TMT Acquisition Corp (“TMTC”) (NASDAQ: TMTCU), a publicly traded

special purpose acquisition company (SPAC), and eLong Power Holding

Limited (“eLong Power”), a provider of high power battery

technologies for commercial and specialty vehicles and energy

storage systems, today announced that they have entered into a

definitive business combination agreement, dated December 1, 2023,

that will result in eLong Power becoming a publicly traded company.

Huizhou Yipeng Energy Technology Co., Ltd. (“Yipeng Huizhou”,

together with eLong Power, the “Company”) is the operating entity

of eLong Power. Upon the closing of the transaction, the combined

company is expected to be named eLong Power Inc. and its securities

are expected to be listed on the Nasdaq Stock Exchange. The

transaction has been approved by the Board of Directors of both

companies and is expected to close in the first half of 2024.

ELONG POWER OVERVIEW

The Company, founded in 2014, develops

disruptive battery technologies for commercial and specialty

vehicles as well as energy storage systems, with research and

development and production capabilities that span multiple battery

cell chemistries, modules and packs. The Company’s lower-cost, high

power and fast-charging batteries are designed specifically for

commercial electric vehicles (“EVs”) and large-scale energy storage

systems.

The Company’s battery solutions are powered by

its broad, proprietary intellectual property portfolio, which is

fully owned and protected by numerous patents and other

intellectual properties. Due to its highly differentiated,

vertically integrated R&D and industrialization system, the

Company believes it delivers faster product development, tighter

cost control and greater customization to its customers than does

its competitors. As a result, the Company is supported by marquee

strategic partnerships with industry leaders.

TMTC believes that market opportunities for

eLong Power are significant, with two primary focuses: 1)

commercial vehicles such as light, medium and heavy-duty trucks,

vans, buses, automated guided vehicles, and mining trucks; and 2)

large-scale energy storage systems for municipal and industrial

applications. Given its unique focus on battery solutions for

commercial EVs and energy storage, eLong Power believes it is

poised to capitalize on a large and rapidly growing global

commercial EV market that is projected to grow from US$11.3 billion

in 2023 to approximately US$54.3 in 2030, representing a CAGR of

29.9%.1 Battery energy storage is also a fast-growing industry and

eLong Power is focusing on becoming a leading player in China in

the short term and globally longer term. The energy storage market,

including Behind the Meter (“BTM”) and commercial and industrial

(“C&I”), has surpassed US$93.9 billion in 2022 and is

anticipated to grow at CAGR of 18.9% from 2023 to 2032, in which

annual sales are projected to exceed US$0.5 trillion2. This

fast-growing trend is underpinned by several industry and policy

tailwinds, namely: i) the growing adoption of green energy such as

wind, solar, and hydropower, which created significant

opportunities for companies like eLong Power; ii) the decrease in

the cost of renewable energy; and iii) favorable national and local

mandates, policies and incentives in the People’s Republic of

China.

The business combination transaction with TMTC

is expected to provide the Company with access to the U.S. public

equity markets and thereby accelerate its business expansion and

position the Company to explore additional growth and value

creating opportunities.

TMTC and ELONG POWER

COMMENTS

Commenting on the signing of the definitive

agreement, eLong Power’s Chairwoman and CEO, Xiaodan Liu, said, “In

2014, the Company set out to power a mobility revolution for

commercial and industrial EVs by building disruptive battery

technologies. Since then, we have launched a series of generations

of battery technologies that have provided our customers with

improved battery performance meeting the stringent requirements of

commercial vehicle operators. This transaction marks the beginning

of our next chapter working with our marquee customers and

strategic partners to pave the way for the mass adoption of

commercial electric vehicles and energy storage solutions, and we

are thrilled to team up with TMTC’s team to advance the path to

electrification.”

DJ Guo, Chairman and CEO of TMTC said, “The

eLong Power team has not only developed cutting-edge battery

technology that is highly attractive to its suite of market-leading

customers and partners, but also operates a vertically integrated

production process for its battery solutions that is unique in the

industry, enabling both enhanced customer service and the

opportunity to grow its business globally.”

THE PROPOSED BUSINESS COMBINATION

Pursuant to the proposed business combination

agreement, a subsidiary of TMTC will be merged with and into eLong

Power, the result of which eLong Power will become a wholly-owned

subsidiary of TMTC, with the newly combined publicly traded company

to be named eLong Power Inc. In the transaction, all shares of

eLong Power would be converted into ordinary shares of the newly

combined entity. As a result, upon closing, eLong Power’s

shareholders would receive 45,000,000 ordinary shares of the new

eLong Power Inc., which, at an implied value of $10.00 per share,

would represent $450 million in equity. In addition, eLong Power’s

majority shareholder is entitled to receive up to 9,000,000

ordinary shares of the combined company upon the achievement of

certain revenue-based milestones during calendar years 2024 and

2025.

At closing, any cash remaining in TMTC’s trust

account will be contributed to eLong Power to support ongoing

operations and planned business expansion efforts. References to

available cash from the TMTC trust account and retained transaction

proceeds are subject to any redemption by the public shareholders

of TMTC ordinary shares and payment of transaction fees and

expenses.

TMTC and eLong Power have agreed to work

together to pursue commitments for a private placement of equity

financings of up to $15 million.

The transaction, which has been unanimously

approved by both Boards of Directors of eLong Power and TMTC, is

subject to approval by the shareholders of TMTC and other customary

closing conditions. The proposed business combination is expected

to be completed in the first half of 2024.

A more detailed description of the transaction

terms and a copy of the business combination agreement will be

included in a Current Report on Form 8-K to be filed by TMTC with

the United States Securities and Exchange Commission ("SEC"). In

connection with the transaction, TMTC intends to file a

registration statement (which will contain a proxy

statement/prospectus) with the SEC.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy any of the

securities described herein, nor shall there be any sale of these

securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to the registration or

qualification under the securities laws of any such state or

jurisdiction.

ADVISORS

The Crone Law Group P.C. is acting as U.S. legal

advisor to TMTC. Ogier is acting as Cayman Island legal advisor to

TMTC. Graubard Miller is acting as U.S. legal advisor to eLong

Power, Harneys is acting as Cayman Island legal advisor to eLong

Power and Han Kun Law Offices is acting as China legal advisor to

eLong Power. Ever Talent Consultants Limited is acting as exclusive

financial advisor to TMTC.

IMPORTANT INFORMATION ABOUT THE PROPOSED

BUSINESS COMBINATION AND WHERE TO FIND IT

In connection with the proposed business

combination, TMTC intends to file a registration statement on Form

S-4 that will include a proxy statement of TMTC and a prospectus of

eLong Power. The proxy statement/prospectus will be sent to all

TMTC shareholders. Before making any voting decision, securities

holders of TMTC are urged to read the proxy statement/prospectus

and all other relevant documents filed or that will be filed with

the SEC in connection with the proposed business combination as

they become available because they will contain important

information about the proposed business combination and the parties

to the proposed business combination.

Investors and securities holders will be able to

obtain free copies of the proxy statement/prospectus and all other

relevant documents filed or that will be filed with the SEC by TMTC

through the website maintained by the SEC at www.sec.gov. The

documents filed by TMTC may be obtained free of charge by written

request to TMT Acquisition Corporation, 420 Lexington Avenue, Suite

2446, New York, New York 10170.

PARTICIPANTS IN THE

SOLICITATION

eLong Power and TMTC and certain of their

respective directors, executive officers, and other members of

management and employees may, under SEC rules, be deemed to be

participants in the solicitations of proxies from TMTC’s

shareholders in connection with the proposed transaction.

Information about TMTC’s directors and executive officers and their

ownership of TMTC’s securities is set forth in TMTC’s filings with

the SEC, including TMTC’s final prospectus of March 27, 2023 in

connection with TMTC’s initial public offering and its Quarterly

Report on Form 10-Q for the fiscal period ended September 30, 2023.

To the extent that holdings of TMTC’s securities have changed since

the amounts printed in TMTC’s final prospectus of March 27, 2023,

such changes have been or will be reflected on Statements of Change

in Ownership on Form 4 filed with the SEC.

Additional information regarding the

participants in the proxy solicitation and a description of their

direct and indirect interests will be included in the proxy

statement/prospectus when it becomes available. Shareholders,

potential investors, and other interested persons in respect of

eLong Power and TMTC should read the proxy statement/prospectus

carefully when it becomes available before making any voting or

investment decisions. You may obtain free copies of these documents

from the sources indicated above.

About eLong Power

eLong Power Holding Limited, a Cayman Islands

exempted company, is a provider of high power battery technologies

for commercial and specialty vehicles and energy storage systems,

with research and development and production capabilities that span

multiple battery cell chemistries, modules and packs. The Company

is led by Ms. Xiaodan Liu, eLong Power’s Chairwoman and CEO.

About TMT Acquisition Corp

TMT Acquisition Corp is a blank check company,

also commonly referred to as a special purpose acquisition company

(SPAC) formed for the purpose of effecting a merger, share

exchange, asset acquisition, share purchase, reorganization, or

similar business combination with one or more businesses or

entities. TMTC is led by Dajiang Guo, Chairman and Chief Executive

Officer, and Jichuan Yang, Chief Financial Officer, who are

growth-oriented executives with a long track record of value

creation across industries.

Forward-Looking Statements

This press release may contain "forward-looking

statements" within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934,

including statements regarding the benefits of the transaction, the

anticipated timing of the transaction, the products offered by

eLong Power and the markets in which it operates, and eLong Power’s

projected future results. These forward-looking statements

generally are identified by the words “believe,” “project,”

“expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,”

“opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,”

“will continue,” “will likely result,” and similar expressions.

Forward-looking statements are predictions, projections and other

statements about future events that are based on current

expectations and assumptions and, as a result, are subject to risks

and uncertainties. Many factors could cause actual future events to

differ materially from the forward-looking statements in this

document, including, but not limited to: Such statements are made

based on our expectations and beliefs concerning future events

impacting eLong Power. You can identify these statements by the

fact that they use words such as "believe," "anticipate,"

"estimate," "expect," "plan," “would,” "should," and "may" and

other words and terms of similar meaning or use of future dates.

Forward-looking statements are based on management's current

expectations and are subject to risks and uncertainties that could

negatively affect our business, operating results, financial

condition and stock price. Factors that could cause actual results

to differ materially from those currently anticipated are: the risk

that the transaction may not be completed by TMTC’s business

combination deadline and the potential failure to obtain an

extension of the business combination deadline if sought by TMTC;

the failure to satisfy the conditions to the consummation of the

transaction, including the adoption of the business combination

agreement by the shareholders of TMTC; the satisfaction of the

minimum net tangible assets amount following redemptions by TMTC’s

public shareholders; the occurrence of any event, change or other

circumstance that could give rise to the termination of the

business combination agreement; the effect of the announcement or

pendency of the transaction on eLong Power’s business

relationships, performance, and business generally; risks that the

proposed business combination disrupts current plans or operations

of eLong Power; the outcome of any legal proceedings that may be

instituted against eLong Power or TMTC related to the business

combination agreement or the proposed business combination; the

ability to maintain the listing of TMTC’s securities (which would

be eLong Power Inc. securities) on Nasdaq after the closing of the

transaction; after the closing of the transaction, the price of

eLong Power Inc.’s securities may be volatile due to a variety of

factors, including changes in the competitive and highly regulated

industries in which eLong Power Inc. will operate, variations in

performance across competitors, changes in laws and regulations

affecting eLong Power Inc.’s business and changes in its capital

structure; the ability to implement business plans, forecasts, and

other expectations after the completion of the proposed business

combination, and identify and realize additional opportunities

provided by the business combination; its need for substantial

additional funds; the parties’ dependence on third-party suppliers;

risks relating to the results of research and development

activities, market and other conditions; its ability to attract,

integrate, and retain key personnel; risks related to its growth

strategy; patent and intellectual property matters; and the

parties’ ability to obtain, perform under and maintain financing

and strategic agreements and relationships. These risks have been

and may be further impacted by Covid-19 and global geopolitical

events, such as the war in Ukraine and the Middle East.

Accordingly, these forward-looking statements do not constitute

guarantees of future performance, and you are cautioned not to

place undue reliance on these forward-looking statements. Risks

regarding TMTC’s business are described in detail in TMTC’s SEC

filings which are available on the SEC’s website at www.sec.gov,

including in TMTC’s registration statement on Form S-1 (File No.

333-259879), filed with the SEC and updated by TMTC’s subsequent

filings with the SEC. These forward-looking statements speak only

as of the date hereof, and TMTC expressly disclaims any obligation

or undertaking to release publicly any updates or revisions to any

forward-looking statements contained herein to reflect any change

in our expectations or any changes in events, conditions, or

circumstances on which any such statement is based, except as

required by law.

1. Estimates based on report by Market Research

Future

2. Estimates based on research report of China

Energy Storage Market Size by Global Market Insight

eLong Power Investor Contact:Shilin Xun Email:

xunshilin@elongpower.com

TMTC ContactDajiang Guo Email:

dguo@tmtacquisitioncorp.com 347-627-0058

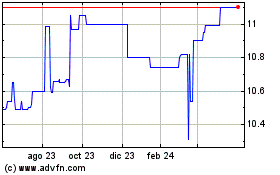

TMT Acquisition (NASDAQ:TMTCU)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

TMT Acquisition (NASDAQ:TMTCU)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024