TravelCenters of America Stockholders Approve Pending BP Transaction

10 Mayo 2023 - 12:30PM

Business Wire

Transaction Expected to Close on May 15,

2023

TravelCenters of America Inc. (Nasdaq: TA), the nationwide

operator and franchisor of the TA, Petro Stopping Centers and TA

Express travel center brands, today announced that, at its Special

Meeting of Stockholders held earlier today, TA stockholders voted

to approve TA’s merger with and into a wholly-owned indirect

subsidiary of BP p.l.c. (NYSE: BP). As previously announced, under

the terms of the merger agreement between TA and BP’s wholly-owned

subsidiary, BP’s wholly-owned subsidiary will acquire all of the

outstanding shares of TA common stock for $86.00 per share in cash.

The transaction price represents an 84% premium to TA’s average

trading price over the 30 days ending February 15, 2023, the date

the BP merger agreement was signed.

TA stockholders approved the BP merger with more than 72% of the

shares outstanding and 93.0% of the total shares voted in favor of

the merger. The final voting results of TA’s special meeting will

be reported in a Form 8-K with the U.S. Securities and Exchange

Commission.

The closing of the transaction remains subject to customary

closing conditions and is expected to occur on May 15, 2023. Upon

completion of the transaction, shares of TA’s common stock will be

canceled and will no longer trade on the Nasdaq, and TA will become

a wholly-owned indirect subsidiary of BP.

About TravelCenters of

America

TravelCenters of America Inc. (Nasdaq: TA) is the nation's

largest publicly traded full-service travel center network. Founded

in 1972 and headquartered in Westlake, Ohio, its over 18,000 team

members serve guests in 281 locations in 44 states, principally

under the TA®, Petro Stopping Centers® and TA Express® brands.

Offerings include diesel and gasoline fuel, truck maintenance and

repair, full-service and quick-service restaurants, travel stores,

car and truck parking and other services dedicated to providing

great experiences for its guests. TA is committed to

sustainability, with its specialized business unit, eTA, focused on

sustainable energy options for professional drivers and motorists.

TA operates over 600 full-service and quick-service restaurants and

nine proprietary brands, including Iron Skillet® and Country

Pride®. For more information, visit www.ta-petro.com.

Warning Regarding

Forward Looking Statements

This communication contains “forward-looking statements,”

including statements containing the words “expect,” “intend,”

“plan,” “believe,” “will,” “should,” “would,” “could,” “may,” and

words of similar meaning, as well as other words or expressions

referencing future events, conditions or circumstances. Statements

that describe or relate to BP’s or TA’s plans, goals, intentions,

strategies, or financial outlook, and statements that do not relate

to historical or current fact, are examples of forward-looking

statements. Examples of forward-looking statements include the

occurrence of any event, change or other circumstances that could

give rise to the termination of the TA’s merger agreement with BP;

the ability of the parties to consummate the proposed transaction

on a timely basis or at all; the satisfaction of the conditions

precedent to consummation of the proposed transaction; and the

anticipated timing of the closing of the proposed transaction.

Forward-looking statements are not guarantees of future

performance, and there are a number of important factors that could

cause actual outcomes and results to differ materially from the

results contemplated by such forward-looking statements, including

those factors listed in the section entitled “Risk Factors” in Item

1A of TA’s Annual Report on Form 10-K filed with the SEC on March

1, 2023, and those factors detailed from time to time in TA’s other

SEC reports including quarterly reports on Form 10-Q and current

reports on Form 8-K. TA does not undertake any obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise, except

as otherwise required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230510005802/en/

Investor Contact: Stephen Colbert TravelCenters of

America scolbert@ta-petro.com

Media Contacts: Tina Arundel TravelCenters of America

tarundel@ta-petro.com

Andrew Siegel / Jack Kelleher Joele Frank 212-355-4449

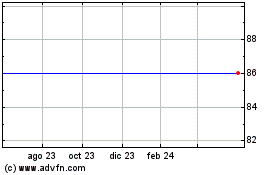

TravelCenters of America (NASDAQ:TA)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

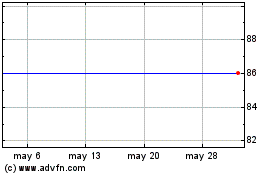

TravelCenters of America (NASDAQ:TA)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025