Soluna Holdings Reports Q1’24 Results

16 Mayo 2024 - 7:00AM

Business Wire

Quarterly Adjusted EBITDA jumps by $8.1 million

year-over-year, Cash grows by 32%

Soluna Holdings, Inc. (“SHI” or the “Company”), (NASDAQ: SLNH),

a developer of green data centers for intensive computing

applications including Bitcoin mining and AI, announced financial

results for the first quarter ended March 31, 2024.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240516765827/en/

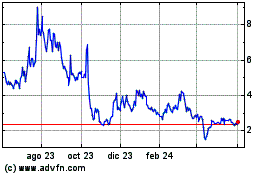

Soluna Holdings Adjusted EBITDA &

Revenue FY 2023-23 by Quarter (in 000's) (Graphic: Business

Wire)

John Belizaire, CEO of Soluna, said, “This year’s first quarter

is the first time Projects Sophie, Dorothy 1A, and Dorothy 1B were

fully operational and scaled up as can be seen in our strong

financial performance. Revenue grew 307% while Cost of Revenue grew

only 78% and General and Administrative Expenses shrank by 5%,

yielding a positive Operating Income of $0.407M compared to last

year this time.”

Belizaire went further on to say, “Our strategic diversification

to Data Hosting is paying off and has us focused on several

important and exciting new projects that we look forward to

announcing in the coming months. We have positioned ourselves well

for Post-Halving and are driving hard to launch the recently

announced Soluna Cloud business and confirm Dorothy 2 financing and

timing.”

Finance and Operational Highlights:

- Record Adjusted EBITDA – Adjusted EBITDA (non-GAAP)

ramped to $5.1 million compared to the first quarter of 2023 of

($2.9) million, an increase of $8.1 million driven by strong

revenue growth and cost discipline.

- Strong Cash Growth – Cash grew 85% from the first

quarter of 2023 and 32% from the end of 2023 to $8.4 million.

- Another Record Revenue Quarter – Revenue continued to

grow, up 24% to $12.5 million compared to $10.1 million in the

fourth quarter of 2023.

- Completed Winter Demand Response System Period – As part

of its ancillary services plan, Soluna earned $875,000 as it

completed the program’s winter period at Project Dorothy,

demonstrating our ability to effectively diversify sources of

revenue.

- Soluna Launches New AI Cloud Service – The Company

recently announced its new AI Cloud service, Soluna Cloud, in

collaboration with a leading High Performance Computing Company,

during the second quarter of 2024.

- Post-Halving Optimizations – The Company continued its

post-halving optimization plan to boost hashrate for its hosting

clients and its proprietary mining operations. The Company’s

optimizations include MaestroOS™ upgrades to increase granular

control of miners, sites with industry-leading Power Usage

Effectiveness (PUE) and electrical design, software-based tuning to

improve J/TH, and preventative maintenance using predictive

systems.

- New CFO – John Tunison was appointed as CFO, replacing

David Michaels who will be returning to his role on the board.

Financial Summary:

Key financial results for the first quarter include:

- The strong first quarter results of $12.6 million in revenue

represented a 24% increase as compared to the fourth quarter of

2023 and an increase of 307% compared to the first quarter

of 2023.

- Cryptocurrency Mining Revenue increased by approximately

$3.6 million - compared to the first quarter of 2023, due to a

significant increase related to the average price of Bitcoin

increasing by 134%. In addition, the dollars per Petahash per

day was 26.6% higher.

- Data Hosting Revenue increased by approximately $5.0 million

- compared to the first quarter of 2023, primarily related to

the energization and deployment of hosting customers at Project

Dorothy 1A in the second quarter of 2023.

Revenue & Cost of Revenue

by Project Site

First Quarter 2024

(dollars in Thousands)

Project Dorothy 1B

Project Dorothy 1A

Project Sophie

Project Marie

Other

Total

Cryptocurrency mining revenue $

6,396

$

-

$ $

-

$

-

$

6,396

Data hosting revenue

-

3,542

1,736

5,278

Demand response services

-

-

875

875

Total revenue $

6,396

$

3,542

$

1,736

$

-

$

875

$

12,549

Cost of cryptocurrency mining, exclusive of depreciation $

1,841

$

-

$ $

-

$

-

1,841

Cost of data hosting revenue, exclusive of depreciation

-

1,737

514

-

-

2,251

Cost of revenue- depreciation

1,084

284

150

-

2

1,523

Total cost of revenue $

2,925

$

2,021

$

664

$

-

$

2

$

5,615

Revenue & Cost of Revenue

by Project Site

First Quarter 2023

(Dollars in thousands)

Project Dorothy 1B Project

Dorothy 1A Project Sophie Project Marie

Other Total Cryptocurrency mining revenue $

-

$

-

$

2,027

$

769

$

-

$

2,796

Data hosting revenue

-

-

-

276

10

286

Demand response services

-

-

-

-

-

-

Total revenue $

-

$

-

$

2,027

$

1,045

$

10

$

3,082

Cost of cryptocurrency mining, exclusive of depreciation $

61

$

-

1,389

801

-

2,251

Cost of data hosting revenue, exclusive of depreciation

-

58

-

214

-

272

Cost of revenue- depreciation

-

-

503

122

-

625

Total cost of revenue $

61

$

58

$

1,892

$

1,137

$

-

$

3,148

- Gross Profit improved by nearly $7.0 million - as

operations pivoted to Data Hosting and Project Dorothy reached full

energization, costs of revenue either met or exceeded expectations,

enabling strong Gross Profit growth from ($0.1 million) for the

first quarter of 2023 to $6.9 million for the first quarter of

2024.

- Record Adjusted EBITDA of $5.1 million – Adjusted EBITDA

(non-GAAP) ramped from ($2.9 million) to $5.1 million, an increase

of $8.0 million driven by strong revenue growth and cost

discipline.

- General and administrative expenses excluding depreciation

and amortization decreased by approximately $366 thousand or 8% for

the first quarter of 2024 - to $4.0 million from $4.4 million

compared to the first quarter of 2023. Stock-based compensation

costs were lower, at $656 thousand, for the first quarter of

2024.

- Legal fees were reduced by approximately $469 thousand -

compared to the three months ended March 31, 2023, mainly

attributable to fewer legal fees associated with Project Dorothy 1A

and 1B with Spring Lane.

- General and administrative stock-based compensation expense

decreased by approximately $166 thousand - for the three months

ended March 31, 2024, compared to the three months ended March 31,

2023, due to an acceleration of the Company’s grants and awards

that occurred in May of 2023

- Investor relations decreased by $92 thousand - compared

to the three months ended March 31, 2023, due to expenses

associated with higher investor acquisition programs, in addition

to the Special Meeting held in March 2023.

- Accounting for warrant modifications - a requirement for

Shareholders to vote on modifications to warrants related to the

Convertible Loan Note 4th Amendment during the period gave rise to

a liability during the first quarter. The impact was to reduce

Additional Paid in Capital (APIC) and establish a Current Warrant

Liability which was revalued to $6.0 million as of the end of March

2024.

The unaudited financial statements are available online,

here. A presentation of this First Quarter Update can

also be found online, here.

___

Safe Harbor Statement

This announcement contains forward-looking statements. These

statements are made under the "safe harbor" provisions of the U.S.

Private Securities Litigation Reform Act of 1995. These

forward-looking statements can be identified by terminology such as

"will," "expects," "anticipates," "future," "intends," "plans,"

"believes," "estimates," "confident" and similar statements. Soluna

Holdings, Inc. may also make written or oral forward-looking

statements in its periodic reports to the U.S. Securities and

Exchange Commission, in its annual report to shareholders, in press

releases and other written materials and in oral statements made by

its officers, directors or employees to third parties. Statements

that are not historical facts, including but not limited to

statements about Soluna’s beliefs and expectations, are

forward-looking statements. Forward-looking statements involve

inherent risks and uncertainties, further information regarding

which is included in the Company's filings with the Securities and

Exchange Commission. All information provided in this press release

is as of the date of the press release, and Soluna Holdings, Inc.

undertakes no duty to update such information, except as required

under applicable law.

In addition to figures prepared in accordance with GAAP, Soluna

from time to time presents alternative non-GAAP performance

measures, e.g., EBITDA, adjusted EBITDA, adjusted net profit/loss,

adjusted earnings per share, free cash flow. These measures should

be considered in addition to, but not as a substitute for, the

information prepared in accordance with GAAP. Alternative

performance measures are not subject to GAAP or any other generally

accepted accounting principle. Other companies may define these

terms in different ways.

About Soluna Holdings, Inc (SLNH)

Soluna is on a mission to make renewable energy a global

superpower using computing as a catalyst. The company designs,

develops and operates digital infrastructure that transforms

surplus renewable energy into global computing resources. Soluna’s

pioneering data centers are strategically co-located with wind,

solar, or hydroelectric power plants to support high-performance

computing applications including Bitcoin Mining, Generative AI, and

other compute intensive applications. Soluna’s proprietary software

MaestroOS(™) helps energize a greener grid while delivering

cost-effective and sustainable computing solutions, and superior

returns. To learn more visit solunacomputing.com. Follow us on X

(formerly Twitter) at @SolunaHoldings.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240516765827/en/

John Tunison Chief Financial Officer Soluna Holdings, Inc.

jtunison@soluna.io

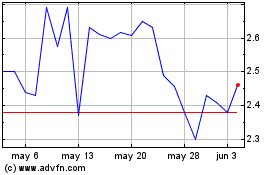

Soluna (NASDAQ:SLNH)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Soluna (NASDAQ:SLNH)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025