VALUE LINE, INC. DECLARES A QUARTERLY CASH DIVIDEND OF $0.28 PER COMMON SHARE

21 Julio 2023 - 12:57PM

Value Line, Inc. (NASDAQ:

VALU) announced today

that its Board of Directors declared on July 21, 2023 a quarterly

cash dividend of $0.28 per common share, payable on August 10,

2023, to stockholders of record on July 31, 2023. The Company has

9,430,529 shares of common stock outstanding as of July 21, 2023.

Value Line, Inc. is a leading New York based

provider of investment research. The Value Line Investment

Survey is one of the most widely used sources of

independent equity investment research. Value Line also publishes a

range of proprietary investment research in both print and digital

formats including research in the areas of Mutual Funds, ETFs and

Options. Value Line’s acclaimed research also enables the Company

to provide specialized products such as Value Line

Select, The Value Line Special

Situations Service, Value Line

Select: ETFs, Value Line Select: Dividend Income & Growth,

The New Value Line ETFs Service, The Value Line M

& A Service,

Information You Should Know Wealth

Newsletter, The Value

Line Climate Change Investing Service and certain

Value Line copyrights, distributed under

agreements including certain proprietary ranking system information

and other proprietary information used in third party products.

Investment Advisory services are provided through its non-voting

interests in EULAV Asset Management, the investment advisor to The

Value Line Family of Mutual Funds. Value Line’s products are

available to individual investors by mail, at www.valueline.com or

by calling 1-800-VALUELINE or 1-800-825-8354, while

institutional-level services for professional investors, advisers,

corporate, academic, and municipal libraries are offered at

www.ValueLinePro.com, www.ValueLineLibrary.com and by calling

1-800-531-1425.

Cautionary Statement Regarding

Forward-Looking Information

In this report, “Value Line,” “we,” “us,” “our”

refers to Value Line, Inc. and “the Company” refers to Value Line

and its subsidiaries unless the context otherwise requires.

This report contains statements that are

predictive in nature, depend upon or refer to future events or

conditions (including certain projections and business trends)

accompanied by such phrases as “believe”, “estimate”, “expect”,

“anticipate”, “will”, “intend” and other similar or negative

expressions, that are “forward-looking statements” as defined in

the Private Securities Litigation Reform Act of 1995, as amended.

Actual results for the Company may differ materially from those

projected as a result of certain risks and uncertainties, including

but not limited to the following:

- maintaining revenue from

subscriptions for the Company’s digital and print published

products;

- changes in investment trends and

economic conditions, including global financial issues;

- changes in Federal Reserve policies

affecting interest rates and liquidity along with resulting effects

on equity markets;

- stability of the banking system,

including the success of U.S. government policies and actions in

regard to banks with liquidity or capital issues, along with the

associated impact on equity markets;

- continuation of orderly markets for

equities and corporate and governmental debt securities;

- problems protecting intellectual

property rights in Company methods and trademarks;

- protecting confidential information

including customer confidential or personal information that we may

possess;

- dependence on non-voting revenues

and non-voting profits interests in EULAV Asset Management, a

Delaware statutory trust (“EAM” or “EAM Trust”), which serves as

the investment advisor to the Value Line Funds and engages in

related distribution, marketing and administrative services;

- fluctuations in EAM’s and third

party copyright assets under management due to broadly based

changes in the values of equity and debt securities, redemptions by

investors and other factors;

- possible changes in the valuation

of EAM’s intangible assets from time to time;

- possible changes in future revenues

or collection of receivables from significant customers;

- dependence on key executive and

specialist personnel;

- risks associated with the

outsourcing of certain functions, technical facilities, and

operations, including in some instances outside the U.S.;

- competition in the fields of

publishing, copyright and investment management, along with

associated effects on the level and structure of prices and fees,

and the mix of services delivered;

- the impact of government regulation

on the Company’s and EAM’s businesses;

- the availability of free or low

cost investment data through discount brokers or generally over the

internet;

- military conflicts, civil unrest,

and associated travel and supply disruptions and other

effects;

- Russia’s

invasion of Ukraine and the impact on inflation;

- continued

availability of generally dependable energy supplies in the

geographic areas in which the company and certain suppliers

operate;

- terrorist

attacks, cyber attacks and natural disasters;

- insufficiency

in our business continuity plans or systems in the event of

anticipated or unpredictable disruption;

- the coronavirus

pandemic, which has drastically affected markets, employment, and

other economic conditions, and may have additional unpredictable

impacts on employees, suppliers, customers, and operations;

- other possible

epidemics;

- changes in

prices and availability of materials and other inputs and services,

such as freight and postage, required by the Company;

- other risks and

uncertainties, including but not limited to the risks described in

Part I, Item 1A, herein, “Risk Factors” of this Annual Report on

Form 10-K for the year ended April 30, 2023 and other risks and

uncertainties arising from time to time.

These factors are not necessarily all of the

important factors that could cause actual results to differ

materially from those expressed in any of our forward-looking

statements. Other unknown or unpredictable factors which may

involve external factors over which we may have no control or

changes in our plans, strategies, objectives, expectations or

intentions, which may happen at any time at our discretion, could

also have material adverse effects on future results. Except as

otherwise required by applicable law, we have no duty to update

these statements, and we undertake no obligation to publicly update

or revise any forward-looking statements, whether as a result of

new information, future events or otherwise. In light of these

risks and uncertainties, current plans, anticipated actions, and

future financial conditions and results may differ from those

expressed in any forward-looking information contained herein.

www.valueline.comwww.ValueLinePro.com,

www.ValueLineLibrary.comFacebook | LinkedIn | Twitter Complimentary

Value Line® Reports on Dow 30 Stocks

Contact: Howard A. Brecher

Value Line, Inc.

212-907-1500

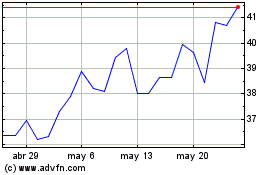

Value Line (NASDAQ:VALU)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

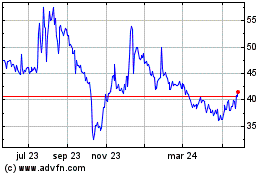

Value Line (NASDAQ:VALU)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024