0001287032false424B200012870322023-12-292023-12-290001287032ck0001287032:ASharesMember2023-12-292023-12-29xbrli:pure0001287032ck0001287032:MSharesMember2023-12-292023-12-29iso4217:USD0001287032ck0001287032:PriceOfCommonStockMayFluctuateSignificantlyRiskMember2023-12-292023-12-290001287032ck0001287032:HolderAndIssuerOptionalConversionIsUncertainRiskMember2023-12-292023-12-290001287032ck0001287032:A4AndM4SharesDoNotHaveAHolderOptionalConversionFeatureMember2023-12-292023-12-290001287032ck0001287032:ConversionOfPreferredStockCouldCauseCommonStockToDeclineRiskMember2023-12-292023-12-290001287032ck0001287032:FutureSalesOfCommonStockCouldAffectValueOfStockRiskMember2023-12-292023-12-290001287032ck0001287032:PreferredStockEarlyRedemptionRiskMember2023-12-292023-12-290001287032ck0001287032:PreferredStockTermsRiskMember2023-12-292023-12-290001287032ck0001287032:PreferredStockDividendRiskMember2023-12-292023-12-290001287032ck0001287032:InvestingNetProceedsRiskMember2023-12-292023-12-290001287032ck0001287032:InterestRateRiskMember2023-12-292023-12-290001287032ck0001287032:FloatingRateSecuritiesHaveRisksThatFixedRateSecuritiesDoNotMember2023-12-292023-12-290001287032ck0001287032:ReformOfSOFRMember2023-12-292023-12-290001287032ck0001287032:SOFRHasALimitedHistoryMember2023-12-292023-12-290001287032ck0001287032:TermSOFRHasALimitedHistoryMember2023-12-292023-12-290001287032ck0001287032:FailureOfSOFRToGainMarketAcceptanceMember2023-12-292023-12-290001287032ck0001287032:SOFRAndTermSOFRMayBeMoreVolatileThanOtherBenchmarksMember2023-12-292023-12-290001287032ck0001287032:IlliquidityPriorToExchangeListingRiskMember2023-12-292023-12-290001287032ck0001287032:NoticePeriodPriorToIssuerOptionalRedemptionRiskMember2023-12-292023-12-290001287032ck0001287032:MarketPriceFluctuationRiskMember2023-12-292023-12-290001287032ck0001287032:CommonStockRanksJuniorToPreferredStockRiskMember2023-12-292023-12-290001287032ck0001287032:CommonStockMayBeIssuedFromOtherOfferingsRiskMember2023-12-292023-12-290001287032ck0001287032:RedemptionFollowingDeathOfAHolderRiskMember2023-12-292023-12-290001287032ck0001287032:A4AndM4RedemptionAtHoldersOptionIsLimitedMember2023-12-292023-12-290001287032ck0001287032:SpecialRisksToHoldersOfPreferredStockRiskMember2023-12-292023-12-290001287032ck0001287032:AdditionalRisksOfNotesToHoldersOfPreferredStockMember2023-12-292023-12-290001287032ck0001287032:SeniorSecuritiesExposeToAdditionalRisksRiskMember2023-12-292023-12-290001287032ck0001287032:BrokerDealersMayImpactAbilityToRaiseCapitalRiskMember2023-12-292023-12-290001287032ck0001287032:RisksRelatingToOurCommonStockRiskMember2023-12-292023-12-290001287032ck0001287032:PreferredStockMember2023-12-292023-12-29

Filed pursuant to Rule 424b2

File No. 333-269714

PROSPECTUS SUPPLEMENT

(To Prospectus dated February 10, 2023)

Prospect Capital Corporation

Maximum of 80,000,000 Shares

Up to $2,000,000,000 Aggregate Liquidation Preference

5.50% Series A1 Preferred Stock (the “Series A1 Shares”)

6.50% Series A3 Preferred Stock (the “Series A3 Shares,” and together with the Series A1 Shares, the “A1/A3 Shares”)

Floating Rate Series A4 Preferred Stock (the “Series A4 Shares”)

5.50% Series M1 Preferred Stock (the “Series M1 Shares”)

5.50% Series M2 Preferred Stock (the “Series M2 Shares”)

6.50% Series M3 Preferred Stock (the “Series M3 Shares”, and together with the

Series M1 Shares and Series M2 Shares, the “M1/M2/M3 Shares”)

Floating Rate Series M4 Preferred Stock (the “Series M4 Shares”)

This is an offering by Prospect Capital Corporation of up to 80,000,000 shares, par value $0.001 per share of preferred stock, with a $2,000,000,000 aggregate liquidation preference (the “Preferred Stock”). The Preferred Stock will be issued in multiple series, including the 5.50% Series A1 Preferred Stock (the “Series A1 Shares”), the 6.50% Series A3 Preferred Stock (the “Series A3 Shares,” and together with the Series A1 Shares, the “A1/A3 Shares”), the Floating Rate Series A4 Preferred Stock (the “Series A4 Shares), the 5.50% Series M1 Preferred Stock (the “Series M1 Shares”), the 5.50% Series M2 Preferred Stock (the “Series M2 Shares”), the 6.50% Series M3 Preferred Stock (the "Series M3 Shares", and together with the Series M1 Shares and the Series M2 Shares, the “M1/M2/M3 Shares”), and the Floating Rate Series M4 Preferred Stock (the “Series M4 Shares). We are offering the A1/A3 Shares, the Series A4 Shares, the M1/M2/M3 Shares, and the Series M4 Shares by this prospectus supplement. If, in the future, we offer any additional series of Preferred Stock, the dividend rate, fees and expenses of such future series may vary from those of the Preferred Stock offered by this prospectus supplement and such future series will be offered under a revised or a separate prospectus supplement. This prospectus supplement and the related prospectus also cover the shares of common stock into which the A1/A3 Shares and the M1/M2/M3 Shares may be converted.

Floating Rate for Series A4 Shares and Series M4 Shares. The Series A4 Shares and Series M4 Shares will pay a monthly dividend, when, as and if authorized by, or under authority granted by, the Board, and declared by us out of funds legally available therefor, at an annualized floating rate equal to one-month Term SOFR (as defined below) plus 2.00%, subject to a minimum annualized dividend rate of 6.50% (the “Cap Rate”) and a maximum annualized dividend rate of 8.00%, each with respect to the Stated Value of $25.00 per share of the Series A4 Shares and Series M4 Shares (computed on the basis of a 360-day year consisting of twelve 30-day months). The floating dividend rate on the Series A4 Shares and Series M4 Shares will reset upon each dividend declaration by the Board, and will reset to the applicable rate as determined two U.S. Government Securities Business Days (as defined below) prior to such declaration, as adjusted for the terms herein. The Board presently declares dividends on the Preferred Stock once per quarter for the subsequent three months. Therefore, the applicable floating dividend rate on the Series A4 Shares and Series M4 Shares is presently expected to reset approximately once every three months.

Holder Optional Conversion. At any time prior to the listing of the A1/A3 Shares or M1/M2/M3 Shares on a national securities exchange, such shares of the Preferred Stock will be convertible, at the option of the holder of such Preferred Stock

(the “Holder Optional Conversion”). We will settle any Holder Optional Conversion by paying or delivering, as the case may be, (A) any portion of the Settlement Amount (as defined below) that we elect to pay in cash and (B) a number of shares of our common stock at a conversion rate equal to (1) (a) the Settlement Amount, minus (b) any portion of the Settlement Amount that we elect to pay in cash, divided by (2) the arithmetic average of the daily volume weighted average price of shares of our common stock over each of the five consecutive trading days ending on the Holder Conversion Exercise Date (as defined herein) (such arithmetic average, the “5-day VWAP”). For the A1/A3 Shares, “Settlement Amount” means (A) $25.00 per share (the “Stated Value”), plus (B) unpaid dividends accrued to, but not including, the Holder Conversion Exercise Date, minus (C) the A Share Holder Optional Conversion Fee applicable on the respective Holder Conversion Deadline. For the M1/M2/M3 Shares, “Settlement Amount” means (A) the Stated Value, plus (B) unpaid dividends accrued to, but not including, the Holder Conversion Exercise Date, but if a holder of M1/M2/M3 Shares exercises a Holder Optional Conversion within the first twelve months of issuance of such M1/M2/M3 Shares, the Settlement Amount payable to such holder will be reduced by the aggregate amount of all dividends, whether paid or accrued, on such M1/M2/M3 Shares in the three full months prior to the Holder Conversion Exercise Date. Subject to certain limited exceptions, we will not pay any portion of the Settlement Amount in cash (other than cash in lieu of fractional shares of our common stock) until the five year anniversary of the date on which a share of A1/A3 Shares or M1/M2/M3 Shares Preferred Stock has been issued. Beginning on the five year anniversary of the date on which a share of A1/A3 Shares or M1/M2/M3 Shares is issued, we may elect to settle all or a portion of any Holder Optional Conversion in cash without limitation or restriction. The right of holders to convert a share of A1/A3 Shares or M1/M2/M3 Shares will terminate upon the listing of such share on a national securities exchange. The Series A4 Shares and Series M4 Shares are not convertible.

Holder Optional Redemption. At any time prior to the listing of the Series A4 Shares or Series M4 Shares on a national securities exchange, shares of the Series A4 Shares and the Series M4 Shares will be redeemable, at the option of the holder of such Preferred Stock, on a monthly basis (the "Holder Optional Redemption"). For all shares of Series A4 Shares and Series M4 Shares duly submitted to us for redemption on or before a monthly Holder Redemption Deadline (defined below), we will determine the HOR Settlement Amount (defined below) on any business day after such Holder Redemption Deadline but before the Holder Redemption Deadline occurring two months thereafter (such date, the “Holder Redemption Exercise Date”). Within such period, we may select the Holder Redemption Exercise Date in our sole discretion. We will settle any Holder Optional Redemption by paying the HOR Settlement Amount in cash. In addition, the aggregate amount of Holder Optional Redemptions by the holders of Series A4 Shares and Series M4 Shares will be subject to the following redemption limits: (i) no more than 2% of the outstanding Series A4 Shares and Series M4 Shares, in aggregate, as of the end of the most recent fiscal quarter will be redeemed per calendar month; (ii) no more than 5% of the outstanding Series A4 Shares and Series M4 Shares, in aggregate, as of the end of the most recent fiscal quarter will be redeemed per fiscal quarter and (iii) no more than 20% of the outstanding Series A4 Shares and Series M4 Shares, in aggregate, as of the end of the most recent fiscal quarter will be redeemed per Annual Redemption Period. An "Annual Redemption Period" means our then current fiscal quarter and the three fiscal quarters immediately preceding our then current fiscal quarter. A Series A4 Share is subject to an early redemption fee if it is redeemed by its holder within five years of issuance. Redemption capacity of the Series A4 Shares and the Series M4 Shares will be allocated on a pro rata basis based on the number of Series A4 Shares or Series M4 Shares, as applicable, submitted in the event that a monthly redemption is oversubscribed, based on any of the foregoing redemption limits. We may waive the foregoing redemption limits in our sole discretion at any time.

Issuer Optional Redemption. Subject to certain limited exceptions allowing earlier redemption, beginning on the earlier of the five year anniversary of the date on which a share of A1/A3 Shares or M1/M2/M3 Shares has been issued, or the two year anniversary of the date on which a share of Series A4 Shares or Series M4 Shares has been issued or, for listed shares of A1/A3 Shares or M1/M2/M3 Shares, five years from the earliest date on which any series that has been listed was first issued and, for listed shares of Series A4 Shares or Series M4 Shares, two years from the earliest date on which any series that has been listed was first issued (the earlier of such dates as applicable to a series of Preferred Stock, the “Redemption Eligibility Date”), such share of Preferred Stock may be redeemed at any time or from time to time at our option (the “Issuer Optional Redemption”) upon not less than 10 calendar days nor more than 90 calendar days written notice to the holder prior to the date fixed for redemption thereof, at a redemption price of 100% of the Stated Value of the shares of Preferred Stock to be redeemed plus unpaid dividends accrued to, but not including, the date fixed for redemption.

Issuer Optional Conversion. Subject to certain limitations, each share of A1/A3 Shares or M1/M2/M3 Shares will be convertible at our option, upon not less than 30 calendar days nor more than 90 calendar days written notice to the holder (the

“Issuer Optional Conversion”) prior to the date fixed for conversion thereof. We will settle any Issuer Optional Conversion by paying or delivering, as the case may be, (A) any portion of the IOC Settlement Amount (as defined below) that we elect to pay in cash and (B) a number of shares of our common stock at a conversion rate equal to (1) (a) the IOC Settlement Amount, minus (b) any portion of the IOC Settlement Amount that we elect to pay in cash, divided by (2) the 5-day VWAP. For both the A1/A3 Shares and the M1/M2/M3 Shares, “IOC Settlement Amount” means (A) the Stated Value, plus (B) unpaid dividends accrued to, but not including, the date fixed for conversion. We will not exercise an Issuer Optional Conversion with respect to a share of A1/A3 Shares or M1/M2/M3 Shares until after the second anniversary of its issuance, except as described in this prospectus supplement. In connection with an Issuer Optional Conversion, we will use commercially reasonable efforts to obtain or maintain any stockholder approval that may be required under the Investment Company Act of 1940 (the “1940 Act”) to permit us to sell our common stock below net asset value. If we do not have or have not obtained any required stockholder approval under the 1940 Act to sell our common stock below net asset value and the 5-day VWAP is at a discount to our net asset value per share of common stock, we will settle any conversions in connection with an Issuer Optional Conversion by paying or delivering, as the case may be, (A) any portion of the IOC Settlement Amount that we elect to pay in cash and (B) a number of shares of our common stock at a conversion rate equal to (1) (a) the IOC Settlement Amount, minus (b) any portion of the IOC Settlement Amount that we elect to pay in cash, divided by (2) the net asset value (“NAV”) per share of common stock at the close of business on the business day immediately preceding the date of conversion. We will not pay any portion of the IOC Settlement Amount from an Issuer Optional Conversion in cash (other than cash in lieu of fractional shares of our common stock) until the Redemption Eligibility Date. Beginning on the Redemption Eligibility Date, we may elect to settle any Issuer Optional Conversion in cash without limitation or restriction. In the event that we exercise an Issuer Optional Conversion with respect to any shares of A1/A3 Shares or M1/M2/M3 Shares, the holder of such A1/A3 Shares or M1/M2/M3 Shares may instead elect a Holder Optional Conversion with respect to such A1/A3 Shares or M1/M2/M3 Shares provided that the date of conversion for such Holder Optional Conversion would occur prior to the date of conversion for an Issuer Optional Conversion. The Series A4 Shares and Series M4 Shares are not convertible.

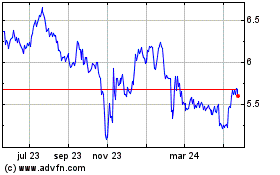

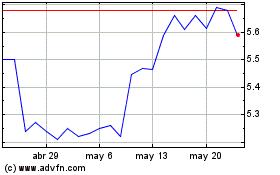

Our common stock is listed on The Nasdaq Global Select Market under the symbol “PSEC.” The last reported sale price of our common stock on December 27, 2023 was $6.05 per share.

We may in the future apply for listing of one or more series of the Preferred Stock on a national securities exchange.

We are also offering shares of our preferred stock in a separate offering. See “Incorporation by Reference”.

Investing in the Preferred Stock involves certain risks, including those described in the “Risk Factors” section beginning on page S-22 of this prospectus supplement and page 12 of the accompanying prospectus.

| | | | | | | | | | | |

| Per Preferred Stock | | Maximum Offering |

Public offering price | $25.00 | | $2,000,000,000 |

Selling commission - A1/A3 Shares and Series A4 Shares (1)(2)(3) | $1.75 | | $140,000,000 |

Selling commission - M1/M2/M3 Shares and Series M4 Shares (1)(2) | $0.00 | | $0.00 |

Dealer manager fee(1)(2)(3) | $0.75 | | $60,000,000 |

Proceeds to Prospect Capital Corporation (before expenses)(3)(4)(5) | $22.50 | | $1,800,000,000 |

(1) With respect to the A1/A3 Shares and Series A4 Shares, we will pay a selling commission up to 7% of the Stated Value and a dealer manager fee equal to 3% of the Stated Value. The M1/M2/M3 Shares and Series M4 Shares will not have a selling commission and will have a dealer manager fee equal to 3% of the Stated Value. The selling commission and the dealer manager fee are payable by us to our dealer manager. Reductions in selling commissions on sales of A1/A3 Shares and Series A4 Shares will be reflected in reduced public offering prices as described in the “Plan of Distribution” section of this prospectus supplement and the net proceeds to us will generally not be impacted by such reductions; therefore, we will bear a reduction in net proceeds to us up to 7% of the Stated Value on all A1/A3 Shares and Series A4 Shares although the selling commission paid by us to our dealer manager may represent less than 7% of the Stated Value. We or our affiliates also may provide permissible forms of non-cash compensation to registered representatives of our dealer manager and the participating broker-dealers. The value of such items will be considered underwriting compensation in connection with this offering, and the corresponding payments of our dealer manager fee will be reduced by the aggregate value of such items. The combined selling commission, dealer manager fee and cash and non-cash underwriting compensation for this offering will not exceed 10% of the aggregate gross proceeds of this offering, which is referred to as FINRA's 10% underwriting compensation cap. The selling commission on the Series A4 Shares cannot be reduced below 5%. See “Plan of Distribution”.

(2) We expect our dealer manager to authorize third-party broker-dealers that are members of FINRA, which we refer to as participating broker-dealers, to sell our Preferred Stock. Our dealer manager may reallow all or a portion of its selling commission attributable to a participating broker- dealer.

(3) Assumes all shares sold were subject to maximum selling commission and dealer manager fee applicable to A1/A3 Shares and Series A4 Shares.

(4) The selling commission and dealer manager fee, when combined with issuer expenses (including due diligence expenses and fees for establishing servicing arrangements for new stockholder accounts), are not currently expected to exceed 11.5% of the gross offering proceeds (collectively, “organization and offering expenses”). Our Board of Directors may, in its discretion, authorize the Company to incur organization and offering expenses in excess of 11.5% of the gross offering proceeds, but not in excess of FINRA’s limit on organization and offering expenses of 15% of the gross proceeds. However, in no event will the combined selling commission, dealer manager fee and all other underwriting compensation exceed FINRA's 10% cap.

(5) For illustrative purposes only. Assuming all shares sold were subject to maximum selling commission and dealer manager fee applicable to A1/A3 Shares and Series A4 Shares of 10% of Stated Value and issuer expenses of 1.5%, net proceeds to us, after theses organization and offering expenses, would be $1,770,000,000.

The dealer manager of this offering is Preferred Capital Securities, LLC (“PCS”). The dealer manager is not required to sell any specific number or dollar amount of the Preferred Stock, but will use its “reasonable best efforts” to sell the Preferred Stock offered. The minimum permitted purchase is generally $5,000, but purchases of less than $5,000 may be made in our sole discretion. We may terminate this offering at any time or may offer Preferred Stock pursuant to a new registration statement.

This offering is a continuation of our continuous offering of the Preferred Stock begun on August 3, 2020. As of the date of this prospectus supplement, there remain 17,213,730 shares of Preferred Stock, with an aggregate liquidation preference of $430.3 million, available for sale. We may increase the amount of Preferred Stock available for sale in our discretion and will supplement this prospectus supplement if we determine to increase the amount of Preferred Stock available for sale in the future.

Prospect Capital Corporation is a financial services company that lends to and invests in middle market, privately-held companies. Our investment objective is to generate both current income and long-term capital appreciation through debt and equity investments. We are organized as an externally-managed, non-diversified closed-end management investment company that has elected to be treated as a business development company under the 1940 Act. Prospect Capital Management L.P. manages our investments and Prospect Administration LLC provides the administrative services necessary for us to operate.

This prospectus supplement and the accompanying prospectus contain important information you should know before investing in our securities. Please read it before you invest and keep it for future reference. We file annual, quarterly and current reports, proxy statements and other information about us with the Securities and Exchange Commission, or the “SEC.” This information is available free of charge by contacting us at 10 East 40th Street, 42nd Floor, New York, NY 10016 or by telephone at (212) 448-0702. The SEC maintains a website at www.sec.gov where such information is available without charge upon written or oral request. Our internet website address is www.prospectstreet.com. Information contained on our website is not incorporated by reference into this prospectus supplement or the accompanying prospectus and you should not consider information contained on our website to be part of this prospectus supplement or the accompanying prospectus.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense. Obligations of Prospect Capital Corporation and any subsidiary of Prospect Capital Corporation are not guaranteed by the full faith and credit of the United States of America. Neither Prospect Capital Corporation nor any subsidiary of Prospect Capital Corporation is a government-sponsored enterprise or an instrumentality of the United States of America.

We will deliver the A1/A3 Shares, the Series A4 Shares, the Series M1 Shares, the Series M3 Shares, and the Series M4 Shares through the facilities of The Depository Trust Company (“DTC Settlement”) or through Direct Registration System settlement (“DRS Settlement”). We will deliver the Series M2 Shares through DRS Settlement. See the section entitled “Plan of Distribution” in this prospectus supplement for a description of these settlement methods.

| | |

| Preferred Capital Securities |

As Dealer Manager

Prospectus Supplement dated December 29, 2023.

INCORPORATION BY REFERENCE

This prospectus supplement is part of a registration statement that we have filed with the SEC. We are allowed to “incorporate by reference” the information that we file with the SEC, which means that we can disclose important information to you by referring you to those documents. We incorporate by reference into this prospectus supplement the documents listed below and any future filings we make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934 (the “Exchange Act”), including any filings on or after the date of this prospectus supplement from the date of filing (excluding any information furnished, rather than filed), until we have sold all of the offered securities to which this prospectus supplement and accompanying prospectus relates or the offering is otherwise terminated. The information incorporated by reference is an important part of this prospectus supplement. Any statement in a document incorporated by reference into this prospectus supplement will be deemed to be automatically modified or superseded to the extent a statement contained in (1) this prospectus supplement or (2) any other subsequently filed document that is incorporated by reference into this prospectus supplement modifies or supersedes such statement. The documents incorporated by reference herein include:

•our Annual Report on Form 10-K for the fiscal year ended June 30, 2023 filed with the SEC on September 8, 2023;

•our Quarterly Report on Form 10-Q for the quarter ended September 30, 2023 filed with the SEC on November 8, 2023;

•our Current Reports on Form 8-K filed with the SEC on September 29, 2023 and October 30, 2023; and

•our definitive Proxy Statement on Schedule 14A filed with the SEC on September 20, 2023.

To obtain copies of these filings, see “Available Information” in this prospectus supplement. We will also provide without charge to each person, including any beneficial owner, to whom this prospectus supplement is delivered, upon written or oral request, a copy of any and all of the documents that have been or may be incorporated by reference in this prospectus supplement or the accompanying prospectus. You should direct requests for documents by writing to:

Preferred Shareholder Services

3290 Northside Parkway NW, Suite 800

Atlanta, GA 30327

This prospectus supplement is also available on our website at http://www.prospectstreet.com. Information contained on our website is not incorporated by reference into this prospectus supplement or the accompanying prospectus and should not be considered to be part of this prospectus supplement or accompanying prospectus.

FORWARD-LOOKING STATEMENTS

Our annual report on Form 10-K for the year ended June 30, 2023, any of our quarterly reports on Form 10-Q or current reports on Form 8-K, or any other oral or written statements made in press releases or otherwise by or on behalf of Prospect Capital Corporation including this prospectus supplement, the accompanying prospectus and any related free writing prospectus may contain forward-looking statements within the meaning of Section 21E of the Exchange Act which involve substantial risks and uncertainties. Forward-looking statements predict or describe our future operations, business plans, business and investment strategies and portfolio management and the performance of our investments and our investment management business. These forward-looking statements are not historical facts, but rather are based on current expectations, estimates and projections about our industry, our beliefs and our assumptions. Words such as “intends,” “intend,” “intended,” “goal,” “estimate,” “estimates,” “expects,” “expect,” “expected,” “project,” “projected,” “projections,” “plans,” “seeks,” “anticipates,” “anticipated,” “should,” “could,” “may,” “will,” “designed to,” “foreseeable future,” “believe,” “believes,” “continues” and “scheduled” and variations of these words and similar expressions are intended to identify forward-looking statements. Our actual results or outcomes may differ materially from those anticipated. Readers are cautioned not to place undue reliance on these forward looking statements, which speak only as of the date the statement was made. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. These forward-looking statements do not meet the safe harbor for forward-looking statements pursuant to Section 27A of the Securities Act of 1933, or the “Securities Act.” These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements, including without limitation:

•our, or our portfolio companies’, future operating results;

•our business prospects and the prospects of our portfolio companies;

•the return or impact of current or future investments that we expect to make;

•our contractual arrangements and relationships with third parties;

•the dependence of our future success on the general economy and its impact on the industries in which we invest;

•the impact of global health epidemics, wars and civil disorder and other events outside of our control, including, but not limited to, the renewed hostilities in the Middle East and the conflict between Russia and Ukraine, on our and our portfolio companies’ business and the global economy;

•uncertainty surrounding inflation and the financial stability of the United States, Europe, and China;

•the financial condition of, and ability of our current and prospective portfolio companies to, achieve their objectives;

•difficulty in obtaining financing or raising capital, especially in the current credit and equity environment, and the impact of a protracted decline in the liquidity of credit markets on our and our portfolio companies’ business;

•the level, duration and volatility of prevailing interest rates and credit spreads, magnified by the current turmoil in the credit markets;

•the phase-out and the cessation of the London Interbank Offered Rate (“LIBOR”) and the use of the Secured Overnight Financing Rate (“SOFR”) as a replacement rate on our operating results;

•adverse developments in the availability of desirable loan and investment opportunities whether they are due to competition, regulation or otherwise;

•a compression of the yield on our investments and the cost of our liabilities, as well as the level of leverage available to us;

•the impact of changes in laws or regulations governing our operations or the operations of our portfolio companies;

•our regulatory structure and tax treatment, including our ability to operate as a business development company and a regulated investment company;

•the adequacy of our cash resources and working capital;

•the timing of cash flows, if any, from the operations of our portfolio companies;

•the ability of our investment adviser to locate suitable investments for us and to monitor and administer our investments;

•the timing, form and amount of any dividend distributions;

•authoritative generally accepted accounting principles or policy changes from such standard-setting bodies as the Financial Accounting Standards Board, the Securities and Exchange Commission, Internal Revenue Service, the

NASDAQ Global Select Market, the New York Stock Exchange LLC, and other authorities that we are subject to, as well as their counterparts in any foreign jurisdictions where we might do business; and

•any of the other risks, uncertainties and other factors identified herein or in our Annual Report on Form 10-K for the fiscal year ended June 30, 2023 and any subsequent filings we have made with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act that are incorporated by reference into this prospectus or any prospectus supplement.

Although we believe that the assumptions on which these forward-looking statements are based are reasonable, any of those assumptions could prove to be inaccurate, and as a result, the forward-looking statements based on those assumptions also could be inaccurate. Important assumptions include our ability to originate new loans and investments, ability to obtain certain margins and levels of profitability and the availability of additional capital. In light of these and other uncertainties, the inclusion of a projection or forward-looking statement in this prospectus supplement, the accompanying prospectus and any related free writing prospectus should not be regarded as a representation by us that our plans and objectives will be achieved. These risks and uncertainties include those described or identified in “Risk Factors” and elsewhere in this prospectus supplement, the accompanying prospectus and any related free writing prospectus, and such risks and uncertainties could cause actual results to differ materially from those in any forward-looking statements. The Company reminds all investors that no forward-looking statement can be relied upon as an accurate or even mostly accurate forecast because humans cannot forecast the future. You should not place undue reliance on these forward-looking statements, which apply only as of the date of this prospectus supplement, the accompanying prospectus or any related free writing prospectus, as applicable.

You should rely only on the information contained in this prospectus supplement, the accompanying prospectus, any related free writing prospectus and the documents incorporated herein or therein. We have not, and the agent(s) or dealer(s) has not, authorized any other person to provide you with information that is different from that contained in this prospectus supplement or the accompanying prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the agents are not, making an offer of these securities in any jurisdiction where the offer is not permitted. You should assume that the information appearing in this prospectus supplement and the accompanying prospectus is accurate only as of their respective dates and we assume no obligation to update any such information. Our business, financial condition and results of operations may have changed since those dates. Although we undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise, you are advised to consult any additional disclosures that we may make directly to you or through reports that we have filed with the SEC, including annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K.

This prospectus supplement supersedes the accompanying prospectus to the extent it contains information that is different from or in addition to the information in that prospectus. You should carefully read this entire prospectus supplement, the accompanying prospectus, any free writing prospectus relating to this offering and the documents incorporated by reference in this prospectus supplement and the accompanying prospectus before investing in the Preferred Stock.

TABLE OF CONTENTS

| | | | | |

| PROSPECTUS SUPPLEMENT | Page |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| PROSPECTUS | Page |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

PROSPECTUS SUMMARY

This summary highlights some information from this prospectus supplement and the accompanying prospectus, and it may not contain all of the information that is important to you. To understand the terms of the Preferred Stock offered hereby, you should read this prospectus supplement and the accompanying prospectus carefully. Together, these documents describe the specific terms of the offering. In addition, you should read the more detailed information appearing elsewhere in this prospectus supplement, the accompanying prospectus, in any related free writing prospectus and in the documents incorporated by reference in this prospectus supplement and accompanying prospectus, as provided in “Incorporation by Reference” beginning on page S-i of this prospectus supplement and page i of the prospectus and in “Available Information” beginning on page S-83 of this prospectus supplement and on page 72 of the accompanying prospectus. The terms “we,” “us,” “our” and “Company” refer to Prospect Capital Corporation; “Prospect Capital Management,” “Investment Adviser” and “PCM” refer to Prospect Capital Management L.P.; and “Prospect Administration” and the “Administrator” refer to Prospect Administration LLC.

The Company

Prospect Capital Corporation is a financial services company that primarily lends to and invests in middle market privately-held companies. Our investment objective is to generate both current income and long-term capital appreciation through debt and equity investments. We are a closed-end investment company incorporated in Maryland. We have elected to be regulated as a business development company (“BDC”) under the Investment Company Act of 1940 (the “1940 Act”). As a BDC, we have elected to be treated as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). We are a non-diversified company within the meaning of the 1940 Act. Our headquarters are located at 10 East 40th Street, 42nd Floor, New York, NY 10016, and our telephone number is (212) 448-0702. We were organized on April 13, 2004 and were funded in an initial public offering completed on July 27, 2004. We are one of the largest BDCs with approximately $7.9 billion of total assets as of September 30, 2023.

We are externally managed by our investment adviser, Prospect Capital Management. Prospect Administration provides administrative services and facilities necessary for us to operate.

On May 15, 2007, we formed a wholly-owned subsidiary Prospect Capital Funding LLC (“PCF”), a Delaware limited liability company and a bankruptcy remote special purpose entity, which holds certain of our portfolio loan investments that are used as collateral for the revolving credit facility at PCF. PCF has been consolidated since operations commenced.

Investment Portfolio

As of September 30, 2023, we had investments in 128 portfolio companies and collateralized loan obligations (“CLOs”). The aggregate fair value as of September 30, 2023 of investments in these portfolio companies and CLOs held on that date is approximately $7.7 billion. Our portfolio across all our performing interest-bearing investments had an annualized current yield of 12.7% as of September 30, 2023, excluding equity investments and non-accrual loans. Our annualized current yield was 10.3% as of September 30, 2023 across all investments.

Recent Developments

On November 8, 2023, we announced the declaration of monthly dividends for our 5.50% Preferred Stock for holders of record on the following dates based on an annual rate equal to 5.50% of the Stated Value of $25.00 per share as set forth in the Articles Supplementary for the Preferred Stock, from the date of issuance or, if later from the most recent dividend payment date (the first business day of the month, with no additional dividend accruing in January as a result), as follows:

| | | | | | | | | | | |

| Monthly Cash 5.50% Preferred Shareholder Distribution | Record Date | Payment Date | Monthly Amount ($ per share), before pro ration for partial periods |

| December 2023 | 12/20/2023 | 1/2/2024 | $0.114583 |

| January 2024 | 1/17/2024 | 2/1/2024 | $0.114583 |

| February 2024 | 2/21/2024 | 3/1/2024 | $0.114583 |

On November 8, 2023, we announced the declaration of monthly dividends for our 6.50% Preferred Stock for holders of record on the following dates based on an annual rate equal to 6.50% of the Stated Value of $25.00 per share as set forth in the Articles Supplementary for the Preferred Stock, from the date of issuance or, if later from the most recent dividend payment date (the first business day of the month, with no additional dividend accruing in January as a result), as follows:

| | | | | | | | | | | |

| Monthly Cash 6.50% Preferred Shareholder Distribution | Record Date | Payment Date | Monthly Amount ($ per share), before pro ration for partial periods |

| December 2023 | 12/20/2023 | 1/2/2024 | $0.135417 |

| January 2024 | 1/17/2024 | 2/1/2024 | $0.135417 |

| February 2024 | 2/21/2024 | 3/1/2024 | $0.135417 |

On November 8, 2023, we announced the declaration of quarterly dividends for our 5.35% Preferred Stock for holders of record on the following dates based on an annual rate equal to 5.35% of the Stated Value of $25.00 per share as set forth in the Articles Supplementary for the 5.35% Preferred Stock, from the date of issuance or, if later from the most recent dividend payment date, as follows:

| | | | | | | | | | | |

| Quarterly Cash 5.35% Preferred Shareholder Distribution | Record Date | Payment Date | Amount ($ per share) |

| November 2023 - January 2024 | 1/17/2024 | 2/1/2024 | $0.334375 |

On November 8, 2023, we announced the declaration of monthly dividends on our common stock as follows:

| | | | | | | | | | | |

| Monthly Cash Common Shareholder Distribution | Record Date | Payment Date | Amount ($ per share) |

| November 2023 | 11/28/2023 | 12/19/2023 | $0.0600 |

| December 2023 | 12/27/2023 | 1/18/2024 | $0.0600 |

| January 2024 | 1/29/2024 | 2/20/2024 | $0.0600 |

Risk Factors

See “Risk Factors” beginning on page S-17 of this prospectus supplement and page 12 of the accompanying prospectus, “Risk Factors” in our most recent Annual Report on Form 10-K, our most recent Quarterly Report on Form 10-Q, filed on November 8, 2023, and the risks sections in any of our other filings with the SEC and in any related free writing prospectus to read about risks that you should consider before investing in the Preferred Stock.

The Offering

| | | | | |

| Issuer | Prospect Capital Corporation |

| Securities Offered | Up to 80,000,000 shares, par value $0.001 per share of preferred stock, with a $2,000,000,000 aggregate liquidation preference (the “Preferred Stock”). The Preferred Stock will be issued in multiple series, including the 5.50% Series A1 Preferred Stock (the “Series A1 Shares”), the 6.50% Series A3 Preferred Stock (the "Series A3 Shares," and together with the Series A1 Shares, the "A1/A3 Shares"), the Floating Rate Series A4 Preferred Stock (the “Series A4 Shares”), the 5.50% Series M1 Preferred Stock (the “Series M1 Shares”), the 5.50% Series M2 Preferred Stock (the “Series M2 Shares”), the 6.50% Series M3 Preferred Stock (the "Series M3 Shares," and together with the Series M1 Shares and the Series M2 Shares, the “M1/M2/M3 Shares”) and the Floating Rate Series M4 Preferred Stock (the “Series M4 Shares”). |

| Offering Price | $25.00 per share (subject to adjustment for the A1/A3 Shares and Series A4 Shares based on the selling commission as disclosed herein). |

| Stated Value | $25.00 per share. |

| Ranking | The A1/A3 Shares and Series A4 Shares rank, with respect to the payment of dividends and rights upon liquidation, dissolution or winding up, (a) senior to our common stock, (b) on parity with each other series of our preferred stock, including any series of Preferred Stock and (c) junior to our existing and future secured and unsecured indebtedness.

The M1/M2/M3 Shares and Series M4 Shares rank, with respect to the payment of dividends and rights upon liquidation, dissolution or winding up, (a) senior to our common stock, (b) on parity with each other series of our preferred stock, including any series of Preferred Stock and (c) junior to our existing and future secured and unsecured indebtedness.

As of December 27, 2023, we and our subsidiaries had approximately $1.6 billion of unsecured senior indebtedness outstanding and $970.2 million of secured indebtedness outstanding. |

| Maturity | Shares of the Preferred Stock have no stated maturity. Shares of the Preferred Stock will remain outstanding indefinitely unless they are redeemed, repurchased or converted. We are not required to set apart for payment funds to redeem the Preferred Stock. |

| | | | | |

| Dividends | Shares of the Preferred Stock will pay a monthly dividend, when, as and if authorized by, or under authority granted by, the Board, and declared by us out of funds legally available therefor, at (a) a fixed annual rate of 5.50% per annum for the Series A1 Shares, Series M1 Shares and Series M2 Shares, (b) a fixed annual rate of 6.50% per annum for the Series A3 Shares and the Series M3 Shares, and (c) an annualized floating rate equal to one-month Term SOFR (as defined below) plus 2.00%, subject to a minimum annualized dividend rate of 6.50% (the "Cap Rate”) and a maximum annualized dividend rate of 8.00%, for the Series A4 Shares and the Series M4 Shares, each with respect to the Stated Value of $25.00 per share of the Preferred Stock (computed on the basis of a 360-day year consisting of twelve 30-day months) payable in cash or through the issuance of additional Preferred Stock through the Preferred Stock Dividend Reinvestment Plan.

The floating dividend rate on the Series A4 Shares and Series M4 Shares will reset upon each dividend declaration by the Board, and will reset to the applicable rate as determined two U.S. Government Securities Business Days (as defined below) prior to such declaration, as adjusted for the terms herein. The Board presently declares dividends on the Preferred Stock once per quarter for the subsequent three months. Therefore, the applicable floating dividend rate on the Series A4 Shares and Series M4 Shares is presently expected to reset approximately once every three months.

Dividends on each share of Preferred Stock begin accruing on, and are cumulative from, the date of issuance. If the Company is then offering a series of A1/A3 Shares or M1/M2/M3 Shares with a higher dividend rate than any other series of A1/A3 Shares or M1/M2/M3 Shares, respectively, the Company and the dealer manager will treat any subscriptions submitted for a corresponding series of A1/A3 Shares or M1/M2/M3 Shares with a lower dividend rate as a subscription for the corresponding series of A1/A3 Shares or M1/M2/M3 Shares with the higher dividend rate. For example, if the Company is then offering the Series A3 Shares, it will treat any subscriptions submitted for Series A1 Shares as subscriptions for Series A3 Shares. |

| Liquidation Preference | Upon any voluntary or involuntary liquidation, dissolution or winding-up of our affairs, before any distribution or payment shall be made to holders of our common stock, the holders of shares of Preferred Stock will be entitled to be paid out of our assets legally available for distribution to our stockholders, after payment or provision for our debts and other liabilities, a liquidation preference equal to the Stated Value per share, plus an amount equal to any accrued and unpaid dividends to but excluding the date of payment, whether or not earned or declared, but excluding interest on any such distribution or payment. |

| | | | | |

| Conversion at the Option of the A1/A3 Shares or M1/M2/M3 Shares Holder | At any time prior to the listing of the A1/A3 Shares or M1/M2/M3 Shares on a national securities exchange, shares of the A1/A3 Shares and the M1/M2/M3 Shares will be convertible, at the option of the holder of such Preferred Stock (the "Holder Optional Conversion") as follows:

Holder Conversion Notice: Holders of A1/A3 Shares and M1/M2/M3 Shares may elect to convert their shares of A1/A3 Shares and M1/M2/M3 Shares at any time by delivering to Preferred Shareholder Services a notice of conversion (the “Holder Conversion Notice”)

Holder Conversion Deadline: A Holder Conversion Notice will be effective as of: the 15th day of the month (or, if the 15th day of the month is not a business day, then on the business day immediately preceding the 15th day) or the last business day of the month, whichever occurs first after a Holder Conversion Notice is duly received by Preferred Shareholder Services (each such date, a “Holder Conversion Deadline”). Any Holder Conversion Notice received after 5:00 p.m. Eastern time on a Holder Conversion Deadline will be effective as of the next Holder Conversion Deadline.

Holder Conversion Exercise Date: For all shares of A1/A3 Shares and M1/M2/M3 Shares duly submitted to us for conversion on or before a Holder Conversion Deadline, we will determine the Settlement Amount (defined below) on any business day after such Holder Conversion Deadline but before the next Holder Conversion Deadline (such date, the “Holder Conversion Exercise Date”). Within such period, we may select the Holder Conversion Exercise Date in our sole discretion. We may, in our sole discretion, permit a holder to revoke their Holder Conversion Notice at any time prior to 5:00 pm, Eastern time, on the business day immediately preceding the Holder Conversion Exercise Date.

We will settle any Holder Optional Conversion by paying or delivering, as the case may be, (A) any portion of the Settlement Amount (as defined below) that we elect to pay in cash and (B) a number of shares of our common stock at a conversion rate equal to (1) (a) the Settlement Amount, minus (b) any portion of the Settlement Amount that we elect to pay in cash, divided by (2) the arithmetic average of the daily volume weighted average price of shares of our common stock over each of the five consecutive trading days ending on the Holder Conversion Exercise Date (such arithmetic average, the “5-day VWAP”).

For the A1/A3 Shares, “Settlement Amount” means (A) the Stated Value, plus (B) unpaid dividends accrued to, but not including, the Holder Conversion Exercise Date, minus (C) the A Share Holder Optional Conversion Fee applicable on the respective Holder Conversion Deadline.

For the M1/M2/M3 Shares, "Settlement Amount" means (A) the Stated Value, plus (B) unpaid dividends accrued to, but not including, the Holder Conversion Exercise Date, but if a holder of M1/M2/M3 Shares exercises a Holder Optional Conversion within the first twelve months of issuance of such M1/M2/M3 Shares, the Settlement Amount payable to such holder will be reduced by the aggregate amount of all dividends, whether paid or accrued, on such M1/M2/M3 Shares in the three full months prior to the Holder Conversion Exercise Date, if any (such amount, the “M1/M2/M3 Shares Clawback”). We are permitted to waive the M1/M2/M3 Shares Clawback through public announcement of the terms and duration of such waiver. Any such waiver would apply to any holder of Preferred Stock qualifying for the waiver and exercising a Holder Optional Conversion during the pendency of the term of such waiver. Although we have retained the right to waive the M1/M2/M3 Shares Clawback in the manner described above, we are not required to establish any such waivers and we may never establish any such waivers.

We will not pay any portion of the Settlement Amount for a share of A1/A3 Shares or M1/M2/M3 Shares from a Holder Optional Conversion in cash (other than cash in lieu of fractional shares of our common stock) until the five year anniversary of the date on which such share of A1/A3 Shares or M1/M2/M3 Shares has been issued, unless our Board determines, in its sole discretion, that the issuance of common stock in satisfaction of a Holder Optional Conversion would be materially detrimental to, and not in the best interest of, existing common stockholders. Beginning on the five year anniversary of the date on which a share of A1/A3 Shares or M1/M2/M3 Shares is issued, we may elect to settle all or a portion of any Holder Optional Conversion in cash without limitation or restriction.

We do not need stockholder approval in order to issue shares of common stock based on a conversion rate that is below the net asset value (“NAV”) per share of common stock in connection with a Holder Optional Conversion.

|

| | | | | |

| In the event that we provide notice of our intent to exercise the Issuer Optional Conversion or Issuer Optional Redemption with respect to shares of A1/A3 Shares or M1/M2/M3 Shares for which a holder has provided notice of its intent to exercise the Holder Optional Conversion, such holder may revoke its notice with respect to such shares of A1/A3 Shares or M1/M2/M3 Shares by delivering, prior to the applicable Holder Conversion Exercise Date, a written notice of revocation to the Company. In the event that we exercise an Issuer Optional Conversion (as defined below) with respect to any shares of A1/A3 Shares or M1/M2/M3 Shares, the holder of such Preferred Stock may instead elect a Holder Optional Conversion (which would be effected at the 5-day VWAP, which may represent a discount to the NAV per share of the common stock on the date of the conversion) provided that the date of conversion for such Holder Optional Conversion would occur prior to the date of conversion for an Issuer Optional Conversion (which may be effected at a conversion rate based on the NAV per share of the common stock on the date of conversion). See "Conversion at the Option of the Issuer" and "Liquidity Event" below.

The Series A4 Shares and Series M4 Shares are not convertible. |

| A1/A3 Share Holder Optional Conversion Fee: | An A1/A3 Share is subject to an early conversion fee if it is converted by its holder within five years of issuance. The amount of the fee equals a percentage of the maximum public offering price disclosed herein based on the year in which the conversion occurs after the A1/A3 Share is issued as follows:

•Prior to the first anniversary of the issuance of such Preferred Stock: 9.00% of the maximum public offering price disclosed herein, which equals $2.25 per A1/A3 Share; •On or after the first anniversary but prior to the second anniversary: 8.00% of the maximum public offering price disclosed herein, which equals $2.00 per A1/A3 Share; •On or after the second anniversary but prior to the third anniversary: 7.00% of the maximum public offering price disclosed herein, which equals $1.75 per A1/A3 Share; •On or after the third anniversary but prior to the fourth anniversary: 6.00% of the maximum public offering price disclosed herein, which equals $1.50 per A1/A3 Share; •On or after the fourth anniversary but prior to the fifth anniversary 5.00% of the maximum public offering price disclosed herein, which equals $1.25 per A1/A3 Share; and •On or after the fifth anniversary: 0.00%.

We are permitted to waive the Holder Optional Conversion Fee through public announcement of the terms and duration of such waiver. Any such waiver would apply to any holder of Preferred Stock qualifying for the waiver and exercising a Holder Optional Conversion during the pendency of the term of such waiver. Although we have retained the right to waive the Holder Optional Conversion Fee in the manner described above, we are not required to establish any such waivers and we may never establish any such waivers. |

| | | | | |

| Redemption at the Option of the Series A4 Shares or Series M4 Shares Holder | At any time prior to the listing of the Series A4 Shares or Series M4 Shares on a national securities exchange, shares of the Series A4 Shares and the Series M4 Shares will be redeemable, at the option of the holder of such Preferred Stock (the "Holder Optional Redemption") as follows:

Holder Redemption Notice: Holders of Series A4 Shares and Series M4 Shares may elect to redeem their shares of Series A4 Shares and Series M4 Shares at any time by delivering to Preferred Shareholder Services a notice of redemption (the “Holder Redemption Notice”).

Holder Redemption Deadline: A Holder Redemption Notice will be effective as of the last business day of the month after a Holder Redemption Notice is duly received by Preferred Shareholder Services (each such date, a “Holder Redemption Deadline”). Any Holder Redemption Notice received after 5:00 p.m. Eastern time on a Holder Redemption Deadline will be effective as of the next Holder Redemption Deadline.

Holder Redemption Exercise Date: For all shares of Series A4 Shares and Series M4 Shares duly submitted to us for redemption on or before a Holder Redemption Deadline, we will determine the HOR Settlement Amount (defined below) on any business day after such Holder Redemption Deadline but before the Holder Redemption Deadline occurring two months thereafter (such date, the “Holder Redemption Exercise Date”). Within such period, we may select the Holder Redemption Exercise Date in our sole discretion. We may, in our sole discretion, permit a holder to revoke their Holder Redemption Notice at any time prior to 5:00 pm, Eastern time, on the business day immediately preceding the Holder Redemption Exercise Date.

We will settle any Holder Optional Redemption by paying the HOR Settlement Amount (as defined below) in cash.

For the Series A4 Shares, “HOR Settlement Amount” means (A) the Stated Value, plus (B) unpaid dividends accrued to, but not including, the Holder Redemption Exercise Date, minus (C) the Series A4 Share Holder Optional Redemption Fee applicable on the respective Holder Redemption Deadline.

For the Series M4 Shares, "HOR Settlement Amount" means (A) the Stated Value, plus (B) unpaid dividends accrued to, but not including, the Holder Redemption Exercise Date, but if a holder of Series M4 Shares exercises a Holder Optional Redemption within the first twenty-four months of issuance of such Series M4 Shares, the HOR Settlement Amount payable to such holder will be reduced by (i) during the first twelve months of issuance of such Series M4 Shares, the aggregate amount of all dividends, whether paid or accrued, on such M4 Shares in the six-month period prior to the Holder Redemption Exercise Date, and (ii) during the second twelve months of issuance of such Series M4 Shares, the aggregate amount of all dividends, whether paid or accrued, on such M4 Shares in the three-month period prior to the Holder Redemption Exercise Date (such amount, the “Series M4 Shares Clawback”). We are permitted to waive the Series M4 Shares Clawback through public announcement of the terms and duration of such waiver. Any such waiver would apply to any holder of Preferred Stock qualifying for the waiver and exercising a Holder Optional Redemption during the pendency of the term of such waiver. Although we have retained the right to waive the Series M4 Shares Clawback in the manner described above, we are not required to establish any such waivers and we may never establish any such waivers.

|

| | | | | |

| In addition, the aggregate amount of Holder Optional Redemptions by the holders of Series A4 Shares and Series M4 Shares will be subject to the following redemption limits: (i) no more than 2% of the outstanding Series A4 Shares and Series M4 Shares, in aggregate, as of the end of the most recent fiscal quarter will be redeemed per calendar month; (ii) no more than 5% of the outstanding Series A4 Shares and Series M4 Shares, in aggregate, as of the end of the most recent fiscal quarter will be redeemed per fiscal quarter; and (iii) no more than 20% of the outstanding Series A4 Shares and Series M4 Shares, in aggregate, as of the end of the most recent fiscal quarter will be redeemed per Annual Redemption Period. An "Annual Redemption Period" means our then current fiscal quarter and the three fiscal quarters immediately preceding our then current fiscal quarter.

Redemptions pursuant to an Issuer Optional Redemption (as described below) will not count toward the 2% / 5% / 20% limits above applied to Holder Optional Redemptions by holders of the Series A4 Shares and Series M4 Shares. Optional redemptions following death of a holder (as described below) will count toward the 2% / 5% / 20% limits above but will not be subject to such limits.

If, after applying the redemption limits above, a holder would own less than one share of Series A4 Shares or Series M4 Shares, all of such holder’s shares of Series A4 Shares or Series M4 Shares, as applicable, will be redeemed. Otherwise, all redemption amounts will be rounded down such that after giving effect to any Holder Optional Redemption, no holder is left owning a fractional share. For example, if after applying the redemption limits, an investor would own 2.5 shares, we will redeem 0.5 fewer shares from such holder so that the holder is left owning three shares.

If, after applying the redemption limits above, the number of shares of Series A4 Shares or Series M4 Shares to be redeemed is less than the number of shares of Series A4 Shares or Series M4 Shares, as applicable, submitted for redemption by a holder, the excess shares of Series A4 Shares or Series M4 Shares, as applicable, will not be deemed submitted for redemption for future periods and, if a holder wishes to redeem additional shares, such holder will need to submit any remaining Series A4 Shares or Series M4 Shares they hold and wish to redeem on a subsequent Holder Redemption Deadline. Redemption capacity of the Series A4 Shares and the Series M4 Shares will be allocated on a pro rata basis based on the number of Series A4 Shares or Series M4 Shares, as applicable, submitted in the event that a monthly redemption is oversubscribed, based on any of the foregoing redemption limits. We may waive the foregoing redemption limits in our sole discretion at any time. |

| Series A4 Share Holder Optional Redemption Fee: | A Series A4 Share is subject to an early redemption fee if it is redeemed by its holder within five years of issuance. The amount of the fee equals a percentage of the maximum public offering price disclosed herein based on the year in which the redemption occurs after the Series A4 Share is issued as follows:

• Prior to the third anniversary of the issuance of such Preferred Stock: 10.00% of the maximum public offering price disclosed herein, which equals $2.50 per Series A4 Share; • On or after the third anniversary but prior to the fourth anniversary: 8.00% of the maximum public offering price disclosed herein, which equals $2.00 per Series A4 Share; • On or after the fourth anniversary but prior to the fifth anniversary 5.00% of the maximum public offering price disclosed herein, which equals $1.25 per Series A4 Share; and • On or after the fifth anniversary: 0.00%.

We are permitted to waive the Holder Optional Redemption Fee through public announcement of the terms and duration of such waiver. Any such waiver would apply to any holder of Series A4 Shares qualifying for the waiver and exercising a Holder Optional Redemption during the pendency of the term of such waiver. Although we have retained the right to waive the Holder Optional Redemption Fee in the manner described above, we are not required to establish any such waivers and we may never establish any such waivers. |

| | | | | |

| Redemption at the Option of the Issuer | Subject to the restrictions described herein, a share of Preferred Stock may be redeemed at our option (the “Issuer Optional Redemption”) at any time or from time to time upon not less than 10 calendar days nor more than 90 calendar days written notice to the holder prior to the date fixed for redemption thereof, at a redemption price of 100% of the Stated Value of the shares of Preferred Stock to be redeemed plus dividends accrued to, but excluding, the date fixed for redemption, whether or not earned or declared, but excluding interest on any such distribution or payment.

We will not exercise the Issuer Optional Redemption prior to the earlier of the five year anniversary of the date on which a share of A1/A3 Shares or M1/M2/M3 Shares has been issued, or the two year anniversary of the date on which a share of Series A4 Shares or Series M4 Shares has been issued or, for listed shares of A1/A3 Shares or M1/M2/M3 Shares, five years from the earliest date on which any series that has been listed was first issued or, for listed shares of Series A4 Shares or Series M4 Shares, two years from the earliest date on which any series that has been listed was first issued (the earlier of such dates as applicable to a series of Preferred Stock, the “Redemption Eligibility Date”), unless we determine, in our sole discretion, that doing so would be necessary to comply with the asset coverage requirements under the 1940 Act or to maintain our status as a RIC.

If we exercise the Issuer Optional Redemption for less than all of the outstanding shares of Preferred Stock, then shares of Preferred Stock will be selected for redemption on a pro rata basis or by lot across holders of the series of Preferred Stock selected for redemption; provided that, if the redemption occurs prior to the Redemption Eligibility Date applicable to a series of Preferred Stock, we will first redeem on a pro rata basis or by lot the minimum number of shares of such series of Preferred Stock that have met the Redemption Eligibility Date to comply with the asset coverage requirements of the 1940 Act or to maintain our status as a RIC, and, if the redemption of all such shares of Preferred Stock is insufficient to cause us to comply with the asset coverage requirements of the 1940 Act or to maintain our status as a RIC, we will then redeem on a pro rata basis or by lot the minimum number of shares of such series of Preferred Stock that have not met the Redemption Eligibility Date necessary for us to comply with the asset coverage requirements of the 1940 Act or to maintain our status as a RIC.

There is no Holder Optional Conversion Fee or Holder Optional Redemption Fee charged, nor do the M1/M2/M3 Shares Clawback or the Series M4 Shares Clawback, apply upon an Issuer Optional Redemption. |

| | | | | |

| Conversion at the Option of the Issuer | Subject to certain limitations, a share of A1/A3 Shares or M1/M2/M3 Shares may be converted at our option (the “Issuer Optional Conversion”) at any time or from time to time for cash or shares of our common stock upon not less than 30 calendar days nor more than 90 calendar days written notice to the holder prior to the date fixed for conversion thereof. We will settle any Issuer Optional Conversion by paying or delivering, as the case may be, (A) any portion of the IOC Settlement Amount (as defined below) that we elect to pay in cash and (B) a number of shares of our common stock at a conversion rate equal to (1) (a) the IOC Settlement Amount, minus (b) any portion of the IOC Settlement Amount that we elect to pay in cash, divided by (2) the 5-day VWAP, subject to our ability to obtain or maintain any stockholder approval that may be required under the 1940 Act to permit us to sell our common stock below net asset value if the 5-day VWAP represents a discount to our net asset value per share of common stock. See “1940 Act Approval” below.

For both the A1/A3 Shares or the M1/M2/M3 Shares, “IOC Settlement Amount” means (A) the Stated Value, plus (B) unpaid dividends accrued to, but not including, the date fixed for conversion.

We will not pay any portion of the IOC Settlement Amount from an Issuer Optional Conversion in cash (other than cash in lieu of fractional shares of our common stock) until the Redemption Eligibility Date. Beginning on the Redemption Eligibility Date, we may elect to settle any Issuer Optional Conversion in cash without limitation or restriction.

We will not exercise the Issuer Optional Conversion prior to the two year anniversary of the date on which a share of A1/A3 Shares or M1/M2/M3 Shares has been issued (provided that following the listing of A1/A3 Shares or M1/M2/M3 Shares on a national securities exchange, such date shall be the two year anniversary of the first date on which shares of A1/A3 Shares or M1/M2/M3 Shares, as appliable, were issued) unless the Board determines, in its sole discretion, that the conversion of such Preferred Stock is necessary to cause the Company to comply with the asset coverage requirements of the 1940 Act applicable to the Company, to maintain the Company’s status as a RIC, to maintain or enhance one or more of the Company’s credit ratings, to help comply with regulatory or other obligations, to achieve a strategic transaction, or to improve the liquidity position of the Company.

If we exercise the Issuer Optional Conversion for less than all of the outstanding shares of A1/A3 Shares and M1/M2/M3 Shares, then shares of A1/A3 Shares and M1/M2/M3 Shares, as applicable, will be selected for conversion on a pro rata basis or by lot across holders of the series of A1/A3 Shares and M1/M2/M3 Shares selected for conversion; provided that if we exercise the Issuer Optional Conversion prior to the two year anniversary of the issuance of any shares of A1/A3 Shares and M1/M2/M3 Shares, we will first convert on a pro rata basis or by lot the minimum number of shares of A1/A3 Shares and M1/M2/M3 Shares that have been issued for more than two years necessary to achieve the Board’s objective for the conversion, and, if the conversion of all such shares of A1/A3 Shares and M1/M2/M3 Shares is insufficient to cause us to achieve such objective, we will then convert on a pro rata basis or by lot the minimum number of shares of A1/A3 Shares and M1/M2/M3 Shares that have not been outstanding for two years for us to achieve the Board’s objective.

There is no Holder Optional Conversion Fee charged nor does the M1/M2/M3 Shares Clawback apply upon an Issuer Optional Conversion.

The Series A4 Shares and Series M4 Shares are not convertible. |

| | | | | |

| Stock outstanding after this offering | 80,000,000 shares of Preferred Stock, assuming the maximum offering of 80,000,000 Preferred Stock in this offering.

656,353,371 shares of common stock, including shares of common stock that may be issued upon conversion of all shares of the A1/A3 Shares and M1/M2/M3 Shares offered hereby assuming all the shares of Preferred Stock so converted pay a Holder Optional Conversion Fee of 9.00% and are converted at a conversion rate based on the 5-day VWAP calculated as if the conversion date was December 26, 2023, which was $6.15. The actual 5-day VWAP of our common stock on a conversion date may be more or less than $6.15, which may result in more or less shares of common stock issued. The foregoing only reflects the impact of this offering and does not reflect the impact of common or preferred stock sold in any other offering. |

| Liquidity Event | The Board will consider from time to time whether to (1) keep the Preferred Stock outstanding, (2) whether to list the Preferred Stock for trading on a national securities exchange or (3) elect an Issuer Optional Conversion with regard to the A1/A3 Shares or the M1/M2/M3 Shares (the “Liquidity Event”).

The decision of whether to complete a Liquidity Event will be at our sole discretion and will be made based on economic and market conditions at the time and the judgment of the Board as to what is in the best interests of the Company and its stockholders.

If the Board decides to list the Preferred Stock on a national securities exchange, we will provide no less than 60 days' written notice of the decision to list the A1/A3 Shares or M1/M2/M3 Shares. There will be a 30 day period prior to the listing in which holders of A1/A3 Shares or M1/M2/M3 Shares may exercise the Holder Optional Conversion with the applicable Holder Optional Conversion Fee (with respect to the A1/A3 Shares) or M1/M2/M3 Shares Clawback (with respect to the M1/M2/M3 Shares) waived.

Any listing of the Series A4 Shares or the Series M4 Shares shall require the approval of the holders of the Series A4 Shares or the Series M4 Shares, as applicable, voting as a separate class. The vote required to approve such a proposal for listing is a majority of the votes cast by the holders of Series A4 Shares or Series M4 Shares, as applicable, voting on such proposal at a meeting where a quorum of Series A4 Shares or Series M4 Shares, as applicable, is present. For purposes of voting on any such proposal to list the Series A4 Shares or Series M4 Shares, the quorum required for voting on such proposal is 33 1/3% of the outstanding Series A4 Shares or Series M4 Shares, as applicable, entitled to vote on such proposal, unless the Board by resolution establishes a higher quorum. A favorable vote on any such proposal shall be non-binding and the Board shall retain sole discretion as to whether to complete such listing. |

| 1940 Act Approval | In connection with any Issuer Optional Conversion of A1/A3 Shares or M1/M2/M3 Shares, we will use commercially reasonable efforts to obtain or maintain any stockholder approval that may be required under the 1940 Act to permit us to sell our common stock below net asset value. If we do not have or obtain any required stockholder approval under the 1940 Act to sell our common stock below net asset value and the 5-day VWAP is at a discount to our net asset value per share of common stock, we will settle any conversions in connection with an Issuer Optional Conversion of A1/A3 Shares or M1/M2/M3 Shares by paying or delivering, as the case may be, (A) any portion of the IOC Settlement Amount that we elect to pay in cash and (B) a number of shares of our common stock at a conversion rate equal to (1) (a) the IOC Settlement Amount, minus (b) any portion of the IOC Settlement Amount that we elect to pay in cash, divided by (2) the NAV per share of common stock at the close of business on the business day immediately preceding the date of conversion. See “Description of the Preferred Stock-1940 Act Approval.”

In the event that we exercise an Issuer Optional Conversion with respect to any shares of A1/A3 Shares or M1/M2/M3 Shares, the holder of such A1/A3 Shares or M1/M2/M3 Shares may instead elect a Holder Optional Conversion provided that the date of conversion for such Holder Optional Conversion would occur prior to the date of conversion for the Issuer Optional Conversion. |

| | | | | |

| Selling Commission - A1/A3 Shares and Series A4 Shares | Up to 7.0% of the Stated Value borne paid by the Company. Reductions in selling commissions will be reflected in reduced public offering prices as described in the "Plan of Distribution" section of this prospectus supplement and the net proceeds to us will generally not be impacted by such reductions; therefore, we will bear a reduction in net proceeds to us up to 7% of the Stated Value on all A1/A3 Shares and Series A4 Shares although the selling commission compensation paid by us to our dealer manager may represent less than 7% of the Stated Value. The selling commission on the Series A4 Shares cannot be reduced below 5%. |

| Selling Commission - M1/M2/M3 Shares and Series M4 Shares | None. |

| Dealer Manager Fee | 3.0% on the Stated Value paid by the Company. |

| Offering Expenses | The selling commission and dealer manager fee, when combined with organization and offering expenses (including due diligence expenses and fees for establishing servicing arrangements for new stockholder accounts), are not currently expected to exceed 11.5% of the gross offering proceeds. Our Board of Directors may, in its discretion, authorize the Company to incur underwriting and other offering expenses in excess of 11.5% of the gross offering proceeds. In no event will the combined selling commission, dealer manager fee and offering expenses exceed FINRA’s limit on underwriting and other offering expenses. |

| Preferred Stock Dividend Reinvestment Plan | Our Transfer Agent will administer a Preferred Stock Dividend Reinvestment Plan, pursuant to which Holders will have dividends on their Preferred Stock automatically reinvested in additional shares of such Preferred Stock at a price per share of Preferred Stock of $23.75 per share (95% of the Stated Value of the $25.00 per share of Preferred Stock) for Series A1 Shares, Series A3 Shares, Series M1 Shares, Series M2 Shares and Series M3 Shares, and $25.00 per share for Series A4 Shares and Series M4 Shares, if they so elect.

Shares of Preferred Stock received through the Preferred Stock Dividend Reinvestment Plan will be of the same series and have the same original issue date for purposes of the Holder Optional Conversion Fee, the Holder Optional Redemption Fee, the M1/M2/M3 Shares Clawback, or the Series M4 Shares Clawback, as applicable, and for other terms of the Preferred Stock based on issuance date as the Preferred Stock for which the dividend was declared. |

| Optional Redemption Following Death of a Holder | Subject to restrictions, beginning on the date of original issuance and ending upon the listing of the Preferred Stock on a national securities exchange, we will redeem shares of Preferred Stock of a beneficial owner who is a natural person (including a natural person who holds shares of Preferred Stock through an Individual Retirement Account or in a personal or estate planning trust) upon his or her death at the written request of the beneficial owner’s estate at a redemption price equal to the Stated Value plus an amount equal to any accumulated, accrued and unpaid dividends thereon to, but excluding, the date of such redemption. The beneficial owner or the beneficial owner’s estate must hold the Preferred Stock for a minimum of 6 months before their shares of Preferred Stock are eligible for such redemption.

We will have a discretionary right to limit the aggregate liquidation preference of Preferred Stock subject to redemption following the death of a beneficial owner that may be exercised in any calendar year to an amount equal to the greater of $10 million or 5% of all the Preferred Stock outstanding as of the end of the most recent calendar year. Upon any such redemption request from a beneficial owner’s estate upon the death of such beneficial owner, we have the right, in our sole discretion, to pay the redemption price in cash or, with regards to the A1/A3 Shares and the M1/M2/M3 Shares but not the Series A4 Shares nor the Series M4 Shares, in equal value of our common stock, or a combination thereof, calculated based on the 5-day VWAP, in exchange for the A1/A3 Shares or M1/M2/M3 Shares. If we do not have or have not obtained any required stockholder approval under the 1940 Act to sell our common stock below net asset value and the 5-day VWAP is at a discount to our net asset value per share of common stock, we will settle any redemption request from a beneficial owner's estate upon the death of such beneficial owner by paying the redemption price in cash, provided that cash is available after taking into account the leverage requirements under the 1940 Act and the terms of any of our outstanding senior securities at the time. |

| | | | | |