Sunrun Prices Record Setting $886.3 million Senior Securitization of Residential Solar and Battery Systems

04 Junio 2024 - 4:40PM

Sunrun (Nasdaq: RUN), the nation’s leading provider of clean energy

as a subscription service, today announced it has priced a

securitization of leases and power purchase agreements. The

securitization represents the largest in Sunrun’s history and the

largest residential solar securitization industry wide.

“Sunrun continues to set industry benchmarks, with

our robust performance and ability to attract competitively priced

capital,” said Danny Abajian, Sunrun’s Chief Financial

Officer. “Not only was this the largest securitization for

Sunrun and the industry, our proven track record as an originator

and servicer has been recognized by KBRA, assigning a higher rating

for comparable advance rates relative to precedent ABS

transactions.”

The transaction was structured with two pari passu

tranches of A+ rated notes (the “Class A-1” and “Class A-2”,

respectively and together the “Class A”) and a single class of BB

(“Class B”) rated notes. The $443.15mm Class A-1 notes were

marketed in a public asset backed securitization, whereas the

$443.15mm Class A-2 notes were privately placed. The Class A notes

were priced with a coupon of 6.25%. The Class A-1 notes pricing

reflects a 205bps spread and a 6.385% yield. The spread of 205bps

represents an improvement of 35bps from Sunrun’s 2023-2 asset

backed securitization in September 2023. The initial balance of the

Class A notes represents an 72.6% advance rate on the

Securitization Share of ADSAB (present value using a 6% discount

rate). The Class A notes have an expected weighted average life of

6.8 years, an Anticipated Repayment Date of July 30, 2031, and a

final maturity date of July 30, 2059. Similar to prior

transactions, Sunrun anticipates raising additional subordinated

subsidiary-level non-recourse financing (secured, in part, by the

distributions from the retained Class B notes), which is expected

to increase the cumulative advance rate obtained by Sunrun.

The notes are backed by a diversified portfolio of

48,628 systems distributed across 19 states, and Washington D.C.

and Puerto Rico and 79 utility service territories. The weighted

average customer FICO score is 741. The transaction is expected to

close by June 11, 2024.

ATLAS SP Securities was the sole structuring agent

and served as joint bookrunner along with J.P. Morgan Securities,

Morgan Stanley & Co., MUFG Securities Americas, and RBC Capital

Markets. Citigroup Global Markets and KeyBanc Capital Markets

served as co-managers for the securitization.

This press release does not constitute an offer to

sell or the solicitation of an offer to buy nor shall there be any

sale of these securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of such jurisdiction.

Investor & Analyst

Contact:Patrick JobinInvestor Relations

Officerinvestors@sunrun.com

Media Contact:Wyatt

SemanekDirector, Corporate Communicationspress@sunrun.com

About Sunrun

Sunrun Inc. (Nasdaq: RUN) revolutionized the solar

industry in 2007 by removing financial barriers and democratizing

access to locally-generated, renewable energy. Today, Sunrun is the

nation’s leading provider of clean energy as a subscription

service, offering residential solar and storage with no upfront

costs. Sunrun’s innovative products and solutions can connect homes

to the cleanest energy on earth, providing them with energy

security, predictability, and peace of mind. Sunrun also manages

energy services that benefit communities, utilities, and the

electric grid while enhancing customer value. Discover more at

www.sunrun.com.

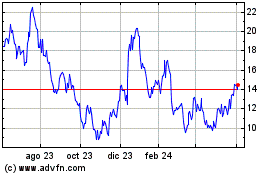

Sunrun (NASDAQ:RUN)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

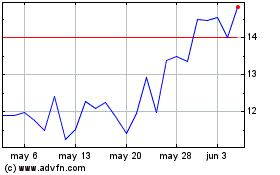

Sunrun (NASDAQ:RUN)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024