Progyny, Inc. (Nasdaq: PGNY) (“Progyny” or the “Company”), a

transformative fertility, family building and women's health

benefits solution, today announced its financial results for the

three-month period ended March 31, 2024 (“the first quarter of

2024”) as compared to the three-month period ended March 31,

2023 (“the first quarter of 2023” or “the prior year period”).

“Utilization through the end of February was

consistent with the record engagement we saw a year ago. However,

March was modestly below our expectations, coinciding with the

national conversations concerning fertility treatments and access

to maternal healthcare following the Alabama Supreme Court ruling.

This, in combination with the previously-disclosed unfavorable

treatment mix shift that we experienced for a limited period of

time earlier in the first quarter, lowered our first quarter

revenue growth rate,” said Pete Anevski, Chief Executive Officer of

Progyny. “As the second quarter begins, utilization has persisted

at a level that is higher than where it was in 2022, but remains

below the record level from 2023, while mix has continued to be

consistent with historical patterns. Accordingly, we expect an

acceleration in revenue growth over the remainder of 2024.”

“While it is early in the selling season, our

active pipeline and sales activity are favorable as compared to a

year ago, with a healthy number of early commitments for 2025

launches,” continued Anevski. “Even though Progyny is the market

leader with 6.7 million lives in 2024, this is just a fraction of

the more than 105 million lives in our target market. During the

quarter, we have also continued to advance agreements to expand our

distribution reach through new strategic partnerships, including

health plans, further validating our position as the provider of

choice for fertility and family building solutions.”

“Our first quarter results reflect meaningful

increases in gross profit, Adjusted EBITDA and operating cash flow,

and we returned value to our shareholders through the purchase of

more than 720,000 shares in the first quarter under the buyback

program that began at the end of February,” said Mark Livingston,

Progyny’s Chief Financial Officer.

First Quarter

2024 Highlights:

| (unaudited; in thousands, except

per share amounts) |

1Q 2024 |

|

1Q 2023 |

|

Revenue |

$ |

278,078 |

|

|

$ |

258,394 |

|

| |

|

|

|

| Gross Profit |

$ |

62,406 |

|

|

$ |

58,640 |

|

|

Gross Margin |

|

22.4 |

% |

|

|

22.7 |

% |

| Net Income |

$ |

16,898 |

|

|

$ |

17,678 |

|

| |

|

|

|

| Net Income per Diluted

Share1 |

$ |

0.17 |

|

|

$ |

0.18 |

|

| |

|

|

|

| Adjusted Earnings Per Diluted

Share2 |

$ |

0.39 |

|

|

$ |

0.34 |

|

| |

|

|

|

| Adjusted EBITDA2 |

$ |

50,291 |

|

|

$ |

46,360 |

|

|

Adjusted EBITDA Margin2 |

|

18.1 |

% |

|

|

17.9 |

% |

|

|

|

|

|

|

|

|

|

- Net income per diluted share

reflects weighted-average shares outstanding as adjusted for

potential dilutive securities, including options, restricted stock

units, warrants to purchase common stock, and shares issuable under

the employee stock purchase plan.

- Adjusted earnings per diluted

share, Adjusted EBITDA, and Adjusted EBITDA margin are financial

measures that are not required by, or presented in accordance with,

U.S. generally accepted accounting principles ("GAAP"). Please see

Annex A of this press release for a reconciliation of Adjusted

earnings per diluted share to earnings per share, and Adjusted

EBITDA to net income, the most directly comparable financial

measures stated in accordance with GAAP for each of the periods

presented. We calculate Adjusted earnings per diluted share as net

income per diluted share excluding the impact of stock-based

compensation, adjusted for the impact of taxes. We calculate

Adjusted EBITDA margin as Adjusted EBITDA divided by revenue.

Financial Highlights

Revenue was $278.1 million, a 7.6% increase as

compared to the $258.4 million reported in the first quarter of

2023, primarily as a result of the increase in our number of

clients and covered lives.

- Fertility benefit services revenue

was $169.8 million, an 8.0% increase from the $157.1 million

reported in the first quarter of 2023.

- Pharmacy benefit services revenue

was $108.3 million, a 7.0% increase as compared to the $101.2

million reported in the first quarter of 2023.

Gross profit was $62.4 million, an increase of

6% from the $58.6 million reported in the first quarter of 2023,

primarily due to the higher revenue. Gross margin was 22.4%, as

compared to the 22.7% reported in the prior year period.

Net income was $16.9 million, or $0.17 income

per diluted share, as compared to the $17.7 million, or $0.18

income per diluted share, reported in the first quarter of 2023.

The lower net income was due primarily to a provision for income

taxes in the current period, as compared to an income tax benefit

in the prior year period.

Adjusted EBITDA was $50.3 million, an increase

of 8% as compared to the $46.4 million reported in the first

quarter of 2023, reflecting the higher gross profit and operating

efficiencies realized on our higher revenues. Adjusted EBITDA

margin was 18.1%, a slight increase from the 17.9% Adjusted EBITDA

margin in the first quarter of 2023.

Please refer to Annex A for a reconciliation of

Adjusted EBITDA to net income.

Cash FlowNet cash provided by

operating activities in the first quarter of 2024 was $25.7

million, compared to net cash provided by operating activities of

$21.0 million in the prior year period. The higher cash flow as

compared to the prior year period was primarily due to higher

profitability as well as the impact of timing on certain working

capital items.

Balance Sheet and Financial

PositionAs of March 31, 2024, the Company had total

working capital of approximately $475.6 million and no debt. This

included cash and cash equivalents and marketable securities of

$371.8 million, an increase of $0.7 million from the balances as of

December 31, 2023.

On February 29, 2024, the Company announced that

its Board of Directors had approved a share repurchase program to

repurchase up to $100 million of its common stock. During the first

quarter of 2024, the Company purchased 723,577 shares for

$26.4 million through the program. To date, the Company has

purchased approximately 2 million shares in the program, and

$32 million remains available under the existing

authorization.

Key Metrics

The Company had 451 clients as of March 31,

2024, as compared to 379 clients as of March 31, 2023.

| |

Three Months Ended March 31, |

|

|

2024 |

|

2023 |

|

ART Cycles* |

14,802 |

|

|

13,171 |

|

|

Utilization – All Members** |

0.53 |

% |

|

0.54 |

% |

|

Utilization – Female Only** |

0.46 |

% |

|

0.48 |

% |

|

Average Members*** |

6,350,000 |

|

|

5,335,000 |

|

|

|

|

|

|

|

|

* Represents the number of ART cycles performed,

including IVF with a fresh embryo transfer, IVF freeze all

cycles/embryo banking, frozen embryo transfers, and egg freezing.**

Represents the member utilization rate for all services, including,

but not limited to, ART cycles, initial consultations, IUIs, and

genetic testing. The utilization rate for all members includes all

unique members (female and male) who utilize the benefit during

that period, while the utilization rate for female only includes

only unique females who utilize the benefit during that period. For

purposes of calculating utilization rates in any given period, the

results reflect the number of unique members utilizing the benefit

for that period. Individual periods cannot be combined as member

treatments may span multiple periods.***Includes approximately

300,000 members from a single client who are not reflected in

utilization as a result of the client's chosen benefit design.

Financial OutlookAs previously

disclosed, a number of clients are scheduled to launch over the

coming months. Once all new clients are live in 2024, the Company

continues to anticipate having more than 460 clients, representing

an estimated 6.7 million covered lives by year end.

“Since becoming a public company, our guidance

has always been based on the utilization we are currently seeing,

which informed our previous view of 2024. As utilization is now

slightly lower than the record levels we saw in 2023, we are

revising our guidance for the year,” said Mr. Anevski.

The Company is providing the following financial

guidance for the full year ending December 31, 2024 and the

three-month period ending June 30, 2024:

- Full Year 2024 Outlook:

- Revenue is now projected to be

$1,230 million to $1,270 million, reflecting growth of 13% to

17%

- Net income is projected to be $68.4

million to $75.4 million, or $0.68 to $0.75 per diluted share, on

the basis of approximately 100 million assumed weighted-average

fully diluted-shares outstanding

- Adjusted EBITDA1 is projected to be

$216.0 million to $226.0 million

- Adjusted earnings per diluted

share1 is projected to be $1.61 to $1.68

- Second Quarter of 2024 Outlook:

- Revenue is projected to be $300.0

million to $310.0 million, reflecting growth of 7% to 11%

- Net income is projected to be $15.7

million to $17.8 million, or $0.16 to $0.18 per diluted share, on

the basis of approximately 99 million assumed weighted-average

fully diluted-shares outstanding

- Adjusted EBITDA1 is projected to be

$52.0 million to $55.0 million

- Adjusted earnings per diluted

share1 is projected to be $0.39 to $0.41

- Adjusted EBITDA and Adjusted

earnings per diluted share are financial measures that are not

required by, or presented in accordance with, GAAP. Please see

Annex A of this press release for a reconciliation of

forward-looking Adjusted EBITDA to forward-looking net income and

Adjusted net income to net income, the most directly comparable

financial measures stated in accordance with GAAP, for the period

presented.

Conference Call

InformationProgyny will host a conference call at 4:45

P.M. Eastern Time (1:45 P.M. Pacific Time) today, May 9, 2024, to

discuss its financial results. Interested participants from the

United States may join by calling 1.866.825.7331 and using

conference ID 265484. Participants from international locations may

join by calling 1.973.413.6106 and using the same conference ID. A

replay of the call will be available until May 16, 2024 at 5:00

P.M. Eastern Time by dialing 1.800.332.6854 (U.S. participants) or

1.973.528.0005 (international) and entering passcode 265484. A live

audio webcast of the call and subsequent replay will also be

available through the Events & Presentations section of the

Company’s Investor Relations website at investors.progyny.com.

About ProgynyProgyny (Nasdaq:

PGNY) is a transformative fertility, family building and women's

health benefits solution, trusted by the nation's leading

employers, health plans and benefit purchasers. We envision a world

where everyone can realize their dreams of family and ideal health.

Our outcomes prove that comprehensive, inclusive and intentionally

designed solutions simultaneously benefit employers, patients, and

physicians.

Our benefits solution empowers patients with

concierge support, coaching, education, and digital tools; provides

access to a premier network of fertility and women's health

specialists who use the latest science and technologies; drives

optimal clinical outcomes; and reduces healthcare costs.

Headquartered in New York City, Progyny has been

recognized for its leadership and growth by CNBC Disruptor 50,

Modern Healthcare’s Best Places to Work in Healthcare, Forbes' Best

Employers, Financial Times, INC. 5000, INC. Power Partners and

Crain’s Fast 50 for NYC. For more information, visit

www.progyny.com.

Safe Harbor Statement Under the Private

Securities Litigation Reform Act of 1995This press release

contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. We intend such

forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in Section 27A

of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. All statements

contained in this press release other than statements of historical

fact, including, without limitation, statements regarding our

financial outlook for the second quarter and full year 2024,

including the impact of our sales season and client launches; our

anticipated number of clients and covered lives for 2024; our

expected utilization rates and mix; the demand for our solutions;

our expectations for our selling season for 2025 launches; our

positioning to successfully manage economic uncertainty on our

business; the timing of client decisions; our ability to retain

existing clients and acquire new clients; and our business

strategy, plans, goals and expectations concerning our market

position, future operations, and other financial and operating

information. The words “anticipates,” “assumes,” “believe,”

“contemplate,” “continues, ” “could,” “estimates,” “expects,”

“future,” “intends,” “may,” “plans,” “predict,” “potential,”

“project,” “seeks,” “should,” “target,” “will,” and the negative of

these or similar expressions and phrases are intended to identify

forward-looking statements, though not all forward-looking

statements use these words or expressions.

Forward-looking statements are neither promises

nor guarantees, but involve known and unknown risks, uncertainties

and other important factors that may cause our actual results,

performance or achievements to be materially different from any

future results, performance or achievements expressed or implied by

the forward-looking statements. These risks include, without

limitation, failure to meet our publicly announced guidance or

other expectations about our business; competition in the market in

which we operate; our history of operating losses and ability to

sustain profitability; risks related to the impact of the COVID-19

pandemic, such as the scope and duration of the outbreak, the

spread of new variants, government actions and restrictive measures

implemented in response, delays and cancellations of fertility

procedures and other impacts to the business; competition in the

market in which we operate; our history of operating losses and

ability to sustain profitability in the future; unfavorable

conditions in our industry or the United States economy; our

limited operating history and the difficulty in predicting our

future results of operations; our ability to attract and retain

clients and increase the adoption of services within our client

base; the loss of any of our largest client accounts; changes in

the technology industry; changes or developments in the health

insurance market; negative publicity in the health benefits

industry; lags, failures or security breaches in our computer

systems or those of our vendors; a significant change in the level

or the mix of utilization of our solutions; our ability to offer

high-quality support; positive references from our existing

clients; our ability to develop and expand our marketing and sales

capabilities; the rate of growth of our future revenue; the

accuracy of the estimates and assumptions we use to determine the

size of target markets; our ability to successfully manage our

growth; reductions in employee benefits spending; seasonal

fluctuations in our sales; the adoption of new solutions and

services by our clients or members; our ability to innovate and

develop new offerings; our ability to adapt and respond to the

medical landscape, regulations, client needs, requirements or

preferences; our ability to maintain and enhance our brand; our

ability to attract and retain members of our management team, key

employees, or other qualified personnel; our ability to maintain

our Company culture; risks related to any litigation against us;

our ability to maintain our Center of Excellence network of

healthcare providers; our strategic relationships with and

monitoring of third parties; our ability to maintain or any

disruption of our pharmacy distribution network or their supply

chain; our relationship with key pharmacy program partners or any

decline in rebates provided by them; our ability to maintain our

relationships with benefits consultants; exposure to credit risk

from our members; risks related to government regulation; risks

related to potential sales to government entities; our ability to

protect our intellectual property rights; risks related to

acquisitions, strategic investments, partnerships, or alliances;

federal tax reform and changes to our effective tax rate; the

imposition of state and local state taxes; our ability to utilize a

significant portion of our net operating loss or research tax

credit carryforwards; our ability to develop or maintain effective

internal control over financial reporting and the increased costs

of operating as a public company; and our ability to adapt and

respond to the changing SEC expectations regarding environmental,

social and governance practices. For a detailed discussion of these

and other risk factors, please refer to our filings with the

Securities and Exchange Commission (the “SEC”), including in the

section entitled “Risk Factors” in our Annual Report on Form 10-K

for the fiscal year ended December 31, 2023, and subsequent reports

that we file with the SEC which are available at

http://investors.progyny.com and on the SEC’s website at

https://www.sec.gov.

Forward-looking statements represent our

management’s beliefs and assumptions only as of the date of this

press release. Our actual future results could differ materially

from what we expect. Except as required by law, we assume no

obligation to update these forward-looking statements publicly, or

to update the reasons.

Non-GAAP Financial MeasuresIn

addition to disclosing financial measures prepared in accordance

with U.S. generally accepted accounting principles (“GAAP”), this

press release and the accompanying tables include the non-GAAP

financial measures Adjusted EBITDA, Adjusted EBITDA margin,

Adjusted EBITDA margin on incremental revenue and Adjusted earnings

per share.

Adjusted EBITDA, Adjusted EBITDA margin,

Adjusted EBITDA margin on incremental revenue and Adjusted earnings

per share are supplemental financial measures that are not required

by, or presented in accordance with, GAAP. We believe that these

non-GAAP measures, when taken together with our GAAP financial

results, provides meaningful supplemental information regarding our

operating performance and facilitates internal comparisons of our

historical operating performance on a more consistent basis by

excluding certain items that may not be indicative of our business,

results of operations or outlook. In particular, we believe that

the use of Adjusted EBITDA, Adjusted EBITDA margin, Adjusted EBITDA

margin on incremental revenue and Adjusted earnings per share are

helpful to our investors as they are measures used by management in

assessing the health of our business, determining incentive

compensation, evaluating our operating performance, and for

internal planning and forecasting purposes.

Adjusted EBITDA, Adjusted EBITDA margin,

Adjusted EBITDA margin on incremental revenue and Adjusted earnings

per share are presented for supplemental informational purposes

only, have limitations as analytical tools and should not be

considered in isolation or as a substitute for financial

information presented in accordance with GAAP. Some of the

limitations of Adjusted EBITDA, Adjusted EBITDA margin, Adjusted

EBITDA margin on incremental revenue and Adjusted earnings per

share include: (1) it does not properly reflect capital commitments

to be paid in the future; (2) although depreciation and

amortization are non-cash charges, the underlying assets may need

to be replaced and Adjusted EBITDA does not reflect these capital

expenditures; (3) it does not consider the impact of stock-based

compensation expense; (4) it does not reflect other non-operating

income and expenses, including other income, net and interest

income, net; (5) it does not reflect tax payments that may

represent a reduction in cash available to us. In addition, our

non-GAAP measures may not be comparable to similarly titled

measures of other companies because they may not calculate such

measures in the same manner as we calculate these measures,

limiting their usefulness as comparative measures. Because of these

limitations, when evaluating our performance, you should consider

Adjusted EBITDA, Adjusted EBITDA margin, Adjusted EBITDA margin on

incremental revenue and Adjusted earnings per share alongside other

financial performance measures, including our net income, gross

margin, and our other GAAP results.

We calculate Adjusted EBITDA as net income,

adjusted to exclude depreciation and amortization; stock-based

compensation expense; other income, net; interest income, net; and

(benefit) provision for income taxes. We calculate Adjusted EBITDA

margin as Adjusted EBITDA divided by revenue. We calculate Adjusted

EBITDA margin on incremental revenue as incremental Adjusted EBITDA

in 2024 divided by incremental revenue in 2024. We calculate

Adjusted earnings per diluted share as net income per diluted share

excluding the impact of stock-based compensation, adjusted for the

associated impact of taxes. Please see Annex A: “Reconciliation of

GAAP to Non-GAAP Financial Measures” elsewhere in this press

release.

For Further Information, Please Contact:

Investors: James Hartinvestors@progyny.com

Media:Selena Yangmedia@progyny.com

PROGYNY,

INC.Consolidated Balance

Sheets(Unaudited)(in thousands,

except share and per share amounts)

| |

|

March 31, |

|

December 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

| ASSETS |

|

|

|

|

| Current assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

114,959 |

|

|

$ |

97,296 |

|

|

Marketable securities |

|

|

256,872 |

|

|

|

273,791 |

|

|

Accounts receivable, net of $50,054 and $46,636 of allowances at

March 31, 2024 and December 31, 2023, respectively |

|

|

297,209 |

|

|

|

241,869 |

|

|

Prepaid expenses and other current assets |

|

|

12,472 |

|

|

|

27,451 |

|

| Total current assets |

|

|

681,512 |

|

|

|

640,407 |

|

| Property and equipment,

net |

|

|

10,234 |

|

|

|

10,213 |

|

| Operating lease right-of-use

assets |

|

|

17,181 |

|

|

|

17,605 |

|

| Goodwill |

|

|

11,880 |

|

|

|

11,880 |

|

| Deferred tax assets |

|

|

70,269 |

|

|

|

73,120 |

|

| Other noncurrent assets |

|

|

3,228 |

|

|

|

3,395 |

|

| Total

assets |

|

$ |

794,304 |

|

|

$ |

756,620 |

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

| Current liabilities: |

|

|

|

|

|

Accounts payable |

|

$ |

130,171 |

|

|

$ |

125,426 |

|

|

Accrued expenses and other current liabilities |

|

|

75,748 |

|

|

|

60,524 |

|

| Total current liabilities |

|

|

205,919 |

|

|

|

185,950 |

|

| Operating lease noncurrent

liabilities |

|

|

16,781 |

|

|

|

17,241 |

|

| Total

liabilities |

|

|

222,700 |

|

|

|

203,191 |

|

| Commitments and Contingencies

(Note 6) |

|

|

|

|

| STOCKHOLDERS'

EQUITY |

|

|

|

|

|

Common stock, $0.0001 par value; 1,000,000,000 shares authorized;

96,839,393 and 96,348,522 shares issued; 96,115,816 and 96,348,522

shares outstanding at March 31, 2024 and December 31,

2023, respectively |

|

|

9 |

|

|

|

9 |

|

|

Additional paid-in capital |

|

|

489,343 |

|

|

|

461,639 |

|

|

Treasury stock, at cost, $0.0001 par value; 1,339,557 and 615,980

shares at March 31, 2024 and December 31, 2023,

respectively |

|

|

(27,367 |

) |

|

|

(1,009 |

) |

|

Accumulated earnings |

|

|

106,869 |

|

|

|

89,971 |

|

|

Accumulated other comprehensive income |

|

|

2,750 |

|

|

|

2,819 |

|

| Total stockholders’

equity |

|

|

571,604 |

|

|

|

553,429 |

|

| Total liabilities and

stockholders’ equity |

|

$ |

794,304 |

|

|

$ |

756,620 |

|

| |

|

|

|

|

|

|

|

|

PROGYNY,

INC.Consolidated Statements of

Operations(Unaudited)(in

thousands, except share and per share amounts)

| |

Three Months EndedMarch 31, |

|

|

|

2024 |

|

|

2023 |

|

| Revenue |

$ |

278,078 |

|

$ |

258,394 |

|

| Cost of services |

|

215,672 |

|

|

199,754 |

|

| Gross profit |

|

62,406 |

|

|

58,640 |

|

| Operating expenses: |

|

|

|

|

Sales and marketing |

|

15,454 |

|

|

14,282 |

|

|

General and administrative |

|

28,429 |

|

|

29,347 |

|

| Total operating expenses |

|

43,883 |

|

|

43,629 |

|

| Income from operations |

|

18,523 |

|

|

15,011 |

|

| Other income, net: |

|

|

|

|

Other income, net |

|

3,360 |

|

|

498 |

|

|

Interest income, net |

|

632 |

|

|

822 |

|

| Total other income, net |

|

3,992 |

|

|

1,320 |

|

| Income before income

taxes |

|

22,515 |

|

|

16,331 |

|

|

Provision (benefit) for income taxes |

|

5,617 |

|

|

(1,347 |

) |

| Net income |

$ |

16,898 |

|

$ |

17,678 |

|

| Net income per share: |

|

|

|

|

Basic |

$ |

0.18 |

|

$ |

0.19 |

|

|

Diluted |

$ |

0.17 |

|

$ |

0.18 |

|

| Weighted-average shares used

in computing net income per share: |

|

|

|

|

Basic |

|

96,484,657 |

|

|

93,832,873 |

|

|

Diluted |

|

101,052,933 |

|

|

100,166,008 |

|

|

|

|

|

|

|

|

|

PROGYNY,

INC.Consolidated Statements of Cash

Flows(Unaudited)(in

thousands)

| |

|

Three Months EndedMarch 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

| OPERATING

ACTIVITIES |

|

|

|

|

| Net income |

|

$ |

16,898 |

|

|

$ |

17,678 |

|

| Adjustments to reconcile net

income to net cash provided by operating activities: |

|

|

|

|

|

Deferred tax expense (benefit) |

|

|

2,877 |

|

|

|

(1,347 |

) |

|

Non-cash interest income |

|

|

(190 |

) |

|

|

— |

|

|

Depreciation and amortization |

|

|

716 |

|

|

|

541 |

|

|

Stock-based compensation expense |

|

|

31,052 |

|

|

|

30,808 |

|

|

Bad debt expense |

|

|

4,772 |

|

|

|

5,244 |

|

|

Realized gains on sale of marketable securities |

|

|

(3,395 |

) |

|

|

(502 |

) |

|

Foreign currency exchange rate loss |

|

|

35 |

|

|

|

— |

|

| Changes in operating assets

and liabilities: |

|

|

|

|

|

Accounts receivable |

|

|

(60,118 |

) |

|

|

(78,422 |

) |

|

Prepaid expenses and other current assets |

|

|

15,169 |

|

|

|

(1,456 |

) |

|

Accounts payable |

|

|

4,790 |

|

|

|

36,445 |

|

|

Accrued expenses and other current liabilities |

|

|

12,995 |

|

|

|

11,751 |

|

|

Other noncurrent assets and liabilities |

|

|

131 |

|

|

|

221 |

|

|

Net cash provided by operating activities |

|

|

25,732 |

|

|

|

20,961 |

|

| |

|

|

|

|

| INVESTING

ACTIVITIES |

|

|

|

|

| Purchase of property and

equipment, net |

|

|

(850 |

) |

|

|

(1,251 |

) |

| Purchase of marketable

securities |

|

|

(110,806 |

) |

|

|

(23,435 |

) |

| Sale of marketable

securities |

|

|

131,000 |

|

|

|

40,813 |

|

|

Net cash provided by investing activities |

|

|

19,344 |

|

|

|

16,127 |

|

| |

|

|

|

|

| FINANCING

ACTIVITIES |

|

|

|

|

| Repurchase of common

stock |

|

|

(23,764 |

) |

|

|

— |

|

| Proceeds from exercise of

stock options |

|

|

962 |

|

|

|

1,675 |

|

| Payment of employee taxes

related to equity awards |

|

|

(4,959 |

) |

|

|

(3,815 |

) |

| Proceeds from contributions to

employee stock purchase plan |

|

|

350 |

|

|

|

294 |

|

|

Net cash used in financing activities |

|

|

(27,411 |

) |

|

|

(1,846 |

) |

| Effect of exchange rate

changes on cash and cash equivalents

|

|

|

(2 |

) |

|

|

— |

|

| Net increase in cash and cash

equivalents |

|

|

17,663 |

|

|

|

35,242 |

|

| Cash and cash equivalents,

beginning of period |

|

|

97,296 |

|

|

|

120,078 |

|

| Cash and cash equivalents, end

of period |

|

$ |

114,959 |

|

|

$ |

155,320 |

|

| |

|

|

|

|

| SUPPLEMENTAL

DISCLOSURE OF CASH FLOW INFORMATION |

|

|

|

|

| Cash paid for income taxes,

net of refunds received |

|

$ |

(362 |

) |

|

$ |

(20 |

) |

| SUPPLEMENTAL

DISCLOSURE OF NON-CASH INVESTING AND FINANCING

ACTIVITIES |

|

|

|

|

| Additions of property and

equipment, net included in accounts payable and accrued

expenses |

|

$ |

155 |

|

|

$ |

201 |

|

| |

|

|

|

|

|

|

|

|

ANNEX A

PROGYNY,

INC.Reconciliation of GAAP to Non-GAAP Financial

Measures(unaudited)(in thousands,

except share and per share amounts)

Costs of Services, Gross Margin and Operating Expenses

Excluding Stock-Based Compensation CalculationThe

following table provides a reconciliation of cost of services,

gross profit, sales and marketing and general and administrative

expenses to each of these measures excluding the impact of

stock-based compensation expense for each of the periods

presented:

| |

|

Three Months Ended |

| |

|

March 31, 2024 |

| |

|

GAAP |

|

Stock-BasedCompensationExpense |

|

Non-GAAP |

| |

|

|

|

|

|

|

|

Cost of services |

|

$ |

215,672 |

|

|

$ |

(9,033 |

) |

|

$ |

206,639 |

|

| Gross profit |

|

$ |

62,406 |

|

|

$ |

9,033 |

|

|

$ |

71,439 |

|

| Sales and marketing |

|

$ |

15,454 |

|

|

$ |

(7,503 |

) |

|

$ |

7,951 |

|

| General and

administrative |

|

$ |

28,429 |

|

|

$ |

(14,516 |

) |

|

$ |

13,913 |

|

| |

|

|

|

|

|

|

| Expressed as a

Percentage of Revenue |

|

|

| Gross margin |

|

|

22.4 |

% |

|

|

3.2 |

% |

|

|

25.7 |

% |

| Sales and marketing |

|

|

5.6 |

% |

|

(2.7)% |

|

|

2.9 |

% |

| General and

administrative |

|

|

10.2 |

% |

|

(5.2)% |

|

|

5.0 |

% |

| |

|

|

|

|

|

|

| |

|

Three Months Ended |

| |

|

March 31, 2023 |

| |

|

GAAP |

|

Stock-BasedCompensationExpense |

|

Non-GAAP |

| |

|

|

|

|

|

|

| Cost of services |

|

$ |

199,754 |

|

|

$ |

(8,214 |

) |

|

$ |

191,540 |

|

| Gross profit |

|

$ |

58,640 |

|

|

$ |

8,214 |

|

|

$ |

66,854 |

|

| Sales and marketing |

|

$ |

14,282 |

|

|

$ |

(6,568 |

) |

|

$ |

7,714 |

|

| General and

administrative |

|

$ |

29,347 |

|

|

$ |

(16,026 |

) |

|

$ |

13,321 |

|

| |

|

|

|

|

|

|

| Expressed as a

Percentage of Revenue |

|

|

| Gross margin |

|

|

22.7 |

% |

|

|

3.2 |

% |

|

|

25.9 |

% |

| Sales and marketing |

|

|

5.5 |

% |

|

(2.5)% |

|

|

3.0 |

% |

| General and

administrative |

|

|

11.4 |

% |

|

(6.2)% |

|

|

5.2 |

% |

| |

|

|

|

|

|

|

Note: percentages shown in the table may not cross foot due to

rounding.

Adjusted Earnings Per Diluted Share

CalculationThe following table provides a reconciliation

of net income to Adjusted Earnings Per Diluted Share for each of

the periods presented:

| |

|

|

| |

|

|

| |

|

Three Months Ended |

| |

|

March 31, 2024 |

| |

|

|

|

Net Income |

|

$ |

16,898 |

|

| Add: |

|

|

|

Stock-based compensation |

|

|

31,052 |

|

|

Income tax effect of non-GAAP adjustment |

|

|

(8,817 |

) |

| Adjusted Net income |

|

$ |

39,133 |

|

| |

|

|

| Diluted Shares |

|

|

101,052,933 |

|

| Adjusted Earnings Per Diluted

Share |

|

$ |

0.39 |

|

| |

|

|

| |

|

Three Months Ended |

| |

|

March 31, 2023 |

| |

|

|

| Net Income |

|

$ |

17,678 |

|

| Add: |

|

|

|

Stock-based compensation |

|

|

30,808 |

|

|

Income tax effect of non-GAAP adjustment |

|

|

(13,942 |

) |

| Adjusted Net income |

|

$ |

34,544 |

|

| |

|

|

| Diluted Shares |

|

|

100,166,008 |

|

| Adjusted Earnings Per Diluted

Share |

|

$ |

0.34 |

|

| |

|

|

Adjusted EBITDA and Adjusted EBITDA Margin on

Incremental Revenue CalculationThe following table

provides a reconciliation of Net income to Adjusted EBITDA for each

of the periods presented:

| |

|

Three Months Ended |

| |

|

March 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

|

| Net income |

|

$ |

16,898 |

|

|

$ |

17,678 |

|

| Add: |

|

|

|

|

|

Depreciation and amortization |

|

|

716 |

|

|

$ |

541 |

|

|

Stock‑based compensation expense |

|

|

31,052 |

|

|

$ |

30,808 |

|

|

Other income, net |

|

|

(3,360 |

) |

|

$ |

(498 |

) |

|

Interest income, net |

|

|

(632 |

) |

|

$ |

(822 |

) |

|

Provision (benefit) for income taxes |

|

|

5,617 |

|

|

$ |

(1,347 |

) |

| Adjusted EBITDA |

|

$ |

50,291 |

|

|

$ |

46,360 |

|

| |

|

|

|

|

| Revenue |

|

$ |

278,078 |

|

|

$ |

258,394 |

|

| |

|

|

|

|

| Incremental revenue vs.

2023 |

|

|

19,684 |

|

|

|

| |

|

|

|

|

| Incremental Adjusted EBITDA

vs. 2023 |

|

|

3,931 |

|

|

|

| |

|

|

|

|

| Adjusted EBITDA Margin on

Incremental revenue |

|

|

20.0 |

% |

|

|

| |

|

|

|

|

|

|

Reconciliation of Non-GAAP Financial Guidance for the

Three Months Ending June 30, 2024 and Year Ending December 31,

2024

| |

|

Three Months Ending June 30,

2024 |

|

Year Ending December 31,

2024 |

| (in thousands) |

|

Low |

|

High |

|

Low |

|

High |

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

300,000 |

|

|

$ |

310,000 |

|

|

$ |

1,230,000 |

|

|

$ |

1,270,000 |

|

| Net Income |

|

$ |

15,700 |

|

|

$ |

17,800 |

|

|

$ |

68,400 |

|

|

$ |

75,400 |

|

| Add: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

700 |

|

|

|

700 |

|

|

|

3,000 |

|

|

|

3,000 |

|

|

Stock-based compensation expense |

|

|

32,000 |

|

|

|

32,000 |

|

|

|

131,000 |

|

|

|

131,000 |

|

|

Other income, net |

|

|

(3,000 |

) |

|

|

(3,000 |

) |

|

|

(14,000 |

) |

|

|

(14,000 |

) |

|

Provision for income taxes |

|

|

6,600 |

|

|

|

7,500 |

|

|

|

27,600 |

|

|

|

30,600 |

|

|

Adjusted EBITDA* |

|

$ |

52,000 |

|

|

$ |

55,000 |

|

|

$ |

216,000 |

|

|

$ |

226,000 |

|

| |

|

Three Months Ending June 30,

2024 |

|

Year Ending December 31,

2024 |

| |

|

Low |

|

High |

|

Low |

|

High |

| |

|

|

|

|

|

|

|

|

|

Net Income |

|

$ |

15,700 |

|

|

$ |

17,800 |

|

|

$ |

68,400 |

|

|

$ |

75,400 |

|

| Add: |

|

|

|

|

|

|

|

|

|

Stock-based compensation |

|

|

32,000 |

|

|

|

32,000 |

|

|

|

131,000 |

|

|

|

131,000 |

|

|

Income tax effect of non-GAAP adjustment |

|

|

(9,500 |

) |

|

|

(9,500 |

) |

|

|

(38,100 |

) |

|

|

(38,100 |

) |

| Adjusted Net

income* |

|

$ |

38,200 |

|

|

$ |

40,300 |

|

|

$ |

161,300 |

|

|

$ |

168,300 |

|

| |

|

|

|

|

|

|

|

|

| Diluted Shares |

|

|

99,000,000 |

|

|

|

99,000,000 |

|

|

|

100,000,000 |

|

|

|

100,000,000 |

|

| Adjusted Earnings Per

Diluted Share |

|

$ |

0.39 |

|

|

$ |

0.41 |

|

|

$ |

1.61 |

|

|

$ |

1.68 |

|

* All of the numbers in the table above reflect

our future outlook as of the date hereof. Net income and

Adjusted EBITDA ranges do not reflect any estimate for other

potential activities and transactions, nor do they contemplate any

discrete income tax items, including the income tax impact related

to equity compensation activity.

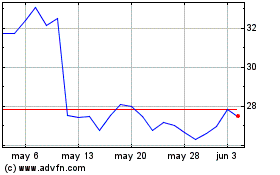

Progyny (NASDAQ:PGNY)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Progyny (NASDAQ:PGNY)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024