false

0000740664

R F INDUSTRIES LTD

DEF 14A

00007406642022-11-012023-10-31

iso4217:USD

00007406642021-11-012022-10-31

00007406642020-11-012021-10-31

thunderdome:item

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| |

☐

|

Preliminary Proxy Statement

|

| |

☐

|

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

| |

☒

|

Definitive Proxy Statement

|

| |

☐

|

Definitive Additional Materials

|

| |

☐

|

Soliciting Material Under Rule 14a-12

|

| |

RF INDUSTRIES, LTD.

|

|

| |

(Name of Registrant as Specified in its Charter)

|

|

Payment of Filing Fee (Check all boxes that apply):

| |

☐

|

Fee paid previously with preliminary materials.

|

| |

☐

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

RF INDUSTRIES, LTD.

16868 Via Del Campo Court

San Diego, California 92127

NOTICE IS HEREBY GIVEN THAT THE ANNUAL MEETING OF STOCKHOLDERS

WILL BE HELD ON SEPTEMBER 5, 2024

An Annual Meeting of Stockholders of RF Industries, Ltd., a Nevada corporation (the “Company”), will be held at the offices of RF Industries, Ltd., 16868 Via Del Campo Court, Suite 200, San Diego, California 92127 on Thursday, September 5, 2024, at 11:00 a.m., for the following purposes:

| |

1.

|

To elect two members of the Company’s Board of Directors to serve until the 2027 Annual Meeting of Stockholders.

|

| |

2.

|

To amend the Company’s 2020 Equity Incentive Plan to increase the number of shares of common stock available for issuance under the plan by 1,000,000 shares from 1,250,000 shares to 2,250,000 shares.

|

| |

3.

|

To approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers.

|

| |

4.

|

To ratify the appointment of CohnReznick LLP as the Company’s independent registered public accounting firm for the fiscal year ending October 31, 2024.

|

| |

5.

|

To transact such other business as may properly come before the Annual Meeting of Stockholders or any adjournment or postponement thereof.

|

The Board of Directors has fixed the close of business on July 9, 2024 as the record date for determination of stockholders entitled to notice of, and to vote at, the Annual Meeting of Stockholders or any adjournment or postponement thereof. Only stockholders of record on July 9, 2024 are entitled to notice of and to vote at the Annual Meeting. Further information regarding voting rights and the matters to be voted upon is presented in the accompanying proxy statement.

This proxy statement and our 2023 Annual Report can be accessed directly at the following internet address: https://materials.proxyvote.com/749552.

YOUR VOTE IS IMPORTANT. Whether or not you plan to attend the Annual Meeting, we urge you to submit your vote via the internet, telephone, or mail.

I hope you will join us.

| |

By Order of the Board of Directors, |

| |

|

| |

|

| |

|

| |

Robert Dawson |

| |

Chief Executive Officer |

San Diego, California

July 26, 2024

RF INDUSTRIES, LTD.

16868 Via Del Campo Court

San Diego, California 92127

PROXY STATEMENT

General

The enclosed proxy is solicited on behalf of the Board of Directors (the “Board”) of RF Industries, Ltd., a Nevada corporation (“we,” “us” or the “Company”), for use at the Annual Meeting of Stockholders (“Annual Meeting”) to be held on Thursday, September 5, 2024, at 11:00 a.m. local time, or at any adjournment or postponement thereof. The Annual Meeting will be held at the offices of RF Industries, Ltd., 16868 Via Del Campo Court, Suite 200, San Diego, California 92127.

The Notice of Internet Availability of Proxy Materials is first being mailed to our stockholders on or about July 26, 2024.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER

MEETING TO BE HELD ON SEPTEMBER 5, 2024

The Company’s Notice of Annual Meeting, this proxy statement, the proxy card, and our Annual Report for the fiscal year ended October 31, 2023 are available on the Internet at https://materials.proxyvote.com/749552 and on our website at www.rfindustries.com under “Investor Information.”

Only stockholders of record of the Company’s common stock at the close of business on July 9, 2024, will be entitled to notice of and to vote at the Annual Meeting. On July 9, 2024, there were 10,361,544 shares of common stock outstanding and entitled to vote. Each stockholder of record will be entitled to one vote for each share held on all matters to be voted upon. The Company is incorporated in Nevada and is not required by Nevada corporation law or its Articles of Incorporation to permit cumulative voting in the election of directors.

The information provided in the “question and answer” format below is for your convenience only and is merely a summary of the information contained in this proxy statement. You should read this entire proxy statement carefully. Information contained on, or that can be accessed through, our website is not intended to be incorporated by reference into this proxy statement and references to our website address in this proxy statement are inactive textual references only.

How can I attend the Annual Meeting?

You may attend the Annual Meeting if you are listed as a stockholder of record as of July 9, 2024, and bring proof of your identity. If you hold your shares in street name through a broker or other nominee, you will need to provide proof that you are the beneficial owner of the shares by bringing either a copy of a brokerage statement showing your share ownership as of July 9, 2024, or a legal proxy if you wish to vote your shares in person at the Annual Meeting.

How can I vote my shares in person at the Annual Meeting?

Shares held directly in your name as the stockholder of record may be voted in person at the Annual Meeting. If you choose to do so, please bring proof of your identity to the Annual Meeting. If your shares are held in a stock brokerage account or by a bank or other nominee, you have the right to direct your broker or nominee on how to vote these shares and are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote these shares in person at the Annual Meeting unless you receive a proxy from your broker or nominee. Your broker or nominee has provided voting instructions for you to use. If you wish to attend the Annual Meeting and vote in person shares held in your brokerage account name, please contact your broker or nominee so that you can receive a legal proxy to present at the Annual Meeting. Even if you plan to attend the Annual Meeting, we urge you to vote in one of the ways described below so that your vote will be counted if you later decide not to attend the Annual Meeting or are unable to attend. Attendance at the Annual Meeting will not cause your previously granted proxy to be revoked unless you change your proxy instructions as described above.

How can I vote my shares without attending the Annual Meeting?

Whether you hold shares directly as the stockholder of record or beneficially in street name, you may direct your vote without attending the Annual Meeting. You may vote by granting a proxy or, for shares held in street name, by submitting voting instructions to your broker or nominee. In most instances, you will be able to do this over the Internet, by telephone or by mail. Please refer to the summary instructions below, the instructions included on the Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”), and if you request printed proxy materials, the instructions included on your proxy card or, for shares held in street name, the voting instruction card provided by your broker or nominee.

| |

●

|

By Internet — If you have Internet access, you may submit your proxy from any location in the world by following the Internet voting instructions on the proxy card or voting instruction card sent to you.

|

| |

●

|

By Telephone — You may submit your proxy by following the telephone voting instructions on the proxy card or voting instruction card sent to you.

|

| |

●

|

By Mail — You may do this by marking, dating, and signing the enclosed proxy or, for shares held in street name, the voting instruction card provided to you by your broker or nominee, and mailing it in the enclosed, self-addressed, postage prepaid envelope. No postage is required if mailed in the United States. Please note that you will be mailed a printed proxy or printed voting instruction card only if you request that such printed materials be sent to you by following the instructions in the Notice of Internet Availability for requesting paper copies of the proxy materials.

|

What vote is required for the proposals?

The representation, in person or by proxy, of at least a majority of the outstanding shares of common stock entitled to vote at the Annual Meeting is necessary to constitute a quorum for the transaction of business. Shares represented by proxies pursuant to which votes have been withheld from any nominee for director, or which contain one or more abstentions or broker “non-votes,” are counted as present or represented for purposes of determining the presence or absence of a quorum for the Annual Meeting. A “non-vote” occurs when a broker or other nominee holding shares for a beneficial owner votes on one proposal, but does not vote on another proposal because the broker does not have discretionary voting power and has not received instructions from the beneficial owner. Brokers and banks have discretionary voting authority to vote with respect to “routine” matters; however, they do not have discretionary authority to vote on “non-routine” matters. Proposal No. 1 (Election of Directors), Proposal No. 2 (Increase to the number of shares of common stock available for issuance) and Proposal No. 3 (Advisory Vote on the Compensation of the Company’s Named Executive Officers) will be considered “non-routine” and therefore your broker will not be able to vote your shares with respect to these proposals unless the broker receives specific voting instructions from you.

Election of Directors (Proposal No. 1). Directors are elected by a plurality of the votes cast, in person or by proxy, at the Annual Meeting. Assuming that a quorum is present at the Annual Meeting and that the election of directors remains uncontested, the two nominees who receive the highest number of affirmative votes cast will be elected as directors of the Company. Shares present or represented by proxy and not so marked as to withhold authority to vote for a particular nominee will be voted in favor of a particular nominee and will be counted toward such nominee’s achievement of a plurality. Shares present at the meeting or represented by proxy where the stockholder properly withholds authority to vote for such nominee in accordance with the proxy instructions and broker “non-votes” will not be counted toward such nominee’s achievement of plurality. Shares abstaining from the vote are included in the number of shares present or represented and voting, but will have no effect on the vote.

Amendment to the 2020 Equity Incentive Plan (Proposal No. 2). For the approval of the amendment to the Company’s 2020 Equity Incentive Plan to increase the number of shares of common stock available for issuance under the plan by 1,000,000 shares from 1,250,000 shares to 2,250,000 shares, the affirmative vote of the majority of shares present, in person or represented by proxy, and voting on the matter is required for approval. Abstentions and broker non-votes are counted as present for purposes of determining the presence of a quorum. Abstentions and broker non-votes will have no effect on the outcome of the vote.

Advisory Vote on the Compensation of our Named Executive Officers (Proposal No. 3). For the advisory vote on the compensation of our Named Executive Officers, the affirmative vote of the majority of shares present, in person or represented by proxy, and voting on that matter is required for approval. Abstentions and broker non-votes are counted as present for purposes of determining the presence of a quorum. Abstentions and broker non-votes will have no effect on the outcome of the vote.

Ratification of Independent Accountants (Proposal No. 4). For the ratification of the appointment of CohnReznick LLP as our independent registered public accounting firm for the fiscal year ending October 31, 2024, an affirmative vote of a majority of the shares present, in person or represented by proxy, and voting on such matter is required for approval. Abstentions are counted as present for purposes of determining the presence of a quorum, but will have no effect on the outcome of the vote.

Other Matters. The Board knows of no other matters to be presented at the Annual Meeting. If any other matter should be presented at the Annual Meeting upon which a vote properly may be taken, the persons named on the enclosed proxy will have discretionary authority to vote the shares represented by such proxies in accordance with their best judgment.

Revocability of Proxies

Any person giving a Proxy in the form accompanying this proxy statement has the power to revoke it any time before its exercise. To revoke a proxy previously submitted by telephone or through the Internet, you may simply vote again at a later date, using the same procedures, in which case your later submitted vote will be recorded and your earlier vote revoked. A proxy may also be revoked by providing to the Secretary of the Company’s principal executive office, 16868 Via Del Campo Court, Suite 200, San Diego, California 92127, an instrument of revocation or a duly executed proxy bearing a later date, or it may be revoked by attending the Annual Meeting and voting in person. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote in person at the Annual Meeting, you must obtain from the record holder a proxy issued in your name.

If I am a beneficial owner of shares, can my brokerage firm vote my shares?

If you are a beneficial owner and do not vote via the Internet, telephone, or by returning a signed voting instruction card to your broker, your shares may be voted only with respect to so-called routine matters where your broker has discretionary voting authority over your shares. Brokers will have such discretionary authority to vote on Proposal 4 regarding the ratification of the selection of our independent registered public accounting firm for 2024, but not on any of the other proposals.

We encourage you to provide instructions to your brokerage firm by returning your voting instruction card. This ensures that your shares will be voted at the Annual Meeting with respect to all of the proposals described in this proxy statement.

Notice of Internet Availability of Proxy Materials

We are furnishing proxy materials to our stockholders primarily via the internet under rules adopted by the U.S. Securities and Exchange Commission (“SEC”), instead of mailing printed copies of those materials to each stockholder. On July 26, 2024, we commenced mailing to our stockholders (other than those who previously requested electronic delivery or a full set of printed proxy materials) a Notice of Internet Availability, which contained instructions on how to access our proxy materials, including this proxy statement.

This process is designed to expedite stockholders’ receipt of proxy materials, lower the cost of the Annual Meeting and help conserve natural resources. If you received the Notice of Internet Availability and prefer to receive printed proxy materials, please follow the instructions included in the Notice of Internet Availability. If you have previously elected to receive our proxy materials electronically, you will continue to receive these materials electronically unless you elect otherwise.

Solicitation

The Company will bear the entire cost of solicitation of proxies, including the preparation, assembly, printing, and mailing of this proxy statement, the proxy, and any additional material furnished to stockholders, should you request a printed copy of the proxy materials. Copies of solicitation material will be furnished to brokerage houses, fiduciaries, and custodians holding shares in their names that are beneficially owned by others to forward to such beneficial owners. In addition, the Company may reimburse such persons for their cost of forwarding the solicitation material to such beneficial owners. The solicitation of proxies by mail may be supplemented by telephone, facsimile, or email, and/or personal solicitation by directors, officers, or employees of the Company. No additional compensation will be paid for any such services. Except as described above, the Company does not intend to solicit proxies.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be published by the Company on Form 8-K within four business days following the Annual Meeting.

PROPOSAL 1:

NOMINATION AND ELECTION OF DIRECTORS

The Company’s Amended and Restated Bylaws (the “Bylaws”) provide for the classification of our Board into three classes of directors, with each class as nearly equal in number as possible, with staggered terms of office. At each annual meeting of stockholders, the successors to the class of directors whose terms expire at that meeting will be elected for a term of office to expire at the third succeeding annual meeting of stockholders after their election and until their successors have been duly elected and qualified.

Our Board is currently composed of the following members: Sheryl Cefali, Gerald T. Garland, Mark K. Holdsworth, Kay L. Tidwell and Robert Dawson. Directors elected at each annual meeting hold office until their terms expire and until their successors are elected and qualified, or until their death, resignation, or removal. At the Annual Meeting, directors for Class I will be elected. The two nominees to be elected at the Annual Meeting are Mr. Holdsworth and Ms. Tidwell.

The two nominees receiving the highest number of affirmative votes cast at the Annual Meeting shall be elected as directors of the Company. Mr. Holdsworth and Ms. Tidwell have agreed to serve if elected. If for any reason either Mr. Holdsworth and Ms. Tidwell is not a candidate when the election occurs, we intend to vote proxies for the election of a substitute nominee or, in lieu thereof, our Board may reduce the number of directors in accordance with our Bylaws. Unless otherwise instructed, the proxy holders will vote the proxies received by them in favor of the election of Mr. Holdsworth and Ms. Tidwell.

A majority of the Directors are “independent directors” as defined by the listing standards of the NASDAQ Stock Market, and the Board has determined that such independent directors have no relationship with the Company that would interfere with the exercise of their independent judgment in carrying out the responsibilities of a director.

Set forth below is information regarding the nominees and the other current Board members, including information furnished by them as to their principal occupations and their ages:

|

Name

|

|

Age

|

|

Director Since

|

|

Sheryl Cefali

|

|

62

|

|

2019

|

|

Gerald T. Garland

|

|

73

|

|

2017

|

|

Mark K. Holdsworth

|

|

58

|

|

2020

|

|

Kay L. Tidwell

|

|

47

|

|

2022

|

|

Robert Dawson

|

|

50

|

|

2018

|

Class I - Nominees for Election for a Three-Year Term Expiring at the 2027 Annual Meeting

Mark K. Holdsworth was appointed to the Board on December 31, 2020 and currently serves as the Chair of the Board. Mr. Holdsworth is the Managing Partner of The Holdsworth Group, LLC (“THG”), which he founded in 2019. THG is a capital partner, advisor, and curator of alternative investments for family offices and corporations worldwide. From 1999-2018, Mr. Holdsworth was a Co-Founder, Managing Partner and Operating Partner of Tennenbaum Capital Partners, LLC (“TCP”), a Los Angeles-based private multi-strategy investment firm that was acquired by BlackRock, Inc. in August 2018, and was a Managing Director of BlackRock until April 2019. Mr. Holdsworth is currently a director of Parsons Corporation (NYSE: PSN), where he previously held the position of Chair of the Corporate Governance and Responsibility Committee, and was a former member of the Executive Committee. Mr. Holdsworth earned a Bachelor of Arts degree from Pomona College, a Bachelor of Science degree (with Honors) from the California Institute of Technology and a Master of Business Administration degree from Harvard Business School.

Kay L. Tidwell was appointed to the Board in 2022 and serves as the Chair of the Nominating and Corporate Governance Committee and a Committee member on the Compensation Committee. Ms. Tidwell is the Executive Vice President, General Counsel and Chief Risk Officer of Hudson Pacific Properties Inc. (“Hudson Pacific”). She joined Hudson Pacific in 2010 and is responsible for the Company’s corporate legal function, overseeing corporate governance matters, SEC and NYSE compliance, insurance and litigation, as well as managing outside counsel. Prior to Hudson Pacific, Ms. Tidwell was an attorney at Latham & Watkins LLP (“Latham and Watkins”), where she began her legal career in the Los Angeles office, advising on a wide variety of corporate and securities matters, including Hudson Pacific’s IPO. Ms. Tidwell also worked as the U.S. associate in the German offices of Latham & Watkins. She received a Bachelor of Arts degree in English, magna cum laude, from Yale College and earned a Juris Doctor degree from Yale Law School.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” ELECTION OF THE FOREGOING NOMINATED DIRECTORS.

Continuing Directors

The following is a description of the incumbent Class II and III directors whose terms of office will continue after the Annual Meeting:

Class III - Director Continuing in Office Until the 2025 Annual Meeting

Sheryl Cefali was appointed to the Board in 2019 and currently serves as the Chair of the Compensation Committee and a Committee member on the Audit Committee and the Nominating and Corporate Governance Committee. Ms. Cefali is a Managing Director in the Duff & Phelps Opinions Practice of Kroll, LLC. Ms. Cefali has over 30 years of experience rendering fairness and solvency opinions and determining valuations of companies and securities. She is a member of the Fairness and Solvency Opinion Senior Review Committee at Duff & Phelps. Prior to joining Duff & Phelps in 1990, she was a Vice President with Houlihan Lokey. Ms. Cefali received her M.B.A. with a concentration in finance from the University of Southern California and her B.A. degree from the University of California at Santa Barbara.

Robert Dawson has been the Company’s Chief Executive Officer since July 17, 2017, and served as the Company’s President from July 2017 until February 2024. Effective July 21, 2018, Mr. Dawson was appointed to the Company’s Board to also serve as a director. Prior to joining RF Industries on July 17, 2017, Mr. Dawson was President and CEO of Vision Technology Services, an information technology consulting and project management company that was acquired by BG Staffing. He spent 2007-2013 at TESSCO Technologies, a publicly traded distributor of wireless products and services. At TESSCO Mr. Dawson held multiple executive roles in sales, marketing, product management and strategy culminating with being Vice President of Sales, responsible for TESSCO’s sales organization and leading a team delivering more than $700 million in sales. He joined TESSCO through the 2007 acquisition of NetForce Solutions, a technology training and consulting firm that he co-founded in 2000 and led as the Chief Executive Officer through seven years of growth before being acquired by TESSCO. Mr. Dawson received his Bachelor's degree in Business Administration from Hillsdale College.

Class II - Director Continuing in Office Until the 2026 Annual Meeting

Gerald T. Garland has been a Board member since 2017 and currently serves as Chair of the Audit Committee and a Committee member on the Compensation Committee. He is currently the CEO and Co-Founder of Life, Leadership and Legacy, LLC. Mr. Garland is also currently Vice Chairman of the World Trade Center Institute and serves on the Executive Committee of the board. From 2003 until 2015, Mr. Garland served as Senior Vice President of Solutions Development and Product Management and SVP of the Commercial Division for TESSCO Technologies, a publicly traded value-added distributor and solutions provider for the wireless industry. He was previously Director of Business Development at American Express Tax and Business Services from 2002 to 2003, where he was involved in an expanded asset recovery capability for Fortune 1000 companies. From 2000 to 2001, he was Chief Financial Officer at Mentor Technologies, a developer of on-line, CISCO certification training products. Mr. Garland was Chief Financial Officer and Treasurer at TESSCO Technologies from 1993 to 1999, during which he oversaw the company’s initial public offering as well as TESSCO’s significant sales expansion. Prior to joining TESSCO, Mr. Garland held leadership positions at Bank of America and Stanley Black & Decker. Mr. Garland received his M.B.A., with a concentration in Finance from Loyola University and his Bachelor of Science in Business Management and Accounting from Towson University. Mr. Garland was a board member for SOZO Children from 2011 through 2020and a Senior Adviser from 2020 to present.

In determining whether the nomination of each current director was appropriate and that each current director is qualified to serve on the Board, the Board considered the following:

Sheryl Cefali: Ms. Cefali has over 30 years of experience rendering fairness and solvency opinions and determining valuations of companies and securities. Ms. Cefali is currently a Managing Director at Kroll, LLC, as well as a member of that firm’s Fairness and Solvency Opinions Senior Review Committee.

Gerald T. Garland: Mr. Garland has significant leadership experience in financial management, product management, sales management, solutions development and global sourcing. Mr. Garland has significant industry experience having served as the Chief Financial Officer and Senior Vice President for a leading publicly traded distributor and solutions provider of wireless products and services for over 18 years. Mr. Garland has also held senior leadership positions with Bank of America, Stanley Black & Decker and American Express Tax and Business Services.

Mark K. Holdsworth: Mr. Holdsworth has significant experience in investment banking and investment management. In addition, Mr. Holdsworth has experience in serving on the Boards of Directors of major public companies and as the Chair of a Corporate Governance and Responsibility Committee.

Kay L. Tidwell: Ms. Tidwell has experience advising public companies as a former attorney at Latham & Watkins. In her current role as Executive Vice President, General Counsel and Risk Officer of Hudson Pacific, she also has relevant corporate governance compliance and risk management experience.

Robert Dawson: Mr. Dawson has significant leadership experience in sales, marketing, product management and strategy for a leading publicly traded distributor of wireless products and services. Mr. Dawson also served as President and CEO of an information technology consulting and project management company and was a co-founder of a successful telecom and wireless technology training and consulting firm that he led for seven years of growth until it was acquired.

Terms of Service

Each director to be elected at the Annual Meeting will hold office until his/her three-year term expires and until his/her successor is elected and has qualified, or until his/her death, resignation, or removal.

Board Leadership Structure

Currently, the positions of Chair of the Board and Chief Executive Officer of the Company are held by separate individuals, with Mr. Holdsworth serving as Chair of the Board and Mr. Dawson serving as Chief Executive Officer and as a director on the Board. Mr. Holdsworth, an independent director, was appointed as the Chair of the Board in June 2021. The Company has continuously had a separate Chair of the Board and Chief Executive Officer since 2007. The Chair of the Board is appointed by our Board.

The Board currently believes that this structure is best for the Company, as it allows Mr. Dawson to focus on the Company’s strategy, business and operations while serving as a liaison between the Board and the Company’s senior management. The Board currently believes the separation of offices is beneficial because a separate Chair can provide the Chief Executive Officer with guidance and feedback on his performance and the Chair provides a more effective channel for the Board to express its views on management. This structure can also enable Mr. Holdsworth and the other members of the Board to be better informed and to communicate more effectively on issues, including with respect to risk oversight matters.

The Board does not believe that a formal policy separating the positions of Chair of the Board and Chief Executive Officer is necessary. The Board continually evaluates our leadership structure and could in the future decide to combine the Chair and Chief Executive Officer positions if it believes that doing so would serve the best interests of the Company and our stockholders.

Risk Oversight

The Board has responsibility for oversight of the Company’s risk management processes and, either as a whole or through its committees, regularly discusses with management the Company’s major risk exposures, their potential impact on the Company’s business, and the steps the Company takes to manage them. The risk oversight process includes receiving regular reports from Board committees and members of senior management to enable the Board to understand the Company’s risk identification, risk management, and risk mitigation strategies with respect to areas of potential material risk, including operations, finance, legal, regulatory, strategic, and reputational risk.

Management

Robert Dawson, 50, has been the Company’s Chief Executive Officer since July 17, 2017, and served as the Company’s President from July 2017 until February 2024. Effective July 21, 2018, Mr. Dawson was appointed to the Company’s Board to also serve as a director. See preceding section for information regarding Mr. Dawson. See, “Class III – Director Continuing in Office Until the 2025 Annual Meeting,” above.

Peter Yin, 41, Chief Financial Officer, was appointed as the Company’s Interim Chief Financial Officer and Corporate Secretary effective July 11, 2020, promoted to Chief Financial Officer on January 12, 2021 and additionally appointed Treasurer on December 10, 2021. Mr. Yin, a Certified Public Accountant and a Certified Fraud Examiner, joined the Company in September 2014 and served as the Company’s Senior Vice President, Finance & Operations since November 2019. Prior to joining the Company, Mr. Yin worked at Sony Corporation of America in Corporate Audit from 2010 to 2014, and at Grant Thornton in the Assurance practice from 2006 to 2010. Mr. Yin received a Bachelor’s degree in Accountancy from the University of San Diego.

Ray Bibisi, 60, joined the Company as Chief Revenue Officer in January 2020, was promoted to Chief Operating Officer effective in May 2022, and was appointed as President effective in February 2024. Prior to joining the Company, he spent over 30 years at Radio Frequency Systems, where he concurrently held the roles of Vice President of Sales and General Manager of North America, and was a member of the Global Governing Executive Committee, and concurrently also oversaw operations, finance, supply chain, and research and development.

Board of Director Meetings and Attendance

During the fiscal year ended October 31, 2023, the Board held five meetings. During the fiscal year ended October 31, 2023, each member of the Board attended at least 75% of the meetings of the Board and of the Board committees on which they served. The Company does not have a formal policy regarding director attendance at annual meetings of stockholders; however, we encourage all of our directors to attend each annual meeting. All of the members of the Board attended the 2023 Annual Meeting of Stockholders.

Board Age Limitation Policy

In December 2020, the Board adopted a policy that no individual shall be eligible to be nominated by the Board for election or re-election as a member of the Board if, at the time of the nomination, no individual has attained the age of 75 years.

Board Committees

During fiscal 2023, the Board maintained four committees: the Compensation Committee, the Audit Committee, the Nominating and Corporate Governance Committee, and the Strategic Planning and Capital Allocation Committee. The Strategic Planning and Capital Allocation Committee was dissolved in November 2023, as the Board determined that it would maintain the responsibilities previously delegated to the committee.

The Audit Committee meets periodically with the Company’s management and independent registered public accounting firm to, among other things, review the results of the annual audit and quarterly reviews and discuss the financial statements. The Audit Committee also hires the independent registered public accounting firm, and receives and considers the accountant’s comments as to controls, adequacy of staff and management performance and procedures. The Audit Committee is also authorized to review related party transactions for potential conflicts of interest and to conduct internal investigations into whistleblower complaints, and to oversee the Company’s cybersecurity risk, policies and procedures. During fiscal 2023, the Audit Committee was composed of Mr. Garland (Chair), Ms. Cefali, and Mr. Cohenour, with Mr. Cohenour resigning from Board and all committees thereof effective as of October 31, 2023. Mr. Holdsworth replaced Mr. Cohenour as a member of the Audit Committee upon his resignation. Each of the current members of the Audit Committee is a non-employee director and is independent as defined under the NASDAQ Stock Market’s listing standards. In addition, each of the members of the Audit Committee has significant knowledge of financial matters, and Messrs. Garland is and Cohenour was, during the time of his service on the Audit Committee, an “audit committee financial expert.” The Audit Committee met five times during fiscal 2023.

The Compensation Committee currently consists of Ms. Cefali (Chair), Mr. Garland, and Ms. Tidwell, each of whom is a non-employee director and is independent as defined under the NASDAQ Stock Market’s listing standards. The Compensation Committee is responsible for considering and recommending to the Board the compensation arrangements for senior management. As part of its other responsibilities, the Compensation Committee provides general oversight of our compensation structure and, if deemed necessary, retains and approves the terms of the retention of compensation consultants and other compensation experts. Other specific duties and responsibilities of the Compensation Committee include reviewing the performance of executive officers; reviewing and approving objectives relevant to executive officer compensation; recommending equity-based and incentive compensation plans; and recommending compensation policies and practices for service on our Board and its committees and for the Chair of our Board. The Compensation Committee works primarily with our Chief Executive Officer to gather internal data and solicit management’s recommendations regarding compensation. However, the Compensation Committee determines the compensation for each of our individual officers outside the presence of the affected officer. The Compensation Committee also advises and consults with other non-executive board members as it determines appropriate regarding compensation issues. The Compensation Committee held seven meetings during fiscal 2023.

The Nominating and Corporate Governance Committee is responsible for developing and recommending corporate governance guidelines to the Board, identifying qualified individuals to become directors, recommending selected nominees to serve on the Board, and performing and overseeing the annual evaluation of the Board and its committees. The Nominating and Corporate Governance Committee currently consists of Ms. Tidwell (Chair), Mr. Holdsworth, and Ms. Cefali, each of whom is a non-employee director and is independent as defined under the NASDAQ Stock Market’s listing standards. The Nominating and Corporate Governance Committee held seven meetings during fiscal 2023.

The Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee, each operate pursuant to a written charter, which charters are available on our website on www.rfindustries.com.

Nominating Directors

The Nominating and Corporate Governance Committee is responsible for identifying and reviewing the qualifications of potential director candidates and recommending to the Board those candidates to be nominated for election to the Board, subject to any obligations and procedures governing the nomination of directors to the Board that may be included in any stockholders agreement to which the Company is a party.

To facilitate the search process for director candidates, the Nominating and Corporate Governance Committee may solicit our current Board members and management for the names of potentially qualified candidates or may ask Board members and management to pursue their own business contacts for the names of potentially qualified candidates. The Nominating and Corporate Governance Committee may also consult with outside advisors or retain search firms to assist in the search for qualified candidates or consider director candidates recommended by our shareholders.

Once potential candidates are identified, the Nominating and Corporate Governance Committee reviews the backgrounds of those candidates, evaluates candidates’ independence from the Company and potential conflicts of interest and determines if candidates meet the qualifications desired by the committee of candidates for election to the Board.

The Nominating and Corporate Governance Committee has not adopted a formal policy with regard to the consideration of diversity when evaluating candidates for election to the Board. However, the Nominating and Corporate Governance Committee believes that membership should reflect diversity in its broadest sense, but should not be chosen nor excluded based on race, color, gender, national origin, or sexual orientation. In this context, the Nominating and Corporate Governance Committee does consider a candidate’s experience, education, industry knowledge, history with the Company, if any, and differences of viewpoint when evaluating his or her qualifications for election to the Board.

The Nominating and Corporate Governance Committee believes that the Board should consist of individuals who possess the integrity, education, work ethic, experience, and ability to work with others necessary to oversee our business effectively and to represent the interests of all of the Company’s stockholders. The Nominating and Corporate Governance Committee also believes that it is desirable for directors to own an equity interest in the Company in order to better align their interests with those of the stockholders. The standards that the Nominating and Corporate Governance Committee considers in selecting candidates (although candidates need not possess all of the following characteristics, and not all factors are weighted equally) include, among other factors determined to be relevant by the Board, each director’s or nominee’s:

| |

●

|

breadth of knowledge about issues affecting the Company; and

|

| |

●

|

time available for meetings and consultation regarding Company matters and other particular skills and experience possessed by the individual.

|

Stockholder Recommendations of Director Candidates. The Board will consider Board nominees recommended by stockholders. In order for a stockholder to nominate a candidate for director, timely notice of the nomination must be given in writing to our Corporate Secretary. To be timely, the notice must be received at our principal executive offices as set forth under “Stockholder Proposals” below. Notice of a nomination must include the following information: your name, address, and number of shares you own; the name, age, business address, residence address and principal occupation of the nominee; and the number of shares beneficially owned by the nominee. The notice must also include the information that would be required to be disclosed in the solicitation of proxies for election of directors under the federal securities laws, as well as whether the individual can understand basic financial statements and the candidate’s other board memberships (if any). Stockholders must submit the nominee’s consent to be elected and to serve, if elected. The Board may require any nominee to furnish any other information that may be needed to determine the eligibility and qualifications of the nominee.

Any recommendations in proper form received from stockholders will be evaluated in the same manner that potential nominees recommended by our Board members or management are evaluated.

Stockholder Communications with Board Members. Stockholders who wish to communicate with our Board members may contact us at our principal executive office at 16868 Via Del Campo Court, San Diego, California 92127. Written communications specifically marked as a communication for our Board, or a particular director, except those that are clearly marketing or soliciting materials, will be forwarded unopened to the Chair of our Board, or to the particular director to whom they are addressed, or presented to the full Board or the particular director at the next regularly scheduled Board meeting.

Board Diversity

Our Nominating and Corporate Governance Committee is committed to ensuring diversity in the composition of our Board, including diversity with respect to race and gender. We seek out candidates whose diversity of experience and perspective will help allow the Board to fulfill its responsibilities. In accordance with the new Nasdaq listing rules, the following table provides information regarding the diversity of our directors, as of July 26, 2024.

Board Diversity Matrix (As of July 26, 2024)

|

Total Number of Directors

|

5

|

| |

Female

|

Male

|

|

Part I: Gender Identity

|

|

|

|

Directors

|

2

|

3

|

|

Part II: Demographic Background

|

|

|

|

Asian

|

1

|

-

|

|

White

|

1

|

3

|

To see our Board Diversity Matrix as of July 26, 2023, please see our proxy statement filed with the SEC on July 26, 2023.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics (the “Code”) that applies to all of our directors, officers and employees, including its principal executive officer and principal financial officer. The Code is posted on our website at www.rfindustries.com. We intend to disclose any amendments to the Code by posting such amendments on its website. In addition, any waivers of the Code for directors or executive officers of the Company will be disclosed in a report on Form 8-K.

COMPENSATION OF EXECUTIVE OFFICERS

This section describes our executive compensation for our Named Executive Officers (“NEOs”) listed below and the most important factors relevant to an analysis of our compensation policies. In addition, this section provides qualitative information regarding the manner and context in which compensation is awarded to and earned by our named executive officers and is intended to place in perspective the data presented in the following tables and the corresponding narrative.

|

Name

|

|

Principal Position

|

|

Robert D. Dawson

|

|

Chief Executive Officer*

|

|

Peter Yin

|

|

Chief Financial Officer

|

|

Ray Bibisi

|

|

President & Chief Operating Officer*

|

* Mr. Dawson served as president until February 2024, when Mr. Bibisi was promoted to the position.

Summary Compensation Table

The following table discloses the compensation awarded to, earned by, paid to or accrued to our NEOs for services rendered to us for the years ended October 31, 2023 and 2022.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-Equity

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Stock |

|

|

Option |

|

|

Incentive Plan |

|

|

All Other |

|

|

|

|

|

| |

|

|

Salary |

|

|

Bonus |

|

|

Awards

|

|

|

Awards

|

|

|

Compensation

|

|

|

Compensation

|

|

|

Total |

|

| Name and Principal Position |

Year |

|

($)

|

|

|

($)

|

|

|

($)(1)

|

|

|

($)(2)

|

|

|

($)

|

|

|

($)(6)

|

|

|

($) |

|

|

Robert D. Dawson

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chief Executive Officer and Director (3)

|

2023

|

|

|

443,333 |

|

|

|

- |

|

|

|

177,863 |

(7) |

|

|

204,240 |

(7) |

|

|

- |

(13) |

|

|

69,231 |

|

|

|

894,667 |

|

| |

2022

|

|

|

435,000 |

|

|

|

- |

|

|

|

165,898 |

(8) |

|

|

179,250 |

(8) |

|

|

243,687 |

(14) |

|

|

58,405 |

|

|

|

1,082,240 |

|

|

Peter Yin

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chief Financial Officer (4)

|

2023

|

|

|

283,333 |

|

|

|

- |

|

|

|

63,525 |

(9) |

|

|

72,942 |

(9) |

|

|

- |

(13) |

|

|

35,803 |

|

|

|

455,603 |

|

| |

2022

|

|

|

275,000 |

|

|

|

- |

|

|

|

59,248 |

(10) |

|

|

166,446 |

(10) |

|

|

102,713 |

(14) |

|

|

45,362 |

|

|

|

648,769 |

|

|

Ray Bibisi

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

President and Chief Operating Officer (5)

|

2023

|

|

|

218,333 |

|

|

|

- |

|

|

|

30,493 |

(11) |

|

|

35,012 |

(11) |

|

|

- |

(13) |

|

|

24,799 |

|

|

|

308,637 |

|

| |

2022

|

|

|

210,000 |

|

|

|

- |

|

|

|

28,440 |

(12) |

|

|

30,728 |

(12) |

|

|

78,435 |

(14) |

|

|

17,202 |

|

|

|

364,805 |

|

| |

(1)

|

Amounts reported under the Stock Awards column do not reflect compensation actually received by the NEO. Instead, the amounts reported reflect the aggregate grant date fair value of restricted stock granted to the executives, determined in accordance with FASB ASC Topic 718. Unless stated otherwise in the notes below, the shares of restricted stock vest over four years as follows: (i) one-quarter of the restricted shares vests on the one-year anniversary of the date of grant; and (ii) the remaining restricted shares vest in twelve equal quarterly installments over the next three years, commencing with the first quarter following the one-year anniversary of the date of grant.

|

| |

(2)

|

Amounts reported under the Option Awards column do not reflect compensation actually received by the NEO. Instead, the amounts reported are the grant date fair value of stock options granted to the executives as determined pursuant to FASB ASC Topic 718, excluding estimated forfeitures. The assumptions used to calculate the value of option awards are set forth under Note 1 and Note 9 to our consolidated financial statements included in our Annual Report on Form 10-K for the year ended October 31, 2023, filed with the SEC on January 29, 2024. The options vest over four years as follows: (i) one-quarter of the options vests on the one-year anniversary of the date of grant; and (ii) the remaining options vest in twelve equal quarterly installments over the next three years, commencing with the first quarter following the one-year anniversary of the date of grant. All incentive stock options expire 10 years from the date of grant.

|

| |

(3)

|

Effective January 10, 2022, Mr. Dawson’s annual salary increased to $435,000, and effective January 11, 2023, his annual salary increased to $443,333. Mr. Dawson also served as the Company’s President until February 2024.

|

| |

(4)

|

Effective January 10, 2022, Mr. Yin’s annual salary increased to $275,000, and effective January 11, 2023, his annual salary increased to $283,333.

|

| |

(5)

|

Effective May 13, 2022, Mr. Bibisi was appointed Chief Operating Officer, effective January 11, 2022, his annual salary increased to $210,000, and effective January 10, 2023, his annual salary increased to $218,333. Effective February 29, 2024, Mr. Bibisi was promoted to President, adding to his role of Chief Operating Officer.

|

| |

(6)

|

Represents accrued vacation.

|

| |

(7)

|

On January 11, 2023, Mr. Dawson was granted 31,818 shares of restricted stock valued at $173,749 and options to purchase 63,636 shares of common stock at an exercise price of $5.59 (the closing price of the Company’s common stock on the date of grant) valued at $204,240.

|

| |

(8)

|

On January 10, 2022, Mr. Dawson was granted 23,333 shares of restricted stock valued at $165,898 and options to purchase 46,667 shares of common stock at an exercise price of $7.11 (the closing price of the Company’s common stock on the date of grant) valued at $179,250.

|

| |

(9)

|

On January 11, 2023, Mr. Yin was granted 11,364 shares of restricted stock valued at $62,055 and options to purchase 22,727 shares of common stock at an exercise price of $5.59 (the closing price of the Company’s common stock on the date of grant) valued at $72,942.

|

| |

(10)

|

On January 10, 2022, Mr. Yin was granted 8,333 shares of restricted stock valued at $59,248 and options to purchase 43,334 shares of common stock at an exercise price of $7.11 (the closing price of the Company’s common stock on the date of grant and consisting of an annual grant of 16,667 options and a special one-time grant of 26,667 options) valued at $166,446.

|

| |

(11)

|

On January 11, 2023, Mr. Bibisi was granted 5,455 shares of restricted stock valued at $29,788 and options to purchase 10,909 shares of common stock at an exercise price of $5.59 (the closing price of the Company’s common stock on the date of grant) valued at $35,012.

|

| |

(12)

|

On January 10, 2022, Mr. Bibisi was granted 4,000 shares of restricted stock valued at $28,440 and options to purchase 8,000 shares of common stock at an exercise price of $7.11(the closing price of the Company’s common stock on the date of grant) valued at $30,728.

|

| |

(13)

|

On March 9, 2023, the Board adopted an incentive compensation plan for officers (including the NEOs) and senior managers of the Company pursuant to which officers and managers were entitled to cash bonuses based upon (i) the Company’s achievement of specified corporate goals and (ii) the satisfaction of subjective personal performance and contribution goals established for that participant. The personal bonus target for Mr. Dawson was 75% and for Mr. Yin and Mr. Bibisi was 50% of their respective annual base salaries. The Board determined that each of these officers did not achieve the established goals, and therefore did not earn a bonus of their respective salary for the fiscal year ended October 31, 2023.

|

| |

(14)

|

On January 10, 2022, the Board adopted an incentive compensation plan for officers (including the NEOs) and senior managers of the Company pursuant to which officers and managers were entitled to cash bonuses based upon (i) the Company’s achievement of specified corporate goals and (ii) the satisfaction of subjective personal performance and contribution goals established for that participant. The personal bonus target for Mr. Dawson was 75% and for Mr. Yin and Mr. Bibisi was 50% of their respective annual base salaries. The Board determined that each of these officers achieved 75% of the established goals, and therefore Mr. Dawson earned approximately 56% and Mr. Yin and Mr. Bibisi each earned a bonus of approximately 37.4% of their respective salary for the fiscal year ended October 31, 2022.

|

Discussion of Summary Compensation Table

This narrative discussion explains our executive compensation program and the Compensation Committee’s process for making pay decisions, as well as its rationale for specific decisions related to the fiscal year ended October 31, 2023. Although we qualify as a “smaller reporting company” as defined by the SEC, which allows us to take advantage of scaled-back disclosure requirements, we are including narrative about our executive compensation program in an effort to be more transparent.

Compensation Philosophy

The Compensation Committee attempts to structure the total compensation for the NEOs to provide a guaranteed amount of cash compensation in the form of competitive base salaries, while also providing a meaningful amount of annual cash compensation in the form of annual bonuses that is at risk and dependent on both the Company’s performance and on the individual performance of the executives. We also seek to provide a portion of total compensation in the form of equity-based awards under our stock option plan in order to align the long-term interests of executives with those of our stockholders and for retention purposes. Historically, we have made larger grants of stock options to our NEOs and other key officers and employees at the time that the officers/key employees first join the Company, which options vest over a longer period of time (often up to nine years). These option grants are supplemented by smaller, annual options grants that are similar to the option grants made to other officers and key employees.

The Compensation Committee retained an independent compensation consultant, Frederic W. Cook & Co., Inc. (“FW Cook”), to advise the Compensation Committee on executive and non-employee director compensation practices during fiscal 2023. The independent compensation consultant reports directly to the Compensation Committee and provides advice on market-comparable compensation for executives and non-employee directors and keeps the Compensation Committee apprised of such matters. In fiscal 2023, the Compensation Committee concluded that the engagement of FW Cook raised no conflict of interest under applicable SEC and Nasdaq rules that would prevent FW Cook from independently providing services to the Compensation Committee.

Components of Compensation

Our compensation program is currently designed to recruit and retain as executive officers individuals with the highest capacity to develop, grow and manage our business, and to align their compensation with the Company’s short-term and long-term goals. To do this, the compensation program for executive officers is made up of the following main components: (i) base salary, designed to compensate our executive officers for work performed during the fiscal year; (ii) year-end cash incentive programs, designed to reward the executive officers for achieving yearly performance goals and for their individual performances during the fiscal year; and (iii) equity-based awards, meant to align the executive officers’ interests with the interests of our stockholders.

Base Salary. Base salaries for our executive officers are determined by an assessment of the Company’s overall financial and operating performance, each executive officer's experience, duties, responsibilities, performance evaluation and changes in his or her responsibilities. We seek to establish annual base salaries that the Compensation Committee believes are fair and competitive with salaries for executive officers in similar positions and with similar responsibilities in the Company’s marketplace. Periodically, the Compensation Committee engages a compensation consultant to advise the Compensation Committee regarding the components and levels of the executive compensation program, including our incentive and equity-based compensation plans.

|

Name

|

|

2023 Base

Salary

|

|

|

Robert D. Dawson

|

|

$ |

445,000 |

|

|

Peter Yin

|

|

$ |

285,000 |

|

|

Ray Bibisi

|

|

$ |

220,000 |

|

Annual Cash Bonuses. Our short-term cash incentive program is designed to motivate our executives, including the NEOs, and reward them with cash payments for achieving quantifiable, pre-established business results and individual performance goals. In order for the NEOs to be eligible to receive a cash bonus, the Company must attain a minimum performance thresholds for the fiscal year in each selected metric, as established by the Compensation Committee. Additionally, each NEO’s award is subject to the discretionary review of his performance by the Compensation Committee, in its sole discretion after consultation with the Company’s Chief Executive Officer.

For fiscal 2023, the Compensation Committee used three metrics in determining the actual annual cash bonus payable to each NEO: (i) the Company’s achievement of certain fiscal 2023 revenues (weighted 30%), (ii) fiscal 2023 adjusted earnings before interest, taxes, depreciation and amortization (“EBITDA”) (weighted 60%), and (iii) a subjective evaluation of each NEO’s performance (weighted 10%). The calculation of adjusted EBITDA excluded the impact of one-time charges related to transaction related expenses, severance payments, relocation costs, earn-out payments or reversals, other non-recurring items, executive bonus payments and equity compensation expenses accrued to management. The Compensation Committee and the Company believe that changes in adjusted EBITDA positively correlate with changes in stockholder value better than other commonly used financial performance measures.

In 2023, the Company did not meet any the established minimum thresholds. Accordingly, no annual cash bonuses were paid to the NEOs.

|

Name

|

|

Base Salary

|

|

|

“Target

Bonus” as a

Percentage of

Base Salary

|

|

|

Target Bonus

Amount

|

|

|

Maximum Bonus (1)

|

|

|

Cash Bonus Paid

Based on Fiscal

2023

Performance

|

|

|

Robert D. Dawson

|

|

$ |

443,333 |

|

|

|

75 |

% |

|

$ |

332,500 |

|

|

$ |

498,750 |

|

|

$ |

- |

|

|

Peter Yin

|

|

$ |

283,333 |

|

|

|

50 |

% |

|

$ |

141,667 |

|

|

$ |

212,500 |

|

|

$ |

- |

|

|

Ray Bibisi

|

|

$ |

218,333 |

|

|

|

50 |

% |

|

$ |

109,000 |

|

|

$ |

163,750 |

|

|

$ |

- |

|

Annual Equity Awards. Our annual equity awards are designed to reward the NEOs based on the future performance of the Company by motivating the creation of stockholder value. The goals of the long-term incentive program are to:

| |

●

|

Ensure NEOs’ financial interests are aligned with our shareholders’ interests

|

| |

●

|

Motivate decision-making that improves financial performance over the long-term

|

| |

●

|

Recognize and reward superior financial performance of the Company

|

| |

●

|

Provide a retention element to our compensation program

|

| |

●

|

Promote compliance with the stock ownership guidelines for executives

|

Annually at its February meeting, the Compensation Committee grants long-term incentive awards. All such equity-based awards are valued on the date of the grant. Typically, equity-based incentive grants are only made annually unless a hire or promotion occurs during the year. For fiscal 2023, the Compensation Committee approved annual equity awards to the NEOs in the form of restricted shares of common stocks and options to purchase shares of the Company’s common stock. Provided the NEO is still employed with the Company or its subsidiaries on the following dates, (i) one-quarter of the restricted shares and options will vest on January 11, 2024; and (ii) the remaining restricted shares and options shall vest in twelve equal quarterly installments over the next three years, commencing with the first quarter following January 11, 2024. The options have a ten-year term and an exercise price of $5.59 per share (which was the closing price of the Company’s common stock on the date of grant).

The table below summarizes all annual equity awards granted to each NEO during fiscal 2023:

|

Name

|

|

Restricted

Stock

|

|

|

Options

|

|

|

Robert D. Dawson

|

|

|

31,818 |

|

|

|

63,636 |

|

|

Peter Yin

|

|

|

11,364 |

|

|

|

22,727 |

|

|

Ray Bibisi

|

|

|

5,455 |

|

|

|

10,909 |

|

Other Compensation. Our NEOs are eligible to participate, on the same basis as our other employees, in our employee benefit plans, including our medical, dental, vision, life and disability plans, and our 401(k) plan. We generally do not provide our NEOs with perquisites or other personal benefits.

Holdings of Previously Awarded Equity

Equity awards held as of October 31, 2023 by each of our NEOs were issued under our 2020 Equity Incentive Plan (the “2020 Plan”) and 2010 Stock Incentive Plan (the “2010 Plan”). The following table sets forth outstanding equity awards held by our NEOs as of October 31, 2023:

Outstanding Equity Awards at October 31, 2023

| |

|

Option Awards

|

| |

|

Number of

|

|

|

Number of

|

|

|

Equity Incentive Plan

|

|

|

|

|

|

|

| |

|

Securities

|

|

|

Securities

|

|

|

Awards: Number of

|

|

|

|

|

|

|

| |

|

Underlying

|

|

|

Underlying

|

|

|

Securities Underlying

|

|

|

Option

|

|

|

| |

|

Unexercised

|

|

|

Unexercised

|

|

|

Unexercised

|

|

|

Exercise

|

|

Option |

| |

|

Options

|

|

|

Options

|

|

|

Unearned Options

|

|

|

Price

|

|

Expiration

|

|

Name

|

|

(#) Exercisable

|

|

|

(#) Unexercisable

|

|

|

(#)

|

|

|

($)

|

|

Date

|

|

Robert D. Dawson

|

|

|

25,000.00 |

|

|

|

- |

|

|

|

|

|

|

|

1.90 |

|

7/16/2027

|

| |

|

|

39,375.00 |

|

|

|

2,625.00 |

|

|

|

- |

(1) |

|

|

6.46 |

|

1/8/2030

|

| |

|

|

28,875.00 |

|

|

|

13,125.00 |

|

|

|

- |

(2) |

|

|

4.98 |

|

1/11/2031

|

| |

|

|

50,000.00 |

|

|

|

- |

|

|

|

- |

|

|

|

8.69 |

|

7/16/2031

|

| |

|

|

20,418.00 |

|

|

|

26,249.00 |

|

|

|

- |

(3) |

|

|

7.11 |

|

1/9/2032

|

| |

|

|

- |

|

|

|

63,636.00 |

|

|

|

- |

(4) |

|

|

5.59 |

|

1/10/2033

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Peter Yin

|

|

|

24,000.00 |

|

|

|

32,000.00 |

|

|

|

- |

(5) |

|

|

2.40 |

|

12/13/2027

|

| |

|

|

3,283.00 |

|

|

|

469.00 |

|

|

|

- |

(6) |

|

|

6.40 |

|

1/9/2030

|

| |

|

|

6,875.00 |

|

|

|

3,125.00 |

|

|

|

- |

(2) |

|

|

4.98 |

|

1/11/2031

|

| |

|

|

18,958.00 |

|

|

|

24,376.00 |

|

|

|

- |

(3) |

|

|

7.11 |

|

1/9/2032

|

| |

|

|

- |

|

|

|

22,727.00 |

|

|

|

- |

(4) |

|

|

5.59 |

|

1/10/2033

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ray Bibisi

|

|

|

40,000.00 |

|

|

|

10,000 |

|

|

|

- |

(7) |

|

|

6.74 |

|

1/5/2030

|

| |

|

|

9,375.00 |

|

|

|

625.00 |

|

|

|

- |

(8) |

|

|

6.40 |

|

1/8/2030

|

| |

|

|

5,157.00 |

|

|

|

2,343.00 |

|

|

|

- |

(2) |

|

|

4.98 |

|

1/11/2031

|

| |

|

|

3,500.00 |

|

|

|

4,500.00 |

|

|

|

- |

(3) |

|

|

7.11 |

|

1/9/2032

|

| |

|

|

- |

|

|

|

10,909.00 |

|

|

|

- |

(4) |

|

|

5.59 |

|

1/10/2033

|

|

(1)

|

Vests over four years as follows: (i) one-quarter vested on January 9, 2021; and (ii) the remaining options shall vest in twelve equal quarterly installments over the subsequent three years, commencing with the first quarter following January 9, 2021.

|

|

(2)

|

Vests over four years as follows: (i) one-quarter vested on January 12, 2022; and (ii) the remaining options shall vest in twelve equal quarterly installments over the subsequent three years, commencing with the first quarter following January 12, 2022.

|

|

(3)

|

Vests over four years as follows: (i) one-quarter vested on January 10, 2023; and (ii) the remaining options shall vest in twelve equal quarterly installments over the subsequent three years, commencing with the first quarter following January 10, 2023.

|

|

(4)

|

Vests over four years as follows: (i) one-quarter shall vest on January 11, 2024; and (ii) the remaining options shall vest in twelve equal quarterly installments over the subsequent three years, commencing with the first quarter following January 11, 2024.

|

|

(5)

|

Vests as follows: (i) 8,000 shares vested on December 13, 2020; and (ii) the remaining options shall vest in in six equal installments over the subsequent six anniversaries of December 13, 2020.

|

|

(6)

|

Vests over four years as follows: (i) one-quarter vested on January 12, 2022; and (ii) the remaining options shall vest in twelve equal quarterly installments over the next three years, commencing with the first quarter following January 12, 2022.

|

|

(7)

|

Vests as follows: (i) 10,000 shares vested on January 6, 2020; and (ii) the remaining options shall vest in five equal installments over the subsequent five anniversaries of January 6, 2020.

|

|

(8)

|

Vests over four years as follows: (i) one-quarter vested on January 9, 2021; and (ii) the remaining options shall vest in twelve equal quarterly installments over the next three years, commencing with the first quarter following January 9, 2021.

|

During the fiscal year ended October 31, 2023, we did not adjust or amend the exercise price of stock options awarded to the NEOs.

Pay Versus Performance

As required by Item 402(v) of Regulation S-K, we are providing the following information about the relationship of compensation actually paid (“CAP”) to our principal executive officer (“PEO”) and other named executive officers (“Non-PEO NEOs”) and our performance. In accordance with the transitional relief under the SEC rules for smaller reporting companies, only three years of information is required as this is the Company’s second year of disclosure under Item 402(v) of Regulation S-K.

For purposes of the tables below, the PEO was Mr. Dawson and non-PEO NEOs were Messrs. Yin and Bibisi for each of fiscal years 2023, 2022, and 2021.

Pay Versus Performance Table

|

Year

|

|

Summary

Compensation

Table Total

for PEO (1)

|

|

|

Compensation

Actually Paid

to PEO (2)

|

|

|

Average

Summary

Compensation

Table Total

for Non-PEO

NEOs (3)

|

|

|

Average

Compensation

Actually Paid

to Non-PEO

NEOs (4)

|

|

|

Value of

Initial Fixed

$100

Investment

Based on

Cumulative

TSR (5)

|

|

|

Net Income

(Loss) (in

thousands)

(6)

|

|

|

2021

|

|

$ |

1,037,842 |

|

|

$ |

1,037,842 |

|

|

$ |

339,604 |

|

|

$ |

339,604 |

|

|

$ |

178 |

|

|

$ |

6,181 |

|

|

2022

|

|

$ |

1,082,240 |

|

|

$ |

1,082,240 |

|

|

$ |

506,787 |

|

|

$ |

506,787 |

|

|

$ |

126 |

|

|

$ |

1,448 |

|

|

2023

|

|

$ |

894,667 |

|

|

$ |

894,667 |

|

|

$ |

382,120 |

|

|

$ |

382,120 |

|

|

$ |

69 |

|

|

$ |

(3,078 |

) |

|

(1)

|

The dollar amounts reported in this column are the amounts of total compensation reported for the PEO for each corresponding year in the “Total” column of the Summary Compensation Table.

|

| |

|

|

(2)

|

The dollar amounts reported in this represent the amount of “compensation actually paid” to the PEO, as computed in accordance with Item 402(v) of Regulation S-K. No adjustments were required to be made to the PEO’s total compensation for each year to determine the compensation actually paid pursuant to the requirements of Item 402(v) of Regulation S-K.

|

| |

|

|

(3)

|

The dollar amounts reported in this column represent the average of the amounts reported for Non-PEO NEOs in the “Total” column of the Summary Compensation Table in each applicable year.

|

| |

|

|

(4)

|

The dollar amounts reported in this represent the average amount of “compensation actually paid” to the non-PEO NEOs as a group, as computed in accordance with Item 402(v) of Regulation S-K. No adjustments were required to be made to average total compensation for the non-PEO NEOs as a group for each year to determine the compensation actually paid pursuant to the requirements of Item 402(v) of Regulation S-K.

|

| |

|

|

(5)

|

The cumulative total shareholder return (“TSR”) amounts reported in this column are calculated by dividing the sum of the cumulative amount of dividends for the measurement period, assuming dividend reinvestment, and the difference between the Company’s share price at the end and the beginning of the measurement period by the Company’s share price at the beginning of the measurement period. No dividends were paid on stock or option awards in fiscal 2021, fiscal 2022 or fiscal 2023.

|

| |

|

|

(6)

|

The dollar amounts reported in this column represent the amount of net income reflected in the Company’s audited financial statements for the applicable year.

|

Narrative Disclosure to Pay Versus Performance Table

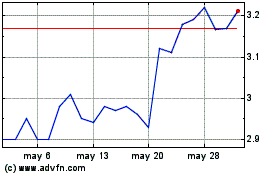

Compensation Actually Paid and Cumulative Total Shareholder Return. The graph below compares the compensation actually paid to our PEO and the average of the compensation actually paid to our remaining NEOs, with our cumulative total stockholder return for the fiscal years ended October 31, 2023 and 2022. Total stockholder return amounts reported in the graph assume an initial fixed investment of $100 on November 1, 2021.

Compensation Actually Paid and Net Income. The graph below compares the compensation actually paid to our PEO and the average of the compensation actually paid to our remaining NEOs, with our net income for the fiscal years ended October 31, 2023 and 2022.

Employment Agreements; Incentive Plan; Change of Control Arrangements

Employment Agreements