Shenandoah Telecommunications Company (“Shentel” or the “Company”)

(Nasdaq: SHEN) announced second quarter 2024 financial and

operating results.

Second Quarter 2024 Highlights

- On April 1, 2024, Shentel completed

its previously announced acquisition of Horizon Acquisition Parent

LLC (“Horizon”) for approximately $385 million, which consisted of

$305 million in cash and 4.1 million shares of Shentel’s common

stock issued to a selling shareholder of Horizon (“Horizon

Transaction”). Cash consideration paid also included purchase price

adjustments for capital expenditure reimbursements and working

capital subject to subsequent adjustments as defined in the merger

agreement. Horizon is a leading commercial fiber provider in Ohio

and adjacent states.

- Glo Fiber Expansion Markets1 added

approximately 5,000 subscribers in the second quarter of 2024. Glo

Fiber Expansion Markets ended the quarter with approximately 53,000

subscribers, including approximately 2,000 acquired from

Horizon.

- Glo Fiber Expansion Markets

passings grew approximately 38,000, including 16,000 acquired from

Horizon, to a total of approximately 298,000.

- Revenue in the second quarter grew

to $85.8 million, up $19.2 million, or 28.7%, compared to the same

period in 2023. The former Horizon markets contributed $16.7

million in revenue. Excluding the former Horizon markets, Glo Fiber

Expansion Markets revenue grew 67% over the same period in

2023.

- Net loss from continuing operations

was $12.8 million in the second quarter of 2024 compared with net

loss from continuing operations of $1.4 million in the second

quarter of 2023. This was due primarily to non-recurring

integration and acquisition expenses and depreciation related to

the Horizon acquisition.

“We made good progress executing our Fiber First

strategy with another solid quarter of Glo Fiber net subscriber

additions and construction of new passings, and integration of our

recent Horizon acquisition with its fiber rich network has gone

well” said President and CEO, Christopher E. French. “Recently

announced acquisitions of Fiber-To-The-Home companies have

re-affirmed our investment thesis for our Glo Fiber line of

business.”

Shentel’s second-quarter earnings conference

call will be webcast at 8:30 a.m. ET on Wednesday, August 7,

2024. The webcast and related materials will be available on

Shentel’s Investor Relations website at

https://investor.shentel.com/.

Second Quarter 2024 Results

- Total Incumbent Broadband Markets2 and Glo Fiber Expansion

Markets broadband data Revenue Generating Units (“RGUs”) as of

June 30, 2024 were 164,566, representing 15.7% year-over-year

growth driven primarily by Glo Fiber. Total Glo Fiber Expansion

Markets passings grew year-over-year by 114,698 to 297,545.

- Revenue in the second quarter of 2024 grew $19.2 million, or

28.7%, to $85.8 million, primarily driven by $16.7 million of

revenue resulting from the acquisition of Horizon. The remaining

$2.5 million in revenue growth is primarily driven by a $4.2

million, or 8.0%, increase in Residential & Small and Medium

Business (“SMB”) revenue and partially offset by a

$1.2 million, or 11.6%, decrease in Commercial Fiber revenue.

Glo Fiber Expansion Markets was the driver of the Residential &

SMB revenue growth due to a 56.3% increase in broadband data RGUs

and an 8.8% increase in broadband data Average Revenue per User

(“ARPU”). Commercial Fiber revenue decreased as expected due to the

previously disclosed decline in T-Mobile revenue from prior period

backhaul circuit disconnects as part of decommissioning the former

Sprint network.

- Cost of services for the three months ended June 30, 2024

increased approximately $9.8 million, or 39.5%, compared with the

three months ended June 30, 2023, primarily driven by

$8.9 million in cost of services resulting from the

acquisition of Horizon. The remaining $0.9 million increase in cost

of services is attributable to higher inventory and maintenance

costs as the Company continues to expand the Glo Fiber network and

a non-recurring charge related to exiting a planned Glo Fiber

expansion market due to further analysis of projected market

economics.

- Selling, general and administrative expense for the three

months ended June 30, 2024, increased $5.2 million, or 20.8%,

compared with the three months ended June 30, 2023, primarily

driven by $4.1 million of recurring selling, general and

administrative costs acquired from Horizon. The remaining

$1.1 million in incremental selling, general and

administrative expense is primarily attributable to higher

advertising and sales headcount to support the Glo Fiber

expansion.

- Integration and acquisition expense for the three months ended

June 30, 2024 increased $11.0 million compared with the three

months ended June 30, 2023, primarily driven by non-recurring

acquisition-related costs related to the Horizon acquisition and

integration.

- Adjusted EBITDA for the three months ended June 30, 2024

increased to $23.3 million, representing a $3.8 million, or 19.7%,

increase compared with the three months ended June 30, 2023. The

former Horizon markets contributed $3.7 million. Excluding the

former Horizon markets, Adjusted EBITDA grew $0.1 million, or 0.8%,

driven by Glo Fiber growth and partially offset by the previously

disclosed decline in T-Mobile revenue from prior period backhaul

circuit disconnects as part of decommissioning the former Sprint

network and declines in RLEC and Incumbent Cable revenues.

- Depreciation and amortization for the three months ended June

30, 2024, increased $9.7 million, or 61.6%, compared with the three

months ended June 30, 2023, primarily driven by $8.3 million

of depreciation and amortization expense resulting from the

acquisition of Horizon. The remaining increase in depreciation and

amortization expense is attributable to the Company’s expansion of

its Glo Fiber network.

Other Information

- Capital expenditures were $150.9 million for the six months

ended June 30, 2024 compared with $135.3 million in the comparable

2023 period. The $15.7 million increase in capital expenditures was

primarily driven by $9.8 million of capital expenditures in the

former Horizon markets. The remaining $5.9 million increase in

capital expenditures is attributable to increased capital

expenditures for expansion of Glo Fiber Expansion Markets and

government-subsidized markets.

- On April 1, 2024, the Company issued $81 million of 7%

Participating Exchangeable Perpetual Preferred Stock (“Preferred

Stock”).

- On April 1, 2024, the Company amended and upsized its credit

facility by $275 million to a total of $675 million. The additional

financing consisted of $225 million of delay-draw term loans due

June 2028 and $50 million in incremental revolving line of credit

due June 2026.

- As of June 30, 2024, our cash and cash equivalents totaled

$43.8 million.

__________________________1 Glo Fiber Expansion

Markets consists of FTTH passings in greenfield expansion markets

in the Shentel and former Horizon markets.2 Incumbent Broadband

Markets consists of Shentel Incumbent Cable Markets and Horizon

Incumbent Telephone Markets with Fiber-To-The-Home (“FTTH”)

passings.

Earnings Call Webcast

Date: Wednesday,

August 7, 2024Time: 8:30 A.M. (ET)Listen via

Internet: https://investor.shentel.com/For Analysts, please

register to dial-in at this link.

A replay of the call will be available for a

limited time on the Investor Relations page of the Company’s

website.

About Shenandoah

Telecommunications

Shenandoah Telecommunications Company (Shentel)

provides broadband services through its high speed,

state-of-the-art fiber optic and cable networks to residential and

commercial customers in eight contiguous states in the eastern

United States. The Company’s services include: broadband internet,

video, voice, high-speed Ethernet, dark fiber leasing, and managed

network services. The Company owns an extensive regional network

with over 16,000 route miles of fiber. For more information, please

visit www.shentel.com.

This release contains forward-looking statements

about Shentel regarding, among other things, its business strategy,

its prospects and its financial position. These statements can be

identified by the use of forward-looking terminology such as

“believes,” “estimates,” “expects,” “intends,” “may,” “will,”

“plans,” “should,” “could,” or “anticipates” or the negative or

other variation of these or similar words, or by discussions of

strategy or risks and uncertainties. The forward-looking statements

are based upon management’s beliefs, assumptions and current

expectations and may include comments as to Shentel’s beliefs and

expectations as to future events and trends affecting its business

that are necessarily subject to uncertainties, many of which are

outside Shentel’s control. Although management believes that the

expectations reflected in the forward-looking statements are

reasonable, forward-looking statements are not, and should not be

relied upon as, a guarantee of future performance or results, nor

will they necessarily prove to be accurate indications of the times

at which such performance or results will be achieved, and actual

results may differ materially from those contained in or implied by

the forward-looking statements as a result of various factors. A

discussion of other factors that may cause actual results to differ

from management’s projections, forecasts, estimates and

expectations is available in Shentel’s filings with the Securities

and Exchange Commission, including our Annual Report on Form 10-K

for the year ended December 31, 2023 and our Quarterly Reports

on Form 10-Q. Those factors may include, among others, the expected

savings and synergies from the Horizon Transaction may not be

realized or may take longer or cost more than expected to realize,

changes in overall economic conditions including rising inflation,

regulatory requirements, changes in technologies, changes in

competition, demand for our products and services, availability of

labor resources and capital, natural disasters, pandemics and

outbreaks of contagious diseases and other adverse public health

developments, such as COVID-19, and other conditions. The

forward-looking statements included are made only as of the date of

the statement. Shentel undertakes no obligation to revise or update

such statements to reflect current events or circumstances after

the date hereof, or to reflect the occurrence of unanticipated

events, except as required by law.

CONTACTS: Shenandoah Telecommunications

Company Jim Volk Senior Vice President and Chief

Financial Officer 540-984-5168

Jim.Volk@emp.shentel.com

|

SHENANDOAH TELECOMMUNICATIONS COMPANY AND

SUBSIDIARIES |

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF

COMPREHENSIVE (LOSS) INCOME |

|

(in thousands, except per share amounts) |

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Service revenue and other |

$ |

85,799 |

|

|

$ |

66,644 |

|

|

$ |

155,047 |

|

|

$ |

133,809 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

Cost of services exclusive of depreciation and amortization |

|

34,541 |

|

|

|

24,753 |

|

|

|

60,526 |

|

|

|

50,183 |

|

|

Selling, general and administrative |

|

30,239 |

|

|

|

25,041 |

|

|

|

58,217 |

|

|

|

51,069 |

|

|

Integration and acquisition |

|

11,325 |

|

|

|

301 |

|

|

|

11,943 |

|

|

|

432 |

|

|

Impairment expense |

|

— |

|

|

|

836 |

|

|

|

— |

|

|

|

1,020 |

|

|

Depreciation and amortization |

|

25,579 |

|

|

|

15,831 |

|

|

|

43,022 |

|

|

|

30,916 |

|

|

Total operating expenses |

|

101,684 |

|

|

|

66,762 |

|

|

|

173,708 |

|

|

|

133,620 |

|

|

Operating (loss) income |

|

(15,885 |

) |

|

|

(118 |

) |

|

|

(18,661 |

) |

|

|

189 |

|

|

Other (expense) income: |

|

|

|

|

|

|

|

|

Interest expense |

|

(3,996 |

) |

|

|

(905 |

) |

|

|

(8,072 |

) |

|

|

(1,297 |

) |

|

Other income, net |

|

1,908 |

|

|

|

1,082 |

|

|

|

3,644 |

|

|

|

2,591 |

|

|

(Loss) income from continuing operations before income taxes |

|

(17,973 |

) |

|

|

59 |

|

|

|

(23,089 |

) |

|

|

1,483 |

|

|

Income tax (benefit) expense |

|

(5,200 |

) |

|

|

1,459 |

|

|

|

(6,226 |

) |

|

|

2,141 |

|

|

Loss from continuing operations |

|

(12,773 |

) |

|

|

(1,400 |

) |

|

|

(16,863 |

) |

|

|

(658 |

) |

|

Discontinued operations: |

|

|

|

|

|

|

|

|

(Loss) income from discontinued operations, net of tax |

|

(99 |

) |

|

|

3,190 |

|

|

|

1,882 |

|

|

|

4,514 |

|

|

Gain on the sale of discontinued operations, net of tax |

|

— |

|

|

|

— |

|

|

|

216,805 |

|

|

|

— |

|

|

Total (loss) income from discontinued operations, net of tax |

|

(99 |

) |

|

|

3,190 |

|

|

|

218,687 |

|

|

|

4,514 |

|

|

Net (loss) income |

|

(12,872 |

) |

|

|

1,790 |

|

|

|

201,824 |

|

|

|

3,856 |

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income: |

|

|

|

|

|

|

|

|

Gain on interest rate hedge, net of tax |

|

143 |

|

|

|

2,127 |

|

|

|

1,737 |

|

|

|

2,127 |

|

|

Comprehensive (loss) income |

$ |

(12,729 |

) |

|

$ |

3,917 |

|

|

$ |

203,561 |

|

|

$ |

5,983 |

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income per share, basic and diluted: |

|

|

|

|

|

|

|

|

Loss from continuing operations |

$ |

(0.24 |

) |

|

$ |

(0.03 |

) |

|

$ |

(0.32 |

) |

|

$ |

(0.01 |

) |

|

(Loss) income from discontinued operations, net of tax |

|

— |

|

|

|

0.07 |

|

|

|

4.16 |

|

|

|

0.09 |

|

|

Net (loss) income per share |

$ |

(0.24 |

) |

|

$ |

0.04 |

|

|

$ |

3.84 |

|

|

$ |

0.08 |

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding, basic and diluted |

|

54,730 |

|

|

|

50,366 |

|

|

|

52,620 |

|

|

|

50,330 |

|

|

SHENANDOAH TELECOMMUNICATIONS COMPANY AND

SUBSIDIARIESUNAUDITED CONDENSED CONSOLIDATED

BALANCE SHEETS |

|

(in thousands) |

June 30,2024 |

|

December 31,2023 |

|

ASSETS |

|

|

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

43,779 |

|

$ |

139,255 |

|

Accounts receivable, net of allowance for credit losses of $1,333

and $886, respectively |

|

29,639 |

|

|

19,782 |

|

Income taxes receivable |

|

5,537 |

|

|

4,691 |

|

Prepaid expenses and other |

|

20,567 |

|

|

11,782 |

|

Current assets held for sale |

|

— |

|

|

561 |

|

Total current assets |

|

99,522 |

|

|

176,071 |

|

Investments |

|

15,135 |

|

|

13,198 |

|

Property, plant and equipment, net |

|

1,337,252 |

|

|

850,337 |

|

Goodwill and intangible assets, net |

|

169,489 |

|

|

81,123 |

|

Operating lease right-of-use assets |

|

20,444 |

|

|

13,024 |

|

Deferred charges and other assets |

|

14,491 |

|

|

11,561 |

|

Non-current assets held for sale |

|

— |

|

|

68,915 |

|

Total assets |

$ |

1,656,333 |

|

$ |

1,214,229 |

|

LIABILITIES, TEMPORARY EQUITY AND SHAREHOLDERS’

EQUITY |

|

|

|

|

Current liabilities: |

|

|

|

|

Current maturities of long-term debt, net of unamortized loan

fees |

$ |

8,726 |

|

$ |

7,095 |

|

Accounts payable |

|

57,725 |

|

|

53,546 |

|

Advanced billings and customer deposits |

|

14,928 |

|

|

12,394 |

|

Accrued compensation |

|

12,308 |

|

|

11,749 |

|

Current operating lease liabilities |

|

3,138 |

|

|

2,222 |

|

Accrued liabilities and other |

|

15,264 |

|

|

7,747 |

|

Current liabilities held for sale |

|

— |

|

|

3,602 |

|

Total current liabilities |

|

112,089 |

|

|

98,355 |

|

Long-term debt, less current maturities, net of unamortized loan

fees |

|

288,570 |

|

|

292,804 |

|

Other long-term liabilities: |

|

|

|

|

Deferred income taxes |

|

186,305 |

|

|

85,664 |

|

Benefit plan obligations |

|

4,971 |

|

|

3,943 |

|

Non-current operating lease liabilities |

|

11,431 |

|

|

7,185 |

|

Other liabilities |

|

40,505 |

|

|

16,912 |

|

Non-current liabilities held for sale |

|

— |

|

|

56,696 |

|

Total other long-term liabilities |

|

243,212 |

|

|

170,400 |

|

Commitments and contingencies (Note 15) |

|

|

|

|

Temporary equity: |

|

|

|

|

Redeemable noncontrolling interest |

|

79,380 |

|

|

— |

|

Shareholders’ equity: |

|

|

|

|

Common stock, no par value, authorized 96,000; 54,572 and 50,272

issued and outstanding at June 30, 2024 and December 31, 2023,

respectively |

|

— |

|

|

— |

|

Additional paid in capital |

|

143,784 |

|

|

66,933 |

|

Retained earnings |

|

785,893 |

|

|

584,069 |

|

Accumulated other comprehensive income, net of taxes |

|

3,405 |

|

|

1,668 |

|

Total shareholders’ equity |

|

933,082 |

|

|

652,670 |

|

Total liabilities, temporary equity and shareholders’ equity |

$ |

1,656,333 |

|

$ |

1,214,229 |

|

SHENANDOAH TELECOMMUNICATIONS COMPANY AND

SUBSIDIARIES |

|

|

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS |

|

|

|

(in thousands) |

Six Months EndedJune 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

Cash flows from operating activities: |

|

|

|

|

Net income |

$ |

201,824 |

|

|

$ |

3,856 |

|

|

Income from discontinued operations, net of tax |

|

218,687 |

|

|

|

4,514 |

|

|

Loss from continuing operations |

|

(16,863 |

) |

|

|

(658 |

) |

|

Adjustments to reconcile net income to net cash provided by

operating activities, net of effects of business acquisition |

|

|

|

|

Depreciation and amortization |

|

43,022 |

|

|

|

30,916 |

|

|

Stock-based compensation expense, net of amount capitalized |

|

6,236 |

|

|

|

6,320 |

|

|

Impairment expense |

|

— |

|

|

|

1,020 |

|

|

Deferred income taxes |

|

(6,226 |

) |

|

|

2,860 |

|

|

Provision for credit losses |

|

1,266 |

|

|

|

1,141 |

|

|

Other, net |

|

150 |

|

|

|

(313 |

) |

|

Changes in assets and liabilities: |

|

|

|

|

Accounts receivable |

|

965 |

|

|

|

4,499 |

|

|

Current income taxes |

|

234 |

|

|

|

25,108 |

|

|

Operating lease assets and liabilities, net |

|

(233 |

) |

|

|

73 |

|

|

Other assets |

|

(3,354 |

) |

|

|

2,233 |

|

|

Accounts payable |

|

(1,140 |

) |

|

|

(3,012 |

) |

|

Other deferrals and accruals |

|

(882 |

) |

|

|

(6,696 |

) |

|

Net cash provided by operating activities - continuing

operations |

|

23,175 |

|

|

|

63,491 |

|

|

Net cash (used in) provided by operating activities - discontinued

operations |

|

(5,476 |

) |

|

|

6,309 |

|

|

Net cash provided by operating activities |

|

17,699 |

|

|

|

69,800 |

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

Capital expenditures |

|

(150,914 |

) |

|

|

(135,261 |

) |

|

Government grants received |

|

7,653 |

|

|

|

110 |

|

|

Cash disbursed for acquisition, net of cash acquired |

|

(347,411 |

) |

|

|

— |

|

|

Proceeds from sale of assets and other |

|

1,715 |

|

|

|

508 |

|

|

Net cash used in investing activities - continuing operations |

|

(488,957 |

) |

|

|

(134,643 |

) |

|

Net cash provided by (used in) investing activities - discontinued

operations |

|

305,827 |

|

|

|

(1,007 |

) |

|

Net cash used in investing activities |

|

(183,130 |

) |

|

|

(135,650 |

) |

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

Principal payments on long-term debt |

|

(2,618 |

) |

|

|

— |

|

|

Proceeds from credit facility borrowings |

|

— |

|

|

|

50,000 |

|

|

Payments for debt amendment costs |

|

(4,390 |

) |

|

|

(300 |

) |

|

Proceeds from the issuance of redeemable noncontrolling interest,

net of financing fees paid |

|

79,380 |

|

|

|

— |

|

|

Taxes paid for equity award issuances |

|

(1,671 |

) |

|

|

(1,317 |

) |

|

Payments for financing arrangements and other |

|

(746 |

) |

|

|

(290 |

) |

|

Net cash provided by financing activities |

|

69,955 |

|

|

|

48,093 |

|

|

Net decrease in cash and cash equivalents |

|

(95,476 |

) |

|

|

(17,757 |

) |

|

Cash and cash equivalents, beginning of period |

|

139,255 |

|

|

|

44,061 |

|

|

Cash and cash equivalents, end of period |

$ |

43,779 |

|

|

$ |

26,304 |

|

|

|

|

|

|

|

Supplemental Disclosures of Cash Flow

Information |

|

|

|

|

Interest paid, net of amounts capitalized |

$ |

(6,526 |

) |

|

$ |

(841 |

) |

|

Income tax (paid) refunds received, net |

$ |

(7,085 |

) |

|

$ |

25,481 |

|

Non-GAAP Financial

MeasuresAdjusted EBITDA and Adjusted EBITDA

Margin

The Company defines Adjusted EBITDA as net

(loss) income from continuing operations calculated in accordance

with GAAP, adjusted for the impact of depreciation and

amortization, impairment, other income (expense), net, interest

income, interest expense, income tax expense (benefit), stock

compensation expense, transaction costs related to acquisition and

disposition events (including professional advisory fees,

integration costs, and related compensatory matters), restructuring

expense, tax on equity award vesting and exercise events, and other

non-comparable items. A reconciliation of net (loss) income from

continuing operations, which is the most directly comparable GAAP

financial measure, to Adjusted EBITDA is provided below herein.

Adjusted EBITDA margin is the Company’s

calculation of Adjusted EBITDA, divided by revenue calculated in

accordance with GAAP.

The Company uses Adjusted EBITDA and Adjusted

EBITDA margin as supplemental measures of performance to evaluate

operating effectiveness and assess its ability to increase revenues

while controlling expense growth and the scalability of the

Company’s business growth strategy. Adjusted EBITDA is also a

significant performance measure used by the Company in its

incentive compensation programs. The Company believes that the

exclusion of the expense and income items eliminated in calculating

Adjusted EBITDA and Adjusted EBITDA margin provides management and

investors a useful measure for period-to-period comparisons of the

Company’s core operating results by excluding items that are not

comparable across reporting periods or that do not otherwise relate

to the Company’s ongoing operations. Accordingly, the Company

believes that Adjusted EBITDA and Adjusted EBITDA margin provide

useful information to investors and others in understanding and

evaluating the Company’s operating results. However, use of

Adjusted EBITDA and Adjusted EBITDA margin as analytical tools has

limitations, and investors and others should not consider them in

isolation or as substitutes for analysis of our financial results

as reported under GAAP. In addition, other companies may calculate

Adjusted EBITDA and Adjusted EBITDA margin or similarly titled

measures differently, which may reduce their usefulness as

comparative measures.

| |

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

|

(in thousands) |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Loss from continuing operations |

$ |

(12,773 |

) |

|

$ |

(1,400 |

) |

|

$ |

(16,863 |

) |

|

$ |

(658 |

) |

|

Depreciation and amortization |

|

25,579 |

|

|

|

15,831 |

|

|

|

43,022 |

|

|

|

30,916 |

|

|

Impairment expense |

|

— |

|

|

|

836 |

|

|

|

— |

|

|

|

1,020 |

|

|

Other expense (income), net |

|

2,088 |

|

|

|

(177 |

) |

|

|

4,428 |

|

|

|

(1,294 |

) |

|

Income tax (benefit) expense |

|

(5,200 |

) |

|

|

1,459 |

|

|

|

(6,226 |

) |

|

|

2,141 |

|

|

Stock-based compensation |

|

2,270 |

|

|

|

2,603 |

|

|

|

6,236 |

|

|

|

6,320 |

|

|

Integration and acquisition |

|

11,325 |

|

|

|

301 |

|

|

|

11,943 |

|

|

|

432 |

|

|

Adjusted EBITDA |

$ |

23,289 |

|

|

$ |

19,453 |

|

|

$ |

42,540 |

|

|

$ |

38,877 |

|

| |

|

|

|

|

|

|

|

|

Adjusted EBITDA margin |

|

27 |

% |

|

|

29 |

% |

|

|

27 |

% |

|

|

29 |

% |

Supplemental Information

Operating Statistics

| |

June 30,2024 |

|

June 30,2023 |

|

Homes and businesses passed (1) |

530,076 |

|

|

396,035 |

|

|

Incumbent Broadband Markets (4) |

232,531 |

|

|

213,188 |

|

|

Glo Fiber Expansion Markets (5) |

297,545 |

|

|

182,847 |

|

| |

|

|

|

|

Residential & Small and Medium Business ("SMB") Revenue

Generating Units ("RGUs"): |

|

|

|

|

Broadband Data |

164,566 |

|

|

142,247 |

|

|

Incumbent Broadband Markets (4) |

111,256 |

|

|

109,404 |

|

|

Glo Fiber Expansion Markets (5) |

53,310 |

|

|

32,843 |

|

|

Video |

42,079 |

|

|

44,800 |

|

|

Voice |

44,126 |

|

|

40,313 |

|

|

Total Residential & SMB RGUs (excludes RLEC) |

250,771 |

|

|

227,360 |

|

| |

|

|

|

|

Residential & SMB Penetration (2) |

|

|

|

|

Broadband Data |

31.0 |

% |

|

35.9 |

% |

|

Incumbent Broadband Markets (4) |

47.8 |

% |

|

51.3 |

% |

|

Glo Fiber Expansion Markets (5) |

17.9 |

% |

|

18.0 |

% |

|

Video |

7.9 |

% |

|

11.3 |

% |

|

Voice |

8.7 |

% |

|

10.7 |

% |

| |

|

|

|

|

Fiber route miles |

16,029 |

|

|

9,082 |

|

|

Total fiber miles (3) |

1,798,211 |

|

|

767,173 |

|

______________________________________________________(1) Homes and

businesses are considered passed (“passings”) if we can connect

them to our network without further extending the distribution

system. Passings is an estimate based upon the best available

information. Passings will vary among video, broadband data and

voice services. (2) Penetration is calculated by dividing the

number of users by the number of passings or available homes, as

appropriate. (3) Total fiber miles are measured by taking the

number of fiber strands in a cable and multiplying that number by

the route distance. For example, a 10 mile route with 144

fiber strands would equal 1,440 fiber miles.(4) Incumbent Broadband

Markets consists of Shentel Incumbent Cable Markets and Horizon

Incumbent Telephone Markets with Fiber-To-The-Home (“FTTH”)

passings.(5) Glo Fiber Expansion Markets consists of FTTH passings

in greenfield expansion markets in the Shentel and former Horizon

markets.

|

Residential and SMB ARPU |

|

|

|

|

|

|

|

| |

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Residential and SMB Revenue: |

|

|

|

|

|

|

|

|

Broadband Data |

$ |

40,823 |

|

$ |

34,152 |

|

$ |

79,404 |

|

$ |

67,326 |

|

Incumbent Broadband |

|

28,324 |

|

|

27,172 |

|

|

56,122 |

|

|

54,445 |

|

Glo Fiber Expansion Markets |

|

12,499 |

|

|

6,980 |

|

|

23,282 |

|

|

12,881 |

|

Video |

|

14,913 |

|

|

14,411 |

|

|

29,307 |

|

|

29,056 |

|

Voice |

|

3,283 |

|

|

3,054 |

|

|

6,306 |

|

|

6,084 |

|

Discounts, adjustments and other |

|

34 |

|

|

950 |

|

|

524 |

|

|

1,860 |

|

Total Residential and SMB Revenue |

$ |

59,053 |

|

$ |

52,567 |

|

$ |

115,541 |

|

$ |

104,326 |

| |

|

|

|

|

|

|

|

|

Average RGUs: |

|

|

|

|

|

|

|

|

Broadband Data |

|

162,581 |

|

|

140,481 |

|

|

157,999 |

|

|

138,376 |

|

Incumbent Broadband |

|

111,689 |

|

|

109,716 |

|

|

110,472 |

|

|

109,737 |

|

Glo Fiber Expansion Markets |

|

50,892 |

|

|

30,765 |

|

|

47,527 |

|

|

28,639 |

|

Video |

|

42,443 |

|

|

45,229 |

|

|

41,869 |

|

|

45,749 |

|

Voice |

|

43,865 |

|

|

40,164 |

|

|

42,277 |

|

|

40,078 |

| |

|

|

|

|

|

|

|

|

ARPU: (1) |

|

|

|

|

|

|

|

|

Broadband Data |

$ |

83.70 |

|

$ |

81.03 |

|

$ |

83.76 |

|

$ |

81.06 |

|

Incumbent Broadband |

$ |

84.53 |

|

$ |

82.55 |

|

$ |

84.67 |

|

$ |

82.69 |

|

Glo Fiber Expansion Markets |

$ |

81.86 |

|

$ |

75.63 |

|

$ |

81.64 |

|

$ |

74.96 |

|

Video |

$ |

117.12 |

|

$ |

106.21 |

|

$ |

116.66 |

|

$ |

105.85 |

|

Voice |

$ |

24.95 |

|

$ |

25.35 |

|

$ |

24.86 |

|

$ |

25.30 |

______________________________________________________(1) Average

Revenue Per RGU calculation = (Residential & SMB Revenue) /

average RGUs / 3 months.

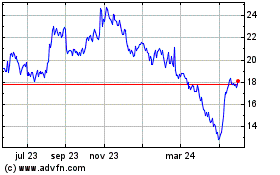

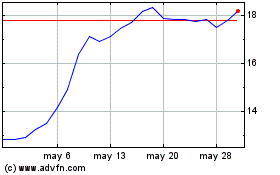

Shenandoah Telecommunica... (NASDAQ:SHEN)

Gráfica de Acción Histórica

De Jul 2024 a Ago 2024

Shenandoah Telecommunica... (NASDAQ:SHEN)

Gráfica de Acción Histórica

De Ago 2023 a Ago 2024