As filed with the Securities and Exchange Commission

on September 24, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Seelos Therapeutics, Inc.

(Exact name of registrant as specified in its

charter)

| Nevada |

2834 |

87-0449967 |

|

(State or other jurisdiction of

incorporation or organization) |

(Primary Standard Industrial

Classification Code Number) |

(I.R.S. Employer

Identification Number) |

Seelos Therapeutics, Inc.

300 Park Avenue, 2nd Floor

New York, NY 10022

(646) 293-2100

(Address, including zip code, and telephone

number,

including area code, of registrant’s principal

executive offices)

Raj Mehra, Ph.D.

President, Chief Executive Officer and Chairman of the Board of Directors

Seelos Therapeutics, Inc.

300 Park Avenue, 2nd Floor

New York, NY 10022

(646) 293-2100

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

Ron Ben-Bassat, Esq.

Eric Victorson, Esq.

Sullivan & Worcester

LLP

1251 Avenue of the Americas

New York, NY 10020

(212)-660-5003

Approximate

date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration

statement.

If any of the securities being

registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of

1933, check the following box. x

If this Form is

filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ¨

If this Form is a post-effective

amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective

amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging

growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting

company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

¨ |

Accelerated filer |

¨ |

| |

|

|

|

| Non-accelerated filer |

x |

Smaller reporting company |

x |

| |

|

|

|

| |

|

Emerging growth company |

¨ |

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

The Registrant hereby amends

this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further

amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of

the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and

Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and

may be changed. The Placement Agent may not sell these securities until the registration statement filed with the Securities and

Exchange Commission is effective. This prospectus is not an offer to sell these securities, and the Placement Agent is not soliciting

offers to buy these securities, in any state where the offer or sale of these securities is not permitted.

| Preliminary Prospectus |

Subject to Completion |

Dated September 24, 2024 |

Up

to Shares of Common Stock

Pre-Funded

Warrants to Purchase up to Shares of Common Stock

Common

Warrants to Purchase up to Shares of Common Stock

We

are offering on a reasonable best efforts basis up to shares of our common

stock, par value $0.001 per share (“common stock”), together with common warrants to purchase up to shares

of our common stock (the “Common Warrants”), based on an assumed combined public offering price of $

per share and accompanying Common Warrant (the last reported sale price of our common stock on The Nasdaq Capital Market on

, 2024). Each Common Warrant will be exercisable for one share of our common stock and have an assumed exercise price of $ per share (or

100% of the assumed offering price per share and accompanying Common Warrant). Each Common Warrant will be exercisable beginning on the

effective date of stockholder approval of the issuance of the shares upon exercise of the Common Warrants (the “Warrant Stockholder

Approval”), provided however, if the Pricing Conditions (as defined below) are met, the Warrant

Stockholder Approval will not be required, and the Common Warrants will be exercisable upon issuance (the “Initial Exercise Date”).

The Common Warrants will expire five years from the Initial Exercise Date or the Warrant Stockholder Approval, as applicable. The shares

of common stock and Common Warrants will be issued separately and will be immediately separable upon issuance but will be purchased together

in this offering. This prospectus also relates to the shares of common stock issuable upon exercise of the Common Warrants sold in this

offering. As used herein “Pricing Conditions” means that the combined public offering price per share and accompanying common

warrants is such that the Warrant Stockholder Approval is not required under the rules of The Nasdaq Stock Market LLC (“Nasdaq”)

because either (i) the offering is an at-the-market offering under Nasdaq rules and such price equals or exceeds the sum of (a) the applicable

“Minimum Price” per share under Nasdaq Rule 5635(d) plus (b) $0.125 per whole share of common stock underlying the common

warrants or (ii) the offering is a discounted offering where the pricing and discount (including attributing a value of $0.125 per whole

share underlying the common warrants) meet the pricing requirements under Nasdaq’s rules.

We

are also offering pre-funded warrants (the “Pre-Funded Warrants” and together with the Common Warrants, the “Warrants”)

to purchase up to shares of common stock to those investors whose purchase

of shares of common stock in this offering would result in the purchaser, together with its affiliates and certain related parties, beneficially

owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock immediately following the consummation

of this offering, in lieu of shares of common stock that would result in beneficial ownership in excess of 4.99% (or, at the election

of the purchaser, 9.99%) of our outstanding common stock. Each Pre-Funded warrant is exercisable for one share of common stock and has

an exercise price of $0.0001 per share. The combined purchase price per Pre-Funded warrant and accompanying Common Warrants is equal

to $ , which is equal to the combined purchase price per share of common stock and accompanying Common Warrants less

$0.0001. Each Pre-Funded Warrant will be exercisable immediately upon issuance and may be exercised at any time until exercised in full.

The Pre-Funded Warrants and Common Warrants will be issued separately and will be immediately separable upon issuance but will be purchased

together in this offering. For each Pre-Funded Warrant we sell, the number of shares of common stock we are offering will be decreased

on a one-for-one basis. This prospectus also relates to the shares of common stock issuable upon exercise of the Pre-Funded Warrants

sold in this offering.

We

refer to the common stock and Warrants to be sold in this offering collectively as the “securities.”

These

securities are being sold in this offering to certain purchasers under a securities purchase agreement dated ,

2024 between us and such purchasers. The securities are expected to be issued in a single closing and the combined public offering price

per share of common stock or Pre-Funded Warrant and accompanying Common Warrants will be fixed for the duration of this offering.

We will deliver all securities to be issued in connection with this offering delivery versus payment or receipt versus payment, as the

case may be, upon receipt of investor funds received by us.

Our

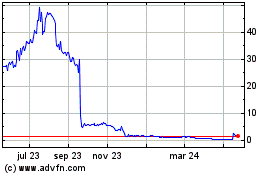

common stock is listed on Nasdaq under the symbol “SEEL.” On September 23, 2024 the last reported sale price of our

common stock on Nasdaq was $0.19 per share. The actual number of securities, the combined offering price per share of common stock or

Pre-Funded Warrant and accompanying Common Warrant and the exercise price per share of common stock for the accompanying Common Warrants

will be as determined between us, the placement agent and the investors in this offering based on market conditions at the time of pricing.

Therefore, the recent market price used throughout this prospectus may not be indicative of the actual public offering price for the

securities, which may be substantially lower than the assumed price used in this prospectus. There is no established public trading market

for the Warrants and we do not expect a market to develop. In addition, we do not intend to apply for a listing of the Warrants on any

national securities exchange or other trading system.

We

have engaged __ to act as our sole placement agent (the “Placement Agent”) in connection with this offering. The Placement

Agent has agreed to use its reasonable best efforts to arrange for the sale of the securities offered by this prospectus. The Placement

Agent is not purchasing or selling any of the securities we are offering and the Placement agent is not required to arrange the purchase

or sale of any specific number of securities or dollar amount. We have agreed to compensate the Placement Agent as set forth in the table

below, which assumes that we sell all of the securities offered by this prospectus. Because there is no minimum number of securities

or minimum aggregate amount of proceeds for this offering to close, we may sell fewer than all of the securities offered hereby, and

investors in this offering will not receive a refund in the event that we do not sell an amount of securities sufficient to pursue the

business goals outlined in this prospectus. Because there is no escrow account and there is no minimum offering amount, investors could

be in a position where they have invested in our company, but we are unable to fulfill our objectives due to a lack of interest in this

offering. Also, any proceeds from the sale of securities offered by us will be available for our immediate use, despite uncertainty about

whether we would be able to use such funds to effectively implement our business plan. This offering will end no later than ,

2024, except that the shares of common stock underlying the Warrants will be offered on a continuous basis pursuant to Rule 415

under the Securities Act of 1933, as amended (the “Securities Act”).

You

should read this prospectus, together with additional information described under the headings “Incorporation of Certain Information

by Reference” and “Where You Can Find More Information,” carefully before you invest in any of our securities.

We

are a “smaller reporting company” as defined in Rule 12b-2 of the Exchange Act and have elected to take advantage of

certain of the scaled disclosure available for smaller reporting companies in this prospectus as well as our filings under the Exchange

Act.

Unless

otherwise noted, all historical share and per share information and historical financial information included in this prospectus have

been adjusted to reflect the reverse stock split of 1-for-8 effected on May 16, 2024.

Investing

in our securities involves a high degree of risk. See the section entitled “Risk Factors” beginning on page 17 of this

prospectus for a discussion of risks that should be considered in connection with an investment in our securities.

Neither

the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the

accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| | |

Per

Share and

accompanying

Common Warrant

| |

Per

Pre-Funded

Warrant and

accompanying

Common Warrant

| |

Total | |

| Public offering price | |

$ |

| |

$ |

| |

$ | | |

| Placement

Agent fees(1) | |

$ |

| |

$ |

| |

$ | | |

| Proceeds

to us, before expenses(2) | |

$ |

| |

$ |

| |

$ | | |

| (1) |

We have agreed to pay the

Placement Agent a cash fee equal to % of the aggregate proceeds of this offering and to reimburse

the Placement Agent for certain of its offering-related expenses. See “Plan of Distribution” beginning on page 34

of this prospectus for a description of the compensation to be received by the Placement Agent. |

| (2) |

The amount of the proceeds

to us presented in this table does not give effect to any exercise of the Warrants. |

Delivery of the shares

of common stock and Warrants is expected to be made on or about , 2024, subject

to satisfaction of customary closing conditions.

Sole

Placement Agent

__

The date of this prospectus is ,

2024.

TABLE OF CONTENTS

We incorporate by reference

important information into this prospectus. You may obtain the information incorporated by reference without charge by following the

instructions under the section of this prospectus entitled “Where You Can Find More Information”. You should carefully read

this prospectus as well as additional information described under the section of this prospectus entitled “Incorporation of Certain

Information by Reference,” before deciding to invest in our Securities.

Unless the context otherwise

requires, the terms “Seelos,” “we,” “us” and “our” in this prospectus refer to Seelos

Therapeutics, Inc., and “this offering” refers to the offering contemplated in this prospectus.

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form S-1 that we filed with the Securities and Exchange Commission (“SEC”)

to register the securities offered hereby under the Securities Act. We may also file a prospectus supplement or post-effective amendment

to the registration statement of which this prospectus forms a part that may contain material information relating to these offerings.

We incorporate by reference important information into this prospectus. You may obtain the information incorporated by reference without

charge by following the instructions under “Where You Can Find More Information.” You should carefully read this prospectus

as well as additional information described under “Incorporation of Certain Information by Reference,” before deciding to

invest in our securities.

We

have not, and the Placement Agent has not, authorized anyone to provide any information or to make any representations other than those

contained in this prospectus or in any free writing prospectuses prepared by or on behalf of us or to which we have referred you. We

take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This

prospectus is an offer to sell only the securities offered hereby, and only under circumstances and in jurisdictions where it is lawful

to do so. The information contained in this prospectus or in any applicable free writing prospectus is current only as of its date, regardless

of its time of delivery or any sale of our securities. Our business, financial condition, results of operations and prospects may have

changed since that date.

For

investors outside the United States: We have not, and the Placement Agent has not, done anything that would permit this offering or possession

or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons

outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating

to, the offering of the securities and the distribution of this prospectus outside the United States.

This

prospectus and the information incorporated by reference into this prospectus may contain references to trademarks belonging to other

entities. Solely for convenience, trademarks and trade names referred to in this prospectus and the information incorporated by reference

into this prospectus, including logos, artwork, and other visual displays, may appear without the ® or TM symbols. We do not intend

our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of

us by, any other company.

No

dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus.

You must not rely on any unauthorized information or representations. This prospectus is an offer to sell only the securities offered

hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is

current only as of its date.

This

prospectus contains estimates and other statistical data made by independent parties and by us relating to market size and growth and

other data about our industry. We obtained the industry and market data in this prospectus from our own research as well as from industry

and general publications, surveys and studies conducted by third parties. This data involves a number of assumptions and limitations

and contains projections and estimates of the future performance of the industries in which we operate that are subject to a high degree

of uncertainty. We caution you not to give undue weight to such projections, assumptions and estimates.

DISCLOSURE REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus and the documents incorporated

by reference in this prospectus may contain “forward-looking statements” by us within the meaning of Section 27A of

the Securities Act and Section 21E of the Exchange Act, including, without limitation, statements as to expectations, beliefs and

strategies regarding the future. These statements involve known and unknown risks, uncertainties and other important factors that may

cause our actual results, performance or achievements to be materially different from any future results, performance or achievements

expressed or implied by the forward-looking statements. These forward-looking statements rely on a number of assumptions concerning future

events and include statements relating to:

| · | the

potential impact to our business, financial condition and employees, including disruptions

to our clinical trials, preclinical studies, supply chain and operations; |

| · | risks

and uncertainties associated with our actual and proposed research and development activities,

including our clinical trials and preclinical studies; |

| · | the

timing or likelihood of regulatory filings and approvals or of alternative regulatory pathways

for our product candidates; |

| · | the

potential market opportunities for commercializing our product candidates; |

| · | our

expectations regarding the potential market size and the size of the patient populations

for our product candidates, if approved for commercial use, and our ability to serve such

markets; |

| · | estimates

of our expenses, future revenue, capital requirements and our needs for additional financing; |

| · | our

ability to continue as a going concern; |

| · | our

ability to maintain the listing of our common stock on the Nasdaq Capital Market; |

| · | our

ability to develop, acquire and advance our product candidates into, and successfully complete,

clinical trials and preclinical studies and obtain regulatory approvals; |

| · | the

implementation of our business model and strategic plans for our business and product candidates; |

| · | the

initiation, cost, timing, progress and results of future and current preclinical studies

and clinical trials, and our research and development programs; |

| · | the

terms of future licensing arrangements, and whether we can enter into such arrangements at

all; |

| · | timing

and receipt or payments of licensing and milestone revenues or payments, if any; |

| · | the

scope of protection we are able to establish and maintain for intellectual property rights

covering our product candidates and our ability to operate our business without infringing

the intellectual property rights of others; |

| · | regulatory

developments in the United States and foreign countries; |

| · | the

performance of our third-party suppliers and manufacturers; |

| · | our

ability to maintain and establish collaborations or obtain additional funding; |

| · | the

success of competing therapies that are currently or may become available; |

| · | our

financial performance; and |

| · | developments

and projections relating to our competitors and our industry. |

Any forward-looking statements should be considered

in light of these factors. Words such as “anticipates,” “believes,” “forecasts,” “potential,”

“goal,” “contemplates,” “expects,” “intends,” “plans,” “projects,”

“hopes,” “seeks,” “estimates,” “strategy,” “continues,” “ongoing,”

“opportunity,” “could,” “would,” “should,” “likely,” “will,”

“may,” “can,” “designed to,” “future,” “foreseeable future” and similar expressions

and variations, and negatives of these words, identify forward-looking statements. These forward-looking statements are based on the

expectations, estimates, projections, beliefs and assumptions of our management based on information currently available to management,

all of which are subject to change. These forward-looking statements are not guarantees of future performance and are subject to risks

and uncertainties that could cause actual results to differ materially from the results contemplated by the forward-looking statements.

Many of the important factors that will determine these results and values are beyond our ability to control or predict. You are cautioned

not to put undue reliance on any forward-looking statements. Except as otherwise required by law, we do not assume any obligation to

update any forward-looking statements.

In evaluating an investment in shares of our

securities, you should carefully consider the discussion of risks and uncertainties described under the heading “Risk Factors”

contained in this prospectus, and under similar headings in other documents, including in our Annual Report on Form 10-K for the

fiscal year ended December 31, 2023, our Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, our Quarterly

Report on Form 10-Q for the quarter ended June 30, 2024 and in our other filings with the SEC, that are incorporated by reference

in this prospectus. You should carefully read this prospectus together with the information incorporated by reference in this prospectus

as described under the headings “Where You Can Find More Information” and “Incorporation of Certain Information by

Reference” completely and with the understanding that our actual future results may be materially different from what we expect.

All subsequent written and oral forward-looking

statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by our cautionary statements.

The forward-looking statements included or incorporated by reference herein are made only as of the date of this prospectus (or as of

the date of any such document incorporated by reference). We do not intend, and undertake no obligation, to update these forward-looking

statements, except as required by law.

PROSPECTUS SUMMARY

This

summary highlights selected information contained elsewhere in, or incorporated by reference into, this prospectus. This summary is not

complete and may not contain all of the information that is important to you and that you should consider before deciding whether or

not to invest in our securities. For a more complete understanding of Seelos and this offering, you should carefully read this prospectus,

including any information incorporated by reference into this prospectus, in its entirety. Before you decide whether to

purchase our securities, you should read this entire prospectus carefully, including the risks of investing in our securities discussed

under the section of this prospectus entitled “Risk Factors” and similar headings in the other documents that are incorporated

by reference into this prospectus. You should also carefully read the information incorporated by reference into this prospectus, including

our financial statements, and the exhibits to the registration statement of which this prospectus is a part.

The Company

Overview

We are a clinical-stage biopharmaceutical company

focused on achieving efficient development of products that address significant unmet needs in Central Nervous System (“CNS”)

disorders and other rare disorders.

Our business model is to advance multiple late-stage

therapeutic candidates with proven mechanisms of action that address large markets with unmet medical needs and for which there is a

strong economic and scientific rationale for development.

Our product development pipeline is as follows:

| Product |

|

Indication |

|

Development

Phase |

|

Development

Status |

| |

|

|

|

|

|

|

SLS-002

Intranasal

Racemic

Ketamine |

|

Acute Suicidal Ideation

and Behavior (“ASIB”) in Major Depressive Disorder (“MDD”) |

|

Phase II |

|

Completed open-label patient enrollment and

announced the initial topline data from Part 1 of the proof-of-concept (“PoC”) study on May 17, 2021;

enrollment of Part 2 of a Phase II study

closed in June 2023; topline data for Part 2 announced on September 20, 2023 |

| |

|

|

|

|

|

|

SLS-005

IV Trehalose |

|

Amyotrophic Lateral Sclerosis

(“ALS”) |

|

Phase II/III |

|

Completed enrollment of

final participants in February 2023 in the registrational study; topline data announced on March 19, 2024 |

| |

|

|

|

|

|

|

| |

|

Spinocerebellar

Ataxia (“SCA”) |

|

Phase

IIb/III |

|

Announced

dosing of the first participant in the registrational study in October 2022; enrollment of additional patients temporarily paused

on March 29, 2023 |

| |

|

|

|

|

|

|

| |

|

Huntington’s Disease

(“HD”) and Alzheimer’s Disease (“AD”) |

|

Phase II |

|

Obtaining biomarker activity |

| |

|

|

|

|

|

|

SLS-004

Gene Therapy |

|

Parkinson’s Disease (“PD”)

|

|

Pre-IND |

|

Preclinical in vivo studies ongoing; announced

partial results from a study demonstrating downregulation of α-synuclein in December 2022;

currently analyzing data while temporarily

pausing additional spend |

| |

|

|

|

|

|

|

SLS-007

Peptide Inhibitor |

|

PD |

|

Pre-IND |

|

Preclinical study completed

and analysis of the results ongoing; next steps for development of this program will be decided in concert with SLS-004 results and

readouts, as both target the same pathway upstream; temporarily pausing additional spend |

| |

|

|

|

|

|

|

| SLS-009 |

|

HD,

AD, ALS |

|

Pre-IND |

|

Preclinical

in vivo studies ongoing |

Lead Programs

Our lead programs are currently SLS-002 for the

potential treatment of ASIB in adults with MDD and SLS-005 for the potential treatment of ALS and SCA. SLS-005 for the potential treatment

of Sanfilippo Syndrome currently requires additional natural history data, which is being considered.

SLS-002 is

intranasal racemic ketamine with two investigational new drug applications (“INDs”). The lead program is focused on the treatment

of ASIB in MDD. SLS-002 was originally derived from a Javelin Pharmaceuticals, Inc./Hospira, Inc. program with 16 clinical

studies involving approximately 500 subjects. SLS-002 is being developed to address an unmet need for an efficacious drug to treat suicidality

in the United States. Traditionally, anti-depressants have been used in this setting but many of the existing treatments are known to

contribute to an increased risk of suicidal thoughts in some circumstances, and if and when they are effective, it often takes weeks

for the full therapeutic effect to be manifested. We believe there is a large opportunity in the United States and European markets for

products in this space. Based on information gathered from the databases of the Agency for Healthcare Research and Quality, there were

approximately 1.48 million visits to emergency rooms for suicidal ideation or suicide attempts in 2017 in the United States alone.

Experimental studies suggest ketamine has the potential to be a rapid, effective treatment for depression and suicidality.

The clinical development program for SLS-002

includes two parallel healthy volunteer studies (Phase I). We announced interim data from our Phase I study of SLS-002 during

the quarterly period ended March 31, 2020. As a result, in March 2020, we completed a Type C meeting with the U.S. Food and

Drug Administration (the “FDA”) and received guidance to conduct a Phase II PoC study of SLS-002 for ASIB in adults

with MDD, to support the further clinical development of this product candidate, together with nonclinical data under development.

As a result of the Type C meeting and the Fast

Track designation for SLS-002 for the treatment of ASIB in patients with MDD, we believe we are well positioned to pursue the FDA’s

expedited programs for drug development and review.

On June 23, 2020, we announced the final

safety data from our Phase I pharmacokinetics/pharmacodynamics study of intranasal racemic ketamine (SLS-002) as well as the planned

design of a Phase II double blind, placebo-controlled PoC study for ASIB in subjects with MDD. We initiated this PoC study in two

parts: Part 1 was an open-label study of 17 subjects, and was followed by Part 2, which is a double blind, placebo-controlled

study of approximately 175 subjects. On January 15, 2021, we announced dosing of the first subjects in Part 1 of the PoC study.

On March 5, 2021, we announced the completion of open-label enrollment of subjects in Part 1 of the PoC study. On May 17,

2021, we announced positive topline data from Part 1 of the PoC study, the open-label cohort, of our study of SLS-002 (intranasal

racemic ketamine), demonstrating a significant treatment effect and a well-tolerated safety profile for ASIB in patients with MDD. This

study enrolled 17 subjects diagnosed with MDD requiring psychiatric hospitalization due to significant risk of suicide with a baseline

score of ≥ 28 points on the Montgomery-Åsberg Depression Rating Scale (“MADRS”), a score of 5 or 6 on MADRS Item-10,

a score of ≥ 15 points on the Sheehan-Suicidality Tracking Scale (S-STS) and a history of previous suicide attempt(s), as confirmed

on the Columbia Suicide Severity Rating Scale (C-SSRS) with a history of at least one actual attempt, or if the attempt was interrupted

or aborted, is judged to have been serious in intent. SLS-002 demonstrated a 76.5% response rate (response meaning 50% reduction from

baseline) in the primary endpoint on MADRS 24 hours after first dose, with a mean reduction in total score from 39.4 to 14.5 points.

On July 6, 2021, we announced dosing of

the first subject in Part 2 of the Phase II study. Based on feedback from a Type C meeting with the FDA in June 2021,

we increased the subjects in Part 2 to increase the sample size and power to support a potential marketing application. On June 20,

2023, we announced the close of enrollment of this study and released the topline results on September 20, 2023.

SLS-005

is IV trehalose, a protein stabilizer that crosses the blood-brain barrier and activates autophagy and the lysosomal pathway.

Based on preclinical and in vitro studies, there is a sound scientific rationale for developing trehalose for the treatment of

ALS, SCA and other indications such as Sanfilippo Syndrome. Trehalose is a low molecular weight disaccharide (0.342 kDa) that protects

against pathological processes in cells. It has been shown to penetrate muscle and cross the blood-brain barrier. In animal models of

several diseases associated with abnormal cellular protein aggregation, it has been shown to reduce pathological aggregation of misfolded

proteins as well as to activate autophagy pathways through the activation of Transcription Factor EB (“TFEB”), a key factor

in lysosomal and autophagy gene expression. Activation of TFEB is an emerging therapeutic target for a number of diseases with pathologic

accumulation of storage material.

Trehalose 90.5 mg/mL IV solution has demonstrated

promising clinical potential in prior Phase II clinical development for oculopharyngeal muscular dystrophy (“OPMD”)

and spinocerebellar ataxia type 3 (“SCA3”), also known as Machado Joseph disease, with no significant safety signals to date

and encouraging efficacy results. Pathological accumulation of protein aggregates within cells, whether in the CNS or in muscle, and

eventually leads to loss of function and ultimately cell death. Prior preclinical studies indicate that this platform has the potential

to prevent mutant protein aggregation in other devastating PolyA/PolyQ diseases.

We own three U.S. patents for parenteral administration

of trehalose for patients with OPMD and SCA3, all of which are expected to expire in 2034. In addition, Orphan Drug Designation (“ODD”)

for OPMD and SCA3 has been secured in the United States and in the European Union (“EU”). In February 2019, we assumed

a collaborative agreement, turned subsequently into a research grant, with Team Sanfilippo Foundation (“TSF”), a nonprofit

medical research foundation founded by parents of children with Sanfilippo Syndrome. On April 30, 2020, we were granted ODD for

SLS-005 in Sanfilippo Syndrome from the FDA. SLS-005 was previously granted ODD from the FDA and European Medicines Agency (the “EMA”)

for SCA3 and OPMD as well as Fast Track designation for OPMD. On August 25, 2020, we were issued U.S. patent number 10,751,353 titled

“COMPOSITIONS AND METHODS FOR TREATING AN AGGREGATION DISEASE OR DISORDER” which relates to trehalose (SLS-005). The issued

patent covers the method of use for trehalose (SLS-005) formulation for treating a disease or disorder selected from any one of the following:

spinal and bulbar muscular atrophy, dentatombral-pallidoluysian atrophy, Pick’s disease, corticobasal degeneration, progressive

supranuclear palsy, frontotemporal dementia or parkinsonism linked to chromosome 17. On May 15, 2020, we were granted Rare Pediatric

Disease Designation (“RPDD”) for SLS-005 in Sanfilippo Syndrome from the FDA. RPDD is an incentive program created under

the Federal Food, Drug, and Cosmetic Act to encourage the development of new therapies for the prevention and treatment of certain rare

pediatric diseases. On May 27, 2021, we announced that we were granted ODD for SLS-005 in ALS from the EMA. In December 2020,

we announced the selection of SLS-005 for the Healey ALS platform trial led by Harvard Medical School, Massachusetts. The Healey ALS

platform trial is designed to study multiple potential treatments for ALS simultaneously. The platform trial model aims to greatly accelerate

the study access, reduce costs and shorten development timelines. On February 28, 2022, we announced the dosing of the first participants

in the Healey ALS platform trial. On March 19, 2024 we announced topline results. In November 2021, we announced the FDA acceptance

of an IND and grant of Fast Track designation for SLS-005 for the treatment of SCA. In July 2022, we also announced dosing of the

first patient in an open-label basket study in Australia for the treatment of patients with ALS, SCA, and Huntington’s disease

(“HD”). In October 2022, we also announced the dosing of the first participant in the registrational Phase II/III

study for the treatment of SCA. In March 2023, we announced that in order to focus the majority of our resources on the Phase II

study of SLS-002 (intranasal racemic ketamine) for ASIB in adults with MDD and the fully enrolled Phase II/III study of SLS-005

in ALS, we have temporarily paused additional enrollment of patients in the SLS-005-302 study in SCA. Patients already enrolled will

continue in the study and data will continue to be collected in order to make decisions for resuming enrollment in the future. This temporary

pause has been implemented as a business decision due to financial considerations, and is not based on any data related to safety or

therapeutic effects.

Additionally, we are developing several preclinical

programs, most of which have well-defined mechanisms of action, including SLS-004, licensed from Duke University, and SLS-007, licensed

from The Regents of the University of California, for the potential treatment of PD.

Strategy and Ongoing Programs

SLS-002:

The clinical development program for SLS-002 includes two parallel healthy volunteer studies (Phase I). Following these Phase I studies,

we completed a Type C meeting with the FDA in March 2020 and received guidance to conduct a Phase II PoC study of SLS-002 for ASIB

in adults with MDD. We released topline data for Part 1 of our open-label study on May 17, 2021. We initiated enrollment in

Part 2 of the Phase II study on July 6, 2021, closed enrollment in June 2023, and released the topline data results in

the third quarter of 2023.

We retained Canaccord Genuity to assist in our

ongoing review of potential partnerships, collaborations, and business development opportunities. On the merits of our unique ketamine

expertise with SLS-002 in suicidality and our inclusion in a government sponsored PTSD study, we are currently exploring a potential

collaboration in the mental health space to increase shareholder value. Additionally, we have been evaluating the use of SLS-002 in indications

beyond ASIB and PTSD including but not limited to MDD and adjunctive MDD.

SLS-005: We

completed enrollment in February 2023 for a clinical study in ALS and began enrollment for a clinical study in SCA in October 2022.

In December 2020, we announced the selection of SLS-005 for the Healey ALS platform trial led by Harvard Medical School, Massachusetts.

The Healey ALS platform trial is designed to study multiple potential treatments for ALS simultaneously. The platform trial model aims

to greatly accelerate the study access, reduce costs, and shorten development timelines. On February 28, 2022, we announced dosing

of the first participants in the Healey ALS platform trial. In February 2023, we announced the completion of enrollment of the study

and released the topline data results on March 19, 2024.

In November 2021, we announced the FDA acceptance

of an IND and grant of Fast Track designation for SLS-005 for the treatment of SCA. In July 2022, we announced dosing of the first

patient in an open-label basket study in Australia for the treatment of patients with ALS, SCA, and HD. In October 2022, we also

announced the dosing of the first participant in the registrational Phase II/III study for the treatment of SCA.

During 2022, we received regulatory approval

in Australia to commence a study pursuing the collection of certain biomarker data in patients with AD.

We are also continuing to consider trials in

Sanfilippo Syndrome and are seeking more natural history data based on the guidance from regulatory agencies.

In March 2023, we announced that in order

to focus the majority of our resources on the ongoing Phase II study of SLS-002 (intranasal racemic ketamine) for ASIB in patients with

MDD and the fully enrolled Phase II/III study of SLS-005 in ALS, we have temporarily paused additional enrollment of patients in the

SLS-005-302 study in SCA. Patients already enrolled will continue in the study and data will continue to be collected in order to make

decisions for resuming enrollment in the future. This temporary pause has been implemented as a business decision due to financial considerations,

and is not based on any data related to safety or therapeutic effects.

SLS-004 is

an all-in-one lentiviral vector, targeted for gene editing through DNA methylation within intron 1 of the synuclein alpha (“SNCA”)

gene that expresses alpha-synuclein (“α-synuclein”) protein. SLS-004, when delivered to dopaminergic neurons derived

from human-induced pluripotent stem cells of a PD patient, modified the expression on α-synuclein and exhibited reversal of the

disease-related cellular-phenotype characteristics of the neurons. The role of mutated SNCA in PD pathogenesis and the need to maintain

the normal physiological levels of α-synuclein protein emphasize the yet unmet need to develop new therapeutic strategies, such

as SLS-004, targeting the regulatory mechanism of α-synuclein expression. On May 28, 2020, we announced the initiation of

a preclinical study of SLS-004 in PD through an all-in-one lentiviral vector targeting the SNCA gene. We are constructing a bimodular

viral system harboring an endogenous α-synuclein transgene and inducible regulated repressive CRISPR/dCas9-unit to achieve suppression

of PD-related pathologies. On July 7, 2021, we announced positive in vivo data demonstrating down-regulation of SNCA mRNA and protein

expression under this study. In December 2022, we announced in vivo data demonstrating that a single dose of SLS-004 was successful

in reversing some of the key hallmarks of PD in a humanized mouse model. These findings observed in an in vivo humanized PD model validate

and extend prior findings from in vitro data using SLS-004. SLS-004 demonstrated therapeutically desirable change in SNCA expression

that led to reversing the key hallmarks of PD in the model towards normal physiological levels, indicating disease modifying effect of

single dose administration of SLS-004, a CRISPR/dCas-9 based gene therapy for PD. We have halted any further investment in this program

until additional funding is received.

SLS-007 is

a rationally designed peptide-based approach, targeting the nonamyloid component core (“NACore”) of α-synuclein to

inhibit the protein from aggregation. Recent in vitro and cell culture research has shown that SLS-007 has the ability to stop the propagation

and seeding of α-synuclein aggregates. We will evaluate the potential for in vivo delivery of SLS-007 in a PD transgenic mice model.

The goal will be to establish in vivo pharmacokinetics/pharmacodynamics and target engagement parameters of SLS-007, a family of anti-α-synuclein

peptidic inhibitors. On June 25, 2020, we announced the initiation of a preclinical study of SLS-007 in PD delivered through an

adeno-associated viral (“AAV”) vector targeting the non-amyloid component core of α-synuclein. We have initiated an

in vivo preclinical study of SLS-007 in rodents to assess the ability of two specific novel peptides, S62 and S71, delivered via AAV1/2

vector, to protect dopaminergic function in the AAV A53T overexpression mice model of PD. Production of AAV1/2 vectors encoding each

of the two novel peptides incorporating hemagglutinin tags has already been completed. The results are currently being analyzed and the

next steps for development of this program will be decided in concert with SLS-004 results and readouts, as both target the same pathway

upstream.

SLS-009

is our first internally created program, which follows the mechanism of action known as PROTACs (protein-targeting chimeric

molecules), which uses the body’s own natural process of autophagy and lysosomal degradation to clear out mutant and misfolded

proteins in the body. SLS-009 induces autophagy and enhances lysosomal clearance by augmenting existing endogenous cellular degradation

pathways to remove only the mutant and neurotoxic proteins.

We intend to become a leading biopharmaceutical

company focused on neurological and psychiatric disorders, including orphan indications. Our business strategy includes:

| · | advancing

SLS-002 in ASIB in MDD and post-traumatic stress disorder; |

| · | advancing

SLS-004 in PD; |

| · | advancing

SLS-005 in ALS, SCA, HD and Sanfilippo Syndrome; |

| · | advancing

new formulations of SLS-005 in neurological diseases; and |

| · | acquiring

synergistic assets in the CNS therapy space through licensing and partnerships. |

We also have two legacy product candidates: a

product candidate in the United States for the treatment of erectile dysfunction, which we in-licensed from Warner Chilcott Company, Inc.,

now a subsidiary of Allergan plc; and a product candidate which has completed a Phase IIa clinical trial for the treatment of Raynaud’s

Phenomenon, secondary to scleroderma, for which we own worldwide rights.

Nasdaq Delisting Notice

On April 30, 2024, we received written notice

(the “Bid Notice”) from Nasdaq indicating that, for the last thirty consecutive business days, the bid price for our common

stock had closed below the minimum $1.00 per share requirement for continued listing on the Nasdaq Capital Market under Nasdaq Listing

Rule 5550(a)(2) (“Rule 5550(a)(2)”). In accordance with Nasdaq Listing Rule 5810(c)(3)(A), we have been

provided an initial period of 180 calendar days, or until October 28, 2024, to regain compliance. The Bid Notice states that the

Nasdaq staff will provide written confirmation that we have achieved compliance with Rule 5550(a)(2) if at any time before

October 28, 2024, the bid price of our common stock closes at $1.00 per share or more for a minimum of ten consecutive business

days.

If we do not regain compliance with Rule 5550(a)(2) by

October 28, 2024, we may be eligible for an additional 180 calendar day compliance period. To qualify, we would be required to meet

the continued listing requirement for market value of publicly held shares and all other initial listing standards for the Nasdaq Capital

Market, with the exception of the bid price requirement, and would need to provide written notice to Nasdaq of our intention to cure

the deficiency during the second compliance period, by effecting a reverse stock split, if necessary. However, if it appears to the Nasdaq

staff that we will not be able to cure the deficiency, or if we are otherwise not eligible, Nasdaq would notify us that our securities

will be subject to delisting.

On

November 2, 2023, we received written notice (the “Initial Notice”) from Nasdaq indicating that, for the last thirty-two

consecutive business days, the market value of the Company’s listed securities has been below the minimum requirement of $35 million

for continued listing on the Nasdaq Capital Market under Nasdaq Listing Rule 5550(b)(2) (“Rule 5550(b)(2)”).

In accordance with Nasdaq Listing Rule 5810(c)(3)(C), we were provided a period of 180 calendar days, or until April 30, 2024,

to regain compliance. The Initial Notice stated that the Nasdaq staff will provide written notification that the Company has achieved

compliance with Rule 5550(b)(2) if at any time before April 30, 2024, the market value of the Company’s common stock

closes at $35 million or more for a minimum of ten consecutive business days.

Additionally, on May 1, 2024, we received written

notice (the “Delist Notice” and, together with the Bid Notice and the Initial Notice, the “Notices”) from Nasdaq

indicating that, based upon our continued non-compliance with Rule 5550(b)(2), the Nasdaq staff has determined to delist our common stock

from the Nasdaq Capital Market effective May 10, 2024 unless we timely requested an appeal of this determination before the Nasdaq Hearings

Panel (the “Panel”) by May 8, 2024. We timely requested a hearing before the Panel, which had the effect of staying the suspension

of our common stock pending the Panel’s decision. During the pendency of any requested hearing before the Panel, our common stock

will remain listed and trading on Nasdaq.

In response to our request following a hearing

before the Panel, on July 25, 2024, we received written notification (the “Extension Notice”) from the Panel notifying us

that the Panel had granted our request for an additional period, during which the Company will remain listed on Nasdaq, to regain compliance

with Rule 5550(b)(2) and demonstrate continued compliance with Rule 5550(a)(2). Pursuant to the Extension Notice, the Panel granted the

Company an additional period until August 30, 2024 to regain compliance with Rule 5550(b)(2) and until September 30, 2024 to regain compliance

with Rule 5550(a)(2). The extension is subject to certain conditions specified by the Panel in the Extension Notice.

We are diligently working to evidence compliance

with all applicable requirements for continued listing on the Nasdaq Capital Market and we expect to submit a plan to that effect to

the Panel as part of the hearing process; however, there can be no assurance the Panel will grant any request for continued listing or

that we will be able to regain compliance with the applicable listing criteria within the period of time that may be granted by the Panel.

The Notices have no immediate effect on the listing

or trading of our common stock and the common stock will continue to trade on the Nasdaq Capital Market under the symbol “SEEL.”

We intend to monitor the bid price and market

value of our common stock and consider available options if our common stock does not trade at a level likely to result in us regaining

compliance with Nasdaq’s minimum bid price rule by October 28, 2024 and the minimum market value of listed securities rule, which

may include, among other options, effectuating a reverse stock split. There can be no assurance that we will be able to regain compliance

with Nasdaq’s minimum bid price rule or Nasdaq’s minimum market value of listed securities rule or that we will otherwise

be in compliance with the other listing standards for the Nasdaq Capital Market.

Recent Developments

Announcement of Strategic Focus on Mental Health and Appointment

of Richard Pascoe as Chairman of the Board

On April 29, 2024, we announced our strategic

focus on mental health initiatives and that Richard Pascoe has been appointed as the Chairman of the Board of Directors to lead the ongoing

strategic process and business development discussions and negotiations. Mr. Pascoe has served as member of our Board of Directors

since 2019.

Amendment No. 6 to Convertible Promissory Note

On November 23, 2021, we entered into a

Securities Purchase Agreement (the “Purchase Agreement”) with Lind Global Asset Management V, LLC (“Lind”) pursuant

to which, among other things, on November 23, 2021, we issued and sold to Lind, in a private placement transaction, in exchange

for the payment by Lind of $20.0 million, (i) a convertible promissory note (the “Note”) in an aggregate principal amount

of $22.0 million, which bore no interest until the first anniversary of the issuance of the 2021 Note and thereafter bore interest at

a rate of 5% per annum until October 1, 2023 when the 2021 Note began to bear interest at an annual rate of 12% per annum, and is

set to mature on November 23, 2024, and (ii) 2,229 shares of common stock.

Effective May 1, 2024, we and Lind entered

into an Amendment No. 6 to Convertible Promissory Note (“Amendment No. 6”), which amended the convertible promissory

note we previously issued to Lind on November 23, 2021. Pursuant to Amendment No. 6, we and Lind agreed, among other things,

that: (A) we shall not be required to maintain any minimum balance of cash or cash equivalents with one or more financial institutions

prior to May 31, 2024, and that we shall thereafter be required to maintain an aggregate minimum balance equal to 50% of the then

outstanding principal amount under the note or more in cash or cash equivalents with one or more financial institutions; (B) that

all payments of accrued interest and monthly payments of the outstanding principal amount payable by us under the note in shares of common

stock shall be reduced from ninety percent (90%) to eighty-five percent (85%) of the average of the five lowest daily volume weighted

average price of common stock during the 20 trading days prior to each respective payment date; (C) Lind will, through May 31,

2024, forebear from exercising any right to assert or claim that a Material Adverse Effect (as defined in the note) has occurred as a

result of any event, occurrence, fact, condition or change that occurred on or prior to May 1, 2024.

Amendment No. 7 to Convertible Promissory Note

Effective June 1, 2024, we and Lind entered

into an Amendment No. 7 to Convertible Promissory Note (“Amendment No. 7”), which amended the convertible promissory

note we previously issued to Lind on November 23, 2021 (as amended, the “Amended Note”). Pursuant to Amendment No. 7,

we and Lind agreed, among other things, that: (A) we shall not be required to maintain any minimum balance of cash or cash equivalents

with one or more financial institutions prior to July 31, 2024, and that we shall thereafter be required to maintain an aggregate

minimum balance equal to 50% of the then outstanding principal amount under the Note or more in cash or cash equivalents with one or

more financial institutions; and (B) Lind will, through July 31, 2024, forebear from exercising any right to assert or claim

that a Material Adverse Effect (as defined in the Note) has occurred as a result of any event, occurrence, fact, condition or change

that occurred on or prior to June 1, 2024.

Amendment No. 8 to Convertible Promissory

Note

Effective July 16, 2024, we and Lind entered

into an Amendment No. 8 to Convertible Promissory Note (“Amendment No. 8”), which amended the Note. Pursuant to

Amendment No. 8, we and Lind agreed, among other things, that: (A) we shall not be required to maintain any minimum balance

of cash or cash equivalents with one or more financial institutions prior to October 31, 2024, and that we shall thereafter be required

to maintain an aggregate minimum balance equal to 50% of the then outstanding principal amount under the Note or more in cash or cash

equivalents with one or more financial institutions; (B) Lind will, through October 31, 2024, forebear from exercising any

right to assert or claim that a Material Adverse Effect (as defined in the Note) has occurred as a result of any event, occurrence, fact,

condition or change that occurred on or prior to July 16, 2024; and (C) we shall use our reasonable best efforts to seek, at

a special or annual meeting of our stockholders, to be scheduled to be held no later than October 31, 2024, instead of July 31,

2024, stockholder approval as contemplated by Nasdaq Listing Rule 5635(d) to issue any shares in connection with the repayment

or conversion of any portion of the March 2024 principal increase amount of the Note.

Lind Agreement

On August 30, 2024,

we entered into an agreement with Lind (the “Lind Agreement”). The Lind Agreement relates to the Purchase Agreement. The

Lind Agreement provides that, upon the consummation of a Fundamental Transaction (as defined in the Lind Agreement), Lind shall convert

the outstanding balance of the Note into shares of common stock, at a conversion price per share of common stock to be agreed upon by

the parties at the time of conversion. The conversion is intended to enable us to comply with the continued listing standard set forth

in Rule 5550(b)(1) of the Nasdaq Capital Market listing requirements relating to our stockholders’ equity.

The

conversion of the Note as set forth in the Lind Agreement is subject to our continued listing on Nasdaq and compliance with all applicable

laws and regulations, including any shareholder voting requirements under Nasdaq rules. The Lind Agreement further ensures that no conversion

shall result in Lind exceeding the ownership cap set forth in the original Note.

Reduction in Force

On April 30, 2024, we announced a reduction

in its workforce that affected approximately 33% of our current employees (the “RIF”), along with a reduction in working

hours and related compensation for all of our remaining employees. This decision relates to our recent announcement of our strategic

focus on our mental health initiatives and serves to reduce ongoing operating expenses not related to such initiatives and extend our

cash runway. Total annualized cost savings from the RIF are estimated at approximately $0.8 million and total annualized cost savings

from the reduction in working hours are estimated at approximately $1.6 million. The RIF was substantially completed on April 30,

2024.

We expect to recognize approximately $50,000

in total charges for related benefits for employees whose employment was terminated pursuant to the RIF. These are one-time termination

benefits and are cash charges. The estimates of costs and expenses that we expect to incur in connection with the RIF are subject to

a number of assumptions and actual results may differ materially from those estimates. We may also incur other charges or cash expenditures

not currently contemplated due to events that may occur as a result of, or associated with, the RIF.

Reverse Stock Split

On May 15, 2024, we filed a Certificate

of Change with the Secretary of State of the State of Nevada to (i) effect a 1-for-8 reverse stock split (the “Reverse Stock

Split”) of our issued and outstanding shares of common stock, effective at 12:01 a.m. Eastern Time, on May 16, 2024,

and (ii) decrease the number of total authorized shares of our common stock from 400,000,000 shares to 50,000,000 shares (the “Authorized

Share Decrease”). Our common stock began trading on a Reverse Stock Split-adjusted basis on the Nasdaq Capital Market at the opening

of the market on May 16, 2024. Unless specifically provided otherwise herein, the share and per share information in this prospectus

gives effect to the Reverse Stock Split and the Authorized Share Decrease.

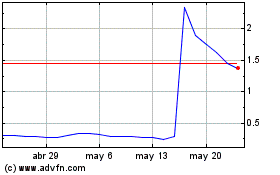

May 2024 Offering

On May 16, 2024, we entered into a securities

purchase agreement with certain institutional investors pursuant to which we agreed to issue

and sell 380,968 shares of common stock and pre-funded warrants to purchase up to 81,239 shares of common stock in a registered direct

offering. In a concurrent private placement, we also agreed to issue and sell to the investors, warrants to purchase up to 924,414 shares

of common stock. The combined purchase price for one share and accompanying common warrant to purchase two shares of common stock for

each share purchased was $2.46. The combined purchase price for one pre-funded warrant to purchase one share of common stock and accompanying

common warrant to purchase two shares of common stock for each share of common stock issuable upon exercise of a purchased pre-funded

warrant was $2.459.

The

pre-funded warrants have an exercise price of $0.001 per share of common stock and were exercisable immediately upon issuance.

Each holder of a pre-funded warrant will not have the right to exercise any portion of its pre-funded warrant if the holder, together

with its affiliates, would beneficially own more than 4.99% (or, at the election of the purchaser, 9.99%) of the number of shares of

common stock outstanding immediately after giving effect to such exercise (the “Warrant Beneficial Ownership Limitation”);

provided, however, that upon 61 days’ prior notice to the Company, the holder may increase the Warrant Beneficial Ownership Limitation,

but not to above 9.99%. The exercise price and number of shares of common stock issuable upon the exercise of the pre-funded warrants

will be subject to adjustment in the event of any stock dividend, stock split, reverse stock split, recapitalization, reorganization

or similar transaction, as described in the pre-funded warrants. The holders may exercise the pre-funded warrants by means of a “cashless

exercise.”

The

common warrants have an exercise price of $2.21 per share of common stock, were exercisable immediately upon issuance and expire

five years following the original issuance date. Each holder of a common warrant will not have the right to exercise any portion of its

common warrant if the holder, together with its affiliates, would beneficially own more than the Warrant Beneficial Ownership Limitation;

provided, however, that upon 61 days’ prior notice to us, the holder may increase the Warrant Beneficial Ownership Limitation,

but not to above 9.99%. The exercise price and number of shares of common stock issuable upon the exercise of the common warrant will

be subject to adjustment in the event of any stock dividend, stock split, reverse stock split, recapitalization, reorganization or similar

transaction, as described in the common warrant. If at any time after the six month anniversary of the date of issuance, a registration

statement covering the resale of the shares of common stock issuable upon exercise of the common warrants is not available for the issuance,

then the holders may exercise the common warrants by means of a “cashless exercise.” The common warrant s are not and will

not be listed for trading on any national securities exchange or other nationally recognized trading system.

On May 16, 2024, we also entered into a

placement agent agreement with Roth Capital Partners, LLC (“Roth”), pursuant to which Roth acted as placement agent for the

offering and we agreed to pay Roth an aggregate fee equal to 7.0% of the aggregate gross proceeds received by us from the sale of the

securities in the offering. The placement agent agreement included indemnity and other customary provisions for transactions of this

nature. We also agreed to reimburse Roth for up to $50,000 for Roth’s legal fees and expenses.

We also agreed, pursuant to the securities purchase

agreement, to file a registration statement on Form S-1 by June 15, 2024 to provide for the resale of the shares. We filed

the registration statement on June 14, 2024 and it became effective as of June 25, 2024.

The closing of the offering occurred on May 21,

2024.

July 2024 Offering

On

July 11, 2024, we entered into an inducement offer letter agreement (the “Inducement Letter”) with certain accredited

investors, who at the time of execution of the Inducement Letter, were holders of warrants to purchase up to an aggregate of 939,739

shares of common stock, originally issued to such investors on December 1, 2023, with an exercise price of $10.56 per share

of common stock and a termination date of December 1, 2028, and January 30, 2024, with an exercise price of $8.40 per share

of common stock and a termination date of January 30, 2029.

Pursuant

to the Inducement Letter, the investors agreed to exercise for cash their existing warrants at an exercise price of $0.61 per share of

common stock in consideration for the Company’s agreement to issue, in a private placement, new warrants to purchase up

to an aggregate of 1,879,478 shares of common stock at an exercise price of $0.61 per share. We received aggregate gross proceeds of

approximately $573,240 from the exercise of such existing warrants by the investors, before deducting placement agent fees and other

offering expenses payable by us.

We engaged H.C. Wainwright & Co., LLC

(“H.C. Wainwright”) to act as our exclusive placement agent in connection with the offering and agreed to pay H.C. Wainwright

a cash fee equal to 7.5% of the aggregate gross proceeds received from the investors’ exercise of their existing warrants, as well

as a management fee equal to 1.0% of the gross proceeds from the exercise of the existing warrants. We also agreed to issue to H.C. Wainwright

or its designees warrants to purchase up to 65,782 shares of common stock (representing 7.0% of the existing warrants being exercised),

which have the same terms as the new warrants except the placement agent warrants have an exercise price equal to $0.7625 per share (125%

of the exercise price of the existing warrants). In addition, we agreed to reimburse H.C. Wainwright for their expenses in connection

with the exercise of the existing warrants and the issuance of the new warrants of: (i) $30,000 for fees and expenses of H.C. Wainwright’s

counsel, and (ii) $15,950 for their clearing costs.

The closing of the offering occurred on July 12, 2024.

We agreed to hold an annual or special meeting

of stockholders on or prior to the date that is ninety (90) days following July 12, 2024 for the purpose of obtaining such approval

as may be required by the applicable rules and regulations of Nasdaq (or any successor entity) from the stockholders of the Company

with respect to issuance of all of the new warrants and the shares upon the exercise thereof. If we do not obtain stockholder approval

at the first meeting, we agreed to call a meeting every ninety (90) days thereafter to seek stockholder approval until the earlier of

the date on which stockholder approval is obtained or the new warrants are no longer outstanding.

We also agreed, pursuant to the Inducement Letter,

to file a registration statement on Form S-3 providing for the resale of the shares issued or issuable upon the exercise of the

new warrants. We filed the registration statement on August 16, 2024 and it became effective as of August 23, 2024.

In addition, pursuant to the Inducement Letter,

we agreed not to issue any shares of common stock or common stock equivalents or to file any other registration statement with the SEC

(in each case, subject to certain exceptions) until fifteen (15) days after July 12, 2024. We also agreed not to effect or agree

to effect any Variable Rate Transaction (as defined in the Inducement Letter) until six (6) months after July 12, 2024 (subject

to certain exceptions).

The

conversion of the Note as set forth in the Agreement is subject to our continued listing on Nasdaq and compliance with all applicable

laws and regulations, including any shareholder voting requirements under Nasdaq rules. The Agreement further ensures that no conversion

shall result in Lind exceeding the ownership cap set forth in the original Note.

Agreement with U.S. Army Medical Materiel

Development Activity

On August 16, 2024, we entered into an agreement

with the U.S. Army Medical Materiel Development Activity (“USAMMDA”) to supply SLS-002 (intranasal racemic ketamine) for

the U.S. Department of Defense's (“DOD”) Military and Veterans Adaptive Platform Clinical Trial to evaluate its potential

for treatment of post-traumatic stress disorder (PTSD).

Dosing of the SLS-002 cohort is expected to commence

prior to the end of 2024 and it is the only ketamine-based therapy selected for inclusion in this study. The trial is funded by the DOD’s

Defense Health Agency and led by USAMMDA’s Warfighter Readiness, Performance, and Brain Health Project Management Office.

Corporate Information

Our principal executive offices are located at

300 Park Avenue, 2nd Floor, New York, NY 10022, and our telephone number is (646) 293-2100. Our website is located at www.seelostherapeutics.com.

Any information contained on, or that can be accessed through, our website is not incorporated by reference into, nor is it in any way

part of, this prospectus and should not be relied upon in connection with making any decision with respect to an investment in our securities.

We are required to file annual, quarterly and current reports, proxy statements and other information with the SEC. You may obtain any

of the documents filed by us with the SEC at no cost from the SEC’s website at www.sec.gov.

We are a “smaller reporting company”

as defined in Rule 12b-2 of the Exchange Act, and have elected to take advantage of certain of the scaled disclosure available for

smaller reporting companies in this prospectus as well as our filings under the Exchange Act.

The Offering

| Common

Stock we are offering |

|

Up

to shares of common stock based on an assumed combined public offering price of $ per

share of common stock and accompanying Common Warrant, which is equal to the last sale price of our common stock as reported by Nasdaq

on , 2024. |

| Pre-Funded

Warrants we are offering |

|

We

are also offering Pre-Funded Warrants to purchase up to shares of common stock in

lieu of shares of common stock to any purchaser whose purchase of shares of common stock in this offering would otherwise result

in such purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the purchaser’s

election, 9.99%) of our outstanding common stock immediately following the consummation of this offering. Each Pre-Funded Warrant

will be exercisable for one share of common stock, will have an exercise price of $0.0001 per share, will be immediately exercisable,

and may be exercised at any time until exercised in full. This prospectus also relates to the offering of the shares of common stock

issuable upon exercise of the Pre-Funded Warrants. |

| Common Warrants

we are offering |

|

We

are also offering Common Warrants to purchase up to shares of common stock. Each Common

Warrant will be exercisable beginning on the effective date of the Warrant Stockholder Approval, provided however, if the Pricing

Conditions are met, the Warrant Stockholder Approval will not be required and the Common Warrant will be exercisable on the Initial

Exercise Date. This prospectus also relates to the offering of the shares of common stock issuable upon exercise of the Common Warrants.

|

| Common Stock

outstanding immediately before this offering |

|

shares

|

| Common Stock

outstanding immediately after this offering |

|

shares,

assuming no sale of any Pre-Funded Warrants and assuming none of the Common Warrants issued in this offering are exercised. |

| Use of proceeds |

|

We

estimate that the net proceeds from this offering will be approximately $ million, based on an

assumed combined public offering price of $ per share, which is the closing price of our common

stock as reported on Nasdaq on , 2024, after deducting the Placement Agent

fees and estimated offering expenses payable by us. We intend to use the proceeds from this offering primarily for general

corporate purposes, to advance the development of our product candidates and to make periodic principal and interest payments under,

or to repay a portion of, the Note. See “Use of Proceeds.” |

| Reasonable

best efforts offering |

|

We

have agreed to offer and sell the securities offered hereby to the purchasers through the Placement Agent. The Placement Agent is

not required to buy or sell any specific number or dollar amount of the securities offered hereby, but will use its reasonable best

efforts to solicit offers to purchase the securities offered by this prospectus. See “Plan of Distribution” on

page 34 of this prospectus. |

| Risk Factors |

|

An

investment in our securities involves a high degree of risk. See “Risk Factors” beginning on page 17 of this prospectus

and the other information included and incorporated by reference in this prospectus for a discussion of the risk factors you should

carefully consider before deciding to invest in our securities. |

| Nasdaq listing symbol |

|

Our common stock is listed

on Nasdaq under the symbol “SEEL”. There is no established trading market for the Common Warrants or the Pre-Funded Warrants

and we do not expect a market to develop. In addition, we do not intend to apply for the listing of the Warrants on any national

securities exchange or other trading market. Without an active trading market, the liquidity of the Common Warrants and Pre-Funded

Warrants will be limited. |

The

number of shares of common stock to be outstanding after this is based on shares

outstanding as of , 2024, and excludes:

| · | shares

of common stock underlying outstanding warrants at a weighted average exercise price of $

per share; |

| · | shares

of common stock underlying outstanding options issued under our Amended and Restated 2012

Stock Long Term Incentive Plan (the "2012 Plan") with a weighted average exercise

price of $ per share; |

| · | shares

of common stock underlying outstanding options issued under our 2019 Inducement Plan (the

"2019 Inducement Plan") with a weighted average exercise price of $ per share; |

| · | shares

of common stock available for future issuance under the 2012 Plan; |

| · | shares

of common stock available for future issuance under the 2019 Inducement Plan; and |

| · | the

shares of common stock issuable upon exercise of the Pre-Funded Warrants and the Common Warrants

issued in this offering. |

Except

as otherwise indicated, the information in this prospectus assumes no exercise of options or exercise of Warrants or sale of Pre-Funded

Warrants in this offering.

The

information discussed above is illustrative only and will adjust based on the actual public offering price and other terms of this offering

determined at pricing.

RISK FACTORS

Investing in our Securities involves a high

degree of risk. Before making an investment decision, you should carefully consider the risks described under “Risk Factors”

in our most recent Annual Report on Form 10-K, and the updates in our Quarterly Reports on Form 10-Q, together with all of

the other information appearing in or incorporated by reference into this prospectus before deciding whether to purchase any of the Securities

being offered. Our business, financial condition or results of operations could be materially adversely affected by any of these risks.

The trading price of shares of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

Risks Related to the Company

Our debt agreement contains restrictive

and financial covenants that may limit our operating flexibility and the failure to comply with such covenants could cause our outstanding

debt to become immediately payable.

On November 23, 2021, we issued and sold