Universal Display Corporation (Nasdaq: OLED), enabling

energy-efficient displays and lighting with its UniversalPHOLED®

technology and materials, today reported financial results for the

second quarter ended June 30, 2024.

“We reported solid second quarter results as the OLED IT

adoption cycle begins to gain momentum,” said Brian Millard, Vice

President and Chief Financial Officer of Universal Display

Corporation. “With leading OEMs embarking on their OLED IT journey

with the introduction of new OLED PC products, we believe that a

new multi-year capex cycle has commenced to support this growth. As

the broadening proliferation of OLEDs across the consumer landscape

fuels the market’s positive trajectory, we are enhancing our

operational and strategic infrastructure and fortifying our

leadership position in the ecosystem. This new chapter in our

long-term growth story is expected to usher in tremendous

opportunities for the industry and for us.”

Financial Highlights for the Second

Quarter of 2024

- Total revenue in the second quarter of 2024 was $158.5 million

as compared to $146.6 million in the second quarter of 2023.

- Revenue from material sales was $95.4 million in the second

quarter of 2024 as compared to $77.1 million in the second quarter

of 2023. The increase in material sales was primarily due to

strengthened demand for our emitter materials.

- Revenue from royalty and license fees was $59.6 million in the

second quarter of 2024 as compared to $64.4 million in the second

quarter of 2023. The decrease in royalty and license fees was

primarily the result of changes in customer mix between periods,

partially offset by increased sales volume.

- Cost of material sales was $35.5 million in the second quarter

of 2024 as compared to $28.6 million in the second quarter of 2023.

The increase in cost of material sales was primarily due to an

increase in the level of materials sales.

- Total gross margin was 76% in the second quarter of 2024 as

compared to 78% in the second quarter of 2023. The decrease was

primarily due to changes in customer and product mix.

- Operating income was $56.4 million in the second quarter of

2024 as compared to $58.6 million in the second quarter of

2023.

- The effective income tax rate was 19.3% and 22.4% in the second

quarter of 2024 and 2023, respectively.

- Net income was $52.3 million or $1.10 per diluted share in the

second quarter of 2024 as compared to $49.7 million or $1.04 per

diluted share in the second quarter of 2023.

Revenue Comparison

($ in thousands)

Three Months Ended June

30,

2024

2023

Material sales

$

95,442

$

77,107

Royalty and license fees

59,551

64,399

Contract research services

3,512

5,059

Total revenue

$

158,505

$

146,565

Cost of Materials

Comparison

($ in thousands)

Three Months Ended June

30,

2024

2023

Material sales

$

95,442

$

77,107

Cost of material sales

35,491

28,570

Gross margin on material sales

59,951

48,537

Gross margin as a % of material sales

63

%

63

%

Financial Highlights for the First Half

of 2024

- Total revenue in the first half of 2024 was $323.8 million as

compared to $277.0 million in the first half of 2023.

- Revenue from material sales was $188.7 million in the first

half of 2024 as compared to $147.3 million in the first half of

2023. The increase in material sales was primarily due to

strengthened demand for our emitter materials.

- Revenue from royalty and license fees was $127.8 million in the

first half of 2024 as compared to $119.6 million in the first half

of 2023. The increase in royalty and license fees was primarily the

result of higher unit material volume, partially offset by a

reduced cumulative catch-up adjustment and changes in customer mix

between periods.

- Cost of material sales was $69.6 million in the first half of

2024 as compared to $58.1 million in the first half of 2023

primarily due to an increase in the level of materials sales,

partially offset by a $3.8 million decrease in inventory reserve

expense.

- Total gross margin was 77% in the first half of 2024 as

compared to 76% in the first half of 2023.

- Operating income was $119.3 million in the first half of 2024

as compared to $104.0 million in the first half of 2023.

- The effective income tax rate was 19.3% and 22.6% in the first

half of 2024 and 2023, respectively.

- Net income was $109.2 million or $2.29 per diluted share in the

first half of 2024 compared to $89.5 million or $1.87 per diluted

share in the first half of 2023.

Revenue Comparison

($ in thousands)

Six Months Ended June

30,

2024

2023

Material sales

$

188,726

$

147,297

Royalty and license fees

127,819

119,609

Contract research services

7,219

10,126

Total revenue

$

323,764

$

277,032

Cost of Materials

Comparison

($ in thousands)

Six Months Ended June

30,

2024

2023

Material sales

$

188,726

$

147,297

Cost of material sales

69,587

58,058

Gross margin on material sales

119,139

89,239

Gross margin as a % of material sales

63

%

61

%

2024 Revised Guidance

The Company has increased the lower end of its previous revenue

guidance and believes that 2024 revenue will be in the range of

$645 million to $675 million. The OLED industry remains at a stage

where many variables can have a material impact on results, and the

Company thus caveats its financial guidance accordingly.

Dividend

The Company also announced a third quarter cash dividend of

$0.40 per share on the Company’s common stock. The dividend is

payable on September 30, 2024 to all shareholders of record as of

the close of business on September 16, 2024.

Conference Call

Information

In conjunction with this release, Universal Display will host a

conference call on Thursday, August 1, 2024 at 5:00 p.m. Eastern

Time. The live webcast of the conference call can be accessed under

the events page of the Company's Investor Relations website at

ir.oled.com. Those wishing to participate in the live call should

dial 1-877-524-8416 (toll-free) or 1-412-902-1028. Please dial in

5-10 minutes prior to the scheduled conference call time. An online

archive of the webcast will be available within two hours of the

conclusion of the call.

About Universal Display

Corporation

Universal Display Corporation (Nasdaq: OLED) is a leader in the

research, development and commercialization of organic light

emitting diode (OLED) technologies and materials for use in display

and solid-state lighting applications. Founded in 1994 and with

subsidiaries and offices around the world, the Company currently

owns, exclusively licenses or has the sole right to sublicense more

than 6,000 patents issued and pending worldwide. Universal Display

licenses its proprietary technologies, including its breakthrough

high-efficiency UniversalPHOLED® phosphorescent OLED technology

that can enable the development of energy-efficient and

eco-friendly displays and solid-state lighting. The Company also

develops and offers high-quality, state-of-the-art UniversalPHOLED

materials that are recognized as key ingredients in the fabrication

of OLEDs with peak performance. In addition, Universal Display

delivers innovative and customized solutions to its clients and

partners through technology transfer, collaborative technology

development and on-site training. To learn more about Universal

Display Corporation, please visit https://oled.com/.

Universal Display Corporation and the Universal Display

Corporation logo are trademarks or registered trademarks of

Universal Display Corporation. All other Company, brand or product

names may be trademarks or registered trademarks.

All statements in this document that are not historical, such as

those relating to the projected adoption, development and

advancement of the Company’s technologies, and the Company’s

expected results, as well as the growth of the OLED market and the

Company’s opportunities in that market, are forward-looking

financial statements within the meaning of the Private Securities

Litigation Reform Act of 1995. You are cautioned not to place undue

reliance on any forward-looking statements in this document, as

they reflect Universal Display Corporation’s current views with

respect to future events and are subject to risks and uncertainties

that could cause actual results to differ materially from those

contemplated. These risks and uncertainties are discussed in

greater detail in Universal Display Corporation’s periodic reports

on Form 10-K and Form 10-Q filed with the Securities and Exchange

Commission, including, in particular, the section entitled “Risk

Factors” in Universal Display Corporation’s Annual Report on Form

10-K for the year ended December 31, 2023. Universal Display

Corporation disclaims any obligation to update any forward-looking

statement contained in this document.

Follow Universal Display Corporation X Facebook

YouTube

(OLED-C)

UNIVERSAL DISPLAY CORPORATION

AND SUBSIDIARIES

CONSOLIDATED BALANCE

SHEETS

(UNAUDITED)

(in thousands, except share and

per share data)

June 30, 2024

December 31, 2023

ASSETS

CURRENT ASSETS:

Cash and cash equivalents

$

92,856

$

91,985

Short-term investments

437,667

422,137

Accounts receivable

124,386

139,850

Inventory

171,843

175,795

Other current assets

132,729

87,365

Total current assets

959,481

917,132

PROPERTY AND EQUIPMENT, net of accumulated

depreciation of $153,523 and $143,908

185,474

175,150

ACQUIRED TECHNOLOGY, net of accumulated

amortization of $195,235 and $186,850

81,940

90,325

OTHER INTANGIBLE ASSETS, net of

accumulated amortization of $11,125 and $10,414

6,163

6,874

GOODWILL

15,535

15,535

INVESTMENTS

362,459

299,548

DEFERRED INCOME TAXES

66,664

59,108

OTHER ASSETS

98,845

105,289

TOTAL ASSETS

$

1,776,561

$

1,668,961

LIABILITIES AND SHAREHOLDERS’

EQUITY

CURRENT LIABILITIES:

Accounts payable

$

23,636

$

10,933

Accrued expenses

58,624

52,080

Deferred revenue

63,784

47,713

Other current liabilities

5,955

8,096

Total current liabilities

151,999

118,822

DEFERRED REVENUE

6,732

12,006

RETIREMENT PLAN BENEFIT LIABILITY

53,870

52,249

OTHER LIABILITIES

37,122

38,658

Total liabilities

249,723

221,735

SHAREHOLDERS’ EQUITY:

Preferred Stock, par value $0.01 per

share, 5,000,000 shares authorized, 200,000 shares of Series A

Nonconvertible Preferred Stock issued and outstanding (liquidation

value of $7.50 per share or $1,500)

2

2

Common Stock, par value $0.01 per share,

200,000,000 shares authorized, 48,814,273 and 48,731,026 shares

issued, and 47,448,625 and 47,365,378 shares outstanding, at June

30, 2024 and December 31, 2023, respectively

488

487

Additional paid-in capital

712,234

699,554

Retained earnings

860,058

789,553

Accumulated other comprehensive loss

(4,660

)

(1,086

)

Treasury stock, at cost (1,365,648 shares

at June 30, 2024 and December 31, 2023)

(41,284

)

(41,284

)

Total shareholders’ equity

1,526,838

1,447,226

TOTAL LIABILITIES AND SHAREHOLDERS’

EQUITY

$

1,776,561

$

1,668,961

UNIVERSAL DISPLAY CORPORATION

AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

INCOME

(UNAUDITED)

(in thousands, except share and

per share data)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

REVENUE:

Material sales

$

95,442

$

77,107

$

188,726

$

147,297

Royalty and license fees

59,551

64,399

127,819

119,609

Contract research services

3,512

5,059

7,219

10,126

Total revenue

158,505

146,565

323,764

277,032

COST OF SALES

38,328

32,139

75,297

65,109

Gross margin

120,177

114,426

248,467

211,923

OPERATING EXPENSES:

Research and development

36,826

32,318

74,811

63,741

Selling, general and administrative

19,841

17,077

39,093

32,473

Amortization of acquired technology and

other intangible assets

4,549

3,994

9,097

6,885

Patent costs

2,401

2,229

4,383

4,484

Royalty and license expense

123

169

1,774

333

Total operating expenses

63,740

55,787

129,158

107,916

OPERATING INCOME

56,437

58,639

119,309

104,007

Interest income, net

9,913

6,198

19,481

13,165

Other loss, net

(1,460

)

(784

)

(3,403

)

(1,487

)

Interest and other loss, net

8,453

5,414

16,078

11,678

INCOME BEFORE INCOME TAXES

64,890

64,053

135,387

115,685

INCOME TAX EXPENSE

(12,553

)

(14,375

)

(26,197

)

(26,168

)

NET INCOME

$

52,337

$

49,678

$

109,190

$

89,517

NET INCOME PER COMMON SHARE:

BASIC

$

1.10

$

1.04

$

2.29

$

1.87

DILUTED

$

1.10

$

1.04

$

2.29

$

1.87

WEIGHTED AVERAGE SHARES USED IN COMPUTING

NET INCOME PER COMMON SHARE:

BASIC

47,549,843

47,572,971

47,553,969

47,548,404

DILUTED

47,628,113

47,618,115

47,628,470

47,593,657

CASH DIVIDENDS DECLARED PER COMMON

SHARE

$

0.40

$

0.35

$

0.80

$

0.70

UNIVERSAL DISPLAY CORPORATION

AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(UNAUDITED)

(in thousands)

Six Months Ended June

30,

2024

2023

CASH FLOWS FROM OPERATING ACTIVITIES:

Net income

$

109,190

$

89,517

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation

13,092

13,207

Amortization of intangibles

9,097

6,885

Amortization of premium and discount on

investments, net

(4,276

)

(6,845

)

Stock-based compensation

18,523

11,320

Deferred income tax benefit

(7,402

)

(12,782

)

Retirement plan expense, net of benefit

payments

962

1,397

Decrease (increase) in assets:

Accounts receivable

15,464

(16,726

)

Inventory

3,952

7,365

Other current assets

(45,364

)

12,038

Other assets

6,444

7,665

Increase (decrease) in liabilities:

Accounts payable and accrued expenses

12,367

(17,651

)

Other current liabilities

(2,141

)

(20,811

)

Deferred revenue

10,797

(15,736

)

Other liabilities

(1,536

)

(1,445

)

Net cash provided by operating

activities

139,169

57,398

CASH FLOWS FROM INVESTING ACTIVITIES:

Purchases of property and equipment

(16,334

)

(27,274

)

Purchases of intangibles

—

(66,063

)

Purchases of investments

(174,757

)

(115,048

)

Proceeds from sale and maturity of

investments

97,620

190,907

Net cash used in investing activities

(93,471

)

(17,478

)

CASH FLOWS FROM FINANCING ACTIVITIES:

Proceeds from issuance of common stock

1,187

971

Payment of withholding taxes related to

stock-based compensation to employees

(7,329

)

(7,429

)

Cash dividends paid

(38,685

)

(33,422

)

Net cash used in financing activities

(44,827

)

(39,880

)

INCREASE IN CASH AND CASH EQUIVALENTS

871

40

CASH AND CASH EQUIVALENTS, BEGINNING OF

PERIOD

91,985

93,430

CASH AND CASH EQUIVALENTS, END OF

PERIOD

$

92,856

$

93,470

SUPPLEMENTAL DISCLOSURES:

Unrealized (loss) gain on

available-for-sale securities

$

(2,976

)

$

1,848

Common stock issued to Board of Directors

and Scientific Advisory Board that was earned and accrued for in a

previous period

300

300

Net change in accounts payable and accrued

expenses related to purchases of property and equipment

(7,082

)

(54

)

Cash paid for income taxes, net of

refunds

47,263

59,849

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240801261409/en/

Universal Display: Darice Liu investor@oled.com

media@oled.com +1 609-964-5123

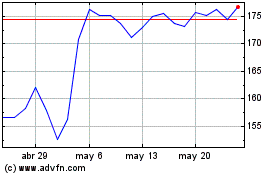

Universal Display (NASDAQ:OLED)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

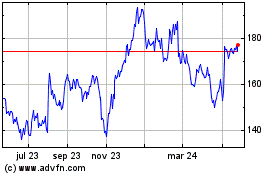

Universal Display (NASDAQ:OLED)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024