UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

|

|

|

SEC

FILE NUMBER

|

|

|

FORM 12b-25

|

001-39042

|

|

|

|

|

|

|

NOTIFICATION OF LATE FILING

|

CUSIP

|

|

|

|

L0164E116

|

|

(Check one):

|

¨ Form10 K

|

x Form 20-F

|

¨ Form 11-K

|

¨ Form 10-Q

|

¨ Form 10-D

|

¨ Form N-SAR

|

|

|

¨ Form N-CSR

|

|

|

|

|

|

For Period Ended:

December 31, 2019

¨ Transition

Report on Form 10-K

¨ Transition

Report on Form 20-F

¨ Transition

Report on Form 11-K

¨ Transition

Report on Form 10-Q

¨ Transition

Report on Form N-SAR

For the Transition

Period Ended: __________________

Nothing in this form shall be construed

to imply that the Commission has verified any information contained herein.

If the notification

relates to a portion of the filing checked above, identify the Item(s) to which the notification relates:

PART I — REGISTRANT INFORMATION

Akazoo S.A.

Full Name of Registrant

Modern Media Acquisition Corp S.A.

Former Name if Applicable

19 Rue de Bitbourg

Address of Principal Executive

Office (Street and Number)

L-1273 Luxembourg

Grand Duchy of Luxembourg

City, State and Zip Code

PART II — RULES 12b-25(b) AND

(c)

If the subject report could

not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following

should be completed. (Check box if appropriate)

|

|

(a)

|

The reason

described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense;

|

|

¨

|

(b)

|

The subject

annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-CEN or Form N-CSR, or portion thereof,

will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report

or transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be filed on or before

the fifth calendar day following the prescribed due date; and

|

|

|

(c)

|

The accountant’s statement or other exhibit required

by Rule 12b-25(c) has been attached if applicable.

|

PART III — NARRATIVE

State below in reasonable detail

why Forms 10-K, 20-F, 11-K, 10-Q, 10-D, N-CEN, N-CSR, or the transition report or portion thereof, could not be filed within

the prescribed time period.

As previously disclosed in a Report on Form

6-K dated April 23, 2020, the Board of Directors (the “Board”) of Akazoo S.A. (the “Company”) has formed

a special committee of independent directors (the “Special Committee”) to investigate the allegations in a report released

by Quintessential Capital Management on April 20, 2020, with the assistance of outside counsel and forensic and technical accounting

advisors.

Also as previously disclosed in

a Report on Form 6-K dated May 1, 2020, the Special Committee has been unable to verify certain operational and financial information

previously reported by the Company. Accordingly, the Special Committee has concluded that the consolidated financial statements

(i) of Akazoo Limited for the years ended December 31, 2018, 2017 and 2016 (and any interim periods therein) audited by

the Company’s former independent registered public accounting firm included or incorporated

by reference in the Company’s Shell Company Report on Form 20-F filed with the U.S. Securities and Exchange Commission (the

“SEC”) on September 17, 2019; (ii) of Akazoo Limited for the three- and six-month periods ended June 30, 2019 and 2018

included in the Company’s Report on Form 6-K furnished to the SEC on September 27, 2019; and (iii) of the Company for the

three- and nine-month periods ended September 30, 2019 and 2018 included in the Company’s Report on Form 6-K furnished to

the SEC on December 9, 2019 should no longer be relied upon due to the possibility that such financial statements contain material

errors. The work of the Special Committee is continuing.

As a result of the foregoing, and due to the

additional time needed for management to prepare the financial statements to be included in the Form 20-F for the year ended December

31, 2019 (the “Form 20-F”) and for the Company’s independent auditors to complete the audit of such financial

statements, the Company was unable to file the Form 20-F by April 30, 2020, without unreasonable effort or expense.

PART IV — OTHER INFORMATION

(1)

Name and telephone number of person to contact in regard to this notification

|

Michael Knott

|

|

+44 20 3727

1193

|

|

(Name)

|

|

(Telephone Number)

|

|

|

(2)

|

Have all other periodic reports required under Section 13 or 15(d) of

the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for

such shorter period that the registrant was required to file such report(s) been filed? If answer is no, identify

report(s). Yes x No ¨

|

|

|

(3)

|

Is it anticipated that any significant change

in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements

to be included in the subject report or portion thereof? Yes x No

¨

|

If so, attach an explanation

of the anticipated change, both narratively and quantitatively, and, if appropriate, state the reasons why a reasonable estimate

of the results cannot be made.

The Special Committee investigation is ongoing,

and we are unable to provide a reasonable estimate of our results of operations for the year-ended December 31, 2019. As a result,

we are unable to estimate what significant changes will be reflected in our 2019 results of operations compared to our 2018 results

of operations.

Cautionary Note Regarding

Forward-Looking Statements

This Form 12b-25 contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including,

without limitation, the Company’s expectations as to when it will be in a position to finalize its audited financial statements,

to file its Annual Report and whether there will be any significant change in its previously reported results of operations.

These forward-looking statements involve risks

and uncertainties, and actual results could vary materially from these forward-looking statements. Factors that may cause future

results to differ materially from management’s current expectations include, among other things, the discovery of additional

information relevant to the internal investigation; the conclusions of the special committee (and the timing of the conclusions)

concerning matters relating to the internal investigation; the timing of the review by, and the conclusions of, the Company’s

independent registered public accounting firm regarding the internal investigation and the Company’s financial statements;

the possibility that additional allegations may be made or issues are uncovered as a result of the internal investigation; and

the risk that the completion and filing of the Annual Report will take longer than expected. The Company disclaims any obligation

to update information contained in these forward-looking statements whether as a result of new information, future events, or otherwise.

|

Akazoo S.A.

|

|

(Name of Registrant as Specified in Charter)

|

has caused this notification

to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date

|

May 1, 2020

|

|

By:

|

/s/ Lewis W. Dickey, Jr.

|

|

|

|

|

|

Name: Lewis J. Dickey, Jr.

|

|

|

|

|

|

Title: Chairman of the Board of Directors

|

|

|

ATTENTION

|

|

Intentional misstatements or omissions of fact constitute Federal Criminal Violations (See 18 U.S.C. 1001).

|

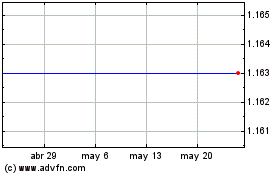

Akazoo (NASDAQ:SONG)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Akazoo (NASDAQ:SONG)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024