true

2023-10-12

0000351834

00-0000000

SunOpta Inc.

0000351834

2023-10-12

2023-10-12

0000351834

exch:XNAS

us-gaap:CommonStockMember

2023-10-12

2023-10-12

0000351834

exch:XTSX

us-gaap:CommonStockMember

2023-10-12

2023-10-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 12, 2023

SUNOPTA INC.

(Exact name of registrant as specified in its charter)

|

Canada

|

001-34198

|

Not Applicable |

| (State or other jurisdiction |

(Commission |

(IRS Employer |

| of incorporation) |

File Number) |

Identification No.) |

7078 Shady Oak Road

Eden Prairie, Minnesota, 55344

(Address of principal executive offices) (ZIP Code)

Registrant’s telephone number, including area code: (952) 820-2518

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbols |

|

Name of each exchange on which registered |

|

Common Shares

|

|

STKL

|

|

The Nasdaq Stock Market LLC

|

|

Common Shares

|

|

SOY

|

|

The Toronto Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b -2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

EXPLANATORY NOTE

On October 17, 2023, SunOpta Inc. (the "Company") filed a Current Report on Form 8-K (the "Original 8-K") reporting that on October 12, 2023, the Company and its subsidiaries, Sunrise Growers, Inc. (the "US Subsidiary") and Sunrise Growers Mexico, S. de R.L. de C.V. and SunOpta Mx, S.A. de C.V. (the "Mexican Subsidiaries" and together with the Company and the US Subsidiary, "SunOpta") entered into an Asset Purchase Agreement ("APA") with Natures Touch Mexico, S. de R.L. de C.V. and Nature's Touch Frozen Fruits, LLC (the "Purchasers") to sell to the Purchasers certain of SunOpta's assets and liabilities related to the SunOpta's business of processing, packaging and selling individually quick frozen fruit for retail, foodservice and industrial applications in Edwardsville, Kansas and Jacona, Michoacan, Mexico, valued at $141 million, inclusive of $20 million of seller promissory notes due in three years (the "Transaction"). On October 12, 2023, the Company completed the Transaction in accordance with the terms of the APA. This Form 8-K/A amends the original Form 8-K to include the unaudited pro forma condensed consolidated financial statements as at and for the two quarters ended July 1, 2023, and each of the three years in the period ended December 31, 2022.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS

(b) Pro Forma Financial Information

The pro forma financial information required by this Item 9.01(b) is filed as Exhibit 99.2 to this report and incorporated by reference in this Item 9.01(b)

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| SUNOPTA INC. |

| |

|

| |

|

| By |

/s/ Jill Barnett |

| |

|

| |

Jill Barnett |

| |

Chief Administrative Officer |

| |

|

| |

|

| Date |

October 18, 2023 |

SUNOPTA INC.

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

On October 12, 2023, SunOpta Inc. (the "Company") entered into an Asset Purchase Agreement ("APA") with Natures Touch Mexico, S. de R.L. de C.V. and Nature's Touch Frozen Fruits, LLC (the "Purchasers") to sell to the Purchasers certain assets and liabilities of the Company's frozen fruit business ("Frozen Fruit") for an aggregate purchase price of $141 million, subject to closing working capital adjustments (the "Transaction"). The aggregate purchase price is inclusive of $20.0 million of seller promissory notes due in three years (the "Seller Financing"). On October 12, 2023 (the "Closing Date"), the Company completed the Transaction in accordance with the terms of the APA. The Transaction represents the Company's exit from the processing, packaging and selling of individually quick frozen fruit for retail, foodservice and industrial applications. Included with the Transaction are owned facilities of Frozen Fruit located in Edwardsville, Kansas, and Jacona, Mexico. A third leased facility of Frozen Fruit, located in Oxnard, California, is not included as part of the Transaction, but primary operations concluded at the facility as of the Closing Date.

The divestiture of Frozen Fruit completes the Company's strategic optimization plan for its non-core commodity-based businesses, which included the divestitures of its sunflower business ("Sunflower") in October 2022 and its global ingredients business, Tradin Organic, in December 2020, in order to focus on value-add products in plant-based and healthy snack categories. Tradin Organic was reported as a discontinued operation beginning in the fourth quarter of 2020. With the Transaction, Frozen Fruit met the held for sale criteria as at September 30, 2023 and, together with Sunflower, qualifies for reporting as discontinued operations under U.S. generally accepted accounting principles ("GAAP") beginning in the third quarter of 2023.

The Transaction is considered a significant disposition for purposes of Item 2.01 of Form 8-K. The accompanying unaudited pro forma condensed consolidated financial statements are prepared in accordance with Article 11 of Regulation S-X. The unaudited pro forma condensed consolidated financial statements are derived from and should be read in conjunction with the Company's audited consolidated financial statements and notes thereto for each of the three years in the period ended December 31, 2022, included in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the U.S. Securities and Exchange Commission (the "SEC") on March 1, 2023, and the Company's unaudited consolidated financial statements and notes thereto for the two quarters ended July 1, 2023, included in the Company's Quarterly Report on Form 10-Q for the quarterly period ended July 1, 2023, filed with the SEC on August 10, 2023.

The unaudited pro forma condensed consolidated statements of operations for the two quarters ended July 1, 2023, and each of the three years in the period ended December 31, 2022, are presented as if the Transaction had occurred on January 1, 2020. The unaudited pro forma condensed consolidated balance sheet as at July 1, 2023, is presented as if the Transaction had occurred on July 1, 2023.

The pro forma adjustments included in the Frozen Fruit and Sunflower columns of the unaudited pro forma condensed consolidated financial statements are consistent with the guidance for discontinued operations under U.S. GAAP. The amounts reflected in these columns are preliminary and could change as the Company finalizes its accounting for discontinued operations to be reported in its Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2023 and in its Annual Report on Form 10-K for the fiscal year ended December 30, 2023. Other pro forma adjustments included in the unaudited pro forma condensed consolidated financial statements are directly attributable to the Transaction and are based upon available information and certain assumptions that the Company believes are reasonable under the circumstances. The pro forma adjustments are described in the notes to the unaudited pro forma condensed consolidated financial statements. The unaudited pro forma condensed consolidated financial statements do not include any management adjustments permitted under Article 11 of Regulation S-X to reflect potential synergies or cost savings that may be achievable or dis-synergies or incremental costs that may be incurred as a result of the Transaction.

The unaudited pro forma condensed consolidated financial statements are for informational purposes only and are not necessarily indicative of the operating results or financial position that would have been achieved had the Transaction been consummated on the dates indicated. The unaudited pro forma condensed consolidated financial information should not be construed as being representative of the Company's future results of operations or financial position. The actual results of operations and financial position may differ significantly from the pro forma amounts reflected herein.

SUNOPTA INC.

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

FOR THE TWO QUARTERS ENDED JULY 1, 2023

(Expressed in thousands of U.S. dollars, except per share amounts)

| |

|

|

|

|

|

Pro Forma |

|

|

|

|

| |

|

|

|

|

|

Adjustments |

|

|

|

|

| |

|

|

|

|

|

Frozen |

|

|

|

|

| |

|

|

Historical |

|

|

Fruit (a) |

|

|

Pro Forma |

|

| |

|

|

|

|

|

|

|

|

|

|

| Revenues |

$ |

431,689 |

|

$ |

135,557 |

|

$ |

296,132 |

|

| Cost of goods sold |

|

387,107 |

|

|

133,683 |

|

|

253,424 |

|

| |

|

|

|

|

|

|

|

|

|

| Gross profit |

|

44,582 |

|

|

1,874 |

|

|

42,708 |

|

| Selling, general and administrative expenses |

|

45,003 |

|

|

4,977 |

|

|

40,026 |

|

| Intangible asset amortization |

|

4,892 |

|

|

4,000 |

|

|

892 |

|

| Other income, net |

|

(192 |

) |

|

(172 |

) |

|

(20 |

) |

| Foreign exchange (gain) loss |

|

(4,588 |

) |

|

(4,669 |

) |

|

81 |

|

| |

|

|

|

|

|

|

|

|

|

| (Loss) earnings before the following |

|

(533 |

) |

|

(2,262 |

) |

|

1,729 |

|

| Interest expense, net |

|

12,781 |

|

|

552 |

|

|

12,229 |

|

| |

|

|

|

|

|

|

|

|

|

| Loss before income taxes |

|

(13,314 |

) |

|

(2,814 |

) |

|

(10,500 |

) |

| Income tax expense |

|

4,147 |

|

|

169 |

|

|

3,978 |

|

| |

|

|

|

|

|

|

|

|

|

| Net loss |

|

(17,461 |

) |

|

(2,983 |

) |

|

(14,478 |

) |

| Dividends and accretion on preferred stock |

|

(1,126 |

) |

|

- |

|

|

(1,126 |

) |

| |

|

|

|

|

|

|

|

|

|

| Loss attributable to common shareholders |

$ |

(18,587 |

) |

$ |

(2,983 |

) |

$ |

(15,604 |

) |

| |

|

|

|

|

|

|

|

|

|

|

| Loss per common share |

|

|

|

|

|

|

|

|

|

| |

Basic |

$ |

(0.16 |

) |

|

|

|

$ |

(0.14 |

) |

| |

Diluted |

$ |

(0.16 |

) |

|

|

|

$ |

(0.14 |

) |

| |

|

|

|

|

|

|

|

|

|

|

| Weighted-average common shares (000s) |

|

|

|

|

|

|

|

|

|

| |

Basic |

|

112,743 |

|

|

|

|

|

112,743 |

|

| |

Diluted |

|

112,743 |

|

|

|

|

|

112,743 |

|

(See the accompanying notes to the unaudited pro forma condensed consolidated financial statements)

|

SUNOPTA INC.

|

|

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

|

|

FOR THE YEAR ENDED DECEMBER 31, 2022

|

|

(Expressed in thousands of U.S. dollars, except per share amounts)

|

|

|

|

| |

|

|

|

|

|

Pro Forma Adjustments |

|

|

|

|

| |

|

|

|

|

|

Frozen |

|

|

|

|

|

Seller |

|

|

|

|

| |

|

|

Historical |

|

|

Fruit (a) |

|

|

Sunflower (a) |

|

|

Financing (b) |

|

|

Pro Forma |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

$ |

934,662 |

|

$ |

285,343 |

|

$ |

57,924 |

|

$ |

- |

|

$ |

591,395 |

|

| Cost of goods sold |

|

811,808 |

|

|

265,171 |

|

|

54,972 |

|

|

- |

|

|

491,665 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

122,854 |

|

|

20,172 |

|

|

2,952 |

|

|

- |

|

|

99,730 |

|

| Selling, general and administrative expenses |

|

89,312 |

|

|

9,571 |

|

|

1,272 |

|

|

- |

|

|

78,469 |

|

| Intangible asset amortization |

|

10,282 |

|

|

8,000 |

|

|

498 |

|

|

- |

|

|

1,784 |

|

| Other expense, net |

|

22,132 |

|

|

(2,746 |

) |

|

23,227 |

|

|

- |

|

|

1,651 |

|

| Foreign exchange gain |

|

(1,748 |

) |

|

(1,641 |

) |

|

- |

|

|

- |

|

|

(107 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings before the following |

|

2,876 |

|

|

6,988 |

|

|

(22,045 |

) |

|

- |

|

|

17,933 |

|

| Interest expense (income), net |

|

14,734 |

|

|

1,578 |

|

|

- |

|

|

(3,188 |

) |

|

9,968 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) earnings before income taxes |

|

(11,858 |

) |

|

5,410 |

|

|

(22,045 |

) |

|

3,188 |

|

|

7,965 |

|

| Income tax (benefit) expense |

|

(2,340 |

) |

|

1,873 |

|

|

1,747 |

|

|

862 |

|

|

(5,098 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) earnings |

|

(9,518 |

) |

|

3,537 |

|

|

(23,792 |

) |

|

2,326 |

|

|

13,063 |

|

| Dividends and accretion on preferred stock |

|

(3,109 |

) |

|

- |

|

|

- |

|

|

- |

|

|

(3,109 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) earnings attributable to common shareholders |

$ |

(12,627 |

) |

$ |

3,537 |

|

$ |

(23,792 |

) |

$ |

2,326 |

|

$ |

9,954 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) earnings per common share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic |

$ |

(0.12 |

) |

|

|

|

|

|

|

|

|

|

$ |

0.09 |

|

| |

Diluted |

$ |

(0.12 |

) |

|

|

|

|

|

|

|

|

|

$ |

0.09 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average common shares (000s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic |

|

107,659 |

|

|

|

|

|

|

|

|

|

|

|

107,659 |

|

| |

Diluted |

|

107,659 |

|

|

|

|

|

|

|

|

|

|

|

110,247 |

|

(See the accompanying notes to the unaudited pro forma condensed consolidated financial statements)

|

SUNOPTA INC.

|

|

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

|

|

FOR THE YEAR ENDED JANUARY 1, 2022

|

|

(Expressed in thousands of U.S. dollars, except per share amounts)

|

|

|

| |

|

|

|

|

|

Pro Forma Adjustments |

|

|

|

|

| |

|

|

|

|

|

Frozen |

|

|

|

|

|

Seller |

|

|

|

|

| |

|

|

Historical |

|

|

Fruit (a) |

|

|

Sunflower (a) |

|

|

Financing (b) |

|

|

Pro Forma |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

$ |

812,624 |

|

$ |

253,075 |

|

$ |

63,094 |

|

$ |

- |

|

$ |

496,455 |

|

| Cost of goods sold |

|

714,904 |

|

|

239,818 |

|

|

59,775 |

|

|

- |

|

|

415,311 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

97,720 |

|

|

13,257 |

|

|

3,319 |

|

|

- |

|

|

81,144 |

|

| Selling, general and administrative expenses |

|

76,599 |

|

|

10,438 |

|

|

1,383 |

|

|

- |

|

|

64,778 |

|

| Intangible asset amortization |

|

9,950 |

|

|

8,000 |

|

|

664 |

|

|

- |

|

|

1,286 |

|

| Other expense, net |

|

8,890 |

|

|

1,955 |

|

|

190 |

|

|

- |

|

|

6,745 |

|

| Foreign exchange loss |

|

1,112 |

|

|

1,018 |

|

|

- |

|

|

- |

|

|

94 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings before the following |

|

1,169 |

|

|

(8,154 |

) |

|

1,082 |

|

|

- |

|

|

8,241 |

|

| Interest expense (income), net |

|

8,769 |

|

|

1,217 |

|

|

- |

|

|

(2,824 |

) |

|

4,728 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) earnings before income taxes |

|

(7,600 |

) |

|

(9,371 |

) |

|

1,082 |

|

|

2,824 |

|

|

3,513 |

|

| Income tax (benefit) expense |

|

(6,428 |

) |

|

(1,712 |

) |

|

138 |

|

|

763 |

|

|

(4,091 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) earnings |

|

(1,172 |

) |

|

(7,659 |

) |

|

944 |

|

|

2,061 |

|

|

7,604 |

|

| Dividends and accretion on preferred stock |

|

(4,197 |

) |

|

- |

|

|

- |

|

|

- |

|

|

(4,197 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) earnings attributable to common shareholders |

$ |

(5,369 |

) |

$ |

(7,659 |

) |

$ |

944 |

|

$ |

2,061 |

|

$ |

3,407 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) earnings per common share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic |

$ |

(0.05 |

) |

|

|

|

|

|

|

|

|

|

$ |

0.03 |

|

| |

Diluted |

$ |

(0.05 |

) |

|

|

|

|

|

|

|

|

|

$ |

0.03 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average common shares (000s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic |

|

104,098 |

|

|

|

|

|

|

|

|

|

|

|

104,098 |

|

| |

Diluted |

|

104,098 |

|

|

|

|

|

|

|

|

|

|

|

106,987 |

|

(See the accompanying notes to the unaudited pro forma condensed consolidated financial statements)

|

SUNOPTA INC.

|

|

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

|

|

FOR THE YEAR ENDED JANUARY 2, 2021

|

|

(Expressed in thousands of U.S. dollars, except per share amounts)

|

|

|

| |

|

|

|

|

|

Pro Forma Adjustments |

|

|

|

|

| |

|

|

|

|

|

Frozen |

|

|

|

|

|

Seller |

|

|

|

|

| |

|

|

Historical |

|

|

Fruit (a) |

|

|

Sunflower (a) |

|

|

Financing (b) |

|

|

Pro Forma |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

$ |

789,213 |

|

$ |

284,559 |

|

$ |

54,618 |

|

$ |

- |

|

$ |

450,036 |

|

| Cost of goods sold |

|

680,136 |

|

|

270,144 |

|

|

55,067 |

|

|

- |

|

|

354,925 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

109,077 |

|

|

14,415 |

|

|

(449 |

) |

|

- |

|

|

95,111 |

|

| Selling, general and administrative expenses |

|

89,463 |

|

|

13,259 |

|

|

1,675 |

|

|

- |

|

|

74,529 |

|

| Intangible asset amortization |

|

8,946 |

|

|

8,000 |

|

|

664 |

|

|

- |

|

|

282 |

|

| Other expense, net |

|

23,393 |

|

|

8,652 |

|

|

2,901 |

|

|

- |

|

|

11,840 |

|

| Foreign exchange (gain) loss |

|

(1,640 |

) |

|

(1,831 |

) |

|

- |

|

|

- |

|

|

191 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) earnings before the following |

|

(11,085 |

) |

|

(13,665 |

) |

|

(5,689 |

) |

|

- |

|

|

8,269 |

|

| Interest expense (income), net |

|

30,042 |

|

|

861 |

|

|

- |

|

|

(1,926 |

) |

|

27,255 |

|

| Loss on retirement of debt |

|

8,915 |

|

|

- |

|

|

- |

|

|

- |

|

|

8,915 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) earnings before income taxes |

|

(50,042 |

) |

|

(14,526 |

) |

|

(5,689 |

) |

|

1,926 |

|

|

(27,901 |

) |

| Income tax (benefit) expense |

|

(7,650 |

) |

|

(415 |

) |

|

(715 |

) |

|

521 |

|

|

(5,999 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) earnings |

|

(42,392 |

) |

|

(14,111 |

) |

|

(4,974 |

) |

|

1,405 |

|

|

(21,902 |

) |

| Dividends and accretion on preferred stock |

|

(10,328 |

) |

|

- |

|

|

- |

|

|

- |

|

|

(10,328 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) earnings attributable to common shareholders |

$ |

(52,720 |

) |

$ |

(14,111 |

) |

$ |

(4,974 |

) |

$ |

1,405 |

|

$ |

(32,230 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss per common share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic |

$ |

(0.59 |

) |

|

|

|

|

|

|

|

|

|

$ |

(0.36 |

) |

| |

Diluted |

$ |

(0.59 |

) |

|

|

|

|

|

|

|

|

|

$ |

(0.36 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average common shares (000s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic |

|

89,234 |

|

|

|

|

|

|

|

|

|

|

|

89,234 |

|

| |

Diluted |

|

89,234 |

|

|

|

|

|

|

|

|

|

|

|

89,234 |

|

(See the accompanying notes to the unaudited pro forma condensed consolidated financial statements)

|

SUNOPTA INC.

|

|

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED BALANCE SHEET

|

|

AS AT JULY 1, 2023

|

|

(Expressed in thousands of U.S. dollars)

|

|

|

| |

|

|

|

|

|

Pro Forma Adjustments |

|

|

|

| |

|

|

|

|

|

|

|

|

Aggregate |

|

|

|

|

|

| |

|

|

|

|

|

Frozen |

|

|

Purchase |

|

|

|

|

|

| |

|

|

Historical |

|

|

Fruit (c) |

|

|

Price (d) |

|

|

|

Pro Forma |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Cash and cash equivalents |

$ |

981 |

|

$ |

- |

|

$ |

67,102 |

|

(e) |

$ |

68,083 |

|

| |

Accounts receivable |

|

72,776 |

|

|

(19,411 |

) |

|

10,500 |

|

|

|

63,865 |

|

| |

Inventories |

|

220,752 |

|

|

(104,079 |

) |

|

- |

|

|

|

116,673 |

|

| |

Prepaid expenses and other current assets |

|

15,734 |

|

|

(266 |

) |

|

- |

|

|

|

15,468 |

|

| |

Income taxes recoverable |

|

4,133 |

|

|

- |

|

|

- |

|

|

|

4,133 |

|

| Total current assets |

|

314,376 |

|

|

(123,756 |

) |

|

77,602 |

|

|

|

268,222 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Notes receivable |

|

- |

|

|

- |

|

|

20,000 |

|

|

|

20,000 |

|

| Property, plant and equipment, net |

|

342,679 |

|

|

(24,533 |

) |

|

- |

|

|

|

318,146 |

|

| Operating lease right-of-use assets |

|

90,454 |

|

|

(738 |

) |

|

- |

|

|

|

89,716 |

|

| Intangible assets, net |

|

130,754 |

|

|

(108,000 |

) |

|

- |

|

|

|

22,754 |

|

| Goodwill |

|

3,998 |

|

|

- |

|

|

- |

|

|

|

3,998 |

|

| Other assets |

|

4,864 |

|

|

- |

|

|

- |

|

|

|

4,864 |

|

| Total assets |

$ |

887,125 |

|

$ |

(257,027 |

) |

$ |

97,602 |

|

|

$ |

727,700 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Accounts payable and accrued liabilities |

$ |

124,826 |

|

$ |

(23,610 |

) |

$ |

(5,286 |

) |

|

$ |

95,930 |

|

| |

Notes payable |

|

19,727 |

|

|

- |

|

|

- |

|

|

|

19,727 |

|

| |

Income taxes payable |

|

180 |

|

|

- |

|

|

- |

|

|

|

180 |

|

| |

Current portion of long-term debt |

|

45,394 |

|

|

- |

|

|

(240 |

) |

|

|

45,154 |

|

| |

Current portion of operating lease liabilities |

|

14,231 |

|

|

(114 |

) |

|

- |

|

|

|

14,117 |

|

| Total current liabilities |

|

204,358 |

|

|

(23,724 |

) |

|

(5,526 |

) |

|

|

175,108 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Long-term debt |

|

270,717 |

|

|

- |

|

|

(9,628 |

) |

|

|

261,089 |

|

| Operating lease liabilities |

|

85,427 |

|

|

(624 |

) |

|

- |

|

|

|

84,803 |

|

| Deferred income taxes |

|

266 |

|

|

- |

|

|

- |

|

|

|

266 |

|

| Total liabilities |

|

560,768 |

|

|

(24,348 |

) |

|

(15,154 |

) |

|

|

521,266 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series B-1 preferred stock |

|

14,264 |

|

|

- |

|

|

- |

|

|

|

14,264 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Common shares |

|

462,290 |

|

|

- |

|

|

- |

|

|

|

462,290 |

|

| |

Additional paid-in capital |

|

22,715 |

|

|

- |

|

|

- |

|

|

|

22,715 |

|

| |

Accumulated deficit |

|

(174,275 |

) |

|

(233,325 |

) (f) |

|

112,756 |

|

(f) |

|

(294,844 |

) |

| |

Accumulated other comprehensive income |

|

1,363 |

|

|

646 |

|

|

- |

|

|

|

2,009 |

|

| Total shareholders' equity |

|

312,093 |

|

|

(232,679 |

) |

|

112,756 |

|

|

|

192,170 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities and shareholders' equity |

$ |

887,125 |

|

$ |

(257,027 |

) |

$ |

97,602 |

|

|

$ |

727,700 |

|

(See the accompanying notes to the unaudited pro forma condensed consolidated financial statements)

SUNOPTA INC.

NOTES TO THE UNAUDITED PRO FORMA

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

1. Basis of Presentation

The unaudited pro forma condensed consolidated financial information as at and for the two quarters ended July 1, 2023 has been derived from and should be read in conjunction with the historical unaudited consolidated financial statements and notes thereto included in the Company's Quarterly Report on Form 10-Q for the quarterly period ended July 1, 2023, and the adjustments described in Note 2 below. The unaudited pro forma condensed consolidated financial information for each of the three years in the period ended December 31, 2022 has been derived from and should be read in conjunction with the historical audited consolidated financial statements and notes thereto, included in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2022, and the adjustments described in Note 2 below.

2. Pro Forma Adjustments

(a) The Frozen Fruit and Sunflower columns in the unaudited pro forma condensed consolidated statements of operations represents the historical financial results directly attributable to Frozen Fruit and Sunflower in accordance with Financial Accounting Standards Board Accounting Standards Codification 205-20, "Presentation of Financial Statements - Discontinued Operations." Selling, general and administrative expenses of Frozen Fruit and Sunflower exclude the allocation of corporate costs. For the year ended December 31, 2022, other expense of Sunflower includes the loss recognized on the Sunflower divestiture of $23.2 million.

(b) The Seller Financing column in the unaudited pro forma condensed consolidated statements of operations reflects the recognition of interest income over the three-year term of the Seller Financing. The Seller Financing bears interest at a rate per annum equal to the secured overnight financing rate ("SOFR"), plus a margin of 4.00% for the first year and 7.00% for the second and third years. Interest is payable quarterly in-kind. The Seller Financing matures on October 12, 2026, and outstanding principal and accrued and unpaid interest is payable on the maturity date. For purposes of these unaudited pro forma condensed consolidated financial statements, the fair value of the Seller Financing is assumed to be equal to the stated principal amount of $20.0 million and the stated interest rate was determined based on SOFR as at the Closing Date plus the applicable margin in each of the three years ended December 31, 2022. The incremental income tax expense on the Seller Financing reflects the applicable historical statutory rates in effect for the periods presented.

(c) The Frozen Fruit column in the unaudited pro forma condensed consolidated balance sheet reflects the elimination of the assets, liabilities, and accumulated other comprehensive loss attributable to the Transaction, measured as at July 1, 2023.

(d) The Aggregate Purchase Price column in the unaudited pro forma condensed consolidated balance sheet reflects the estimated aggregate purchase price of the Transaction measured as at July 1, 2023, net of estimated closing costs, and the required repayment of certain bank loans and other liabilities of Frozen Fruit not assumed by the Purchasers. The estimated aggregate purchase price does not reflect any pre-closing adjustments based on the results of operations and changes in financial position of Frozen Fruit from July 1, 2023 to the Closing Date.

(e) Reflects the estimated net cash proceeds from the Transaction of $67.1 million measured as at July 1, 2023, reflecting deductions for estimated closing costs and the required repayment of certain bank loans and other liabilities of Frozen Fruit not assumed by the Purchasers. The Company intends to utilize the net cash proceeds from the Transaction to repay a portion of the outstanding borrowings under its asset-based revolving credit facilities. The repayment of revolver borrowings, including any associated future cash interest savings, have not been reflected in the unaudited pro forma condensed consolidated financial statements as the repayment is not considered directly attributable to the Transaction.

(f) The change in accumulated deficit reflects the estimated loss on the Transaction of $120.6 million measured as at July 1, 2023, reflecting the difference between the estimated aggregate purchase price, net of estimated closing costs, and the historical carrying value of the net assets of Frozen Fruit attributable to the Transaction. The final determination of the loss on the Transaction as of the Closing Date is subject to the finalization of the closing balance sheet of Frozen Fruit, the completion of a fair value assessment of the Seller Financing, and adjustments to closing costs related to the Transaction. Accordingly, the estimated loss on the Transaction as at July 1, 2023, is preliminary and presented solely for informational purposes. The final loss recognized could be higher or lower than the preliminary estimate.

v3.23.3

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe date the document was made available and submitted, in YYYY-MM-DD format. The date of submission, date of acceptance by the recipient, and the document effective date are all potentially different.

| Name: |

dei_DocumentCreationDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XNAS |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XTSX |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

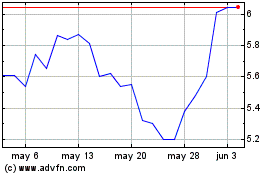

SunOpta (NASDAQ:STKL)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

SunOpta (NASDAQ:STKL)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024