-888-843-7824. The Fund’s prospectus dated March 1, 2013 and statement of additional information dated March 1, 2013 along with the financial statements included in the Fund’s most recent annual report to shareholders dated October 31, 2012 are incorporated by reference into this summary prospectus. The Fund’s statement of additional information and annual report may be obtained, free of charge, in the same manner as the Fund’s prospectus.

Investment Objective:

The Fund seeks long-term capital appreciation.

YOUR EXPENSES.

The table below describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in The Hartford Mutual Funds. More information about these and other discounts is available from your financial professional and in the “Sales Charge Reductions and Waivers” section beginning on page 28 of the Fund’s prospectus and the “Purchase and Redemption of Shares” section beginning on page 153 of the Fund’s statement of additional information.

Shareholder Fees

(fees paid directly from your investment)

|

|

|

Share Classes

|

|

|

|

|

A

|

|

B

|

|

C

|

|

I

|

|

R3

|

|

R4

|

|

R5

|

|

Y

|

|

|

Maximum sales charge (load) imposed on purchases as a percentage of offering price

|

|

5.50%

|

|

None

|

|

None

|

|

None

|

|

None

|

|

None

|

|

None

|

|

None

|

|

|

Maximum deferred sales charge (load) (as a percentage of purchase price or redemption proceeds, whichever is less)

|

|

None (under $1 million invested)(1)

|

|

5.00%

|

|

1.00%

|

|

None

|

|

None

|

|

None

|

|

None

|

|

None

|

|

|

Exchange fees

|

|

None

|

|

None

|

|

None

|

|

None

|

|

None

|

|

None

|

|

None

|

|

None

|

|

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

|

|

|

A

|

|

B

|

|

C

|

|

I

|

|

R3

|

|

R4

|

|

R5

|

|

Y

|

|

|

Management fees

|

|

0.90

|

%

|

0.90

|

%

|

0.90

|

%

|

0.90

|

%

|

0.90

|

%

|

0.90

|

%

|

0.90

|

%

|

0.90

|

%

|

|

Distribution and service (12b-1) fees

|

|

0.25

|

%

|

1.00

|

%

|

1.00

|

%

|

—

|

|

0.50

|

%

|

0.25

|

%

|

—

|

|

—

|

|

|

Other expenses

|

|

0.32

|

%

|

0.48

|

%

|

0.27

|

%

|

0.21

|

%

|

0.29

|

%

|

0.23

|

%

|

0.19

|

%

|

0.08

|

%

|

|

Total annual fund operating expenses

|

|

1.47

|

%

|

2.38

|

%

|

2.17

|

%

|

1.11

|

%

|

1.69

|

%

|

1.38

|

%

|

1.09

|

%

|

0.98

|

%

|

|

Fee waiver and/or expense reimbursement(2)

|

|

—

|

|

0.10

|

%

|

—

|

|

—

|

|

0.04

|

%

|

0.03

|

%

|

0.04

|

%

|

—

|

|

|

Total annual fund operating expenses after fee waiver and/or expense reimbursement(2)

|

|

1.47

|

%

|

2.28

|

%

|

2.17

|

%

|

1.11

|

%

|

1.65

|

%

|

1.35

|

%

|

1.05

|

%

|

0.98

|

%

|

(1)

For investments over $1 million, a 1.00% maximum deferred sales charge may apply.

(2)

Hartford Funds Management Company, LLC (the “Investment Manager”) has contractually agreed to reimburse expenses (exclusive of taxes, interest expenses, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) to the extent necessary to maintain total annual fund operating expenses as follows: 1.60% (Class A), 2.35% (Class B), 2.35% (Class C), 1.35% (Class I), 1.65% (Class R3), 1.35% (Class R4), 1.05% (Class R5) and 1.00% (Class Y). In addition, Hartford Administrative Services Company (“HASCO”), the Fund’s transfer agent, has contractually agreed to reimburse any portion of the transfer agency fees over 0.30% of the average daily net assets per fiscal year for all classes. Each contractual arrangement will remain in effect until February 28, 2014, and shall renew automatically for one-year terms unless the Investment Manager or HASCO, respectively, provides written notice of termination prior to the start of the next term or upon approval of the Board of Directors of the Fund.

2

EXAMPLE.

The examples below are intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The examples assume that:

·

Your investment has a 5% return each year

·

The Fund’s operating expenses remain the same

·

You reinvest all dividends and distributions

·

You pay any deferred sales charge due for the applicable period.

Your actual costs may be higher or lower. Based on these assumptions, for every $10,000 invested, you would pay the following expenses if you sell all of your shares at the end of each time period indicated:

|

Share Classes

|

|

Year 1

|

|

Year 3

|

|

Year 5

|

|

Year 10

|

|

|

A

|

|

$

|

691

|

|

$

|

989

|

|

$

|

1,309

|

|

$

|

2,211

|

|

|

B

|

|

$

|

731

|

|

$

|

1,033

|

|

$

|

1,461

|

|

$

|

2,482

|

|

|

C

|

|

$

|

320

|

|

$

|

679

|

|

$

|

1,164

|

|

$

|

2,503

|

|

|

I

|

|

$

|

113

|

|

$

|

353

|

|

$

|

612

|

|

$

|

1,352

|

|

|

R3

|

|

$

|

168

|

|

$

|

529

|

|

$

|

914

|

|

$

|

1,994

|

|

|

R4

|

|

$

|

137

|

|

$

|

434

|

|

$

|

752

|

|

$

|

1,655

|

|

|

R5

|

|

$

|

107

|

|

$

|

343

|

|

$

|

597

|

|

$

|

1,325

|

|

|

Y

|

|

$

|

100

|

|

$

|

312

|

|

$

|

542

|

|

$

|

1,201

|

|

You would pay the following expenses if you did not redeem your shares:

|

Share Classes

|

|

Year 1

|

|

Year 3

|

|

Year 5

|

|

Year 10

|

|

|

A

|

|

$

|

691

|

|

$

|

989

|

|

$

|

1,309

|

|

$

|

2,211

|

|

|

B

|

|

$

|

231

|

|

$

|

733

|

|

$

|

1,261

|

|

$

|

2,482

|

|

|

C

|

|

$

|

220

|

|

$

|

679

|

|

$

|

1,164

|

|

$

|

2,503

|

|

|

I

|

|

$

|

113

|

|

$

|

353

|

|

$

|

612

|

|

$

|

1,352

|

|

|

R3

|

|

$

|

168

|

|

$

|

529

|

|

$

|

914

|

|

$

|

1,994

|

|

|

R4

|

|

$

|

137

|

|

$

|

434

|

|

$

|

752

|

|

$

|

1,655

|

|

|

R5

|

|

$

|

107

|

|

$

|

343

|

|

$

|

597

|

|

$

|

1,325

|

|

|

Y

|

|

$

|

100

|

|

$

|

312

|

|

$

|

542

|

|

$

|

1,201

|

|

Portfolio Turnover.

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the examples, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 46% of the average value of its portfolio.

PRINCIPAL INVESTMENT STRATEGY.

Under normal circumstances, the Fund invests at least 80% of its assets in the equity securities of health care-related companies worldwide as selected by the sub-adviser, Wellington Management Company, LLP (“Wellington Management”). The focus of the Fund’s investment process is stock selection through fundamental analysis. The Fund takes a broad approach to investing in the health care sector. It may invest in health-related companies, including companies in the pharmaceuticals, biotechnology, medical delivery, medical products, medical services, managed health care, health information services and emerging health-related subsectors. The Fund’s assets will be allocated across the major subsectors of the health care sector, with some

3

representation typically maintained in each major subsector. The Fund will invest in securities of issuers located in a number of different countries throughout the world, one of which may be the United States; however, the Fund has no limit on the amount of assets that may be invested in each country. The Fund may invest in securities of companies of any market capitalization. The Fund will be close to fully invested; cash balances normally will not exceed 10% of net assets.

MAIN RISKS.

The primary risks of investing in the Fund are described below. When you sell your shares they may be worth more or less than what you paid for them, which means that you could lose money as a result of your investment.

An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

As with any fund, there is no guarantee that the Fund will achieve its goal. For more information regarding risks and investment matters please see “Additional Information Regarding Risks and Investment Strategies” in the Fund’s prospectus.

Market Risk

— Market risk is the risk that one or more markets in which the Fund invests will go down in value, including the possibility that the markets will go down sharply and unpredictably. Securities may decline in value due to the activities and financial prospects of individual companies or to general market and economic movements and trends.

Health Care-Related Sector Risk

— The Fund’s focus on the health care-related sector increases the Fund’s exposure to the risks associated with that sector, including changes in laws or regulations, lawsuits and regulatory proceedings, patent considerations, intense competition and rapid technological change and the potential for obsolescence.

Industry Concentration Risk

- The risk that because the Fund’s investments are often focused in a small number of business sectors, the Fund may be exposed to greater liquidity risk and increased risk of loss should adverse economic developments occur in one of those sectors.

Investment Strategy Risk

- The risk that, if the sub-adviser’s investment strategy does not perform as expected, the Fund could underperform its peers or lose money. There is no guarantee that the Fund’s investment objective will be achieved.

Foreign Investments Risk

—

Investments in foreign securities may be riskier than investments in U.S. securities.

Differences between the U.S. and foreign regulatory regimes and securities markets, including the less stringent investor protection and disclosure standards of some foreign markets, as well as political and economic developments in foreign countries and regions, may affect the value of the Fund’s investments in foreign securities.

Changes in currency exchange rates may also adversely affect the Fund’s foreign investments.

Emerging Markets Risk

- The risks related to investing in foreign securities are generally greater with respect to securities of companies that conduct their principal business activities in emerging markets or whose securities are traded principally on exchanges in emerging markets. The risks of investing in emerging markets include risks of illiquidity, increased price volatility, smaller market capitalizations, less government regulation, less extensive and less frequent

4

accounting, financial and other reporting requirements, risk of loss resulting from problems in share registration and custody and substantial economic and political disruptions.

Mid Cap and Small Cap Stock Risk

- Investments in small capitalization and mid capitalization companies involve greater risks than investments in larger, more established companies. Many of these companies are young and have limited operating or business history. These securities may be subject to more abrupt or erratic price movements and may lack sufficient market liquidity, and these issuers often face greater business risks.

The Fund is subject to certain other risks, which are described in the Fund’s prospectus.

PAST PERFORMANCE.

The performance information below indicates the risks of investing in the Fund. Keep in mind that past performance does not indicate future results. Updated performance information is available at www.hartfordfunds.com. The returns:

·

Assume reinvestment of all dividends and distributions

·

Would be lower if the Fund’s operating expenses had not been limited.

The bar chart:

·

Shows how the Fund’s total return has varied from year to year

·

Does not include the effect of sales charges. If sales charges were reflected in the bar chart, returns would have been lower

·

Shows the returns of the Fund’s Class A shares. Because all of the Fund’s shares are invested in the same portfolio of securities, returns for the Fund’s other classes differ only to the extent that the classes do not have the same expenses.

Total returns by calendar year (excludes sales charges)

Highest/Lowest quarterly results during the periods shown in the bar chart were:

Highest

22.15% (2nd quarter, 2003)

Lowest -

17.06% (4th quarter, 2008)

AVERAGE ANNUAL RETURNS.

The table below shows returns for the Fund over time compared to those of a broad-based market index and a broad-based sector index.

5

After-tax returns, which are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes, are shown only for Class A shares and will vary for other classes. Returns prior to the inception date of certain classes of shares may reflect returns of another class of shares. For more information regarding returns see the “Performance Notes” section in the Fund’s prospectus.

Actual after-tax returns, which depend on an investor’s particular tax situation, may differ from those shown and are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

Average annual total returns for periods ending December 31, 2012

(including sales charges)

|

Share Classes

|

|

1 Year

|

|

5 Years

|

|

10 Years

|

|

|

Class A - Return Before Taxes

|

|

13.17

|

%

|

3.24

|

%

|

8.40

|

%

|

|

- After Taxes on Distributions

|

|

13.17

|

%

|

3.09

|

%

|

7.84

|

%

|

|

- After Taxes on Distributions and Sale of Fund Shares

|

|

8.56

|

%

|

2.73

|

%

|

7.21

|

%

|

|

Share Classes

(Return Before Taxes)

|

|

|

|

|

|

|

|

|

Class B

|

|

13.78

|

%

|

3.28

|

%

|

8.37

|

%

|

|

Class C

|

|

17.98

|

%

|

3.69

|

%

|

8.24

|

%

|

|

Class I

|

|

20.14

|

%

|

4.72

|

%

|

9.24

|

%

|

|

Class R3

|

|

19.50

|

%

|

4.18

|

%

|

9.06

|

%

|

|

Class R4

|

|

19.92

|

%

|

4.54

|

%

|

9.29

|

%

|

|

Class R5

|

|

20.27

|

%

|

4.87

|

%

|

9.49

|

%

|

|

Class Y

|

|

20.35

|

%

|

4.92

|

%

|

9.54

|

%

|

|

S&P North American Health Care Sector Index

(reflects no deduction for fees, expenses or taxes)

|

|

15.23

|

%

|

3.54

|

%

|

9.40

|

%

|

|

S&P 500 Index

(reflects no deduction for fees, expenses or taxes)

|

|

15.99

|

%

|

1.66

|

%

|

7.10

|

%

|

MANAGEMENT.

The Fund’s investment manager is Hartford Funds Management Company, LLC (“HFMC”). The Fund’s sub-adviser is Wellington Management.

The Fund has been managed by a team of global industry analysts that specialize in the health care sector since its inception in 2000. Each member of the team manages a portion of the Fund based upon industry sectors which may vary from time to time. Allocations among various sectors within the healthcare industry are made collectively by the team.

|

Portfolio Manager

|

|

Title

|

|

Involved with

Fund Since

|

|

|

|

|

|

|

|

Jean M. Hynes, CFA

|

|

Senior Vice President and Global Industry Analyst

|

|

2000

|

|

|

|

|

|

|

|

Ann C. Gallo

|

|

Senior Vice President and Global Industry Analyst

|

|

2000

|

|

|

|

|

|

|

|

Kirk J. Mayer, CFA

|

|

Senior Vice President and Global Industry Analyst

|

|

2000

|

|

|

|

|

|

|

|

Robert L. Deresiewicz

|

|

Senior Vice President and Global Industry Analyst

|

|

2000

|

6

PURCHASE AND SALE OF FUND SHARES.

Not all share classes are available for all investors. Minimum investment amounts may be waived for certain accounts.

|

Share Classes

|

|

Minimum Initial

Investment

|

|

Minimum

Subsequent

Investment

|

|

|

|

|

|

|

|

Class A

Class C

Class I

|

|

$2,000 for all accounts except:

$250, if establishing an Automatic Investment Plan (“AIP”), with recurring monthly investments of at least $50

Class I shares are offered primarily through advisory fee-based wrap programs

|

|

$

|

50

|

|

|

|

|

|

|

|

Class B

|

|

Closed to new investments

|

|

N/A

|

|

|

|

|

|

|

|

Class R3

Class R4

Class R5

|

|

No minimum initial investment

Offered primarily to employer-sponsored retirement plans

|

|

None

|

|

|

|

|

|

|

|

Class Y

|

|

$250,000

Offered primarily to certain institutional investors and certain employer-sponsored retirement plans

|

|

None

|

For more information, please see the “How To Buy And Sell Shares” section of the Fund’s prospectus.

You may sell your shares of the Fund on those days when the New York Stock Exchange is open, typically Monday through Friday. You may sell your shares on the web at www.hartfordfunds.com, by phone by calling 1-888-843-7824, by electronic funds transfer, or by wire. In certain circumstances you will need to write to The Hartford Mutual Funds, P.O. Box 64387, St. Paul, MN 55164-0387 to request to sell your shares. For overnight mail, please send the request to The Hartford Mutual Funds, 500 Bielenberg Drive, Suite 500,Woodbury, MN 55125-4459.

TAX INFORMATION.

The Fund’s distributions are taxable, and will be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account. Such tax-deferred arrangements may be taxed later upon withdrawal of monies from those arrangements.

7

PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES.

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank or financial advisor), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your financial advisor to recommend the Fund over another investment. Ask your financial advisor or visit your financial intermediary’s website for more information.

MFSUM-HC_030113

March 1, 2013

8

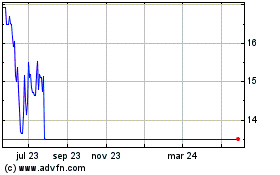

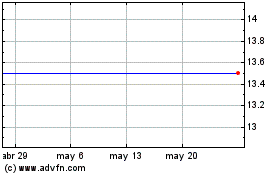

Oconee Federal Financial (NASDAQ:OFED)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Oconee Federal Financial (NASDAQ:OFED)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024