As

filed with the Securities and Exchange Commission on November [__], 2024.

Registration

No. 333-[ ]

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

| SACKS

PARENTE GOLF, INC. |

| (Exact

name of registrant as specified in its charter) |

| Delaware |

|

3949 |

|

82-4938288 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Primary

standard industrial

classification

code number) |

|

(I.R.S.

employer

identification

number) |

551

Calle San Pablo

Camarillo,

California 93012

(855)

774-7888

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Gregor

Campbell

Chief

Executive Officer

551

Calle San Pablo

Camarillo,

California 93012

(855)

774-7888

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

David

L. Ficksman, Esq.

R.

Joilene Wood, Esq.

TroyGould

PC

1801

Century Park East, 16th Floor

Los

Angeles, CA 90067

Tel:

(310) 789-1290 |

|

Anthony

W. Basch, Esq.

J.

Britton Williston, Esq.

Shannon

M. McDonough, Esq.

Kaufman

& Canoles

Two

James Center, 14th floor

Richmond,

VA 23219

Tel:

(804) 771-5700 |

Approximate

date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933 check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”,

“smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

Emerging

growth company |

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date

as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not

soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The

information in this prospectus is not complete and may be changed. The securities may not be sold until the registration statement filed

with the SEC is declared effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy

these securities in any state where the offer or sale is not permitted.

Subject

to Completion, dated November [___], 2024

PRELIMINARY

PROSPECTUS

SACKS

PARENTE GOLF, INC.

[_____]

Common Units, each consisting of [ ] shares of Common Stock, Series A Warrants and Series B Warrants and/or

[_____]

Pre-Funded Units consisting of Pre-Funded Warrants, Series A Warrants and Series B Warrants (and [___] to purchase up to [_____] shares

of Common Stock underlying the Pre-Funded Warrants)

Up

to [_____] shares of Common Stock underlying the Series A Warrants

Up

to [_____] shares of Common Stock Underlying the Series B Warrants

This

is a firm commitment public offering of [_____] common units (“Common Units”) at an assumed public offering price

of $[…..] per Common Unit, which is last reported sales price of our common stock on the Nasdaq Capital Market (“Nasdaq”)

on December [….] 2024. Each Common Unit consists of (a) one share of our common stock, par value $0.01 per share (“common

stock”), (b) one Warrant to purchase one share of our common stock at an exercise price of $[ ] per share (or 125% of the price

of each Common Unit sold in the offering) which Warrant will expire on the five-year anniversary of the date of the Warrant Stockholder

Approval (defined below) (the “Series A Warrants”), and (c) one Warrant to purchase one share of our common stock at an exercise

price of $[ ] per share (or 125% of the price of each Common Unit sold in the offering) or pursuant to an alternative cashless exercise

option, which Warrant will expire on the two and one-half-year anniversary of the date of the Warrant Stockholder Approval (the “Series

B Warrants” and, together with the Series A Warrants, the “Common Warrants”).

Beginning

on the date of the Warrant Stockholder Approval, the Series A Warrants will contain a reset of the exercise price to a price equal to

the lesser of (i) the then exercise price and (ii) the lowest volume weighted average price (VWAP) for the five trading days immediately

following the date we effect a reverse split with a proportionate adjustment to the number of shares underlying the Series A Warrants

(a “Reverse Split Reset”). Any such adjustment will be subject to a floor price (“the Floor Price”) calculated

as follows: (a) prior to the date of the Warrant Stockholder Approval, 50% of the Nasdaq Minimum Price, and (b) after the date of the

Warrant Stockholder Approval, 20% of the Nasdaq Minimum Price. Nasdaq Minimum Price means the lower of the Nasdaq closing price or the

average closing price for the five immediately preceding trading days, all as of the date of the Warrant Stockholder Approval. Additionally,

with certain exceptions, beginning on the date of the Warrant Stockholder Approval, the Series A Warrants will provide for an adjustment

to the exercise price and number of shares underlying the Series A Warrants ( the “Dilutive Adjustment”) upon our issuance

of our common stock or common stock equivalents at any time after the closing of the offering, at a price per share that is less than

the then-current exercise price of the Series A Warrants. Any Dilutive Adjustment will be subject to the Floor Price. Beginning on the

date of the Warrant Stockholder Approval, in lieu of a cash exercise, the holder of the Series B Warrants has the right to elect to receive

an aggregate number of shares of common stock equal to the product of (x) the aggregate number of shares of common stock that would be

issuable upon a cash exercise of the Series B Warrants and (y) 2.0. Also, the Series B Warrants will provide for a Reverse Split Reset

subject to the Floor Price. Additionally, effective on the 11th trading day following the date of the Warrant Stockholder

Approval, the exercise price and the number of shares underlying the Common Warrants will be reset to the then-current lowest VWAP in

the period commencing on the first trading day following the date of the Warrant Stockholder Approval and ending the close of trading

on the tenth trading day thereafter. Such reset will be subject to the Floor Price. With respect to all of the Common Warrants, with

the consent of the holder, we may adjust the exercise price to such amount and for such time as may be agreed upon. None of the Common

Warrants may be exercisable until the Warrant Stockholder Approval. Finally, until the three-month anniversary of the date of the Warrant

Stockholder Approval, the Company is prohibited from effecting or entering into an agreement to effect any issuance by the Company of

Common Stock or Common Stock equivalence involving a variable rate transaction (as defined in the applicable Warrant).

We

have agreed to hold a stockholders meeting within 60 days after the closing of this offering (and every 60 days thereafter until approval

of our stockholders has been obtained (“Warrant Stockholder Approval”) to approve the following matters: (i) exercisability

of the Common Warrants, (ii) removal of clause (a) of the Floor Price definition, (iii) adjustment of the exercise price and number of

Common Warrants pursuant to such adjustment, (iv) the Reverse Split Reset, (v) the Dilutive Adjustment, and (vi) the voluntary adjustment

provisions. In the event that we are unable to obtain the Warrant Stockholder Approval, the Common Warrants will not be exercisable,

and therefore the Common Warrants will have no value. See the Risk Factor on page 16 relating to the Common Warrants and Warrant Stockholder

Approval.

The

public offering price per Common Unit will be determined between us and the underwriter based on market conditions at the time of pricing,

and may be at a discount to the then current market price of our common stock. Therefore, the recent market price of our common stock

referenced throughout this preliminary prospectus may not be indicative of the final offering price per Common Unit. The Common Units

have no stand-alone rights and will not be certified or issued as stand-alone securities. The common stock or Pre-Funded Units (as defined

below) and the Common Warrants are immediately separable and will be issued separately in this offering.

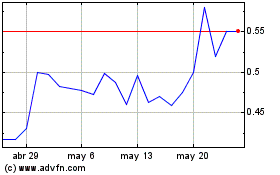

Our

common stock is listed on Nasdaq under the symbol “SPGC”. The closing price of our common stock on Nasdaq on December [___],

2024 was $[___] per share.

We

are also offering to investors in Common Units that would otherwise result in the investor’s beneficial ownership exceeding 4.99%

(or, at the election of the purchaser, 9.99%) of our outstanding shares of common stock immediately following the consummation of this

offering the opportunity to purchase Prefunded Units in lieu of Common Units. Each Pre-Funded Unit consists of one pre-funded warrant

(“Pre-Funded Warrant”) to purchase one share of our common stock, one Series A Warrant and one Series B Warrant. The purchase

price of each Pre-Funded Unit is $.... (which is equal to the assumed public offering price per Common Unit minus $.001). Subject to

limited exceptions, a holder of Pre-Funded Warrants will not have the right to exercise any portion of its Pre-Funded Warrants if the

holder, together with its affiliates, would beneficially own in excess of 4.99% (or, at the election of the holder, such limit may be

increased to up to 9.99%) of the common stock outstanding immediately after giving effect to such exercise.. The Pre-Funded Warrants

will be immediately exercisable (subject to the beneficial ownership cap) and may be exercised at any time until all of the Pre-Funded

Warrants are exercised in full. For each Pre-Funded Unit purchased, the number of Units including a share of common stock we are offering

will be decreased on a one-for-one basis. The Pre-Funded Units have no stand-alone rights and will not be certificated or issued as stand-alone

securities.

We

have engaged Aegis Capital Corp. (the “underwriter” or “Aegis”), to act as our exclusive underwriter in connection

with this offering.

There

is no established trading market for the Pre-Funded Units, the Pre-Funded Warrants or the Common Warrants and we do not expect an active

trading market to develop. We do not intend to list the Pre-Funded Warrants or the Common Warrants on any securities exchange or other

trading market. Without an active trading market, the liquidity of these securities will be limited.

Investing

in our securities is speculative and involves a high degree of risk. You should carefully consider the risk factors beginning on page

16 of this prospectus before purchasing our securities.

We

are an “emerging growth company” under the federal securities laws and are subject to reduced public company reporting requirements.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | |

Per Common Unit(1) | | |

Total | |

| Public offering price | |

$ | | | |

$ | | |

| Underwriter discounts (2) | |

| | | |

| | |

| Proceeds to us, before expenses | |

$ | | | |

$ | | |

| (1) |

Assumes

all Units consist of one share of common stock and [ ] Common Warrants. |

| (2) |

We

have agreed to pay the underwriter a cash fee equal to 7.0% of the aggregate gross proceeds raised in this offering, and to reimburse

the underwriter for certain of its offering-related expenses, including its legal fees, up to a maximum of $100,000. See “Underwriting”

for a description of the compensation to be received by the underwriter. |

We

have granted the underwriter a 45-day option to purchase up to [ ] additional shares of common stock, representing 15% of the Common

Units sold in the offering (at an assumed public offering price of $[ ] per Common Unit, which is the last reported sales price of our

common stock on the Nasdaq Capital Market on December [ ], 2024) and/or up to [ ] additional Pre-Funded Warrants, representing 15% of

the Pre-Funded Warrants sold in the offering, and/or up to [ ] additional Series A Warrants, representing 15% of the Series A Warrants

sold in the offering, and/or up to [ ] additional Series B Warrants, representing 15% of the Series B Warrants sold in the offering,

on the same terms and conditions set forth above solely to cover over-allotments. The underwriter may exercise the over-allotment option

with respect to shares of common stock only, Pre-Funded Warrants only, Series A Warrants only, Series B Warrants only, or any combination

thereof.

The

underwriter is expected to deliver the Common Units (and Pre-Funded Units, if any) on or about December [__ ], 2024, subject to the satisfaction

of customary closing conditions.

Sole

Underwriter

Aegis

Capital Corp.

The

date of this prospectus is November [__], 2024.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

You

should rely only on the information contained in or incorporated by reference into this prospectus and in any free writing prospectus.

We have not and the underwriter has not authorized anyone to provide you with information different from that contained in this prospectus.

We are offering to sell, and seeking offers to buy, our securities only in jurisdictions where offers and sales are permitted. The information

in this prospectus is accurate only as of the date of this prospectus, and any information we have incorporated by reference is accurate

only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any sale of our

securities.

Neither

we nor the underwriter have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction

where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession

of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of our securities and the distribution

of this prospectus outside of the United States.

We

own or have rights to trademarks or trade names that we use in connection with the operation of our business, including our corporate

names, logos and website names. In addition, we own or have the rights to copyrights, trade secrets and other proprietary rights that

protect the content of our products. This prospectus may also contain trademarks, service marks and trade names of other companies, which

are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names or products

in this prospectus is not intended to, and should not be read to, imply a relationship with or endorsement or sponsorship of us. Solely

for convenience, some of the copyrights, trade names and trademarks referred to in this prospectus are listed without their ©, ®

and TM symbols, but we will assert, to the fullest extent under applicable law, our rights to our copyrights, trade names

and trademarks. All other trademarks are the property of their respective owners.

PROSPECTUS

SUMMARY

The

following summary highlights information contained or incorporated by reference elsewhere in this prospectus and does not contain all

of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully

read this entire prospectus, including our consolidated financial statements and the related notes and other documents incorporated by

reference herein, as well as the information under the caption “Risk Factors” herein and under similar headings in the other

documents that are incorporated by reference into this prospectus including documents that are filed after the date hereof. Some of the

statements in this prospectus constitute forward-looking statements that involve risks and uncertainties. See “Cautionary Note

Regarding Forward-Looking Statements”. Our actual results could differ materially from those anticipated in such forward-looking

statements as a result of certain factors, including those discussed in the “Risk Factors” and other sections included in

or incorporated by reference herein. In this prospectus, unless otherwise stated or the context otherwise requires, references to “SPGC”,

the “Company”, “we”, “us”, “our”, or similar references mean Sacks Parente Golf, Inc.

Overview

We

are a technology-forward golf company, with a growing portfolio of golf products, including putting instruments, golf shafts, golf grips,

and other golf-related products. In consideration of its growth opportunities in shaft technologies, in April of 2022, we expanded our

manufacturing business to include advanced premium golf shafts by opening a new shaft manufacturing facility in St. Joseph, MO. It is

our intent to manufacture and assemble substantially all products in the United States as is economically feasible. We anticipate expansion

into golf apparel and other golf-related product lines to enhance its growth. Our future expansions may include broadening its offerings

through mergers, acquisitions or internal developments of product lines that are complementary to its premium brand.

We

currently sell our products through our websites, resellers, and distributors in the United States, Japan, and South Korea.

Historical

Development

We

were formed in 2018 as Sacks Parente Golf Company, LLC, a Delaware limited liability company. On March 18, 2022 we converted into a Delaware

corporation named Sacks Parente Golf, Inc. Pursuant to our Plan of Conversion, on March 18, 2022, all of the outstanding ownership interests

in Sacks Parente Golf Company, LLC, and rights to receive such interest were converted into and exchanged for shares of capital stock

of Sacks Parente Golf, Inc. We retroactively reflected the conversion as of the earliest periods presented herein.

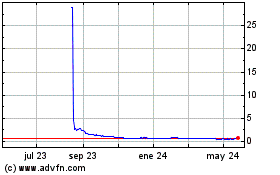

On

August 17, 2023, we closed its initial public offering pursuant to which we sold 320,000 shares of our common stock at a price of $40.00

per share. We received total proceeds, net of fees, of $11,029,000.

On

October 8, 2024, we entered into an underwriting agreement with Aegis relating to the sale of up to 366,000 shares of our common stock

at a public offering price of $2 per share. The offering closed on October 10, 2024. The net proceeds to us for the offering were approximately

$536,000, after deducting underwriting discounts and commissions and estimated offering expenses.

Going

Concern

As

reflected in our financial statements, during the year ended December 31, 2023 and the nine months ended September 30, 2024, we recorded

a net loss of $4,625,000 and $3,408,000, respectively, and used cash in operations for such periods of $5,047,000 and $3,431,000,

respectively. These factors raise substantial doubt about our ability to continue as a going concern within one year after the date of

the financial statements being issued. Our ability to continue as a going concern is dependent upon our ability to raise additional funds

and implement our business plan. The financial statements do not include any adjustments that might be necessary if we are unable to

continue as a going concern.

At

September 30, 2024, we had cash on hand in the amount of $1,313,000. Our continuation as a going concern is dependent upon our ability

to obtain necessary debt or equity financing to continue operations until it begins generating positive cash flow. No assurance can be

given that any future financing will be available or, if available, that it will be on terms that are satisfactory to us. Even if we

are able to obtain additional financing, it may contain undue restrictions on our operations, in the case of debt financing or cause

substantial dilution for our stockholders, in case or equity financing.

Industry

Overview

The

golf equipment market size is estimated at USD 13.32 billion in 2023, and is expected to reach USD 17.64 billion by 2028, growing at

a CAGR of 5.78% during the forecast period (2023-2028).

In

recent years, there has been an increase in young golfers, causing equipment sales to rise. It is one of the significant factors driving

golf equipment sales. The growing middle-class income and the increasing number of professional golfers over the last few years are contributing

to the substantial increase in demand. The participation rate in pro-golf tournaments is increasing, especially among millennials, further

boosting golf equipment sales worldwide. Based on a survey by the National Golf Foundation in 2021, golf is now played in 206 out of

the 251 countries. There are around 38,000 golf courses in over 82% of countries worldwide. Globally, millions of people of all ages

are attracted to golf, participating in the International Golf Federation’s programs and events. Including golf in the Olympic

Games has contributed to a sudden increase in golfers worldwide. The market is highly impacted by product innovations carried out by

key players and considerable investments in marketing and promotional activities to reach a broad customer base. With the substantial

growth of the golf tourism industry, the market is anticipated to have a positive outlook in the coming years. European countries are

investing heavily in Infrastructural developments of the game and hosting many international golf events and competitions. For instance,

in October 2022, several golf courses in Portugal invested heavily in improvements, with some new courses opening and others being upgraded.

Such investments in golf courses are further anticipated to boost the inflow of sports tourists and influence the market positively during

the study period.

Rise

in Demand for Golf Equipment from Asia-Pacific

The

Asia-Pacific golf equipment market is driven by the rising popularity of golf in Japan, China, South Korea, and Thailand, among other

countries. There has been phenomenal growth in the Asia-Pacific golf industry. During the next few years, the golf clothing and equipment

market in the Asia-Pacific region is expected to grow, with major countries such as China, India, Australia, and Japan contributing to

the market growth. Japan is one of the major countries in the Asia-Pacific region in terms of the number of golf players, owing to the

rising awareness about golf and an increase in the golfer population in the country. According to the Ministry of Economy, Trade, and

Industry (METI), the golfing population in Japan increased from 8.93 million in 2018 to approximately 10.3 million in 2021. As the population

becomes more aware of sports and the disposable income of individuals rises, there is a strong likelihood that the regional market will

continue to grow. In addition to already established international brands, the market in the region is being driven by a rise in the

participation of gold tournaments and spending money and time on sports activities. Increasing media exposure to international golf events

has aided the rise in the popularity of golf among the masses. This trend encourages the youth to play such sports, further boosting

the sales of golf equipment in the region.

Source:

https://www.mordorintelligence.com/industry-reports/golf-equipment-market

Markets

Our

products are sold in the Americas, Asia and Europe. We sell our golf equipment products in the United States and internationally, directly

via e-commerce, through distribution or subsidiaries, to wholesale customers, including pro-shops at golf courses and off-course retailers,

sporting goods retailers, on-line retailers, third-party distributors, and through Club Champion Golf, the international leader in golf

club fitting with strategic locations across the U.S. and internationally. We sell certain products to mass merchants, as well as directly

to consumers through retail locations in Japan and have recently begun selling products in South Korea. We offer custom fitting programs

online to help consumers find the best fit for their personal specifications. In addition, we sell to corporate customers who want certain

customizations of our golf equipment.

Advertising

and Marketing

Our

marketing campaigns in connection with the SPG brand are aimed to increase consumer awareness of the products and support our overall

growth strategy. We will focus our advertising efforts mainly on television commercials, primarily on The Golf Channel and web-based

digital, social media advertising, and printed advertisements in national magazines, such as Golf Magazine and Golf Digest, as well as

in-store advertising. We also establish relationships with professional athletes and personalities, including members of various professional

golf tours as well as other athletes and personalities, in order to promote our golf equipment product lines.

Distribution

Our

manufacturing, assembly, warehousing and distribution center is in St. Joseph, MO, with putter head assembly performed at our headquarters

and research and development facility in Camarillo, CA. In 2023, we began manufacturing putter and replacement shafts using our proprietary

mandrels and wrapping technology. In 2024, we expanded our shaft offerings into fairway wood replacement shafts. In addition, we plan

to grow distribution centers in or near Tokyo, Japan, Seoul, South Korea, Mexico City and other prominent cities based on the needs of

these markets.

Production

Process

In

January 2024, we relocated our primary golf putting instrument assembly facility from Camarillo, CA to our St. Joseph, MO facility. It

is our ongoing goal to develop, design and manufacture as many of the company’s products, as is economically feasible in the U.S.

We currently have limited assembly/fitting capabilities in Japan and South Korea. Overall, the golf club assembly process is fairly labor

intensive, requires extensive supply chain coordination and utilizes raw materials that are obtained from suppliers both internationally

and within the United States.

Raw

Material and Suppliers

Our

golf putters raw material consist of a fairly wide variety of steel and aluminum types, along with other metals like tungsten, magnesium,

and titanium. Our shafts consist of carbon fiber and prepreg materials along with coatings, paintings, inks and other decorative materials.

The suppliers of these raw materials are located in the U.S., Japan, South Korea, and other countries around the world. We rely on third-party

suppliers to provide our raw materials and CNC machine certain parts. Our putters are currently assembled from components produced in

the U.S., Taiwan, China, Japan and South Korea. Our shafts are manufactured in-house from materials produced in the U.S. by third parties.

We note that some components or materials may be available only from a limited number of sources. We choose not to enter into long-term

contracts with any of our suppliers or manufacturers for the production and supply of our raw materials and components, and typically

transact business with our suppliers on an order-by-order basis. We also compete with other companies for raw materials and production.

We

currently source the vast majority of our grip products from third-party suppliers in the U.S. and China, and we source some CNC milled

products from the U.S. and Taiwan. However, we are already producing products, shafts and putter heads in the US, and plan to manufacture

as many components in the U.S. as is economically feasible. We have worked with a limited number of manufacturing partners that produced

components in facilities located in Southeast Asia and could do so again. We continuously work to diversify our sourcing and manufacturing

capabilities.

Anytime

a company has limited sources for materials or suppliers, there is significant risk, and we are no different. If we are unable to acquire

raw materials such as carbon fiber, it may take significant time to educate an alternate supplier with the specific engineering and manufacturing

requirements of our materials or designs. If we were unable to secure a reliable supplier for any component or material that we do not

manufacture ourselves and find that replacement in a timely manner, this could have a material adverse effect on our business, financial

condition and results of operations.

We

have experienced supply issues as a result of the U.S. Government blocking all imports from Myanmar, and our source for carbon fiber

shafts was instantly eliminated. With no supplier for shafts this materially impacted our ability to deliver product and grow channels

of distribution. However, our management adapted and within 12 months overcame these issues by opening our own shaft manufacturing facility

in St. Joseph, MO.

Product

Portfolio Characteristics

We

design our golf products to fit golfers of all skill levels, amateur and professional, and our products are designed with the goal of

conforming to the Rules of Golf as published by the United States Golf Association (“USGA”) and the ruling authority (“The

R&A”).

We

live by the statement “Physics not Gimmicks” and as a result, we believe that we have created game changing innovations like

our patented Ultra-Low Balance Point technologies that we believe make any putter a better putter. Ultra-Low Balance Point is a balance

point on the shaft that is five (5) inches or less from the sole of the putter. The Company achieves this, not by making the putter head

heavier like some companies have done, but by making the putter shaft and grip feather light. An ULBP putter has substantially more of

the relative weight at the putter head which makes the putter head feel a lot heavier than it really is. The result, supported by independent

testing, is a putter that promotes a natural pendulum like tempo, natural squaring of the head at impact and a natural release of the

toe of the putter head, all of which can help contribute to better putting performance.

By

investing in research and development and leveraging applied science and physics, we design golf equipment and products to be technologically

superior by breaking the “sea of sameness” that exists in golf today. We have the ability to create and modify product designs

using computer aided design software, finite element analysis software and structural optimization techniques. Further, we utilize a

variety of robotics and testing equipment, along with computer software, including launch monitors, an in-house laboratory and test center

for our golf equipment products.

We

manage our global business operations through our operating and reportable business segments. Our business segments currently include,

golf putting instruments, golf shafts, and golf related products.

SPG

Putters

Our

putter products include golf putters, shafts and grips sold under our SPG brand and are generally made of steel, aluminum, titanium alloys,

carbon fiber, tungsten, our patented magnesium face plate technologies, and various other materials.

Our

putter technology has been shown by The Golf Lab, a Canadian golf research and education provider, to improve players’ ability

to make putts, feel of the putter head, stroke, face angle at impact, and distance control. Our management believes that our proprietary

shaft designs can enhance the performance of players’ putters as well as drivers and other golf clubs. Further, our management

believes that these innovative designs, along with our proprietary manufacturing techniques, create performance improvements over traditional

golf shafts.

We

launched a new line of premium putters under the Gravity brand in October 2024. Management believes that our versions of these models,

while having a familiar shape, could out-perform other versions in the industry because of our design and use of advanced metals.

Newton

Shafts

On

November 20, 2023, we announced a significant expansion of our product portfolio. We introduced “Newton,” the Company’s

latest business division and the Company’s first foray into the world of golf club shafts. The Newton Motion driver shaft, the

first Newton shaft to debut in the market, is a carbon fiber shaft designed to enhance a golfer’s performance by promoting straighter

and longer shots with reduced effort. Using the Company’s proprietary shaft design and construction, the Newton Motion shaft features

four essential technologies:

| |

● |

Elongated

Bend Profile – SPG has created an extreme elongated bend profile that is central to the shaft’s design. Because of SPG’s

proprietary Kinetic Storage Construction, the shaft will bend over a longer span of its length, resulting in improved club speed.

The added flexibility of the carbon fiber gives the impression that the golfer doesn’t need to exert excessive force during

the swing, leading to a more predictable and less jarring experience. This, in turn, enhances the smoothness of the swing. |

| |

|

|

| |

● |

Kinetic

Storage Construction – The kinetic storage profile is the engine of Newton’s Motion Driver Shaft. This proprietary construction

empowers the fibers to store more energy that is harnessed through elongated bend, resulting in a significant boost in exit velocity.

In contrast to most carbon fiber shafts, SPG’s technology ensures perfect symmetry, eliminating the inconsistencies in flex

and spin rates that can often lead to decreased accuracy and distance. |

| |

|

|

| |

● |

Newton

Symmetry360 Design – SPG’s Newton Symmetry360 design ensures consistent flex, regardless of the driver’s clocking

position. This stand-out feature allows for seamless adjustments to both the bend and torque (twist) when most flex changes occur,

providing a truly versatile and adaptive solution. |

| |

● |

Variable

Bend Profile – The Newton Motion driver shaft is equipped with a variable elongated bend profile meticulously designed to match

the bend and torque requirements of each flex. This innovation ensures that every player’s driving performance is optimized,

adapting seamlessly to the unique demands of the swing. Golfers with slower swing speeds need more torque while higher swing speeds

need the opposite. Whether a slow or high swing speed, the Newton Motion technology tailors to the torque. |

In

addition to the four aforementioned technologies, instead of using the traditional categorization of shaft flexes of ladies, senior,

regular, stiff, extra-shift, etc., the Newton Motion shaft uses a DOT system. Ranging from one to six dots, the system allows for a seamless

transition from the most flexible shaft at one dot to the stiffest at six dots. SPG’s innovative DOT system, employed by SPG’s

expert shaft engineers, optimizes golf shaft performance by fine-tuning it to golfer’s unique abilities, leaving traditional flex

systems in the past.

The

Newton Motion shaft is visually captivating. When in motion, the shaft undergoes a mesmerizing color transformation from green to purple

and various shades in between. The coloration not only adds a dash of style to a golfer’s game, but it also distinguishes itself

from other shafts in the market.

The

Newton shafts are manufactured in St. Joseph, Missouri, SPG’s shaft manufacturing facility.

Soft

Goods

In

addition to our existing products, we intend in the future to sell high quality soft goods such as golf apparel and golf accessories

including golf bags, gloves, headwear, practice aids and more. We are in the early stages of planning our soft goods business and do

not anticipate that we will begin manufacturing or selling soft goods until 2025.

Environmental

Matters

We

are subject to federal, state and local environmental laws and regulations that impose limitations on the discharge of pollutants into

the environment and establish standards for the handling, generation, emission, release, discharge, treatment, storage and disposal of

certain materials, substances and wastes and the remediation of environmental contaminants (collectively, “Environmental Laws”).

In the ordinary course of our manufacturing processes, we use paints, chemical solvents and other materials, and generate waste by-products

that are subject to these Environmental Laws.

We

endeavor to adhere to all applicable Environmental Laws and act as necessary to comply with these laws. We maintain an environmental

and safety program at our facilities. The environmental and safety program includes obtaining environmental permits as required, capturing

and appropriately disposing of any waste by-products, tracking hazardous waste generation and disposal, air emissions, safety situations,

material safety data sheet management, storm water management and recycling, and auditing and reporting on its compliance.

Intellectual

Property

We

are the owner or licensee of multiple utility and design patents in the U.S. and foreign countries relating to our products and product

designs, including U.S. and foreign trademark registrations relating to our products, product designs, manufacturing processes and research

and development concepts. Other patent and trademark applications are pending and await registration. In addition, we own various other

protectable rights under copyright, trade dress and other statutory and common laws. Our intellectual property rights are material to

our business, and we seek to protect such rights through the registration of trademarks and utility and design patents, the maintenance

of trade secrets and the creation of trade dress. When necessary and appropriate, we will enforce our rights through litigation.

Our

patents are generally in effect for up to 20 years from the date of the filing of the patent application. Our trademarks are generally

valid as long as they are in use and their registrations are properly maintained and have not been found to become generic.

Patents

We

currently hold the following patents:

| |

● |

US

D874589 S (Series 18 design patent) |

| |

● |

US

D874592 S (Series 54 design patent) |

| |

● |

US

D867494 S (Series 39 design patent) |

| |

● |

US

11,123,614 B2 (Magnesium Golf Clubhead Insert) |

| |

● |

Ultra

Low Balance Point Utility Patent: |

| |

○ |

US

8,608,586 |

| |

○ |

Australia

Patent No. 2012/301755 |

| |

○ |

Canada

Patent No. 2,846,882 |

| |

○ |

China

Patent App No. 2012/80042114.1 |

| |

○ |

European

Patent App. No. 128287695 |

| |

○ |

Japan

Patent No. 2014-528632 |

| |

○ |

South

Korea Patent No. 2014-7008689 |

| |

○ |

South

Africa Patent No. 2014/02273 |

The

Ultra Low Balance Point Utility Patent described above was licensed to us by Parcks Designs, LLC on July 24, 2018. The license granted

to us is perpetual, worldwide, royalty-free, and exclusive aside from one other licensee. The principals of Parcks Designs, LLC are Steve

Sacks and Richard Parente, cofounders of the Company together with Tim Triplett and Akinobu Yorihiro. On May 25, 2022, we and Parcks

Designs entered into a Consulting Agreement whereby Parcks Designs will perform club and shaft testing and analysis, putter head design

consulting and other services as may be agreed upon from time to time. The consulting fees due to Parcks Designs will be nominal in the

beginning and increase to $2,000 per month after June 1, 2024.

On

August 7, 2018, Richard E. Parente and Steve Sacks assigned to us the entire worldwide right, title and interest in and to the Quad Weighted

Lightweight Putter.

Confidential

Information and Trade Secrets

The

success of our business depends, in part, on the maintenance of confidential information and trade secrets, generally referred to as

proprietary information. We have implemented procedures to maintain the confidentiality of our proprietary information. Employees enter

into confidentiality agreements with us and, where appropriate, a confidentiality agreement is executed before confidential information

is revealed. Confidentiality provisions are also present in consulting agreements and supplier agreements in certain cases where the

consultant or supplier may be exposed to confidential information.

Trademarks

The

following marks and phrases, among others, are trademarks of the Company:

| |

● |

USPTO

Reg. No. 5,783,037 (Veni Vidi Vici) |

| |

● |

USPTO

Reg No. 5,822,719 (Sacks Parente) |

| |

● |

South

Korea Reg. No. 40-1820381 (Sacks Parente) |

Domain

names

We

own the domain names listed below. Domain names are generally renewable every year or every two years.

www.sacksparente.com

www.newtonshafts.com

www.spgolfinc.com

www.spgolfco.com

www.spgputter.com

www.spgshafts.com

www.newtonshafts.com

www.spgtour.com

www.physicsnotgimmicks.com

www.spgfangster.com

Social

Media Accounts

We

operate the social media accounts listed below.

| |

● |

Twitter:

https://mobile.twitter.com/sacksparente |

| |

● |

Facebook:

https://www.facebook.com/sacksparente |

| |

● |

LinkedIn:

https://www.linkedin.com/company/sacks-parente-golf/ |

| |

● |

Instagram:

https://www.instagram.com/sacksparente/ |

Government

Regulation

We

are subject to extensive federal, state, local and foreign laws and regulations, as well as other statutory and regulatory requirements,

the Americans with Disabilities Act (the “ADA”), and similar state laws, privacy and cybersecurity laws, environmental, health

and human safety laws and regulations, the Foreign Corrupt Practices Act and other similar anti-bribery and anti-kickback laws. New laws

and regulations or new interpretations of existing laws and regulations from federal, state and local authorities may also impact the

business.

Employees

As

of October 31, 2024, we had 18 full-time equivalent employees. We employ additional people on a part-time basis as needed. We have never

participated in a collective bargaining agreement. We believe relations with our employees are good.

Competition

We

compete on the basis of technologies that improve the player’s experience. Management further believes quality and unparalleled

customer service define the better companies in all industries. In order to better understand trends, management receives and evaluates

internally generated market trends for the United States and foreign markets, as well as periodic public and customized market research

for the United States and Asia. Providers of such market research are Golf Datatech and The National Golf Foundation that include trends

from certain on- and off-course retailers. In addition, we utilize data from other market research firms in Asia.

Our

major competitors for putting instruments are TaylorMade, Ping, Acushnet (Scotty Cameron, Titleist brand) and Callaway Odyssey/Toulon

brands.

Our

major competitors for golf shafts include Fujikura Composites, Inc, Mitsubishi Chemical MCC, Graphite Design, (Asia) Co Ltd, Nippon Shaft

Co. Ltd, and Paderson Kinetixx, Taiwan.

All

these and other competitors have been in business years longer than we have and have substantially greater resources than we do.

Customers

Our

customers include individual golfers as well as wholesalers and retailers, including Club Champion Golf, the international leader in

golf club fitting with strategic locations across the USA and internationally.

Implications

of Being an “Emerging Growth Company”

We

qualify as an “emerging growth company” under the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an emerging

growth company, we have elected to take advantage of reduced reporting requirements and are relieved of certain other significant requirements

that are otherwise generally applicable to public companies. As an emerging growth company:

| |

● |

we

may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis

of Financial Condition and Results of Operations; |

| |

|

|

| |

● |

we

are exempt from the requirement to obtain an attestation and report from our auditors on whether we maintained effective internal

control over financial reporting under the Sarbanes-Oxley Act; |

| |

|

|

| |

● |

we

are permitted to provide less extensive disclosure about our executive compensation arrangements; and |

| |

|

|

| |

● |

we

are not required to give our stockholders non-binding advisory votes on executive compensation or golden parachute arrangements. |

We

may take advantage of these provisions until December 31, 2027 (the last day of the fiscal year following the fifth anniversary of our

initial public offering) if we continue to be an emerging growth company. We would cease to be an emerging growth company if we have

more than $1.235 billion in annual revenue, have more than $700 million in market value of our shares held by non-affiliates or issue

more than $1.0 billion of non-convertible debt over a three-year period. We may choose to take advantage of some but not all of these

reduced burdens. We have elected to provide two years of audited financial statements. Additionally, we have elected to take advantage

of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended, or the Securities Act, for

complying with new or revised accounting standards that have different effective dates for public and private companies until the earlier

of the date we (i) are no longer an emerging growth company or (ii) affirmatively and irrevocably opt out of the extended transition

period provided in Section 7(a)(2)(B) of the Securities Act.

Available

Information

We

maintain a website at the following address: www.sacksparente.com. The information on our website is not incorporated by reference in

this registration statement. We make available on or through our website certain reports and amendments to those reports that we file

with or furnish to the Securities and Exchange Commission (“SEC”) in accordance with the Securities Exchange Act of 1934,

as amended (“Exchange Act”). These include our Annual Reports on Form 10-K, our Quarterly Reports on Form 10-Q and our Current

Reports on Form 8-K. We make this information available on our website free of charge as soon as reasonably practicable after we electronically

file the information with, or furnish it to, the SEC. In addition, we routinely post on the “Investors” page of our website

news releases, announcements and other statements about our business and results of operations, some of which may contain information

that may be deemed material to investors. Therefore, we encourage investors to monitor the “Investors” page of our website

and review the information we post on that page. The SEC maintains a website that contains reports, proxy and information statements,

and other information regarding issuers that file electronically with the SEC at the following address: http://www.sec.gov.

THE

OFFERING

| Issuer: |

|

Sacks

Parente Golf, Inc. |

| |

|

|

| Securities

offered by us: |

|

[____]

Common Units, each Common Unit consisting of one share of our common stock, one Series A

Warrant to purchase one share of our common stock and one Series B Warrant to purchase one

share of our common stock.

We

are also offering to investors in Common Units that would otherwise result in the investor’s beneficial ownership exceeding

4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of common stock immediately following the consummation

of this offering the opportunity to purchase Prefunded Units in lieu of Common Units. Each Pre-Funded Unit consists of one pre-funded

warrant (“Pre-Funded Warrant”) to purchase one share of our common stock, one Series A Warrant and one Series B Warrant.

The purchase price of each Pre-Funded Unit is $[....] (which is equal to the assumed public offering price per Common Unit minus

$0.001). Subject to limited exceptions, a holder of Pre-Funded Warrants will not have the right to exercise any portion of its Pre-Funded

Warrants if the holder, together with its affiliates, would beneficially own in excess of 4.99% (or, at the election of the holder,

such limit may be increased to up to 9.99%) of the common stock outstanding immediately after giving effect to such exercise. The

Pre-Funded Warrants will be immediately exercisable (subject to the beneficial ownership cap) and may be exercised at any time until

all of the Pre-Funded Warrants are exercised in full. For each Pre-Funded Unit purchased, the number of Units including a share of

common stock we are offering will be decreased on a one-for-one basis. The Pre-Funded Units have no stand-alone rights and will not

be certificated or issued as stand-alone securities.

The

Common Units will not be certificated or issued in stand-alone form. The shares of our common stock (or Pre-Funded Warrants) and

the Common Warrants comprising the Common Units are immediately separable upon issuance and will be issued separately in this offering. |

| Over-Allotment

Option |

|

The

offering is being underwritten on a firm commitment basis. We have granted the underwriter a 45-day option to purchase up to [ ]

additional shares of common stock, representing 15% of the Common Units sold in the offering (at an assumed public offering price

of $[ ] per Common Unit, which is the last reported sales price of our common stock on the Nasdaq Capital Market on December [ ],

2024 and/or up to [ ] additional Pre-Funded Warrants, representing 15% of the Pre-Funded Warrants sold in the offering, and/or up

to [ ] additional Series A Warrants, representing 15% of the Series A Warrants sold in the offering, and/or up to [ ] additional

Series B Warrants, representing 15% of the Series B Warrants sold in the offering, on the same terms and conditions set forth above

solely to cover over-allotments. The underwriter may exercise the over-allotment option with respect to shares of common stock only,

Pre-Funded Warrants only, Series A Warrants only, Series B Warrants only, or any combination thereof. |

| |

|

|

| Assumed

public offering price: |

|

$[___]

per Common Unit, which is the closing price of our common stock on Nasdaq on [_____], 2024. |

| |

|

|

| Common

stock outstanding immediately prior to this offering: |

|

1,825,587

shares of common stock. |

| |

|

|

| Common

stock to be outstanding immediately after this offering: |

|

[___]

shares(1) of common stock (or [ ] shares of common stock if the over-allotment option is exercised in full) assuming no

issuance of Pre-Funded Units, and no exercise of the any of the Common Stock Warrants issued in this offering). |

| Use

of proceeds: |

|

We

currently intend to use the net proceeds from this offering for working capital and general corporate purposes. See “Use of

Proceeds”. |

| |

|

|

| Description

of Common Warrants: |

|

Series A Warrants

Each

Series A Warrant will have an exercise price of $[ ] per share (or 125% of the price of each Common Unit) and will expire on the

five-year anniversary of the date of the Warrant Stockholder Approval. Beginning on the date of the Warrant Stockholder Approval,

the Series A Warrants will contain a reset of the exercise price to a price equal to the lesser of (i) the then exercise price and

(ii) the lowest volume weighted average price (VWAP) for the five trading days immediately following the date we effect a reverse

split with a proportionate adjustment to the number of shares underlying the Series A Warrants (a “Reverse Split Reset”).

Any such adjustment will be subject to a floor price (“the Floor Price”) calculated as follows: (a) prior to the date

of the Warrant Stockholder Approval, 50% of the Nasdaq Minimum Price, and (b) after the date of the Warrant Stockholder Approval,

20% of the Nasdaq Minimum Price. Nasdaq Minimum Price means the lower of the Nasdaq closing price or the average closing price for

the five immediately preceding trading days, all as of the date of the Warrant Stockholder Approval. Additionally, with certain exceptions,

beginning on the date of the Warrant Stockholder Approval, the Series A Warrants will provide for an adjustment to the exercise price

and number of shares underlying the Series A Warrants (the “Dilutive Adjustment”) upon our issuance of our common stock

or common stock equivalents at any time after the closing of the offering, at a price per share that is less than the then-current

exercise price of the Series A Warrants. Any Dilutive Adjustment will be subject to the Floor Price. The Series A Warrants may not

be exercised until Warrant Stockholder Approval. |

|

|

Series

B Warrants

Each

Series B Warrant will have an exercise price of $[ ] per share (or 125% of the price of each Common Unit or pursuant to an alternative

cashless exercise option). The Series B Warrant will expire on the 2 and one-half year anniversary of the date of the Warrant Stockholder

Approval. Beginning on the date of the Warrant Stockholder Approval, the holders of the Series B Warrants have the right to receive

an aggregate number of shares equal to the product of (x) the aggregate number of shares of common stock that would be issuable upon

a cash exercise of the Series B Warrants and (y) 2.0. Also, the Series B Warrants will provide for a Reverse Split Reset subject

to the Floor Price. The Series B Warrants may not be exercised until the Warrant Stockholder Approval.

Reset

and Adjustment of the Exercise Price of the Common Warrants; Blocker provisions

Effective

on the 11th trading day following the date of the Warrant Stockholder Approval, the exercise price and the number of shares

underlying the Common Warrants will be reset to the then-current lowest VWAP in the period commencing on the first trading day following

the date of the Warrant Stockholder Approval and ending the close of trading on the tenth trading day thereafter. Such reset will

be subject to the Floor Price. With respect to all of the Common Warrants, with the consent of the holder, we may adjust the exercise

price to such amount and for such time as may be agreed upon.

Each

holder of Common Warrants will be prohibited from exercising its Common Warrant for shares of our common stock if, as a result of

such exercise, the holder, together with its affiliates, would own more than 4.99% of the total number of shares of our common stock

then issued and outstanding. However, any holder may increase such percentage to any other percentage not in excess of 9.99%. The

Common Warrants will be issued in certificated form.

This

offering also relates to the offering of the shares of common stock issuable upon the exercise of the Common Warrants. For more information

regarding the Common Warrants, you should carefully read the section titled “Description of Securities We Are Offering —

Common Warrants” in this prospectus. |

Underwriting: |

|

Aegis

proposes to offer the units purchased pursuant to the underwriting agreement between us and Aegis to the public at the public offering

price set forth on the cover page of this prospectus. In addition, we will reimburse Aegis for certain out-of-pocket expenses, including

legal fees, related to the offering up to a maximum of $100,000. See “Underwriting”. |

| |

|

|

| Nasdaq

trading symbol: |

|

Our

common stock currently trades on Nasdaq under the symbol “SPGC”. We do not intend to list the Pre-Funded Warrants or

Common Warrants offered hereunder on any stock exchange. |

| |

|

|

| Transfer

agent, Common Warrant agent and registrar: |

|

The

transfer agent and registrar for our common stock is VStock Transfer, LLC. |

| |

|

|

| Risk

factors: |

|

The

securities offered by this prospectus are speculative and involve a high degree of risk. Investors purchasing securities should not

purchase the securities unless they can afford the loss of their entire investment. See “Risk Factors” beginning on page

16. |

| (1) |

The

number of shares of our common stock to be outstanding following this offering is based on 1,825,587 shares of common stock outstanding

as of October 31, 2024 and excludes: |

| ● |

291,160

shares of common stock issuable upon the exercise

of common stock options issued to members of management, consultants, and directors at a weighted average exercise price of $8.07

per share; and |

| ● |

Up

to [ ] shares of our common stock issuable upon the exercise of the Series A Warrants based on an assumed offering price of $[ ]

per Common Unit, which is the last reported sales price of our common stock on the Nasdaq Capital Market on November [ ], 2024; and

|

| ● |

Up

to [ ] shares of our common stock issuable upon the exercise of the Series B Warrants, assuming the Series B Warrants are exercised

utilizing the alternative cashless exercise option based on an assumed public offering price of $[ ] per Common Unit, which is the

last reported sales price of our common stock on the Nasdaq Capital Market on November [ ], 2024. |

Unless

otherwise indicated, this prospectus also assumes that no Pre-Funded Units are issued and no exercise by the underwriter of its over-allotment

option to purchase additional shares.

RISK

FACTORS

Investing

in our common stock and Common Warrants is highly speculative and involves a significant degree of risk. You should carefully consider

the following risks and uncertainties as well as the risks and uncertainties described in the section entitled “Risk Factors”

contained in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as well as in our subsequent Quarterly Reports

filed with the Securities and Exchange Commission (the “SEC”), which filings are incorporated in this prospectus by reference

in their entirety, as well as in any prospectus supplement hereto. These risk factors could materially and adversely affect our business,

results of operations or financial condition. Our business faces significant risks and the risks described below or incorporated by reference

herein may not be the only risks we face. Additional risks not presently known to us or that we currently believe are immaterial may

materially affect our business, results of operations, or financial condition. If any of these risks occur, the trading price of our

common stock could decline and you may lose all or part of your investment.

Risks

Related to this Offering and Ownership of our Securities

The

Common Stock and Pre-Funded Warrants (which are exercisable for common stock) sold in this offering will more than [ ] the number of

our shares of common stock from approximately 1,825,587 shares to [ ] shares. If all the Common Warrants sold in this offering are exercised

(assuming the Series B Warrants are exercised on an alternative cashless exercise basis), the number of our shares of common stock will

increase by an additional [ ] shares. The sales of these securities could depress the market price of our shares of common stock and/or

increase the volatility of our trading.

A

substantial number of shares of common stock, Pre-Funded Warrants, and Common Warrants are being offered by this prospectus. Sales of

a substantial number of our shares of common stock in the public markets pursuant to the terms of this offering could depress the market

price of our shares of common stock and impair our ability to raise capital to the sale of additional equity securities. Additionally,

such sales could also greatly increase the volatility associated with the trading of our common stock. We cannot predict the number of

the shares that might be sold, nor the effect future sales of shares would have on the market price of our shares.

If

we fail to satisfy all applicable continued listing requirements of the Nasdaq Capital Market, our common stock may be de-listed from

Nasdaq, which could have an adverse impact on the liquidity and market price of our common stock.

Our

common stock is currently listed on the Nasdaq Capital Market. In order to maintain that listing, we must satisfy minimum financial and

other listing requirements and standards, including, in particular, the minimum bid price requirement of $1.00 per share. There can be

no assurance that we will be able to comply with the applicable listing requirements. In such event, trading of our common stock could

be conducted only in the over-the-counter market. In such an event, it could be more difficult to dispose of our common stock, and there

would likely also be a reduction in coverage by securities analysts and the news media, which could cause the price of our common stock

to decline further. Also, it may be difficult for us to raise additional capital if we are not listed on a major exchange.

We

will likely not receive any additional funds upon the exercise of the Series B Warrants.

The

Series B Warrants may be exercised by way of an alternative cashless exercise, meaning that the holder may not pay a cash purchase price

upon exercise, but instead would receive upon such exercise the net number of shares of our common stock according to the formula set

forth in the applicable Series B Warrant. Accordingly, we will likely not receive any additional funds upon the exercise of the Series

B Warrants.

Exercise

of the Common Warrants will not be available until we receive stockholder approval.

The

provisions of the Common Warrants require that Warrant Stockholder Approval be obtained in order for the Common Warrants to be exercised.

If we are unable to obtain Warrant Stockholder Approval, the Common Warrants will essentially be of no value.

Investors

in this offering will experience immediate and substantial dilution in the book value of their investment.

The

public offering price will be substantially higher than the net tangible book value per share of our outstanding shares of common stock.

As a result, investors in this offering will incur immediate dilution of $[ ] per share based on the assumed public offering price of

$[ ] per Unit. Investors in this offering will pay a price per Unit that substantially exceeds the book value of our assets after subtracting

our liabilities. See “Dilution” for a more complete description of how the value of your investment will be diluted upon

the completion of this offering.

Our

management will have broad discretion over the use of the proceeds we receive in this offering and might not apply the proceeds in ways

that increase the value of your investment.

Our

management will have broad discretion over the use of our net proceeds from this offering, and you will be relying on the judgment of

our management regarding the application of these proceeds. Our management might not apply our net proceeds in ways that ultimately increase

the value of your investment. We expect to use the net proceeds from this offering for working capital and general corporate purposes.

We

have a history of losses, expect to continue to incur losses in the near term and may not achieve or sustain profitability in the future,

and as a result, our management has identified, and our auditors agreed that there is a substantial doubt about our ability to continue

as a going concern.

We

have incurred significant losses since our inception. We experienced net losses of $4,625,000 and $3,505,000 for the years ended December

31, 2023 and 2022, respectively, and $3,408,000 for the nine months ended September 30, 2024. We expect our operating losses will continue,

or even increase, at least through the near term. You should not rely upon our past results as indicative of future performance. We will

not reach profitability in the near future or at any specific time in the future.

The

report of our independent registered public accounting firm that accompanies our audited consolidated financial statements in our Annual

Report on Form 10-K for the fiscal year ended December 31, 2023 contains an explanatory paragraph regarding substantial doubt about our

ability to continue as a going concern. Our consolidated financial statements do not include any adjustments that might result if we

are unable to continue as a going concern. If we are unable to continue as a going concern, holders of our securities might lose their

entire investment.

We

may have to seek to raise additional funds to fund our operations and implement our business plan. Depending on the terms available to

us, if these activities result in significant dilution, it may negatively impact the trading price of our common stock.

Any

additional financing that we secure may require the granting of rights, preferences or privileges senior to, or pari passu with,

those of our common stock. Any issuances by us of equity securities may be at or below the prevailing market price of our common stock

and in any event may have a dilutive impact on your ownership interest, which could cause the market price of our common stock to decline.

We may also raise additional funds through the incurrence of debt or the issuance or sale of other securities or instruments senior to

our shares of common stock, which may be highly dilutive. The holders of any securities or instruments we may issue may have rights superior

to the rights of our common stockholders. If we experience dilution from the issuance of additional securities and we grant superior

rights to new securities over holders of our common stock, it may negatively impact the trading price of our common stock and you may

lose all or part of your investment.

The

Common Warrants and the Pre-Funded Warrants are speculative in nature and there is not expected to be an active trading market for the

Common Warrants.

There

is no established trading market for the Common Warrants or Pre-Funded Warrants and we do not expect an active trading market to develop.

Without an active trading market, the liquidity of the Common Warrants and Pre-Funded Warrants will be limited.

Holders

of the Common Warrants or Pre-Funded Warrants will have no rights as a common stockholder until they acquire our common stock.

The

Common Warrants and the Pre-Funded Warrants offered in this offering do not confer any rights of common stock ownership on their holders,

such as voting rights or the right to receive dividends, but rather merely represent the right to acquire shares of our common stock

at a fixed price for a limited period of time. Specifically, commencing on the date of issuance, holders of the Common Warrants may exercise

their right to acquire the common stock and pay an exercise price of $[*] per share (125% of the public offering price of a Unit, subject

to adjustment), prior to five years from the date of issuance, after which date any unexercised Common Warrants will expire and have

no further value. In the case of Pre-Funded Warrants, holders may exercise their right to acquire the common stock and pay an exercise

price of $0.001 per share. The Pre-Funded Warrants do not expire. Until holders of the Common Warrants or Pre-Funded Warrants acquire

shares of our common stock upon exercise of the Common Warrants or Pre-Funded Warrants, the holders will have no rights with respect

to shares of our common stock issuable upon exercise of the Common Warrants or Pre-Funded Warrants. Upon exercise of the Common Warrants

or Pre-Funded Warrants, the holder will be entitled to exercise the rights of a common stockholder as to the security exercised only

as to matters for which the record date occurs after the exercise.

Provisions

of the Common Warrants could discourage an acquisition of us by a third party.

Certain

provisions of the Common Warrants could make it more difficult or expensive for a third party to acquire us. The Common Warrants prohibit

us from engaging in certain transactions constituting “fundamental transactions” unless, among other things, the surviving

entity assumes our obligations under the Common Warrants. These and other provisions of the Common Warrants offered by this prospectus

could prevent or deter a third party from acquiring us even where the acquisition could be beneficial to you.

A

possible “short squeeze” due to a sudden increase in demand of our shares of common stock that largely exceeds supply may

lead to price volatility in our shares of common stock.

Following

this offering, investors may purchase our shares of common stock to hedge existing exposure in our shares of common stock or to speculate

on the price of our shares of common stock. Speculation on the price of our shares of common stock may involve long and short exposures.

To the extent aggregate short exposure exceeds the number of shares of our common stock available for purchase in the open market, investors

with short exposure may have to pay a premium to repurchase our shares of common stock for delivery to lenders of our shares of common

stock. Those repurchases may in turn, dramatically increase the price of our shares of common stock until investors with short exposure

are able to purchase additional common shares to cover their short position. This is often referred to as a “short squeeze”.

A short squeeze could lead to volatile price movements in our shares of common stock that are not directly correlated to the performance

or prospects of our company and once investors purchase the shares of common stock necessary to cover their short position the price

of our common stock may decline.

An

active, liquid and orderly trading market for our common stock may not develop, the price of our stock may be volatile, and you could

lose all or part of your investment.

Even

though our common stock is currently listed on Nasdaq, we cannot predict the extent to which investor interest in our company will lead

to the development of an active trading market in our securities or how liquid that market might become. If such a market does not develop

or is not sustained, it may be difficult for you to sell your shares of common stock at the time you wish to sell them, at a price that

is attractive to you, or at all. There could be extreme fluctuations in the price of our common stock if there are a limited number of

shares in our public float.

The

trading price of our common stock may be highly volatile and could be subject to wide fluctuations in response to various factors, some

of which are beyond our control. Our stock price could be subject to wide fluctuations in response to a variety of factors, which include:

| |

● |

whether

we achieve our anticipated corporate objectives; |

| |

● |

actual

or anticipated fluctuations in our quarterly or annual operating results; |

| |

● |

changes

in our financial or operational estimates; |

| |

● |

our

ability to implement our operational plans; |

| |

● |

changes

in the economic performance or market valuations of companies similar to ours; and |

| |

● |

general

economic or political conditions in the United States or elsewhere. |

In

addition, broad market and industry factors may seriously affect the market price of companies’ stock, including ours, regardless

of actual operating performance. These fluctuations may be even more pronounced in the trading market for our stock shortly following

this offering. In the past, following periods of volatility in the overall market and the market price of a particular company’s

securities, securities class action litigation has often been instituted against these companies. This litigation, if instituted against

us, could result in substantial costs and a diversion of our management’s attention and resources.

This

offering may cause the trading price of our common stock to decrease.

The