The Real Brokerage Inc. (NASDAQ: REAX) (“Real” or the

"Company"), a technology platform reshaping real estate for agents,

home buyers and sellers, announced today financial results for the

second quarter ended June 30, 2024.

“Real achieved outstanding results in the second quarter,

surpassing our own expectations and achieving new highs in Revenue

and Gross Profit," said Tamir Poleg, Real’s Chairman and Chief

Executive Officer. “Our performance underscores the resilience and

attractiveness of our business model, combined with the

efficiencies enabled by our differentiated technology

platform.”

“We were thrilled to announce the launch of the Real Luxury

division and the Real Partners program this quarter,” said Sharran

Srivatsaa, President of Real. “These initiatives, along with our

ProTeams and Private Label programs, were designed to attract even

more agents to Real and to provide them with access to vetted

vendors and partners, elevating the service we can offer our

clients. As the industry prepares to implement practice changes, we

are doubling down on training and equipping our agents with the

tools and skills they need to thrive in any market condition.”

“We look forward to building on our strong first half results to

deliver continued significant year over year growth and improved

profitability in the balance of the year,” said Michelle Ressler,

Real’s Chief Financial Officer. “We will continue making necessary

investments in our people and platform to support our rapidly

growing agent base, deliver an exceptional experience, and ensure

Real’s long-term success.”

Q2 2024 Operational Highlights1

- The total value of completed real estate transactions reached

$12.6 billion in the second quarter of 2024, an increase of 80%

from $7.0 billion in the second quarter of 2023.

- The total number of transactions closed was 30,367 in the

second quarter of 2024, an increase of 73% from 17,537 in the

second quarter of 2023.

- The total number of agents on the platform increased to 19,540

at the end of the second quarter of 2024, an increase of 70% from

the second quarter of 2023. As of August 7, 2024, over 20,000

agents are now on the Real platform.

Q2 2024 Financial Highlights

- Revenue rose to $340.8 million in the second quarter of 2024,

an increase of 84% from $185.3 million in the second quarter of

2023.

- Gross profit reached $31.9 million in the second quarter of

2024, an increase of 79% from $17.8 million in the second quarter

of 2023.

- Net loss attributable to owners of the Company was $1.2 million

in the second quarter of 2024, compared to $4.1 million in the

second quarter of 2023.

- Adjusted EBITDA2 was $14.0 million in the second quarter of

2024, compared to $2.6 million in the second quarter of 2023.

Adjusted EBITDA in the second quarter of 2024 excludes $0.4 million

of litigation expenses incurred during the quarter related to the

settlement of antitrust litigation.

- Operating expenses, which include General & Administrative,

Marketing, and Research and Development expenses, increased to

$32.5 million in the second quarter of 2024, a 51% increase from

$21.5 million in the second quarter of 2023.

- Revenue share expense, which is included in Marketing expenses,

was $12.5 million in the second quarter of 2024, a 62% increase

compared to $7.7 million in the second quarter of 2023.

- Adjusted operating expenses, which reflect operating expenses

less revenue share expense, stock-based compensation, depreciation,

expenses related to the settlement of antitrust litigation, and

other unique or non-cash expenses, were $14.7 million in the second

quarter of 2024, an increase of 39% from $10.6 million in the

second quarter of 2023. Adjusted operating expense per transaction

was $485 in the second quarter of 2023, a decline of 20% from $606

in the second quarter of 2023.

- Loss per share was $0.01 in the second quarter of 2024,

compared to a loss per share of $0.02 in the second quarter of

2023.

- The Company repurchased 2.7 million common shares for $10.6

million in the second quarter of 2024, pursuant to its normal

course issuer bid.

- As of June 30, 2024, Real had cash and cash equivalents of

$33.6 million, consisting of $23.3 million of unrestricted cash and

$10.3 million held in investments in financial assets.

- Real continues to have no debt.

_________________________ 1 All dollar references are in U.S.

dollars. 2 There are references to "Adjusted EBITDA" and "Adjusted

Operating Expense" in this press release, which are non-IFRS

measures. See accompanying note under the heading "Non-IFRS

Measures" for an explanation of the composition of these non-IFRS

measures.

The Company will discuss the second quarter results on a

conference call and live webcast today at 8:30 a.m. ET.

Conference Call

Details:

Date:

Wednesday, August 7, 2024

Time:

8:30 a.m. ET

Dial-in Number:

North American Toll Free:

888-506-0062

International: 973-528-0011

Access Code:

947955

Webcast:

https://www.webcaster4.com/Webcast/Page/2699/50818

Replay Information:

Replay Number:

North American Toll Free:

877-481-4010

International: 919-882-2331

Access Code:

50818

Replay Link:

https://www.webcaster4.com/Webcast/Page/2699/50818

Non-IFRS Measures

This news release includes references to "Adjusted EBITDA", and

"Adjusted Operating Expense", which are non-International Financial

Reporting Standards (“IFRS”) financial measures. Non-IFRS

measures are not recognized measures under IFRS, do not have a

standardized meaning prescribed by IFRS, and are therefore unlikely

to be comparable to similar measures presented by other

companies.

Adjusted EBITDA is used as an alternative to net income by

removing major non-cash items, such as depreciation, amortization,

interest, stock-based compensation, current and deferred income tax

expenses and other items management considers unique and/or

non-operating in nature.

Adjusted Operating Expense is used as an alternative to

operating expenses by removing major non-cash items such as

stock-based compensation, depreciation, and other unique or

non-cash expenses, while retaining ongoing fixed operating expenses

and excluding variable cash expenses associated with revenue

share.

Adjusted EBITDA and Adjusted Operating Expense have no direct

comparable IFRS financial measures. The Company has used or

included these non-IFRS measures solely to provide investors with

added insight into Real’s financial performance. Readers are

cautioned that such non-IFRS measures may not be appropriate for

any other purpose. Non-IFRS measures should not be considered in

isolation or as a substitute for measures of performance prepared

in accordance with IFRS. Our Adjusted EBITDA is reconciled to the

most comparable IFRS measure for the three months and six months

ended June 30, 2024 and 2023 and is presented in the table below

labeled Reconciliation of Total Comprehensive Loss Attributable to

Owners of the Company to Adjusted EBITDA. Our Adjusted Operating

Expense reconciled to the most comparable IFRS measure is presented

for the three months ended June 30, 2024 and on a quarterly basis

for the prior two fiscal years in the table below labeled

Reconciliation of Operating Expense to Adjusted Operating

Expense.

THE REAL BROKERAGE, INC. INTERIM CONDENSED CONSOLIDATED

STATEMENTS OF FINANCIAL POSITIONS (Expressed in thousands of

U.S. dollars) (unaudited)

As of

June 30, 2024

December 31, 2023

ASSETS CURRENT ASSETS Cash and cash equivalents

$

23,316

$

14,707

Restricted cash

33,124

12,948

Funds held in escrow account

9,250

-

Investments in financial assets

10,276

14,222

Trade receivables

18,631

6,441

Other receivables

56

63

Prepaid expenses and deposits

1,541

2,132

TOTAL CURRENT ASSETS

96,194

50,513

NON-CURRENT ASSETS Intangible assets

2,996

3,442

Goodwill

8,993

8,993

Property and equipment

1,977

1,600

TOTAL NON-CURRENT ASSETS

13,966

14,035

TOTAL ASSETS

110,160

64,548

LIABILITIES AND EQUITY CURRENT LIABILITIES

Accounts payable

1,196

571

Accrued liabilities

33,629

13,374

Customer deposits

33,124

12,948

Other payables

11,028

302

Warrants outstanding

356

-

TOTAL CURRENT LIABILITIES

79,333

27,195

NON-CURRENT LIABILITIES Warrants outstanding

-

269

TOTAL NON-CURRENT LIABILITIES

-

269

TOTAL LIABILITIES

79,333

27,464

EQUITY EQUITY ATTRIBUTABLE TO OWNERS Share

premium

79,075

62,567

Stock-based compensation reserves

57,020

52,937

Deficit

(95,517

)

(78,205

)

Other reserves

422

(167

)

Treasury stock, at cost

(10,435

)

(257

)

EQUITY ATTRIBUTABLE TO OWNERS

30,565

36,875

Non-controlling interests

262

209

TOTAL EQUITY

30,827

37,084

TOTAL LIABILITIES AND EQUITY

$

110,160

$

64,548

THE REAL BROKERAGE, INC. INTERIM CONDENSED

CONSOLIDATED STATEMENTS OF LOSS AND COMPREHENSIVE LOSS

(Expressed in thousands of U.S. dollars, except for per share

amounts) (unaudited)

Three Months Ended

Six Months Ended

June 30, 2024

June 30, 2023

June 30, 2024

June 30, 2023

Revenues

$

340,778

$

185,332

$

541,521

$

293,177

Commissions and other agent-related costs

308,910

167,573

488,894

264,610

Gross Profit

31,868

17,759

52,627

28,567

General & administrative expenses

14,015

9,654

26,151

18,292

Marketing expenses

15,889

10,266

28,518

17,950

Research and development expenses

2,608

1,579

5,070

3,103

Settlement of litigation

-

-

9,250

-

Operating Loss

(644

)

(3,740

)

(16,362

)

(10,778

)

Other income

57

40

230

68

Finance expenses, net

(523

)

(272

)

(1,075

)

(577

)

Net Loss

(1,110

)

(3,972

)

(17,207

)

(11,287

)

Net Income Attributable to Noncontrolling Interests

105

146

105

226

Net Loss Attributable to Owners of the Company

(1,215

)

(4,118

)

(17,312

)

(11,513

)

Other comprehensive income/(loss): Cumulative (Gain)/Loss on

Investments in Debt Instruments Classified as at FVTOCI

Reclassified to Profit or Loss

51

42

94

135

Foreign currency translation adjustment

376

(85

)

495

62

Total Comprehensive Loss Attributable to Owners of the

Company

(788

)

(4,161

)

(16,723

)

(11,316

)

Total Comprehensive Income Attributable to NCI

105

146

105

226

Total Comprehensive Loss

(683

)

(4,015

)

(16,618

)

(11,090

)

Loss per share Basic and diluted loss per share

$

(0.01

)

$

(0.02

)

$

(0.09

)

$

(0.06

)

Weighted-average shares, basic and diluted

189,046

179,764

186,568

178,252

THE REAL BROKERAGE, INC. INTERIM CONDENSED

CONSOLIDATED STATEMENT OF CASH FLOWS (Expressed in thousands of

U.S. dollars) (unaudited)

Three Months Ended

Six Months Ended

June 30, 2024

June 30, 2023

June 30, 2024

June 30, 2023

OPERATING ACTIVITIES Net Loss

$

(1,110

)

$

(3,972

)

$

(17,207

)

$

(11,287

)

Adjustments for: Depreciation and amortization

340

284

666

553

Equity-settled share-based payments

13,536

6,075

22,380

11,836

Finance costs

271

116

671

299

Changes in operating asset and liabilities: Funds held in

restricted escrow account

(9,250

)

-

(9,250

)

-

Trade receivables

(9,096

)

(526

)

(12,190

)

(378

)

Other receivables

34

23

7

22

Prepaid expenses and deposits

(319

)

(306

)

591

(530

)

Accounts payable

103

776

625

672

Accrued liabilities

12,415

6,333

20,255

9,414

Customer deposits

8,684

14,144

20,176

22,099

Other payables

362

641

10,726

166

NET CASH PROVIDED BY OPERATING ACTIVITIES

15,970

23,588

37,450

32,866

INVESTING ACTIVITIES Purchase of property and

equipment

(501

)

(110

)

(597

)

(250

)

Investment deposits in debt instruments held at FVTOCI

(1,542

)

(3,223

)

(1,713

)

(3,729

)

Investment withdrawals in debt instruments held at FVTOCI

5,730

845

5,752

845

NET CASH USED IN INVESTING ACTIVITIES

3,687

(2,488

)

3,442

(3,134

)

FINANCING ACTIVITIES Purchase of common shares for

Restricted Share Unit (RSU) Plan

(10,603

)

(810

)

(15,226

)

(1,411

)

Shares withheld for taxes

(420

)

-

(741

)

-

Proceeds from exercise of stock options

3,010

146

3,623

212

Payment of lease liabilities

-

(16

)

-

(96

)

Cash disbursements for non-controlling interest

(14

)

-

(52

)

-

NET CASH USED IN FINANCING ACTIVITIES

(8,027

)

(680

)

(12,396

)

(1,295

)

Net change in cash, cash equivalents and restricted cash

11,630

20,420

28,496

28,437

Cash, cash equivalents and restricted cash, beginning of year

44,512

26,411

27,655

18,327

Fluctuations in foreign currency

298

(87

)

289

(19

)

CASH, CASH EQUIVALENTS AND RESTRICTED CASH BALANCE, ENDING

BALANCE

$

56,440

$

46,745

$

56,440

$

46,745

THE REAL BROKERAGE, INC. RECONCILIATION OF TOTAL

COMPREHENSIVE LOSS ATTRIBUTABLE TO OWNERS OF THE COMPANY TO

ADJUSTED EBITDA (Expressed in thousands of U.S. dollars)

(unaudited)

Three Months Ended

Six Months Ended

June 30, 2024

June 30, 2023

June 30, 2024

June 30, 2023

Total Comprehensive Loss Attributable to Owners of the Company

(788

)

(4,161

)

(16,723

)

(11,316

)

Add/(Deduct): Finance Expenses, net

523

272

1,075

577

Net Income Attributable to Noncontrolling Interest

105

146

105

226

Cumulative (Gain)/Loss on Investments in Debt Instruments

Classified as at FVTOCI Reclassified to Profit or Loss

(51

)

(42

)

(94

)

(135

)

Depreciation and Amortization

340

284

666

553

Stock-Based Compensation

13,536

6,075

22,380

11,836

Restructuring Expenses

-

44

-

85

Expenses Related to Anti-Trust Litigation Settlement

369

-

10,226

-

Adjusted EBITDA

$

14,034

$

2,618

$

17,637

$

1,826

THE REAL BROKERAGE, INC. BREAKOUT OF REVENUE BY

SEGMENT (Expressed in thousands of U.S. dollars) (unaudited)

Three Months Ended

Six Months Ended

June 30, 2024

June 30, 2023

June 30, 2024

June 30, 2023

Main revenue streams Commissions

$

338,574

$

184,022

$

537,826

$

291,137

Title

1,255

948

2,050

1,546

Mortgage Income

949

362

1,645

494

Total Revenue

$

340,778

$

185,332

$

541,521

$

293,177

THE REAL BROKERAGE INC. RECONCILIATION OF

OPERATING EXPENSE TO ADJUSTED OPERATING EXPENSE BY QUARTER

(Expressed in thousands of U.S. dollars) (unaudited)

2022

2023

2024

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Operating Expense

10,129

13,496

12,886

15,184

17,846

21,499

22,742

26,796

36,477

32,512

Less: Revenue Share Expense

2,703

4,376

3,876

4,020

5,434

7,684

7,946

6,840

9,064

12,475

Revenue Share Expense (% of revenue)

4.4%

3.9%

3.5%

4.2%

5.0%

4.1%

3.7%

3.8%

4.5%

3.7%

Less: Stock-Based Compensation - Employees

1,205

897

281

608

1,019

1,214

285

6,543

1,493

2,265

Stock-Based Compensation - Agents

582

547

1,776

2,614

1,541

1,640

2,769

1,830

2,137

2,335

Depreciation Expense

3

135

87

108

269

284

277

298

326

340

Restructuring Expense

-

-

62

160

41

44

80

58

-

Expenses Related to Anti-Trust Litigation Settlement

-

-

-

-

-

-

-

-

9,857

369

Subtotal

1,790

1,579

2,206

3,490

2,870

3,182

3,411

8,729

13,813

5,309

Adjusted Operating Expense1

5,636

7,541

6,804

7,674

9,542

10,633

11,385

11,226

13,600

14,728

Adjusted Operating Expense (% of revenue)

9.1%

6.7%

6.1%

8.0%

8.8%

5.7%

5.3%

6.2%

6.8%

4.3%

1Adjusted operating expense

excludes revenue share, stock-based compensation, depreciation and

other non-recurring or non-cash expenses.

THE REAL BROKERAGE INC. KEY PERFORMANCE METRICS BY

QUARTER (Dollar amounts expressed in U.S. dollars) (unaudited)

2022

2023

2024

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Transaction Data Closed

Transaction Sides

6,248

10,224

11,233

9,745

10,963

17,537

20,397

17,749

19,032

30,367

Total Value of Home Side Transactions ($, billions)

2.4

4.2

4.2

3.5

4.0

7.0

8.1

6.8

7.5

12.6

Median Home Sale Price ($, thousands)

$345

$375

$360

$348

$350

$369

$370

$355

$372

$384

Agent Metrics Total Agents

4,500

5,600

6,700

8,200

10,000

11,500

12,175

13,650

16,680

19,540

Agent Churn Rate (%)

7.9

7.2

7.3

4.4

8.3

6.5

10.8

6.2

7.9

7.5

Revenue Churn Rate (%)

1.6

2.1

2.5

2.4

4.3

3.8

4.5

4.9

1.9

1.6

Headcount and Efficiency

Metrics Full-Time Employees

112

121

122

118

127

145

162

159

151

231

Full-Time Employees, Excluding One Real Title and One Real Mortgage

82

91

87

84

88

102

120

118

117

142

Headcount Efficiency Ratio1

1:55

1:62

1:77

1:98

1:114

1:113

1:101

1:116

1:143

1:138

Revenue Per Full Time Employee ($, thousands)2

$752

$1,235

$1,283

$1,144

$1,226

$1,817

$1,789

$1,537

$1,716

$2,400

Operating Expense Excluding Revenue Share ($, thousands)

$7,426

$9,120

$9,010

$11,164

$12,412

$13,815

$14,796

$19,956

$27,413

$20,037

Operating Expense Per Transaction Excluding Revenue Share ($)

$1,189

$892

$802

$1,146

$1,132

$788

$725

$1,124

$1,440

$660

Adjusted Operating Expense ($, thousands)3

$5,636

$7,541

$6,804

$7,674

$9,542

$10,633

$11,385

$11,226

$13,600

$14,728

Adjusted Operating Expense Per Transaction ($)

$902

$738

$606

$787

$870

$606

$558

$632

$715

$485

1Defined as the ratio of

full-time brokerage employees (excluding One Real Title and One

Real Mortgage employees) to the number of agents on our

platform.

2Reflects total company revenue

divided by full-time brokerage employees (excluding One Real Title

and One Real Mortgage employees).

3Adjusted operating expense

excludes revenue share, stock-based compensation, depreciation and

other non-recurring or non-cash expenses.

Forward-Looking Information

This press release contains forward-looking information within

the meaning of applicable Canadian securities laws. Forward-looking

information is often, but not always, identified by the use of

words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”,

“expect”, “likely” and “intend” and statements that an event or

result “may”, “will”, “should”, “could” or “might” occur or be

achieved and other similar expressions. These statements reflect

management’s current beliefs and are based on information currently

available to management as at the date hereof. Forward-looking

information in this press release includes, without limiting the

foregoing, information relating to Real’s expectation regarding

increasing the number of agents, revenue growth and profitability

and the business and strategic plans of Real.

Forward-looking information is based on assumptions that may

prove to be incorrect, including but not limited to Real’s business

objectives, expected growth, results of operations, performance,

business projects and opportunities and financial results. Real

considers these assumptions to be reasonable in the circumstances.

However, forward-looking information is subject to known and

unknown risks, uncertainties and other factors that could cause

actual results, performance or achievements to differ materially

from those expressed or implied in the forward-looking information.

Important factors that could cause such differences include, but

are not limited to, slowdowns in real estate markets, economic and

industry downturns, Real’s ability to attract new agents and retain

current agents and those risk factors discussed under the heading

“Risk Factors” in the Company’s Annual Information Form dated March

14, 2024, and “Risks and Uncertainties” in the Company’s Quarterly

Management’s Discussion and Analysis for the period ended June 30,

2024, copies of which are available under the Company’s SEDAR+

profile at www.sedarplus.ca.

These factors should be carefully considered and readers should

not place undue reliance on the forward-looking statements.

Although the forward-looking statements contained in this press

release are based upon what management believes to be reasonable

assumptions, Real cannot assure readers that actual results will be

consistent with these forward-looking statements. These

forward-looking statements are made as of the date of this press

release, and Real assumes no obligation to update or revise them to

reflect new events or circumstances, except as required by law.

About Real

Real (NASDAQ: REAX) is a real estate experience company working

to make life’s most complex transaction simple. The fast-growing

company combines essential real estate, mortgage and closing

services with powerful technology to deliver a single seamless

end-to-end consumer experience, guided by trusted agents. With a

presence in all 50 states throughout the U.S. and Canada, Real

supports over 20,000 agents who use its digital brokerage platform

and tight-knit professional community to power their own

forward-thinking businesses. Additional information can be found on

its website at www.onereal.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240807372723/en/

For additional information, please contact: Ravi Jani Vice

President, Investor Relations and Financial Planning & Analysis

investors@therealbrokerage.com 908.280.2515

For media inquiries, please contact: Elisabeth Warrick Senior

Director, Marketing, Communications & Brand

elisabeth@therealbrokerage.com 201.564.4221

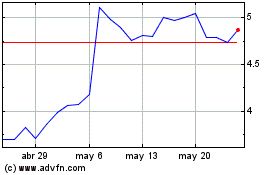

Real Brokerage (NASDAQ:REAX)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Real Brokerage (NASDAQ:REAX)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024