Form DEFR14A - Revised definitive proxy soliciting materials

15 Julio 2024 - 8:40AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule 14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment

No. 1)

| Filed by the

Registrant |

|

☒ |

| Filed by a party other

than the Registrant |

|

☐ |

Check

the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, For Use of the Commission Only (As

Permitted by Rule 14a-6(e)(2)) |

| ☒ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☐ |

Soliciting Material under Rule 14a-12 |

TENON

MEDICAL, INC.

(Name

of Registrant as Specified in its Charter)

N/A

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

| ☐ |

Fee paid previously with

preliminary materials. |

| ☐ | Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

TENON

MEDICAL, INC.

104 Cooper Ct.

Los Gatos, CA 95032

(408) 649-5760

www.tenonmed.com

July

15, 2024

AMENDMENT

TO THE PROXY STATEMENT

FOR

THE ANNUAL MEETING OF STOCKHOLDERS OF

OPORTUN

FINANCIAL CORPORATION

TO

BE HELD ON TUESDAY, JULY 23, 2024

This amendment, dated July 15, 2024 (this “Amendment”),

amends and supplements the definitive proxy statement on Schedule 14A, filed by Tenon Medical, Inc. (the “Company”) with the

Securities and Exchange Commission on June 13, 2024 (as it may be amended, supplemented or otherwise modified from time to time, the “Proxy

Statement”). Terms used in this Amendment that are not defined have the meaning given to them in the Proxy Statement. Except as

described in this Amendment, the information provided in the Proxy Statement is not amended, supplemented or otherwise modified. THIS

AMENDMENT SHOULD BE READ IN CONJUNCTION WITH THE PROXY STATEMENT.

This Amendment amends the Proxy Statement to correct

an inadvertent error in the Proxy Statement regarding the liquidation preference to be provided to holders of the Company’s Series

B Preferred Stock when issued.

The first sentence under the heading “Proposal 2 Approval of the Nasdaq

Compliance Proposal-- Summary of Terms of the Series B Preferred Stock and Series B Warrants—Series B Preferred Stock--Liquidation”

is amended by including the following underlined parenthetical as set forth below:

Upon

any liquidation or winding up of the Company (a “Liquidation”), the holders of Series B Preferred Stock will be entitled

to receive in preference to any other class or series of capital stock of the Company (other than the Corporation’s Series A

Preferred Stock, which shall receive any distributions or payments on a pari passu basis with the Series B preferred Stock), the

greater of (i) the Stated Value plus accrued and unpaid dividends and (ii) what would be paid if the Series B Preferred Stock

plus accrued and unpaid dividends had been converted into common stock.

Section

5(a) of the Form of Certificate of Designations, Rights Preferences of the Series B Preferred Stock set

forth in Annex A of the Proxy Statement is amended by including the following underlined parenthetical as set forth below:

(a) Upon

any voluntary or involuntary liquidation, dissolution, or winding up of the Corporation, before any distribution or payment shall be

made to holders of shares of Common Stock or any other class or series of capital stock of the Corporation (other than the Corporation’s

Series A Preferred Stock, which shall receive any distributions or payments pursuant to this Section 5 on a pari passu basis with the

Series B preferred Stock), the holders of shares of Series B Preferred Stock then outstanding shall be entitled to be paid out of

the assets of the Corporation legally available for distribution to its stockholders, a per share liquidation preference equal to the

greater of (x) the aggregate of the Stated Values of the Series B Preferred Stock and (y) the amount that would be paid to the holders

of the Series B Preferred Stock (including any accrued and unpaid dividends thereon) if, prior to such voluntary or involuntary liquidation,

dissolution, or winding up of the Corporation, the Series B Preferred Stock had been converted into shares of Common Stock pursuant to

Section 9 and the Common Stock that has accrued thereon had been issued. In the event that, upon such voluntary or involuntary

liquidation, dissolution, or winding up, the available assets of the Corporation are insufficient to pay the full amount of the liquidating

distributions on all outstanding shares of Series B Preferred Stock, then the holders of the Series B Preferred Stock shall share ratably

in any such distribution of assets in proportion to the full liquidating distributions to which they would otherwise be respectively

entitled. Written notice of any such voluntary or involuntary liquidation, dissolution, or winding up of the Corporation, stating the

payment date or dates when, and the place or places where, the amounts distributable in such circumstances shall be payable, shall be

given within ten (10) days of the date the Board of Directors approves such action, or no later than twenty (20) days of any stockholders’

meeting called to approve such action, or within twenty (20) days of the commencement of any involuntary proceeding, whichever is earlier,

, to each record holder of shares of Series B Preferred Stock at the respective addresses of such holders as the same shall appear on

the stock transfer records of the Corporation. After payment of the full amount of the liquidating distributions to which they are entitled,

the holders of Series B Preferred Stock will have no right or claim to any of the remaining assets of the Corporation.

2

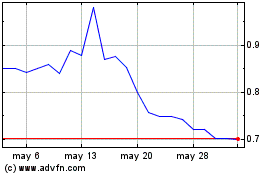

Tenon Medical (NASDAQ:TNON)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

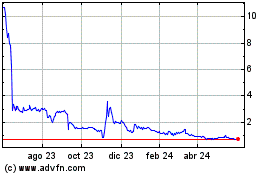

Tenon Medical (NASDAQ:TNON)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024